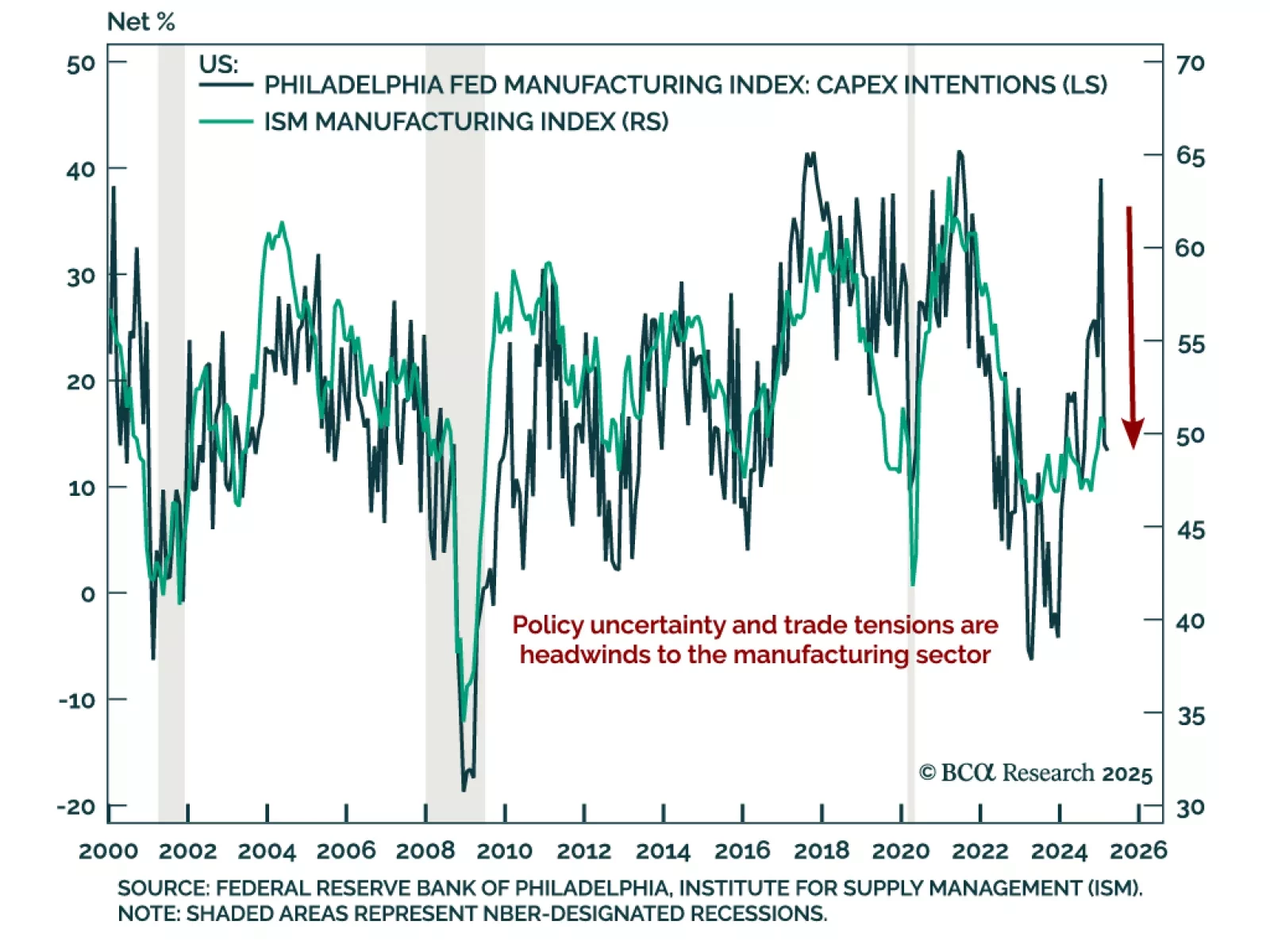

The March Philadelphia Fed Manufacturing index beat expectations, but still fell from 18.1 to 12.5, significantly down from January’s lofty 44.3 reading. Most activity components slowed except for current employment and work hours.…

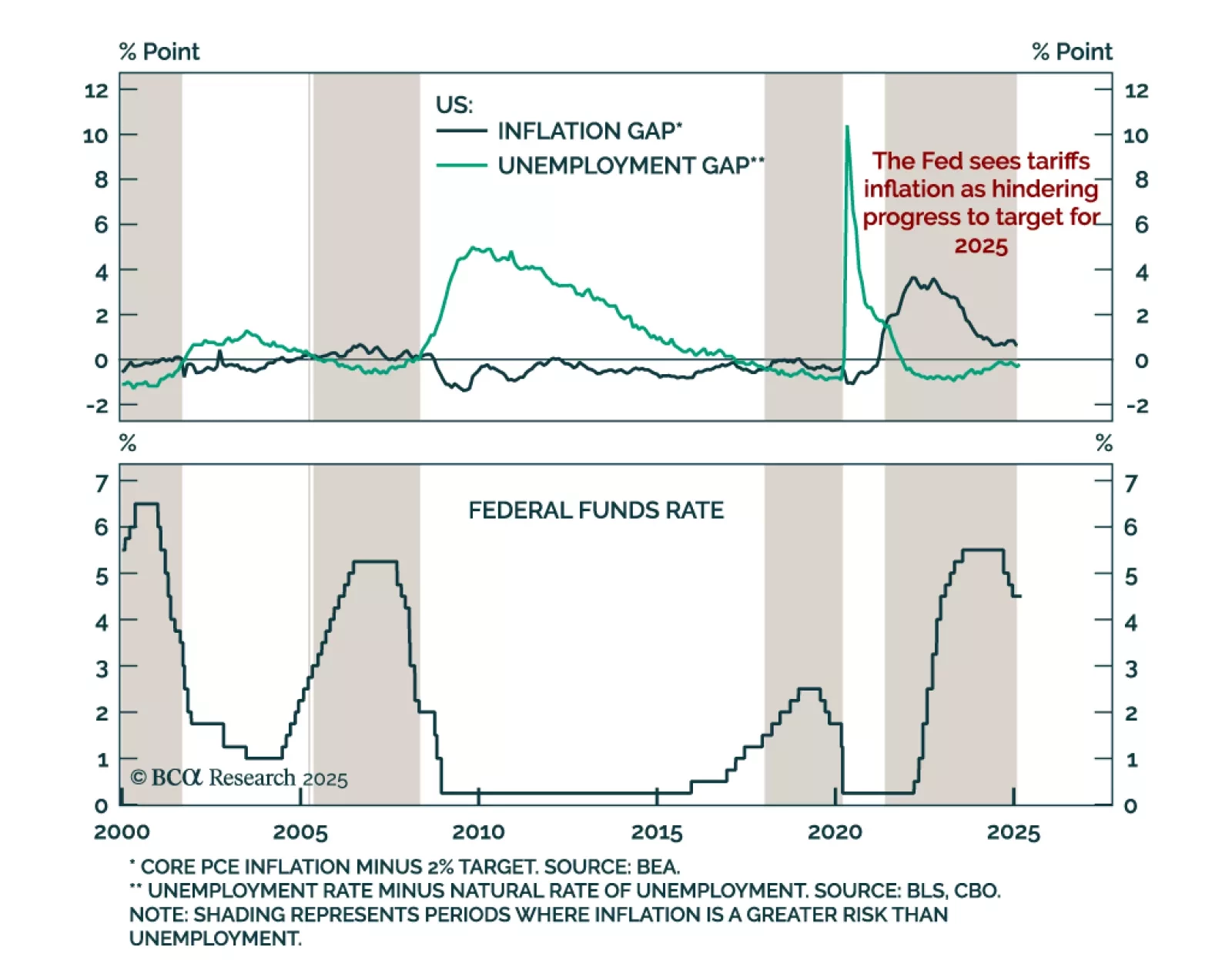

The Federal Reserve held rates at 4.25%-to-4.5% as expected, and slowed down the pace of quantitative tightening. The FOMC remains comfortable waiting and assessing the impact of recent and upcoming policy changes. The dots reflected…

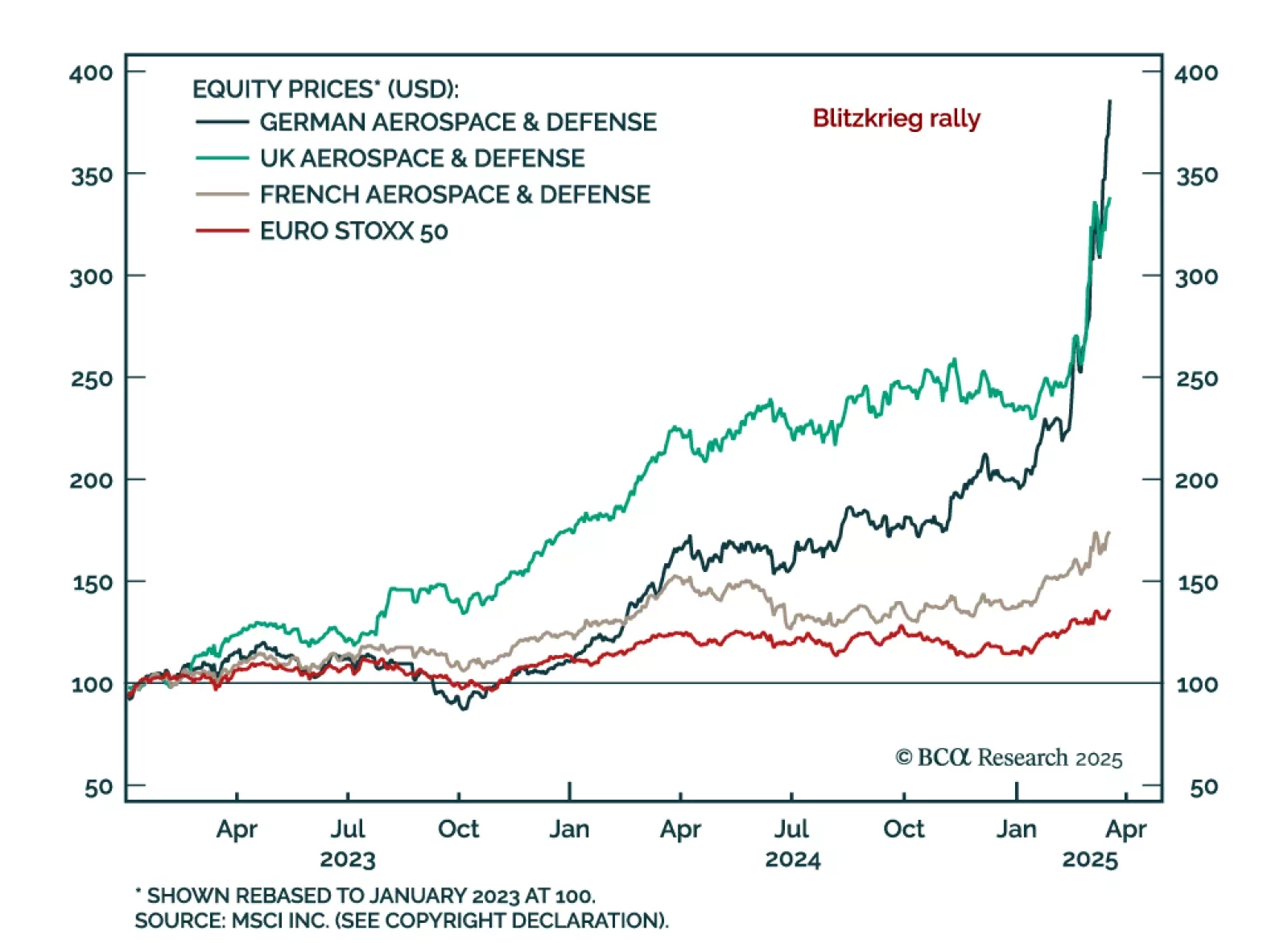

Our European strategists looked at the European defense sector after the massive rally following Germany’s fiscal turnaround. The rally in European defense stocks, up over 100% since their March 2023 recommendation, is…

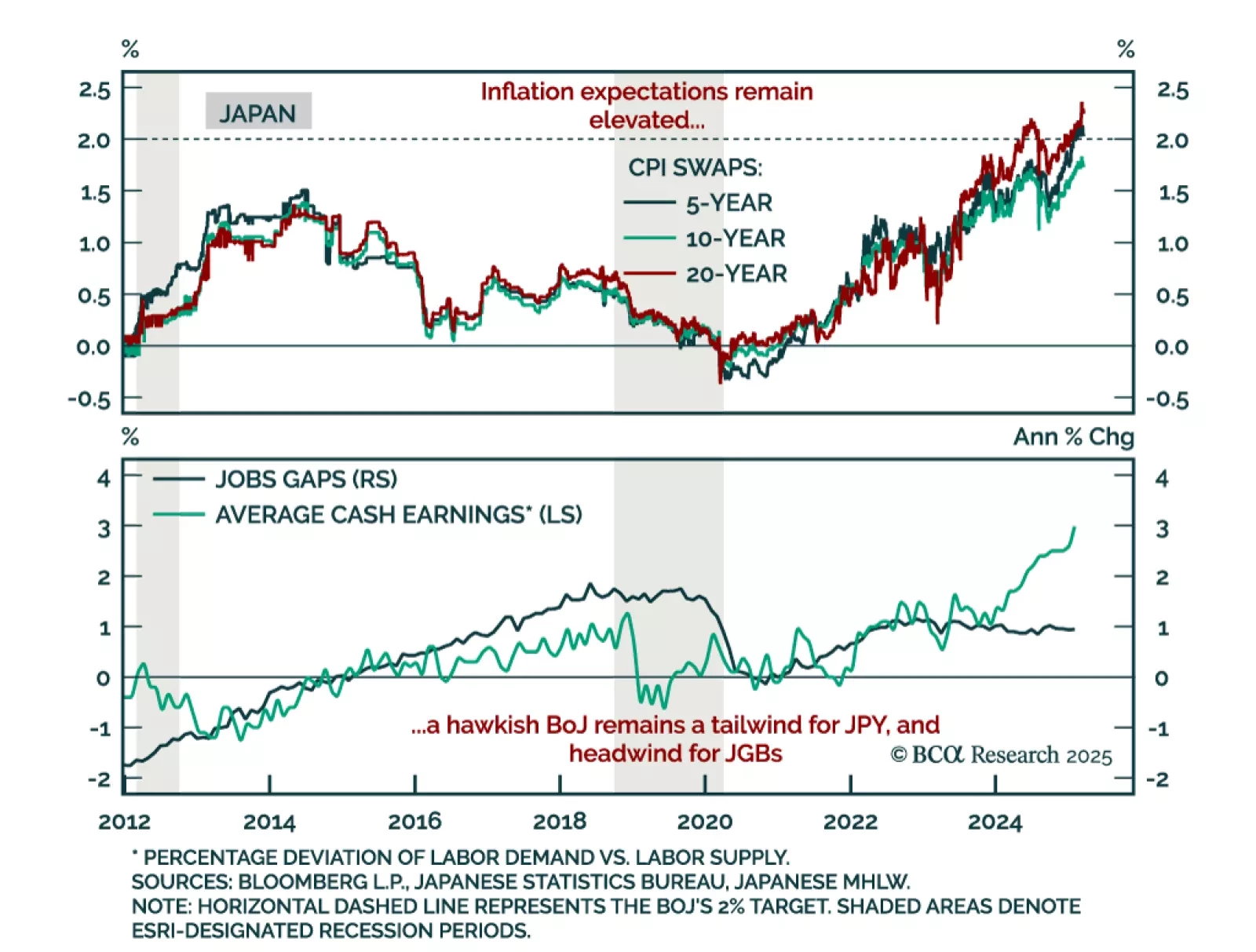

The Bank of Japan left rates unchanged at 0.50%, but maintained a hawkish bias, making it the only G10 central bank in a hiking cycle, as the hot labor market creates sustained domestic price pressures. More rate increases are…

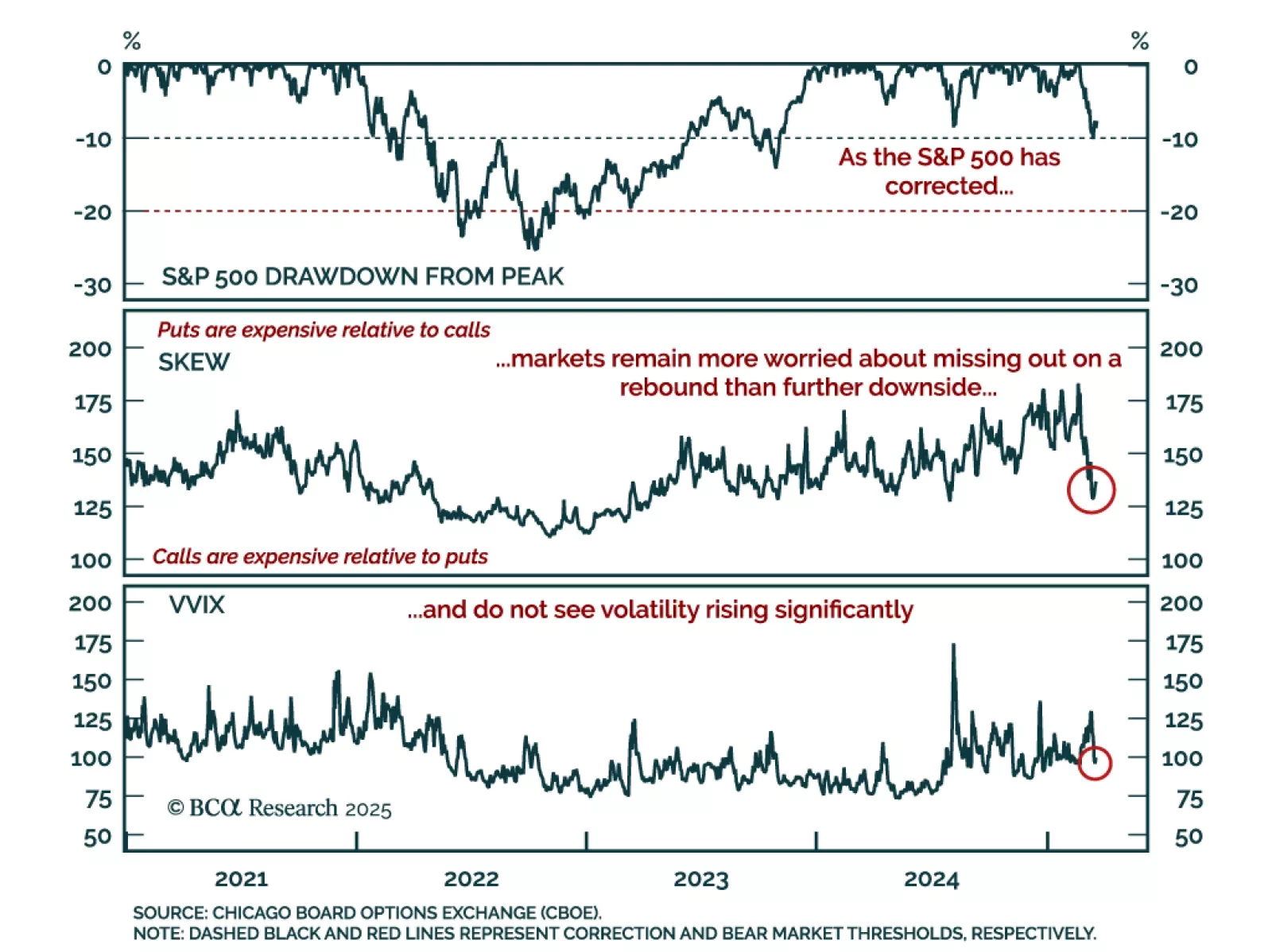

Recent years were marked by US equities rebounding from each drawdown to re-test all-time highs. The best absolute-return strategy has been to “buy the dip” and close your eyes. Is it still the case? The short answer is no, as…

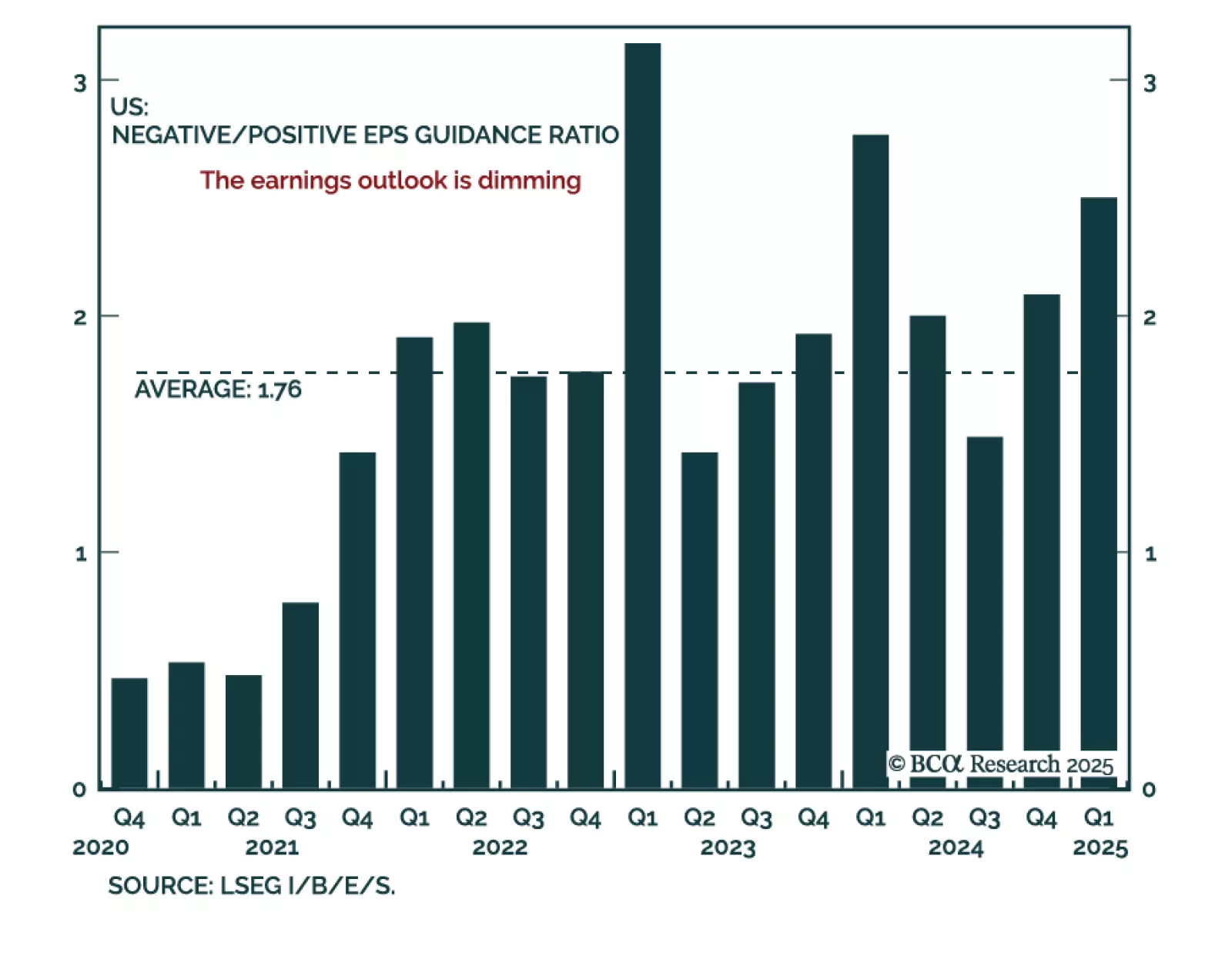

Our US Equity strategists assessed what companies are saying about tariffs, the US dollar, and the US consumer during their latest earnings calls. Q4 earnings were strong, with earnings and sales growth exceeding expectations.…

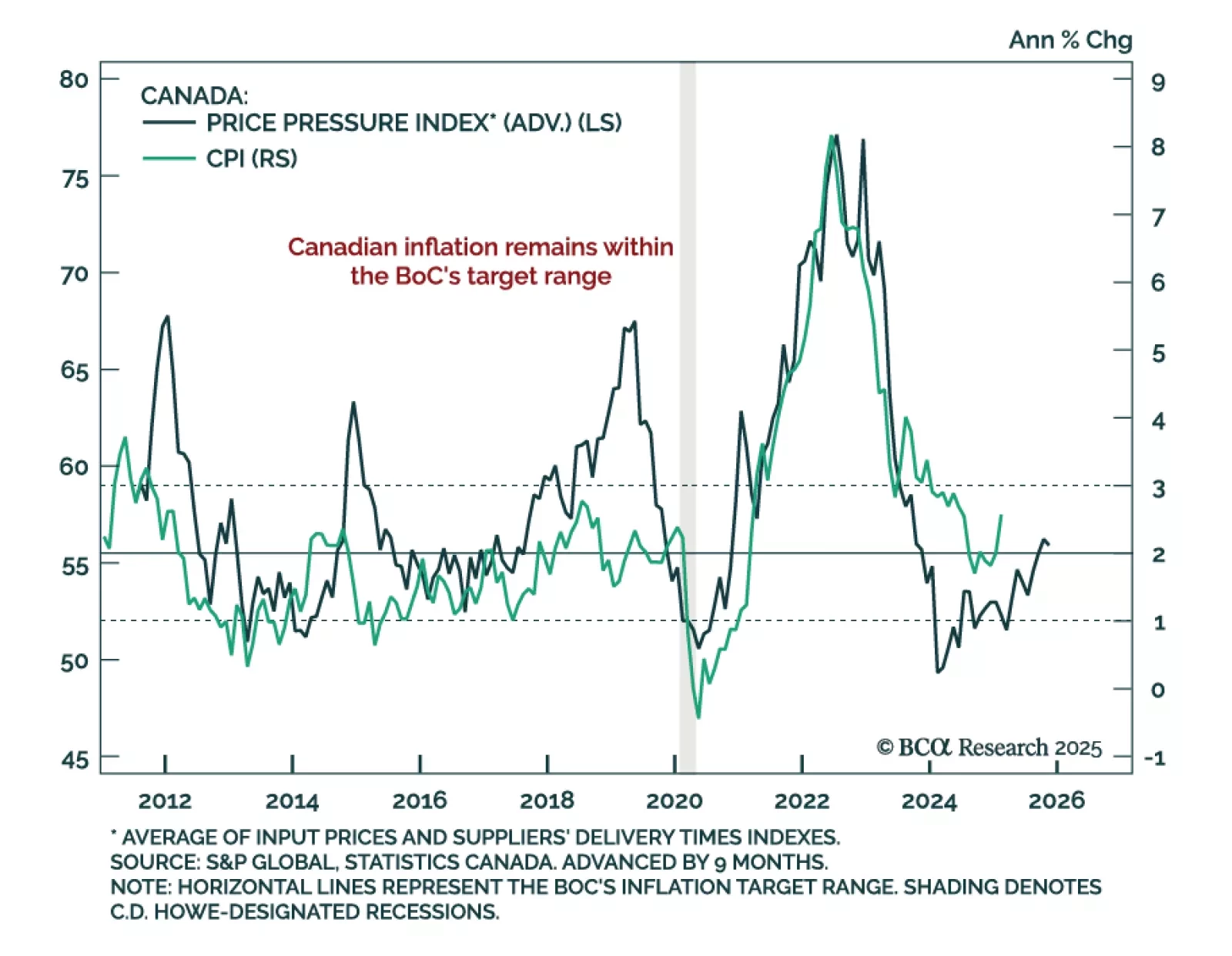

February Canadian headline inflation was stronger than expected, rising to 2.6% y/y from 1.9% in January. The Bank of Canada’s core measures were also slightly hotter than expected, both rising to 2.9% from 2.7% a month prior, near…

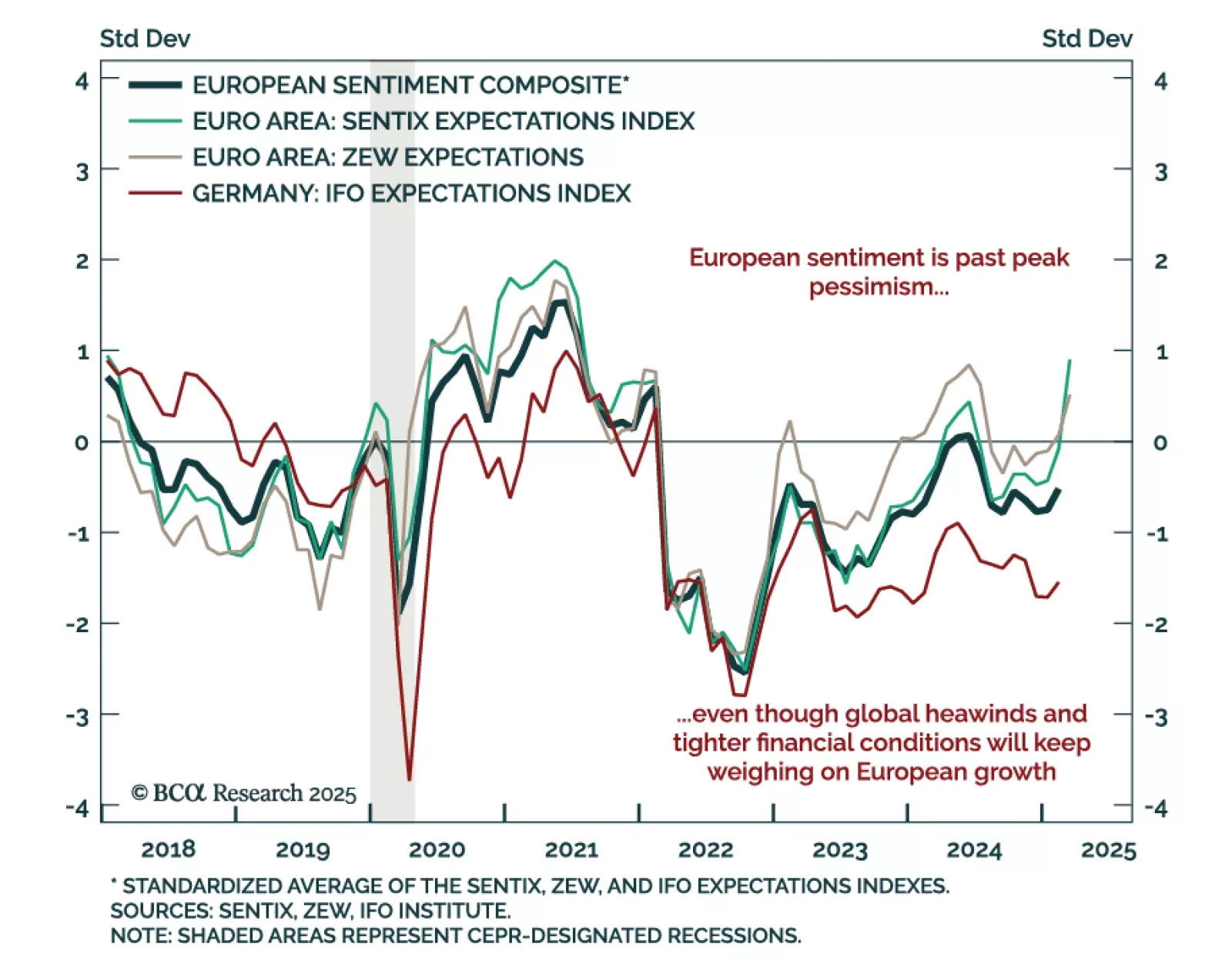

The March ZEW index for Germany and the eurozone beat estimates, with the expectations component rising to 51.6 from 26.0 in February. The current situation assessment only marginally improved yet remains deeply negative at -87.6.…

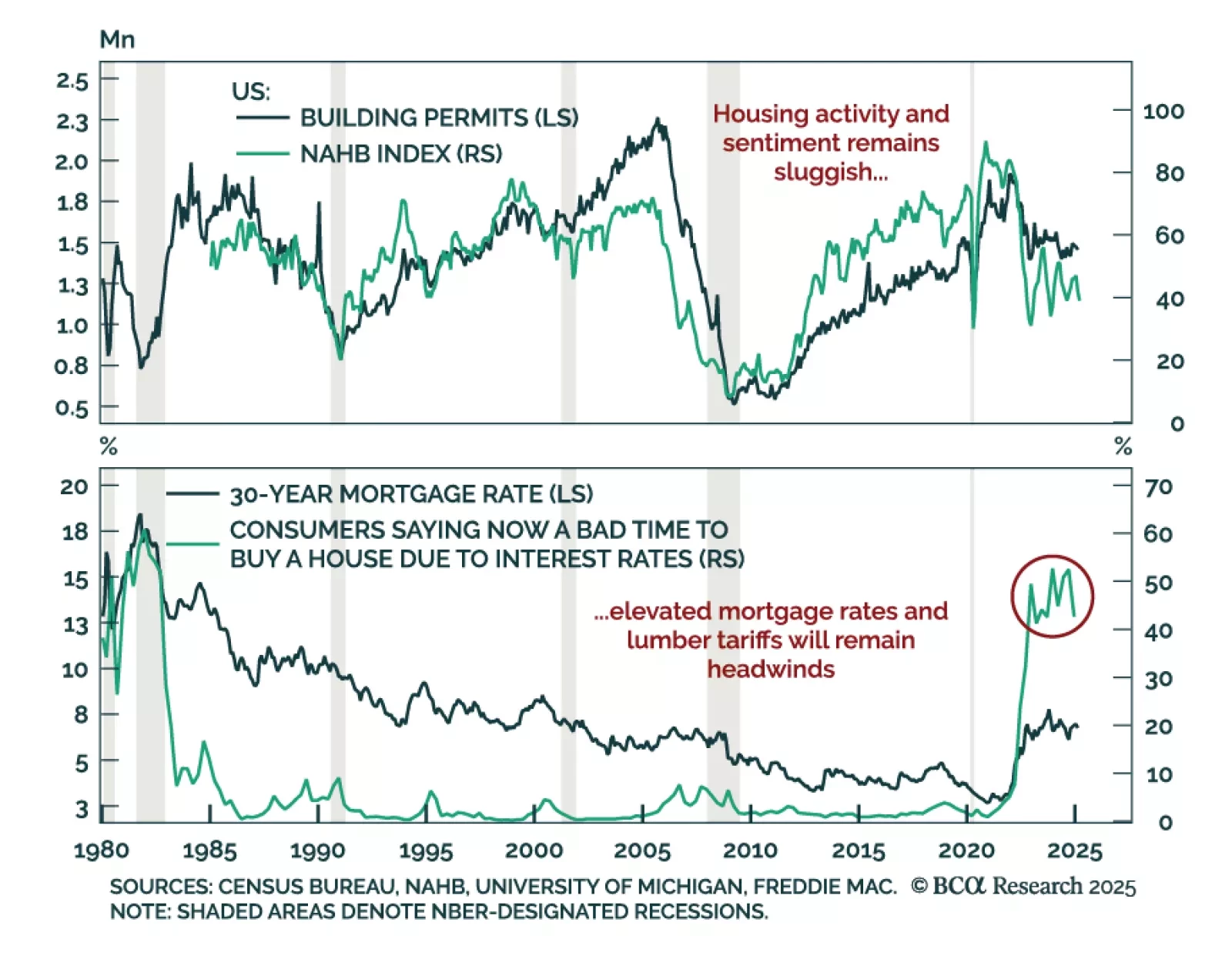

US February housing data was relatively strong, with housing starts rising 11.2% m/m after falling 9.8% in January. While they fell less than expected, building permits still declined at a faster pace than in January. The March NAHB…

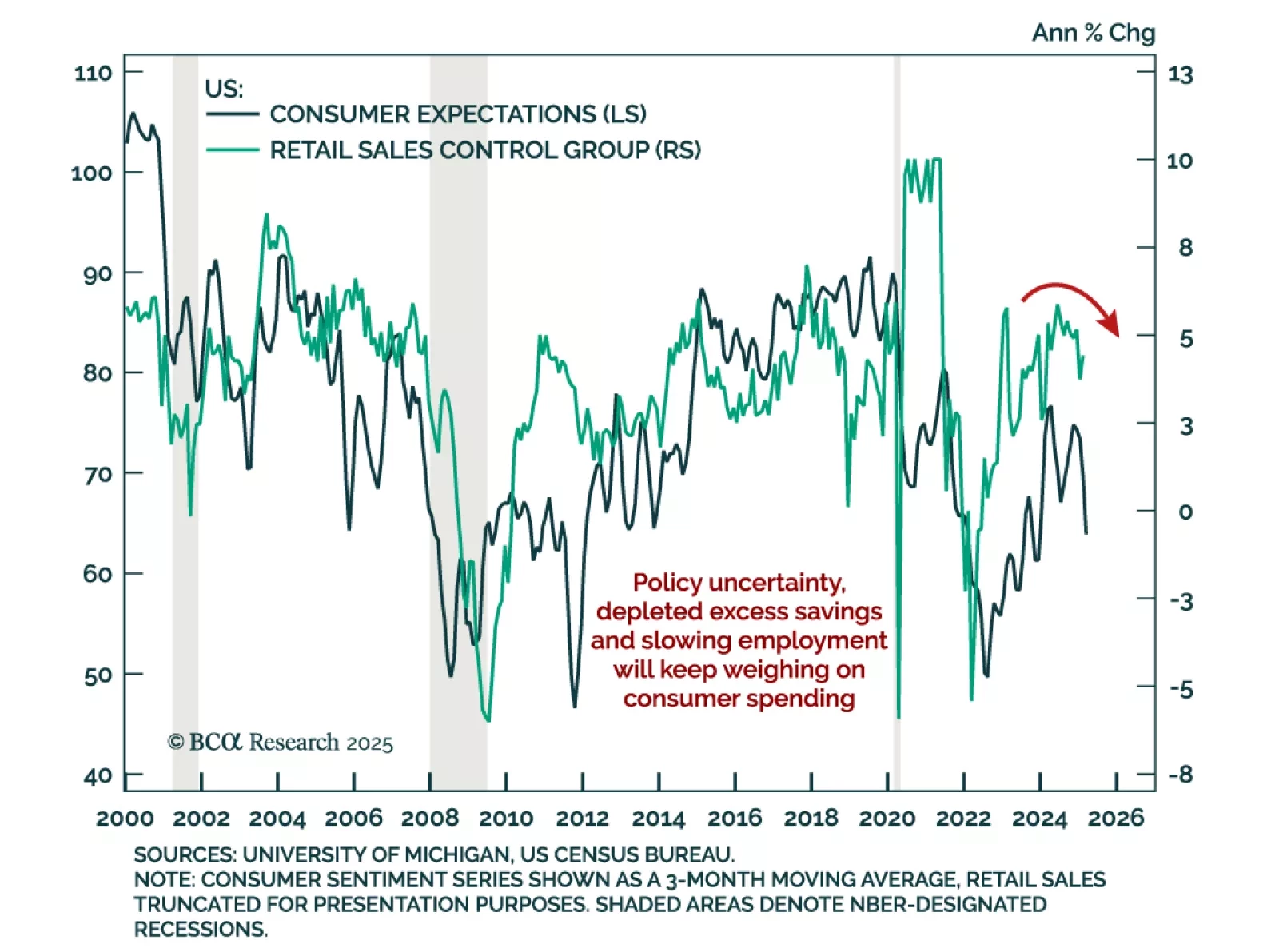

February US retail sales were mixed, with the headline number missing expectations at only 0.2% m/m. January’s reading was revised down to -1.2%. Core measures (excluding gas & autos) were roughly in line with estimates, but the…