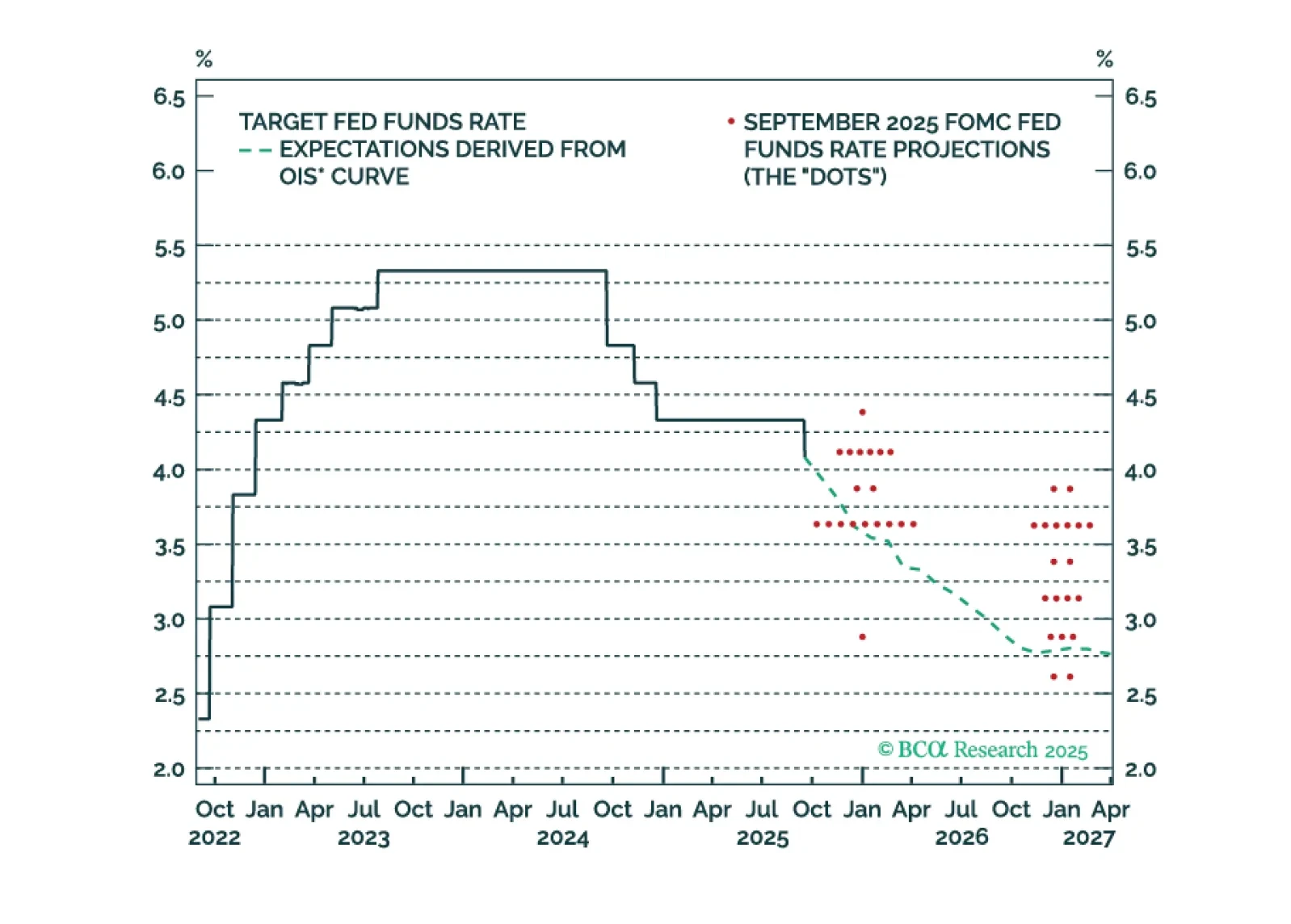

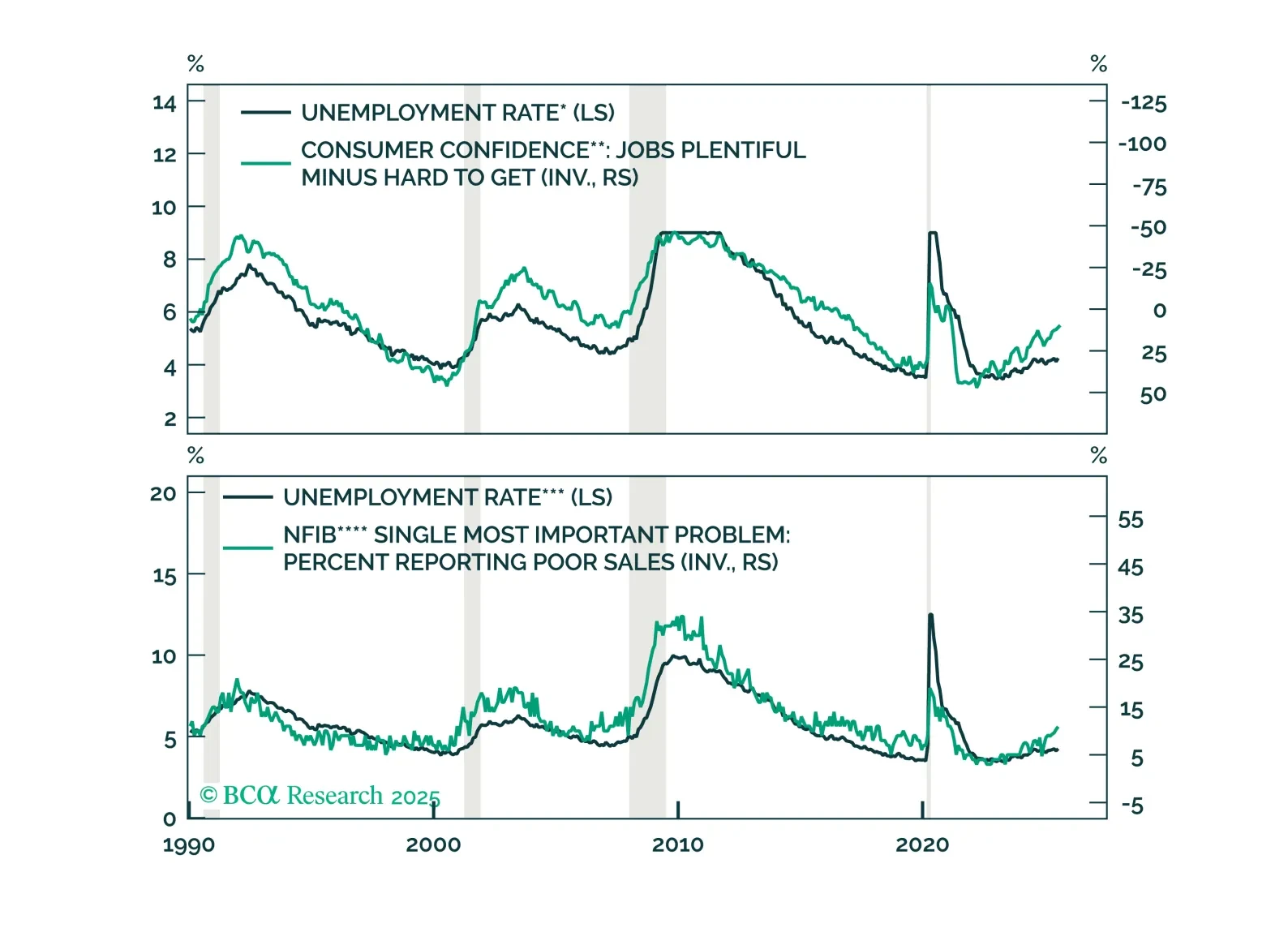

Median Fed unemployment rate projections are overly optimistic. The Fed will end up cutting more in 2026 than it currently anticipates.

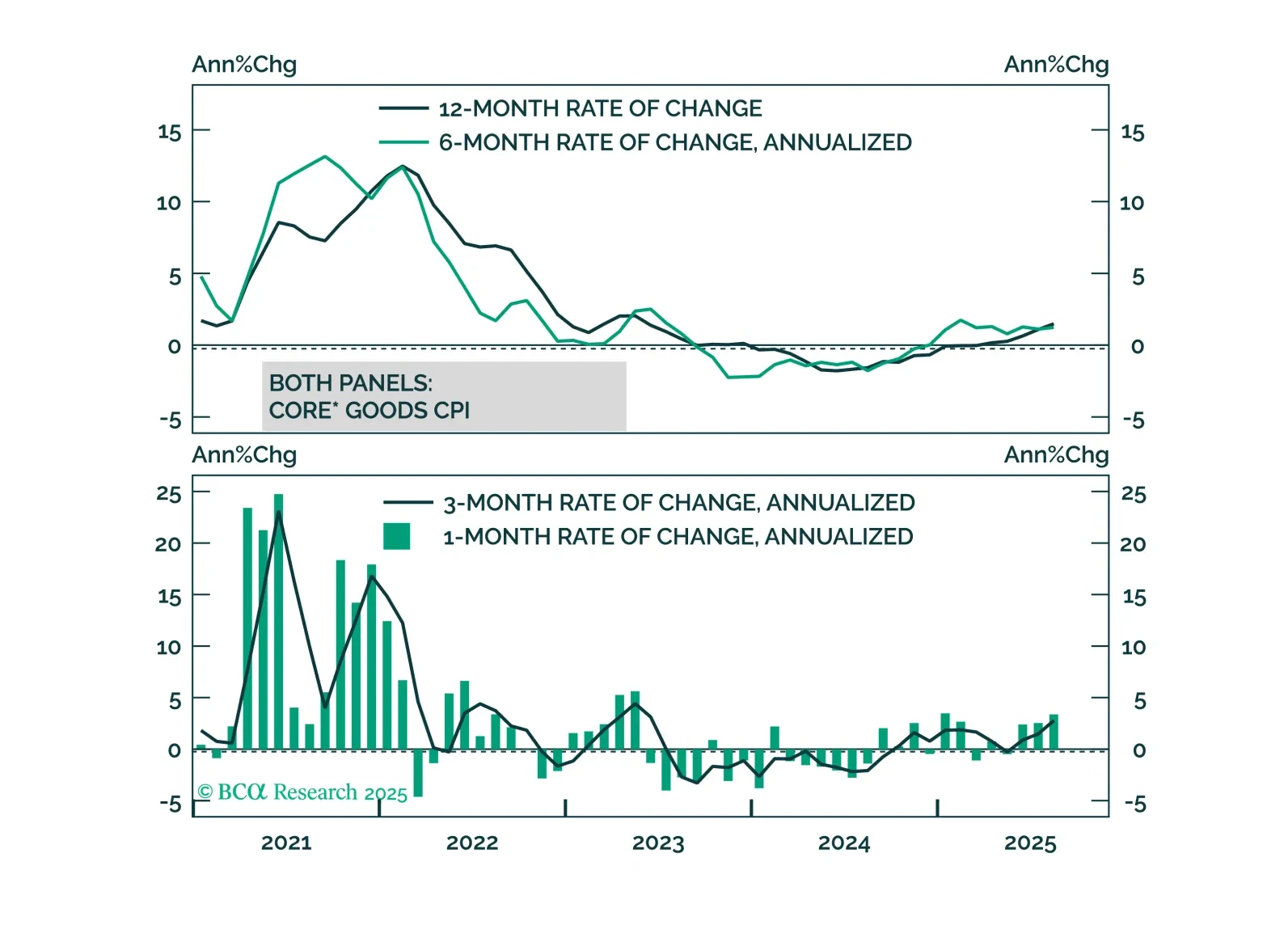

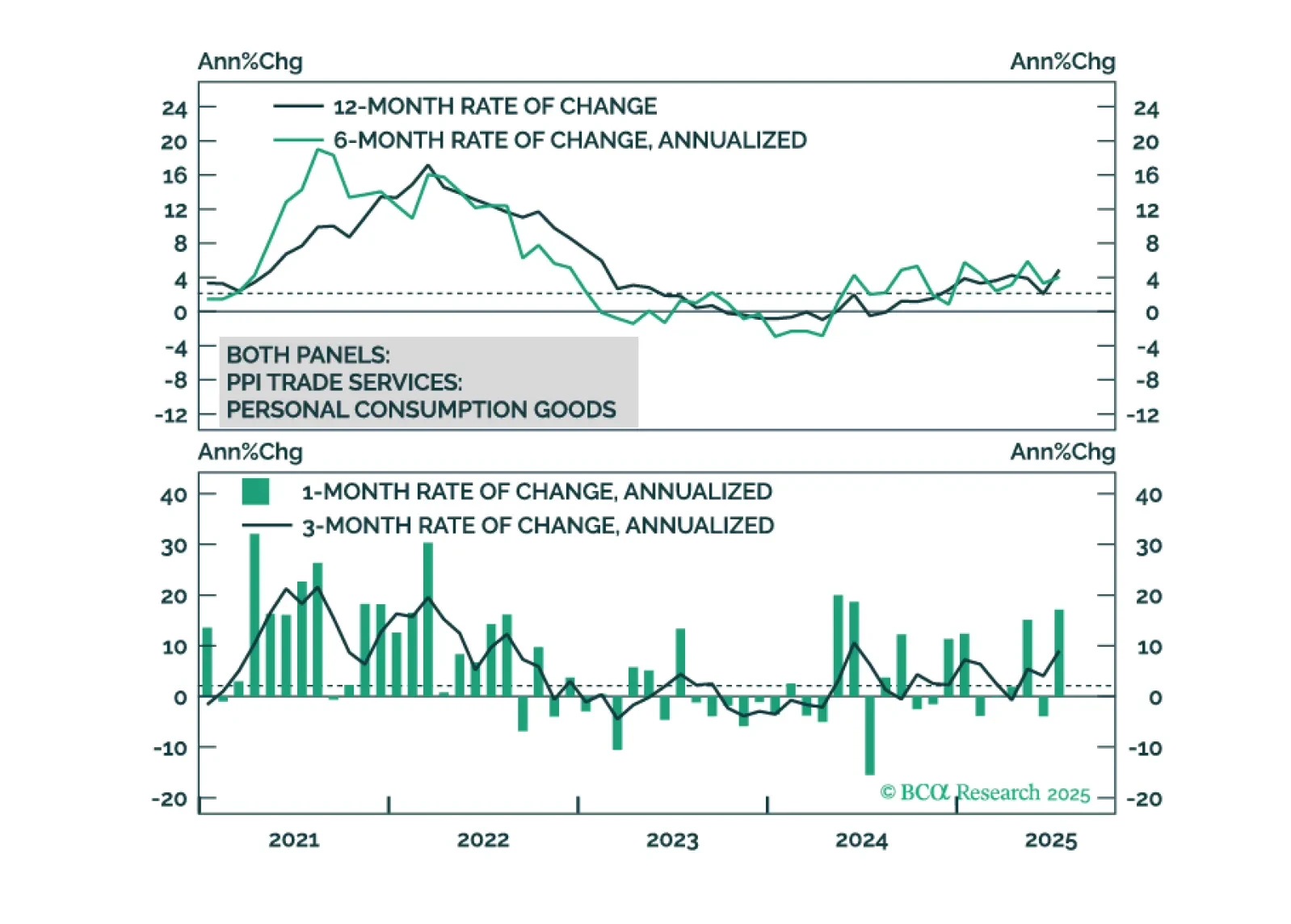

High US inflation is being driven by tariffs, not domestic inflationary pressure. This argues for Fed easing and a bull-steepening of the Treasury curve.

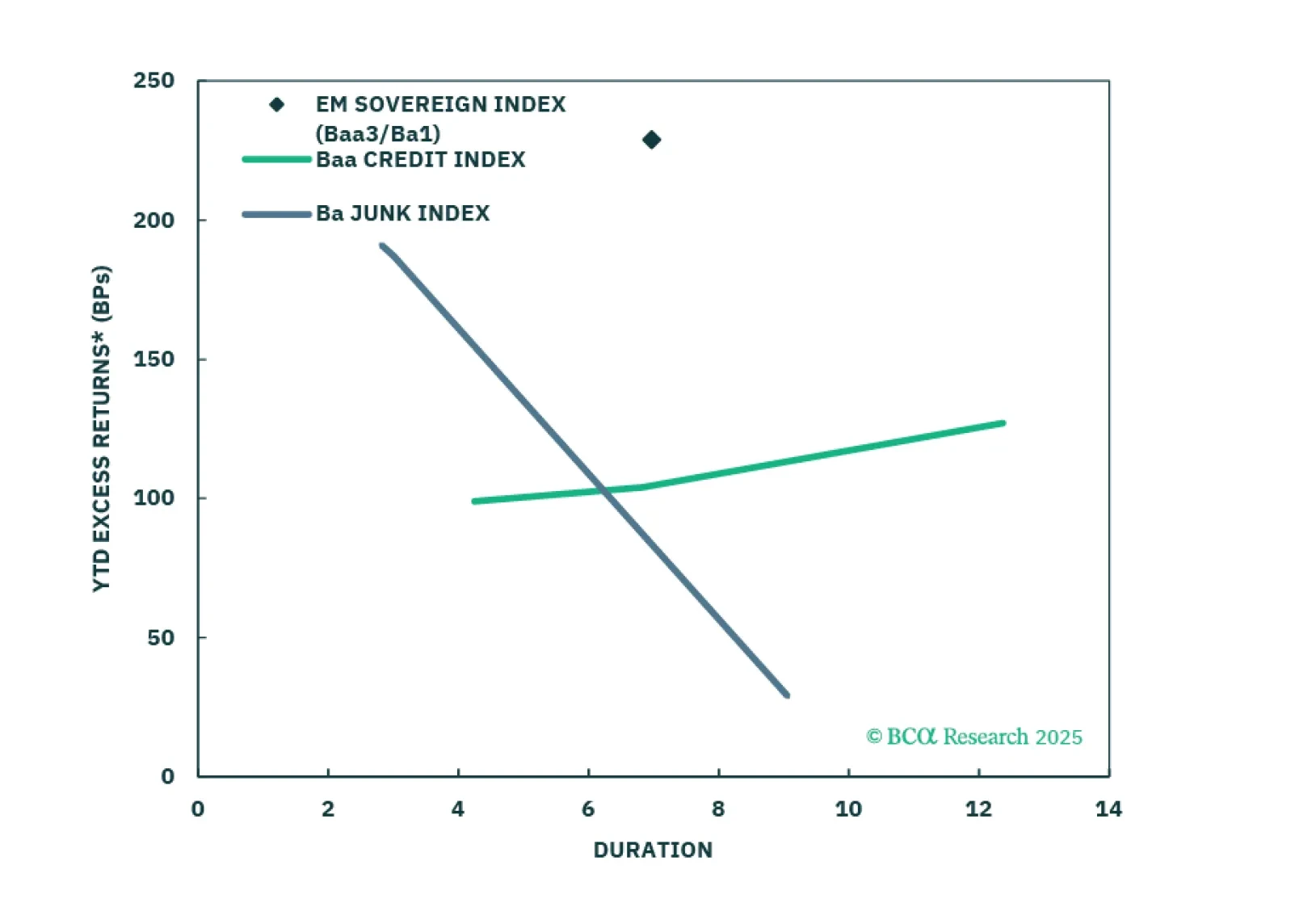

USD-denominated Emerging Market bonds have been outperforming US corporates for the past year. We don’t think the rally is exhausted yet.

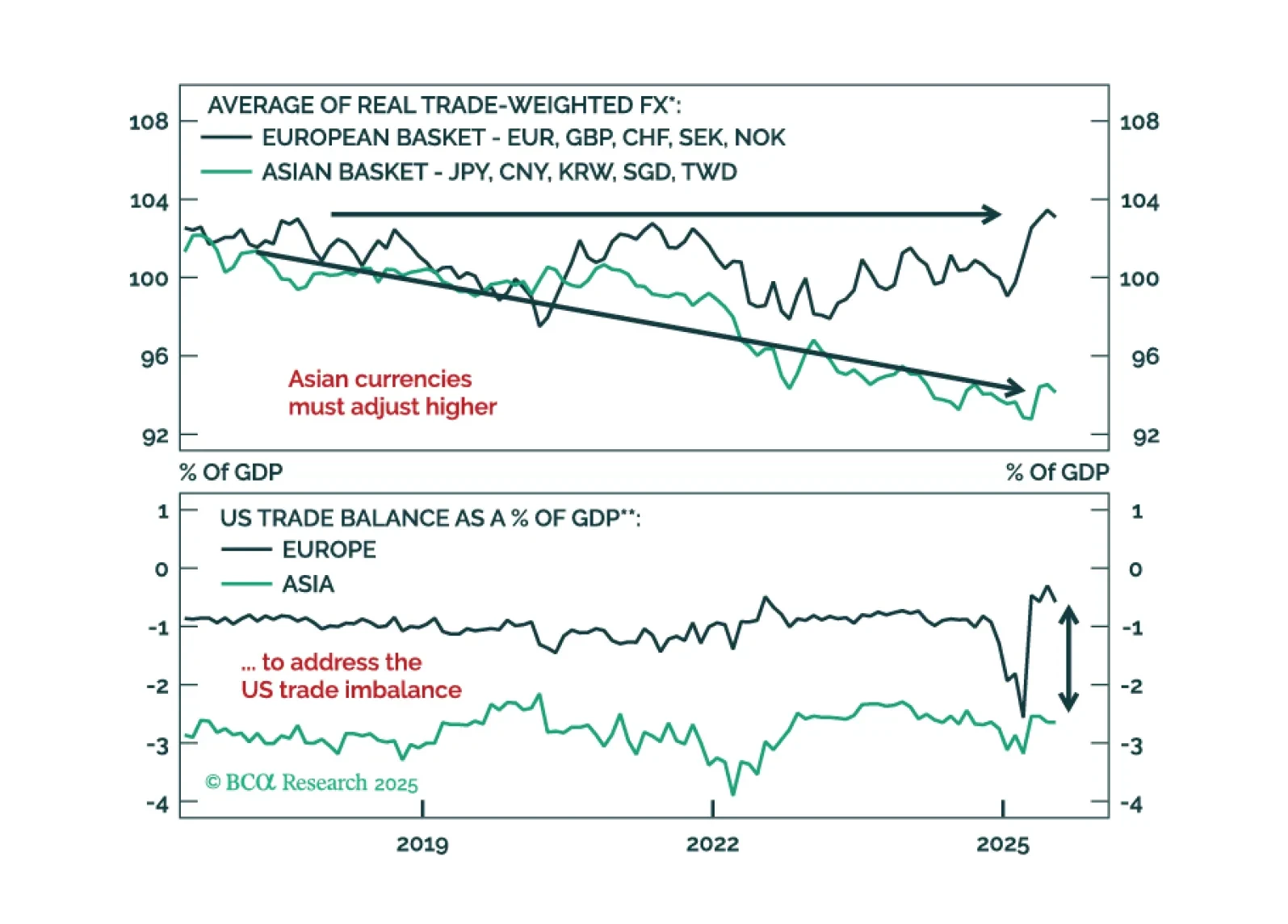

A fleeting greenback rally post Fed rate cut will offer a final chance to reset short dollar exposures. See why undervalued Asian FX are poised to lead the next leg lower in USD and how to position now.

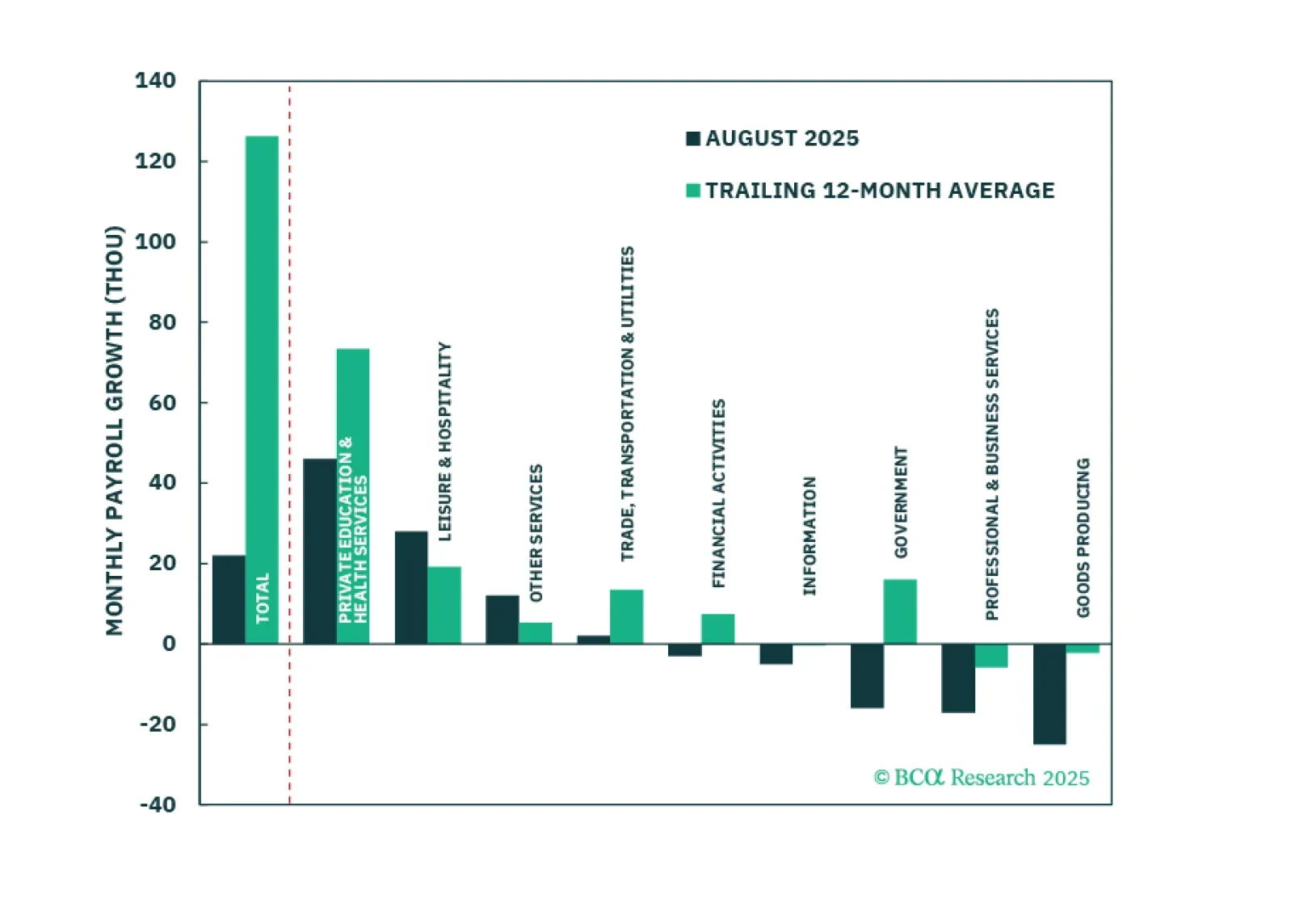

The August employment report showed a modest increase in labor market slack, enough to cement a 25-basis-point rate cut this month.

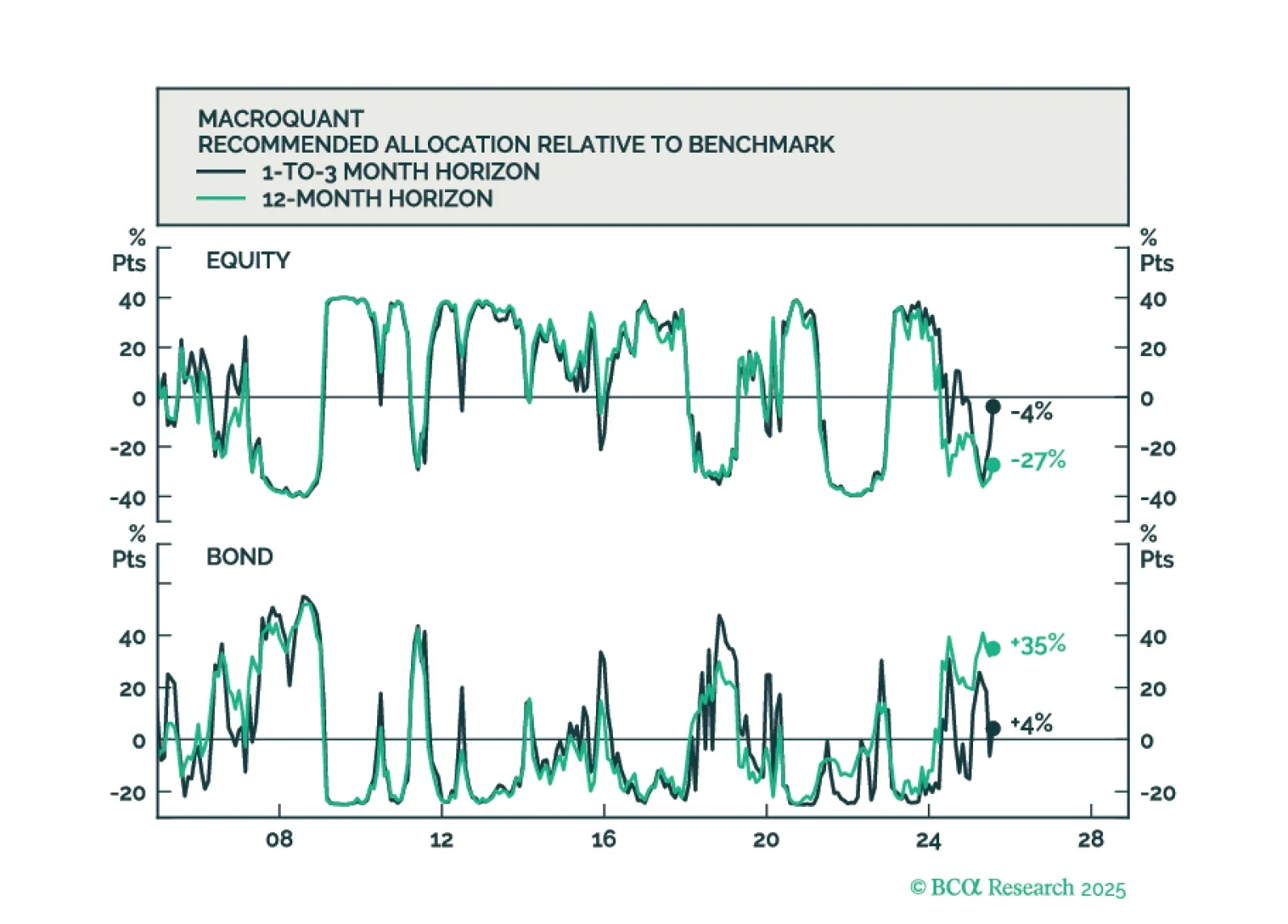

Our Portfolio Allocation Summary for September 2025.

MacroQuant sees downside risks to stocks over a long-term horizon but is not yet saying that we are at imminent risk of an equity bear market.

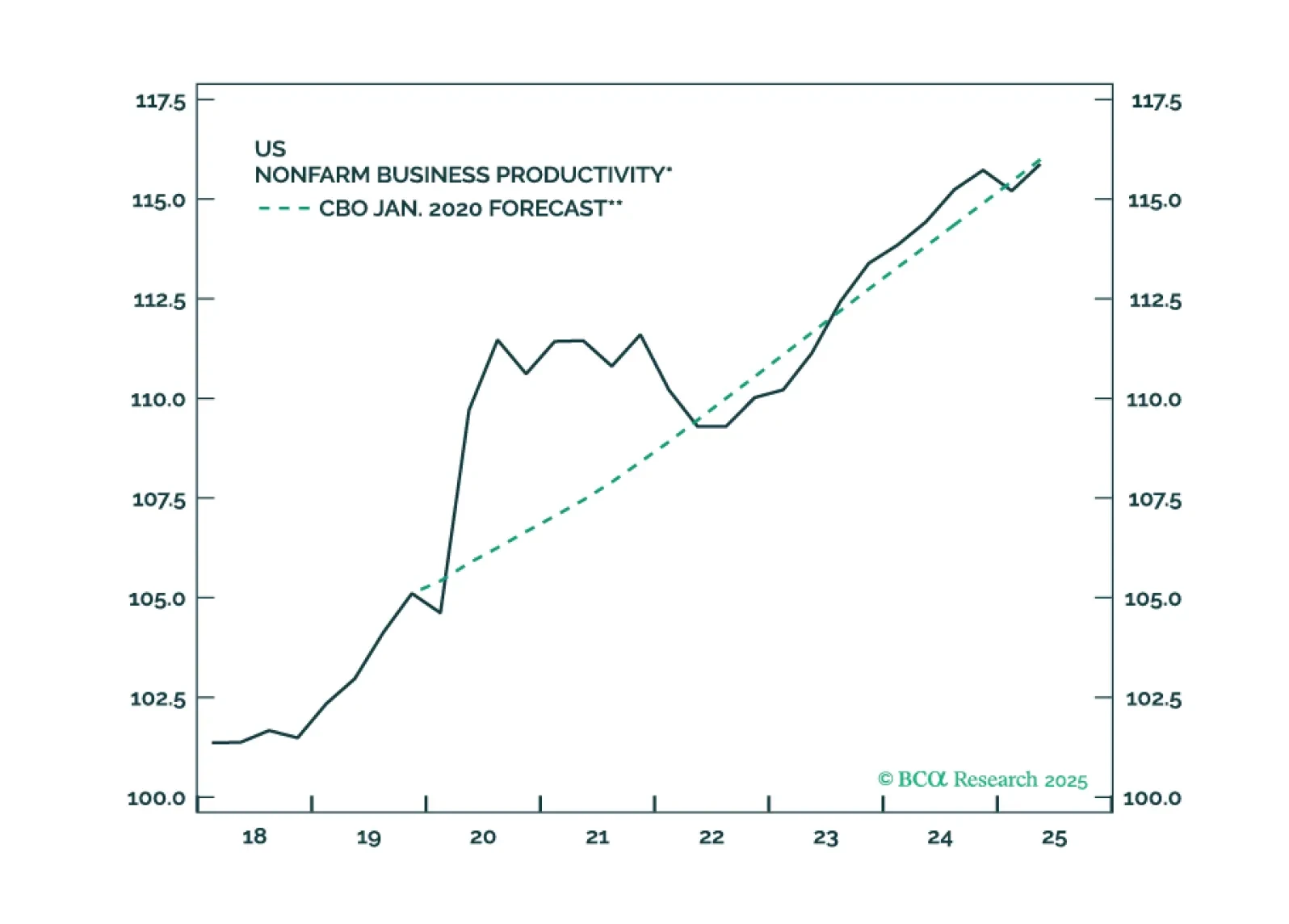

The AI boom has had less of an impact on the economy than widely believed. This may eventually change, but the risk is that investors grow impatient before it does.

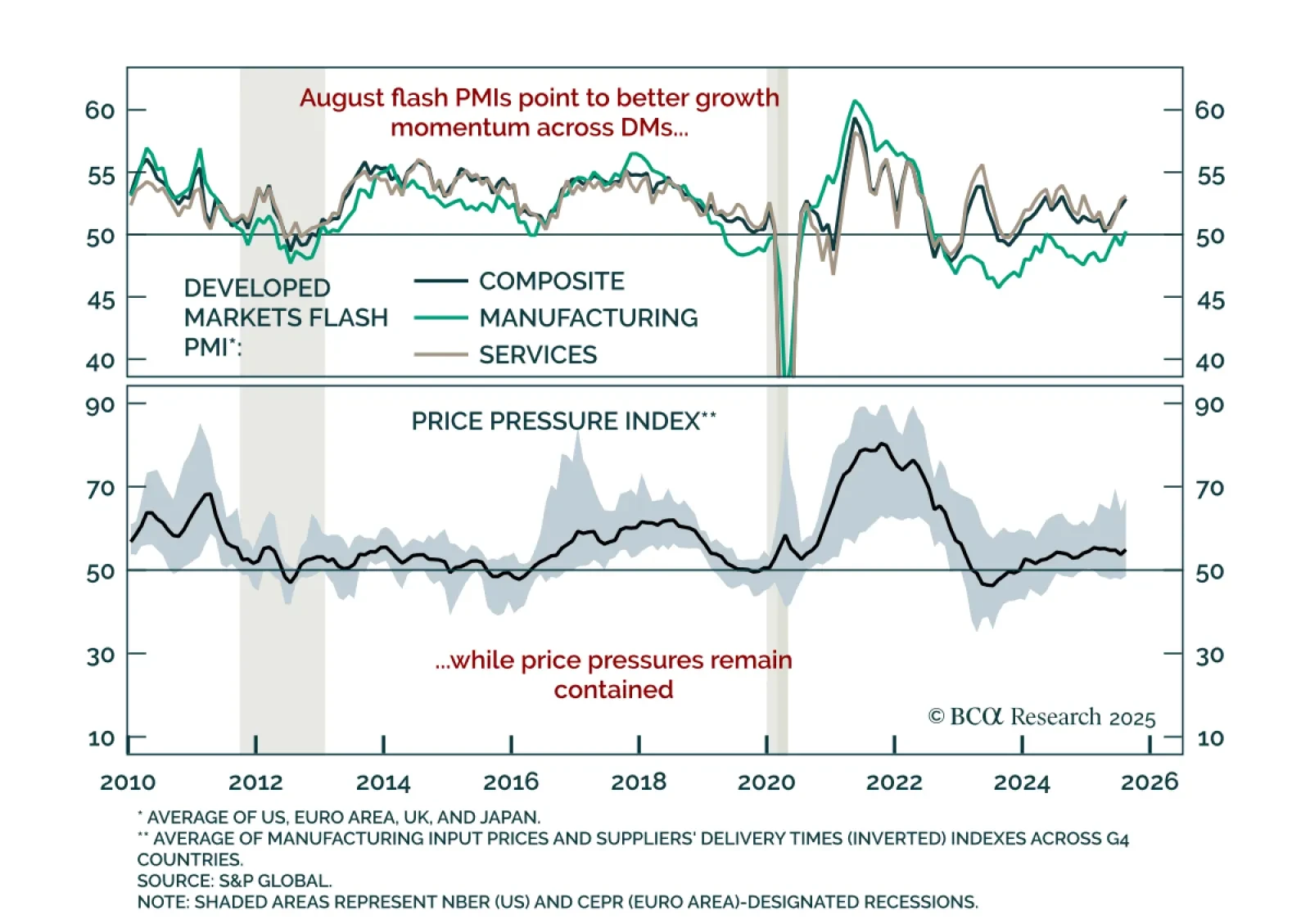

Flash August PMIs show tentative global momentum yet growth remains weak. The composite PMI improved in both the US (55.4 vs. 55.1) and euro area (51.1 vs. 50.9), with manufacturing moving into expansion for the first time in 18…

The cost of tariffs is falling on the US consumer, not foreign exporters or US firms.