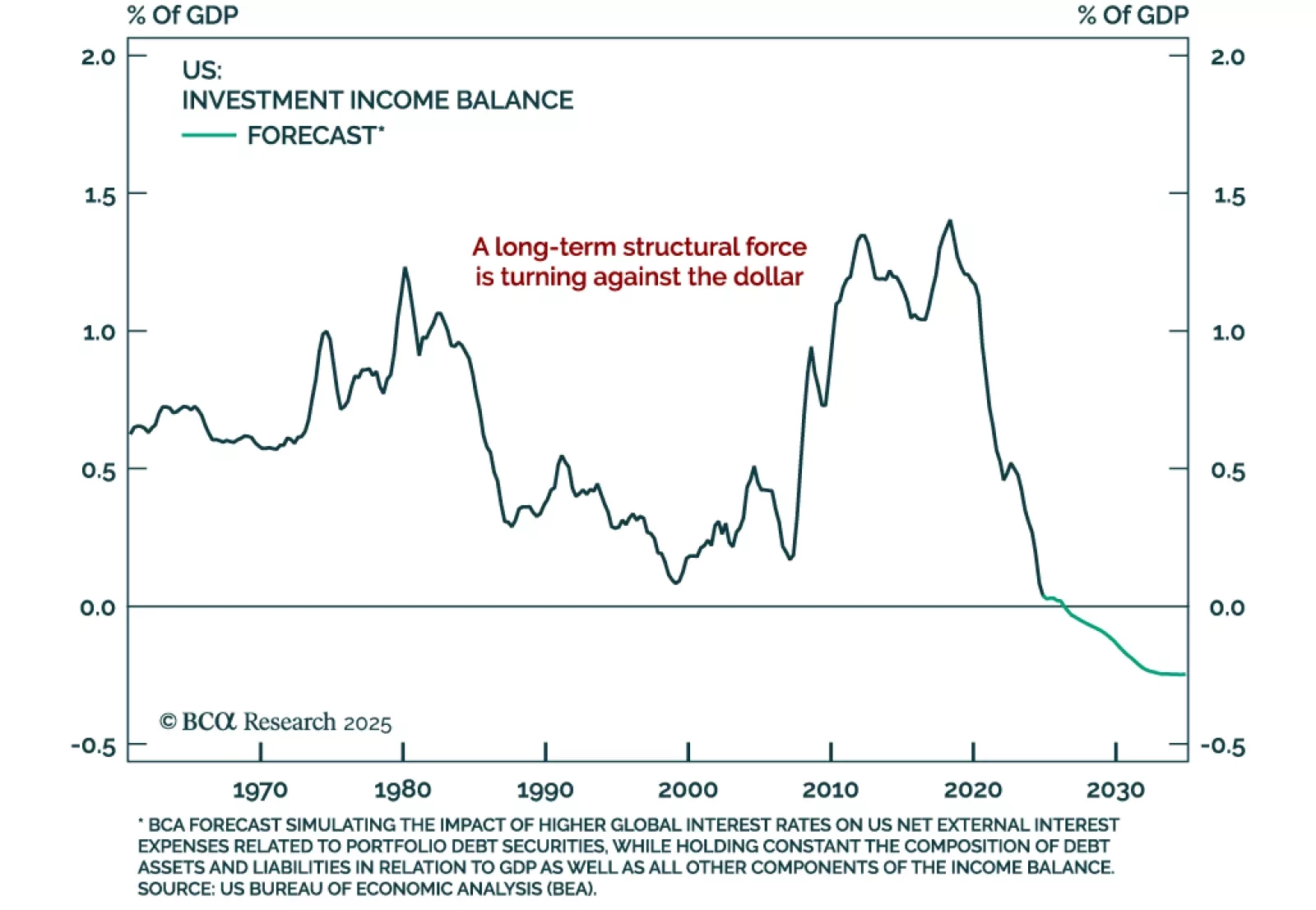

The US dollar’s reserve status is not done, but its foundations are starting to crack. Our Chart Of The Week comes from Juan Correa, Chief Global Asset Allocation Strategist. Most defensive currencies, like the yen and the Swiss…

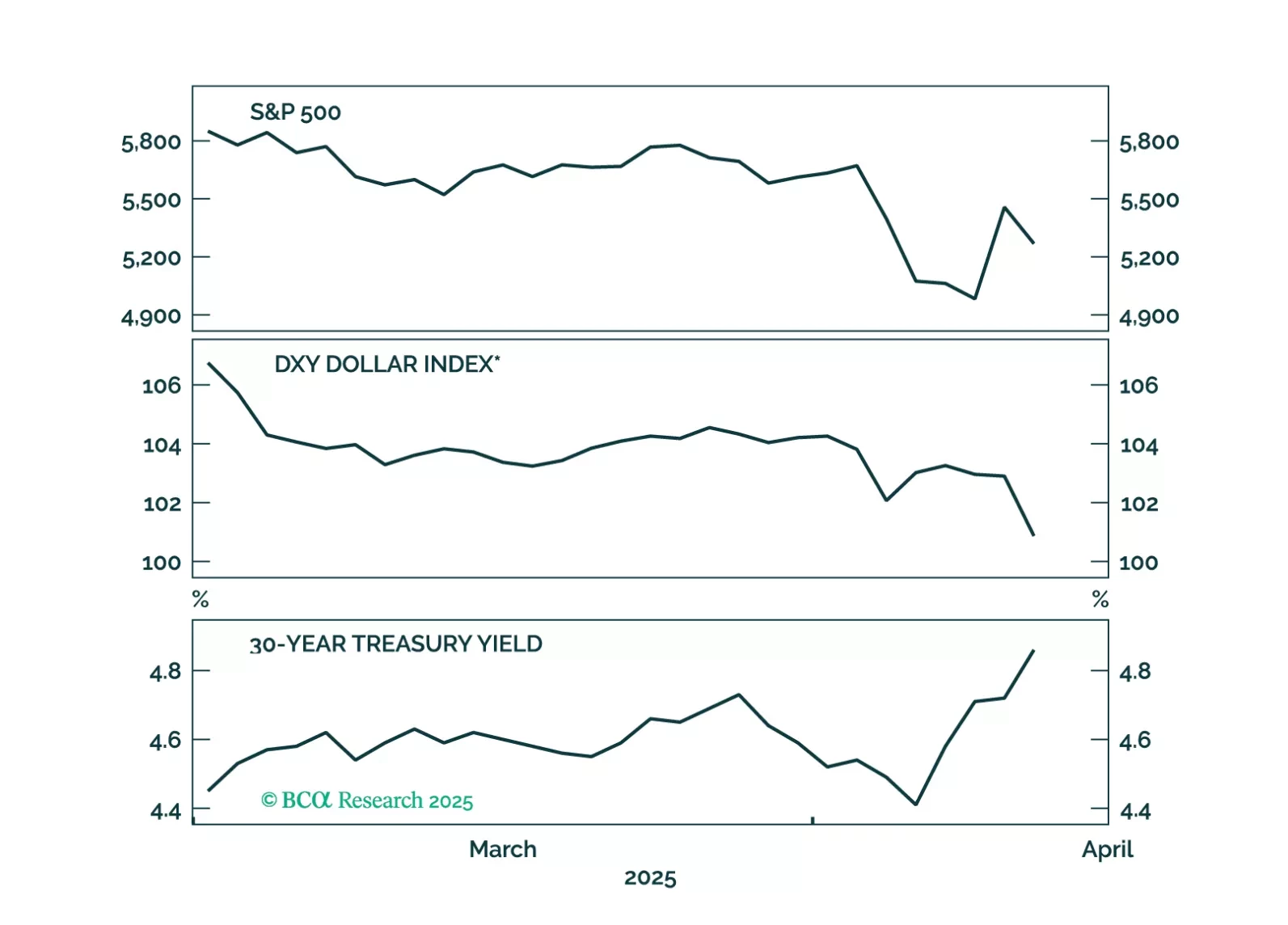

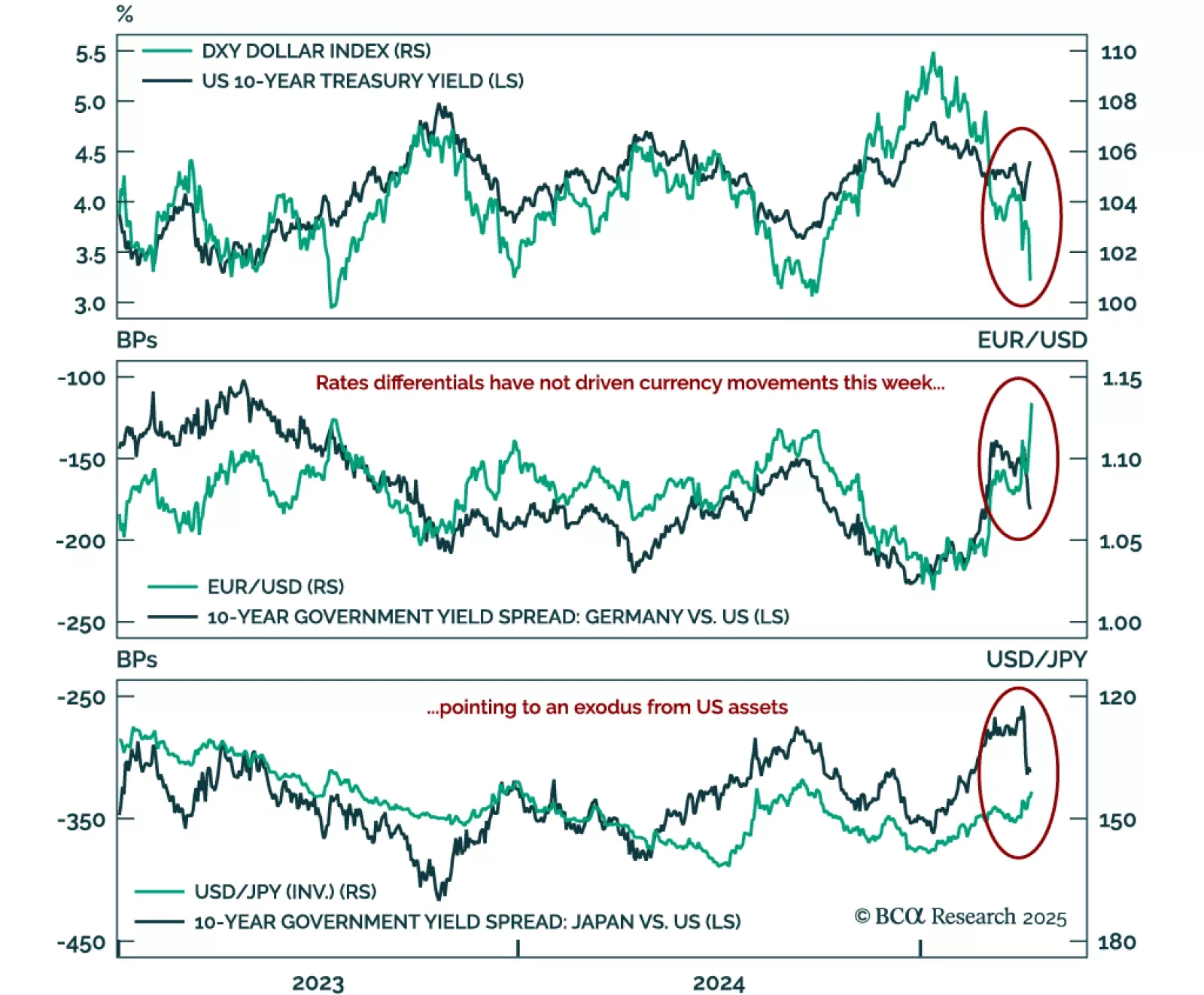

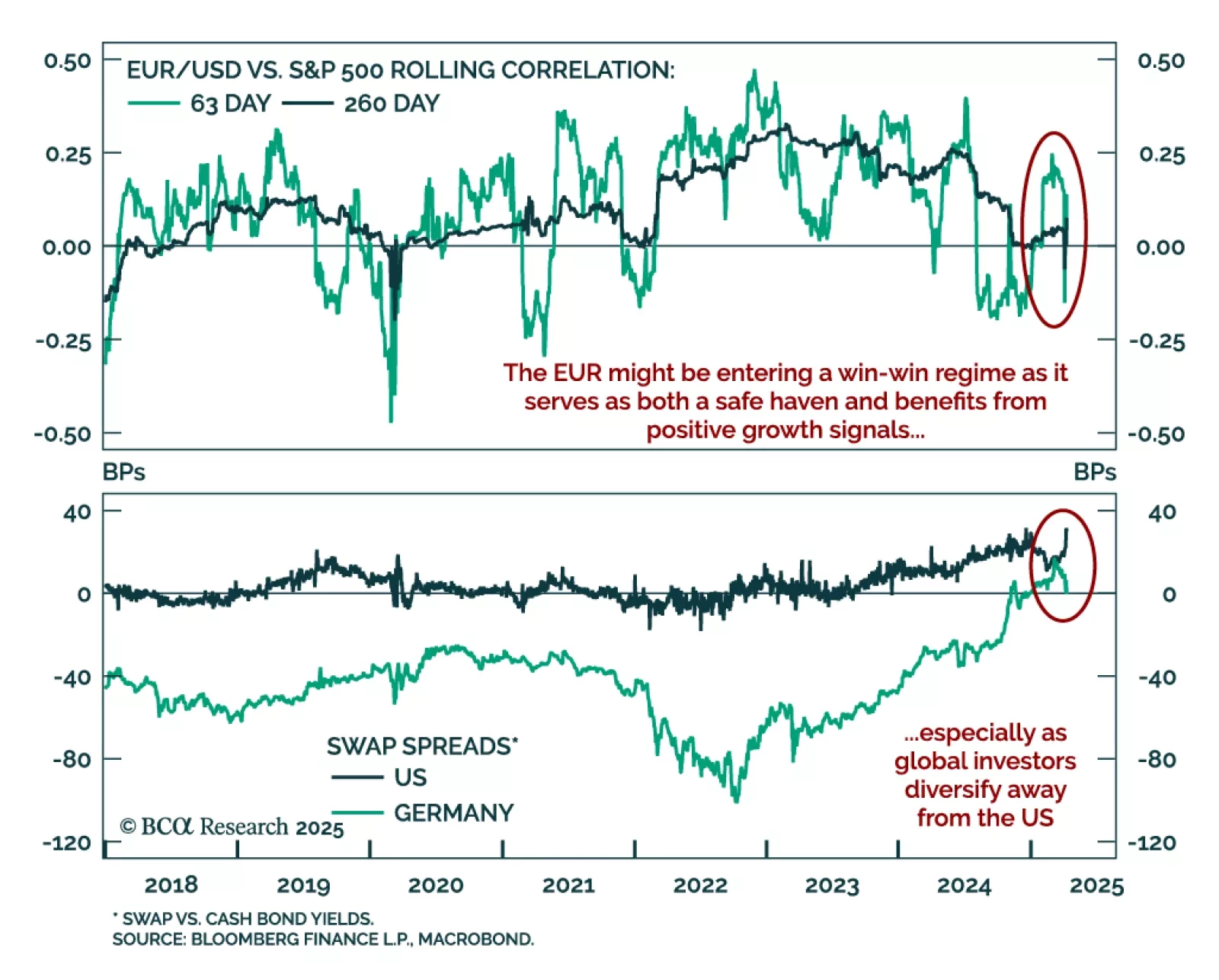

The recent breakdown in cross-asset correlations highlights mounting risk premia on US assets. Last week, the long-standing correlations underpinning our understanding of global markets violently broke down. The Treasury market…

Our Global Investment Strategists remain defensive, expecting a global recession in the coming months unless the trade war de-escalates meaningfully. They maintain a year-end S&P 500 target of 4450, with downside risk to 4200.…

The combination of dollar weakness and rising US yields suggests global investors are questioning the safe-haven status of US Treasuries.

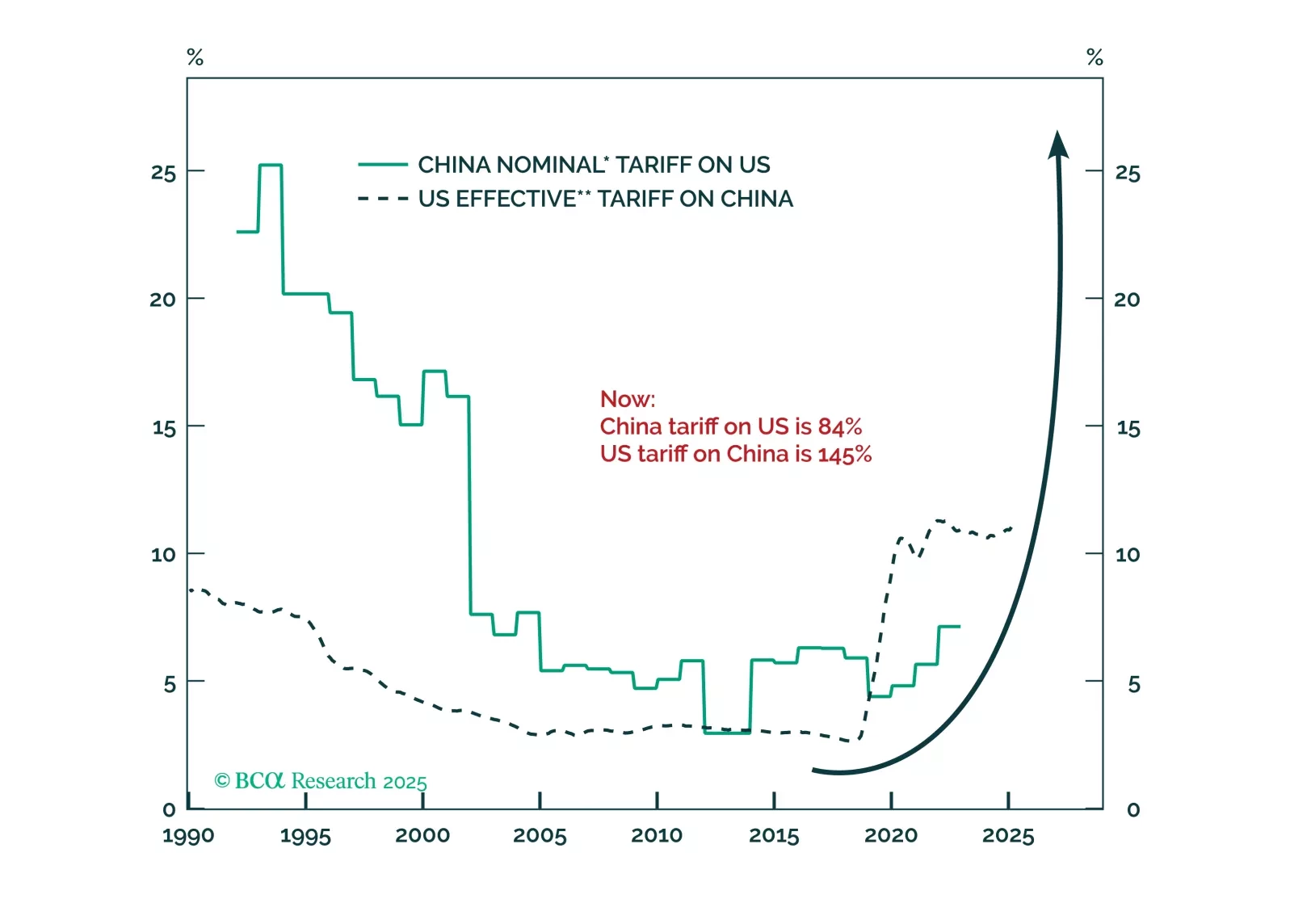

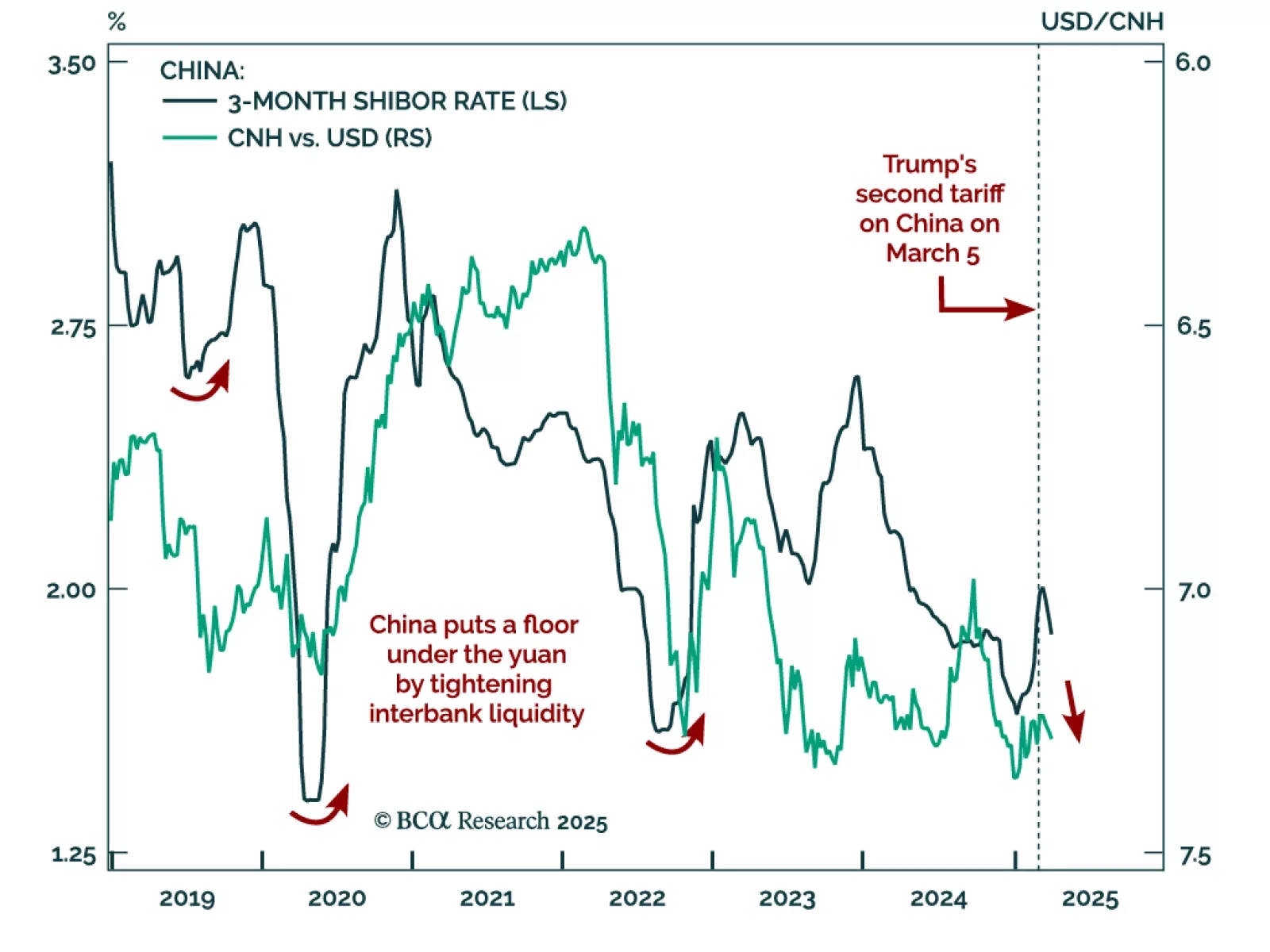

China prepares to devalue the yuan in response to US tariffs. Our Emerging Markets strategists recommend shorting CNH, downgrading offshore Chinese equities, and staying bearish on global risk assets. Beijing sees the tariffs as a…

Dips in European assets remain long-term buying opportunities, even though short-term risks abound. A notable feature of the recent selloff is that US safe havens failed to rally. In a global growth scare, both the US dollar and…

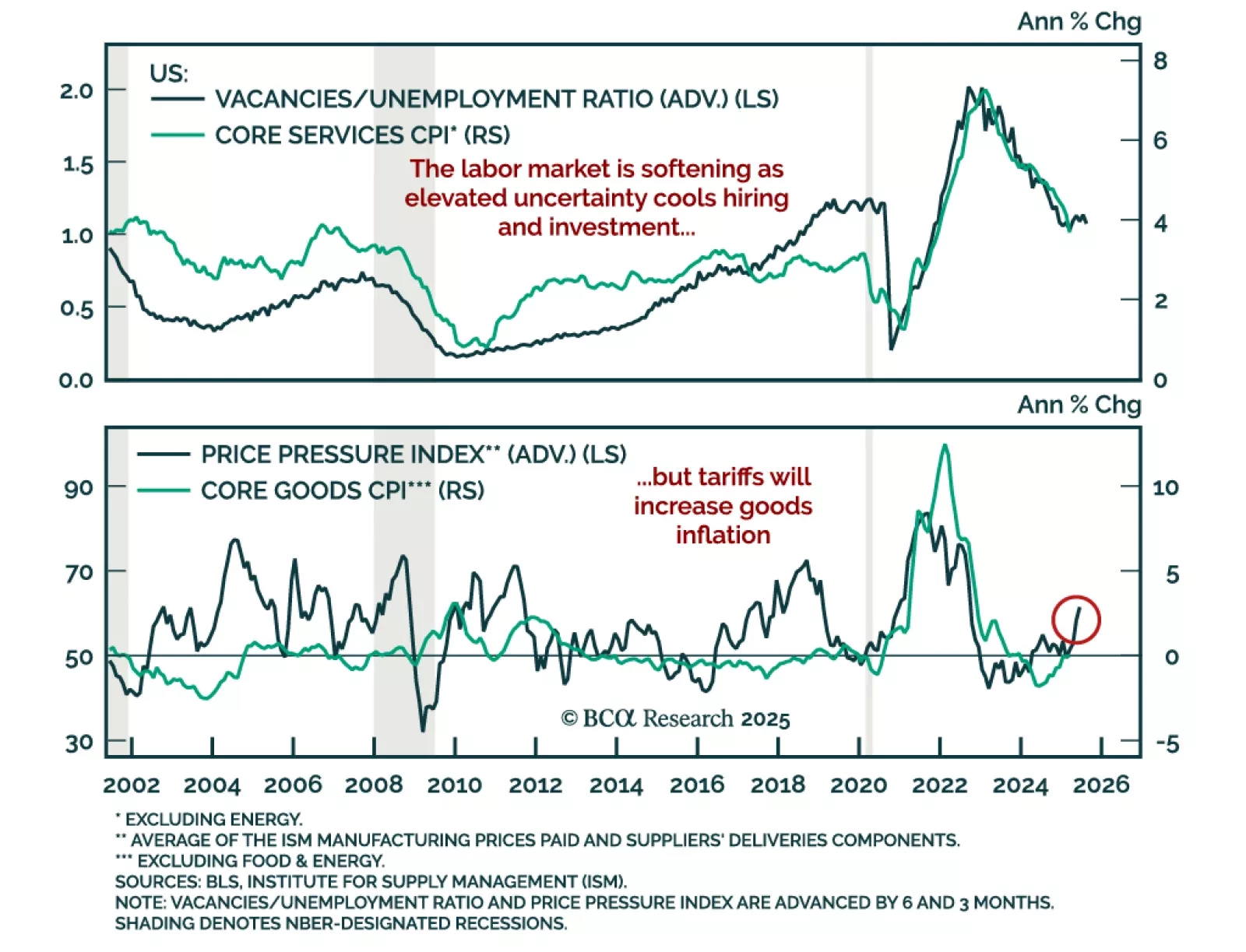

March’s cooler CPI print reinforces our defensive positioning as it points to softening growth that the Fed cannot address yet. Headline CPI came in at -0.1% m/m (2.4% y/y), and core rose just 0.1% m/m, slowing to 2.8% y/y from 3.1…

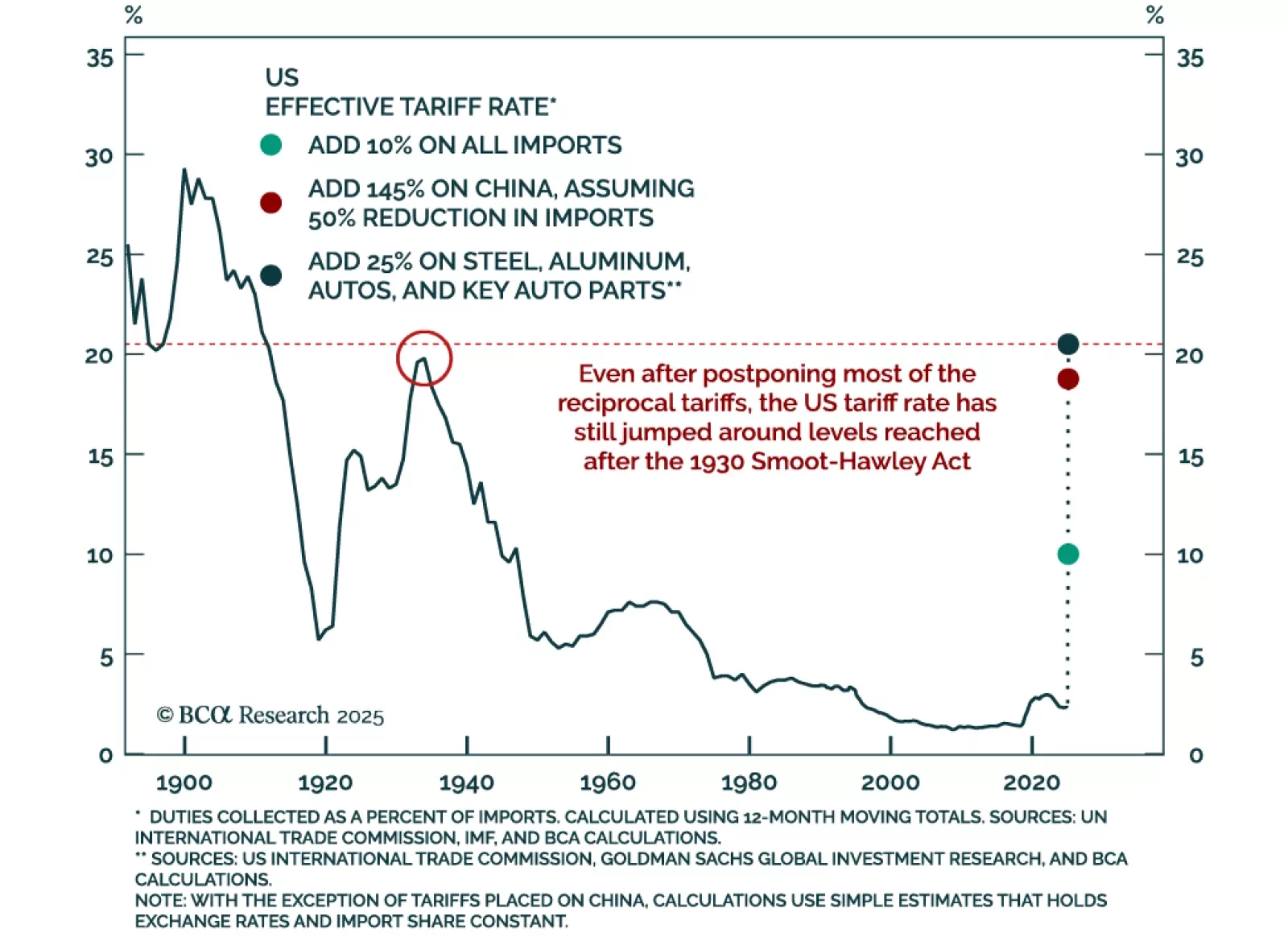

China’s aggressive retaliation against U.S. tariffs will enable President Trump to shift from punishing allies and redirect the trade war toward China. If Beijing does not react to the latest tariffs by doubling its fiscal stimulus,…

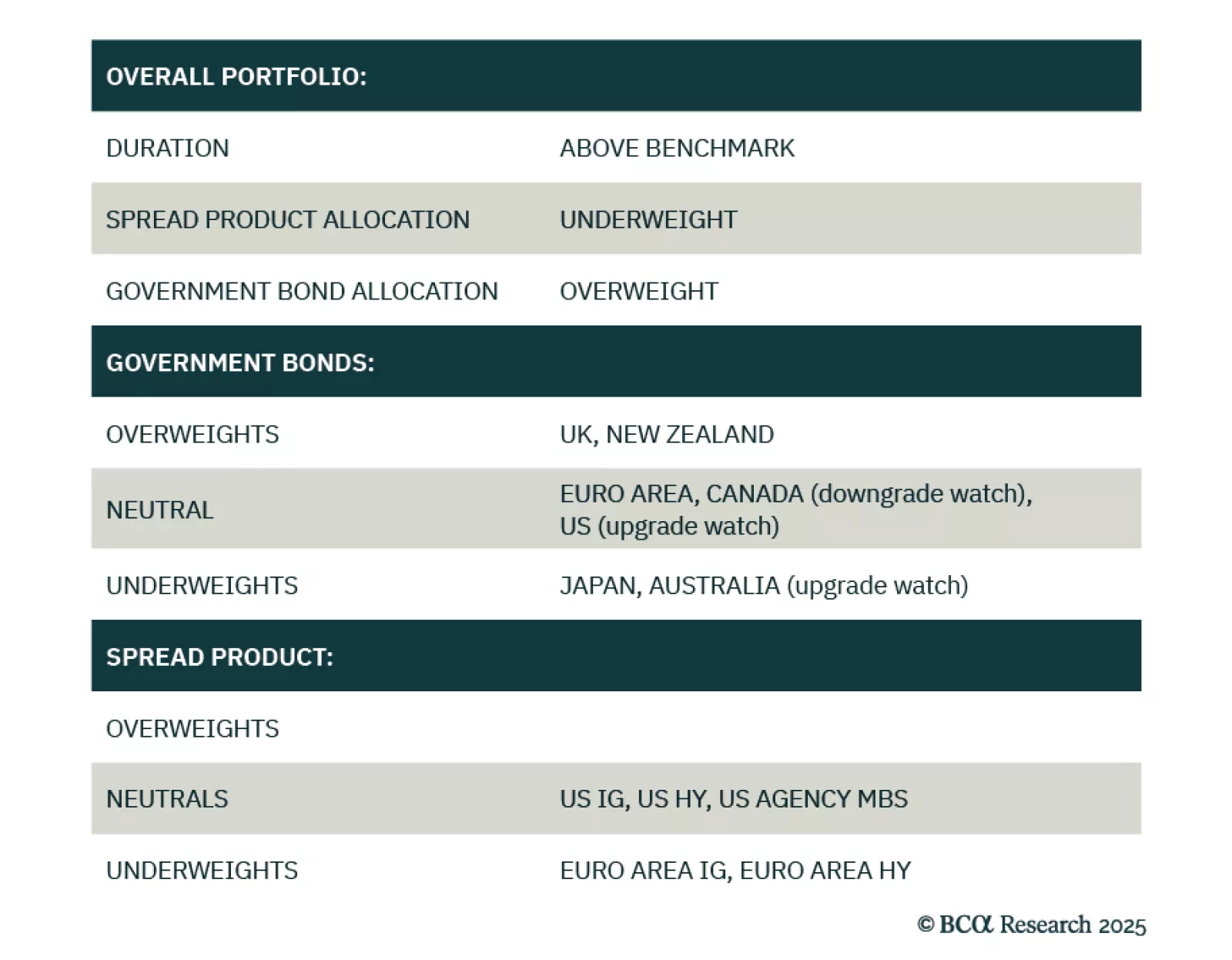

Our Global Fixed Income strategists continue to recommend long duration exposure, curve steepeners, and an underweight in corporate bonds relative to government bonds, as global recession risks rise. The trade war has increased the…

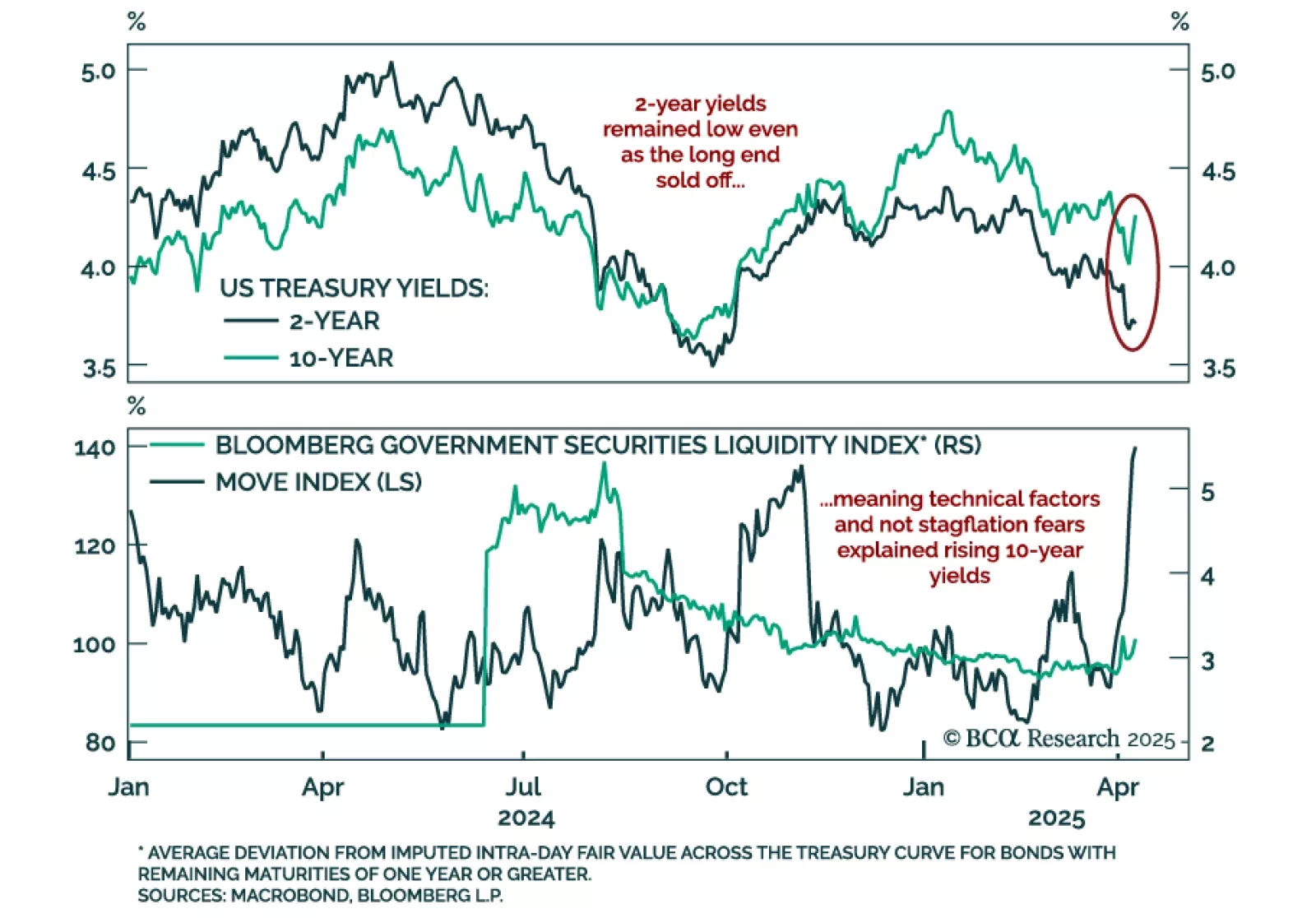

We maintain an overweight in government bonds, as recent yield spikes appear technical and unsustainable. US 10-year Treasury yields have surged even as global markets were selling off on growth fears. The move has spread to higher-…