Despite our Global Investment strategists’ bearish stance, their latest report reviews scenarios that could be bullish for equities. Our colleagues remain bearish on equities, expecting a US recession this year. However, several…

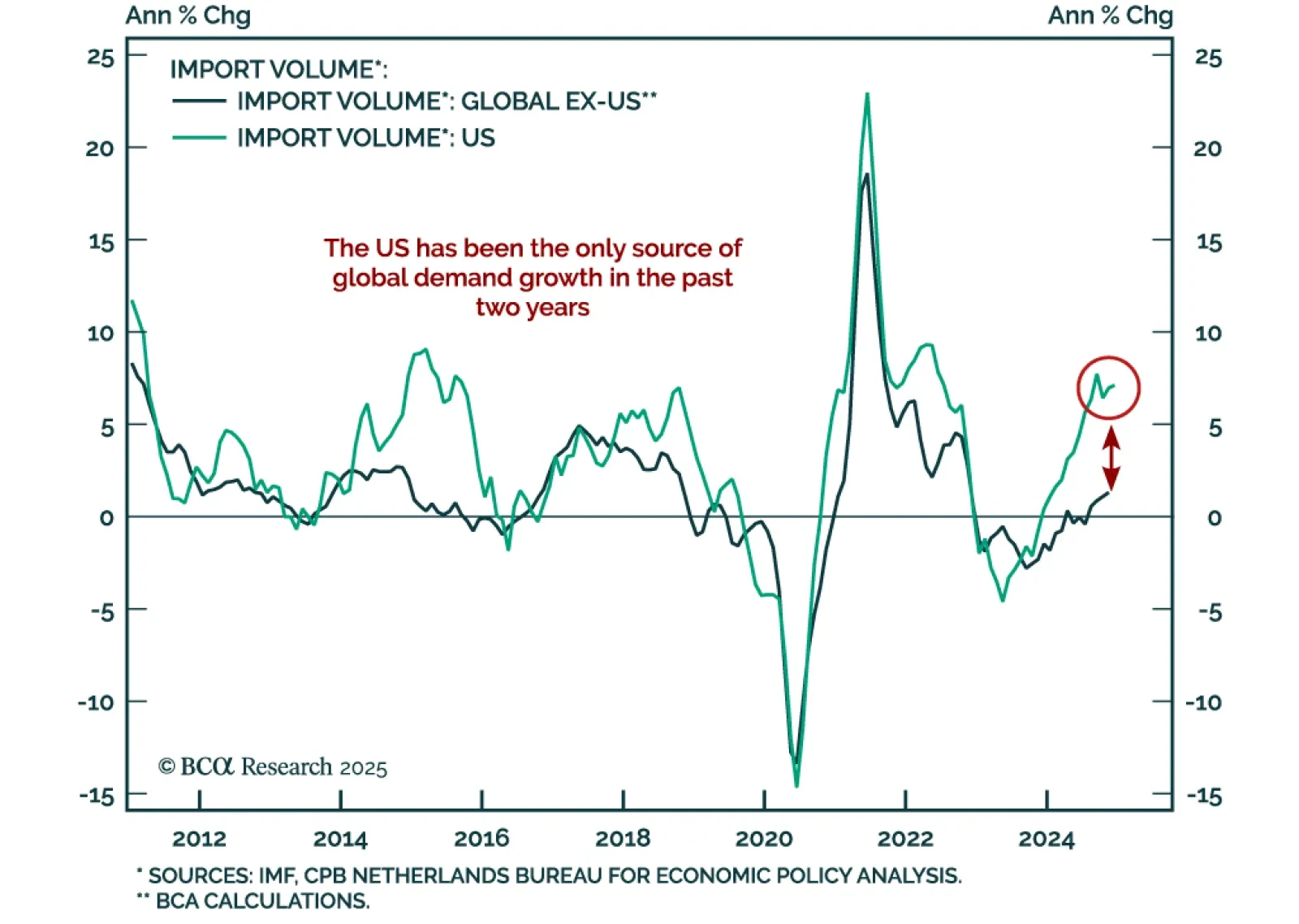

Our Chart Of The Week comes from Arthur Budaghyan, Chief Emerging Markets/China strategist. Arthur highlights a key risk for the global economy, and its implication for the US dollar. By and large, the US economy has been…

Gold is testing the $3,000/oz level. The yellow metal had a great run, outperforming every DM currency for the past few months. Despite rising real yields since the beginning of the year, gold prices are up nearly 15%.The…

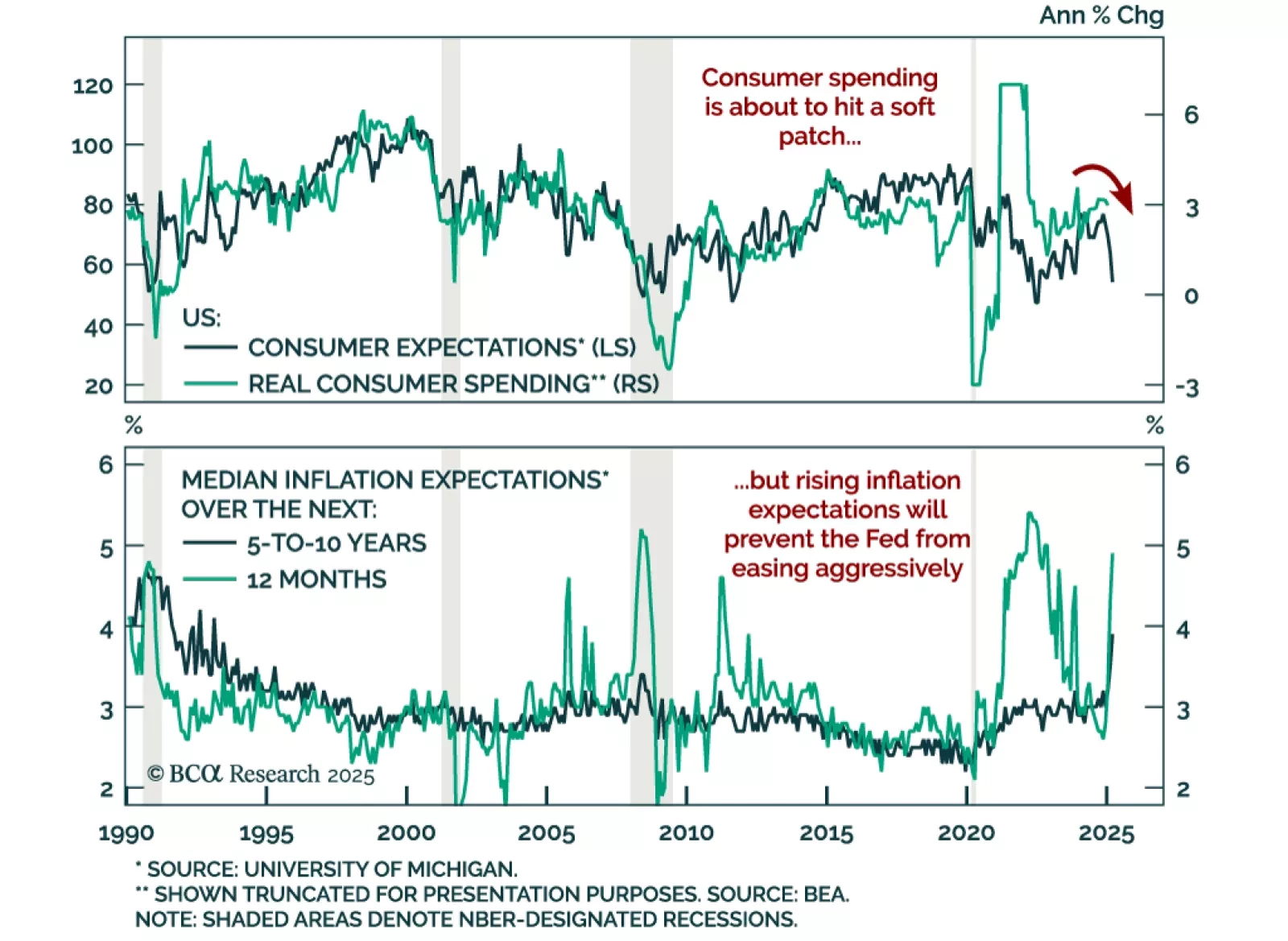

The preliminary March University of Michigan Consumer Sentiment Index missed estimates, falling to 57.9 from 64.7. The decrease came from both the assessment of current conditions and expectations, with the latter falling almost 10…

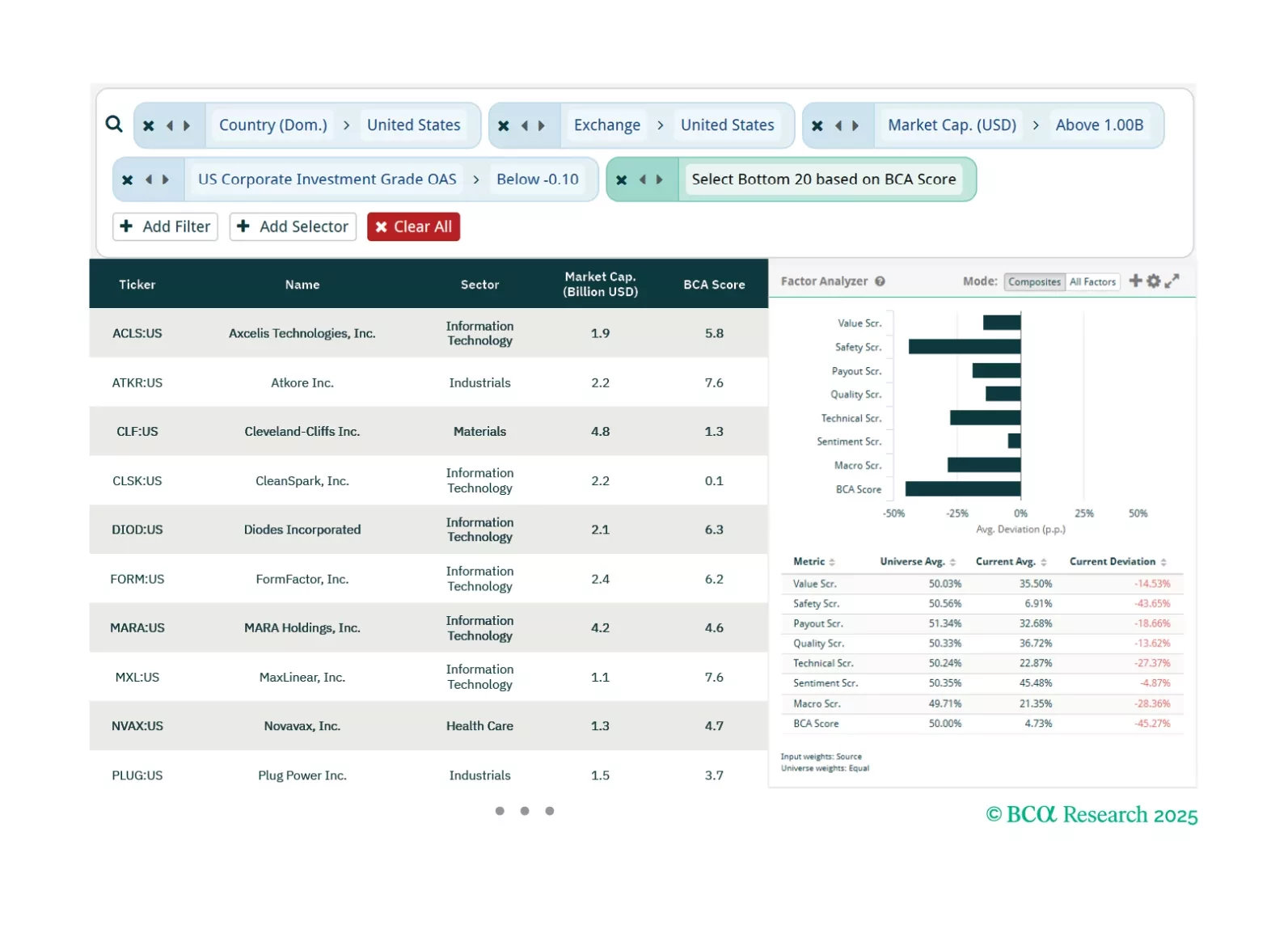

This week, our three screeners cover equity plays in US OAS Spreads, US Exceptionalism, and “DIVE”.

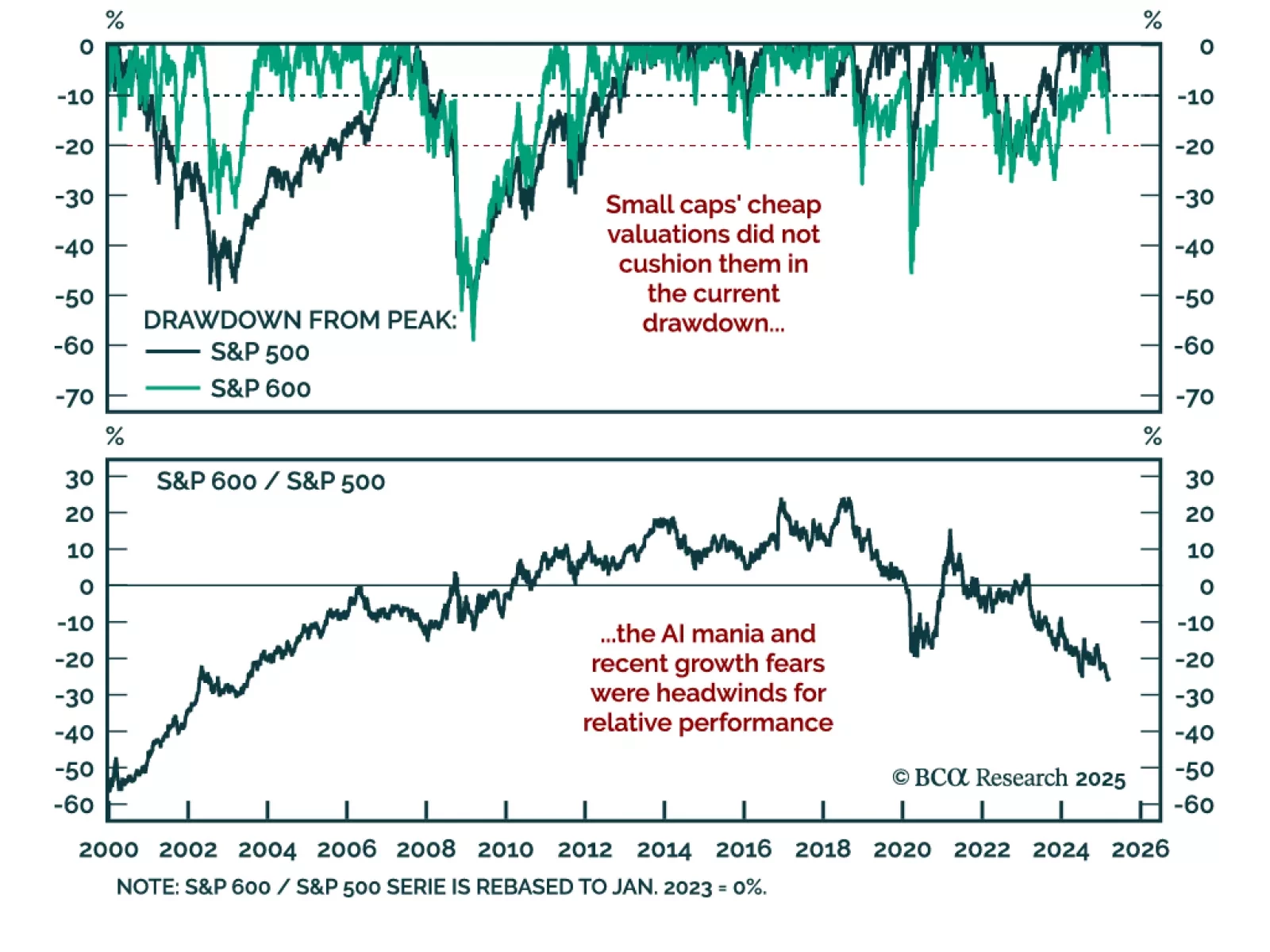

A reoccurring theme in client discussions has been how cheap US small-cap equities could siphon allocation away from their richly-valued large-cap peers. But valuations are no one’s friend in a drawdown. While the S&P 500 is in…

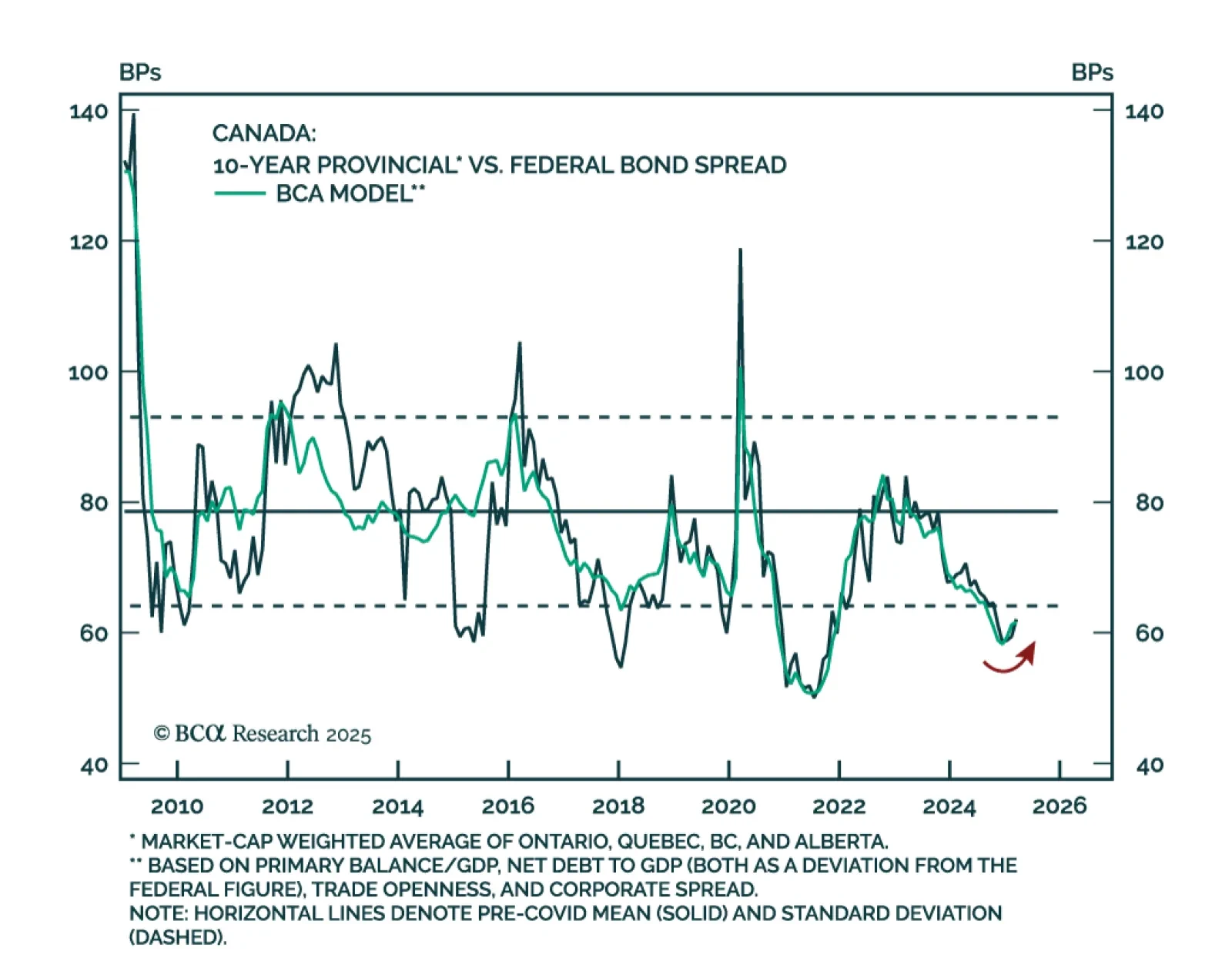

Our Global Fixed Income team wrote a primer on the Canadian provincial bond market, an overlooked yet substantial market. Canadian provincial bonds are a major segment of the country's fixed income market, with spreads primarily…

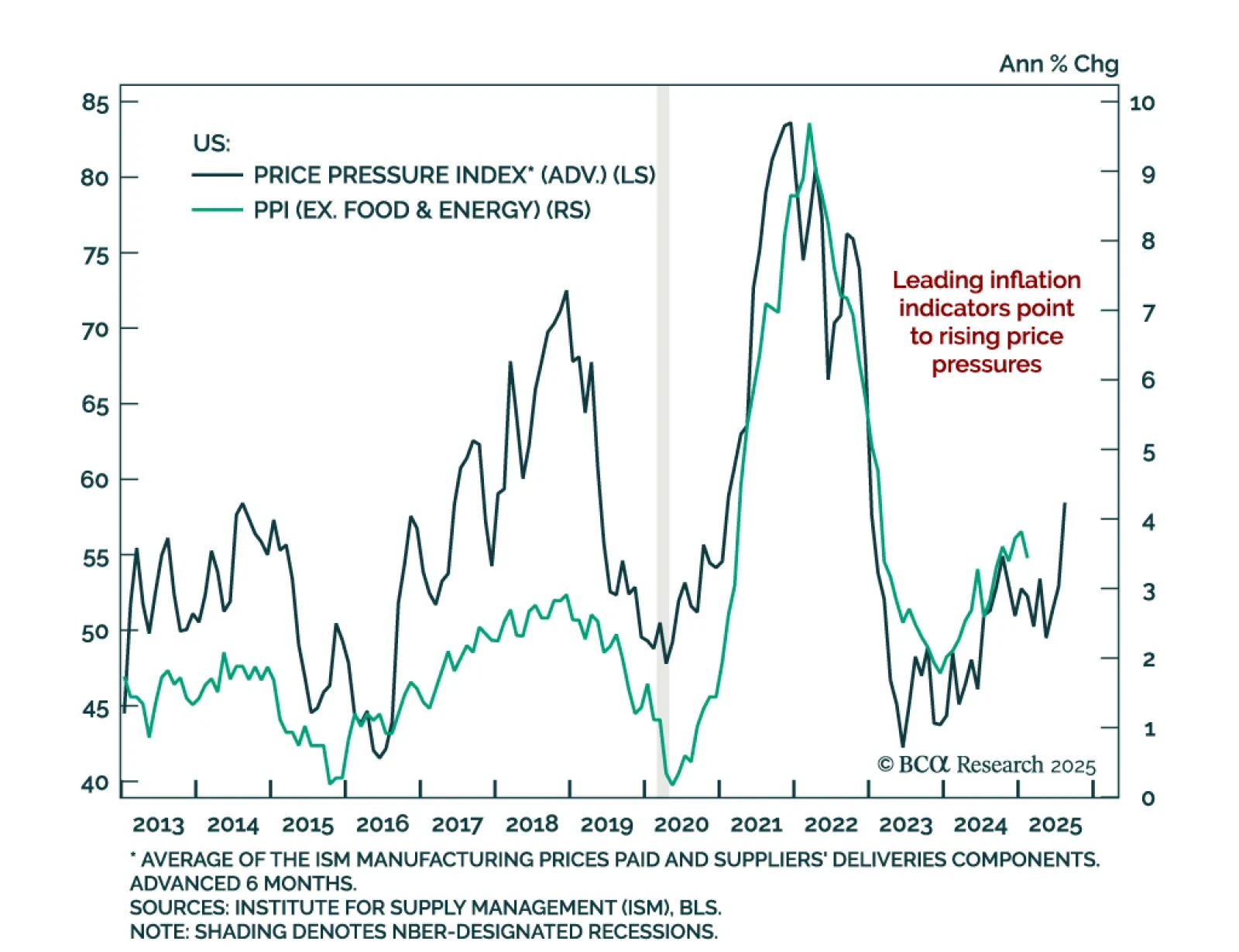

The February US Producer Price Index came in below estimates, with the headline measure showing no monthly change and standing at 3.2% y/y. Core PPI (excluding food, energy, and trade services) was also cooler than expected, coming…

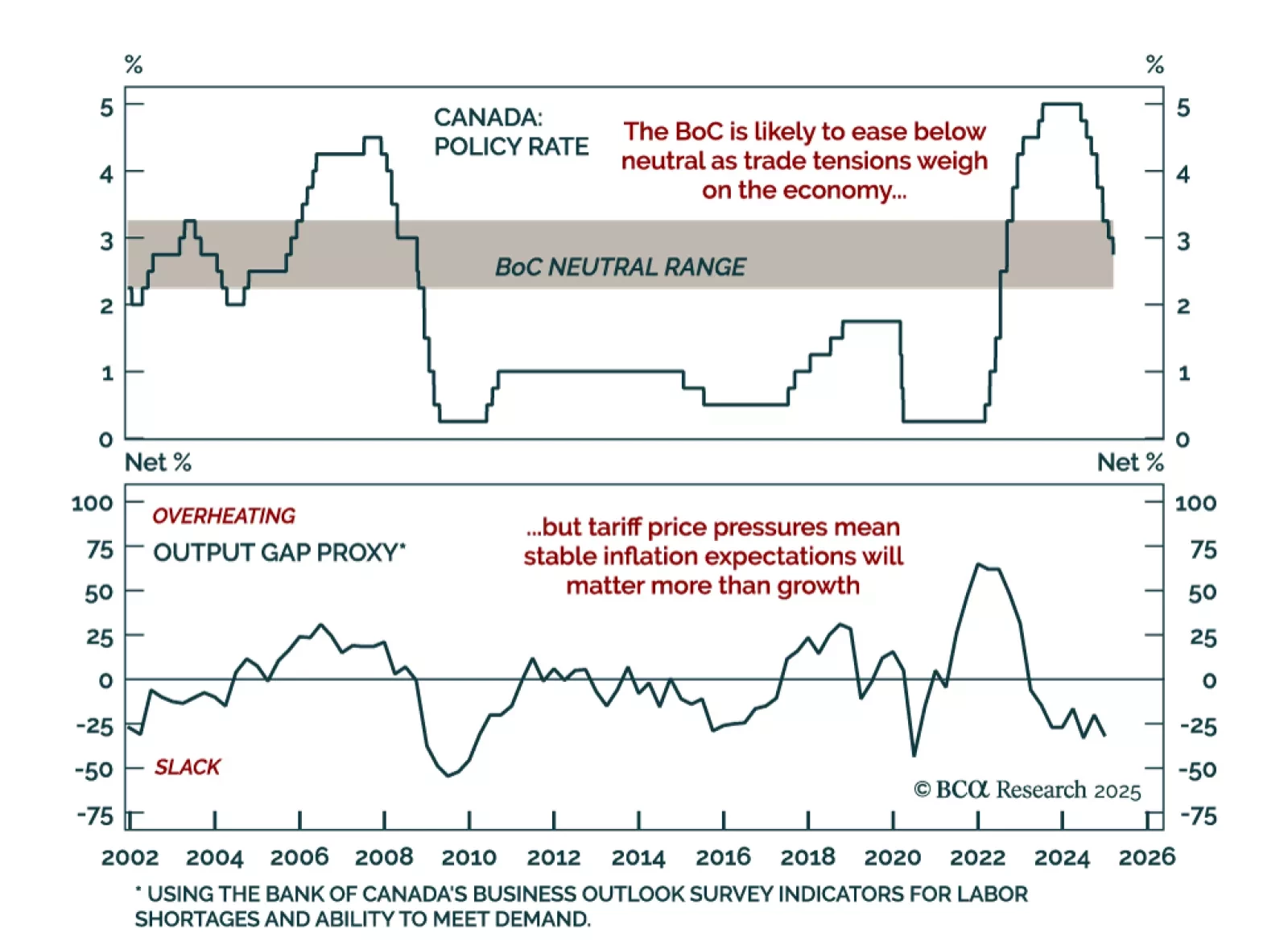

The Bank of Canada cut by 25 bps to 2.75% as expected. This seventh consecutive cut brings the policy rate further into neutral territory, estimated to be in the 2.25%-to-3.25% range. The BoC is in a tough place. The trade war…

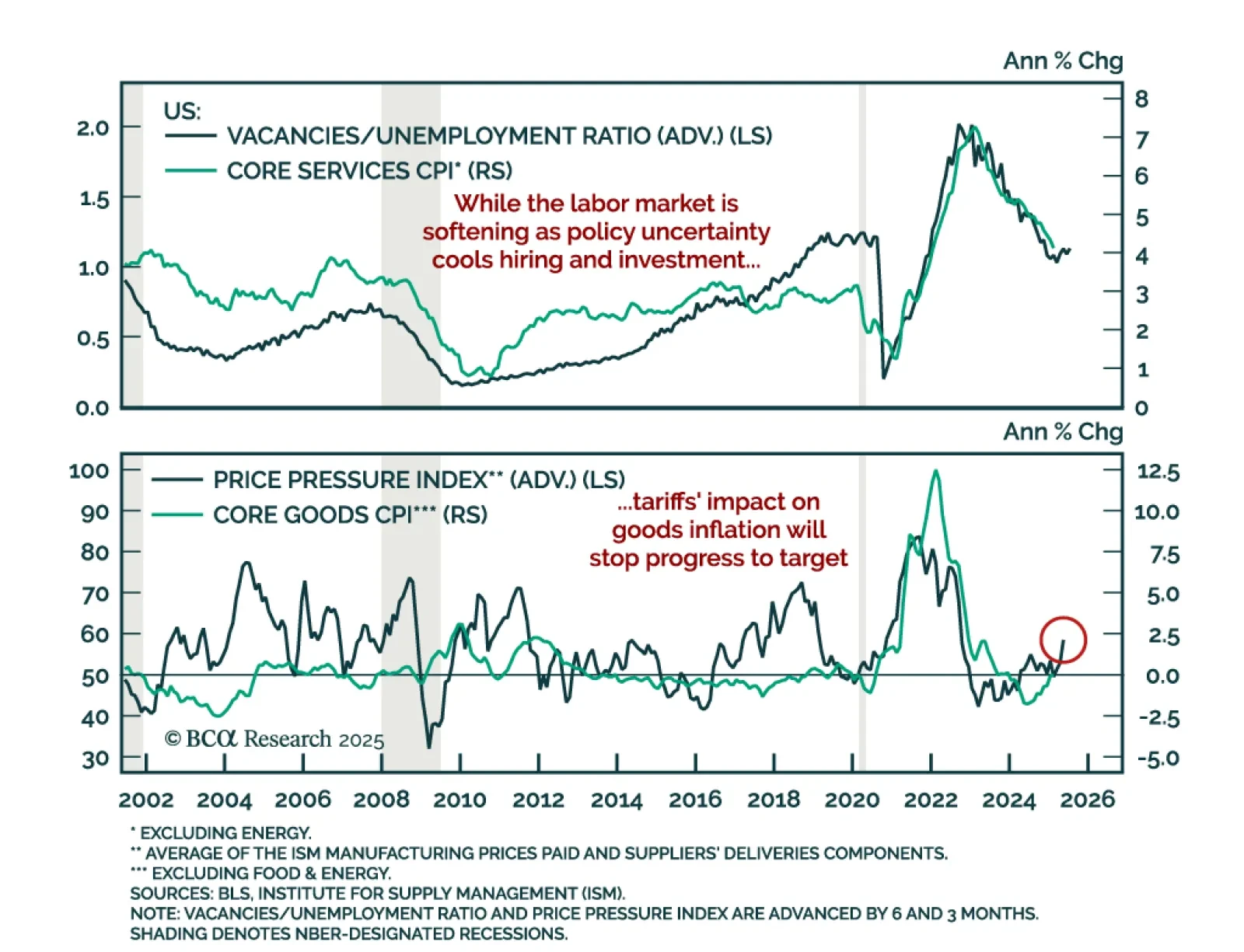

The February US CPI came in cooler than expected. Headline inflation decelerated to 0.2% m/m (2.8% y/y), as did core which now stands at 3.1% y/y. Core services inflation declined while core goods inflation was roughly unchanged.…