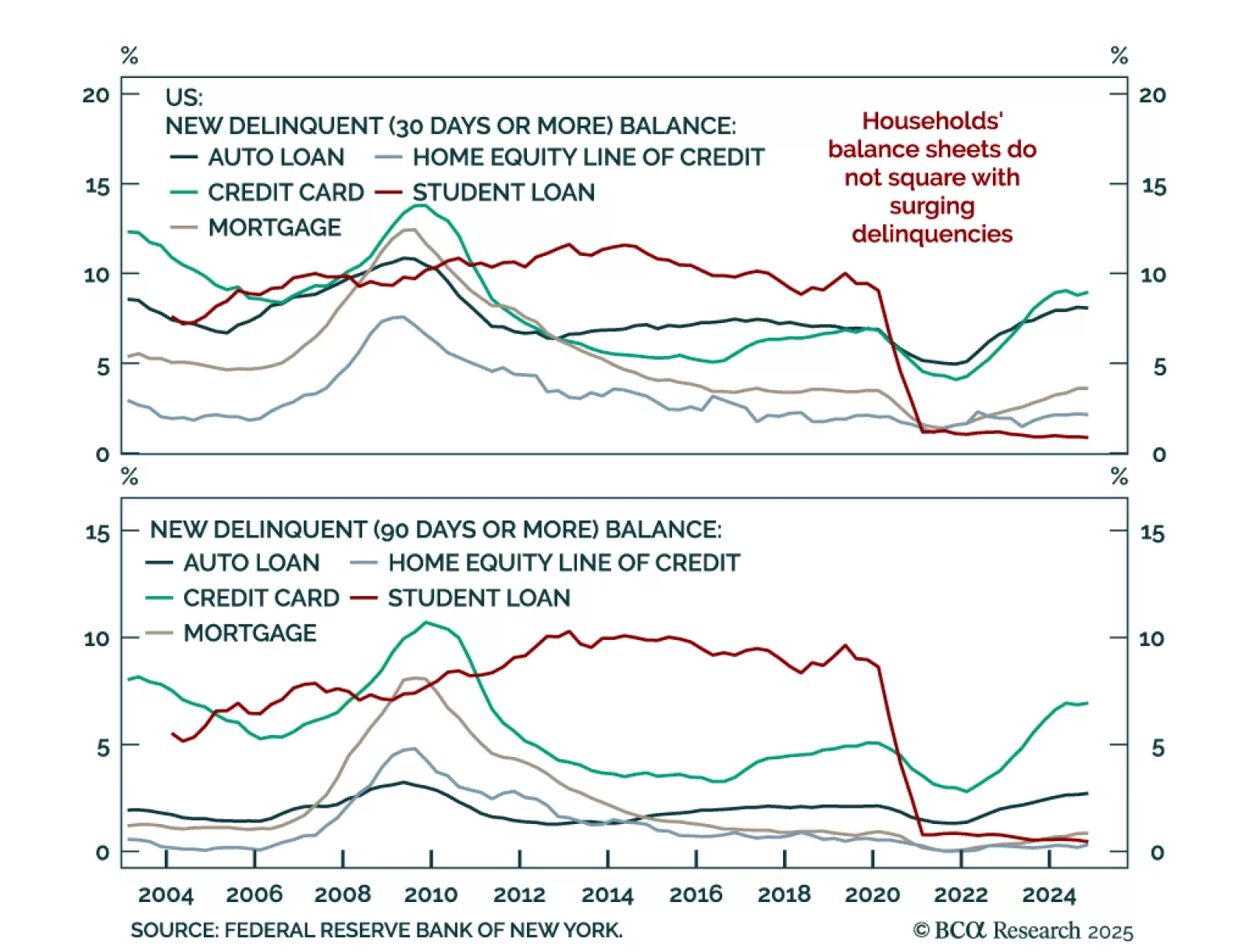

This morning’s weak consumer spending and strong inflation data reinforce our sense that the US economy is heading toward recession.

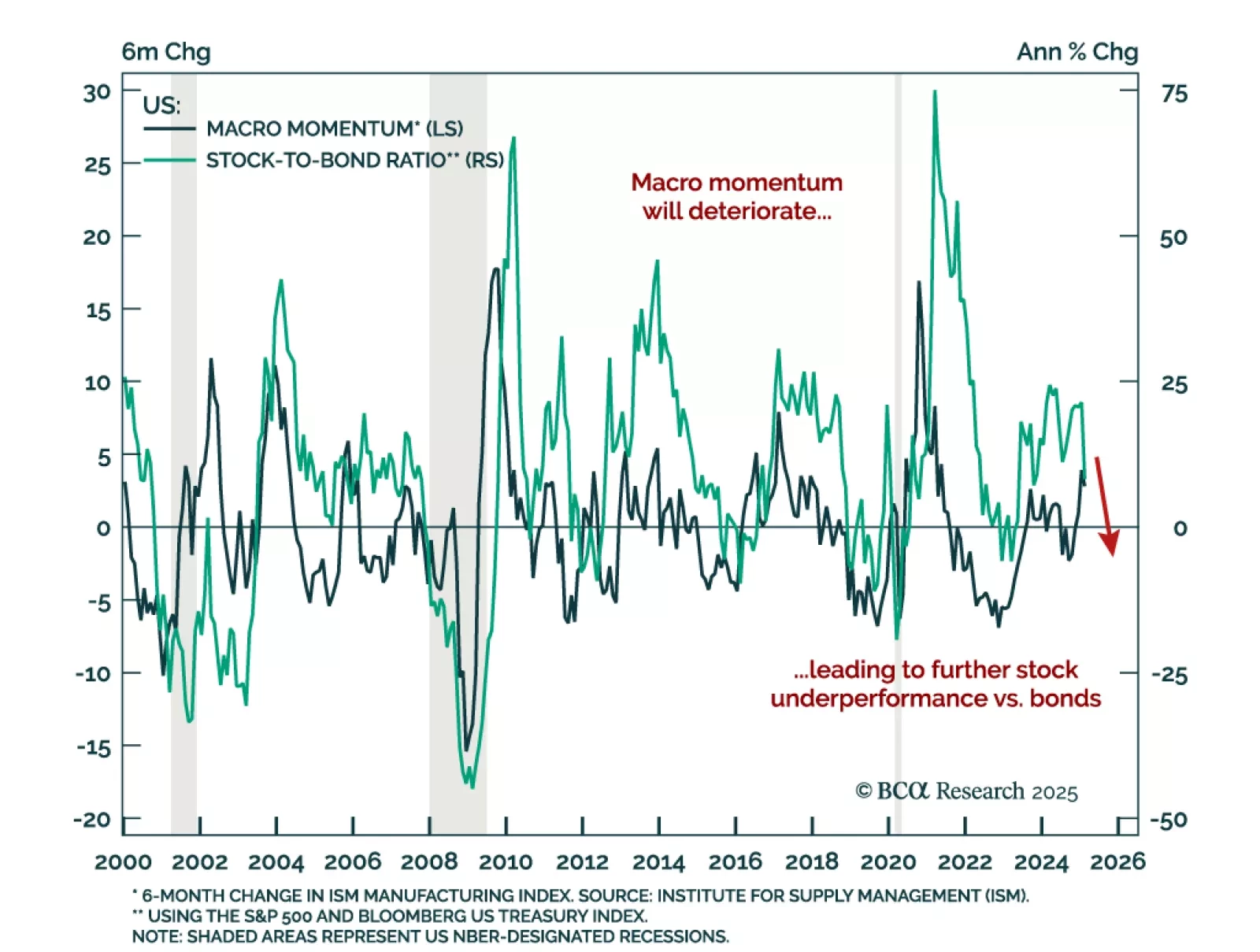

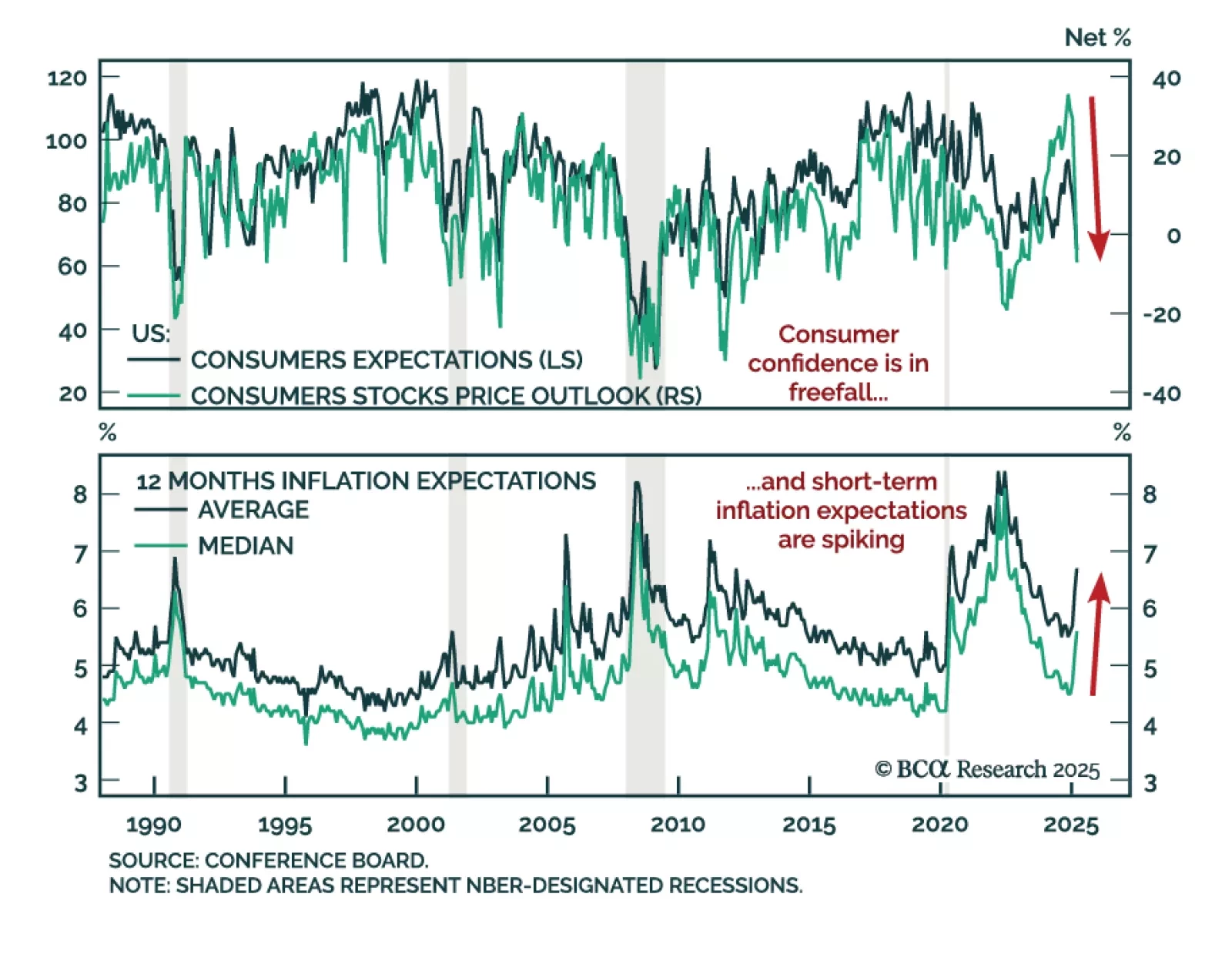

Macro momentum is deteriorating rapidly, and we remain defensively positioned as risks build. Business and consumer confidence have fallen sharply, and while the US post-election period began with optimism, policy uncertainty has…

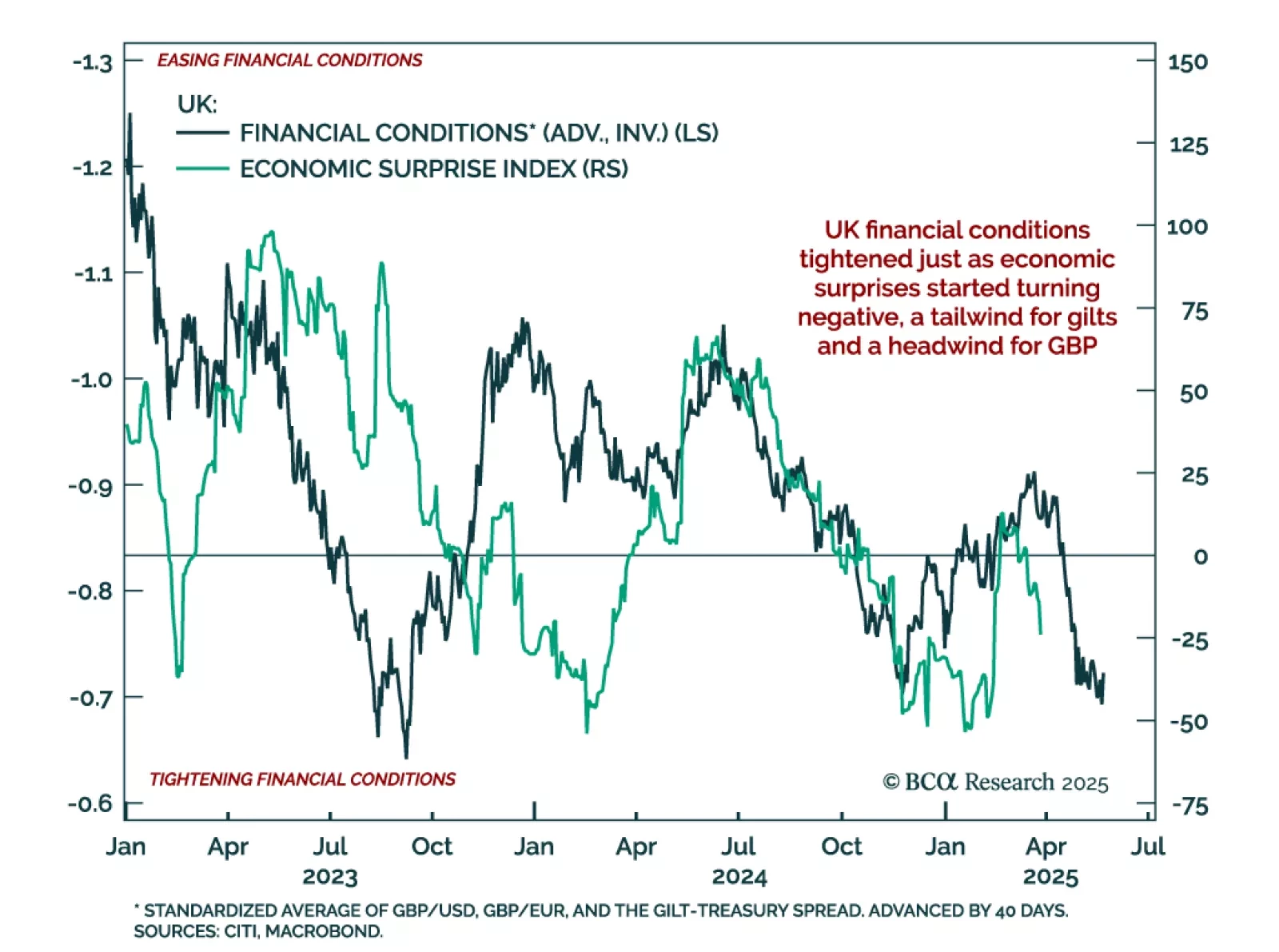

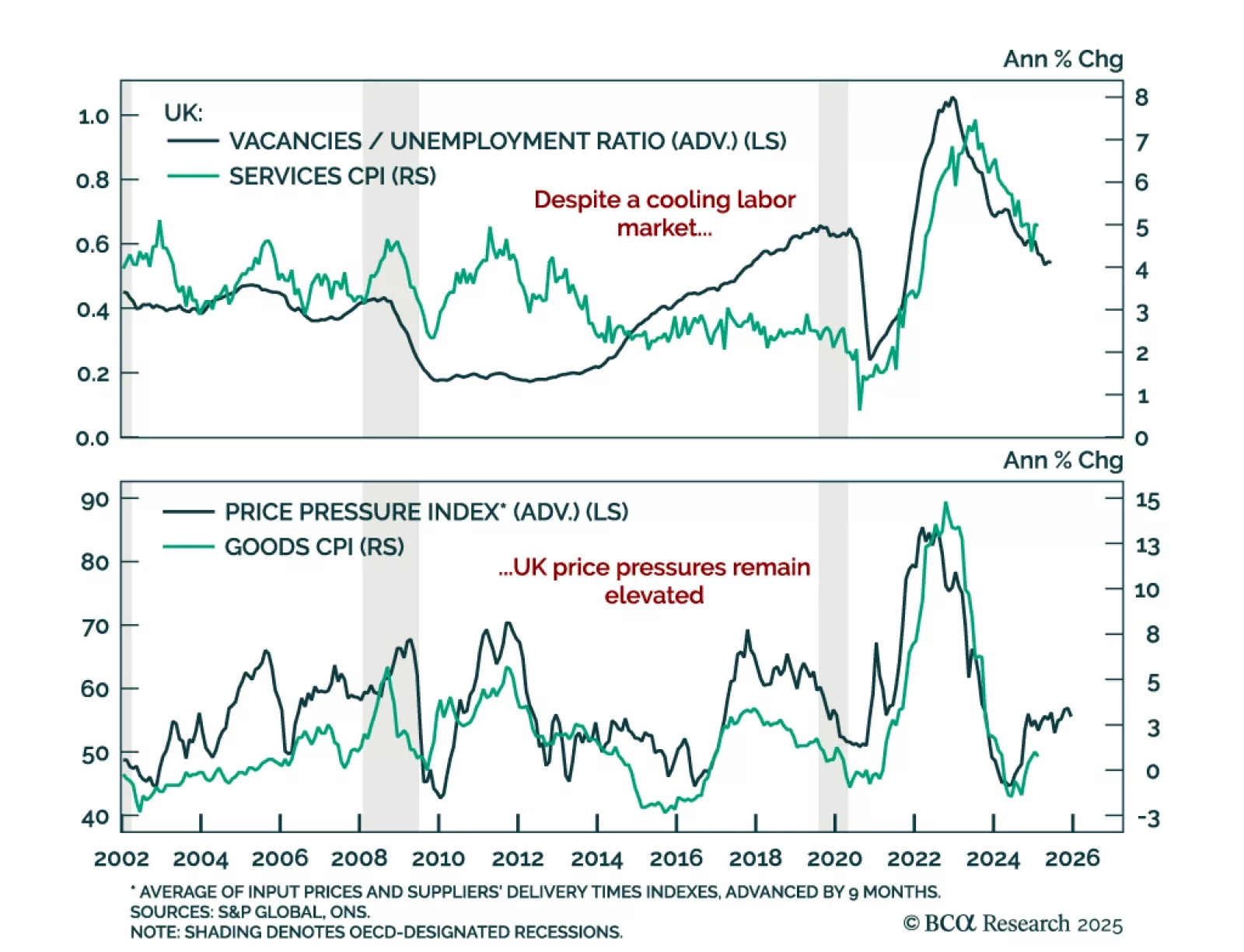

UK financial conditions have tightened just as economic surprises have turned negative, an uncomfortable combination that reinforces our tactical positioning. We remain overweight UK gilts within a global bond portfolio and are…

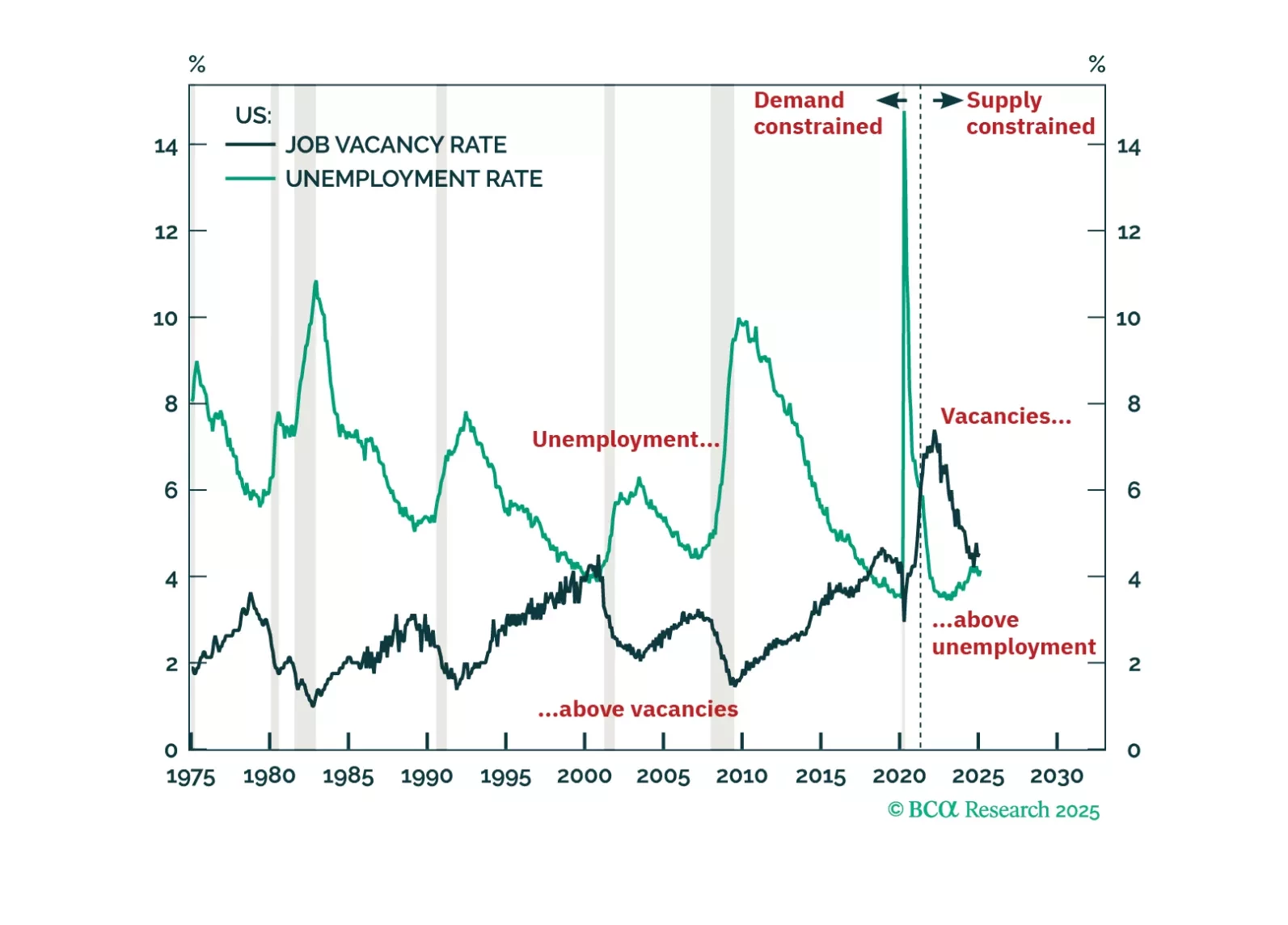

The US economy has never entered a demand-driven recession without labour demand running below labour supply and without the job vacancy rate running below the unemployment rate. Right now though, US labour demand is still running 1.…

Our US Investment Strategy team recommends investors remain defensively positioned. Stay underweight US equities and overweight Treasuries and cash, on both a tactical and cyclical horizon, as the likelihood of a midyear recession…

UK inflation came in cooler than expected in February, but lingering price pressures and a still-firm labor market keep the BoE sidelined, for now. Our Global Fixed-Income strategists view the BoE as the most likely DM central bank…

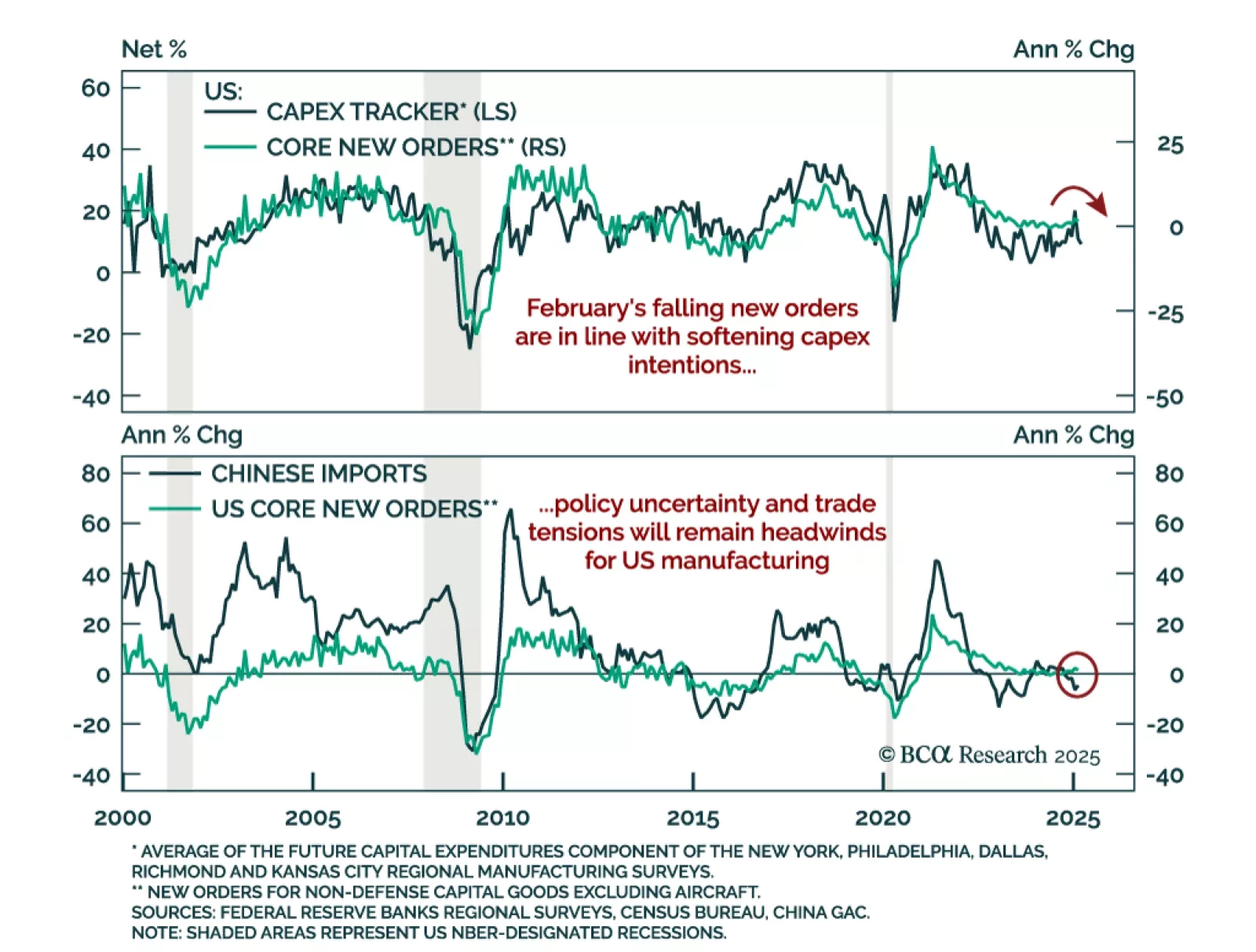

A drop in core capex orders points to slowing business spending and softening global growth. Businesses appear to have front-loaded shipments ahead of potential tariffs while deferring new orders amid policy uncertainty. With hiring…

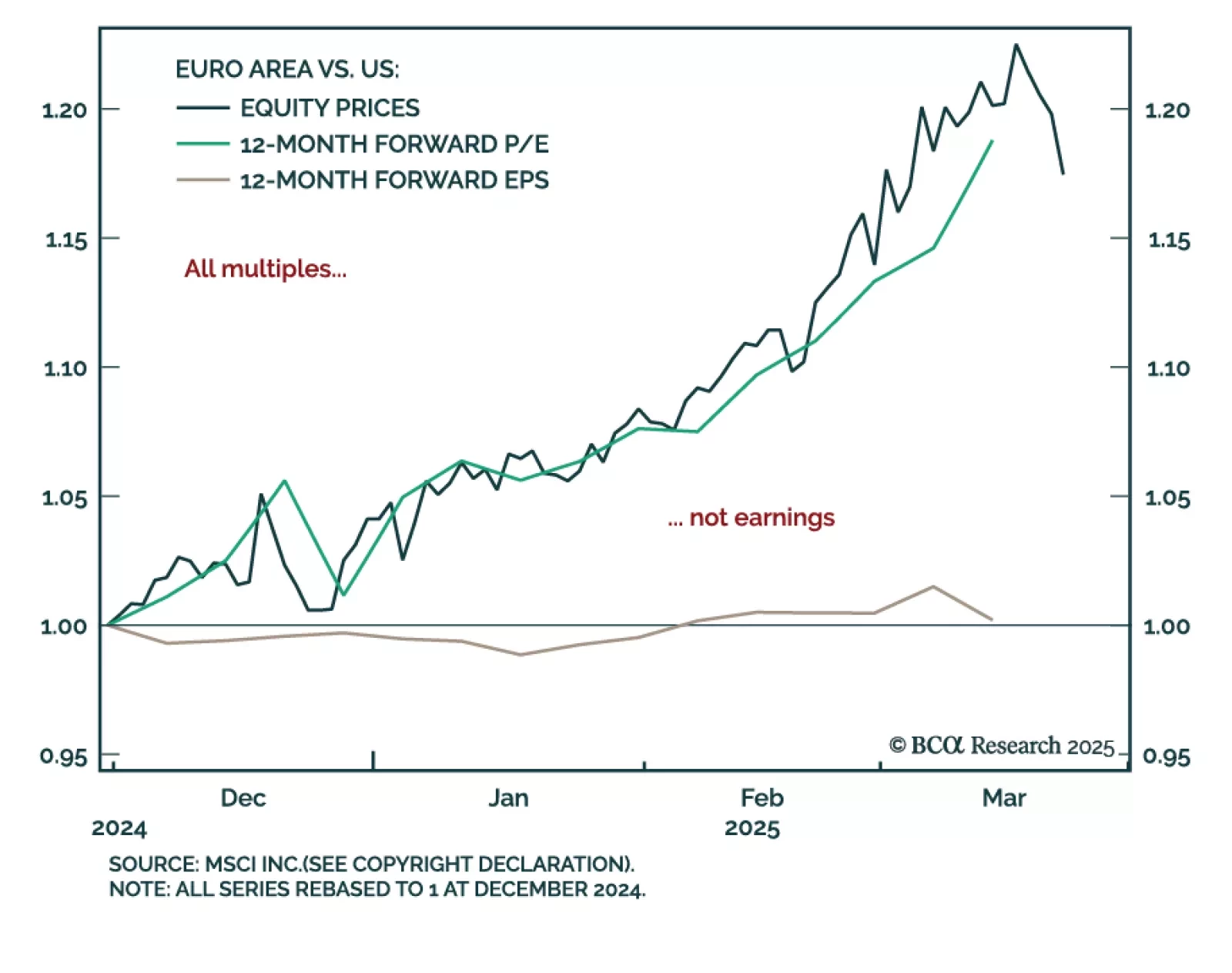

Our European investment strategists recommend underweighting European equities over the next three-to-six months, favoring defensives like telecoms, which may also benefit from reform potential. The rally in European equities…

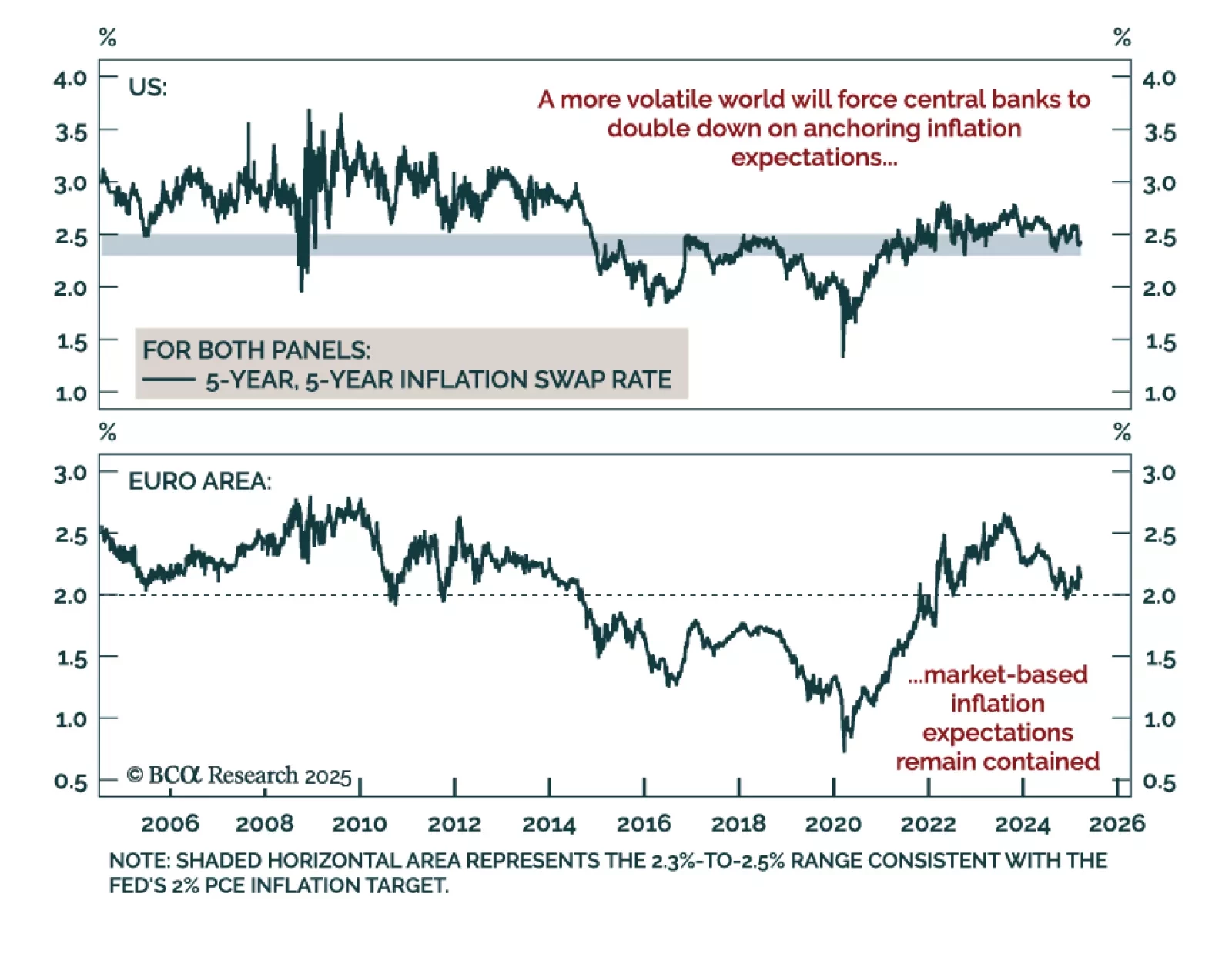

The years ahead will be more complex for investors. Inflation expectations and its leading indicators will matter as much as realized inflation, and rates volatility is likely to remain structurally higher. This calls for increasing…

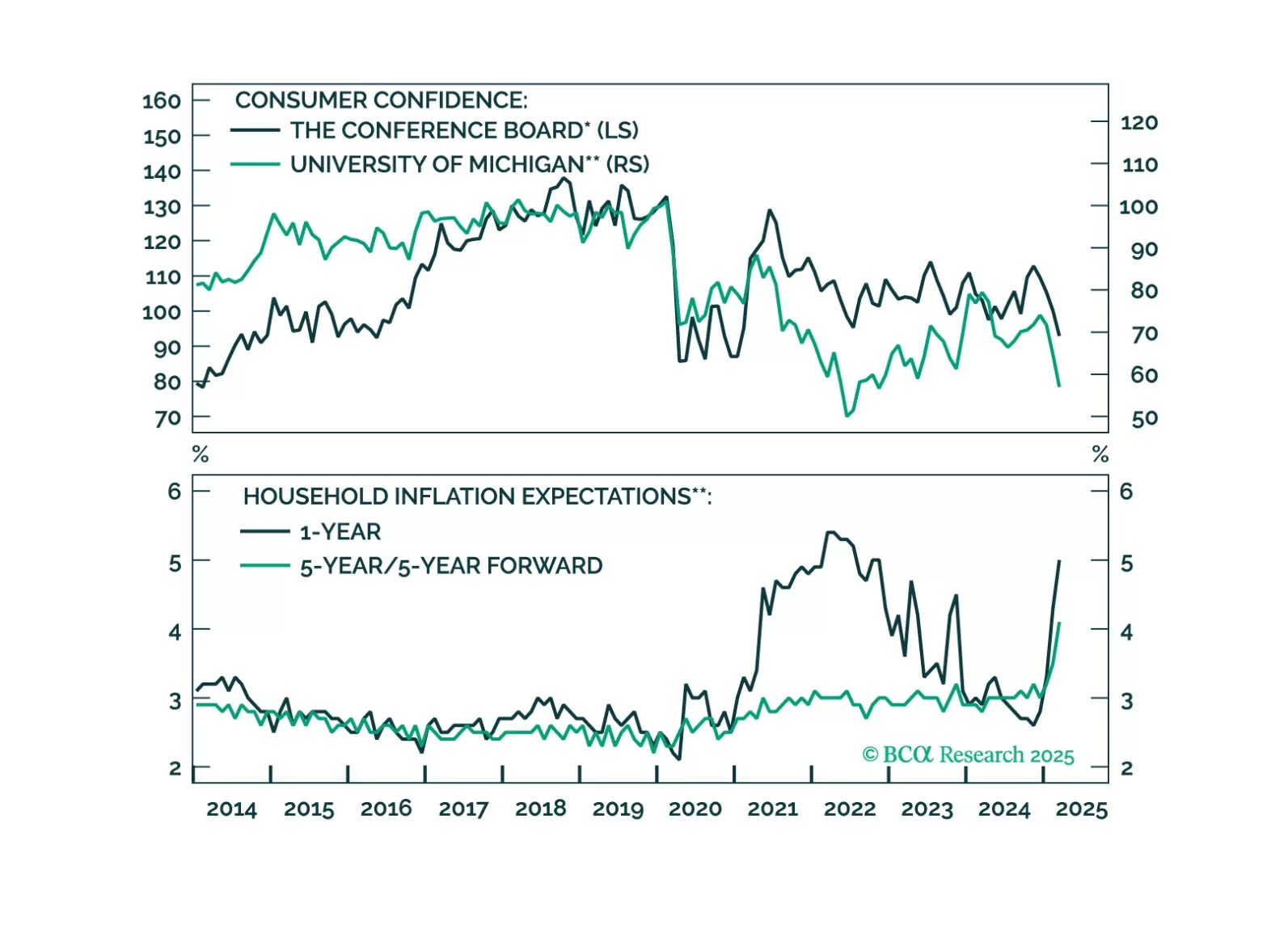

A sharp drop in consumer confidence adds to signs that a consumption slowdown is coming, threatening both US and global growth. Yet rising short-term inflation expectations will keep central banks cautious, weighing on long-term…