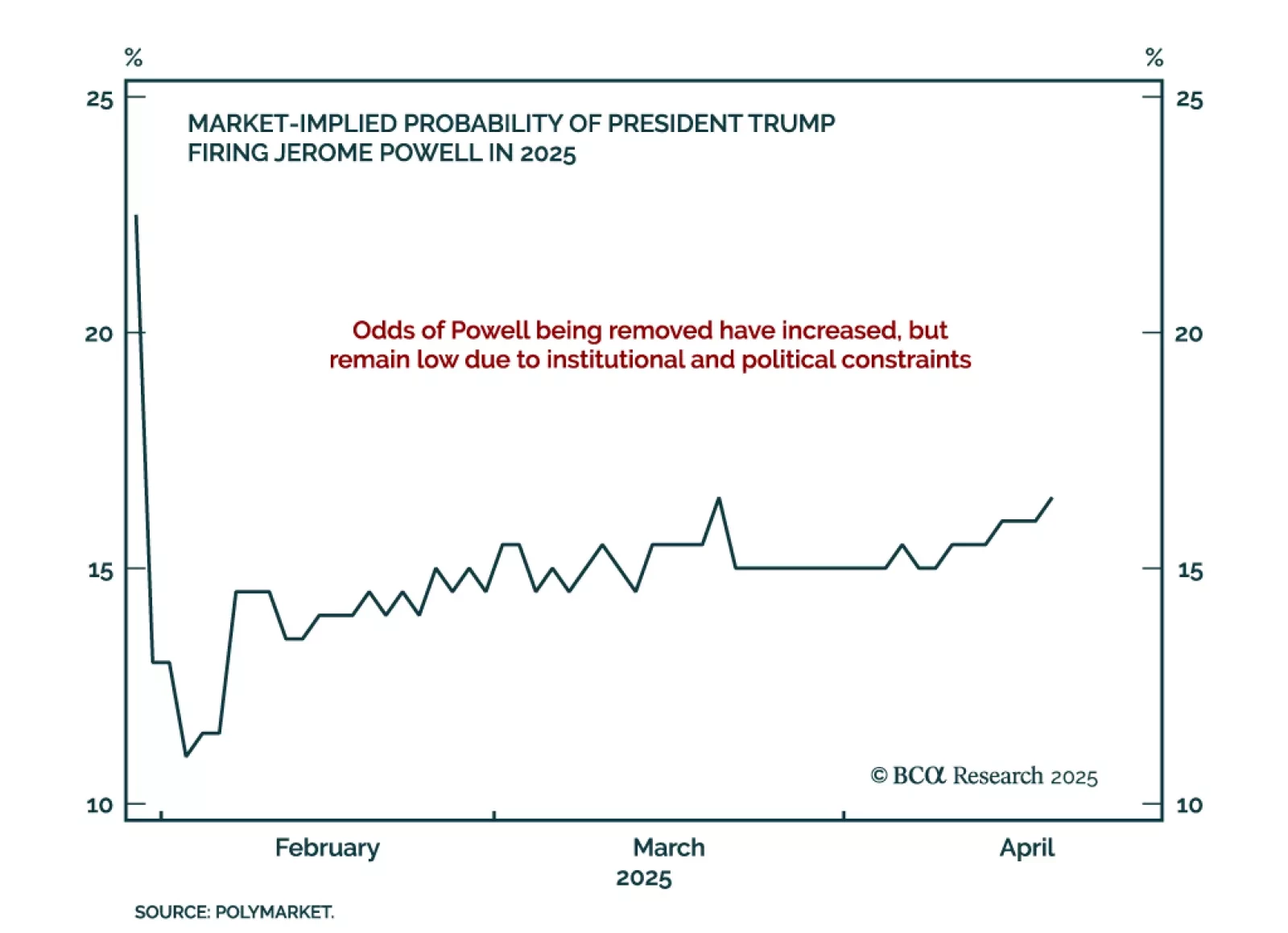

Trump’s renewed attacks on Fed Chairman Jerome Powell raise policy uncertainty but are unlikely to lead to Powell’s removal, reinforcing our expectation for continued restrictive policy and supporting our long duration stance. Trump'…

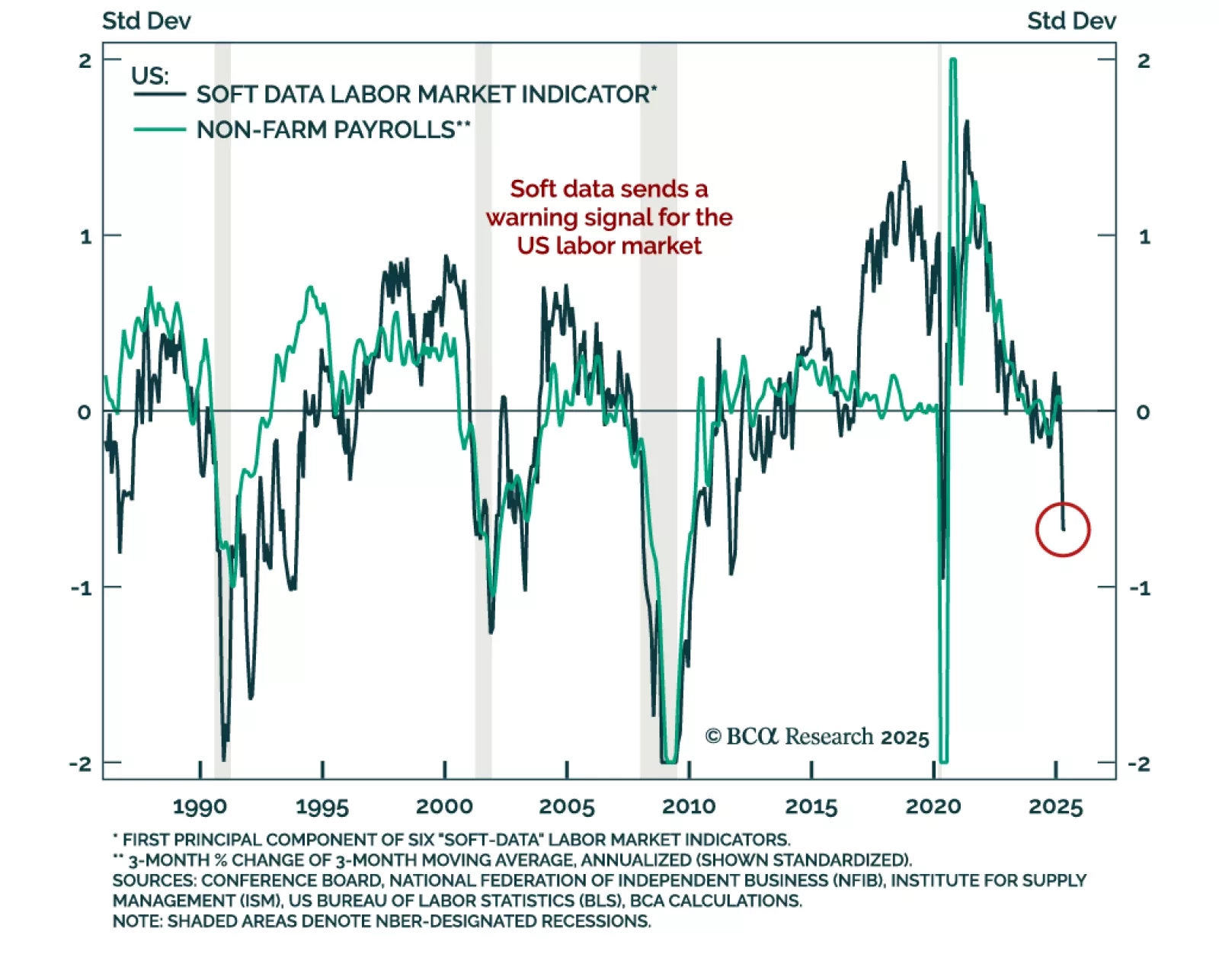

Soft data for the US labor market has turned sharply lower, reinforcing the case for a defensive asset allocation. Our Chart Of The Week comes from Miroslav Aradski from our Global Investment Strategy team. While it may take months…

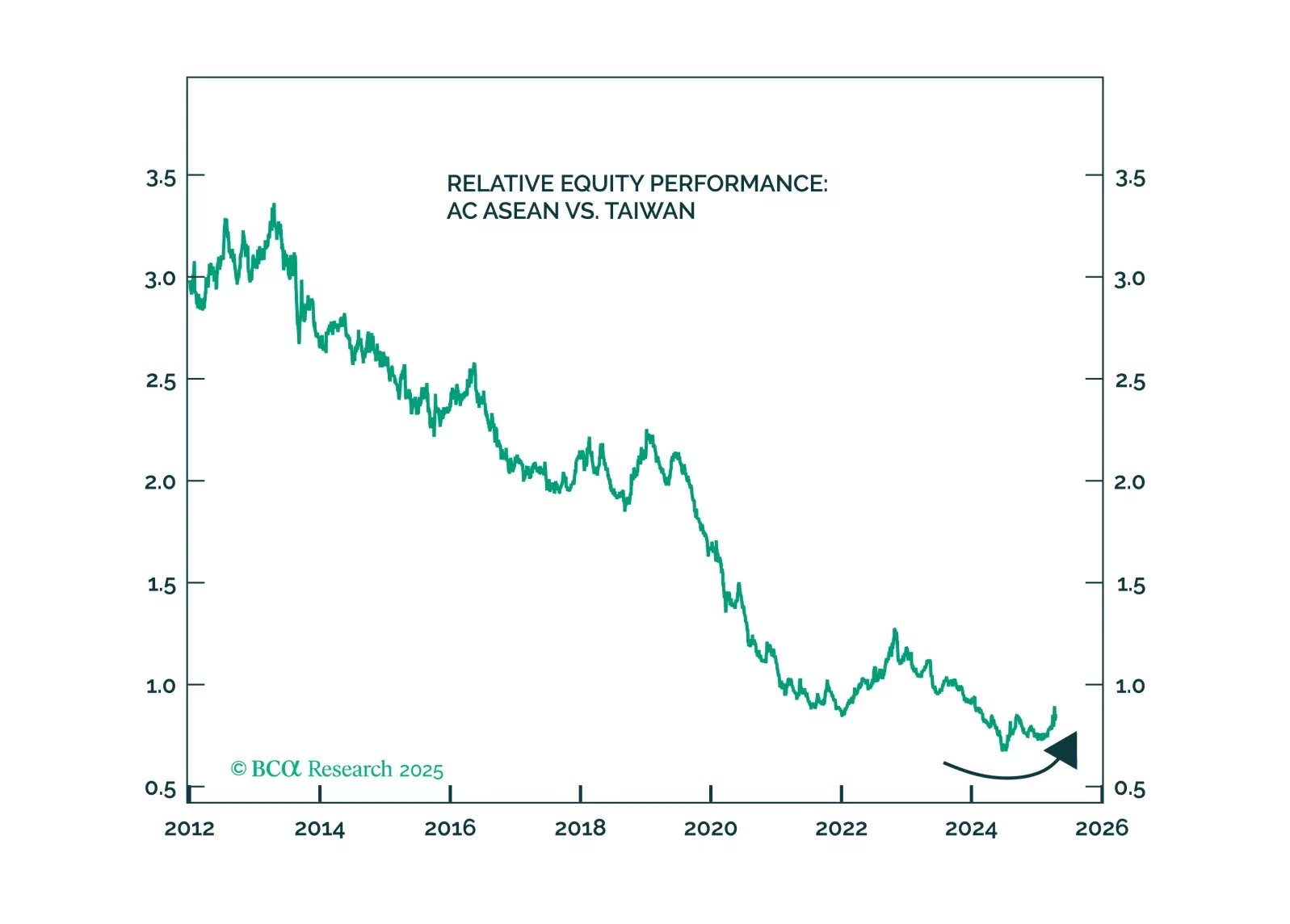

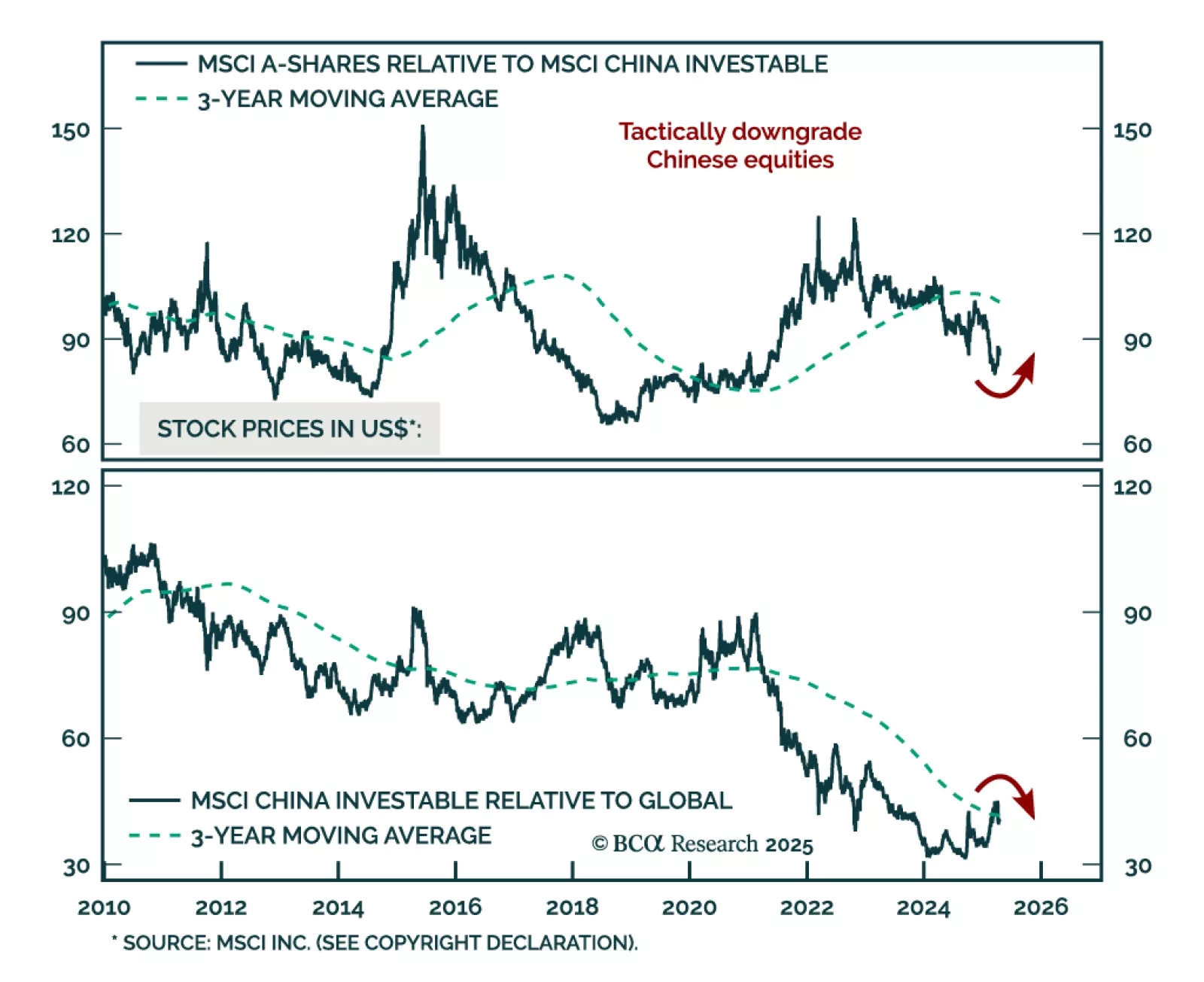

Our China strategists remain defensive and tactically downgrade MSCI China to underweight, citing escalating US China tariff tensions and subdued domestic demand. Favor government bonds over equities, defensive sectors, and A-Shares…

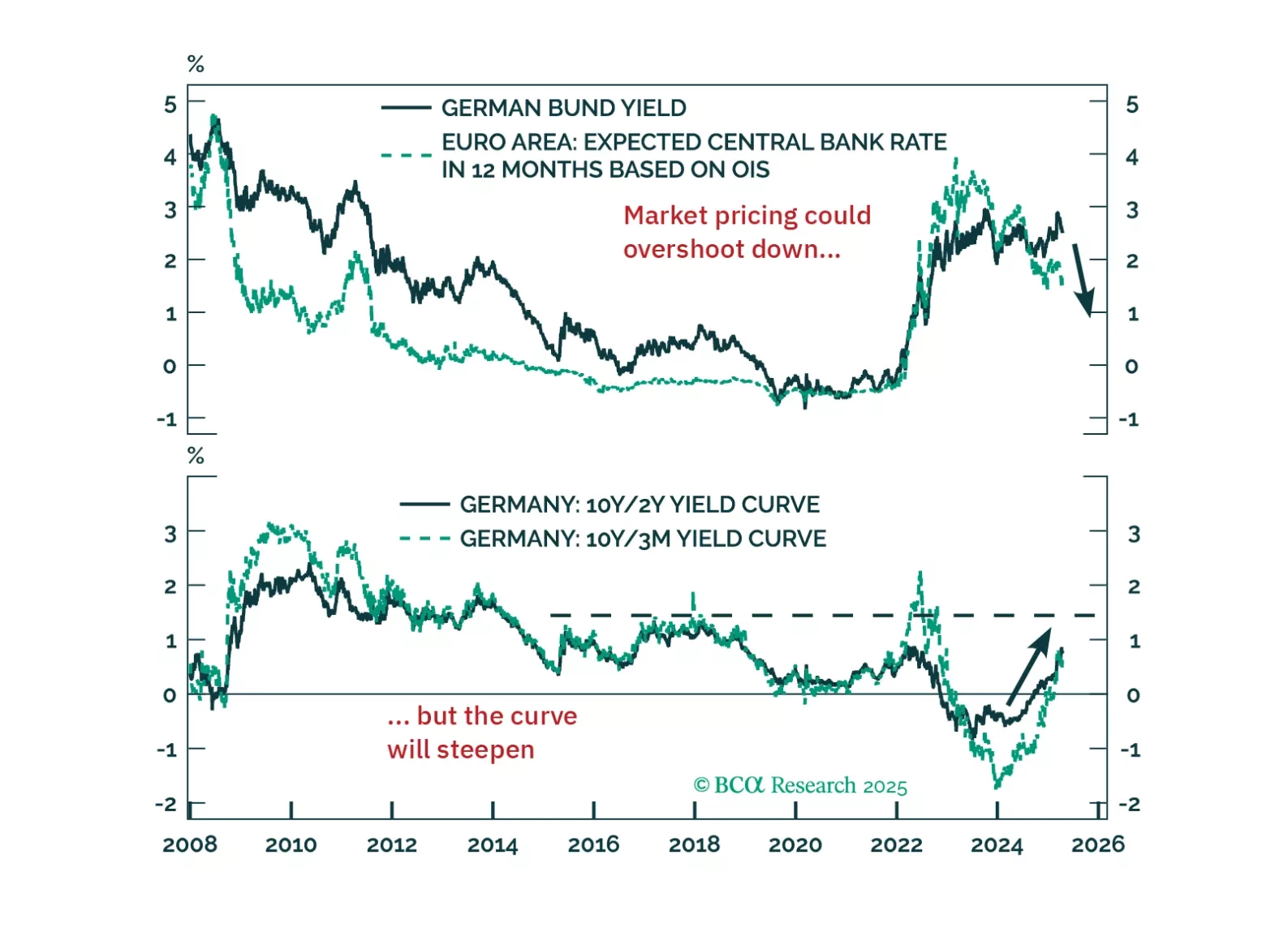

The ECB’s latest 25 bps cut and President Lagarde's notably dovish tone amid rising trade uncertainty reinforce our long December 2025 ESTR futures versus SOFR position. The deposit facility rate now stands at 2.25%, and Lagarde…

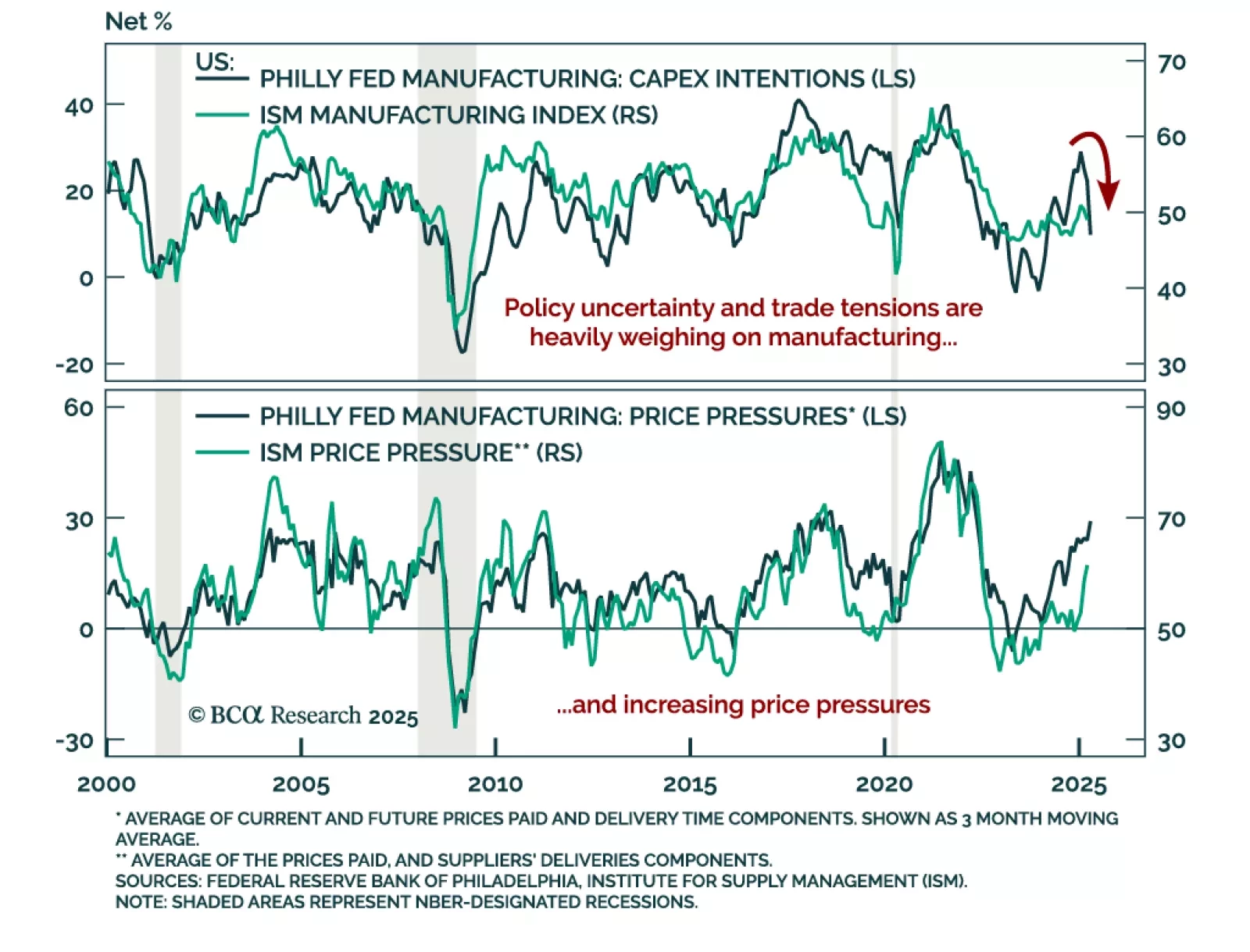

April’s Philadelphia Fed survey adds to recent stagflationary signals, reinforcing our defensive commodities positioning. The headline index collapsed to -26.4 from 12.5 in March, missing expectations and confirming the April…

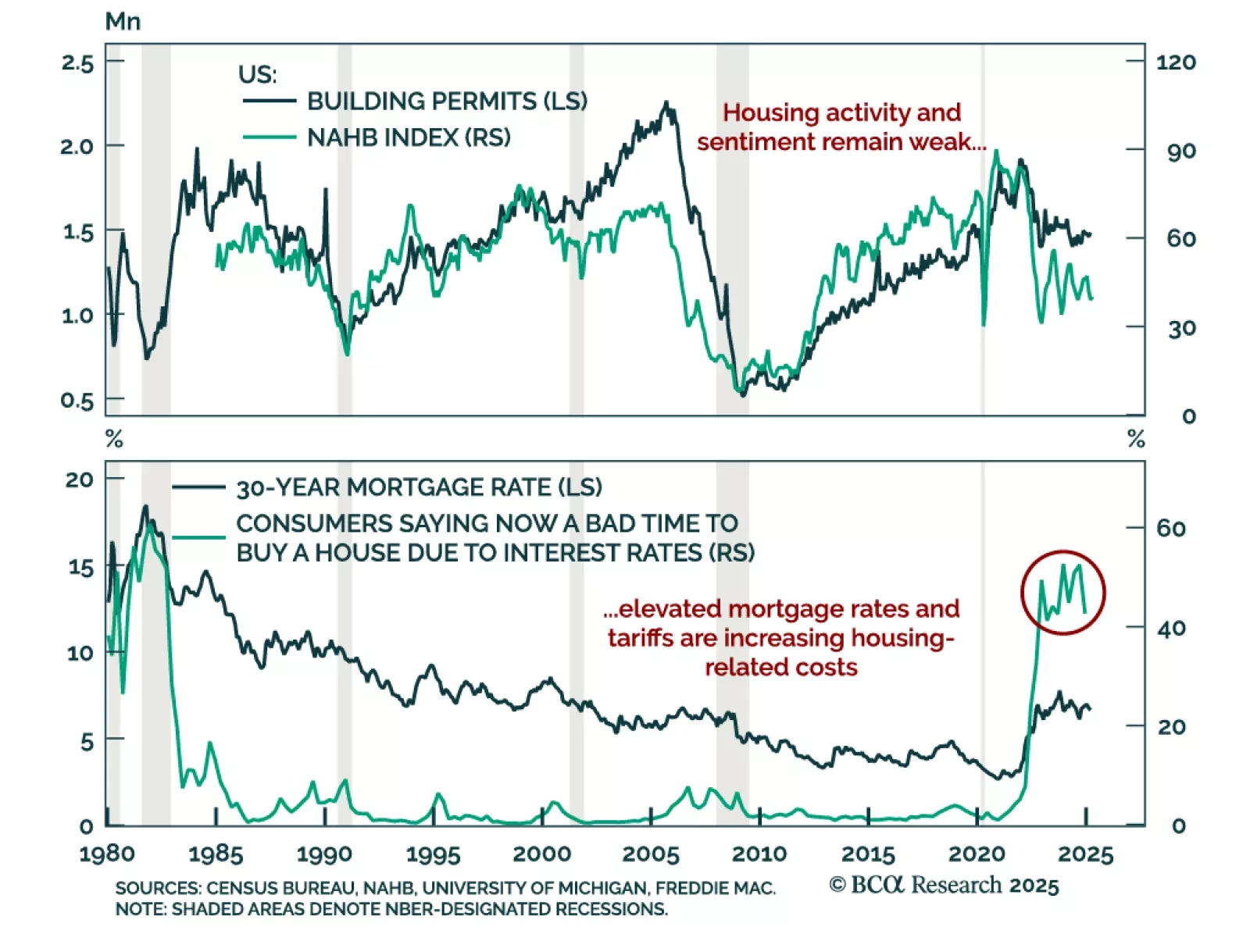

Weak housing data reinforces our defensive positioning, as recession odds remain underpriced in risk assets. US housing starts fell sharply, declining a larger-than-expected annualized rate of 11.4% in March after a 9.8% rebound in…

Europe’s deflation problem is getting harder to ignore. This week’s ECB cut is just the beginning — tariffs, the euro’s rally, and softening demand all point to more easing ahead. We explain what it means for yields, equities, and…

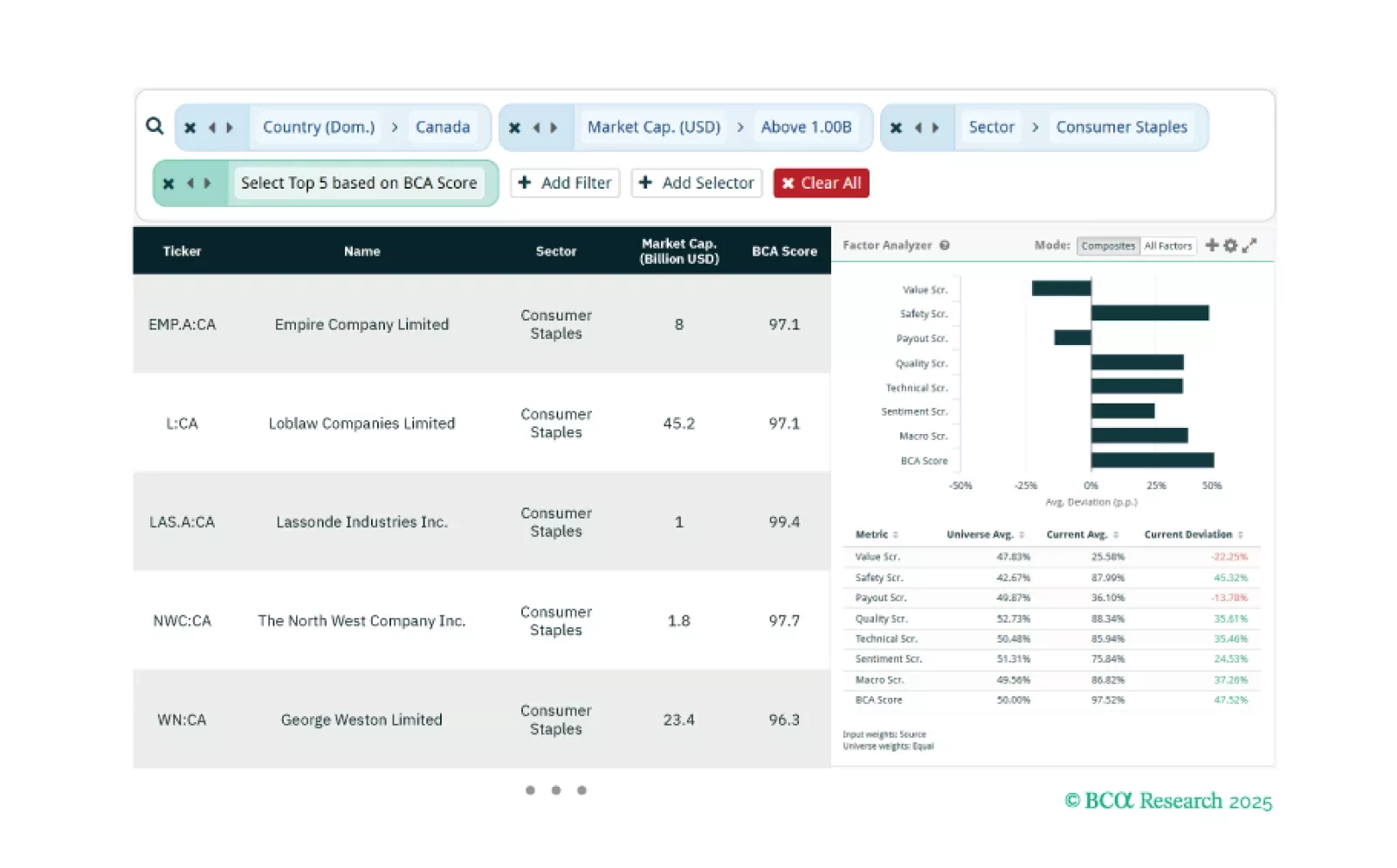

This week, our three screeners cover equity plays in: Canadian Consumer Staples, high-beta Swedish equities, and factor plays across global equities.

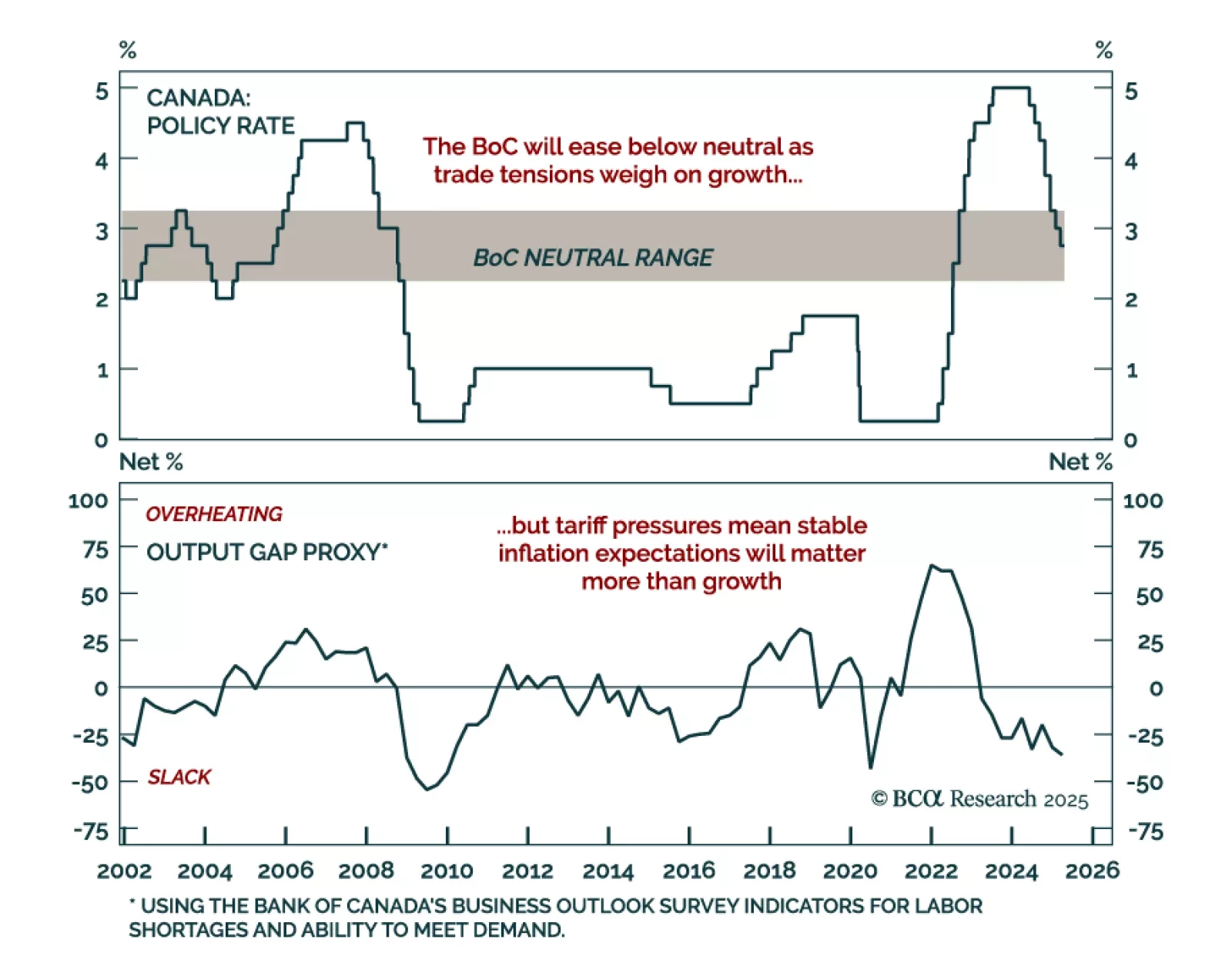

After seven consecutive cuts brought policy into neutral territory, the BoC held its deposit rate at 2.75% reinforcing our neutral-to-negative stance on Canadian government bonds. With policy now within the 2.25%-3.25% neutral range…