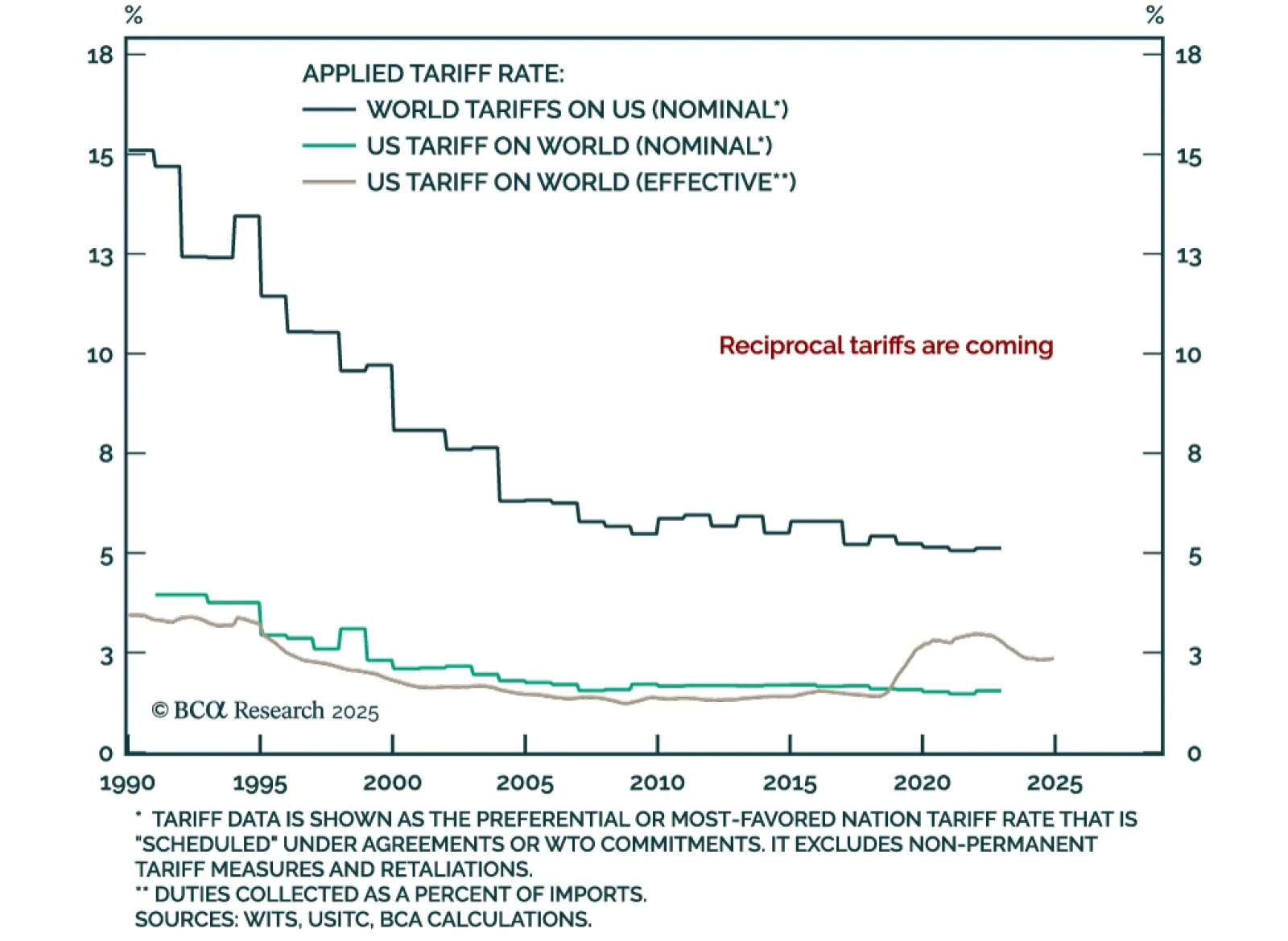

The Trump administration launched its biggest trade action on Tuesday, levying 25% tariffs on Canadian and Mexican goods, and an additional 10% to current tariffs on Chinese imports. Given its crucial role in US supply chains,…

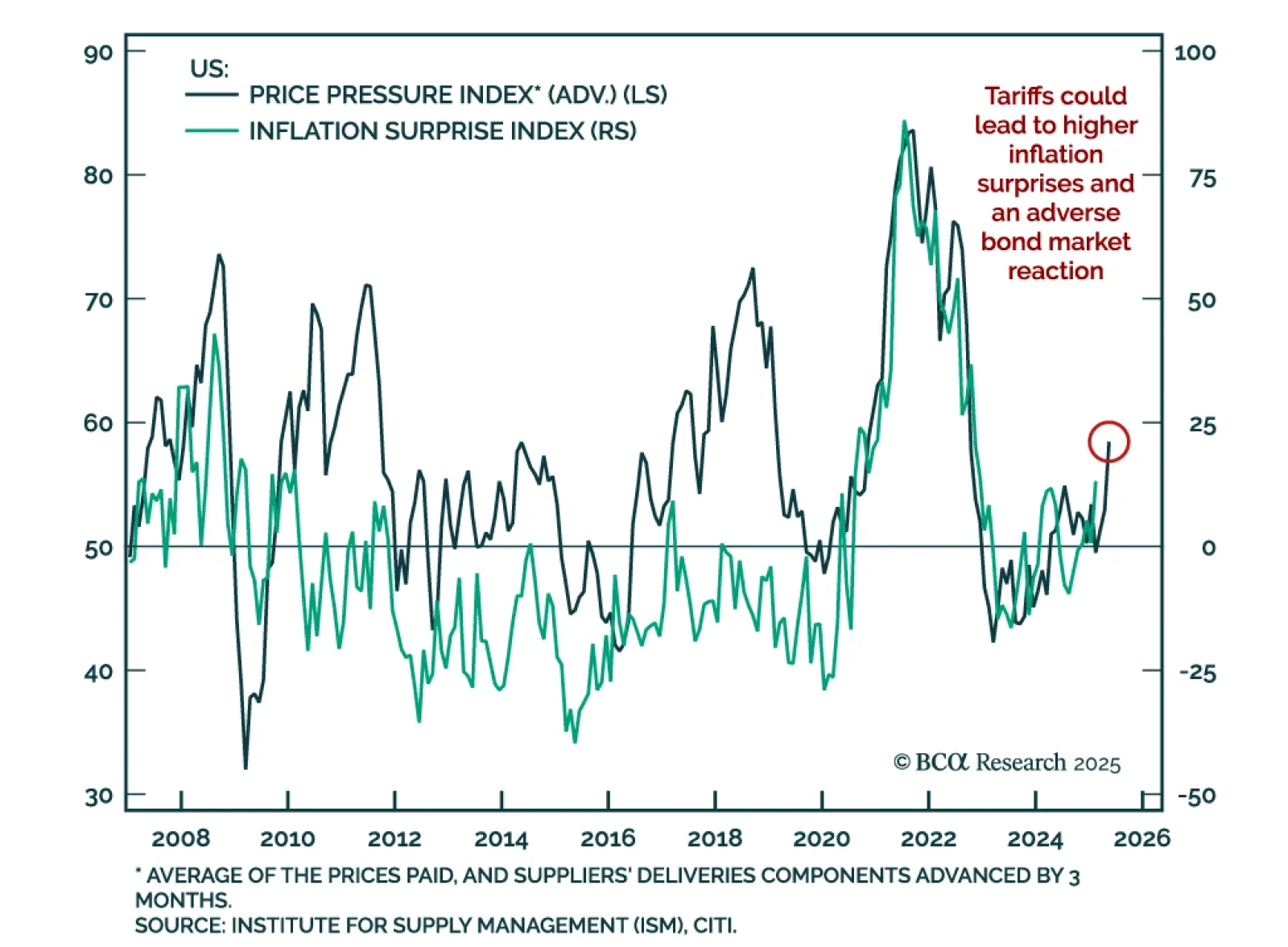

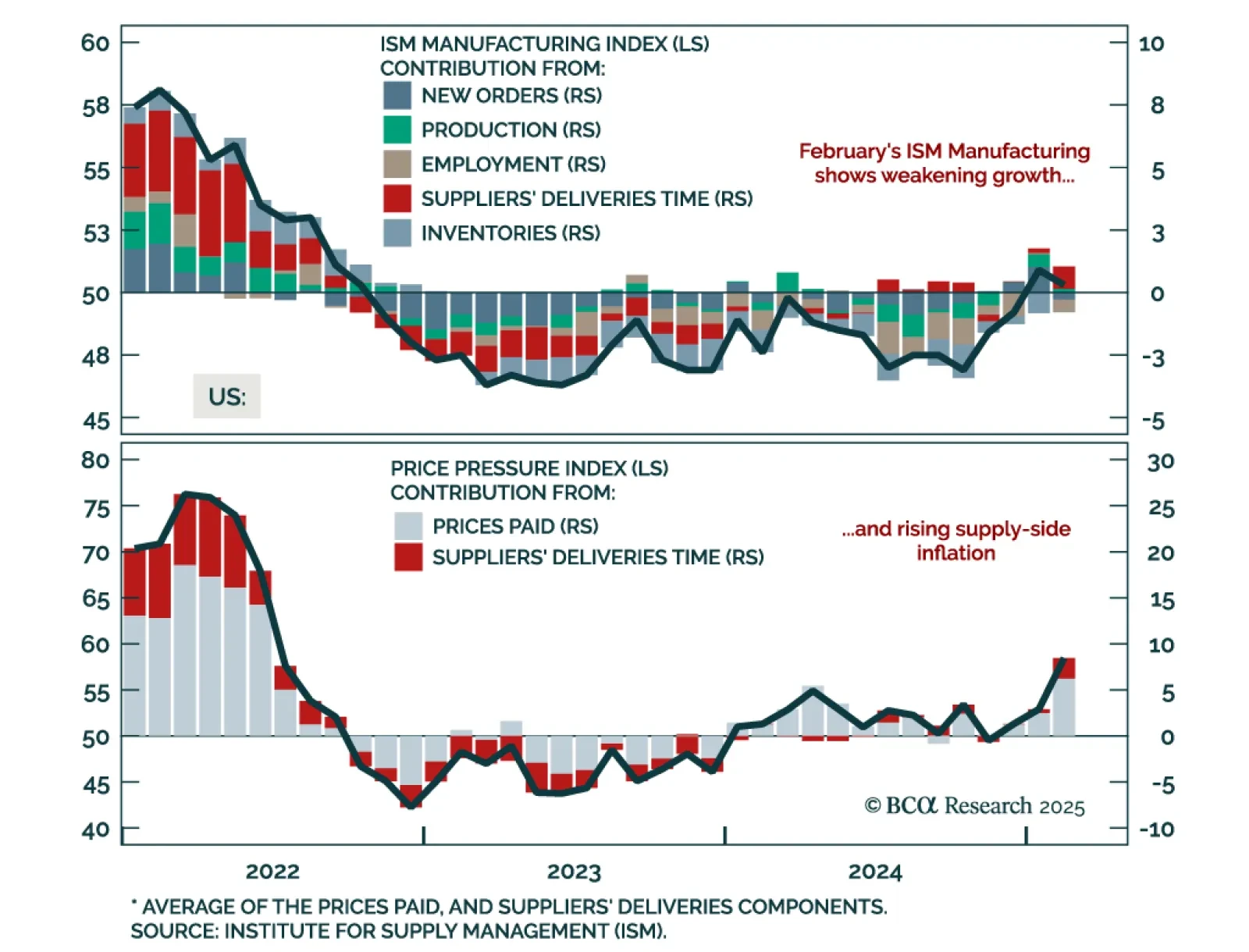

Leading US growth indicators have slowed, with economic surprises now in negative territory. However, Monday’s ISM Manufacturing showed that while activity is slowing due to tariffs uncertainty, supply-side price pressures are…

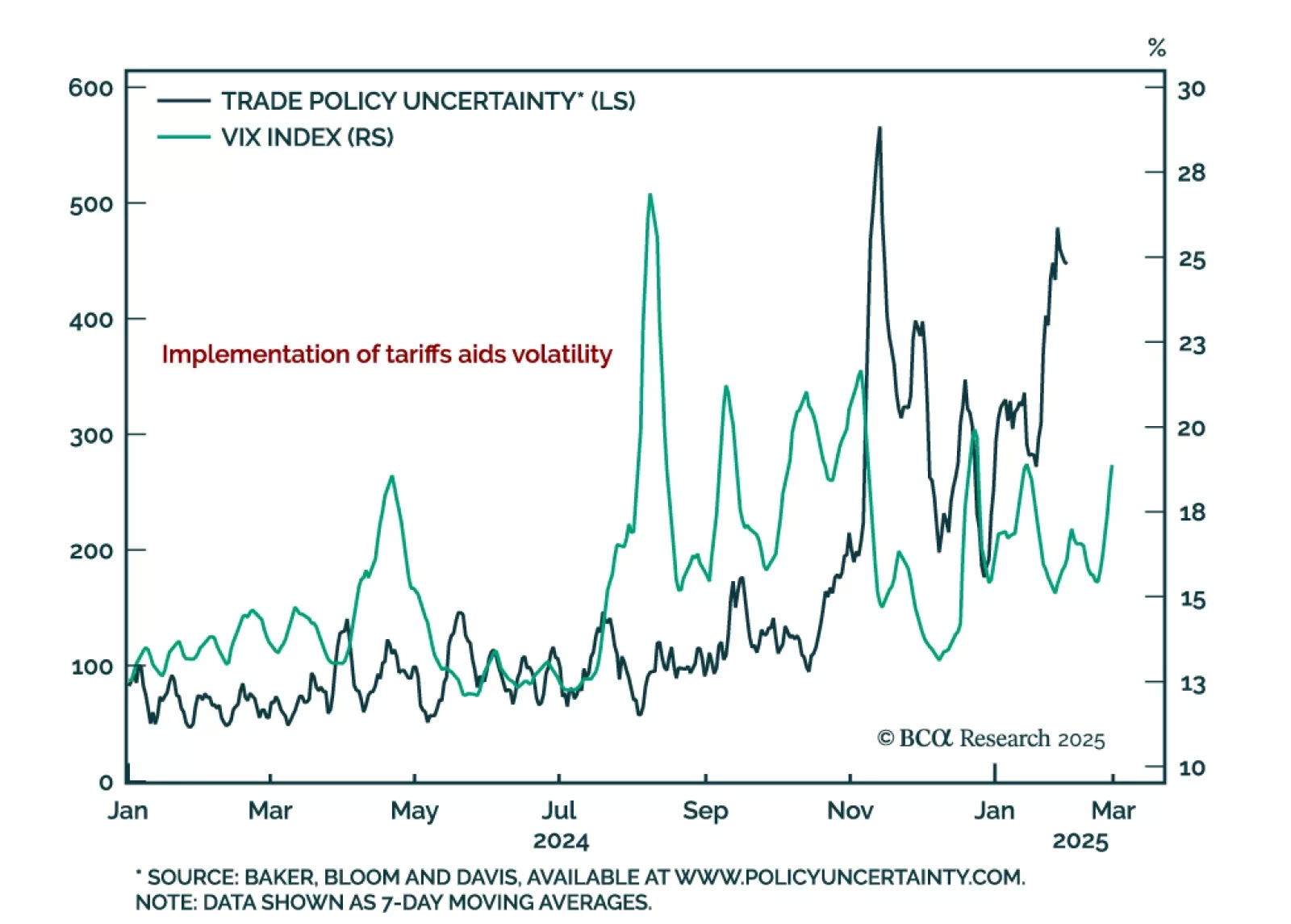

Our Geopolitical strategists received a lot of client questions following rapid US political developments, and addressed them in their latest report. US policy uncertainty is spiking, driving global uncertainty higher. Tariff…

February flash inflation for the Eurozone was slightly hotter than expected but nonetheless declined, with both headline and core inflation falling 0.1% to 2.4% y/y and 2.6%, respectively. Services inflation also declined to 3.7%…

The February ISM Manufacturing index was weaker than expected, declining to 50.3 from 50.9. New orders plunged to 48.6 from 55.1, with employment also contracting. Price pressures however increased. Prices paid and suppliers’…

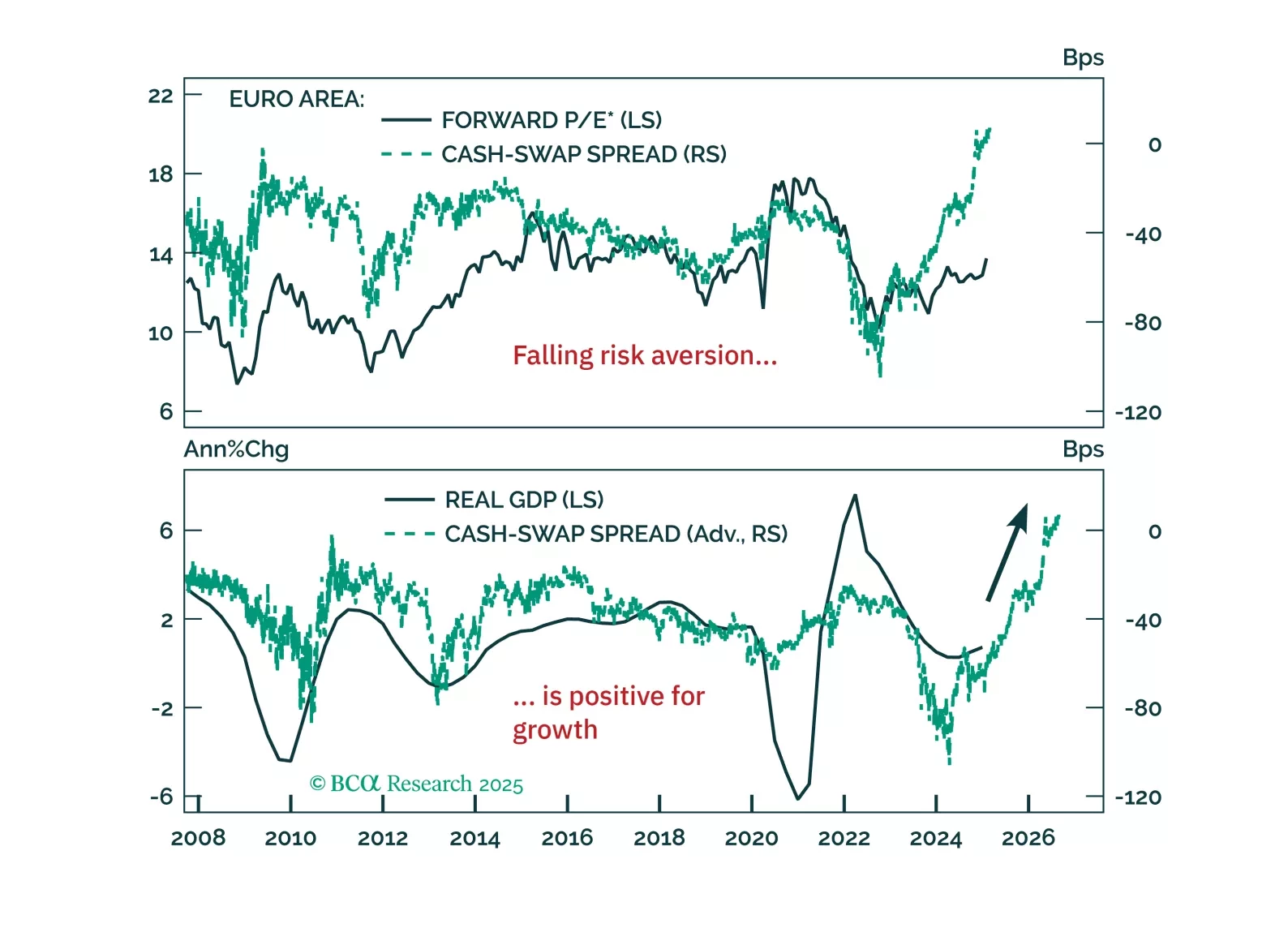

Europe’s resilience to global liquidity deterioration isn’t a fluke—it signals a structural shift. Our latest report explains why the decline in precautionary money demand marks the end of Europe’s liquidity trap and what it means…

Our Bank Credit Analyst strategists published their latest monthly report, and Section II aims to assess whether AI is leading to a productivity increase. Our colleagues remain unconvinced that Generative AI is a true…

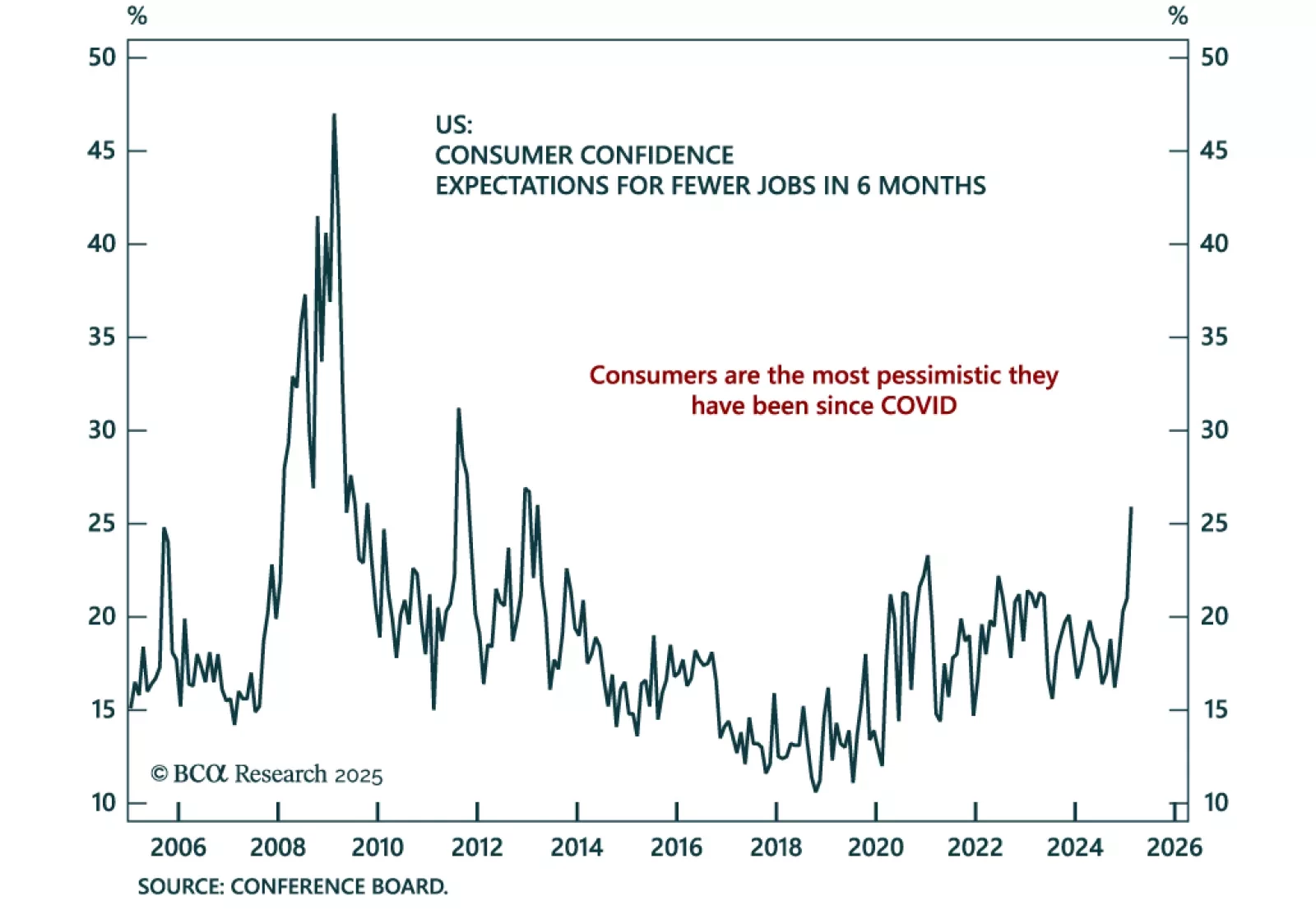

Our Chart Of The Week comes from Juan Correa, from our Global Asset Allocation (GAA) strategy service. Juan highlights weakening US growth observed in the data lately. We have seen a few growth slowdown episodes since 2022…

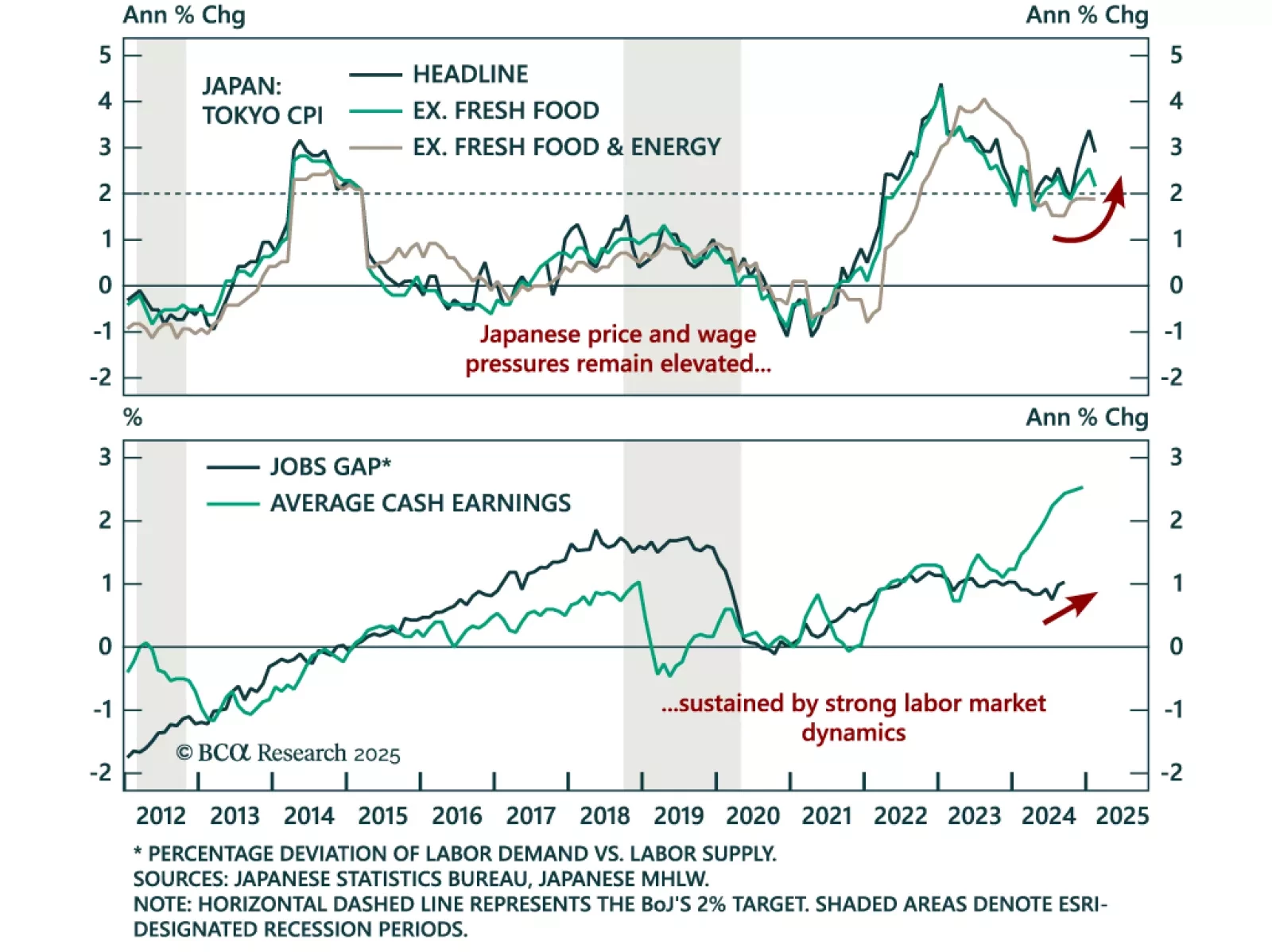

The February Tokyo CPI print came in slightly cooler than expected. Headline inflation moderated to 2.9% y/y from 3.4%, while “core core” was steady at 1.9%. The Tokyo CPI gives an advance reading on national price pressures,…

January PCE inflation was in line with expectations, with headline and core inflation rising 0.3% m/m, leaving the respective annual growth rates at 2.5% and 2.6%, near the Fed’s projection for 2025. Consumer spending missed…