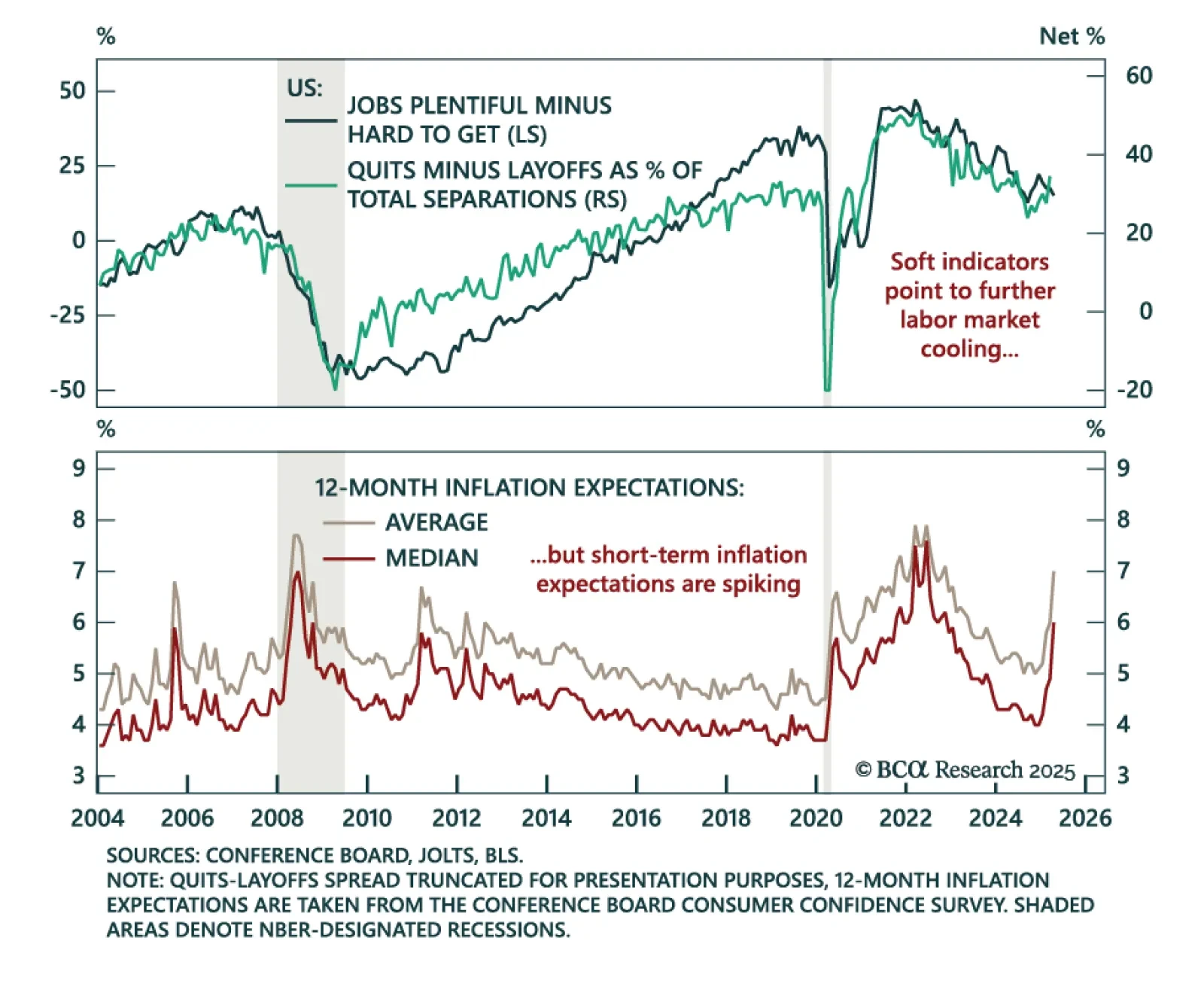

The April Conference Board survey adds to signs of labor market softening, reinforcing our defensive asset allocation. The Consumer Confidence index fell for the fifth consecutive month to 86.0 from 92.9. Expectations plunged to…

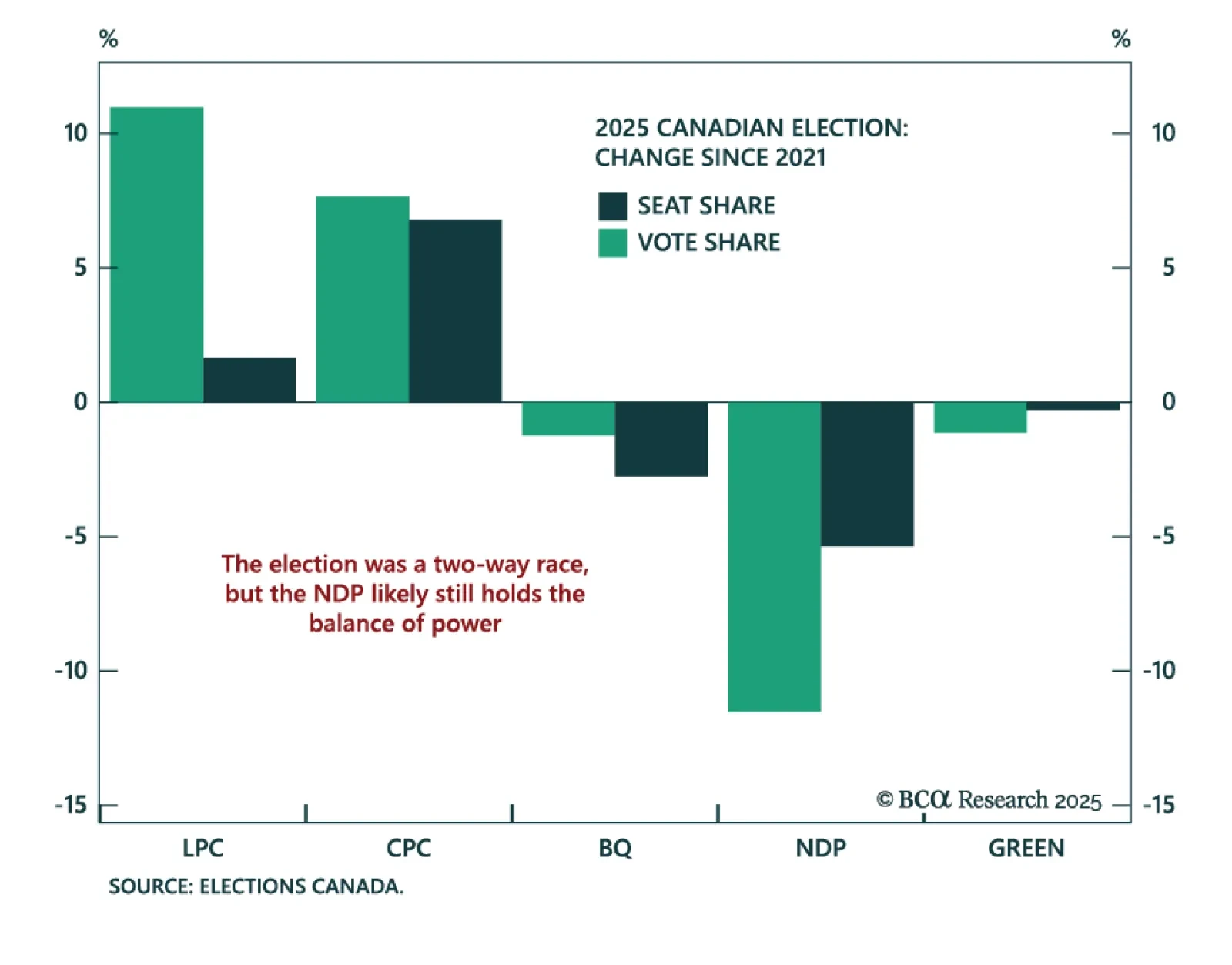

Canada’s election outcome and macro backdrop support our neutral stance on CGBs and long CAD/USD structural positioning. Mark Carney’s Liberals retained power in Monday’s federal election and are likely to form a minority government…

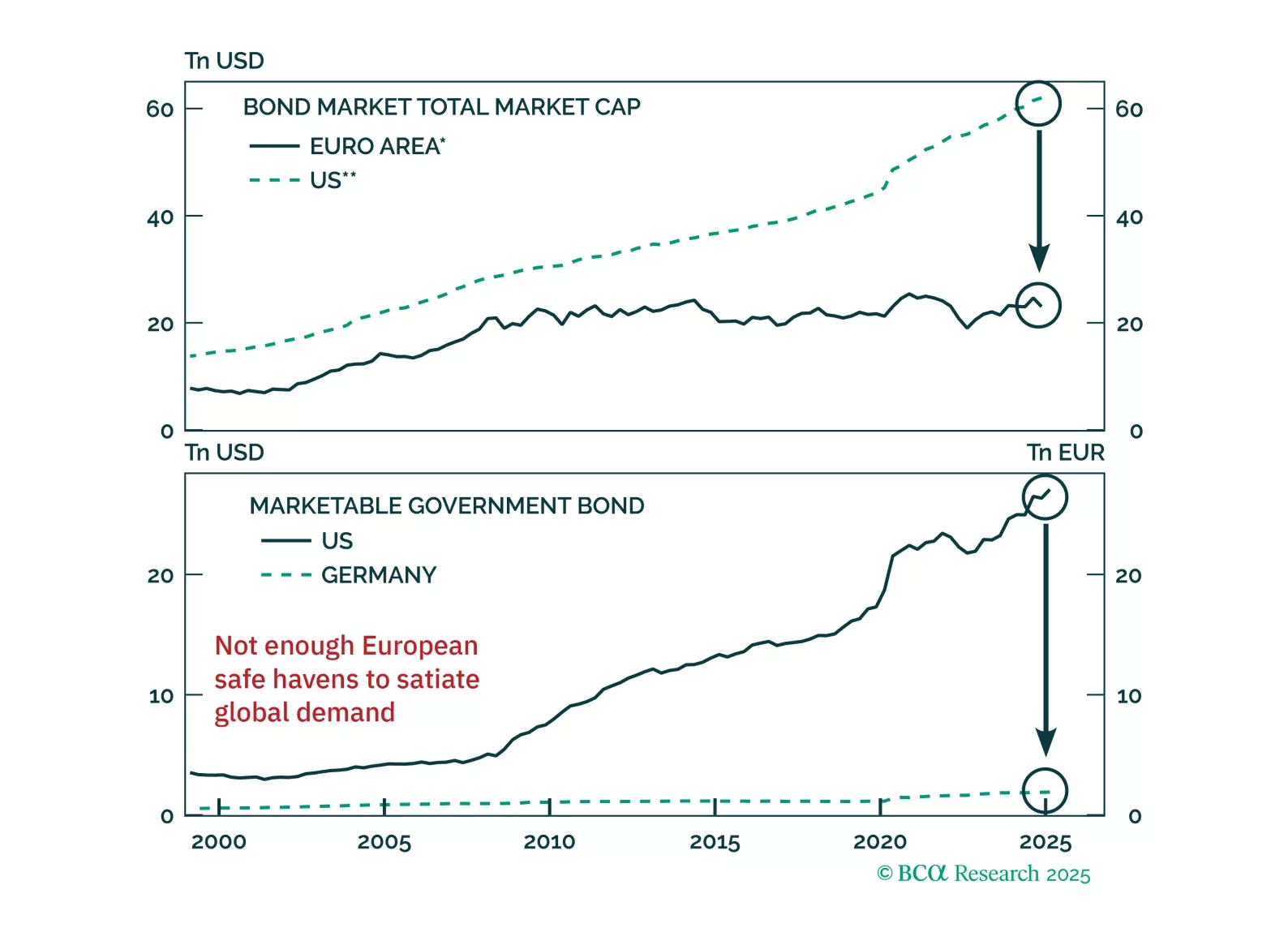

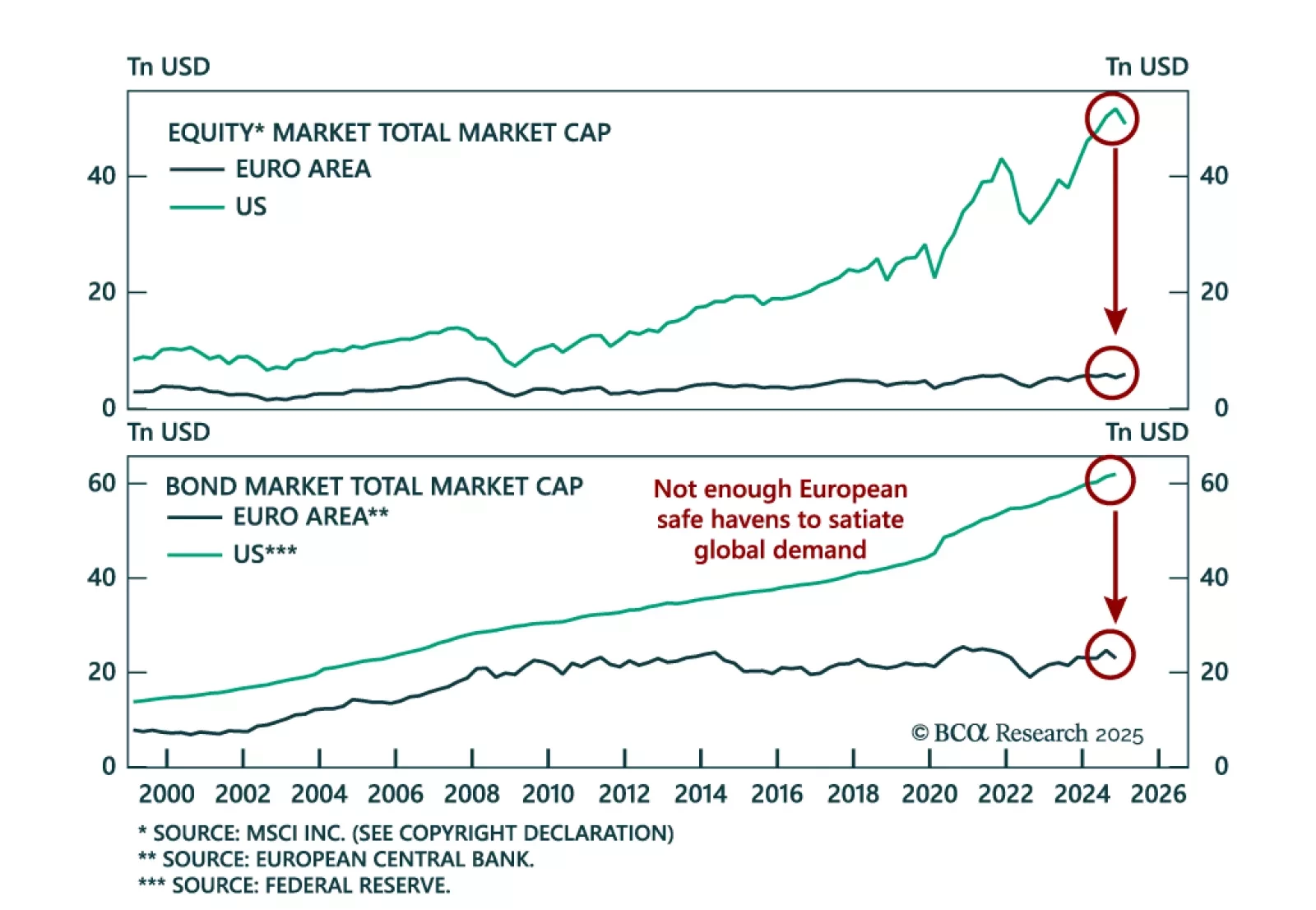

Our European Investment strategists maintain a defensive stance. Favor bunds as an emerging safe-haven complement to US Treasurys and a value tilt in equities. While the dollar and US fixed income remain the global anchor, EUR/USD…

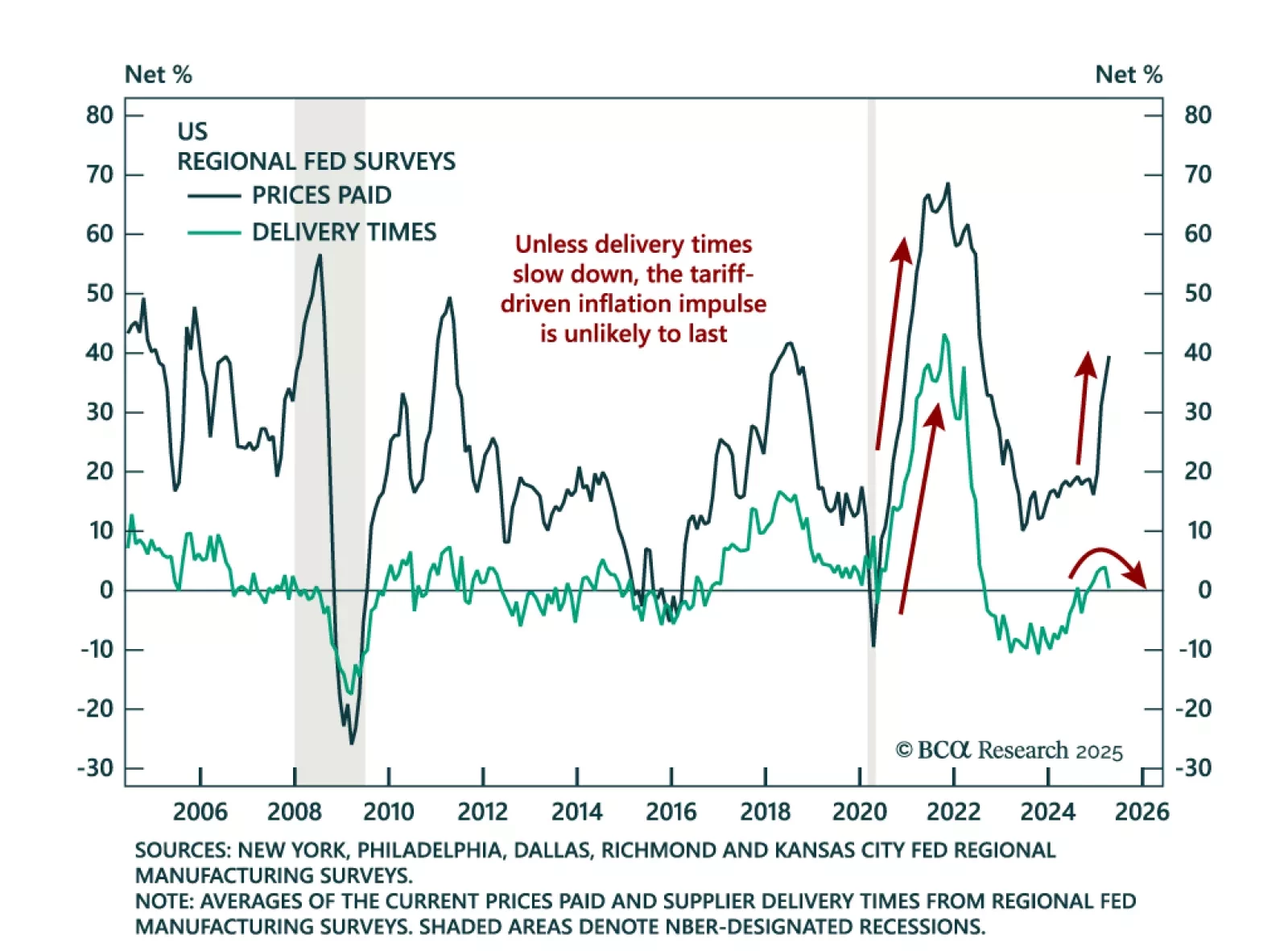

The April Dallas Fed Manufacturing survey adds to recent stagflationary signals, reinforcing our preference for gold over industrial commodities. The index plunged to -35.8 from -16.3 in March, with activity measures deteriorating…

The collapse in soft data points to rising recession risks, but markets are still only priced for a mild slowdown, reinforcing our defensive positioning. As policy uncertainty and market volatility surged, consumers and businesses…

Are bunds the new Treasurys? The euro and German debt are gaining favor as safe havens, but markets may be overplaying the shift. Our latest report dissects what's durable, what's not, and how to trade the dislocation.

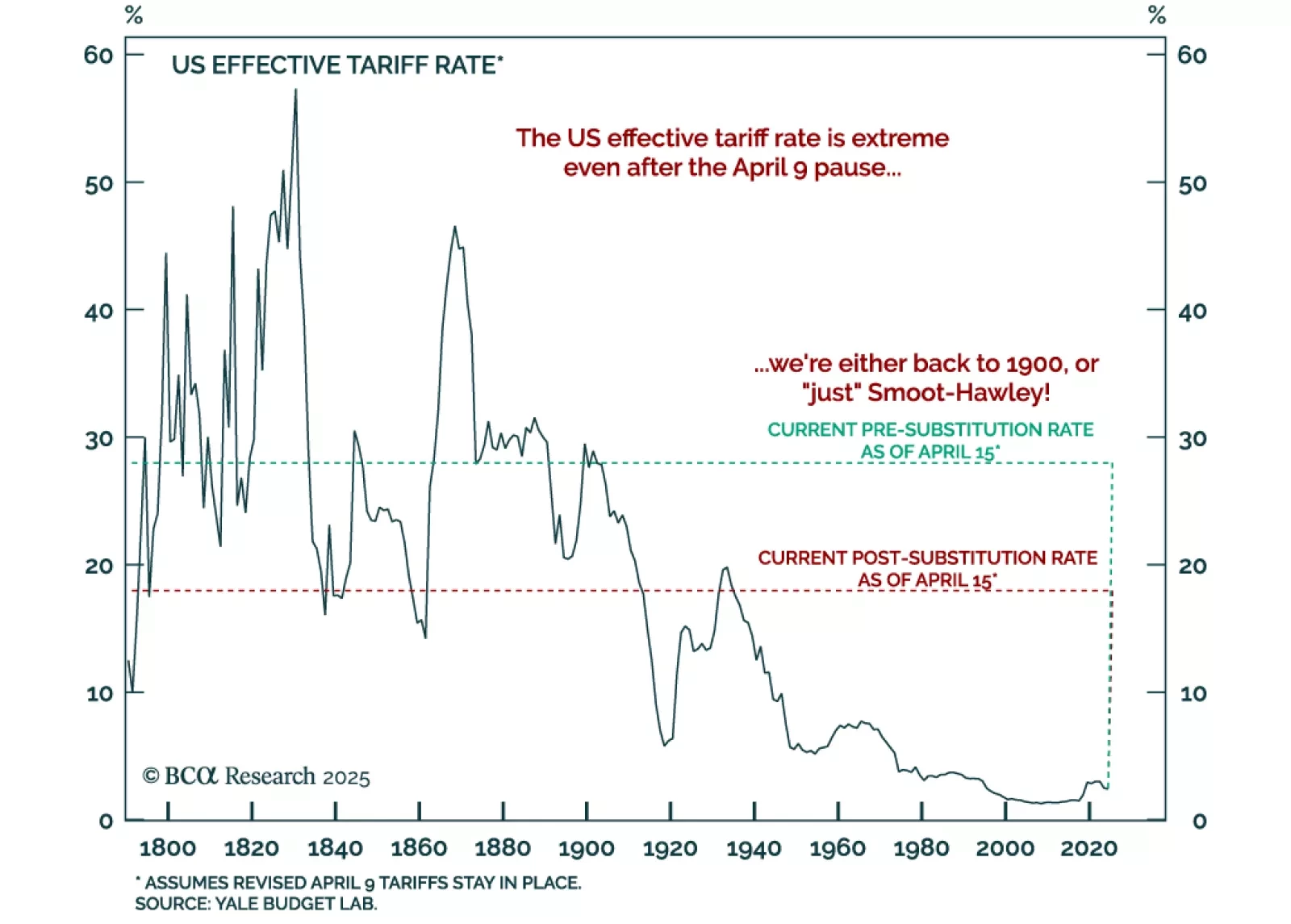

BCA’s House View recommends staying underweight stocks versus bonds, even in a stagflationary scenario. The US and global economies are likely to enter a recession this year unless tariffs are swiftly reversed or meaningful fiscal…

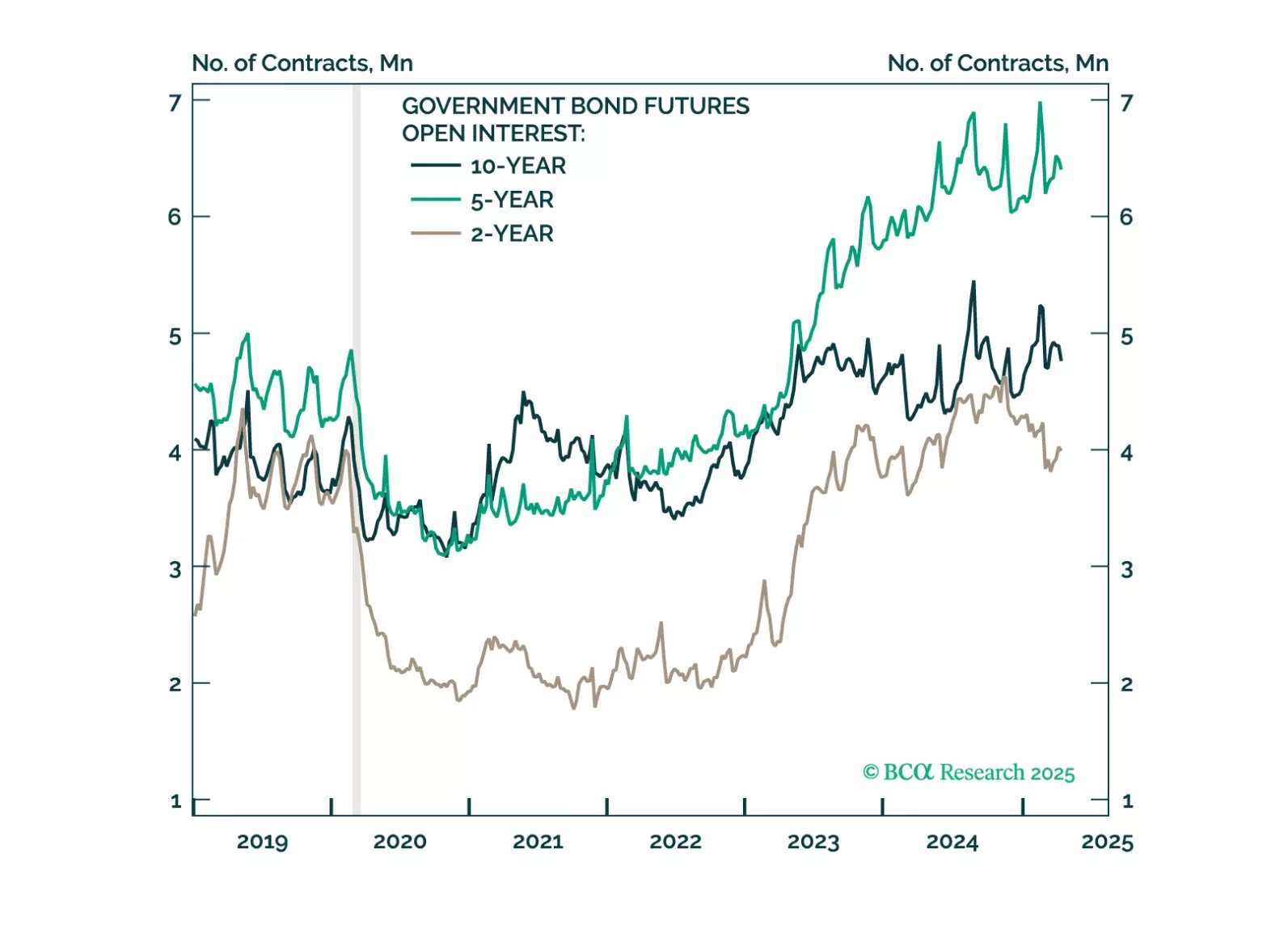

US Treasuries typically outperform both equities and global government bonds during downturns. Recent political shifts could lessen that outperformance this cycle, but we doubt it will disappear completely.