Our Emerging Markets and Commodities strategists explored the dislocations in metals markets as tariffs fears led to physical flows to the US and price spikes. US import tariffs on gold, silver, platinum, and copper are…

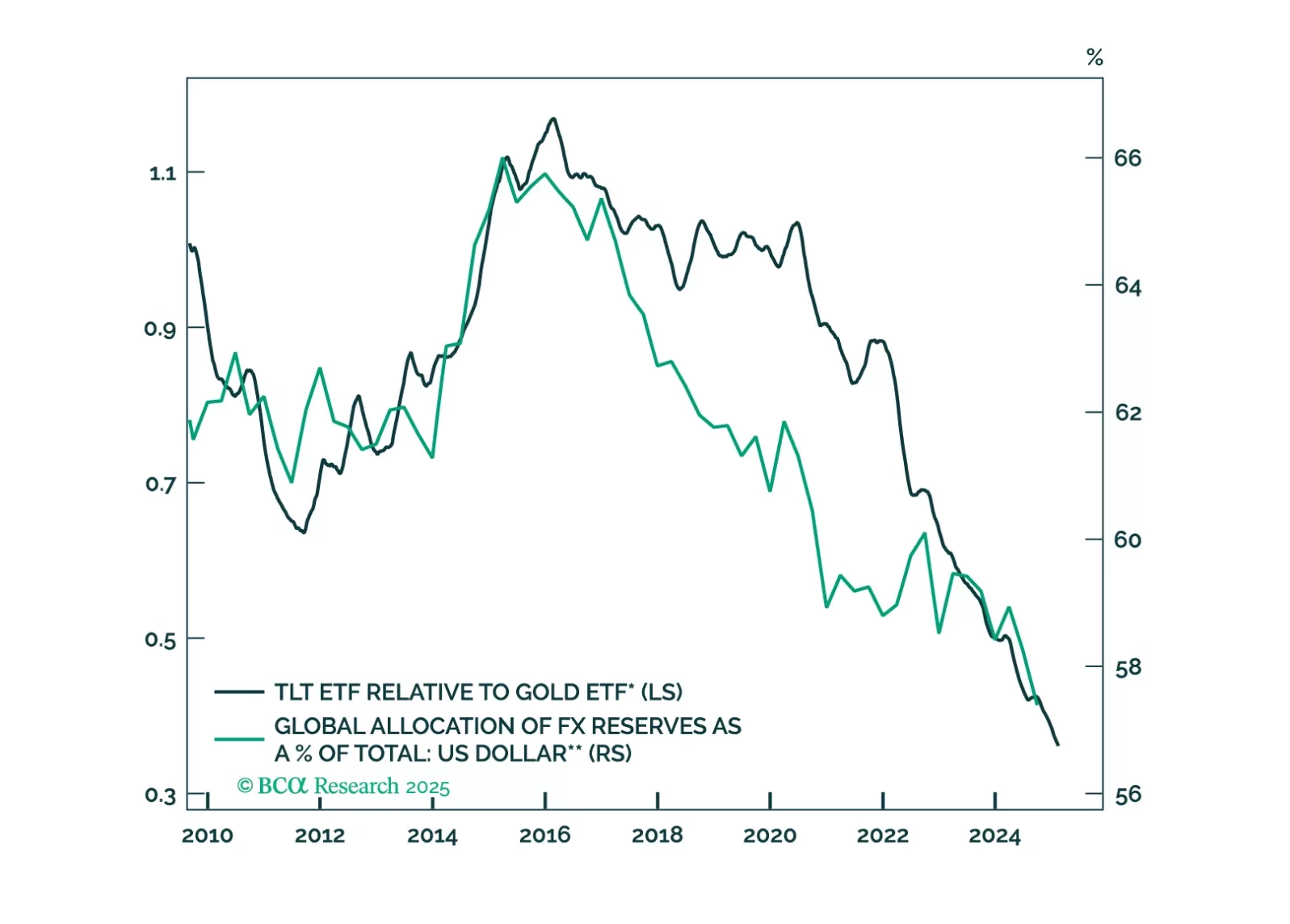

In lieu of all the geopolitical and economic news in media, this report looks at where next the dollar is likely to trend in the next one-to-three months. Our view is down, though on a cyclical horizon (six-to-twelve months), we…

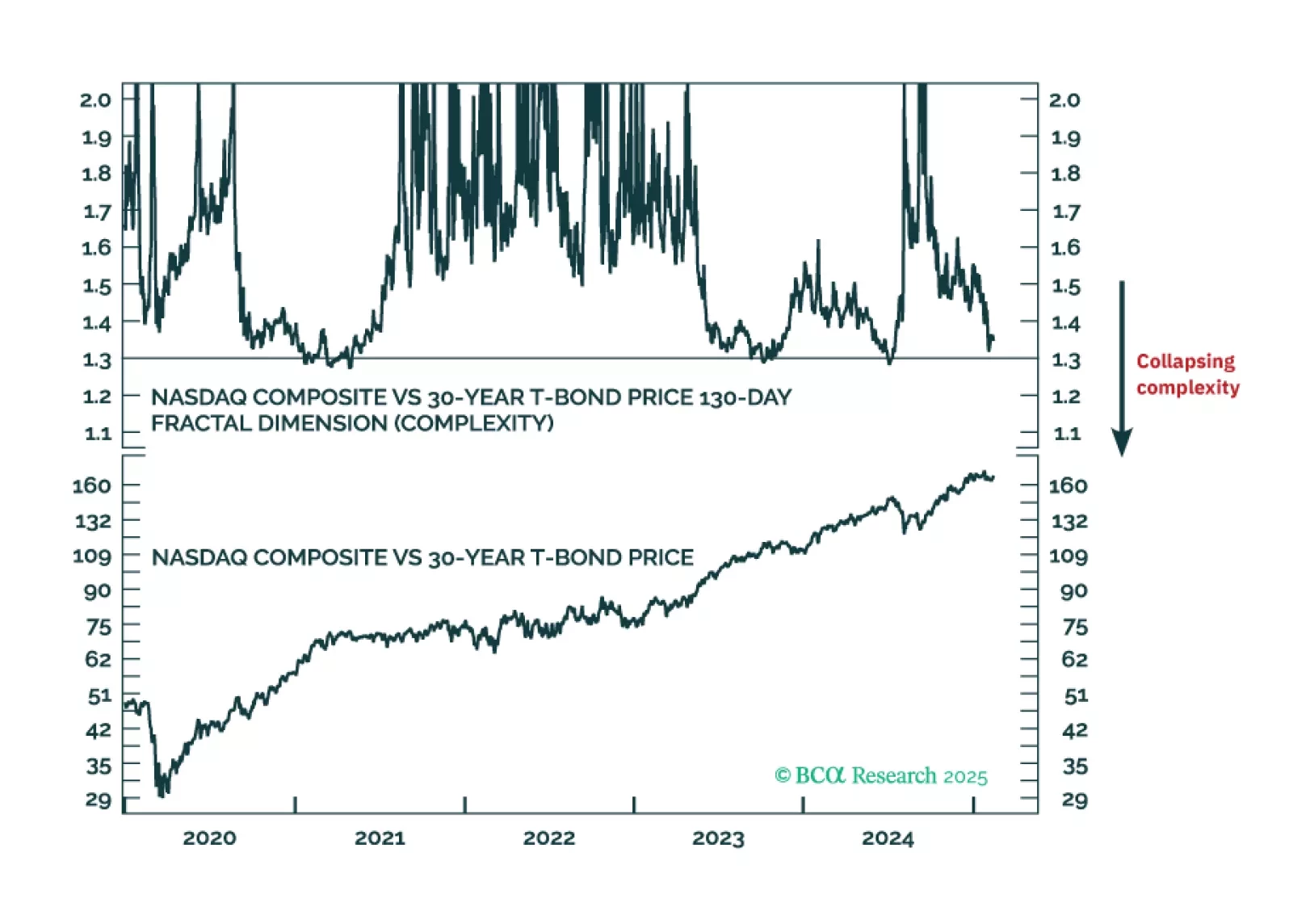

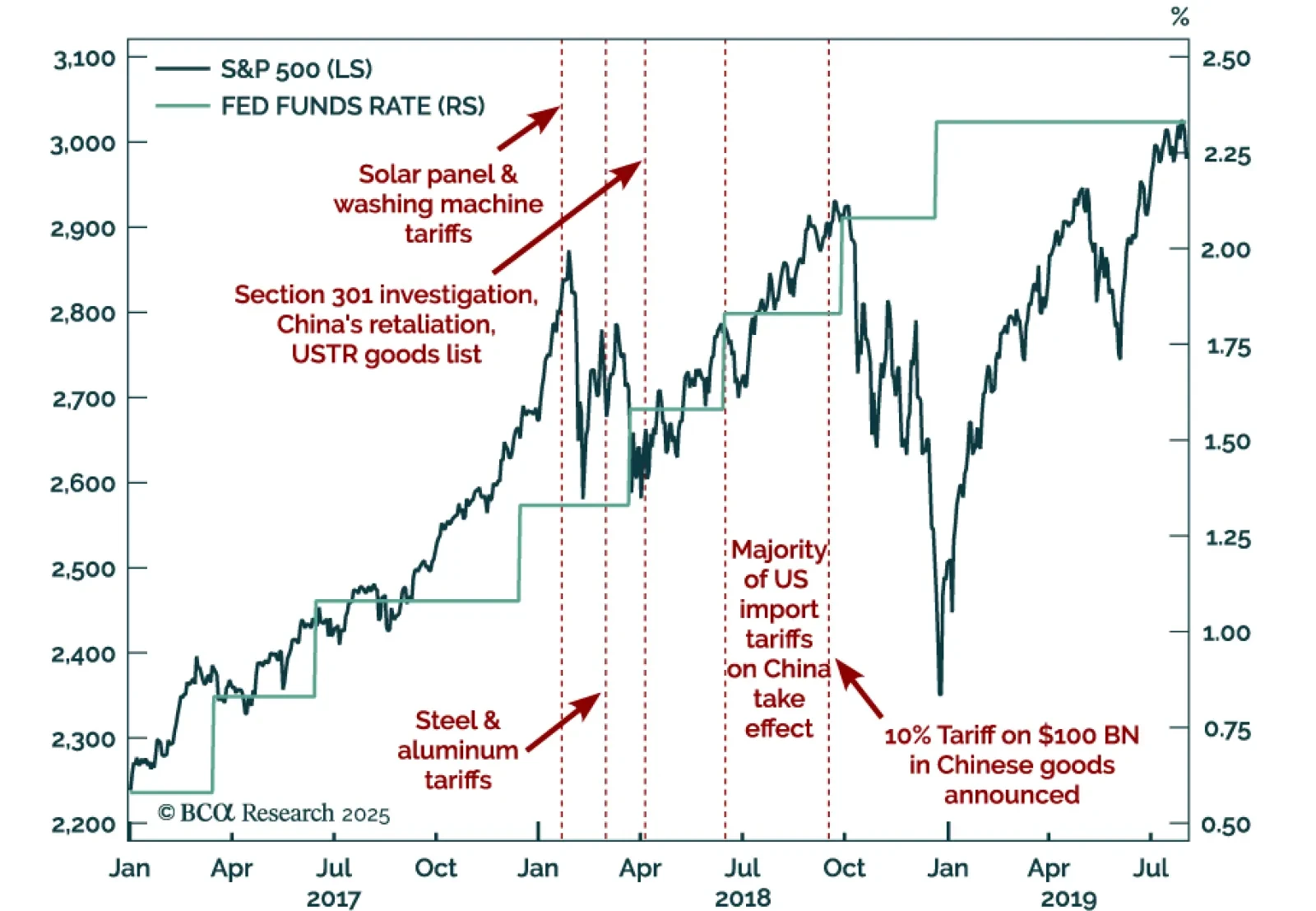

Our Chart Of The Week comes from Jonathan LaBerge, Chief Strategist for our Special Reports Unit. Jonathan asks whether investors should be encouraged by the fact stocks are shrugging off US tariffs. The answer is no, because…

While inflation concerns prevail in the US, Swiss inflation hit its lowest level in almost four years. Headline CPI contracted 0.1% m/m in January, leaving the annual inflation rate at 0.4%, near the bottom of the Swiss National Bank…

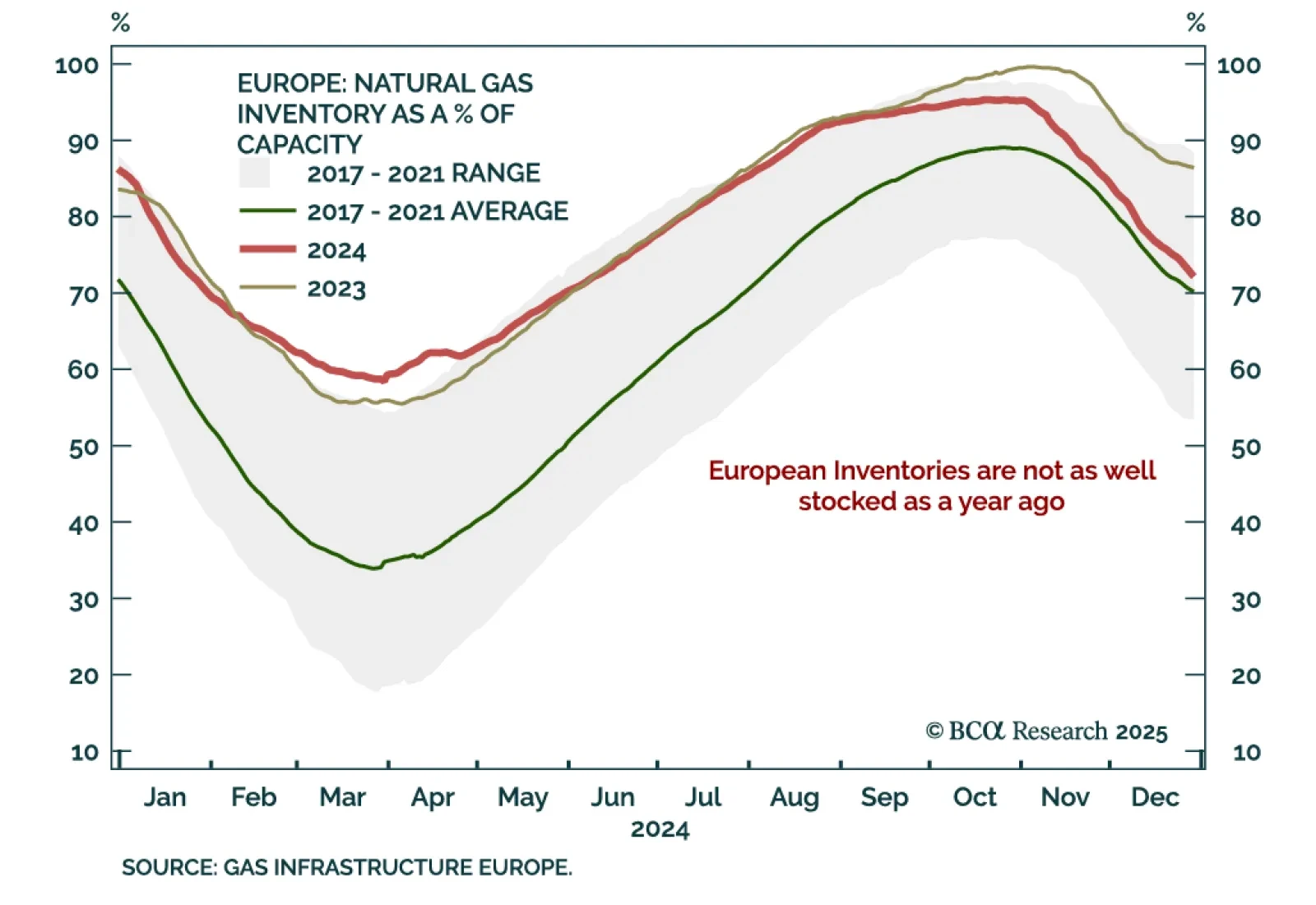

As a push for Russia-Ukraine peace talks emerges, energy prices are easing. Reduced geopolitical risk and the potential lifting of sanctions on Russia would be a headwind for oil and European natural gas prices. Should investors bet…

If the 130-day complexity of the Nasdaq versus 30-year T-bond collapsed to 1.30, it would signal the risk of a -20 percent market slump. This indicator, at 1.37, is not yet at critical, but we recommend that you keep a close eye on…

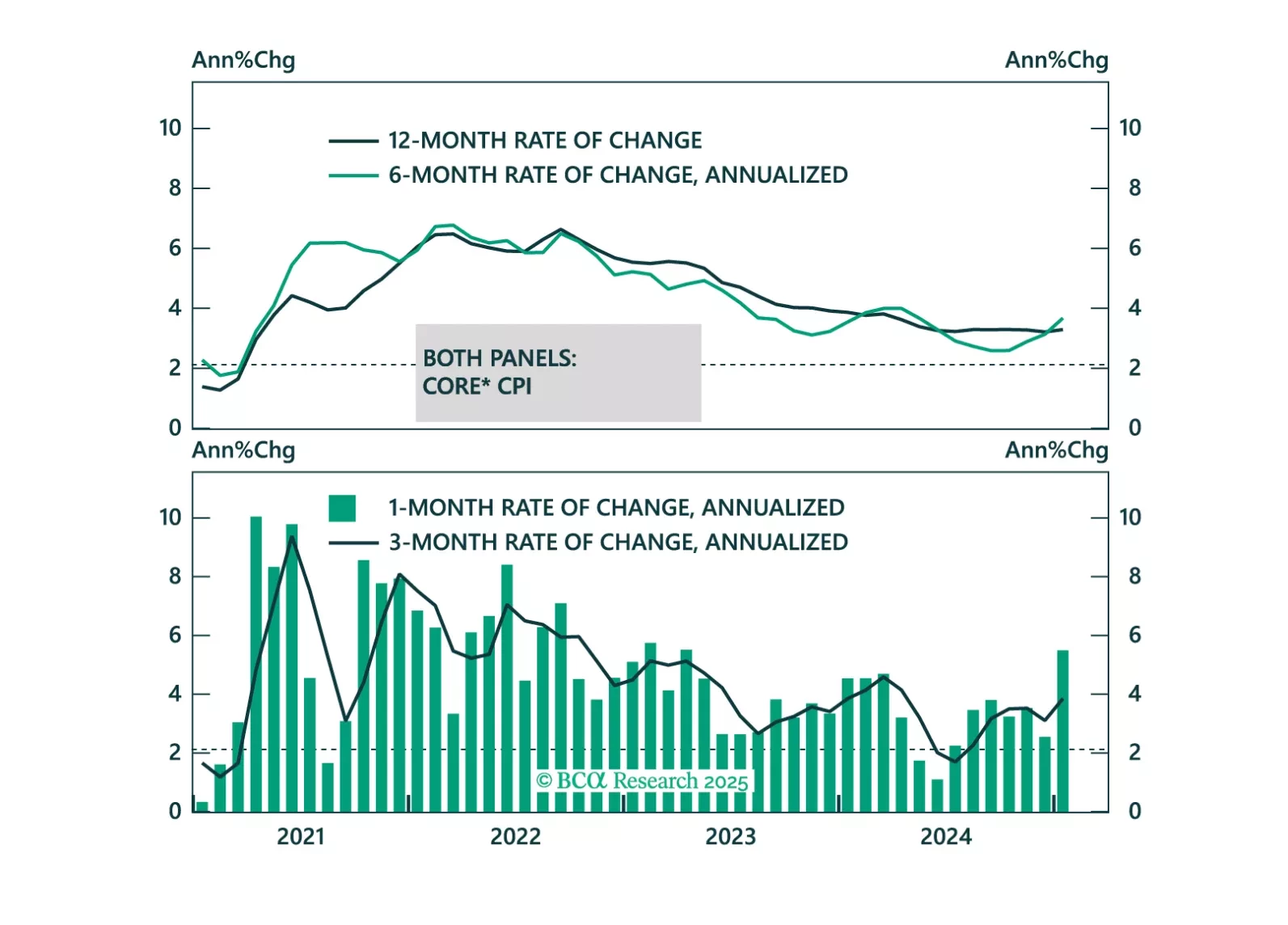

Some thoughts on this morning’s CPI report and its implications for the Fed and Treasury yields.