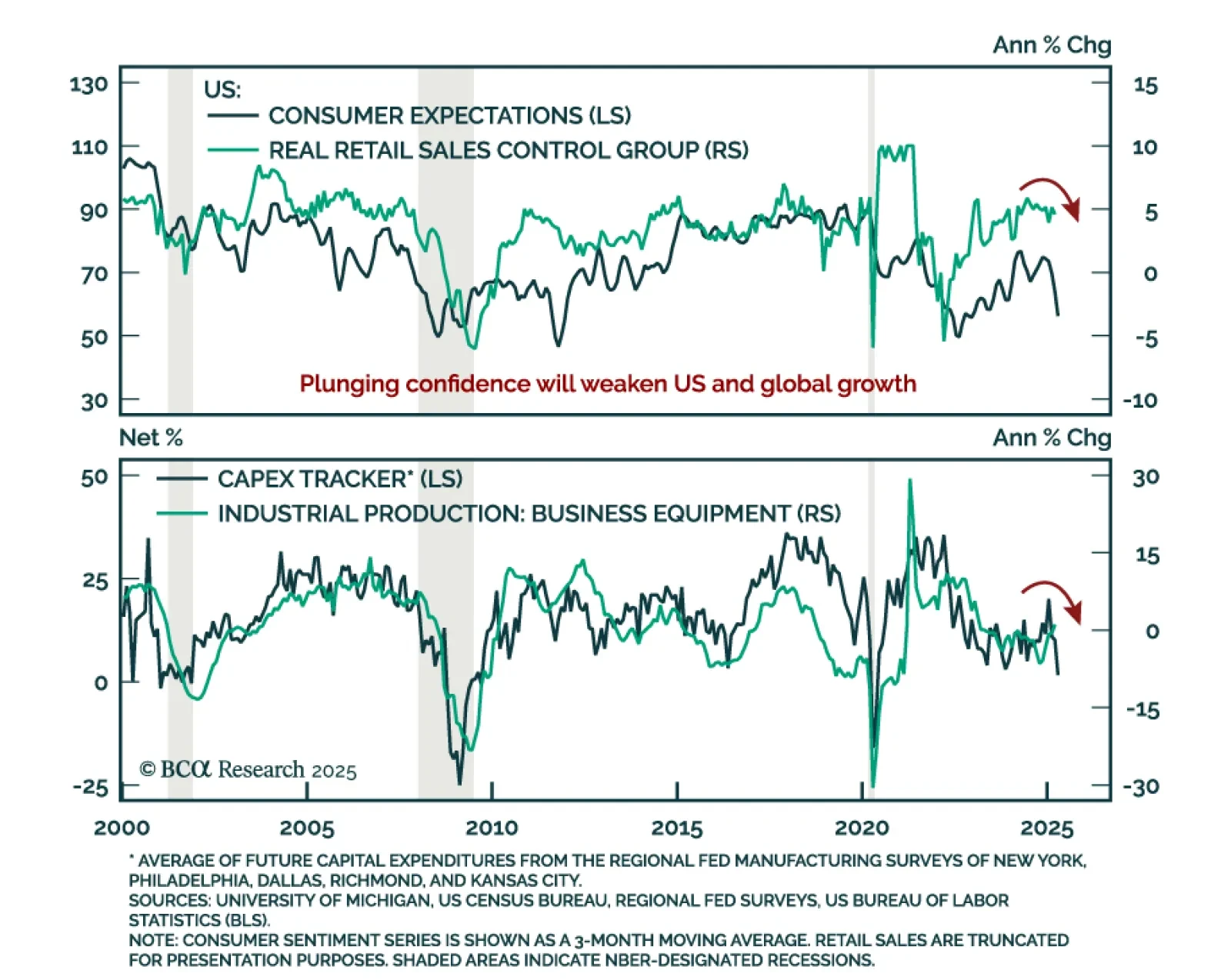

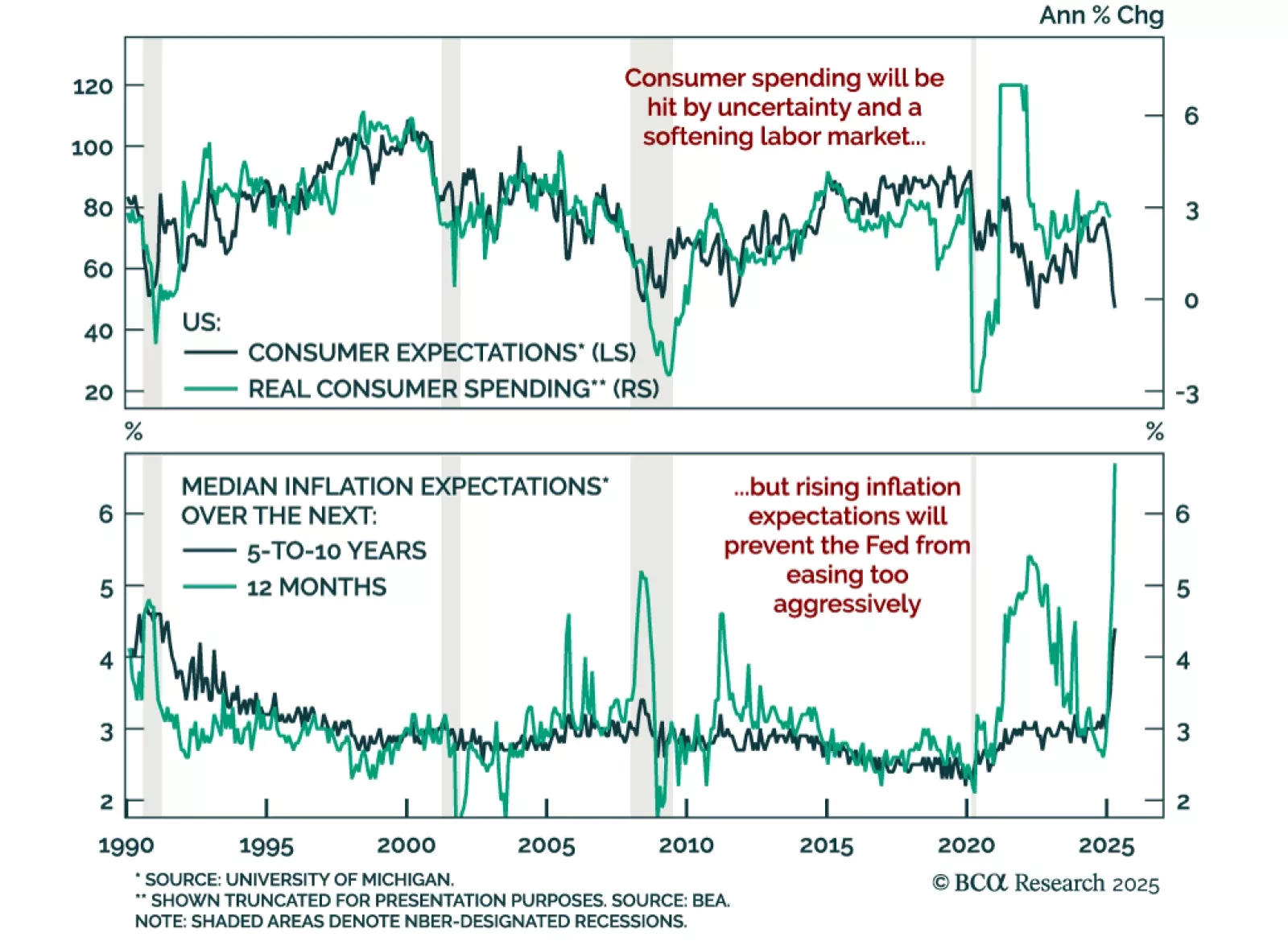

Soft data continues to deteriorate and hard data will soon follow, reinforcing our defensive asset allocation. Consumer and business confidence have plunged as policy uncertainty and inflation expectations rise, with spending, hiring…

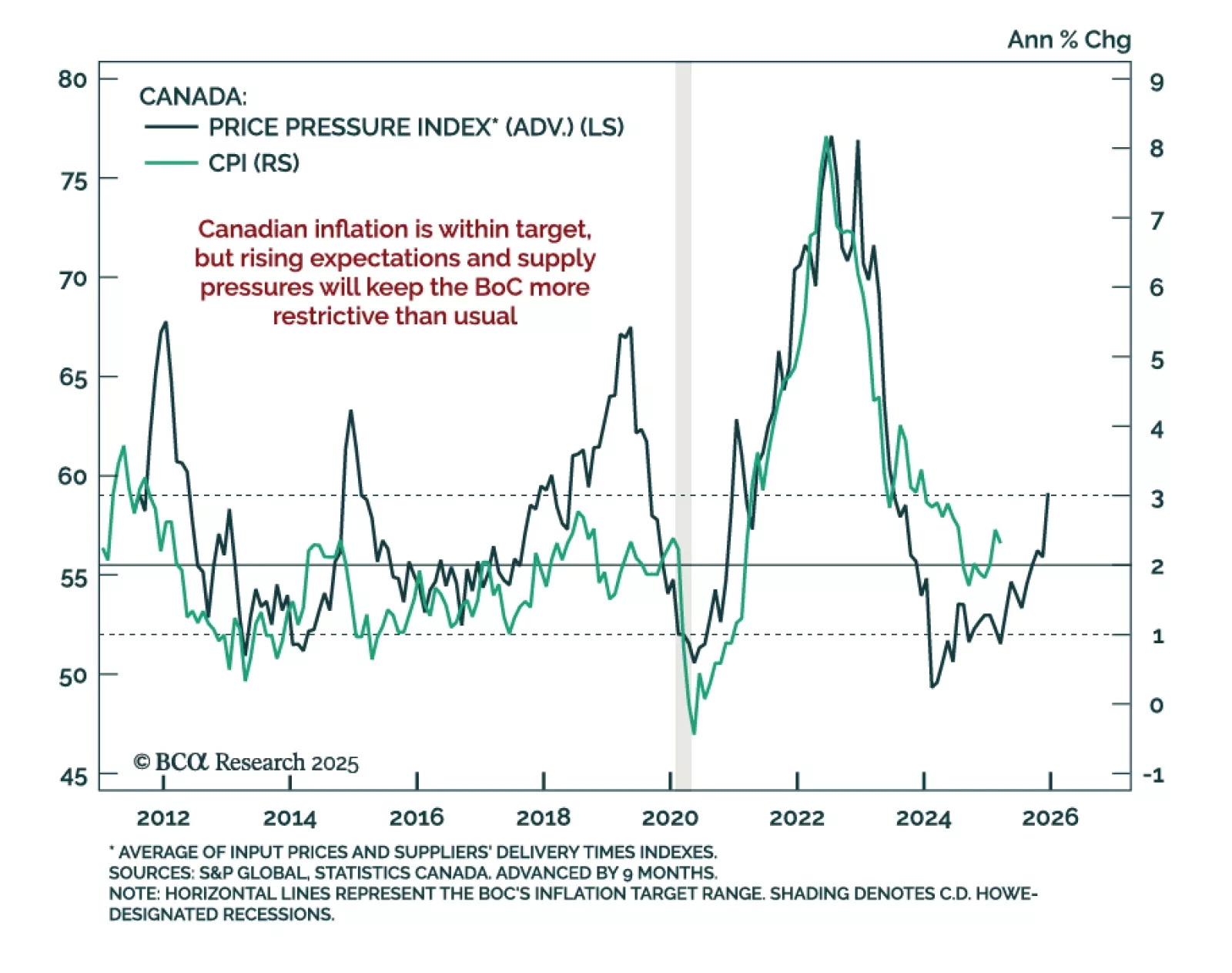

Cooler inflation will not shift the BoC’s stance, as stagflation limits potential easing, keeping us neutral on Canadian bonds. In March, headline CPI slowed more than expected to 2.3% y/y from 2.6%. However, lower energy prices…

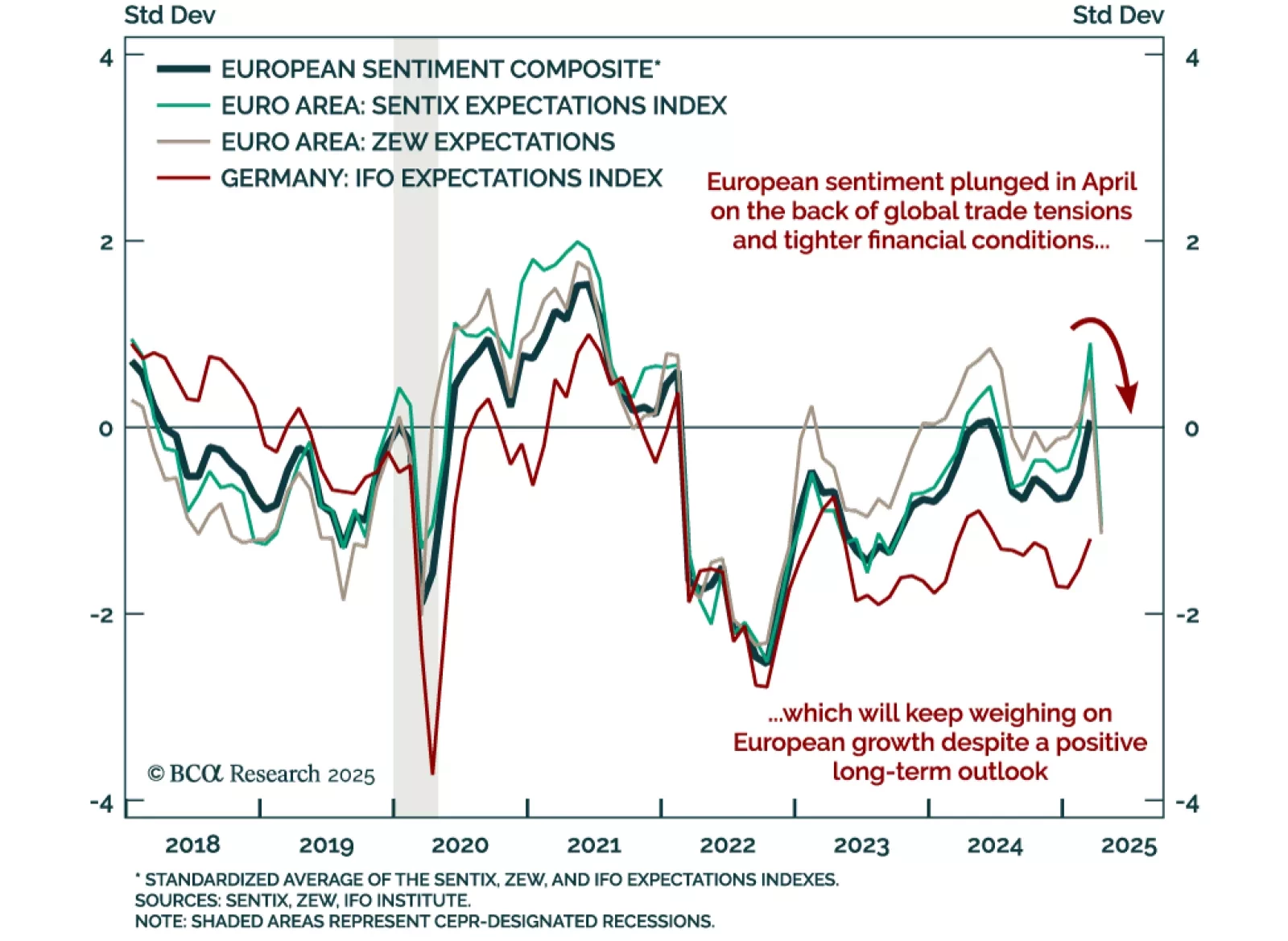

Eurozone sentiment has sharply deteriorated, reinforcing a cautious stance on European assets over the next 6 to 12 months. The April ZEW expectations index for the eurozone collapsed to -18.5 from 39.8, while Germany’s gauge also…

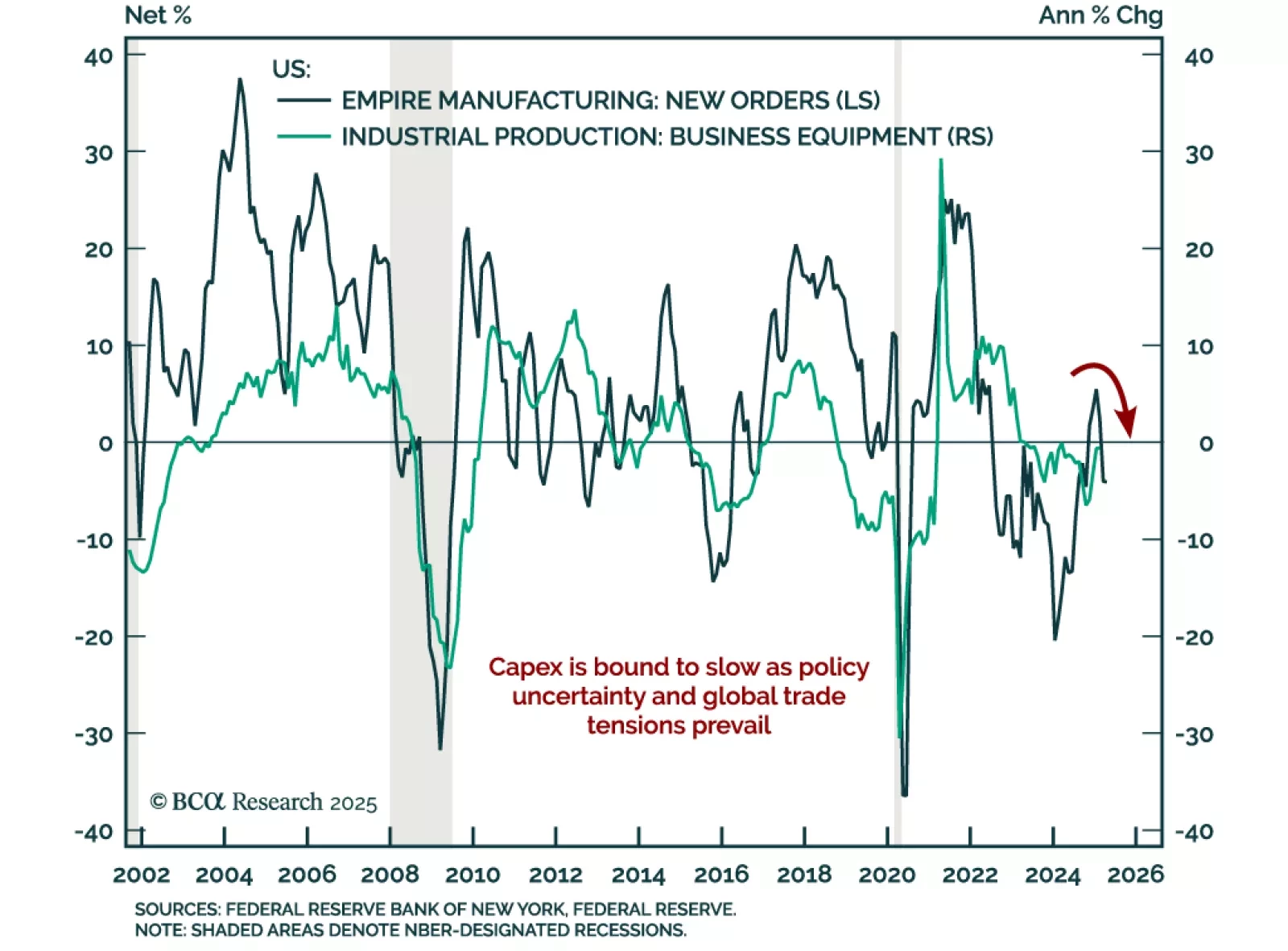

The NY Fed Empire Manufacturing survey adds to recent stagflationary worries, reinforcing our underweight in risk assets and overweight in government bonds. The general business conditions index rose slightly to -8.1 but remains in…

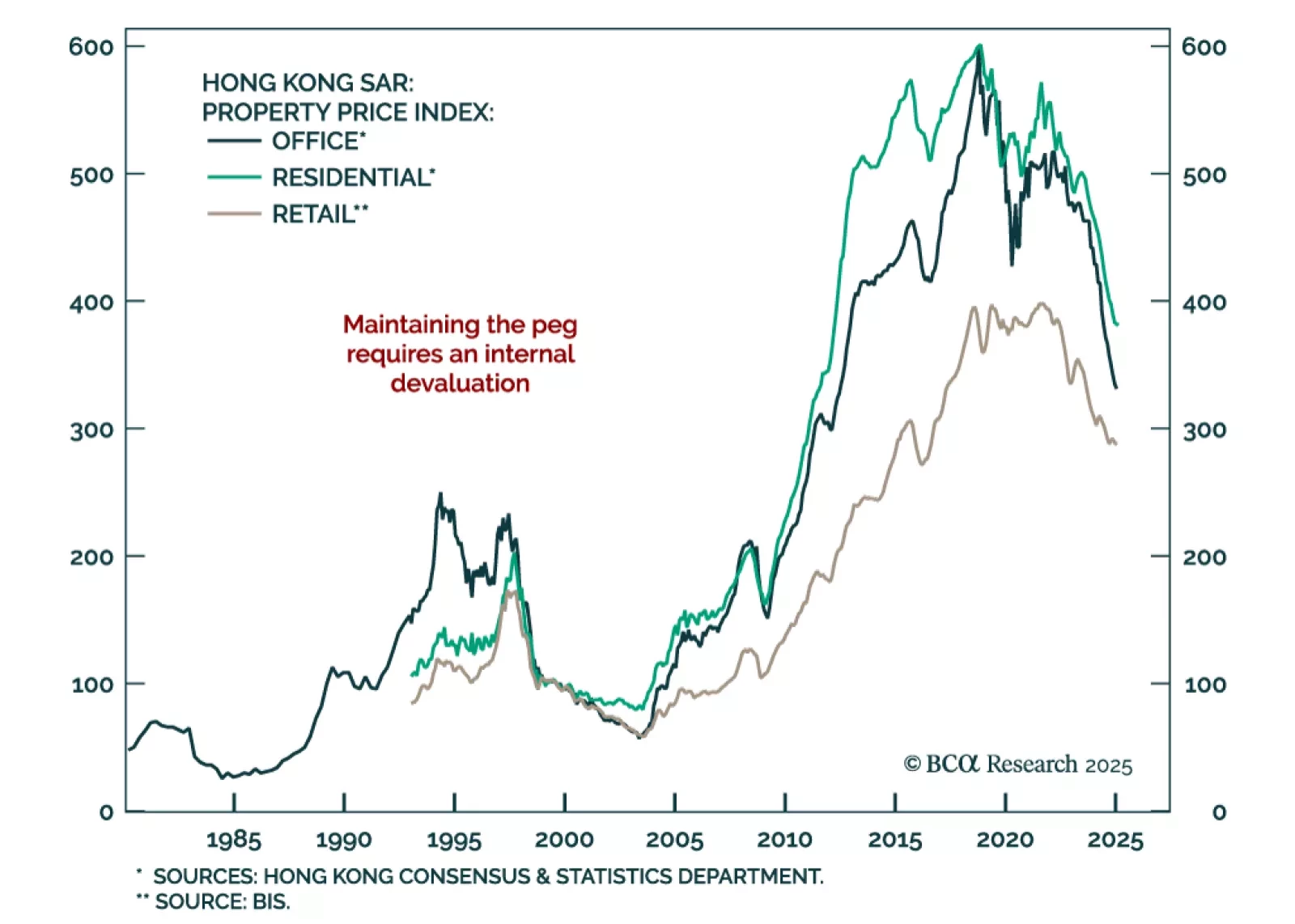

Our FX strategists expect the HKD peg to hold, but at the cost of prolonged economic weakness and debt deflation in Hong Kong. Interest rates remain too high for the local economy, yet monetary easing is off-limits due to the…

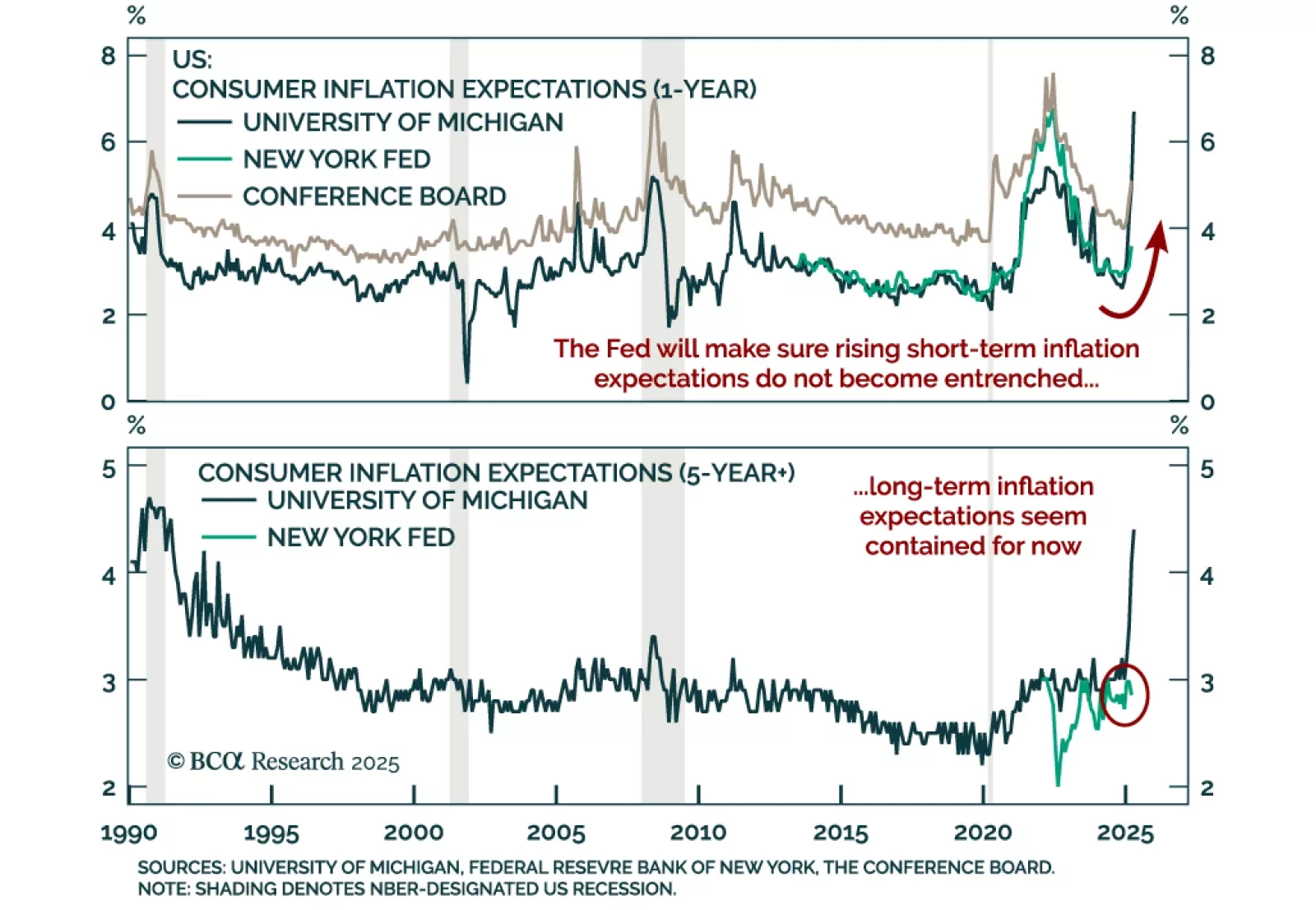

The latest NY Fed Survey of Consumer Expectations reinforces our defensive stance, with growth concerns deepening even as long-term inflation expectations remain anchored. The survey is a useful cross-check against broader sentiment…

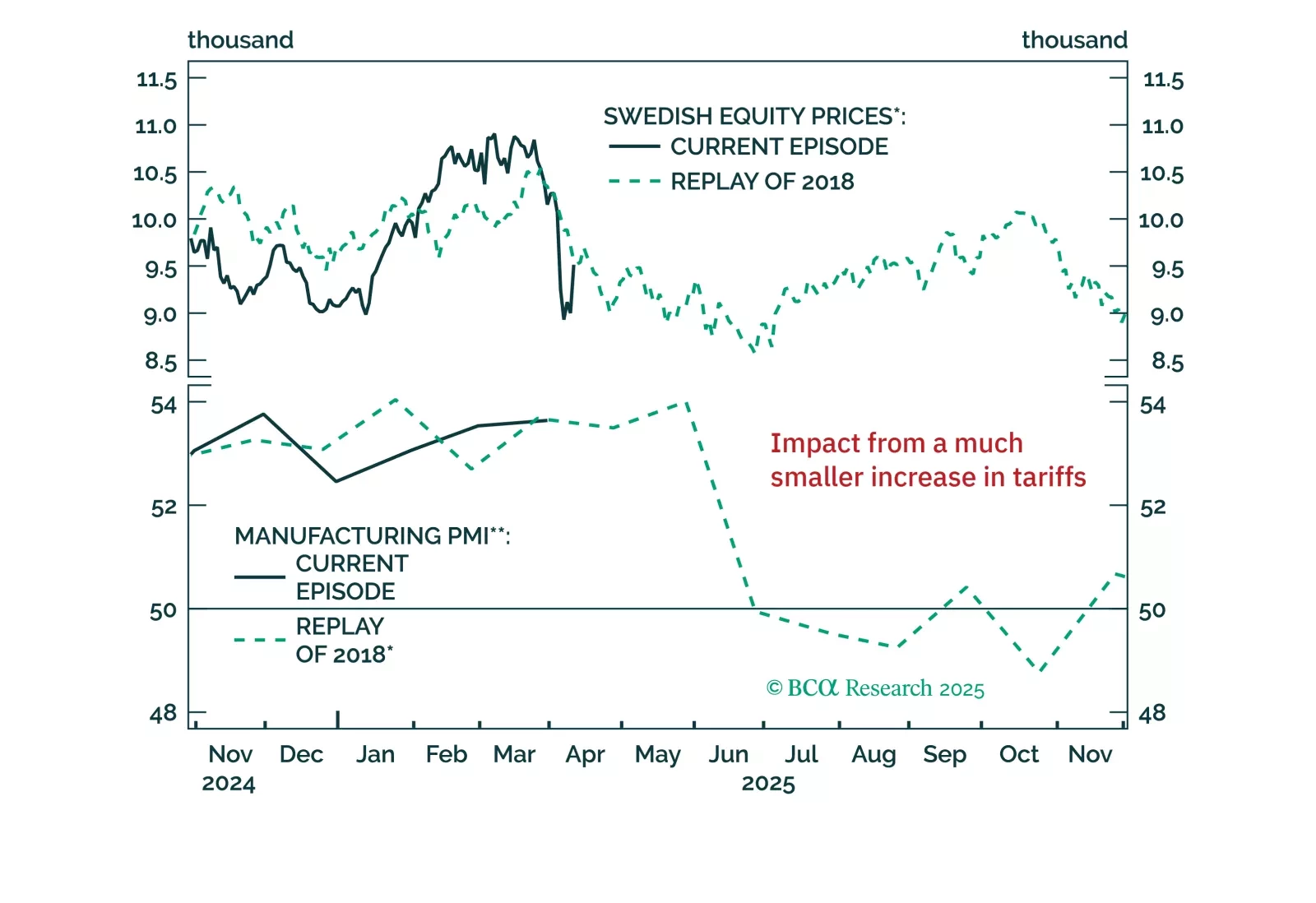

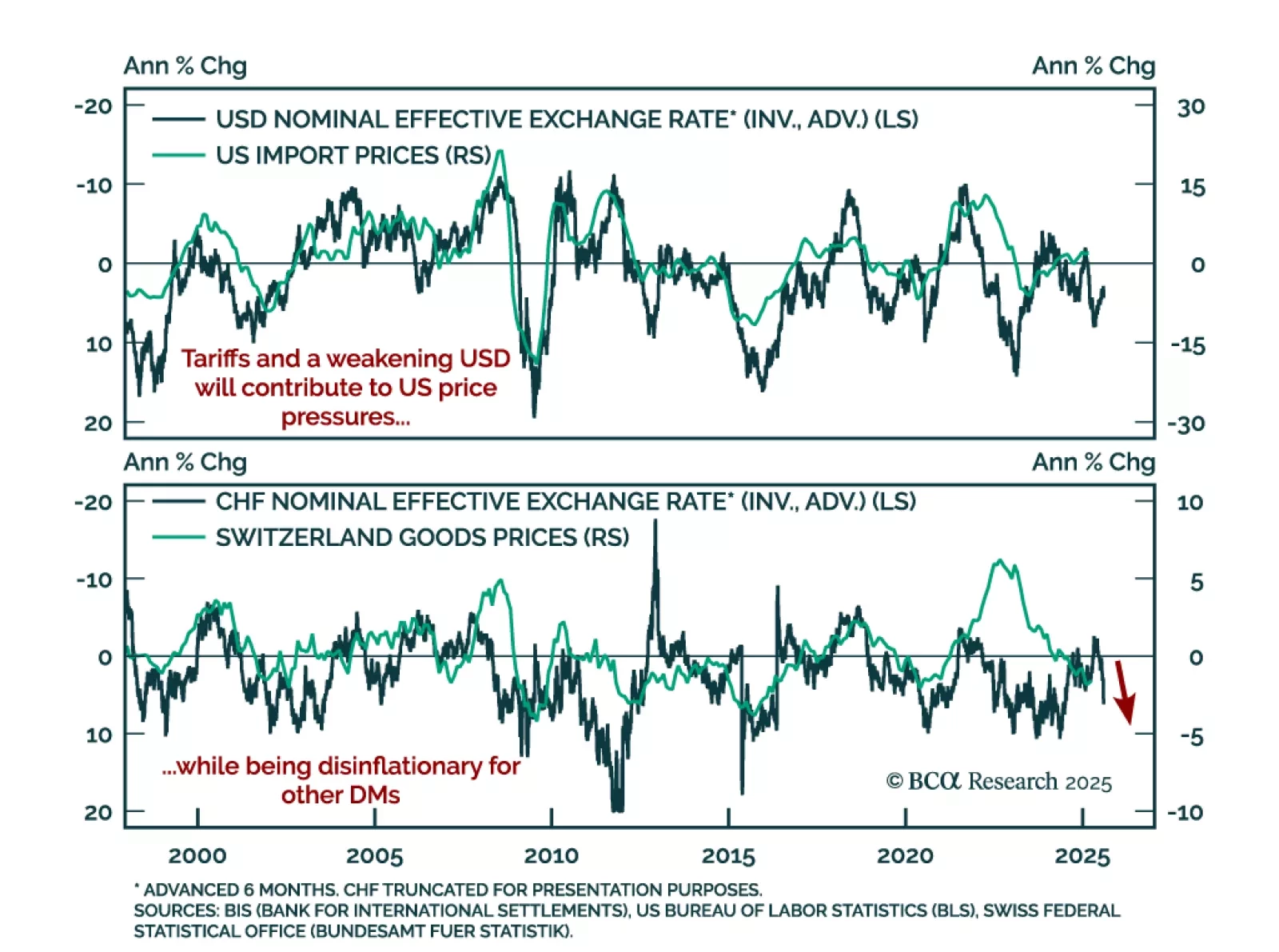

Tariff-driven inflation is diverging across economies, with the US facing mounting pressures while disinflation persists elsewhere. In theory, US tariffs should strengthen the dollar and weaken targeted currencies. In practice, the…

The sharp drop in consumer sentiment and rise in inflation expectations reinforce our defensive positioning and preference for long-duration bonds. The preliminary April University of Michigan Consumer Sentiment Index fell to 50.8…

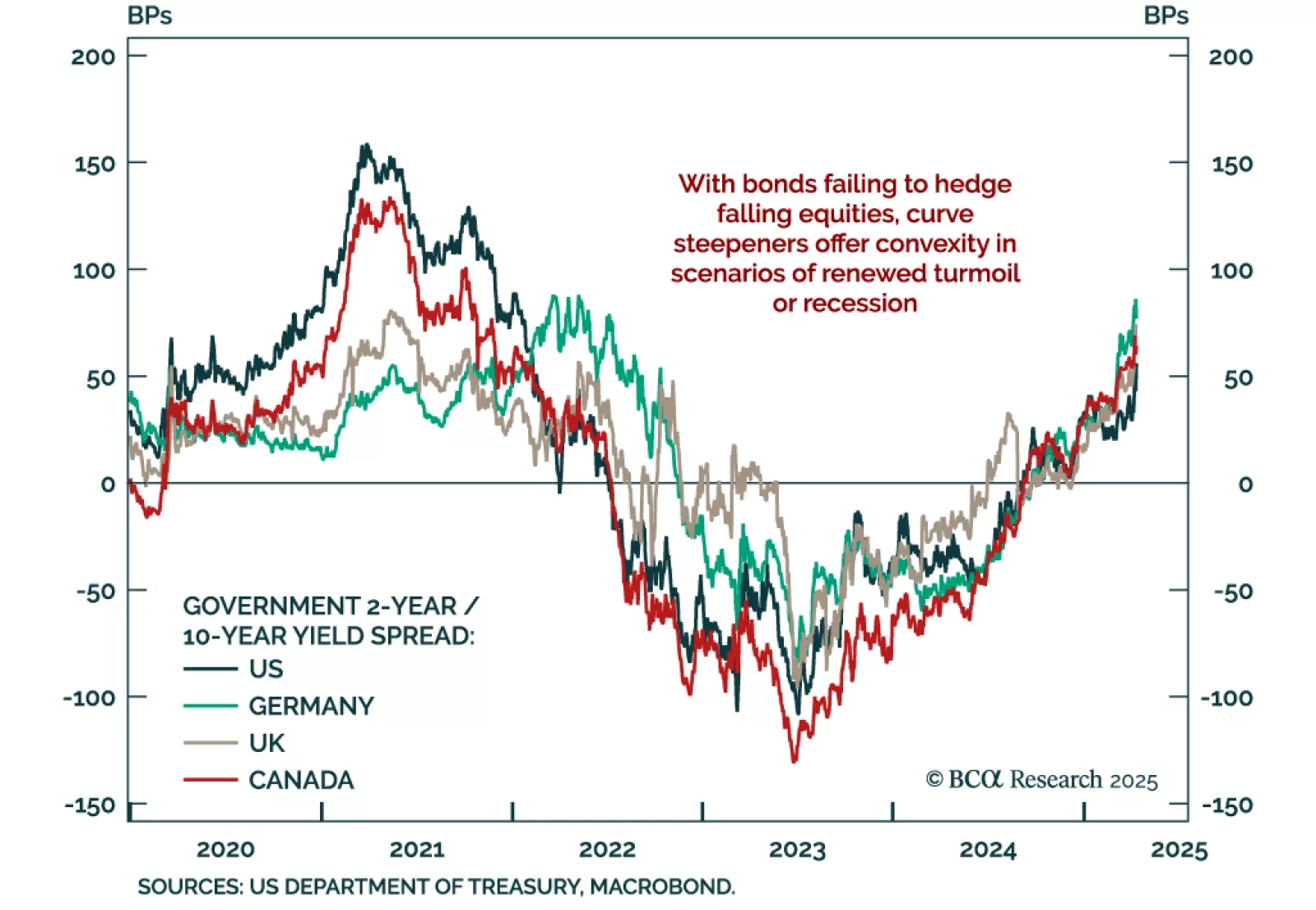

Bonds are failing to deliver defensive convexity; asset allocators should look to tactical curve steepeners for protection. Despite rising growth fears, Treasury yields have risen sharply at the long end. This is a clear break from…