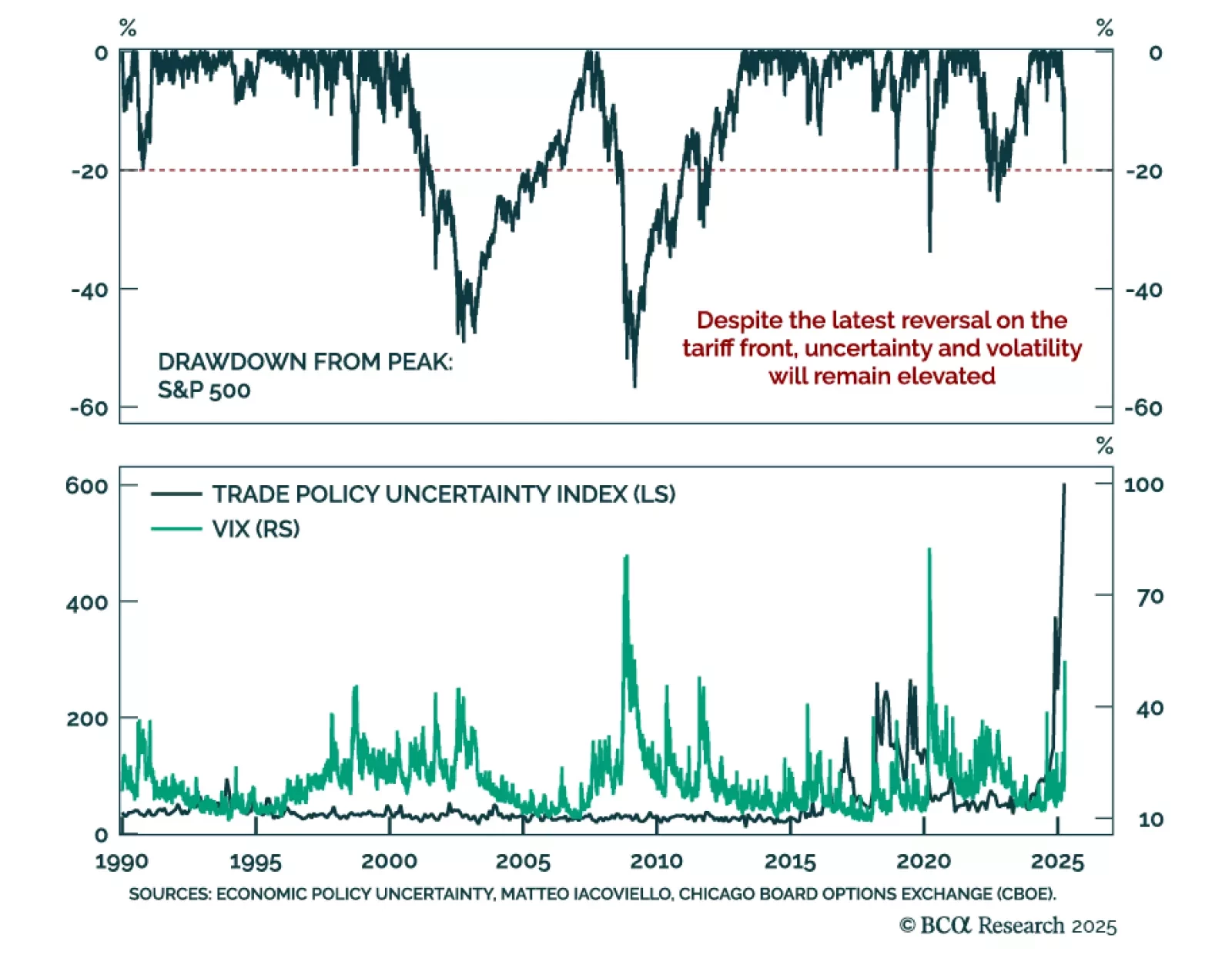

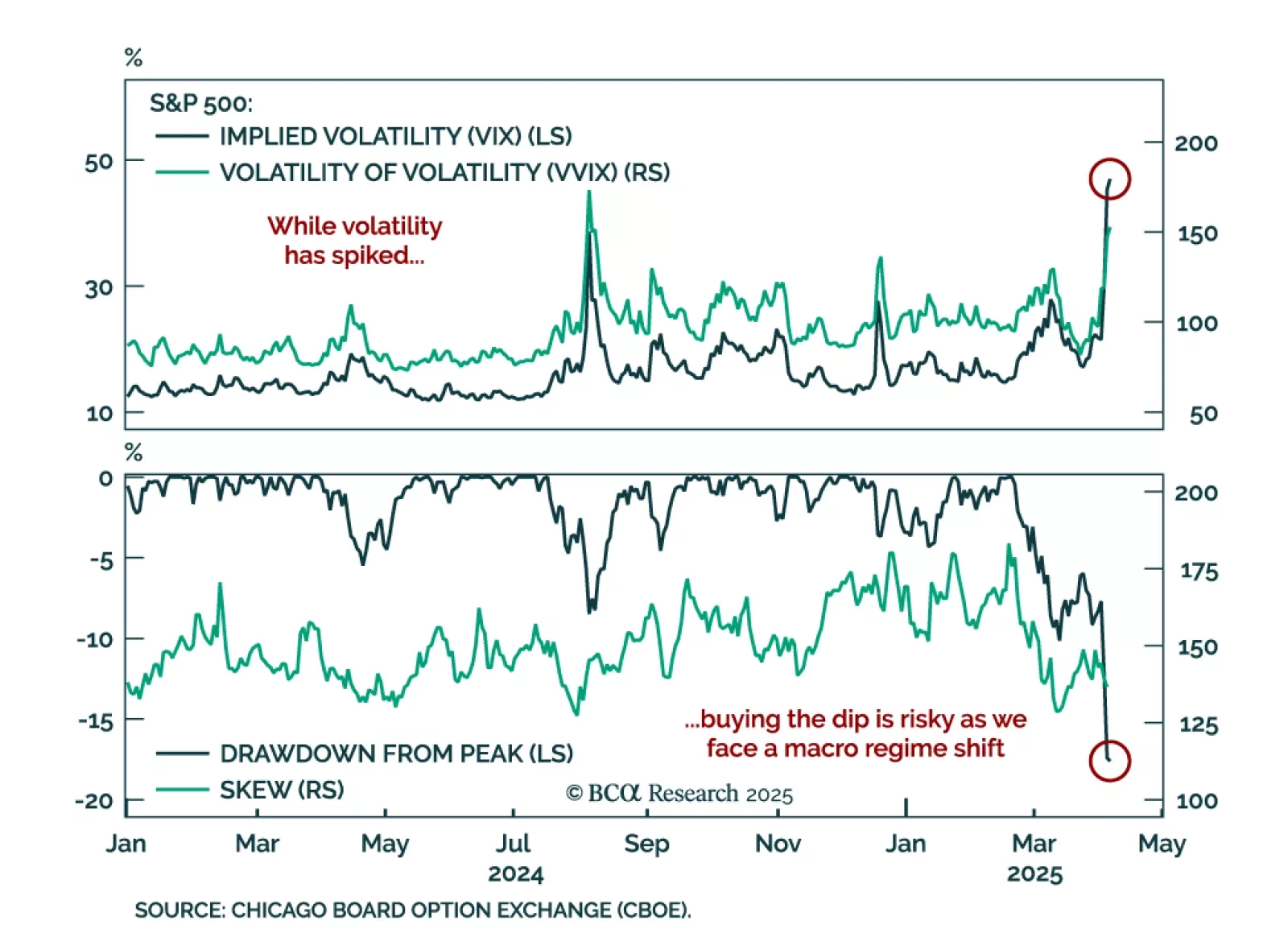

We maintain a defensive asset allocation, as the hit to confidence will linger even if tariff tensions ease. The past few days have seen sharp volatility, with trade headlines swinging markets between despair and euphoria. At the…

Our Portfolio Allocation Summary for April 2025.

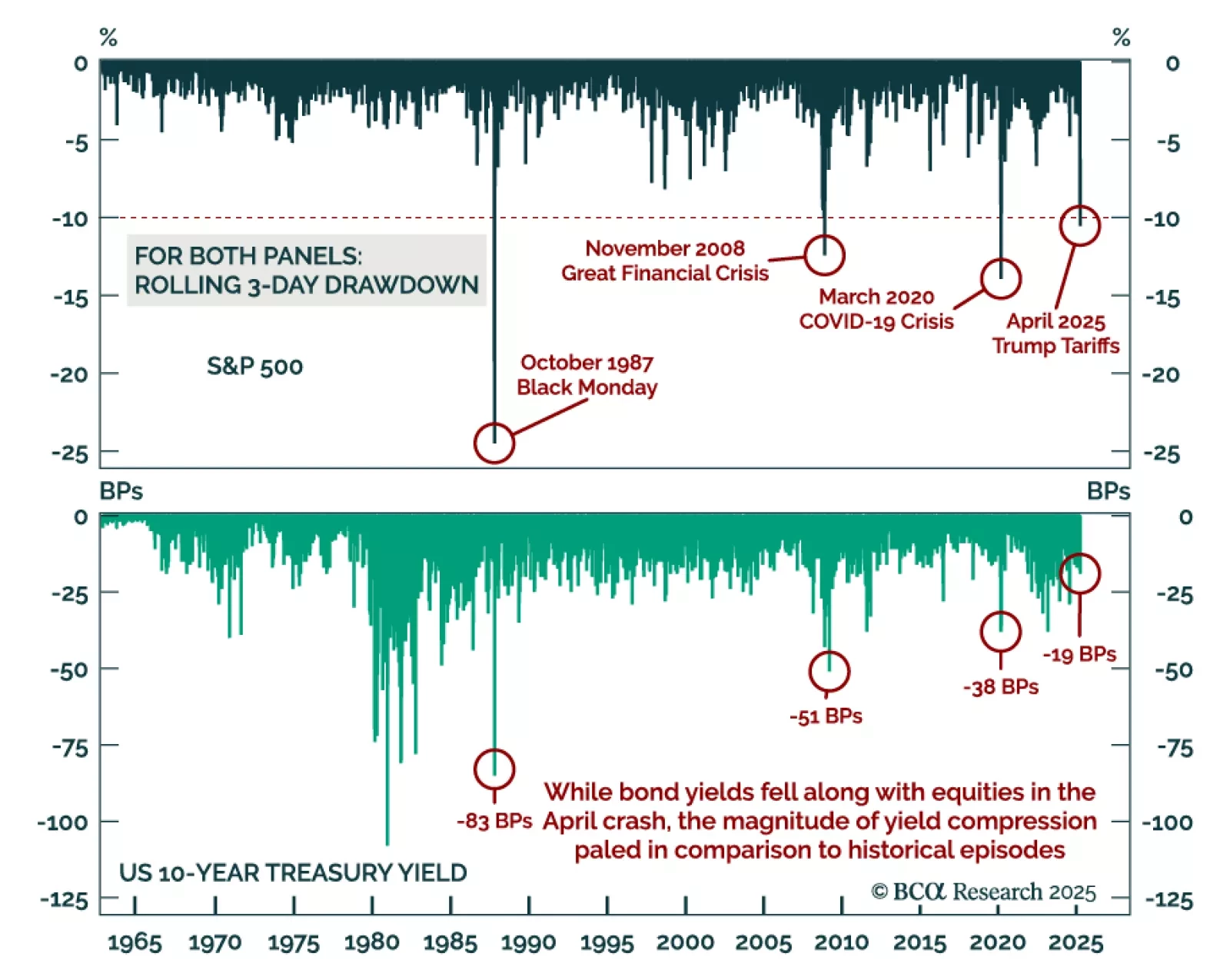

Equities’ post-Liberation Day selloff was historic, but cross-asset signals make it an anomaly. The post-Liberation Day S&P 500’s three-day, 10%+ drawdown joined a list of major episodes that includes the March 2020 COVID-19…

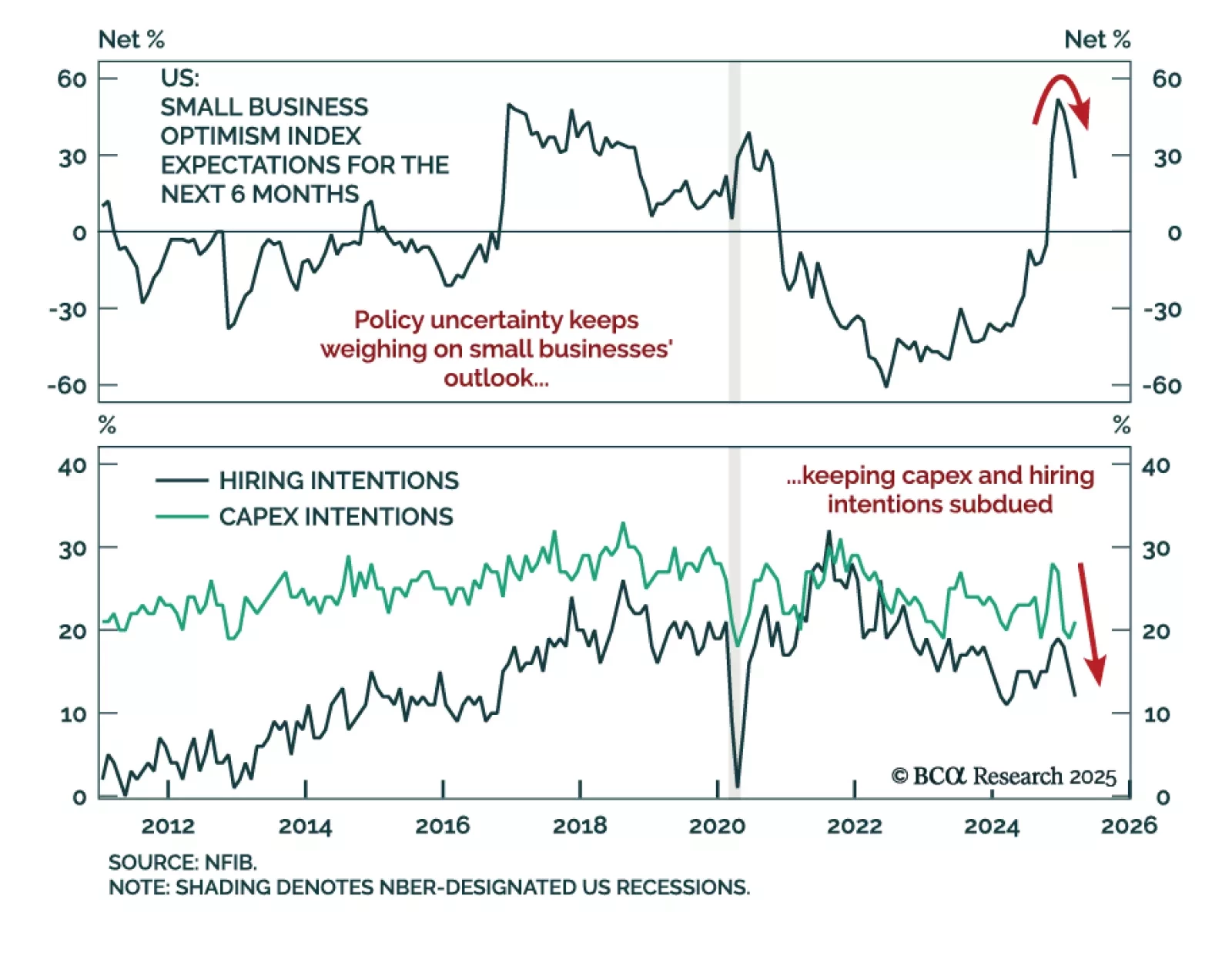

The sharp drop in March’s NFIB survey reinforces our defensive asset allocation, as small business sentiment weakens amid rising policy uncertainty. We remain overweight government bonds and underweight risk assets, while tactically…

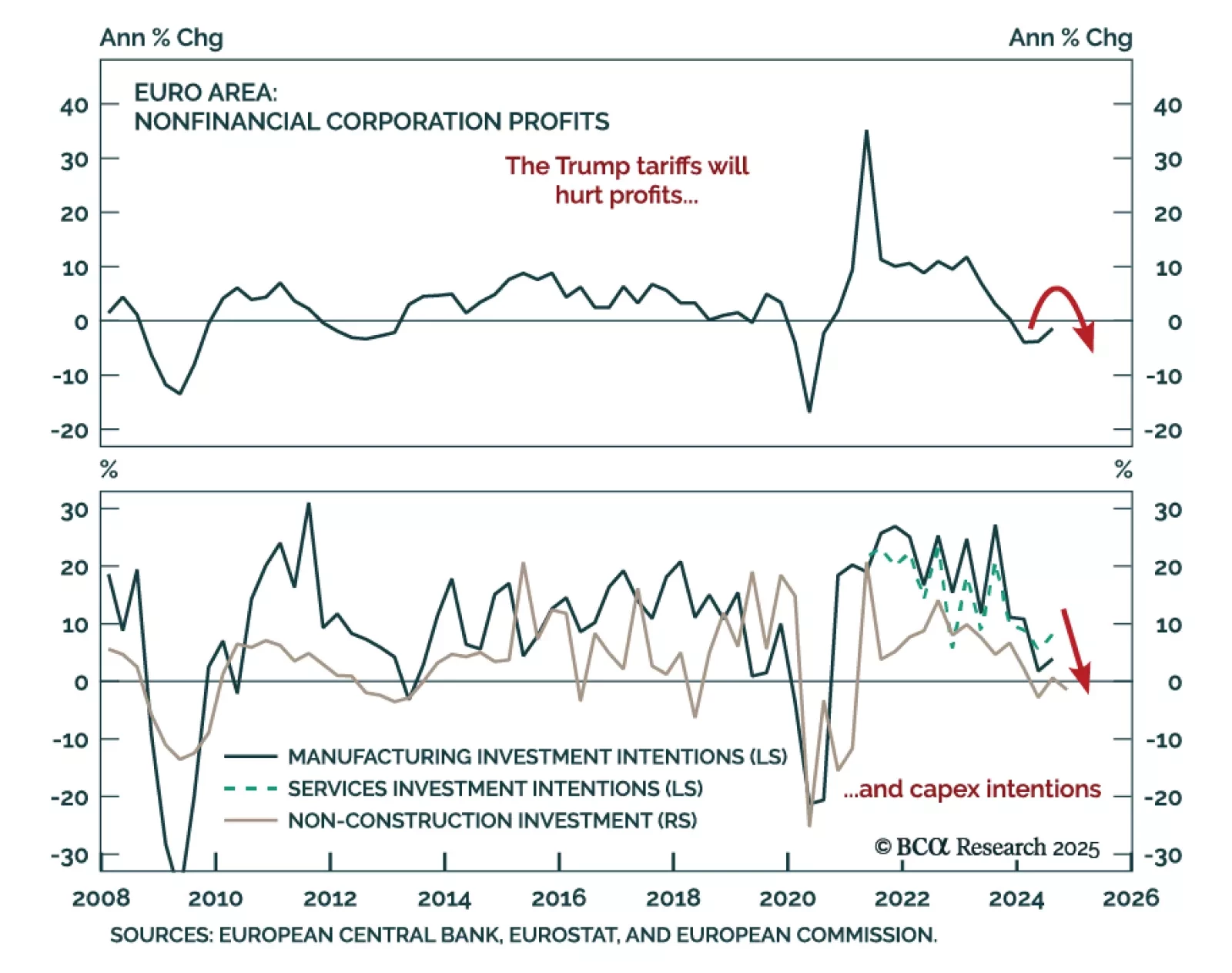

Our European strategists recommend staying defensive in the near term. Favor bonds over equities and defensives over cyclicals, as President Trump’s tariffs are set to push the Eurozone into recession by mid-2025. Industrial…

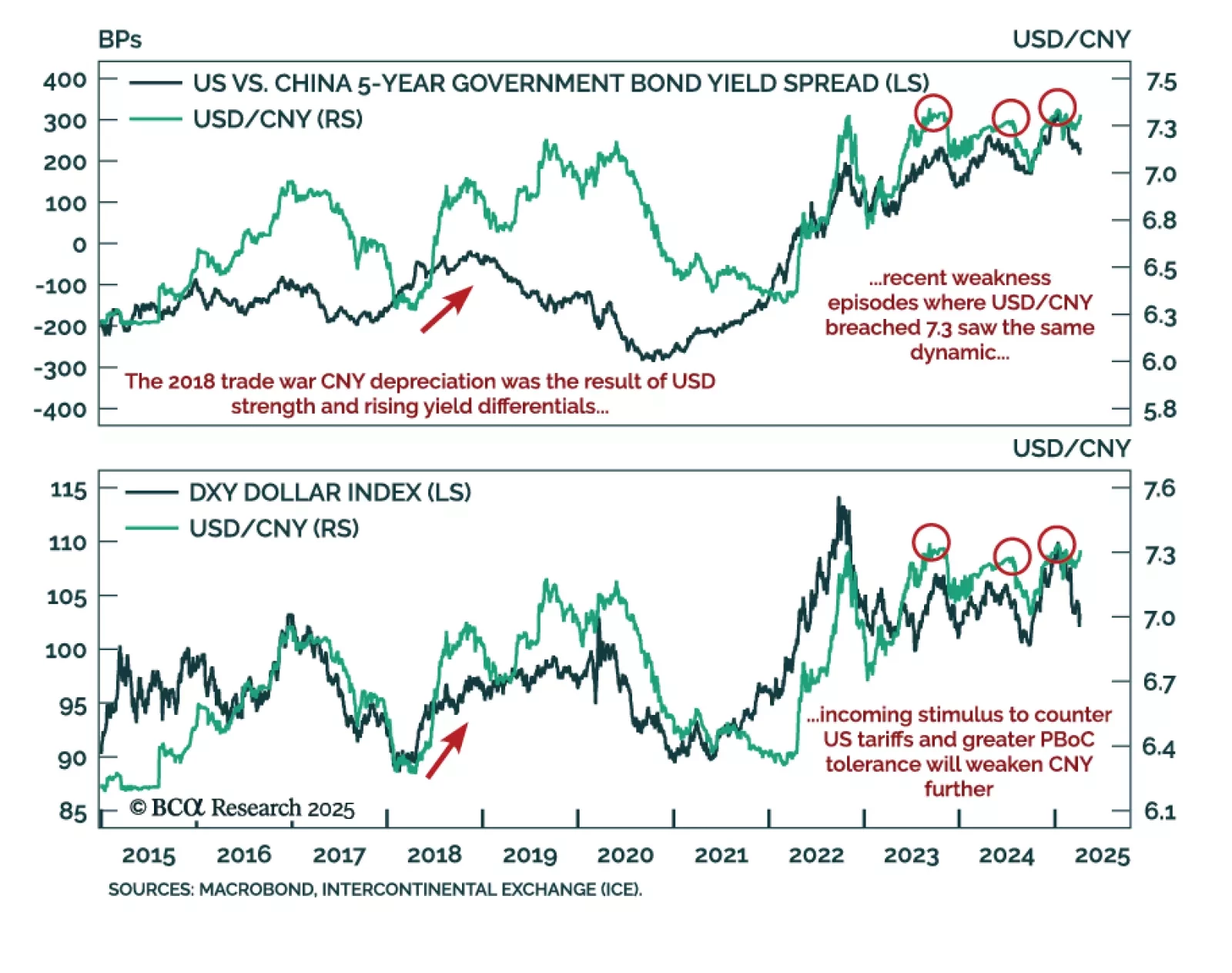

USD/CNY’s break above 7.3 signals more downside is in store for the yuan, supporting short high-beta FX and long CHF and JPY positions. The CNY has weakened in 2025 even as the US dollar has depreciated against most major currencies…

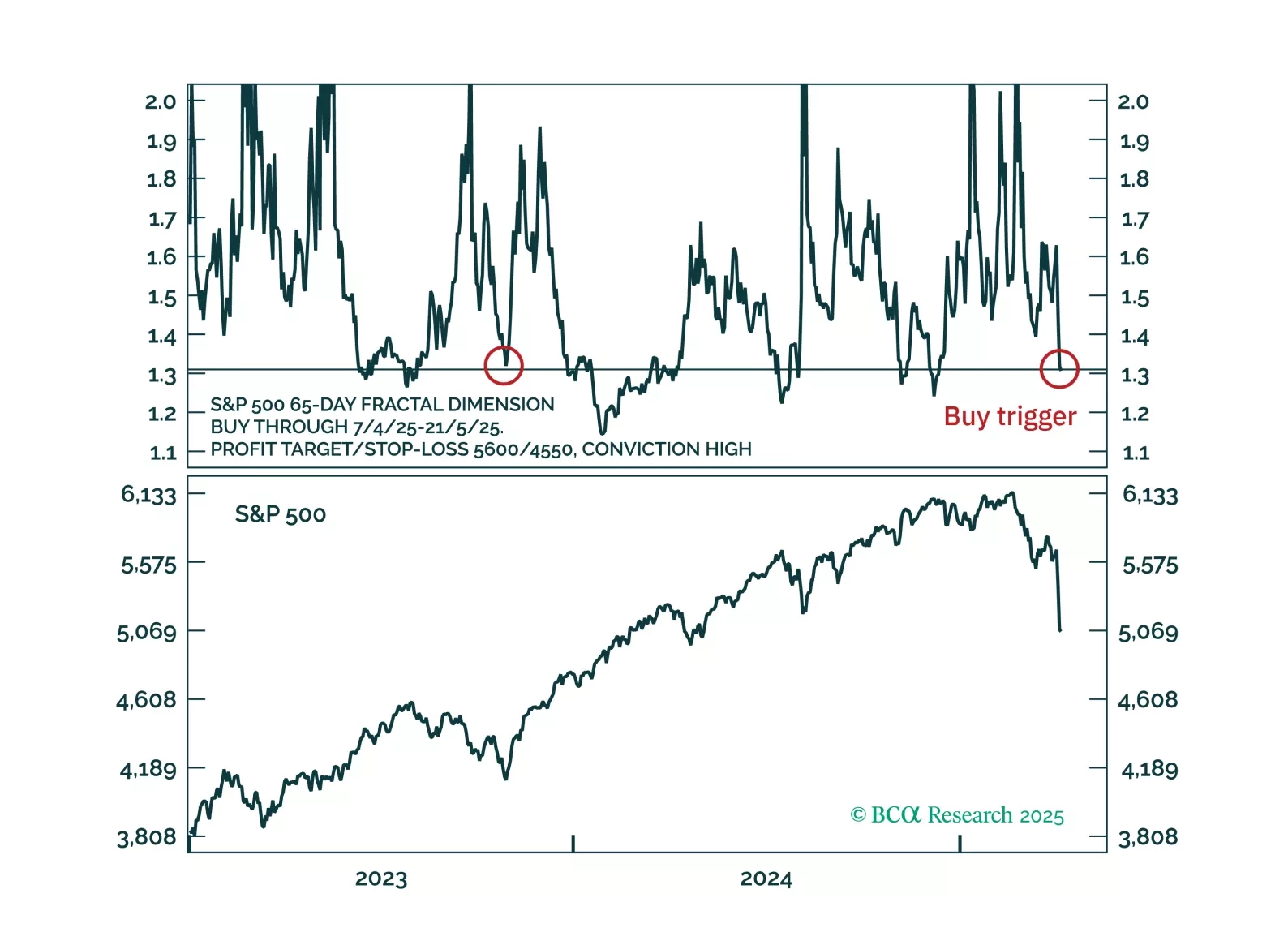

Countertrend buy triggers have been activated for the S&P 500, Nasdaq and Nasdaq versus 30-year T-bond.

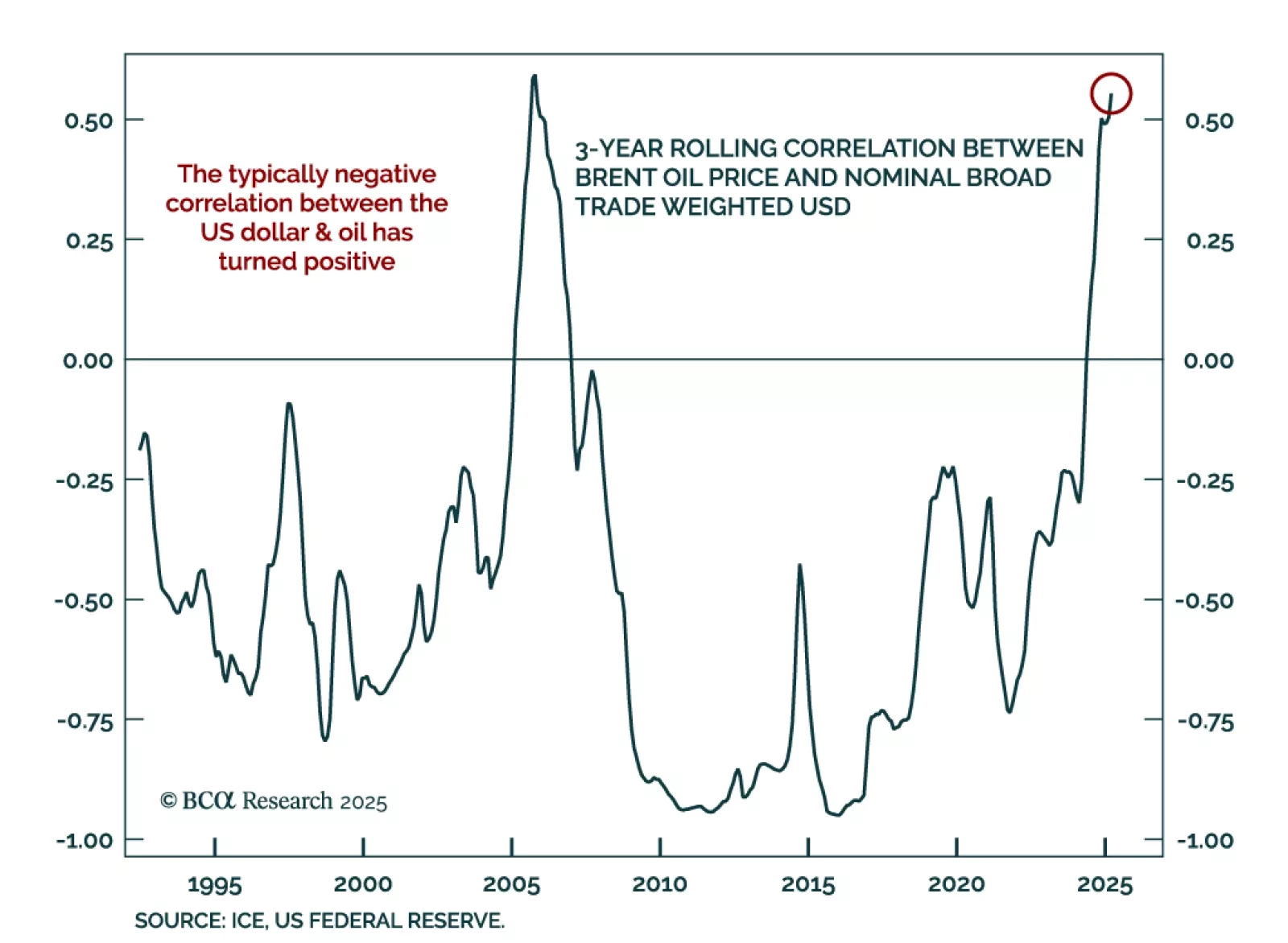

Our Commodities strategists remain defensively positioned, recommending a long gold versus oil and copper trade over a cyclical timeframe. While gold may correct near term, it still offers safe-haven appeal in the face of rising…

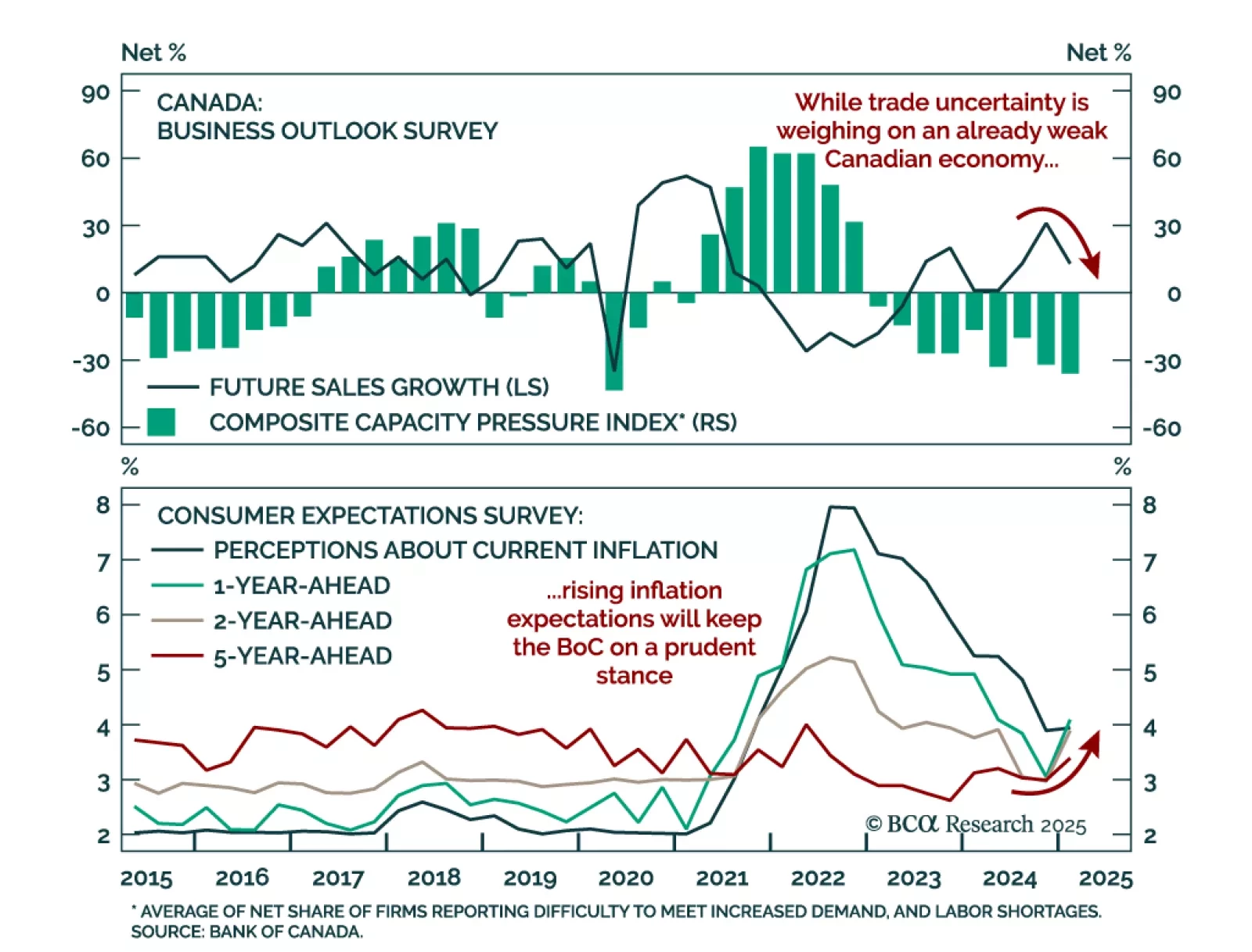

Canada’s difficult macro outlook is already priced, supporting a neutral stance on Canadian government bonds within a global fixed-income portfolio. We continue to recommend a small long CAD/USD position, where bad news is well…

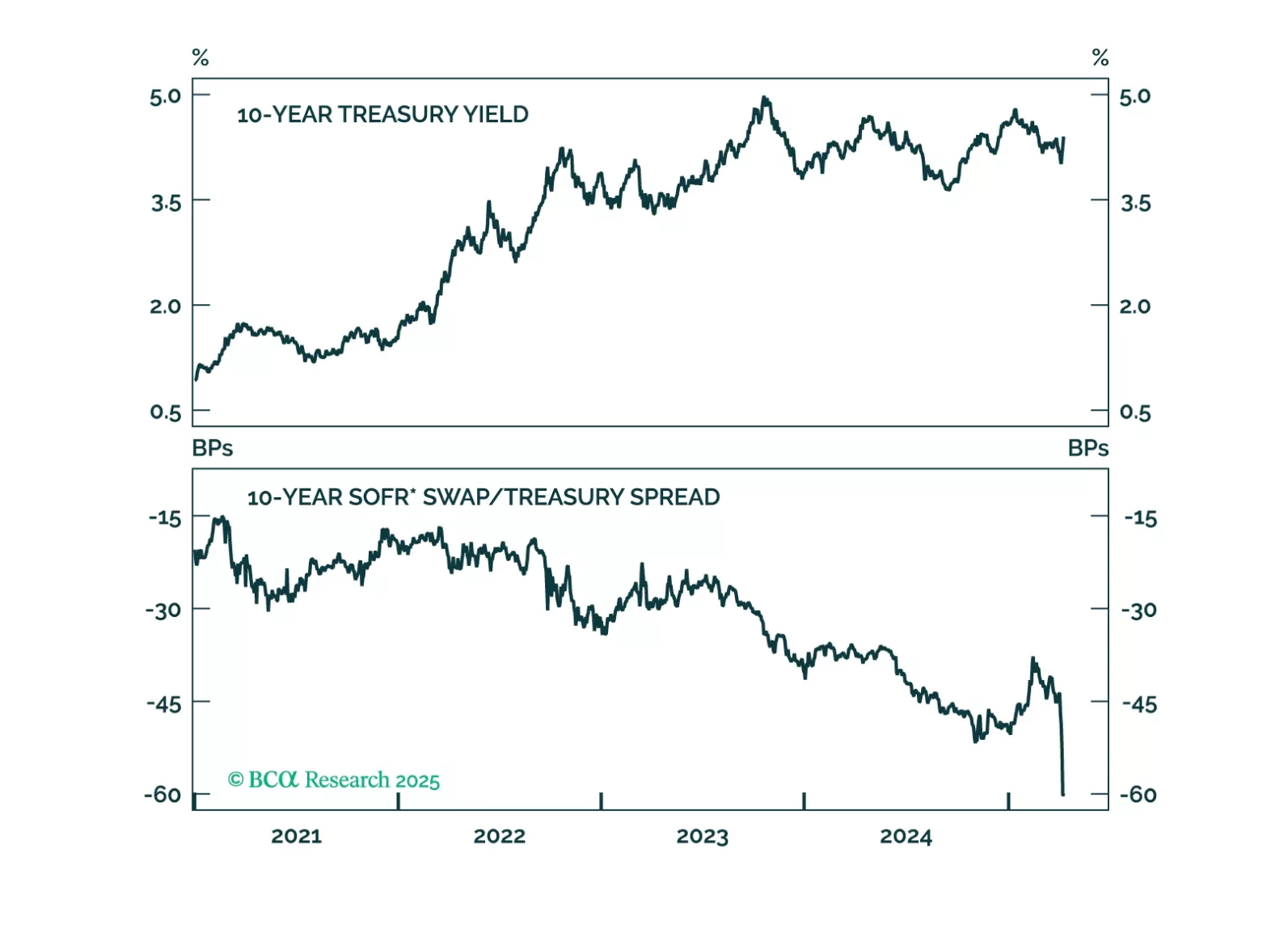

We maintain our defensive positioning as risk assets remain in a lose-lose situation. Monday’s trading session was volatile, and saw a brief rebound on a false headline about a 90-day tariff pause excluding China. The rally partially…