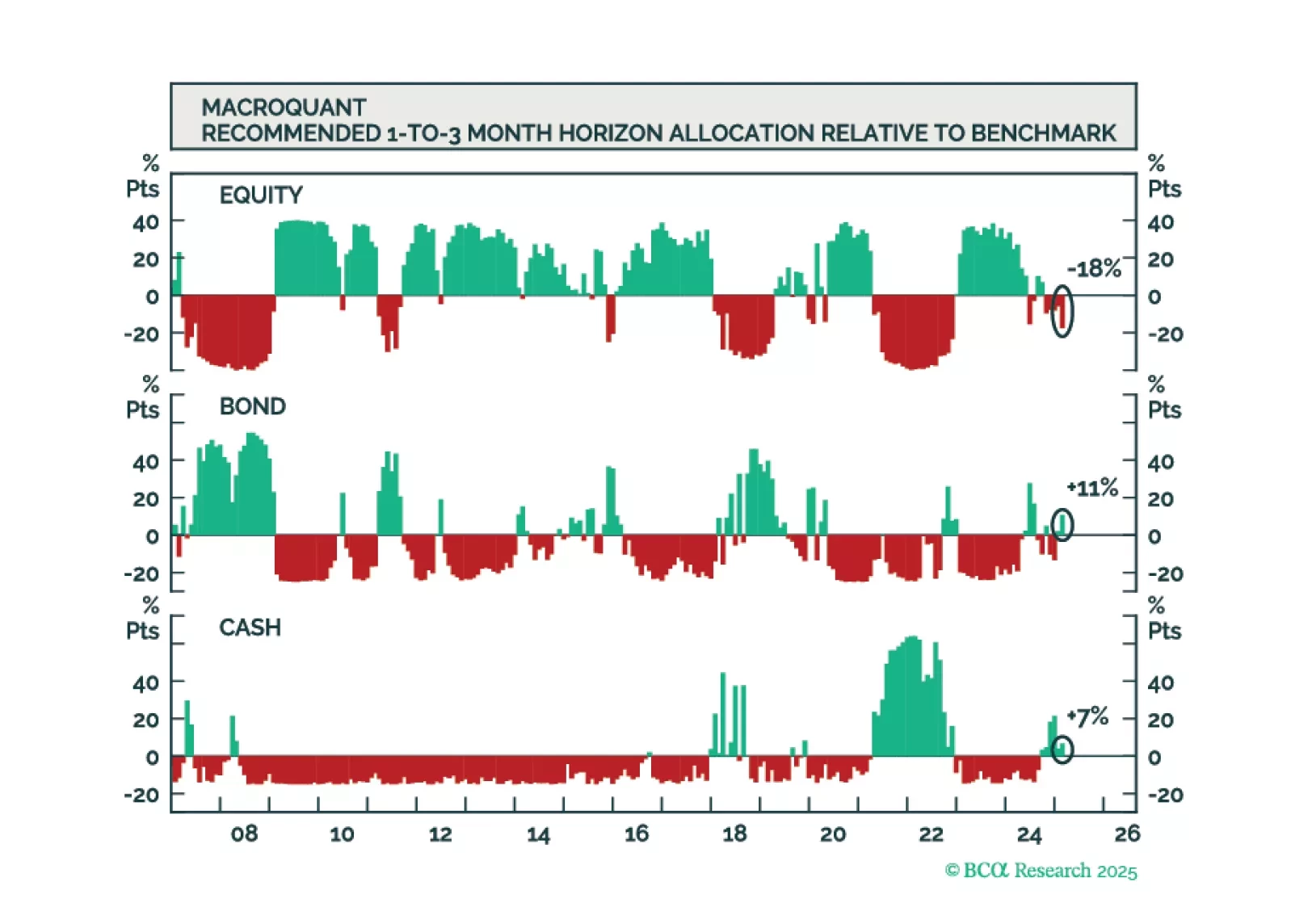

Going into April, MacroQuant recommends a modest underweight on stocks, offset by an overweight on bonds and cash. While MacroQuant is modestly bearish on stocks, we suspect that the downside risks to equities may be greater than…

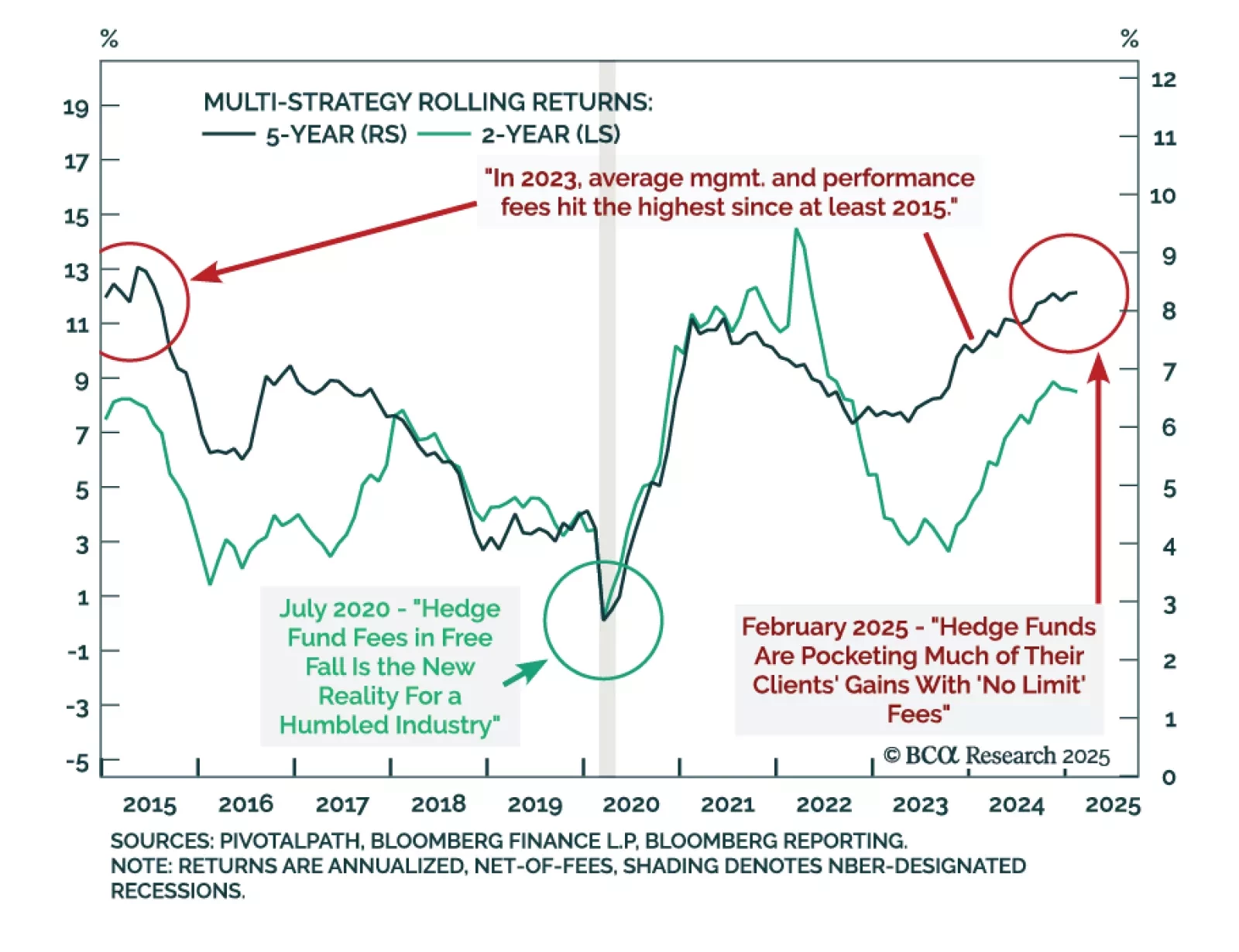

Our Private Markets & Alternatives strategists remain structurally positive but cyclically underweight on Multi-Strategy Hedge Funds. While these funds have delivered consistent alpha and valuable diversification, current market…

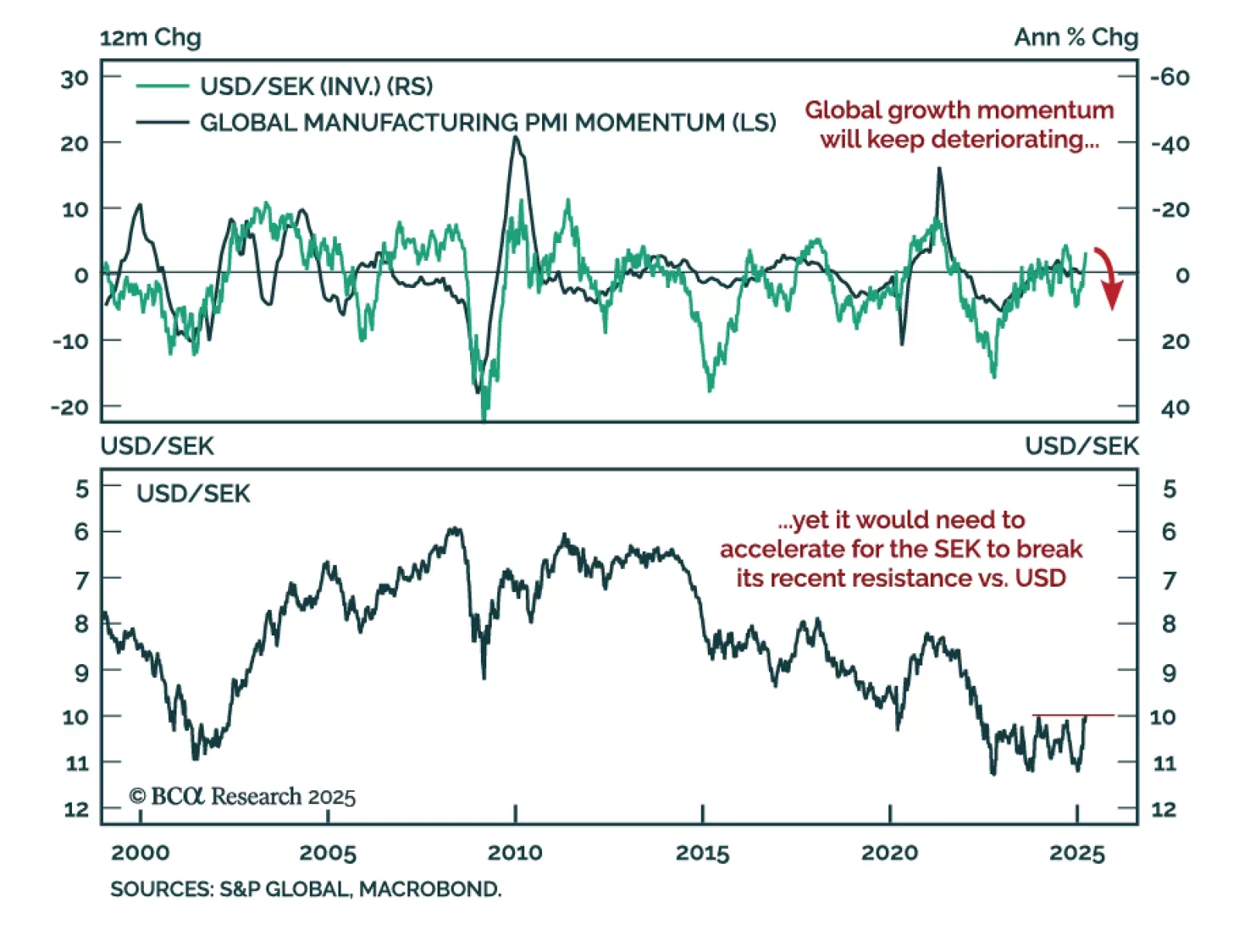

The SEK’s sharp rally is losing steam as local data weakens and EUR strength looks stretched. After appreciating more than 10% against the USD year-to-date, the krona is now showing signs of fatigue. Recent Swedish data has…

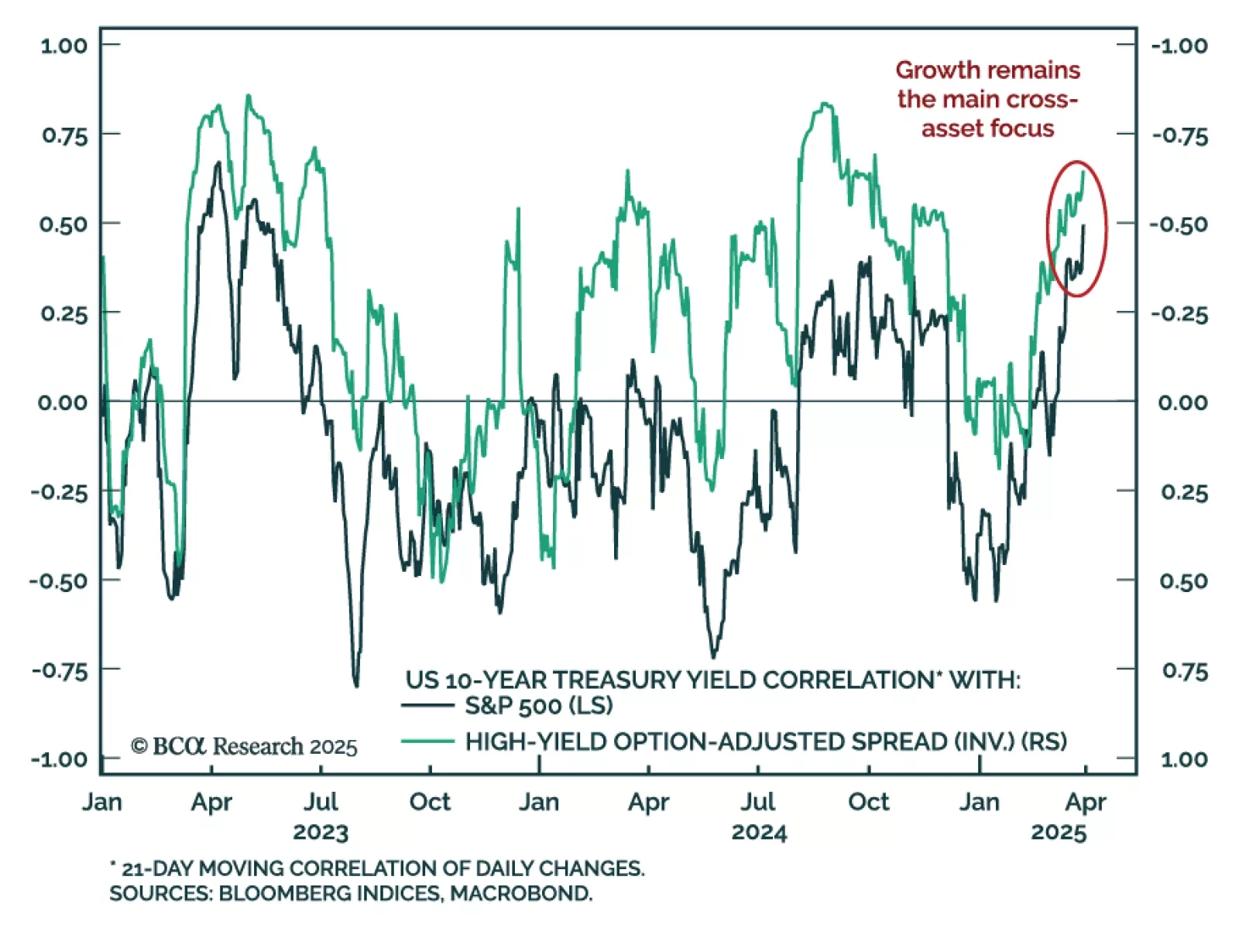

Markets are responding to the growth drag of stagflation, not the inflation impulse, reinforcing our defensive stance. Despite rising short-term inflation pressures in the US, risk assets and bond yields continue to move together,…

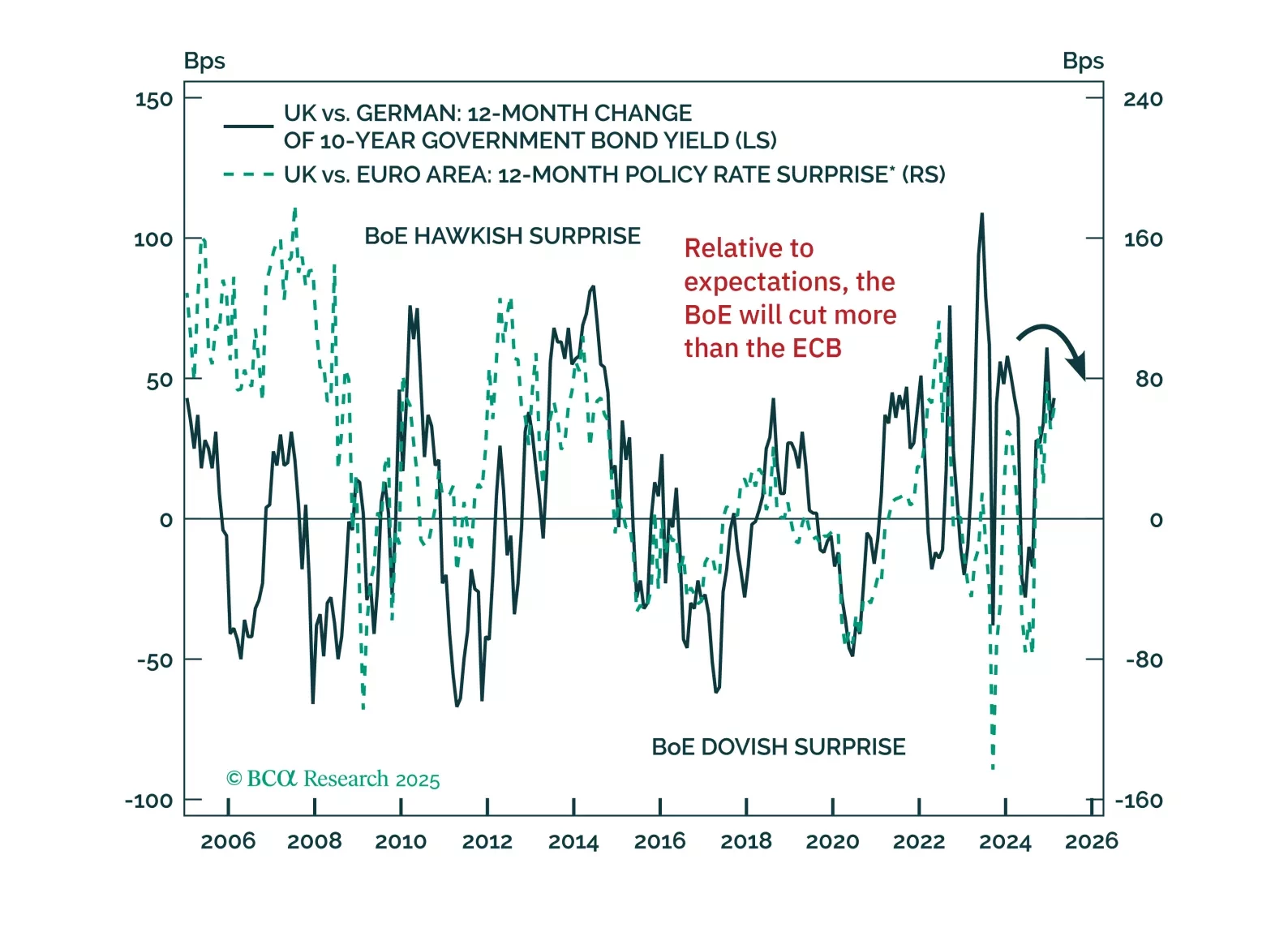

With economic headwinds building and fiscal dynamics shifting, bond markets are at a turning point. Our latest note outlines why German bund yields are set to decline and why UK gilts are poised to outperform — and how to position…

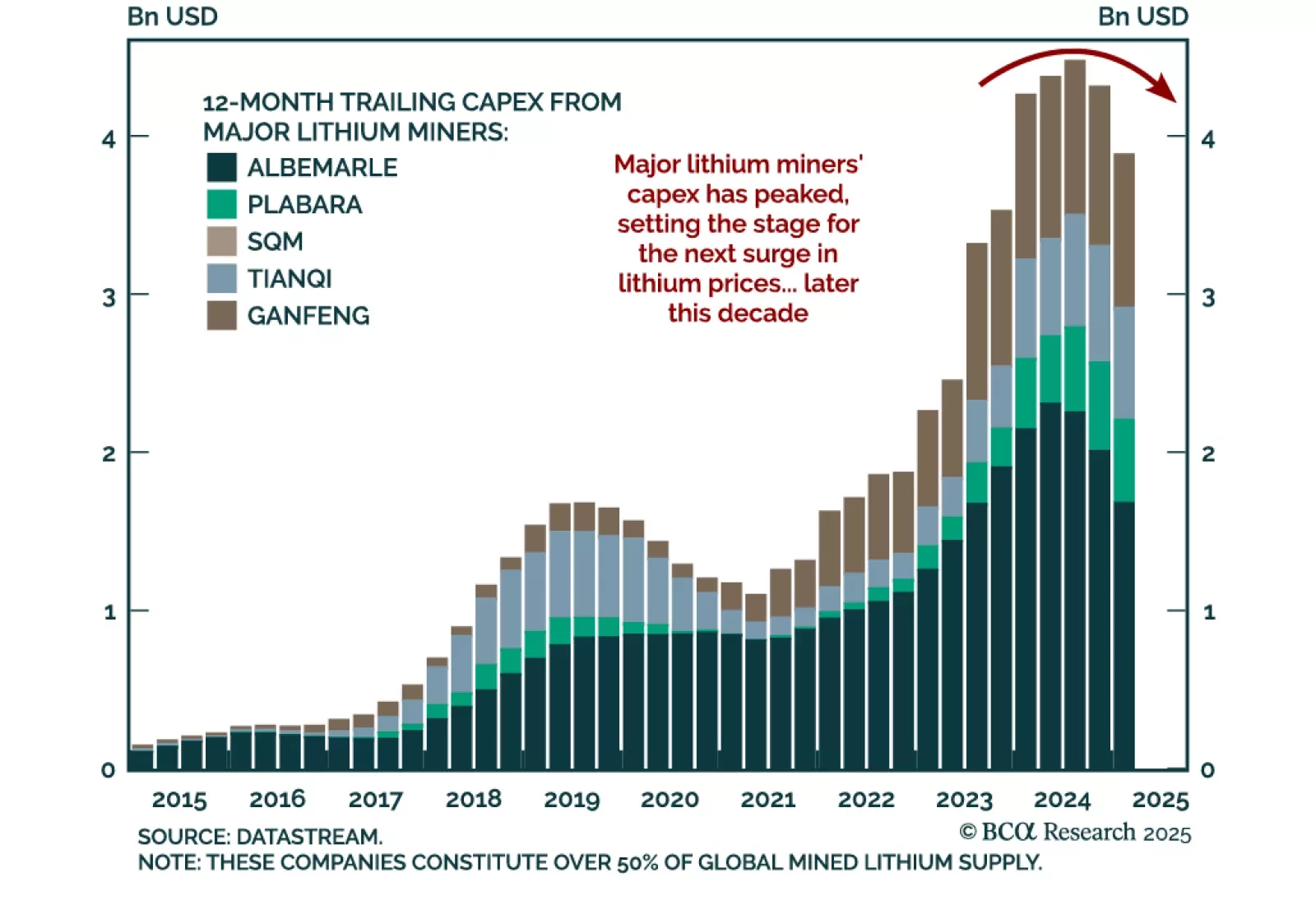

Our Commodities Strategy team advises against positioning for a near-term rebound in lithium prices, given the current headwinds from soft EV sales growth. They recommend patience, with more compelling opportunities likely to emerge…

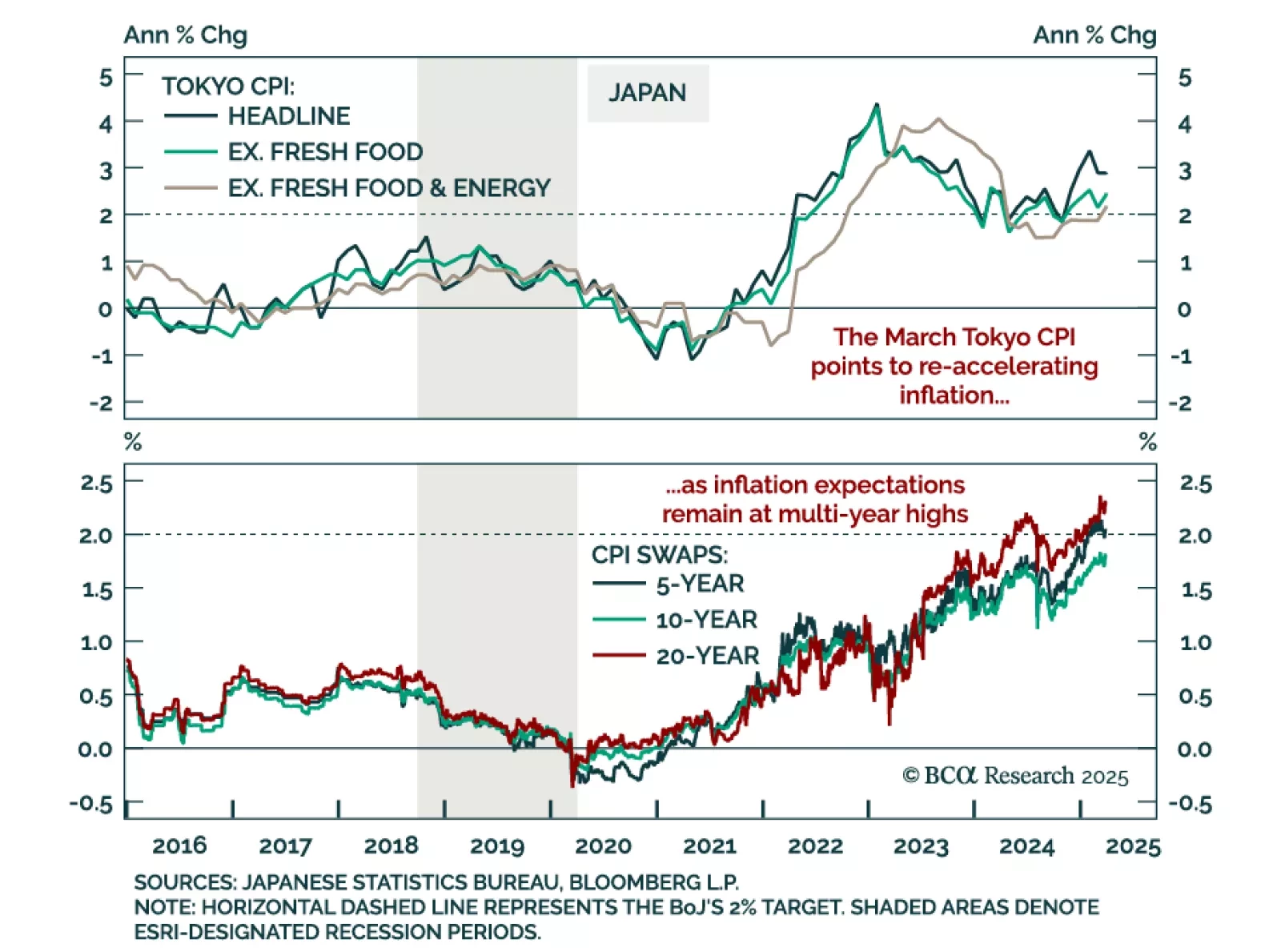

Japan’s inflation pulse remains firm, reinforcing our long JPY stance and cautious view on JGBs. Tokyo CPI for March surprised to the upside, with headline inflation slightly up at 2.9% y/y and “core core” accelerating above the BoJ’…

Markets may be bracing for April 2, but the real surprise could be how unsurprising it ends up being. Our Chart Of The Week comes from GeoMacro Chief Strategist Marko Papic, who sees the looming tariff salvo as the peak of de-…

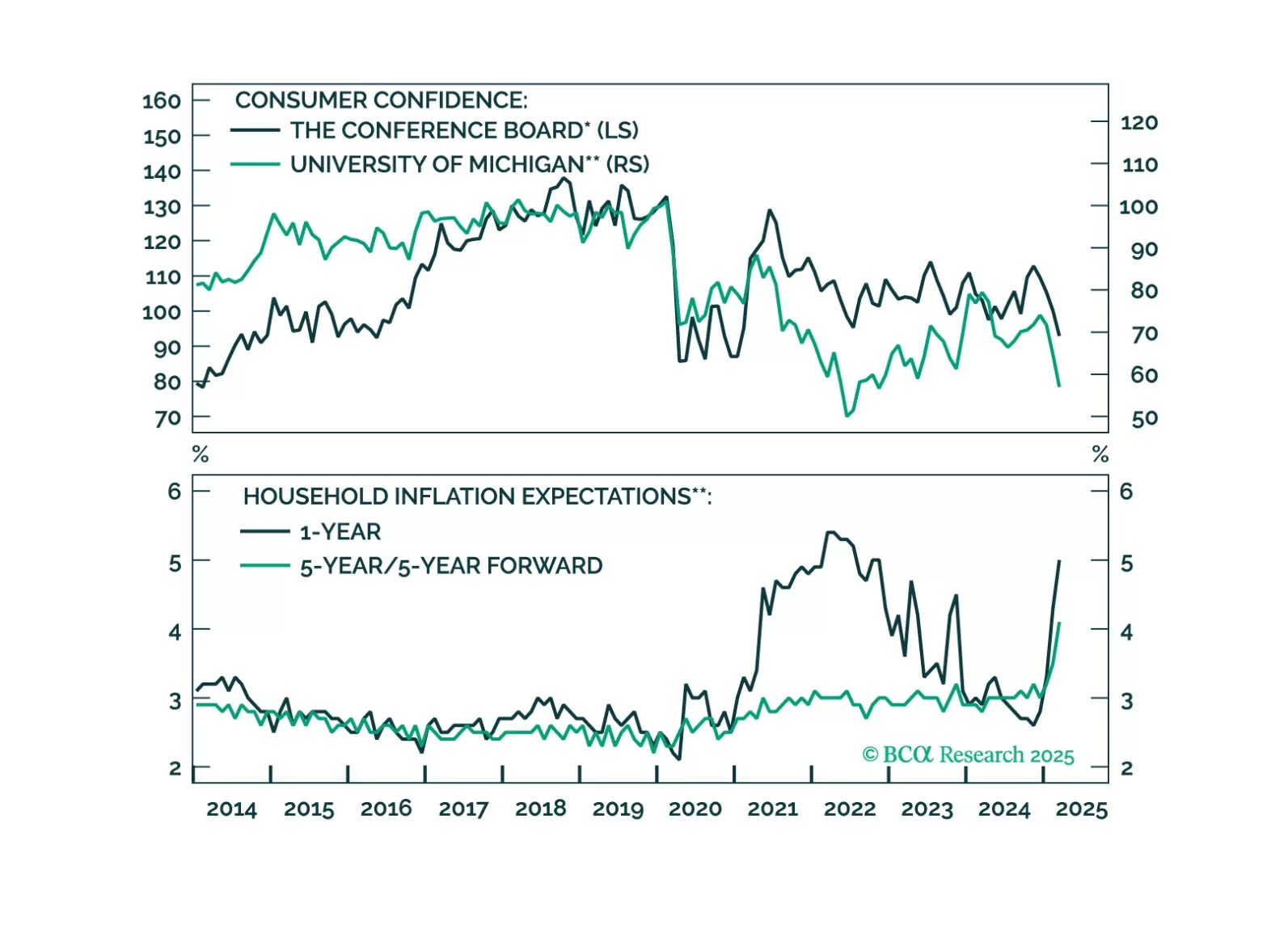

February US PCE data adds to the stagflationary tone, reinforcing our overweight duration stance and tactical short in front-end rates. Core PCE inflation rose 0.4% m/m, lifting the year-on-year rate to 2.8%, matching the Fed’s 2025…

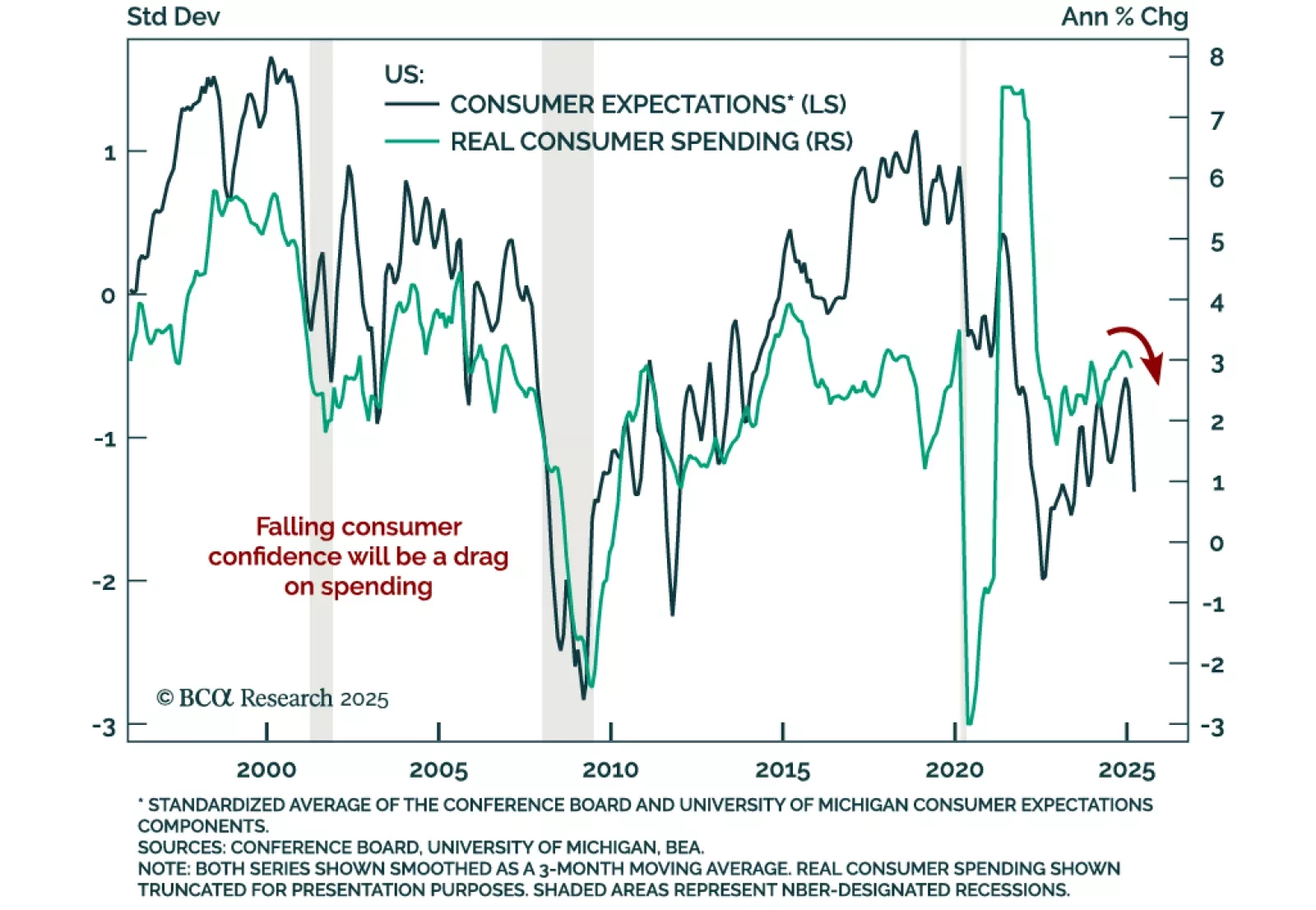

This morning’s weak consumer spending and strong inflation data reinforce our sense that the US economy is heading toward recession.