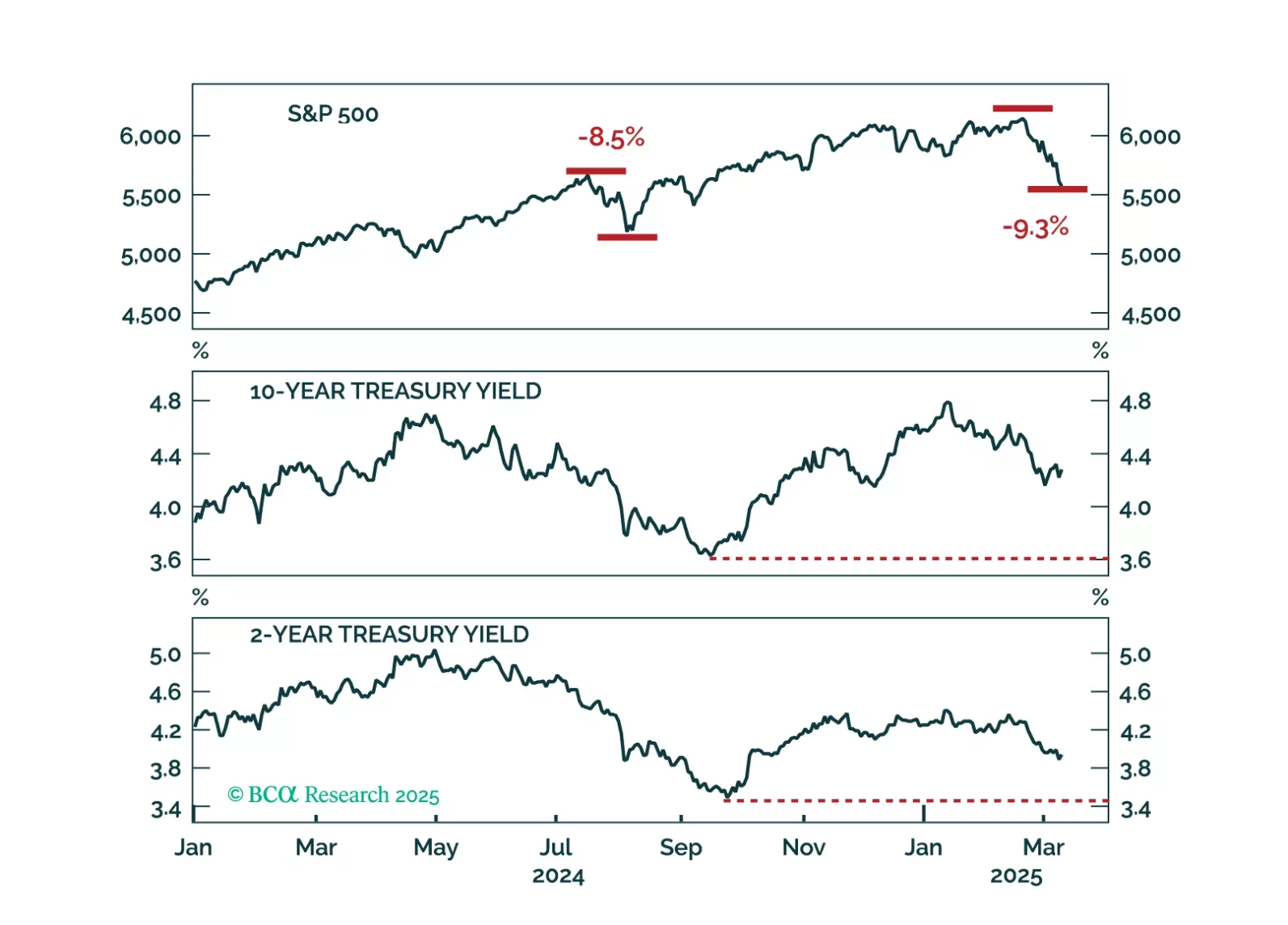

A falling stock market and sticky bond yields represent the worst of both worlds for investors. We interrogate why bond yields haven’t dropped more given the large selloff seen in equities.

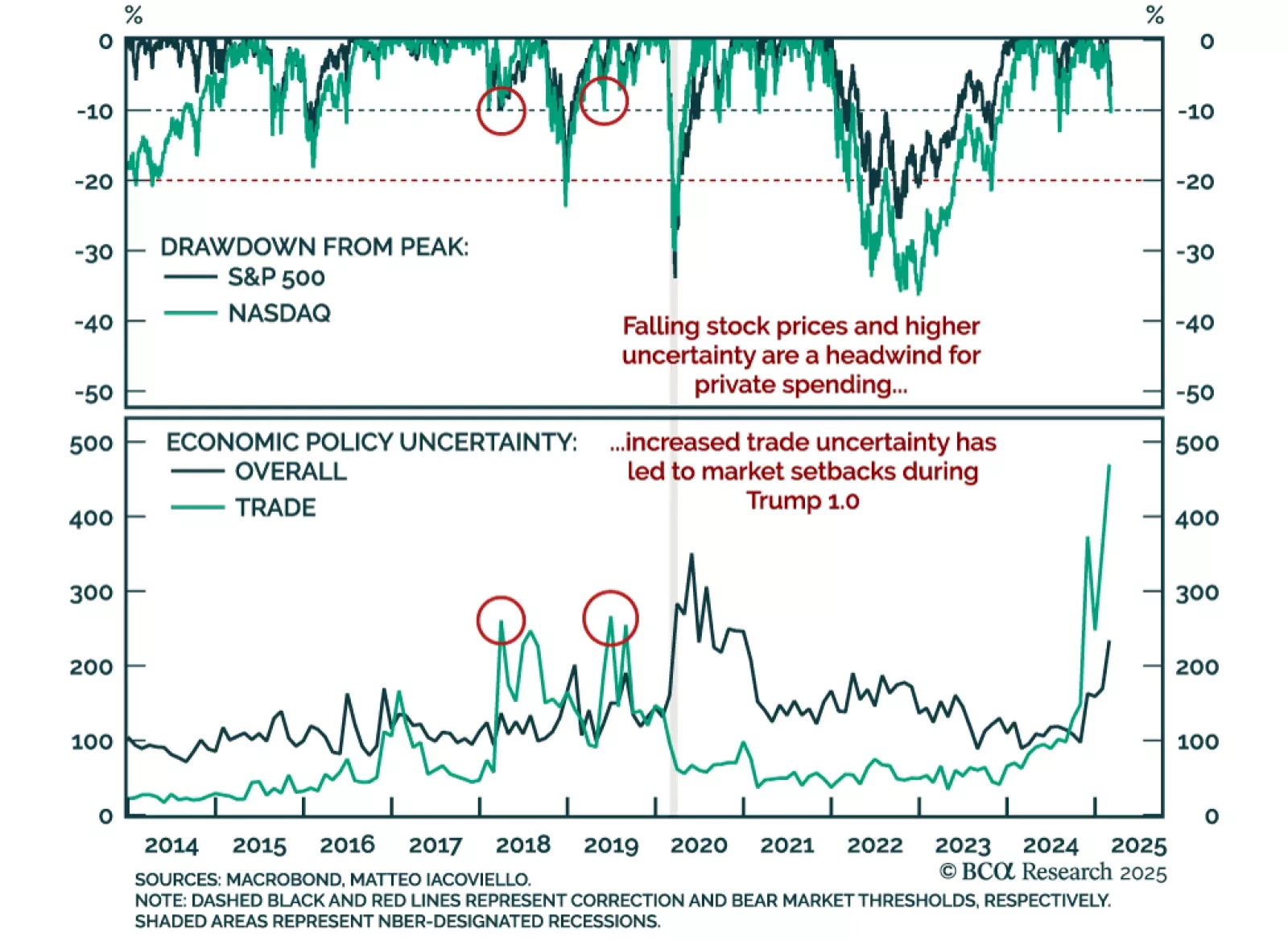

Our US investment strategists believe the Trump administration’s resolve to cut spending as well as tariff uncertainty have increased the probability of a recession.The Department of Government Efficiency’s sweeping cuts may…

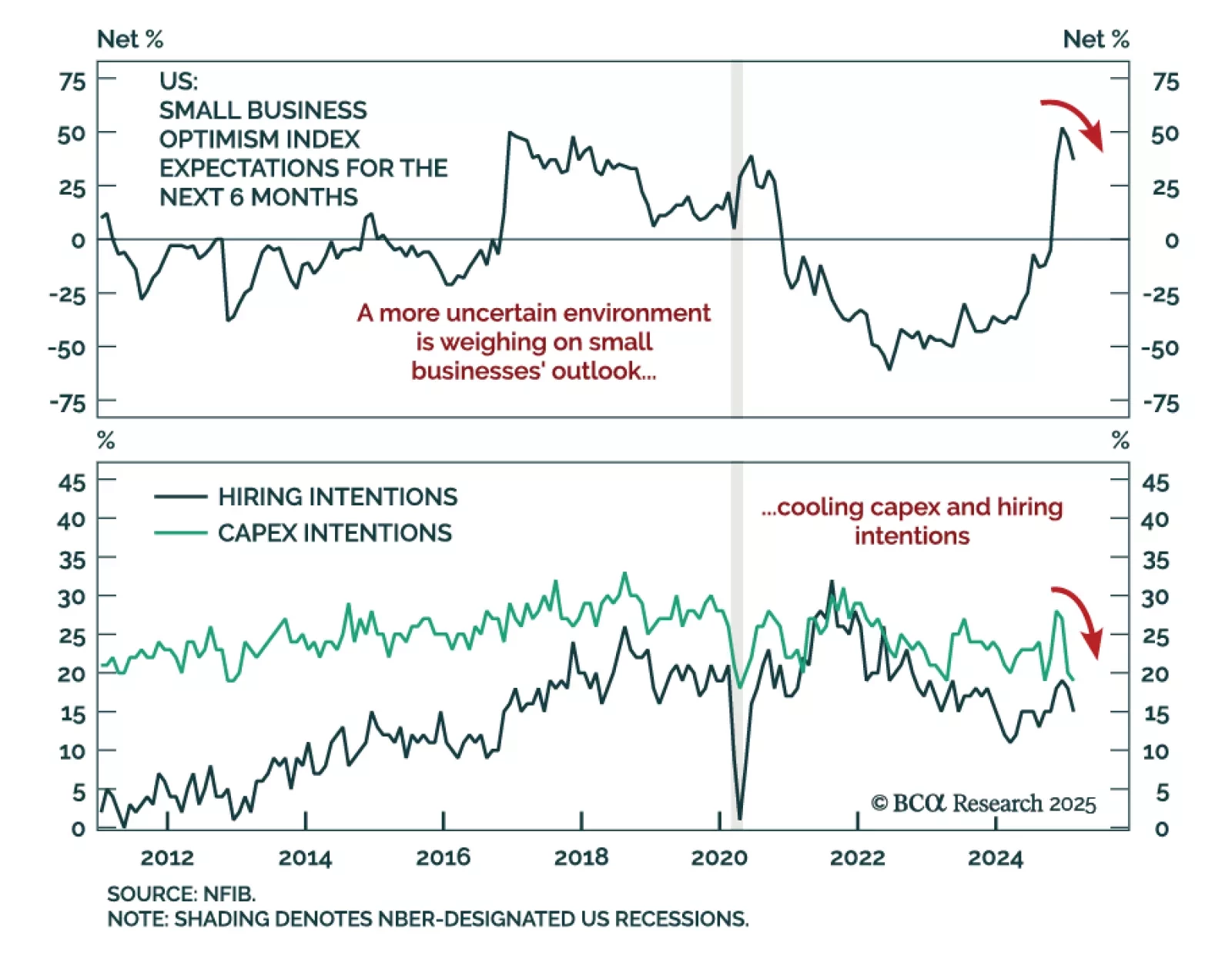

The February NFIB Small Business Optimism index decreased more than expected to 100.7 from 102.8. The decline extends the reversal seen since the November US election as policy optimism yields to uncertainty. The signal from the…

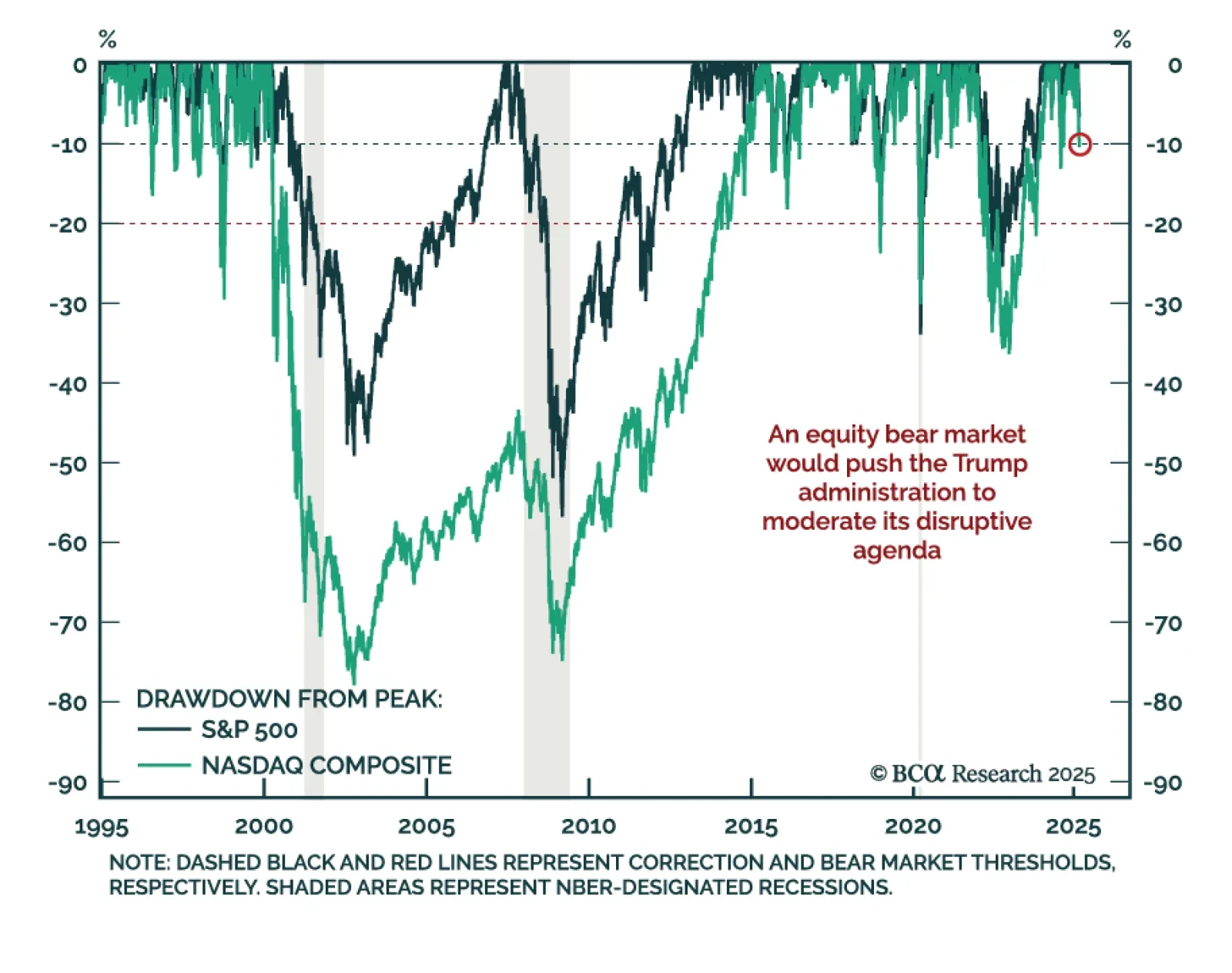

After affirming he does not look at the stock market, President Trump said he cannot exclude the possibility of a recession as he rushes to implement his agenda before the 2026 midterms. Could a President willingly start a recession…

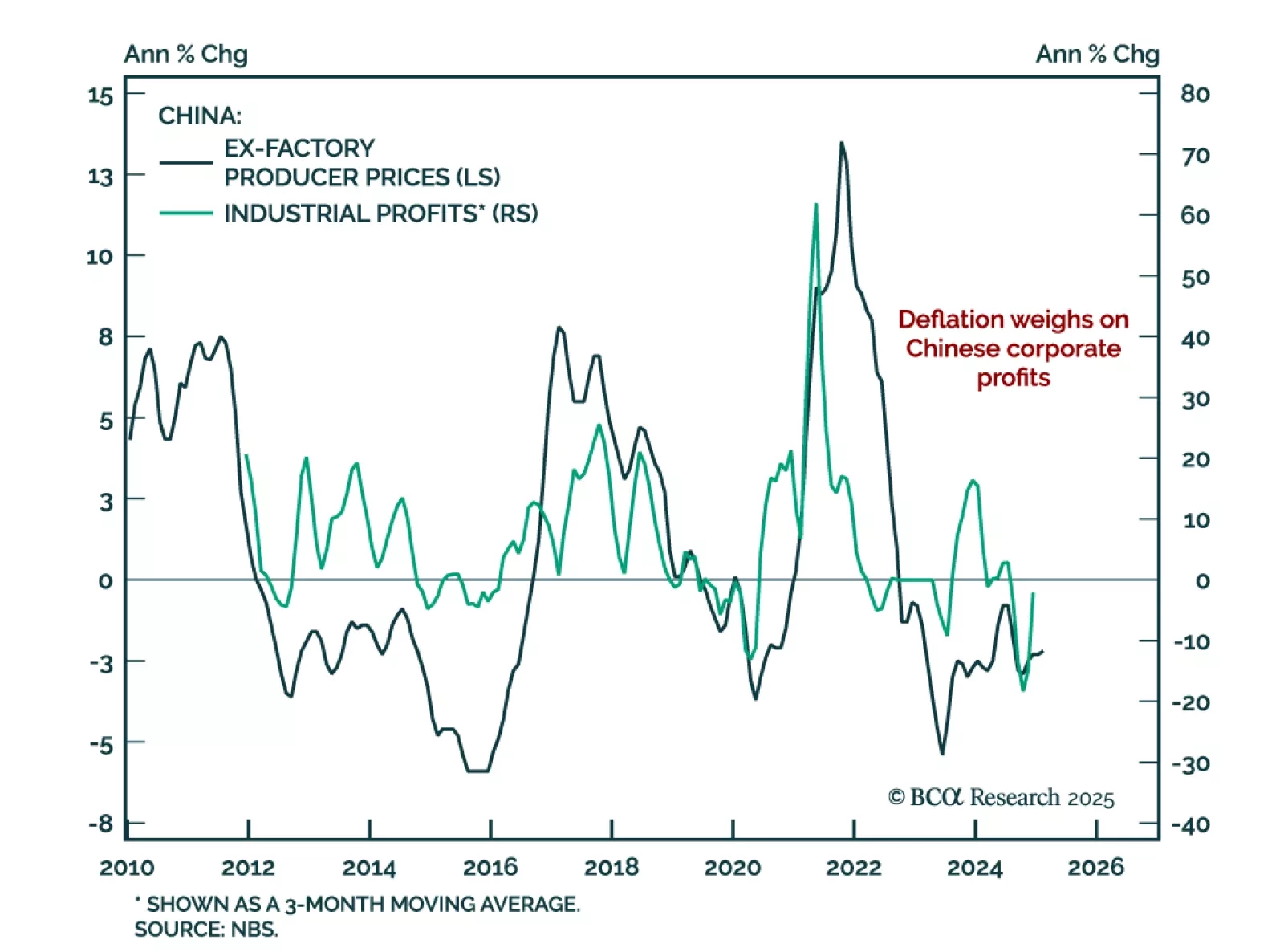

China’s February consumer prices fell 0.7% y/y after expanding on an annual basis in January. Producer price deflation stood at -2.2% y/y, roughly unchanged from a month prior. China’s first quarter data is heavily influenced by…

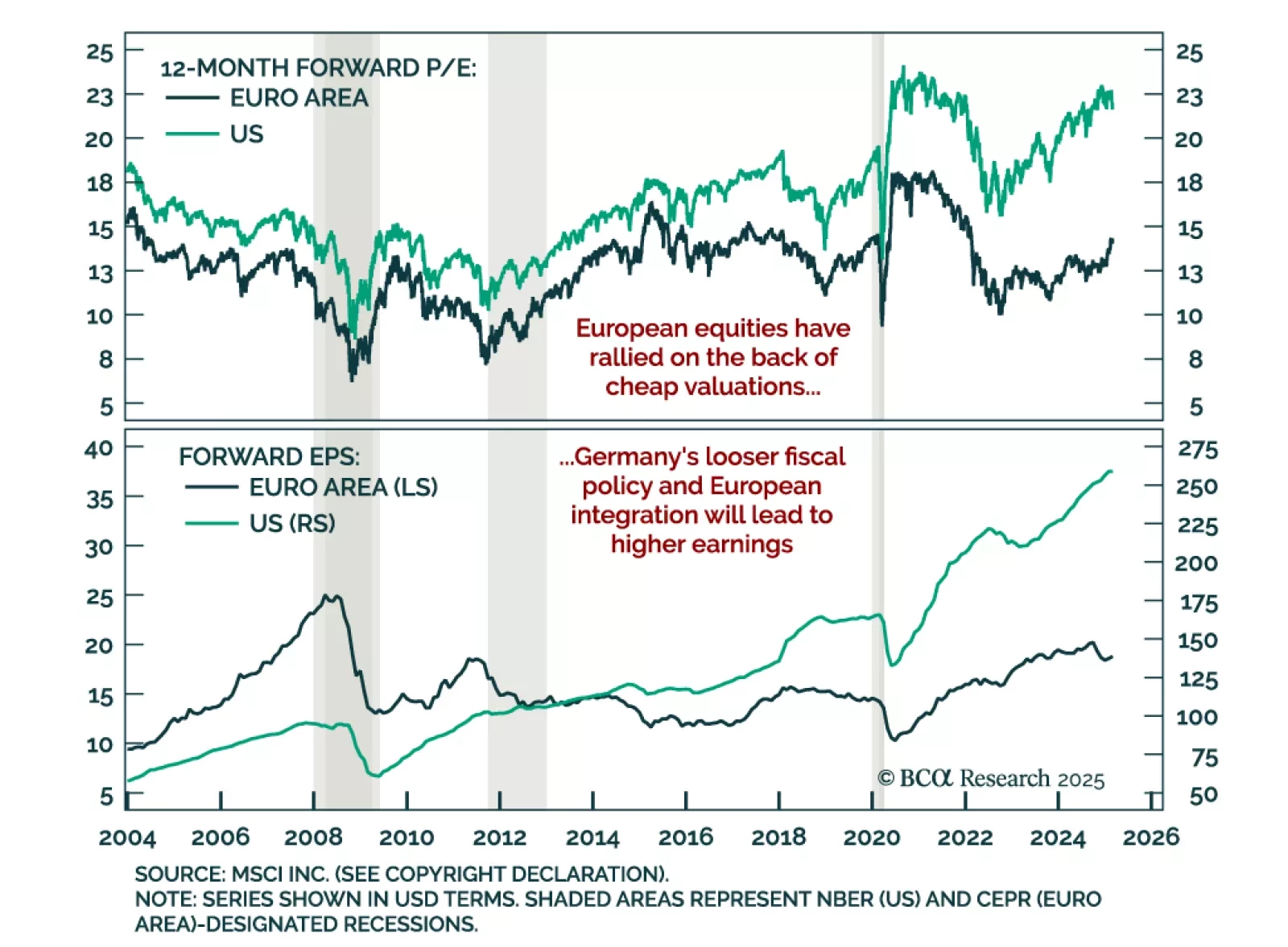

After entering 2025 with depressed growth expectations, measures of European sentiment have seemingly bottomed, and European assets rallied. However, given the changing geopolitical order and Europe’s forceful response thus far, are…

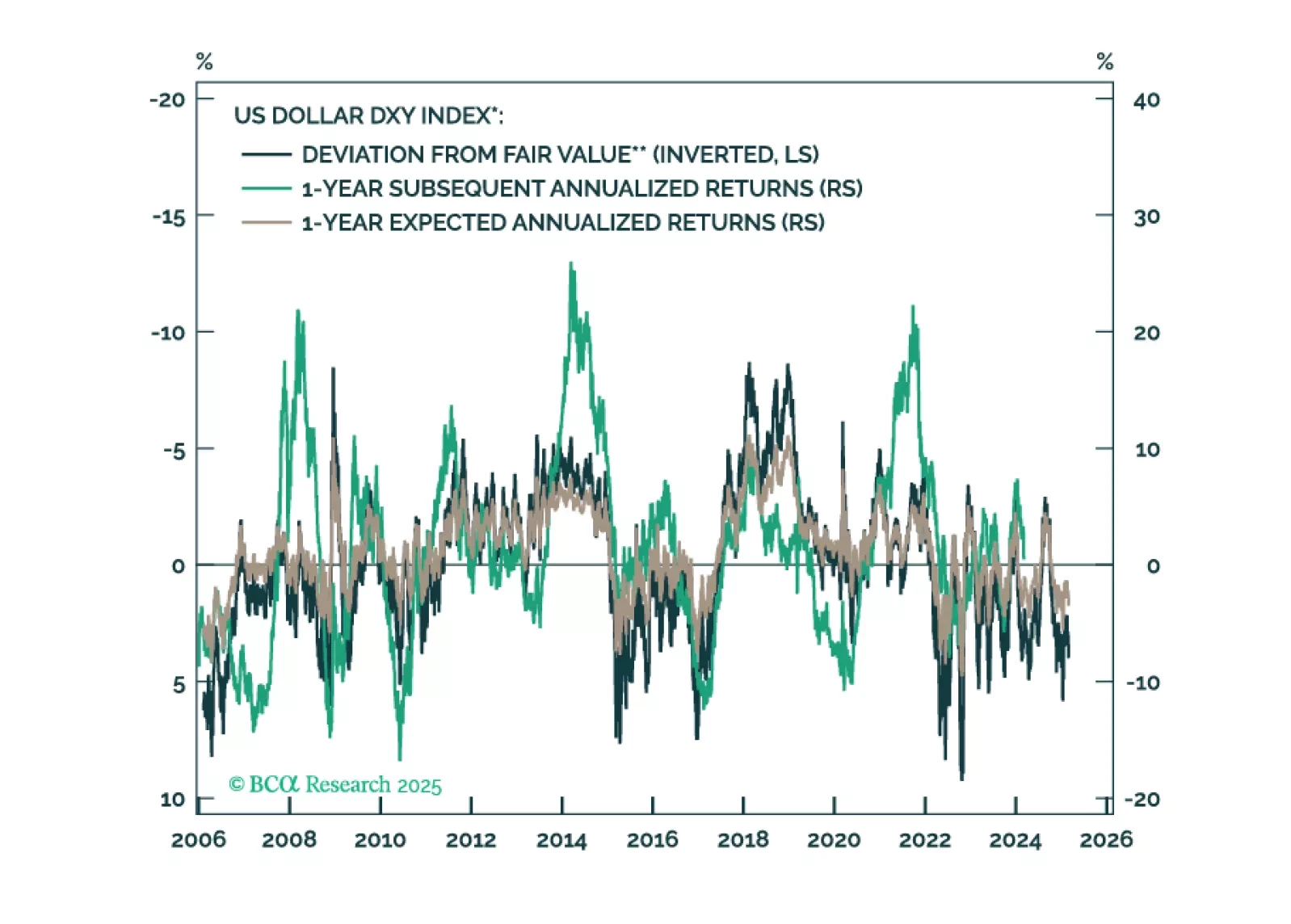

This report is our Part III series on valuation and subsequent returns, where we recalibrate our short-term models to emphasize signals over the next nine-to-twelve months. We will henceforth call these models STTM: Short Term Timing…

Treasury Secretary Scott Bessent said there is no “Trump put”, and acknowledged the administration’s policy could create short-term pain to achieve long-term gains. The concept of a “market put” implies policymakers would aim to put…

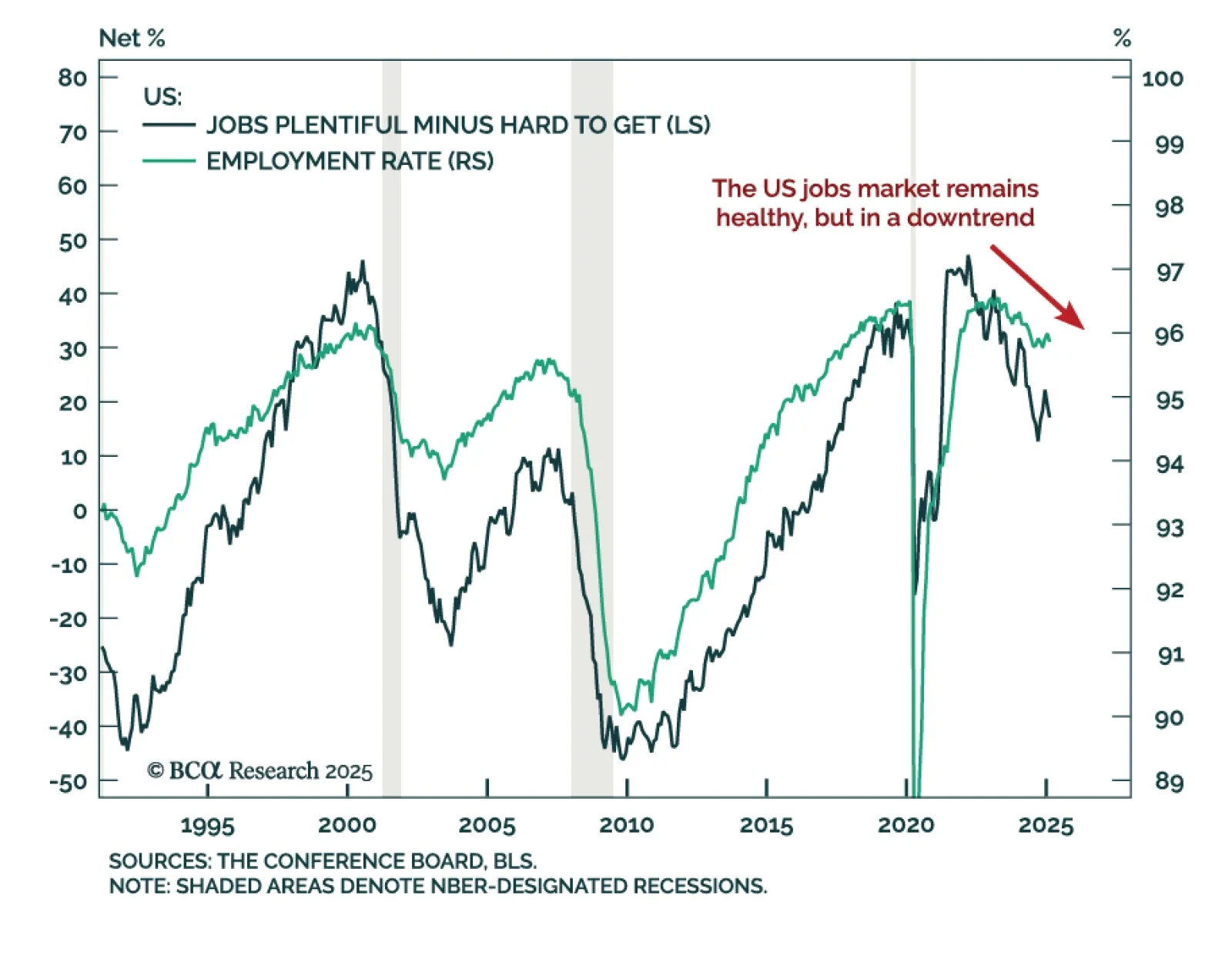

The February US jobs report was slightly weaker than expected, reflecting a slowing but still healthy labor market. At 151k, payrolls missed estimates. January’s number was revised down from 143k to 125k, bringing the 3-month moving…

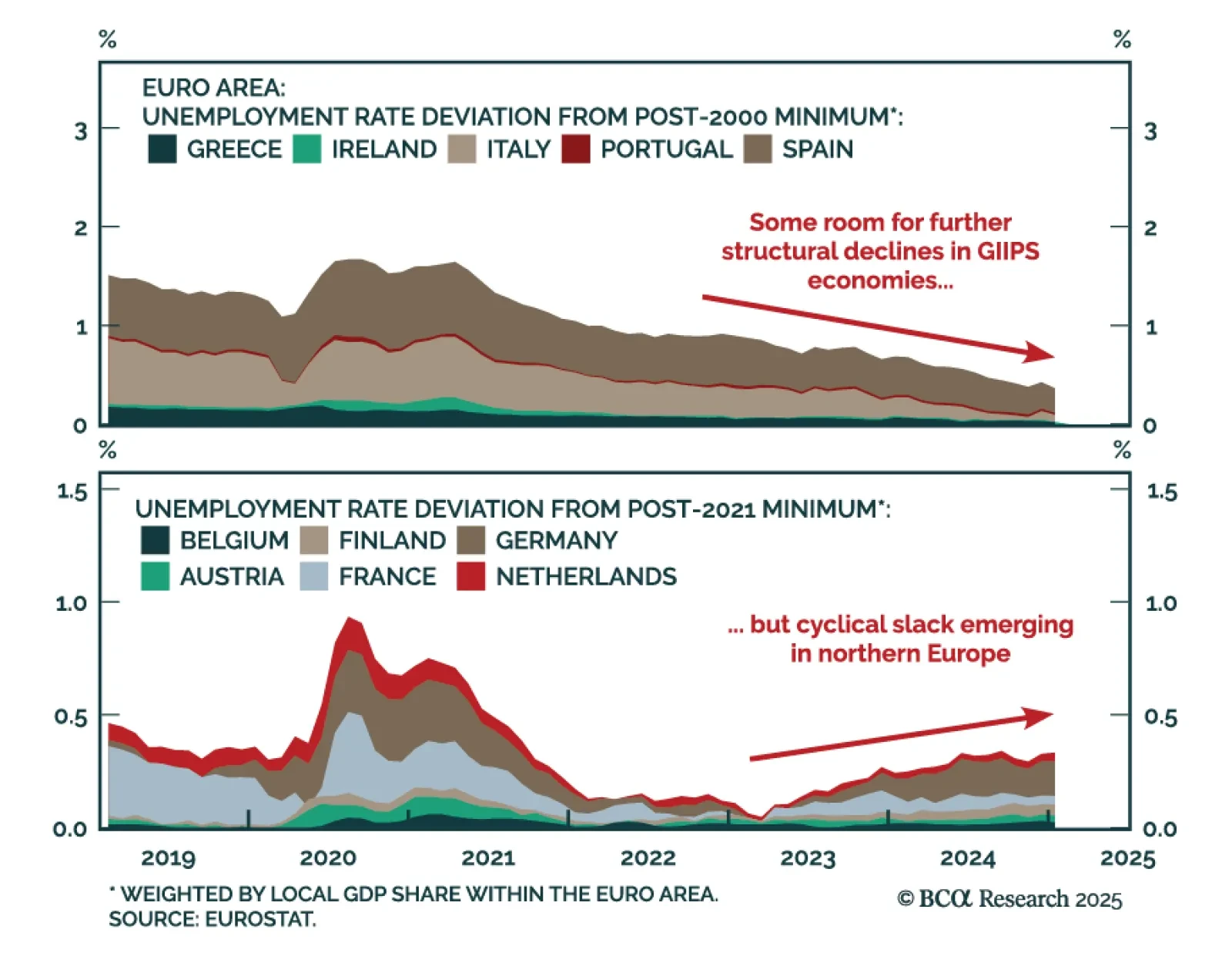

Our Chart Of The Week comes from Robert Timper, strategist in our Global Fixed Income strategy team. Robert digs into Eurozone employment dynamics. January data showed that unemployment remains at record lows, but regional…