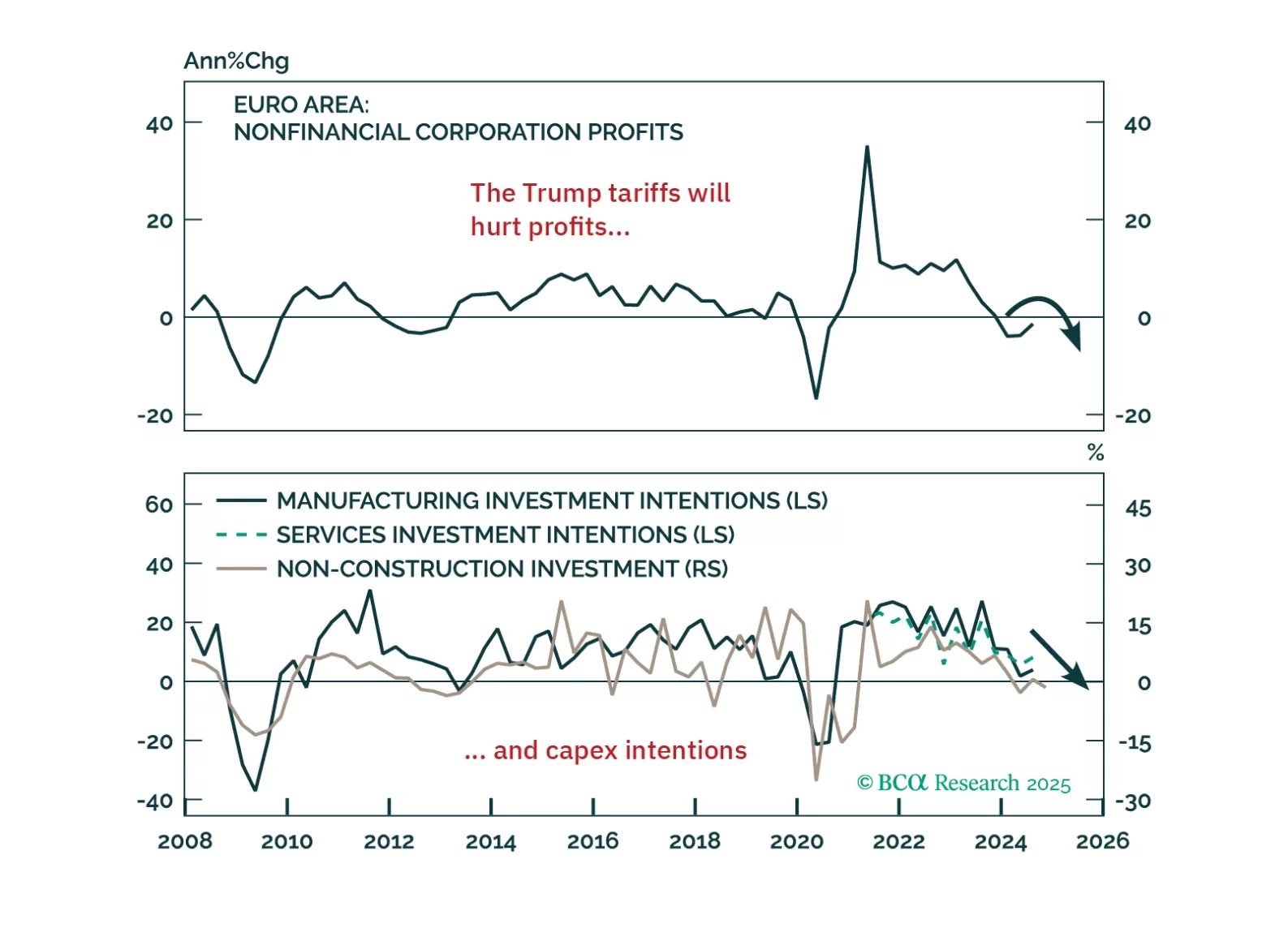

Trump’s tariff shock will push Europe into recession — but it’s also triggering a powerful integration response. In this report, we lay out the tactical case for staying defensive and the structural case for going long European…

This report looks at the FX implications of the Trump tariffs, and the review of our Q1 trades.

Our Emerging Markets strategists recommend staying defensive and adding exposure to EM local currency bonds, which will benefit from US dollar depreciation over the medium and long term. While tariffs are deflationary for US trading…

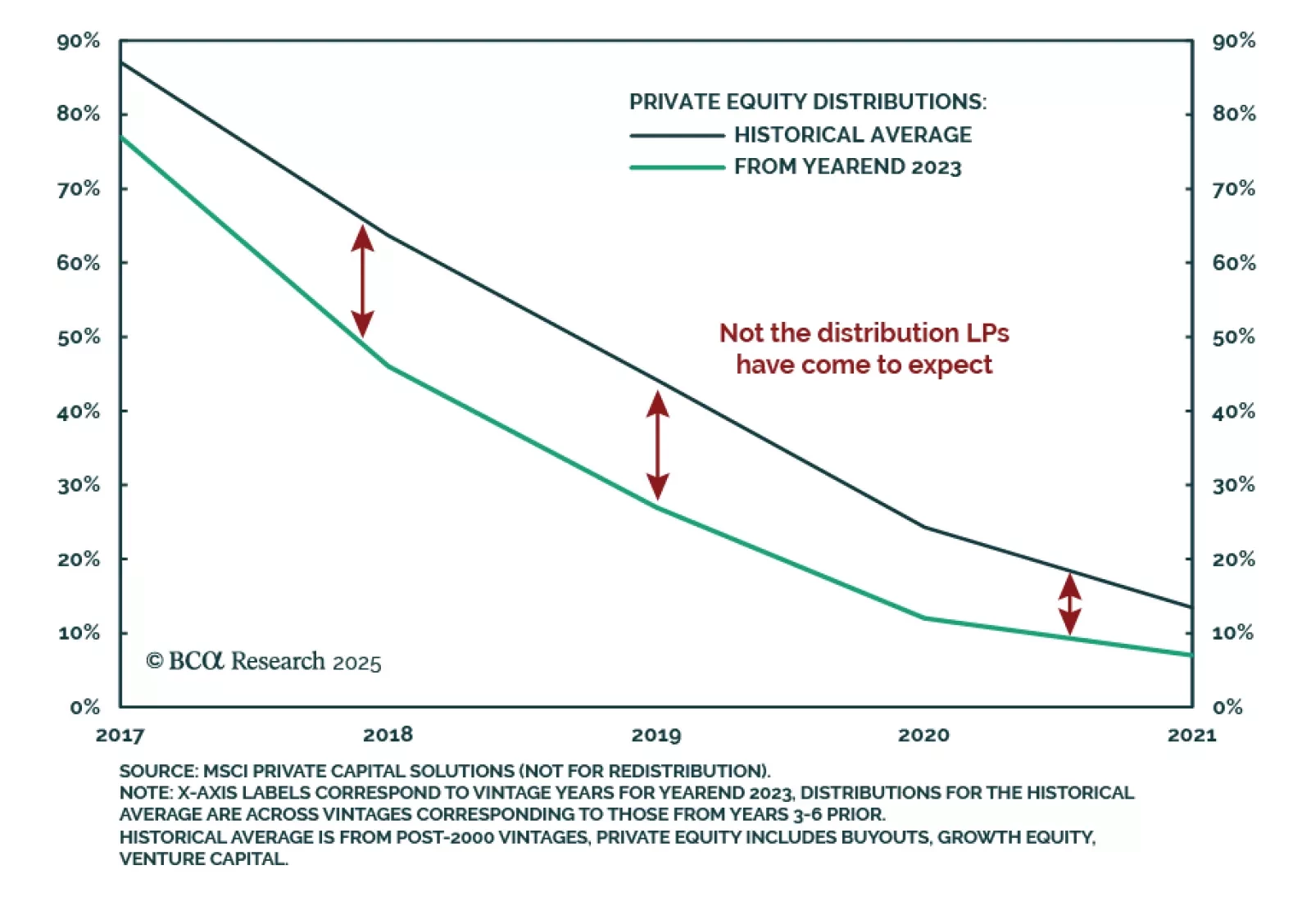

Private Equity’s cash flow problem is showing up in the job market. In August 2024, our Chief Private Markets & Alternatives Strategist Brian Payne highlighted how hard it had become for Private Equity firms to return money to…

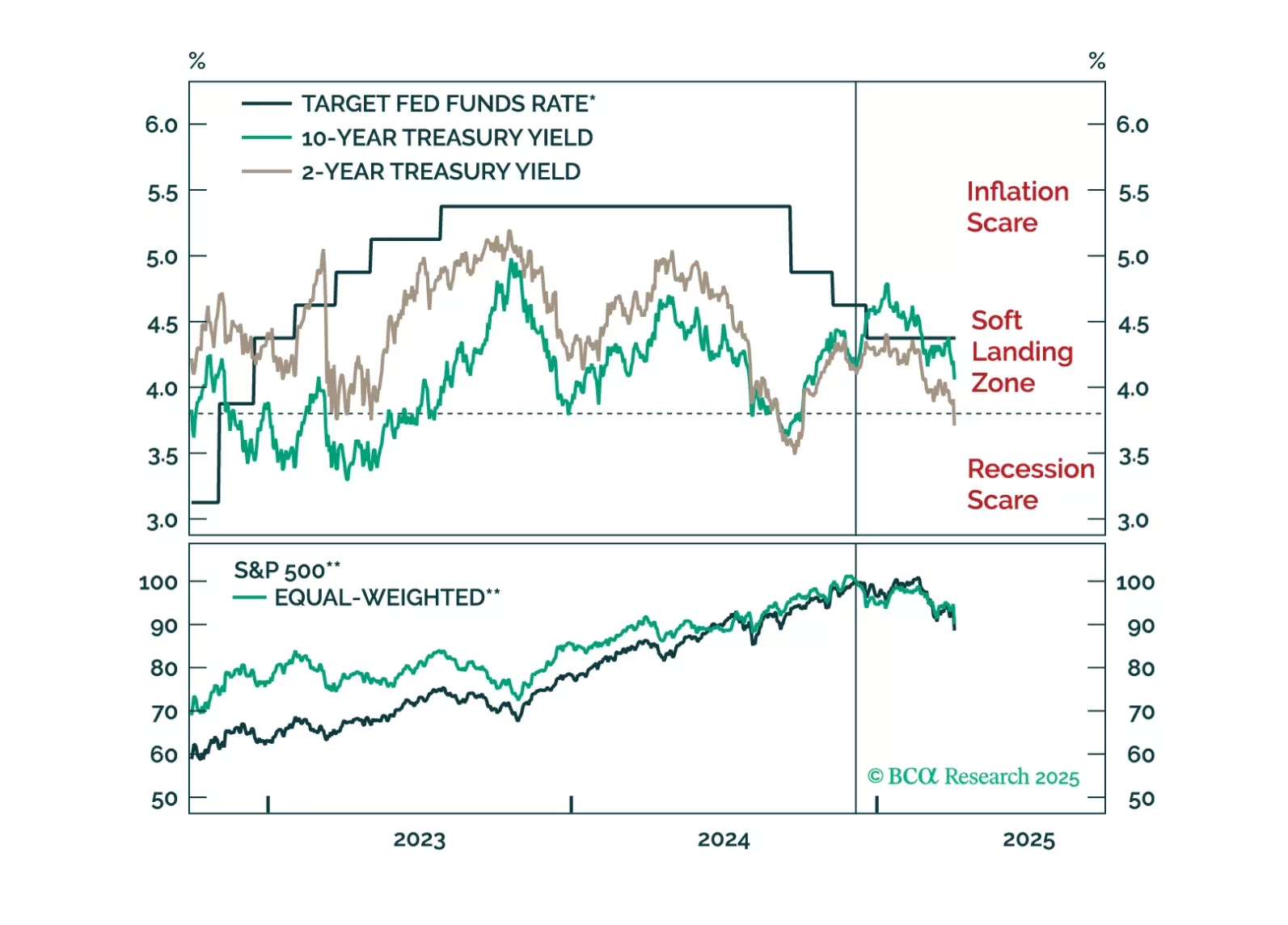

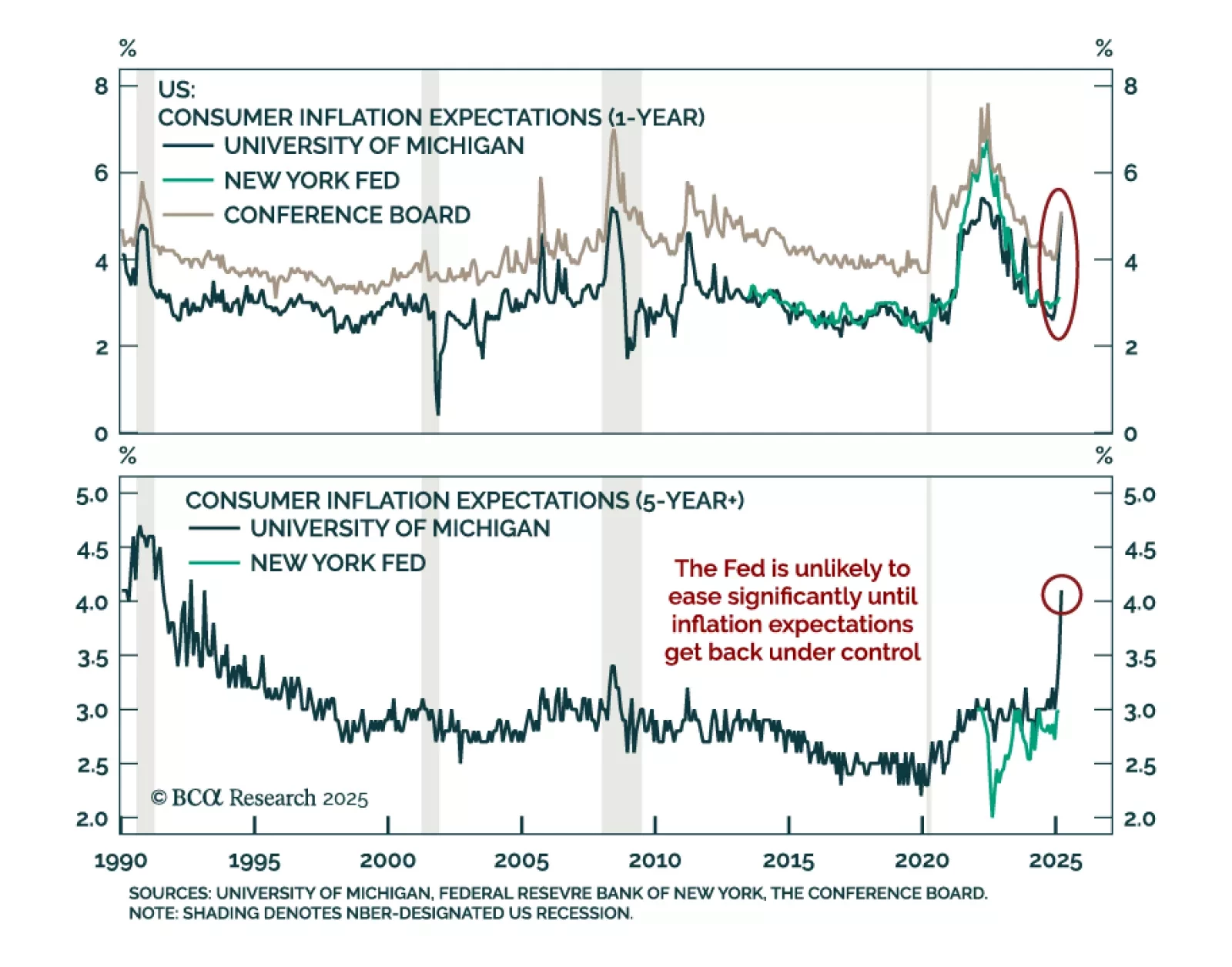

With both the Trump and Fed puts drifting lower, we reiterate our above-benchmark duration stance within a government bond overweight and favor Treasury curve steepeners. If the Trump put’s strike price is declining (See The Numbers…

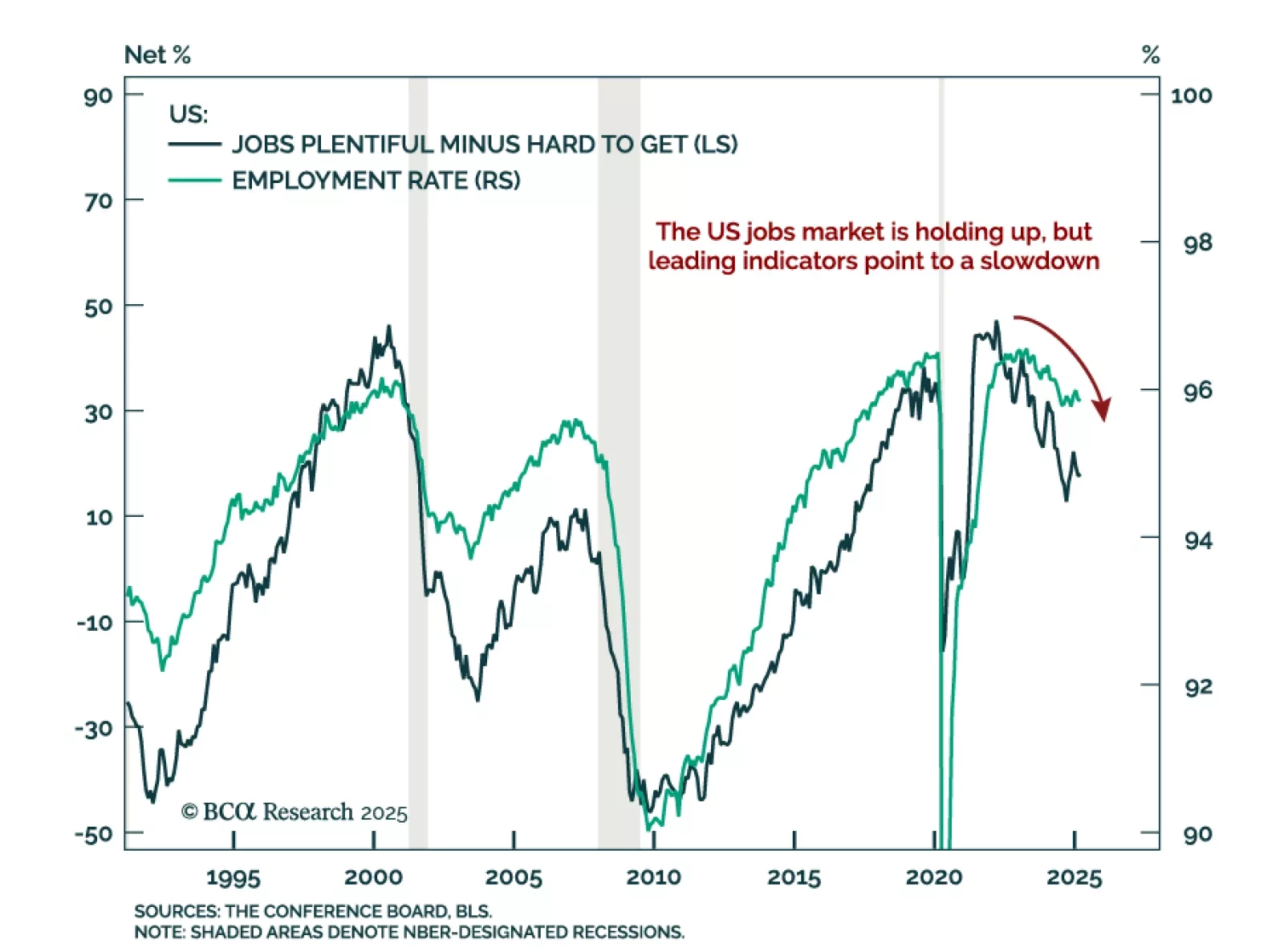

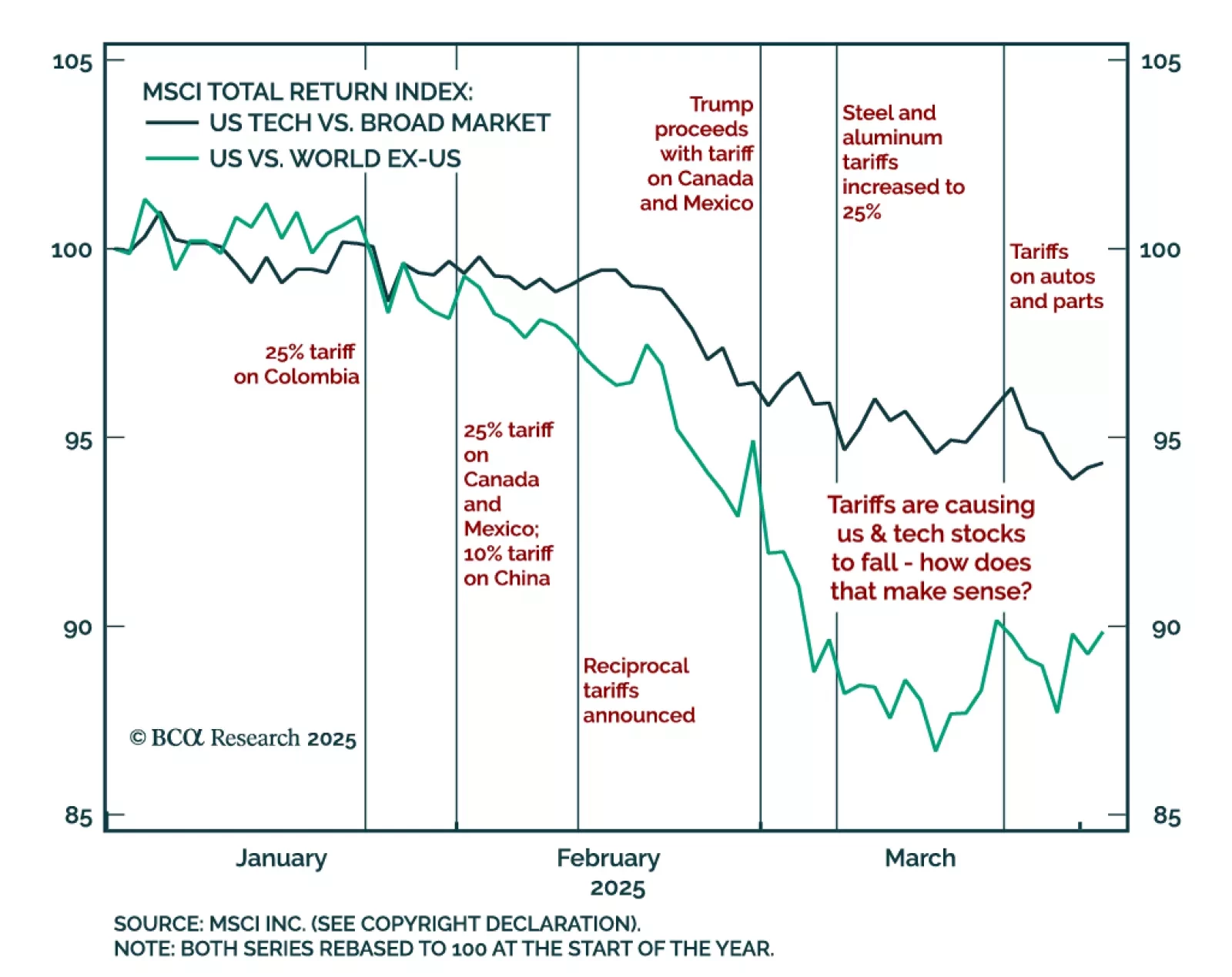

We reiterate our defensive global asset allocation, as risk assets face an asymmetric outlook whether growth slows or re-accelerates. The March US jobs report came in stronger than expected, with payrolls rising by 228k. However, the…

The March employment report showed strong job growth, but the labor market remains in a fragile state and the demand shock from tariffs could be the catalyst that tips it over the edge into recession.

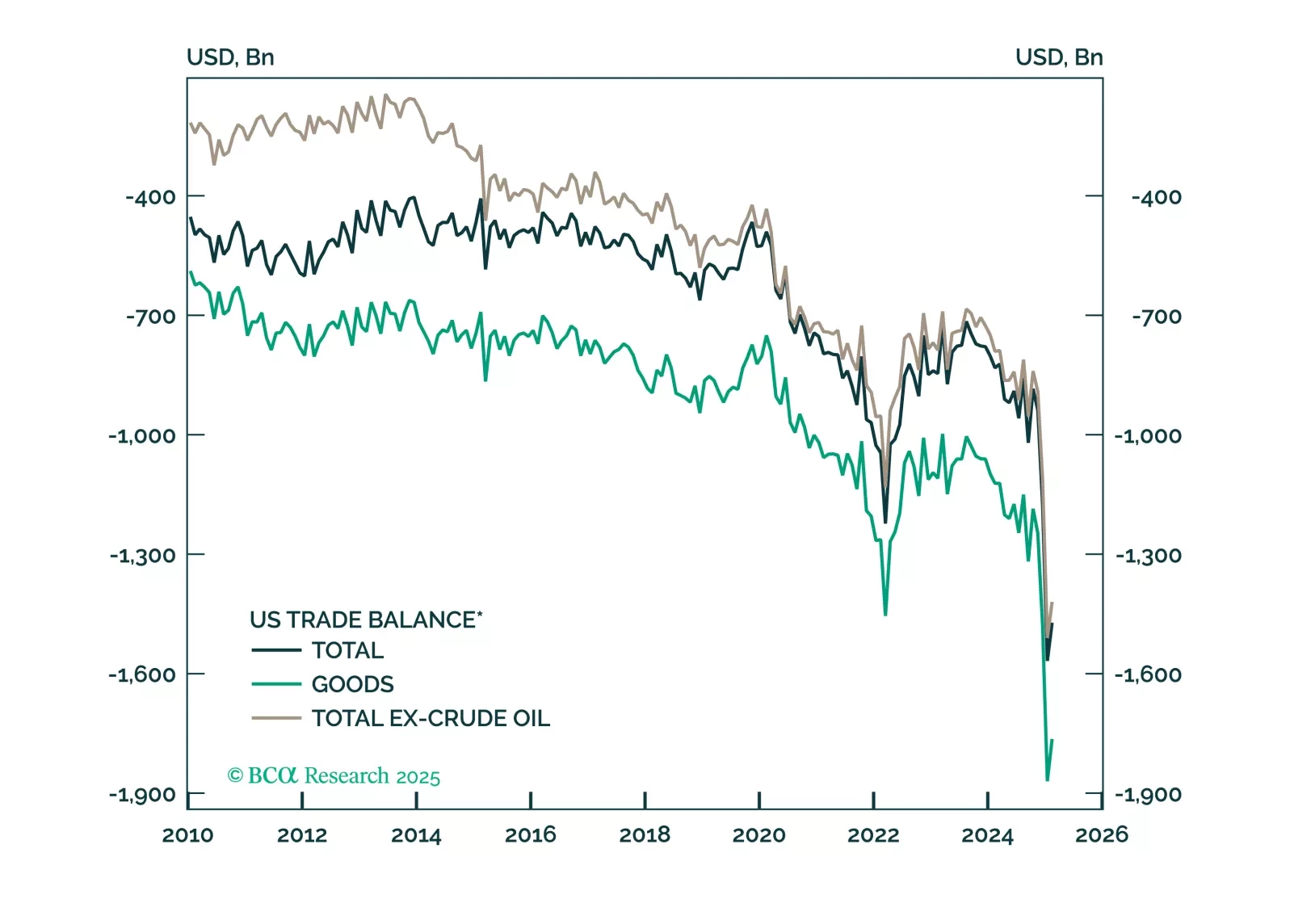

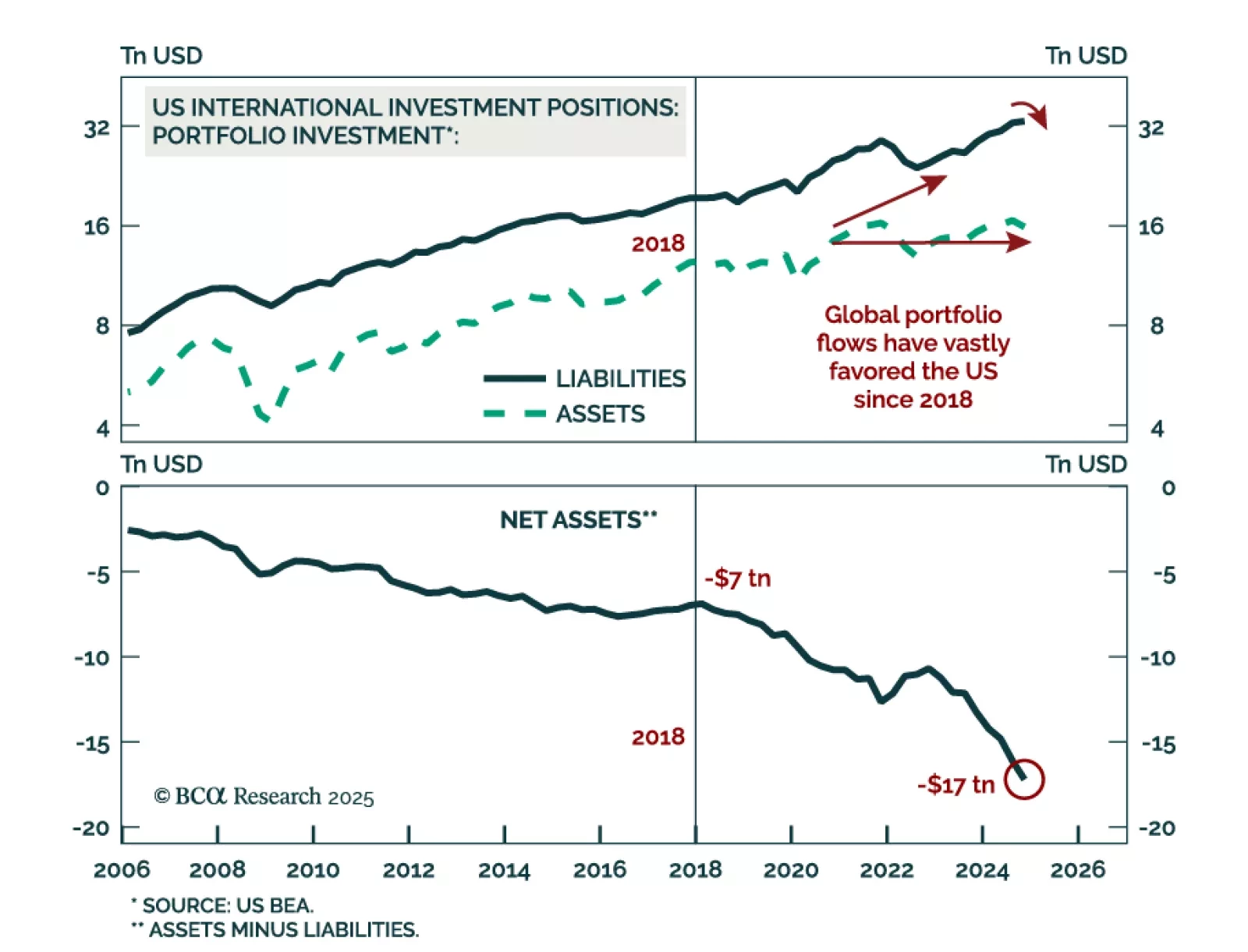

Our GeoMacro strategists recommend positioning for an exodus out of US assets, with long exposure to gold, the yen, and the Canadian dollar. April 2, “Liberation Day,” is likely to mark the peak in de-globalization hysteria, as the…

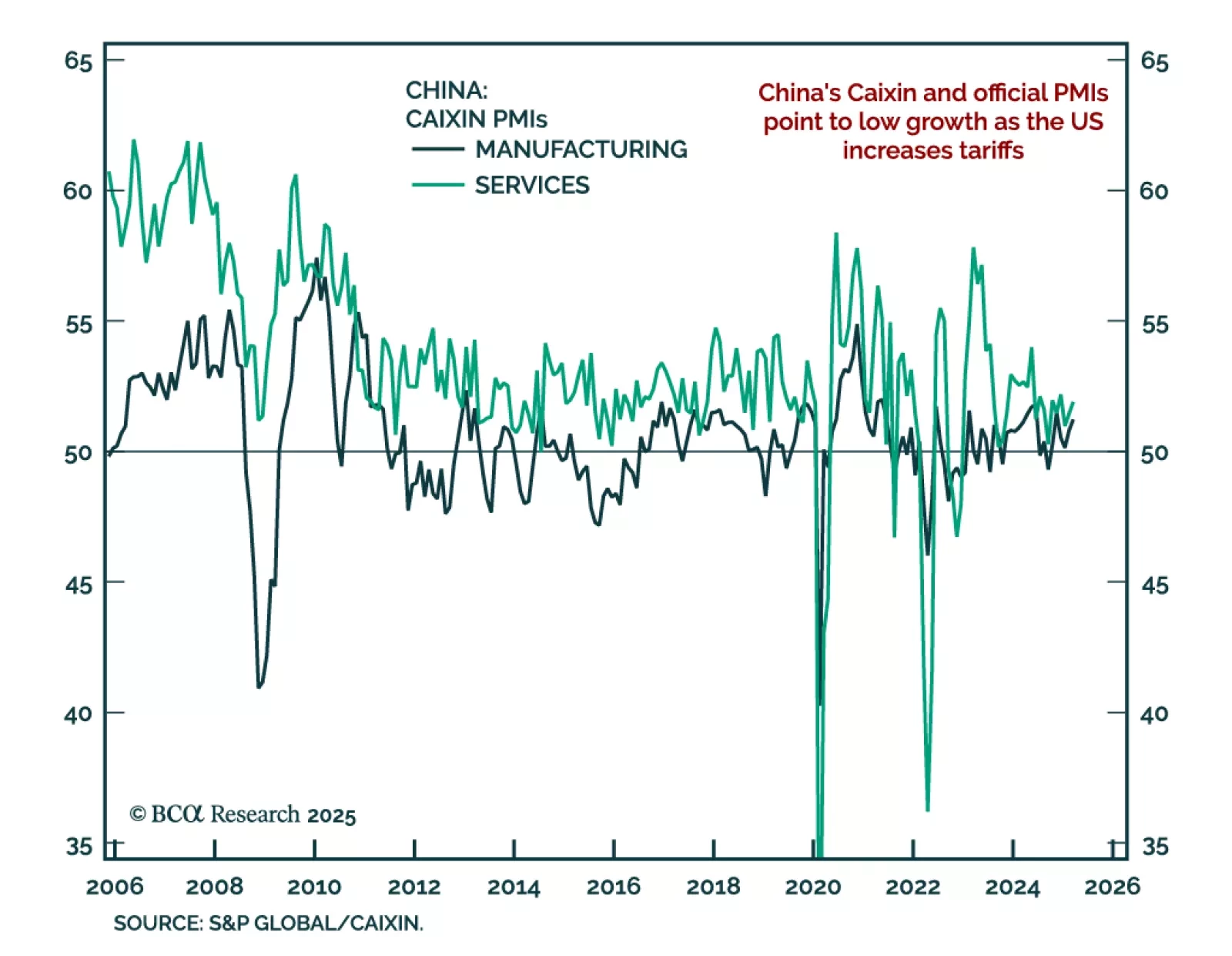

China’s economy remains subdued, supporting our overweight in onshore local-currency bonds and a selective approach to local equities. March Caixin PMIs showed only marginal improvement, with the composite index rising to 51.8 from…

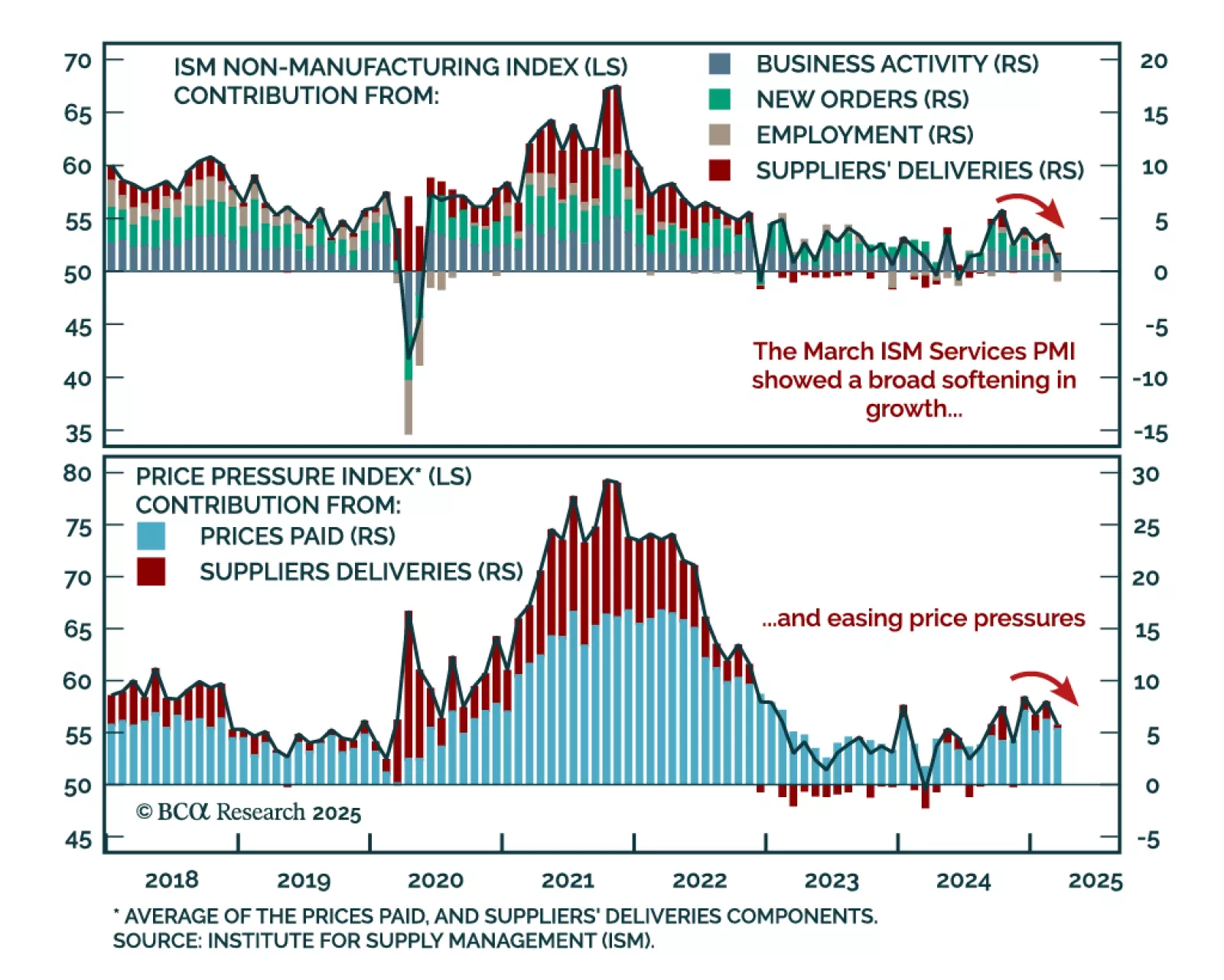

The March ISM Services report sent a recessionary signal, supporting our defensive positioning. The headline index fell sharply to 50.8 from 53.5, missing expectations. New orders dropped to 50.2, while employment collapsed to 46.2…