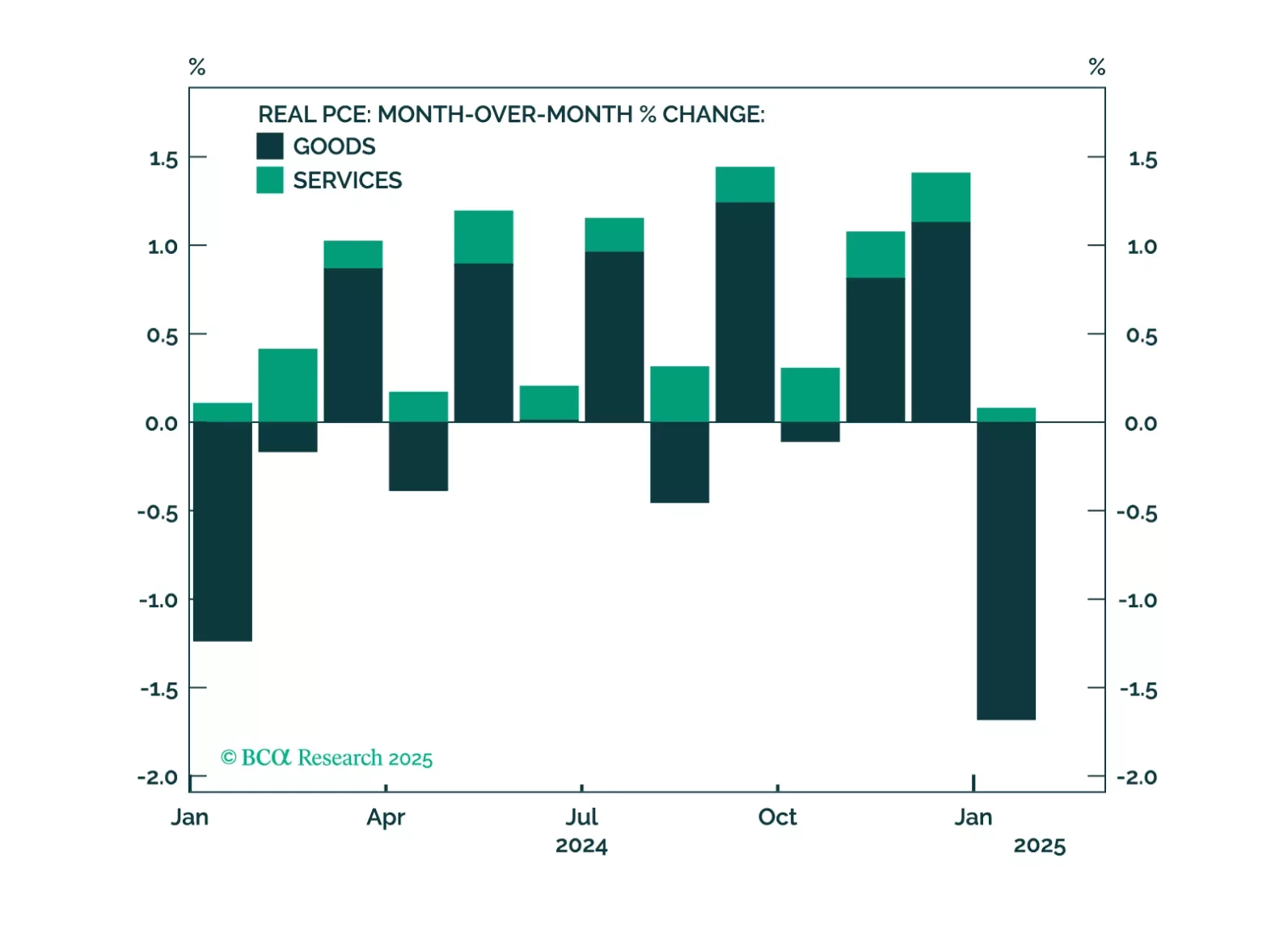

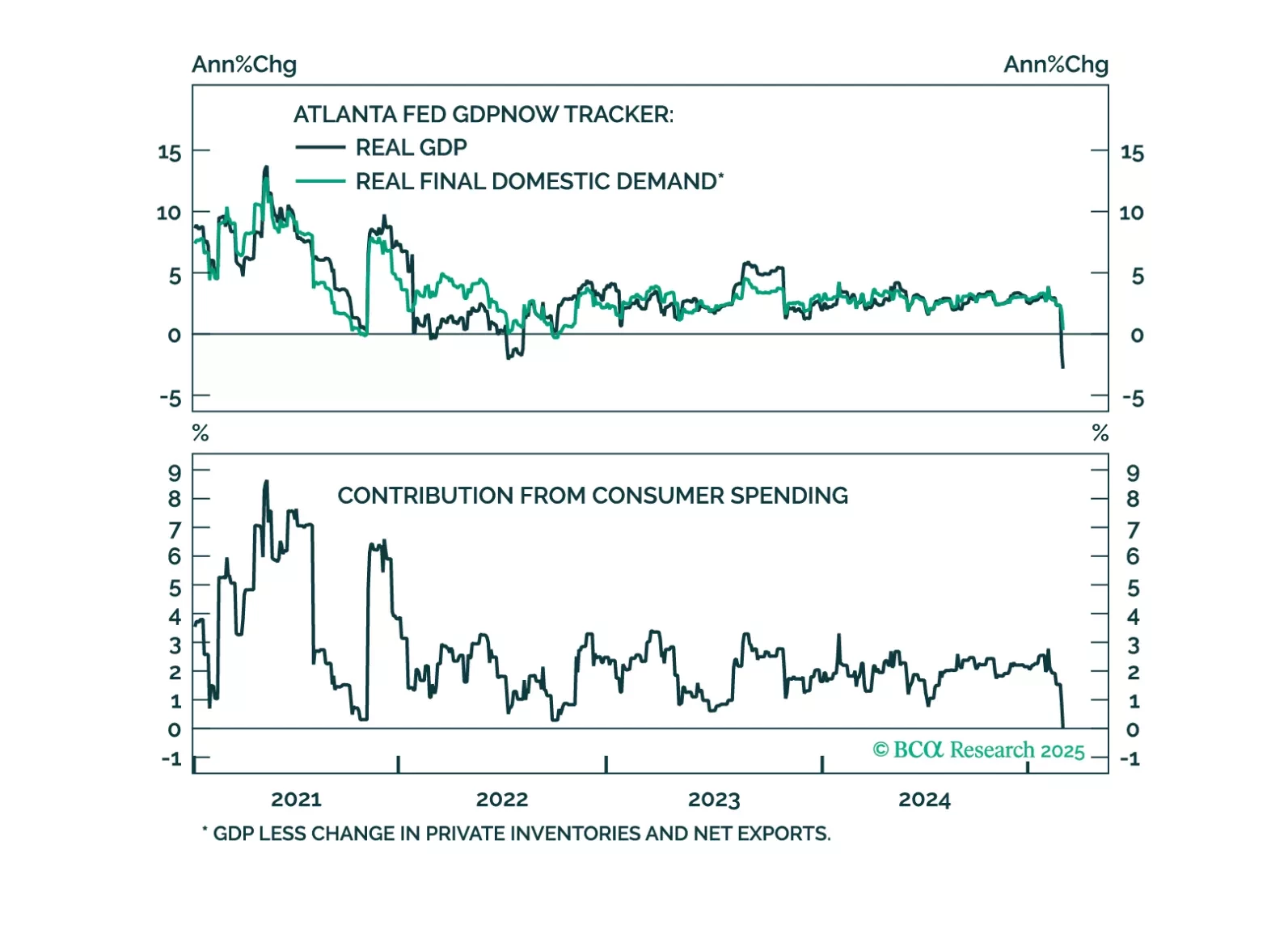

This morning’s employment report showed solid job growth, but recent consumer spending indicators are more concerning. The risk of recession starting within the next few months has increased. We suggest some important indicators for…

The US economy is set to enter a recession within the next few months. Stay underweight equities and overweight cash. Look to increase fixed-income duration exposure over the coming months. The euro is likely to strengthen and…

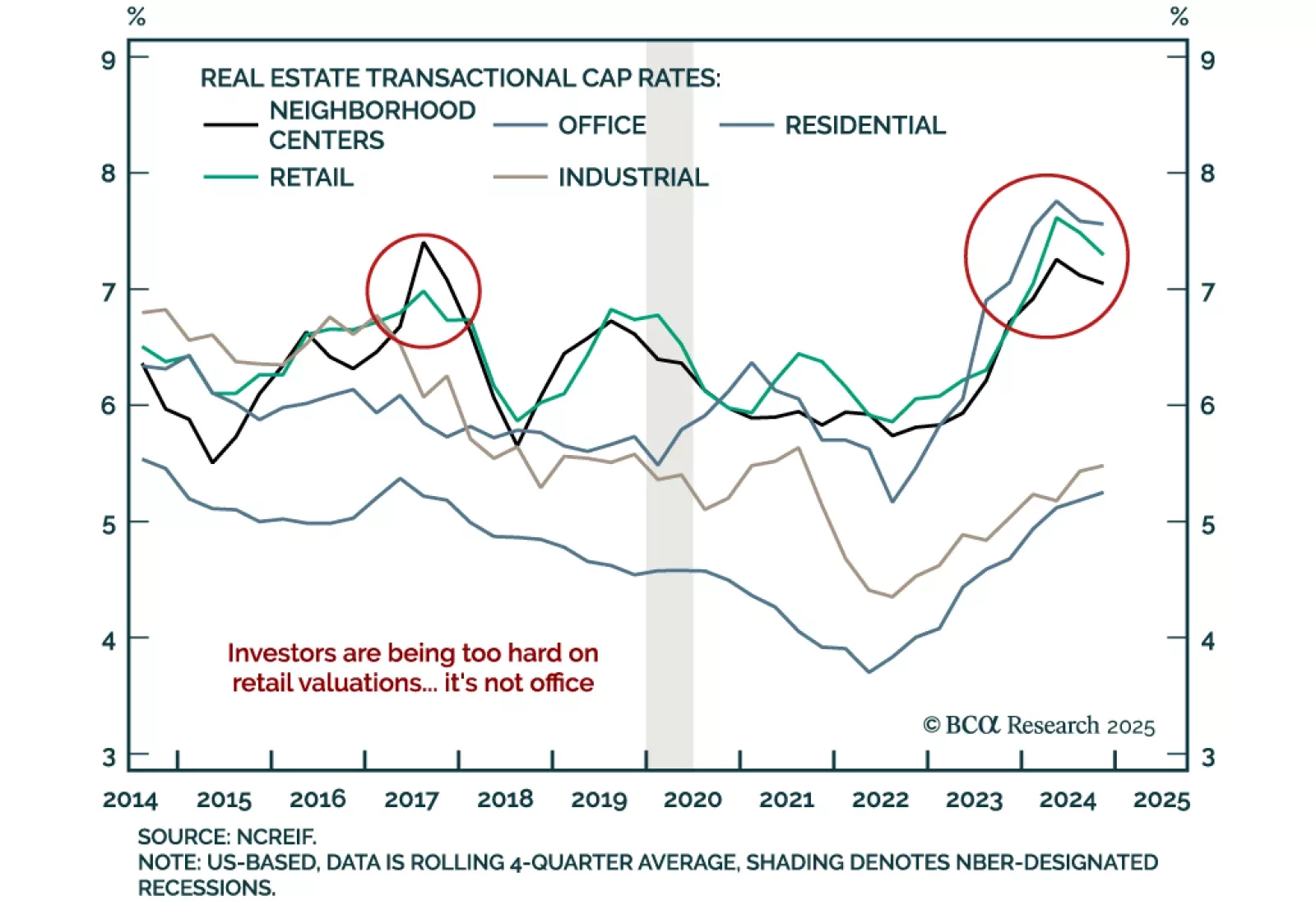

Our Private Markets & Alternatives strategists assessed retail real estate opportunities. Retail Real Estate is a contrarian opportunity, with investor sentiment at rock-bottom levels despite shifting consumption patterns.…

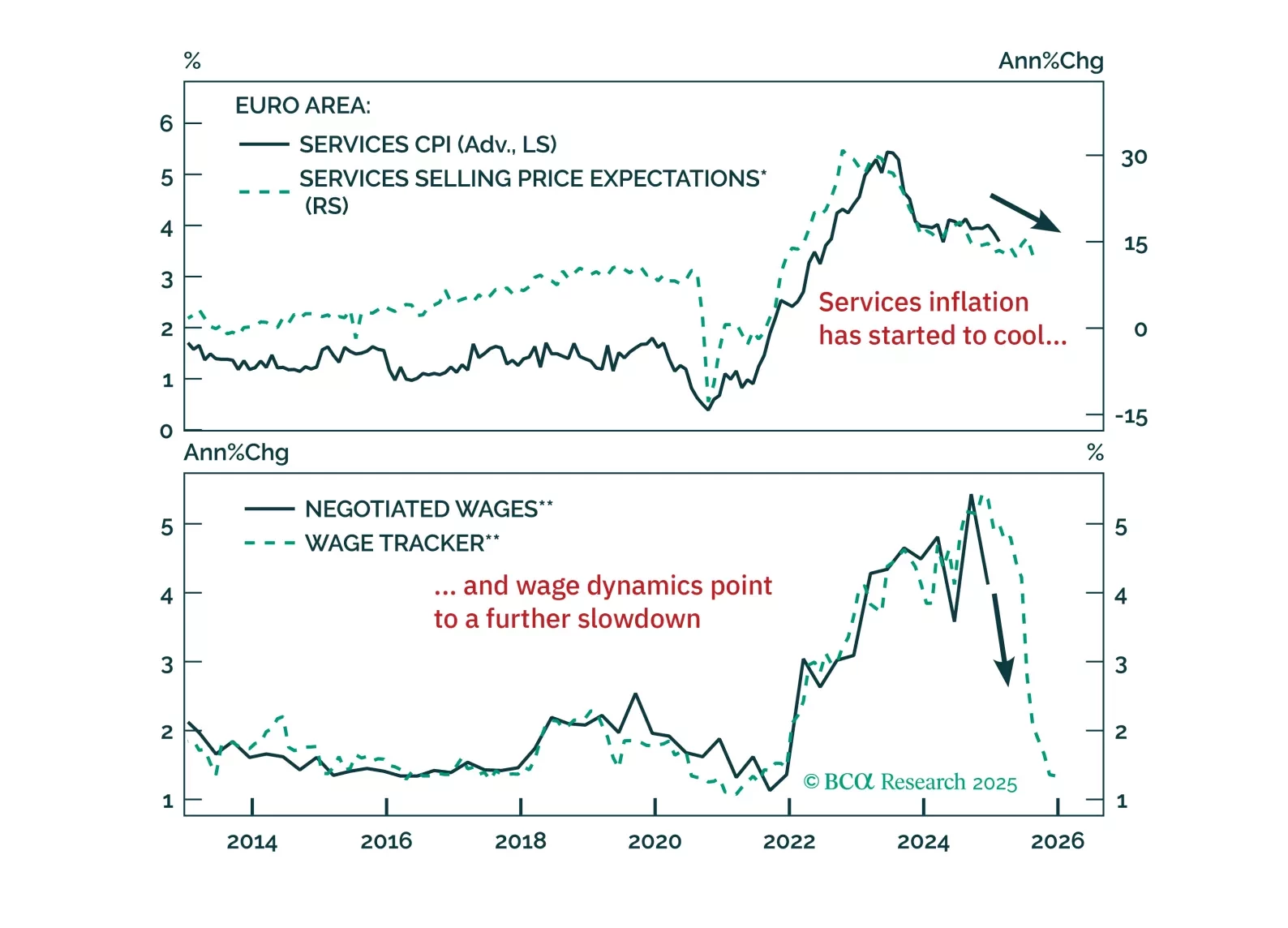

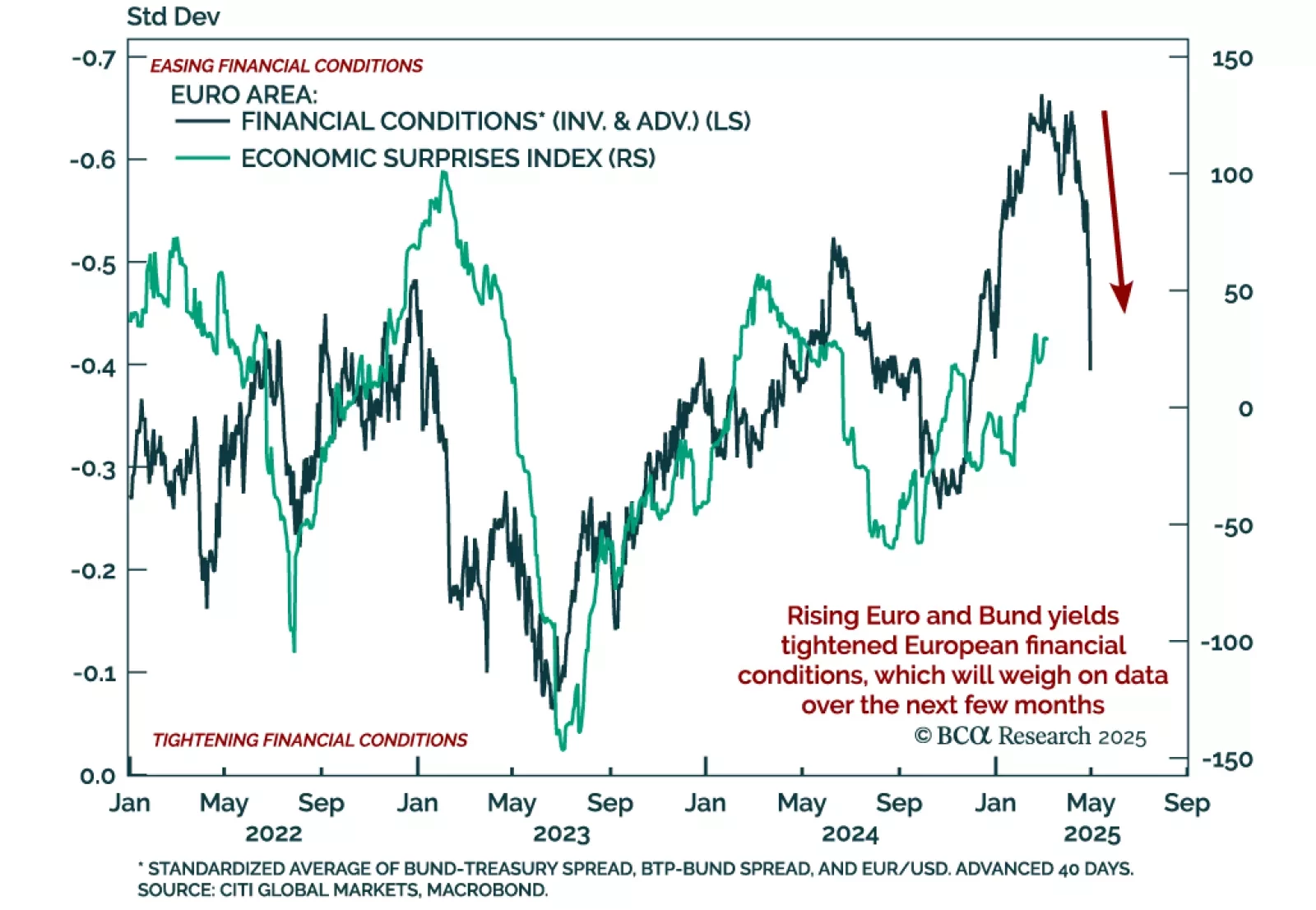

The ECB cut 25 bps as expected, bringing the deposit facility rate to 2.5%. President Lagarde reiterated the disinflationary process is “well on track” and described the policy stance as “meaningfully less restrictive”, signalling…

The ECB cut rates as expected, but rising yields and a stronger euro are tightening financial conditions just as fiscal policy shifts the macro landscape. With more rate cuts ahead and market positioning stretched, we outline the key…

Our Portfolio Allocation Summary for March 2025.

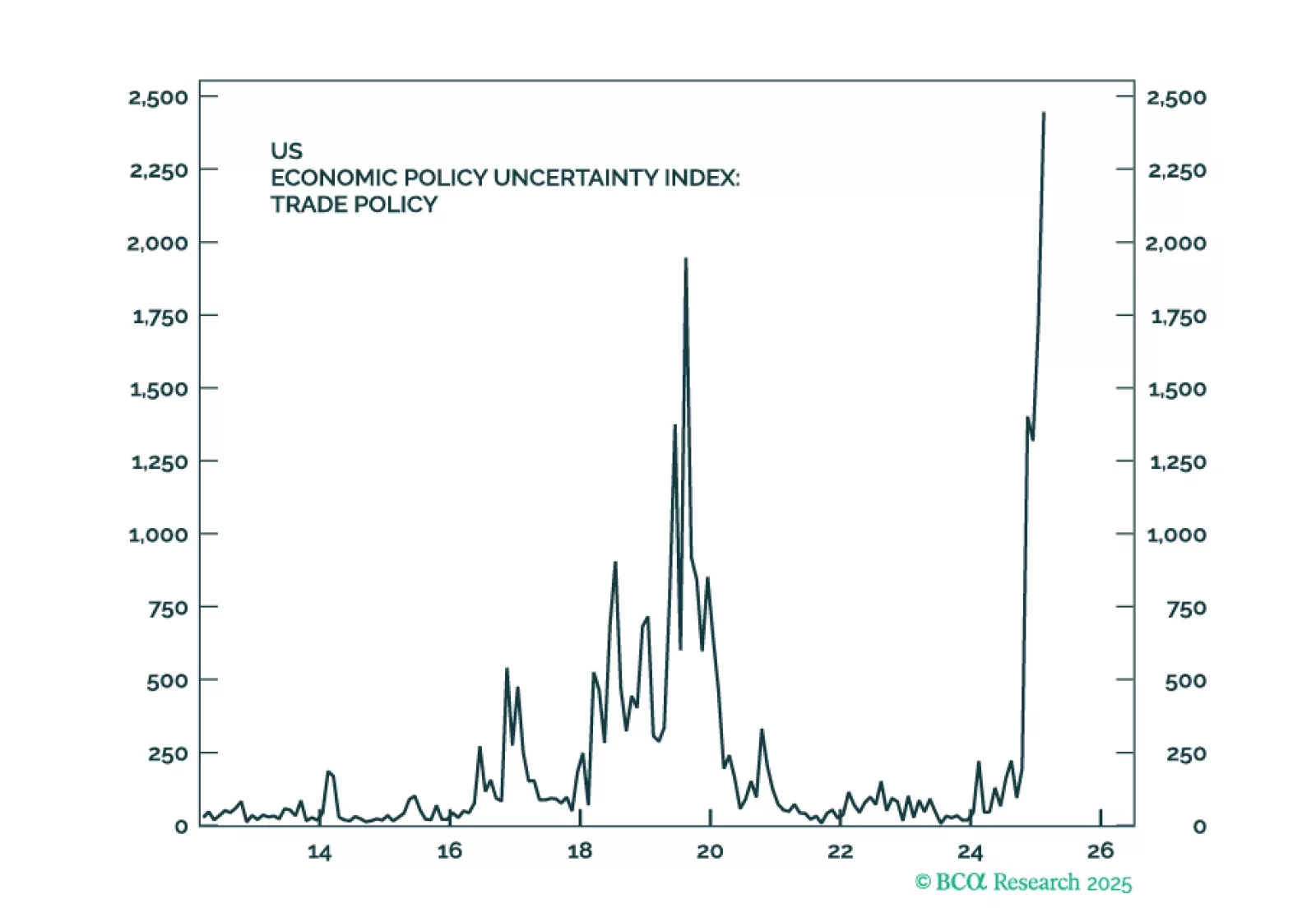

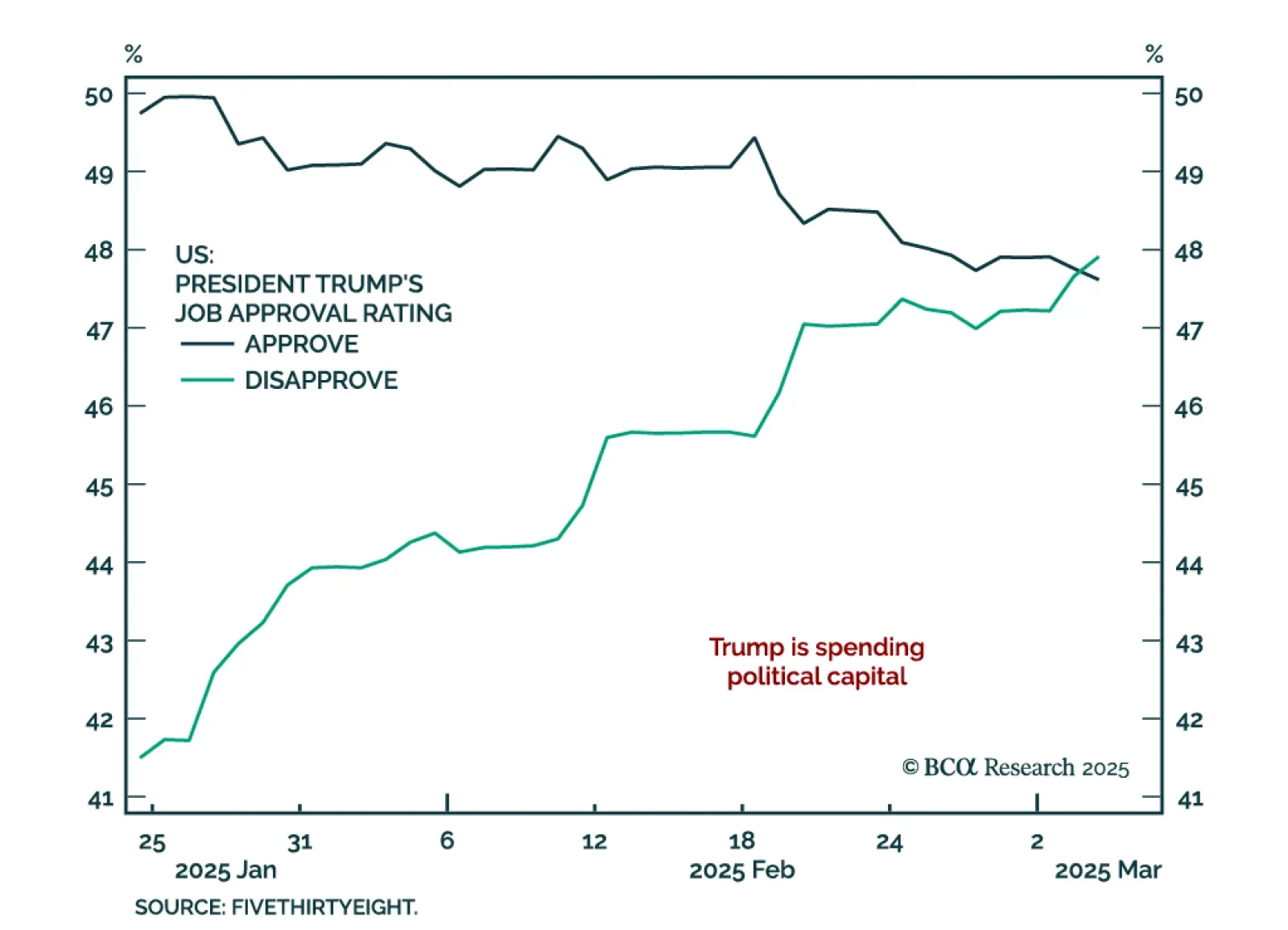

In light of President Trump’s address to Congress and the ebb-and-flow of tariff announcements, our Geopolitical strategists assessed the constraints on the administration’s disruptive agenda. Trump’s ability to implement his…

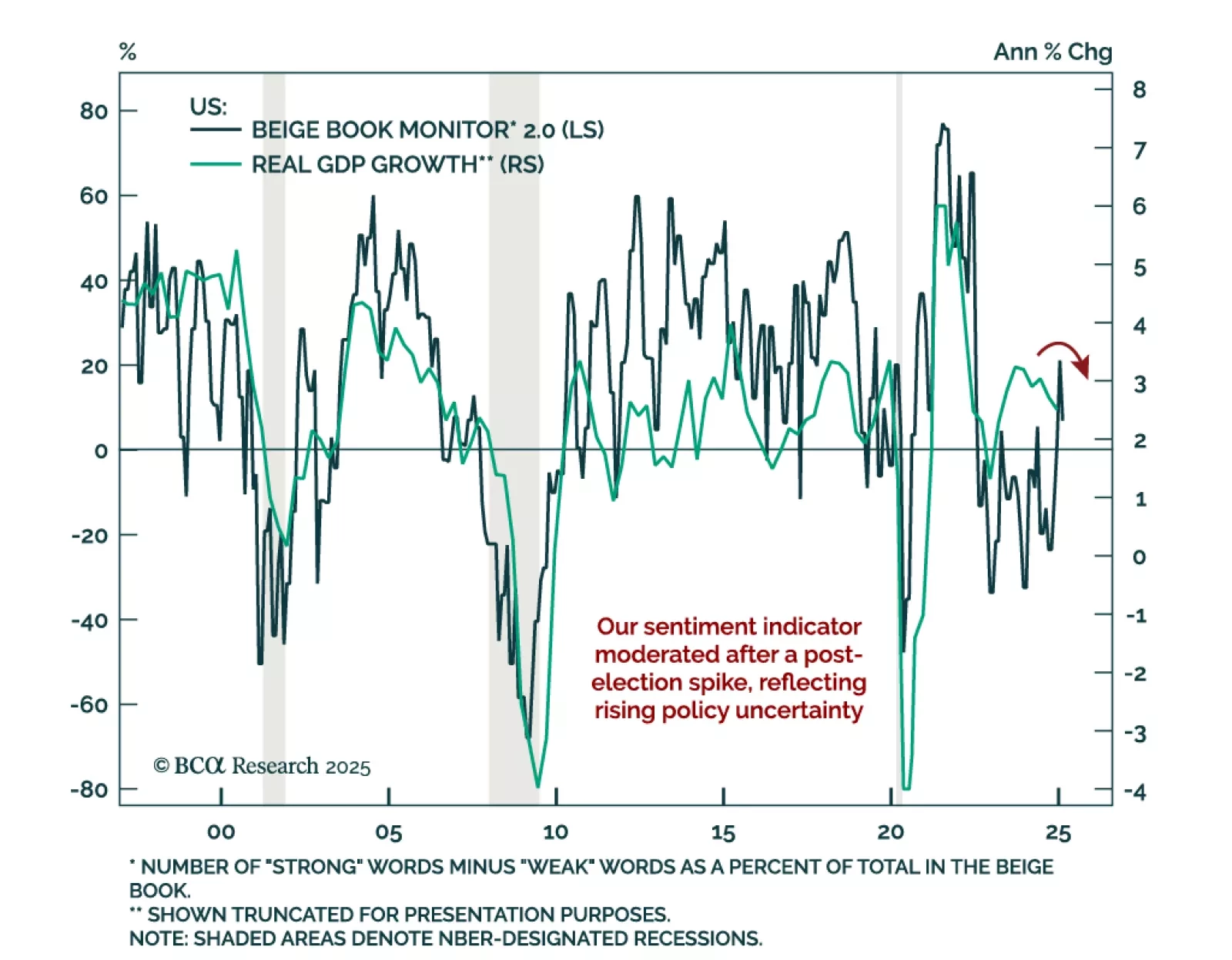

The Federal Reserve’s Beige Book shows a slowing economy, a moderating labor market, and rising price pressures. The latest Beige Book is in line with other sentiment indicators showing slower growth and decreased confidence…

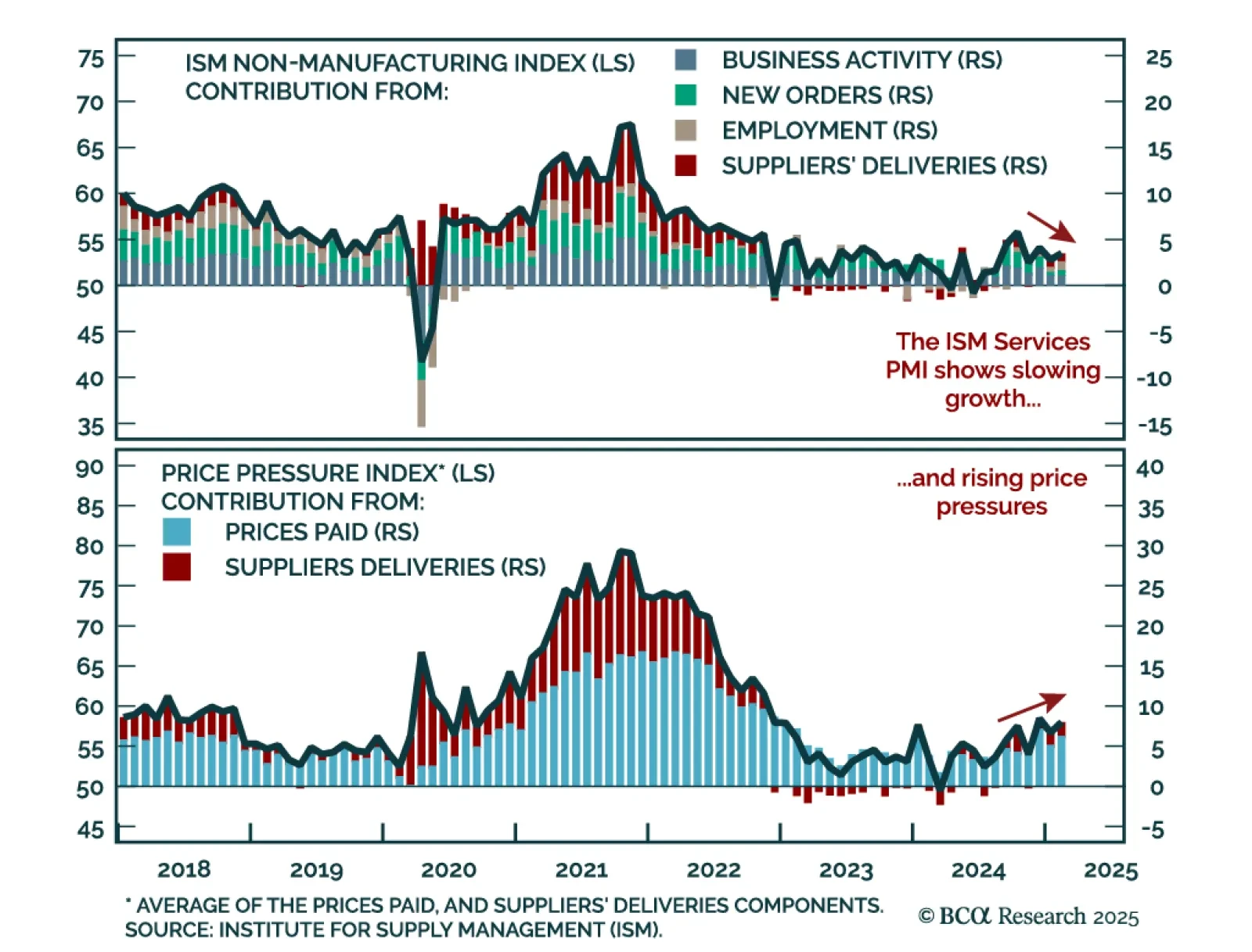

The February ISM Services beat estimates, rebounding to 53.5 from 52.8. All activity subcomponents increased, with new orders and employment ticking up. Price pressures however also increased, as prices paid went up and suppliers’…

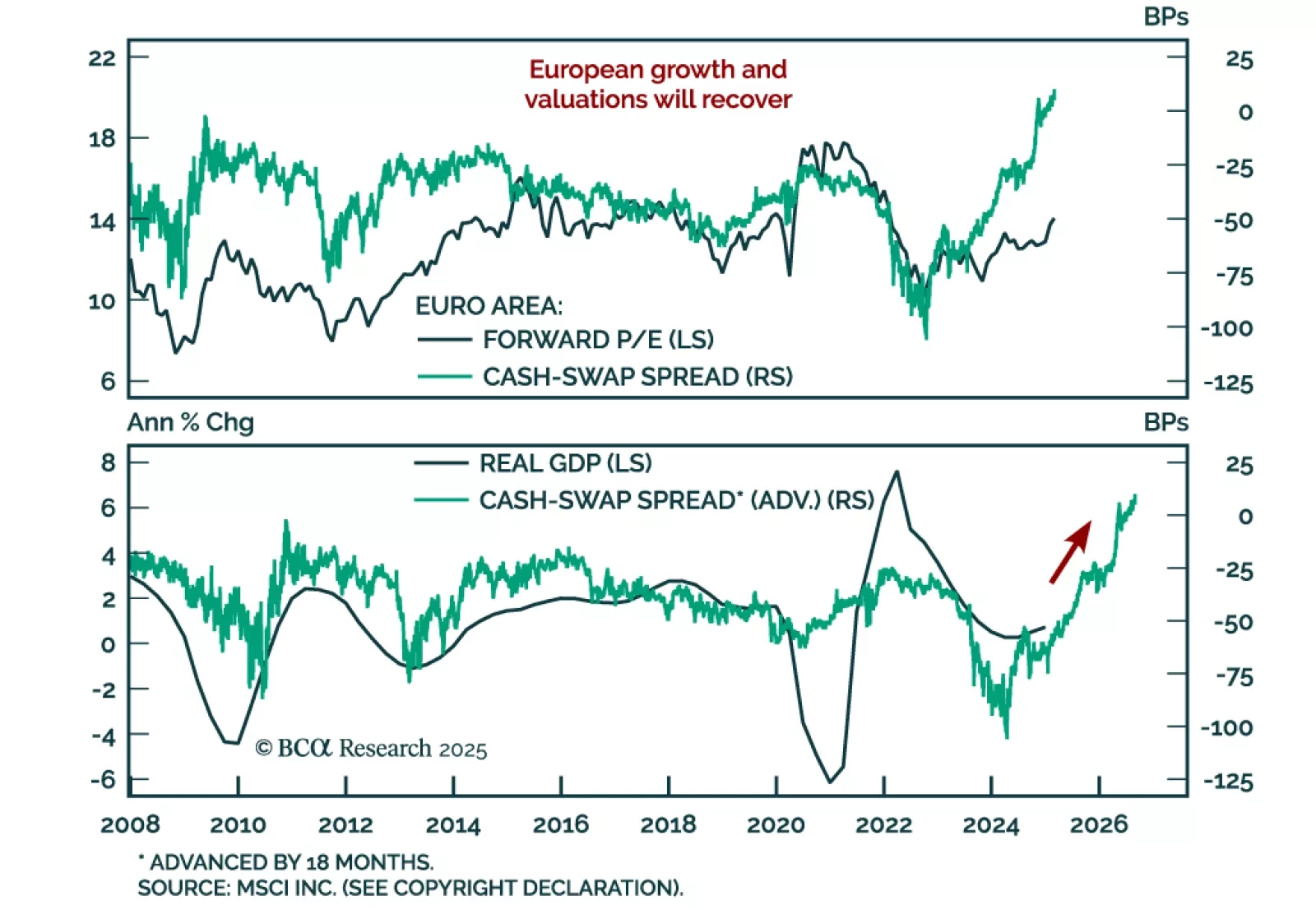

Our European strategists see Europe escaping its liquidity trap, which will create a structural tailwind for European assets. Europe’s resilience amid global shocks is supported by a shift away from precautionary money demand,…