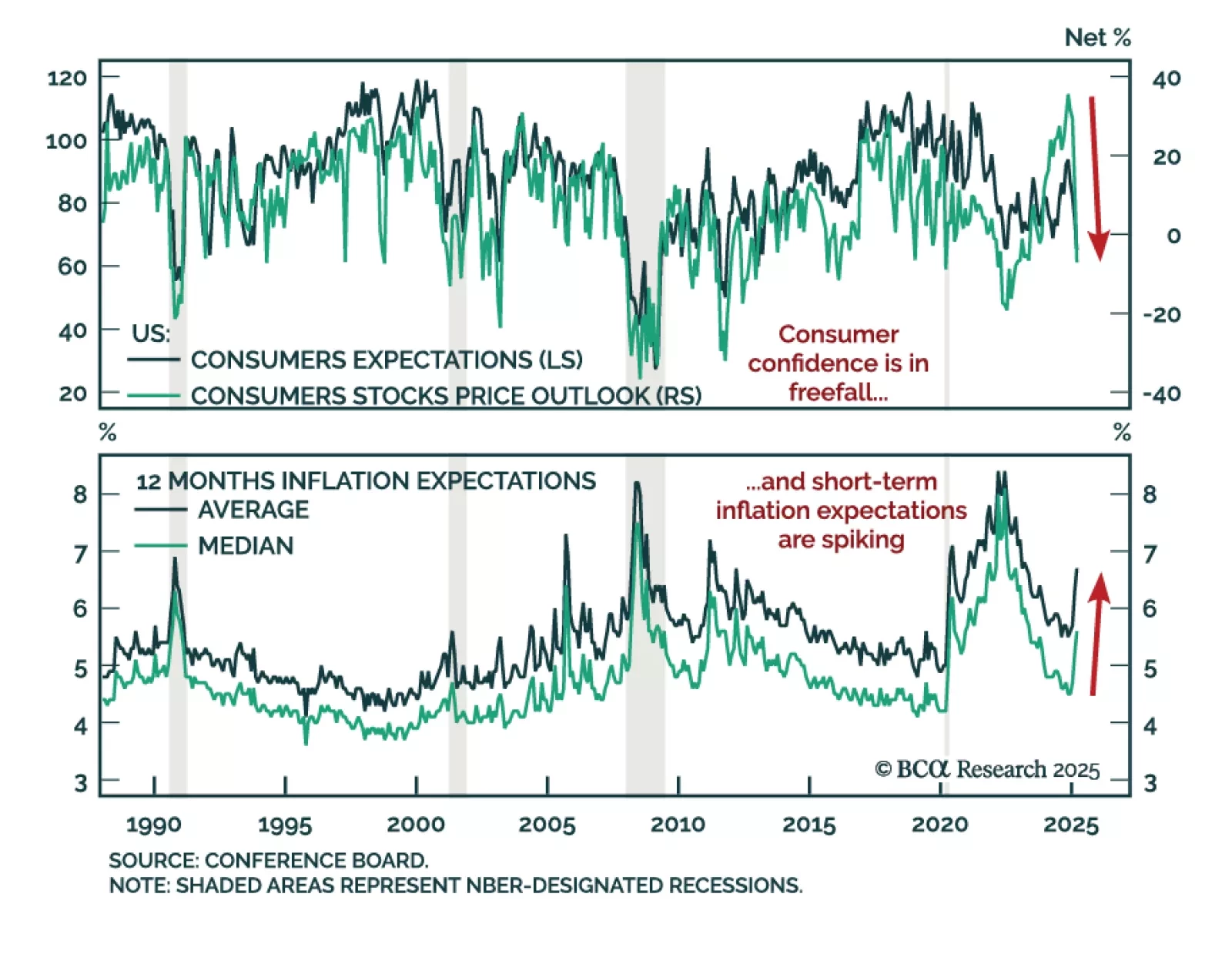

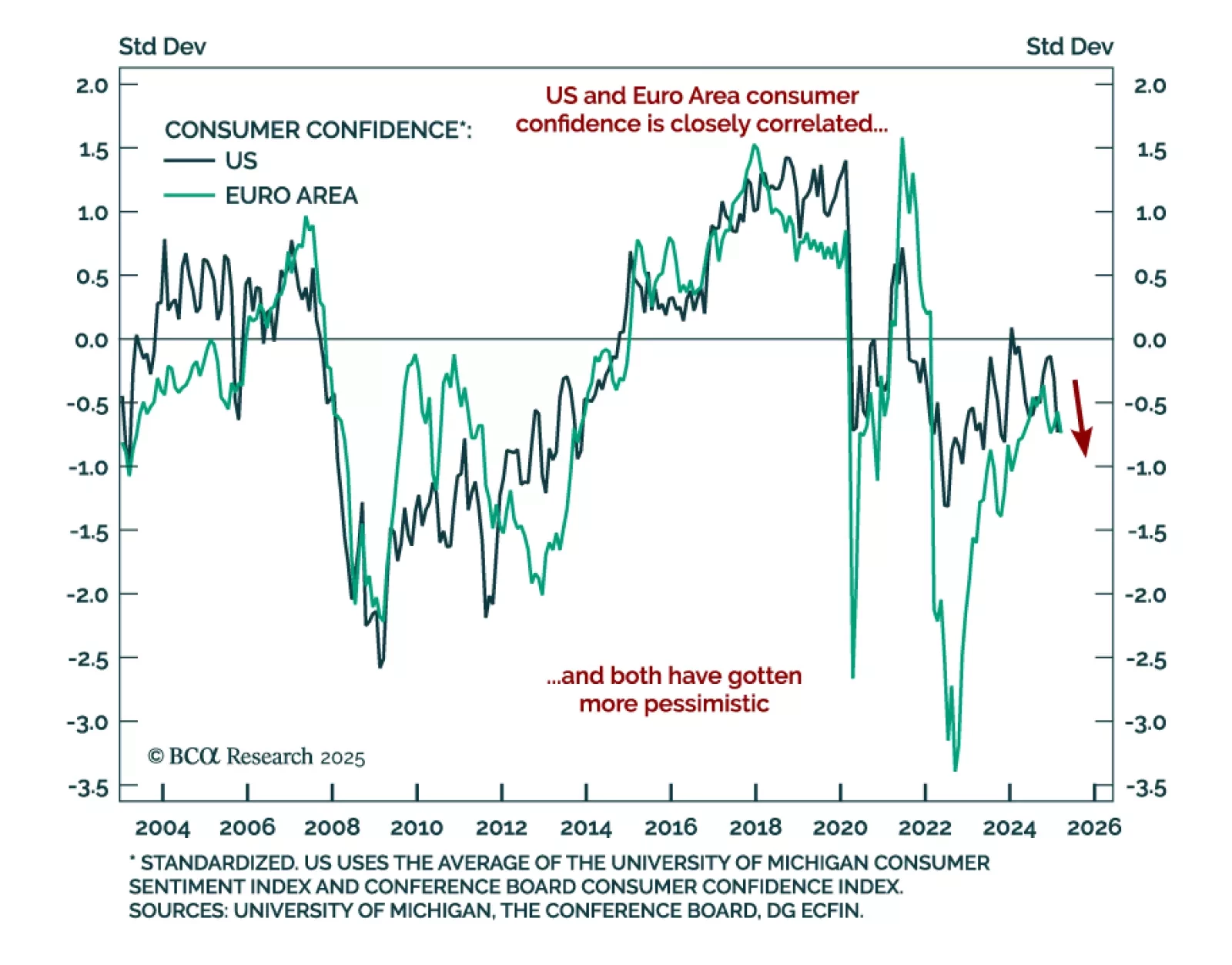

A sharp drop in consumer confidence adds to signs that a consumption slowdown is coming, threatening both US and global growth. Yet rising short-term inflation expectations will keep central banks cautious, weighing on long-term…

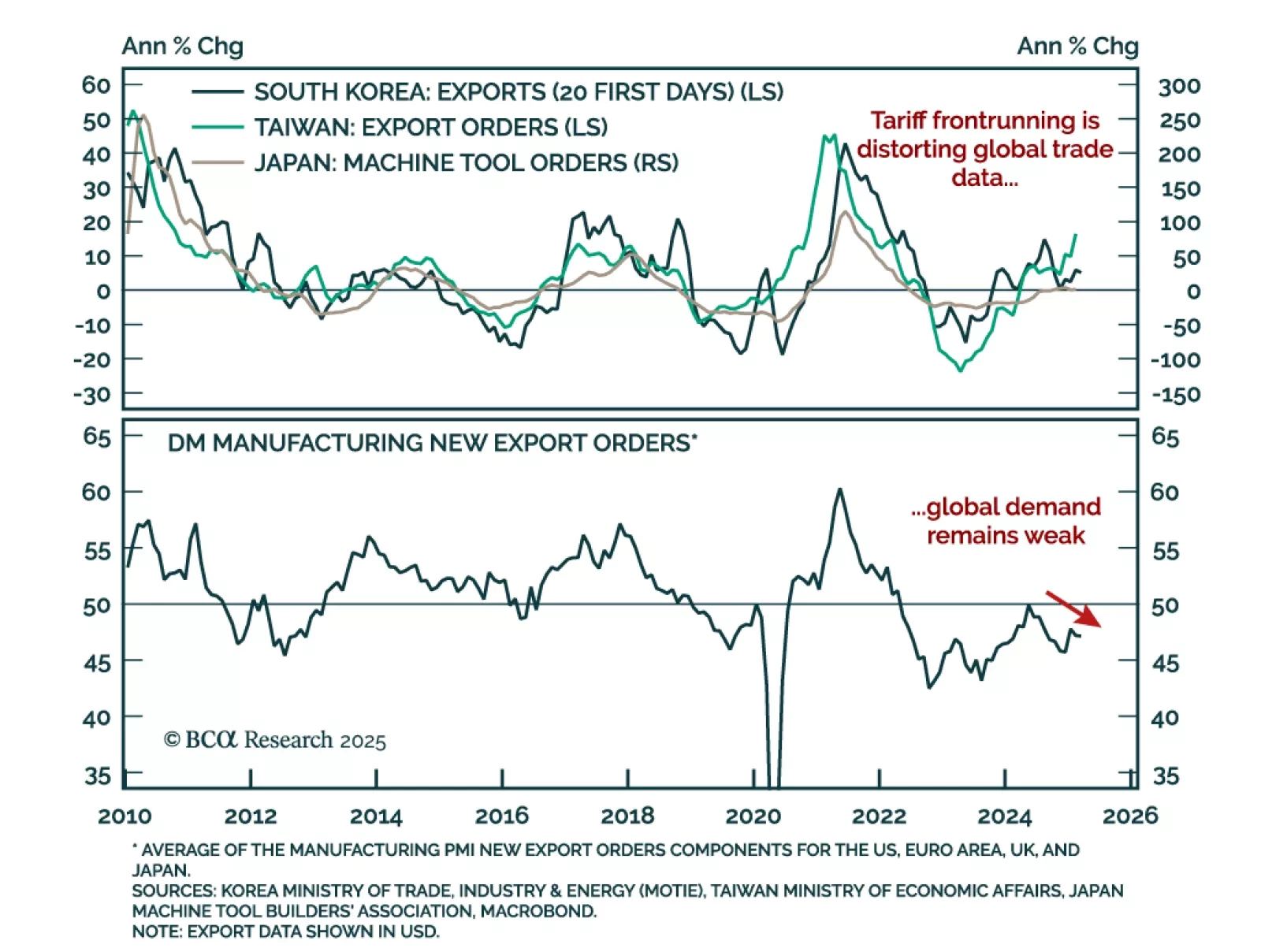

East Asian trade data has been disappointing. Preliminary February data for Japanese machine tool orders showed a slowdown to 3.5% y/y from 4.7% in January. Broader machinery orders were down 3.5% m/m in January. Taiwanese exports…

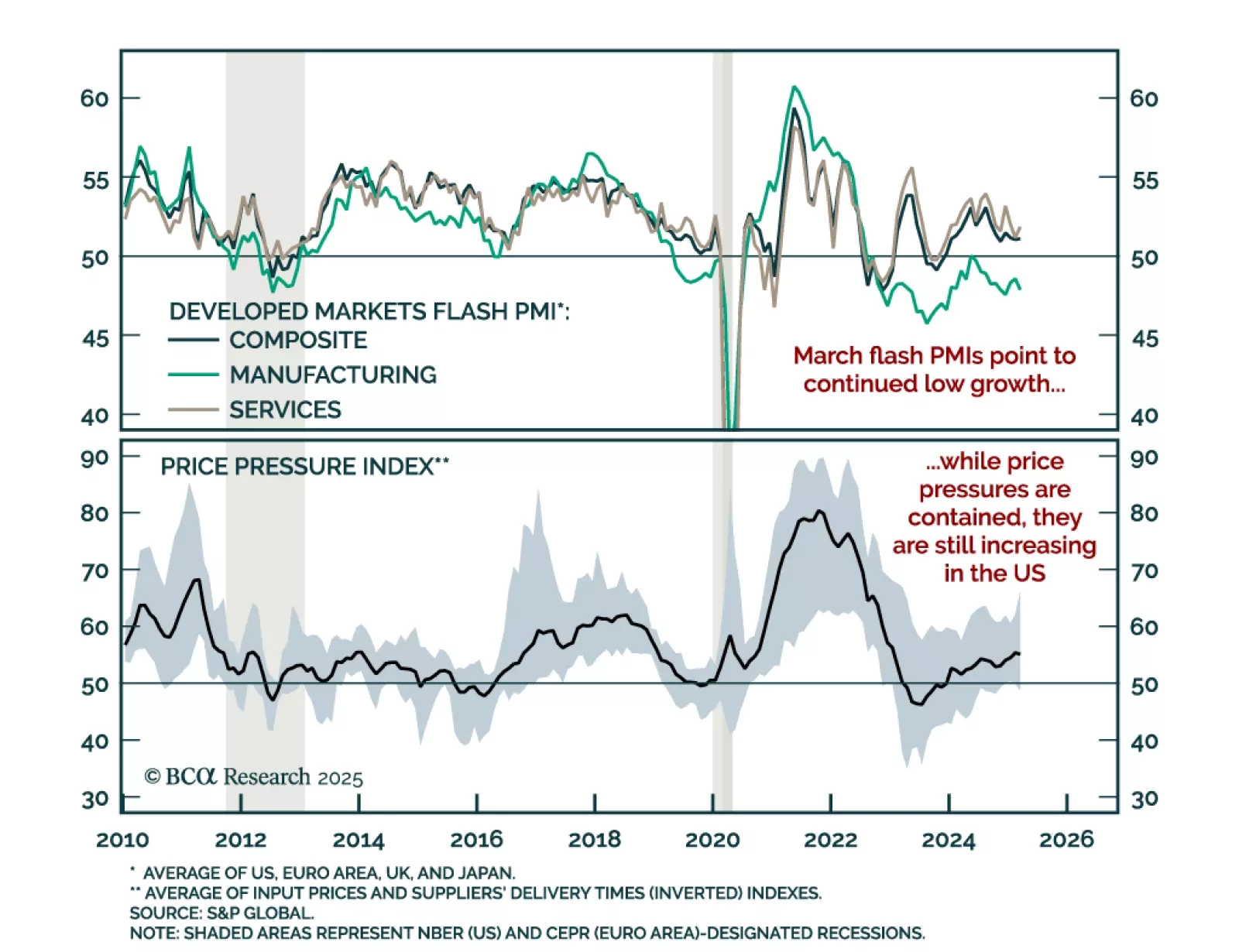

The March PMIs point to a low growth buffer outside the US as uncertainty engulfs the global economy. Aggregate price pressures were contained in March, but input prices still increased in the US. While the market reaction was risk-…

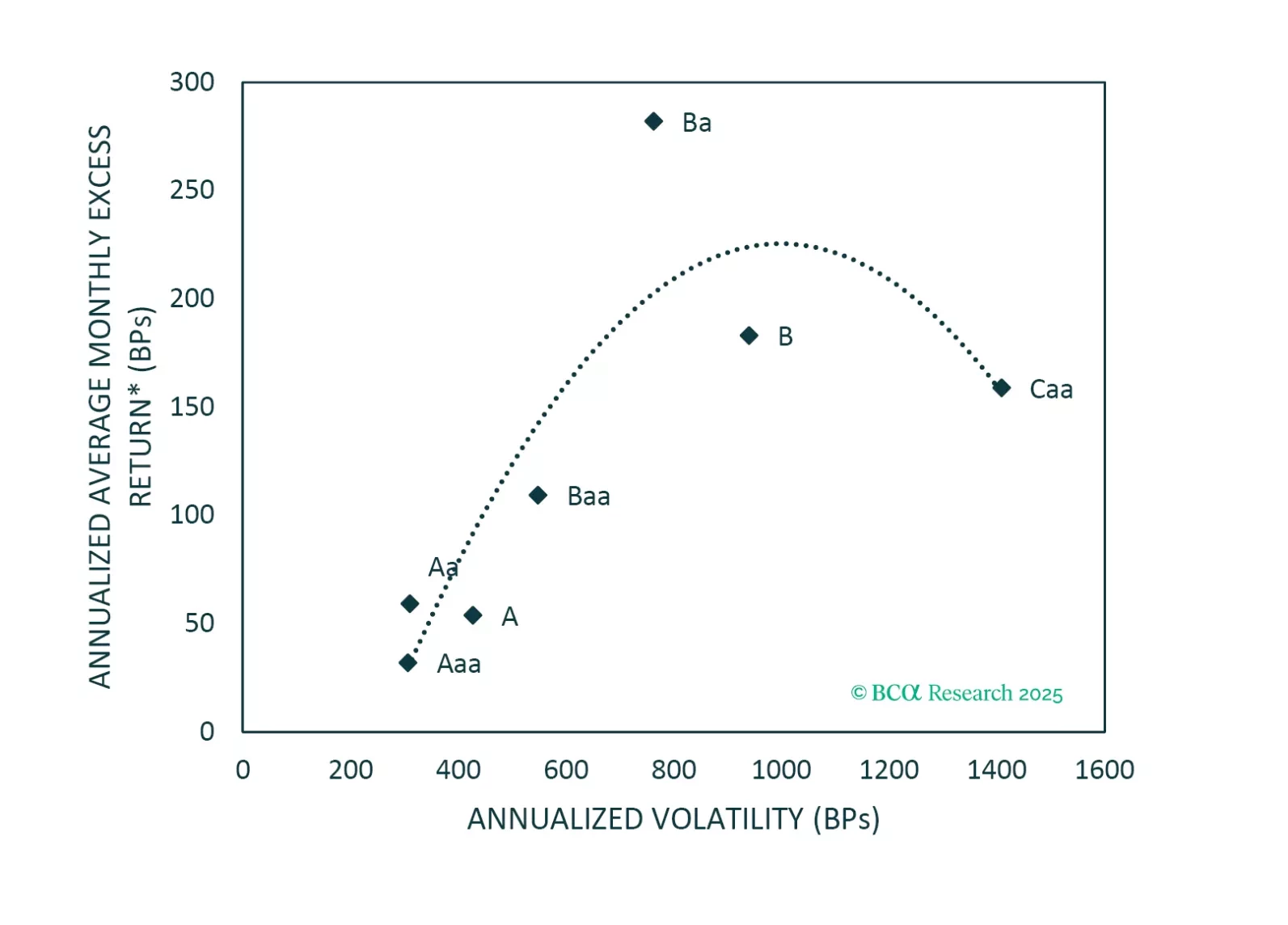

An analysis of historical data shows that Ba-rated bonds outperform other corporate credit tiers in the long-run on a risk-adjusted basis. That said, today’s fragile macro environment warrants a more cautious allocation.

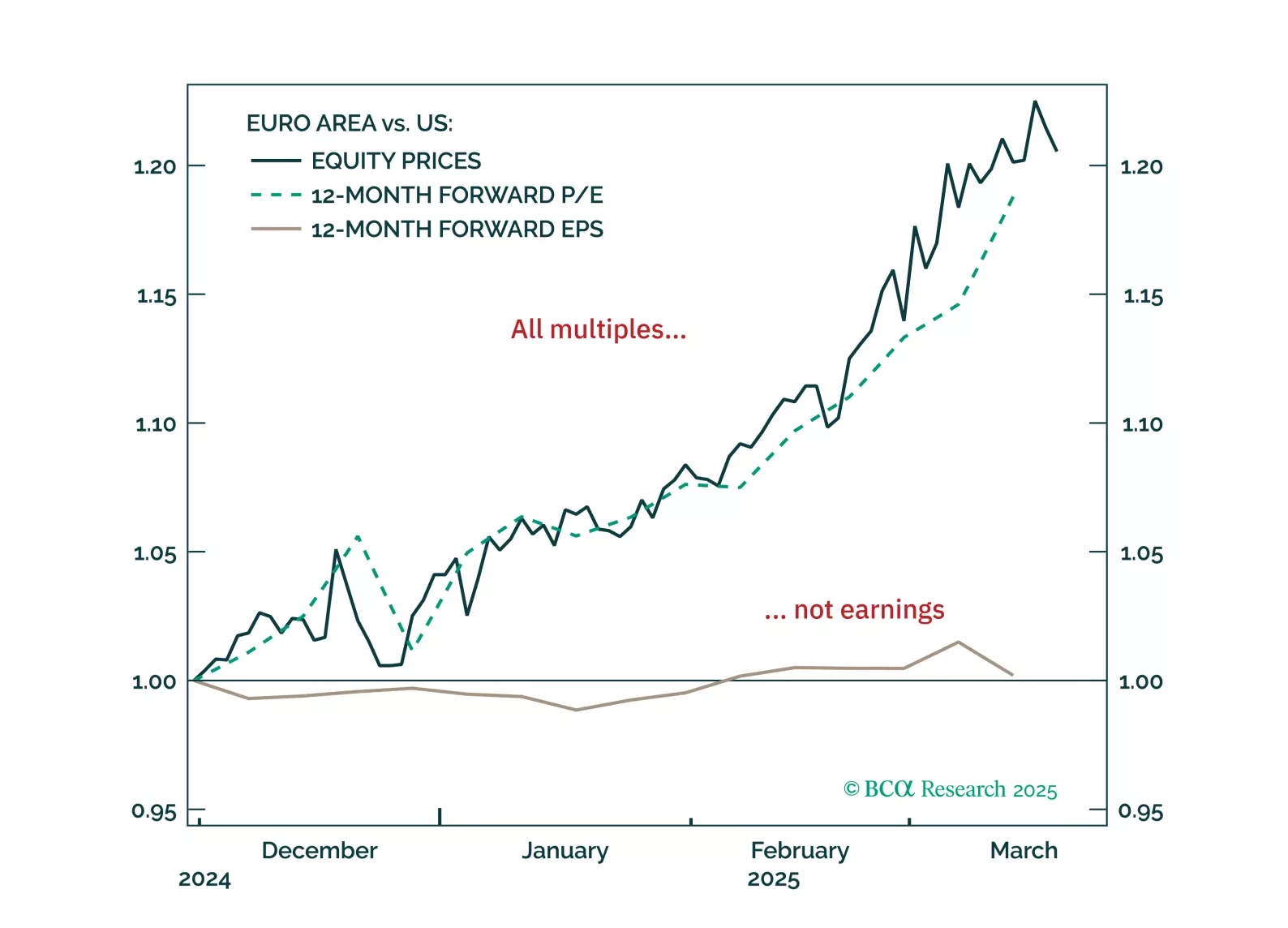

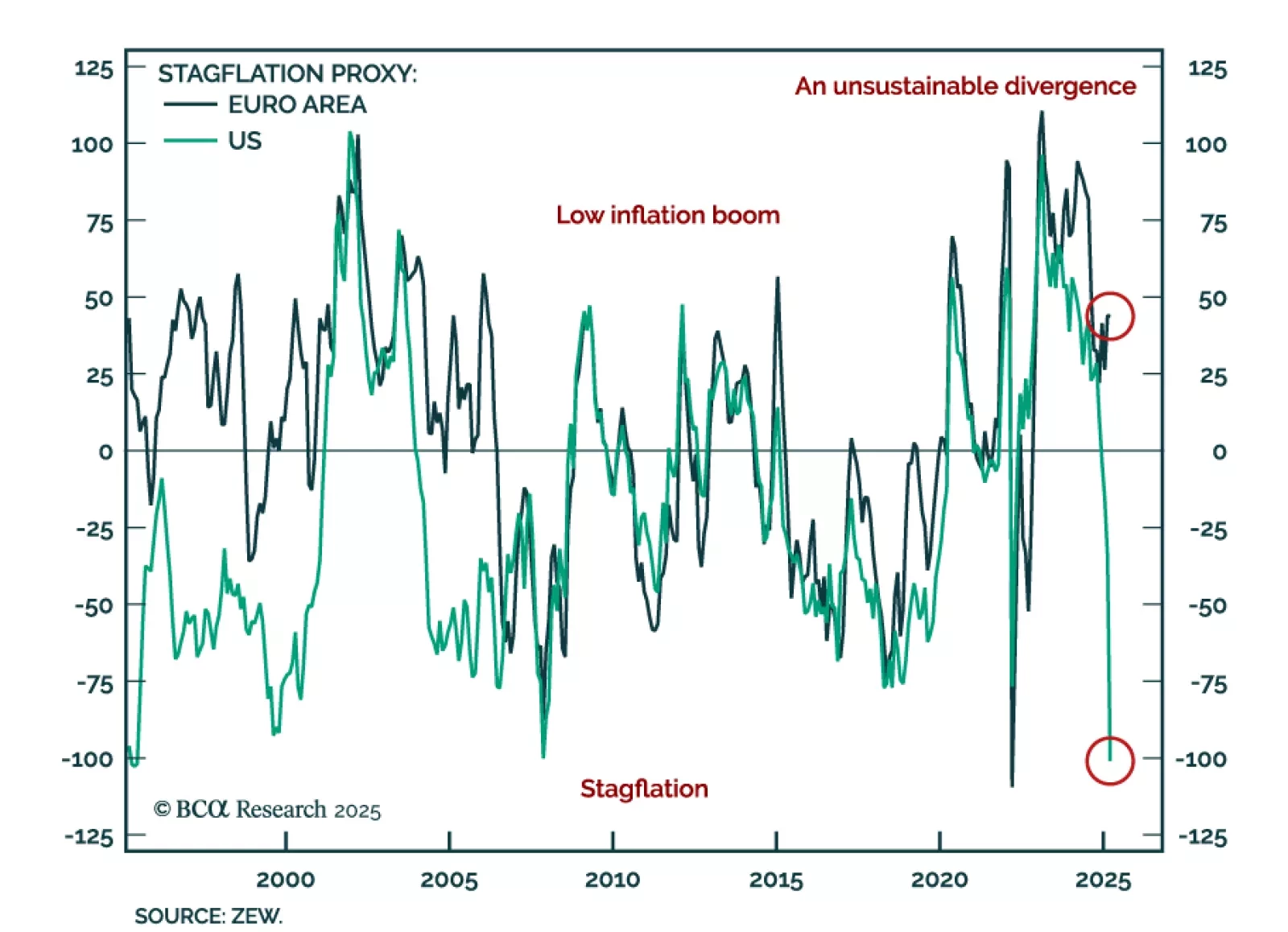

European equities have surged on hopes of a low-inflation boom—but the rally has likely gone too far, too fast. With a pullback now likely, how should investors position themselves over the next 3–6 months?

The March flash estimate for European Consumer Confidence missed estimates, and fell to -14.5 from -13.6 in February. This negative reading is the first European sentiment number missing expectations since January. The sentiment…

Our Chart Of The Week comes from Mathieu Savary, Chief Strategist of our European Investment Strategy service. Mathieu believes the recent outperformance of European over US risk assets is unlikely to last over the next 3-6 months.…

Our tactical framework highlights how financial conditions and economic surprises interact, where growth often sows the seeds of its own demise. Markets price expectations efficiently but lack perfect foresight, making data surprises…

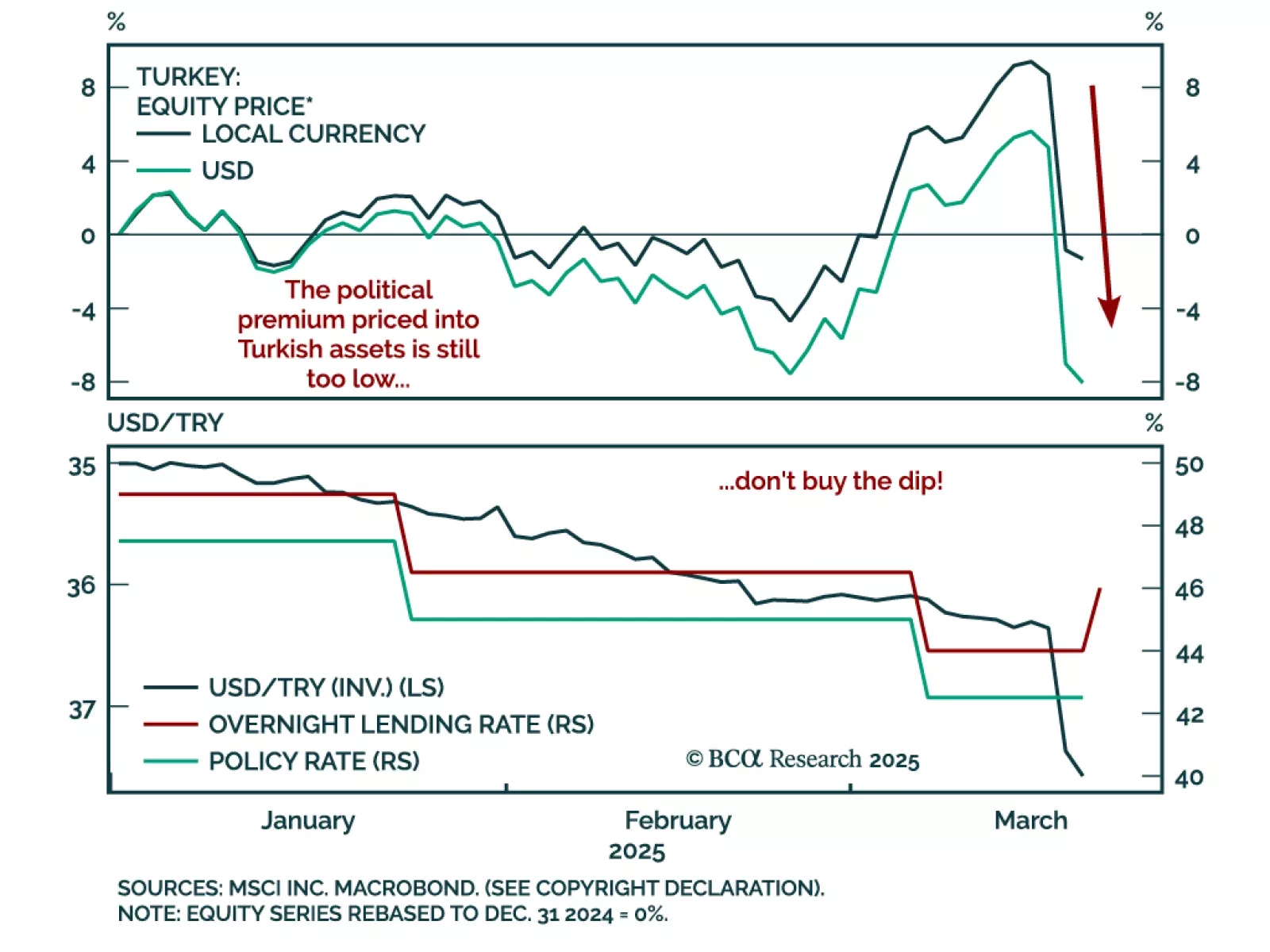

After a period of relative stability and progress towards policy orthodoxy, politics are again haunting Turkish assets. President Erdogan jailed Istanbul mayor Ekrem Imamoglu, a political rival from the opposition party gaining…

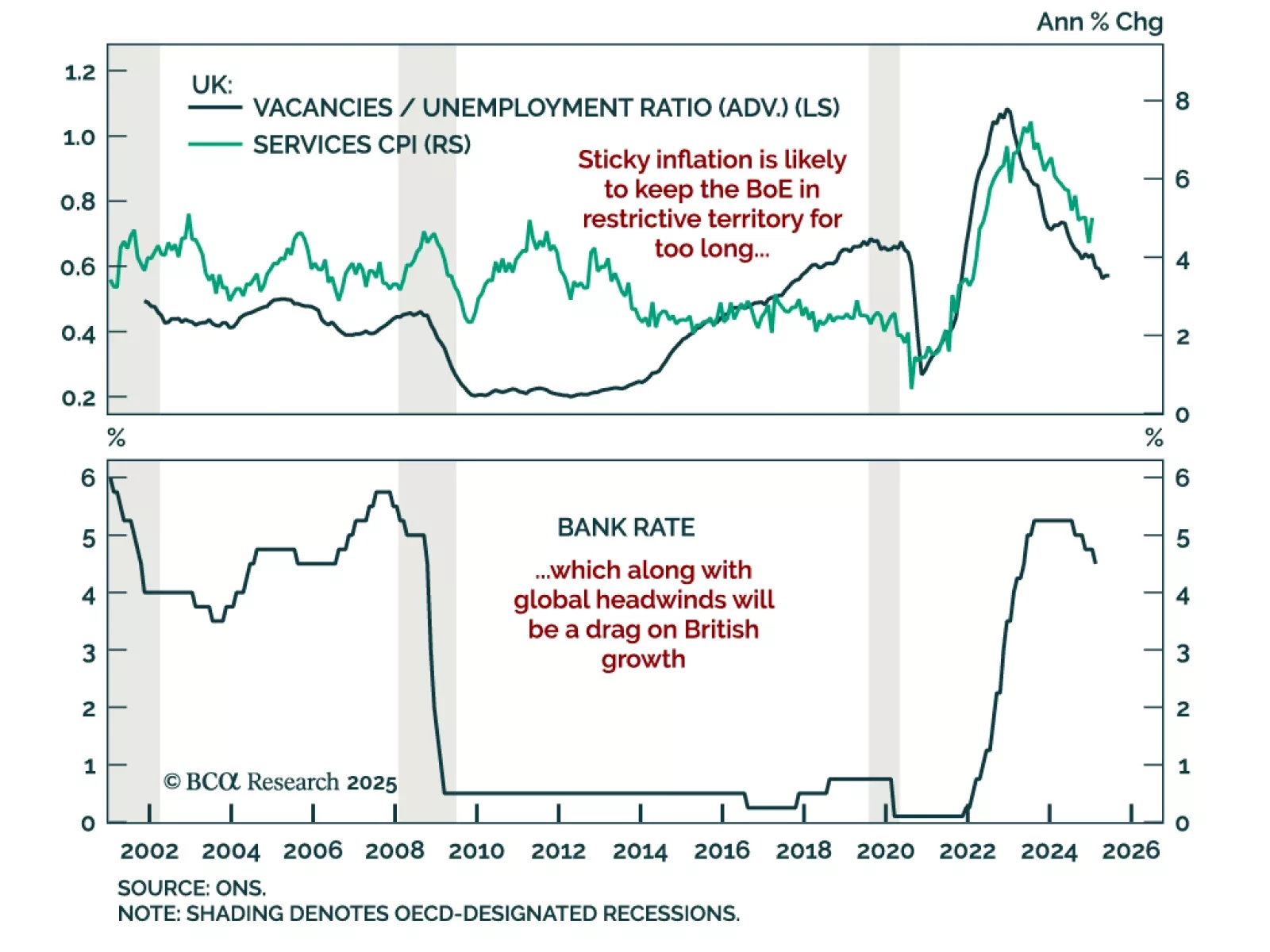

The Bank of England held its policy rate at 4.5%, with only one MPC member dissenting to cut 25 bps. The BoE signaled a slower pace of easing, as inflation remains elevated while global growth becomes increasingly uncertain. …