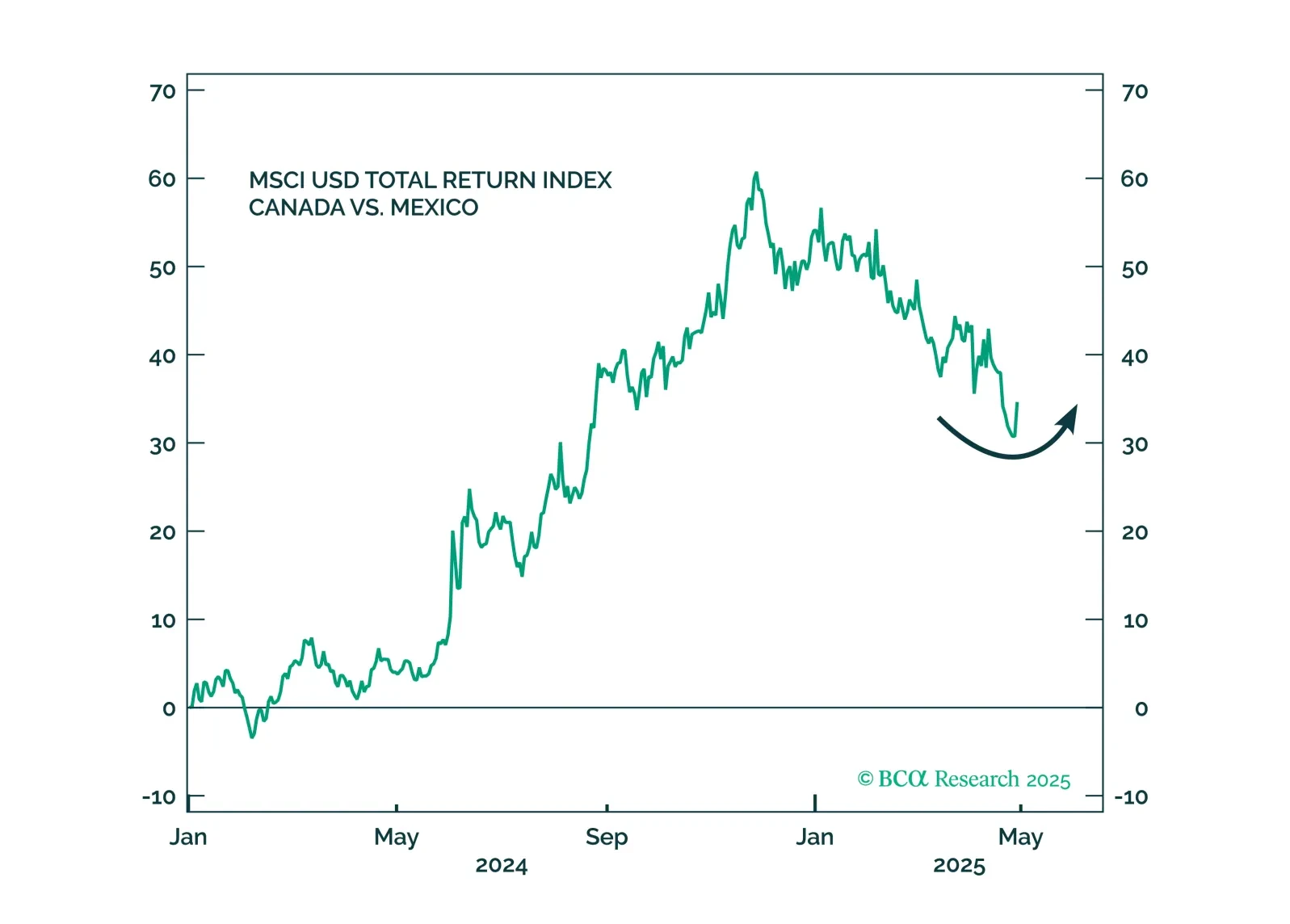

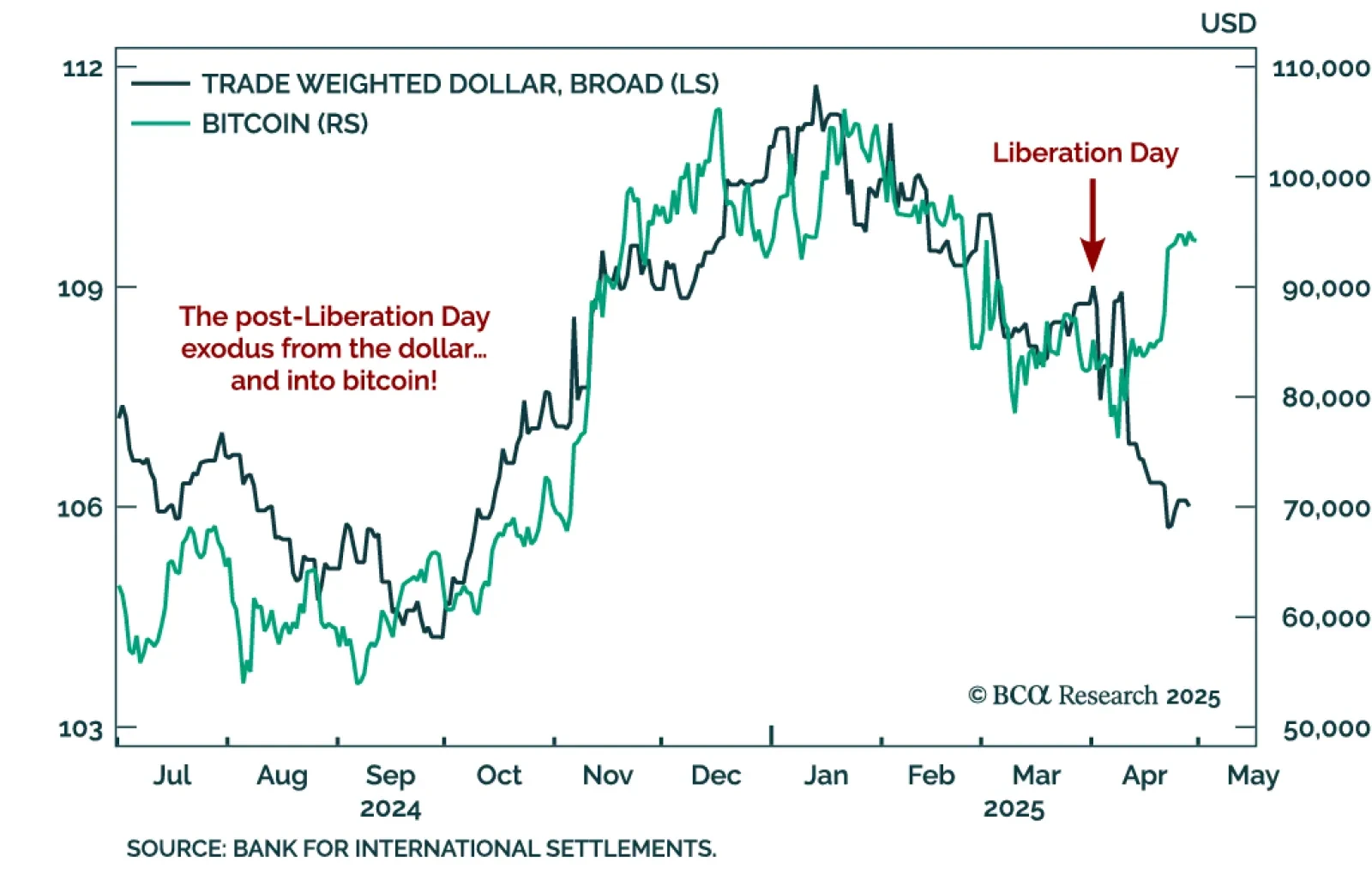

Our Counterpoint strategists overweigh Europe versus the US across both equities and bonds, and are structurally long bitcoin. Trump’s tariffs are deflationary for the world and inflationary for the US, prompting a sharp shift in…

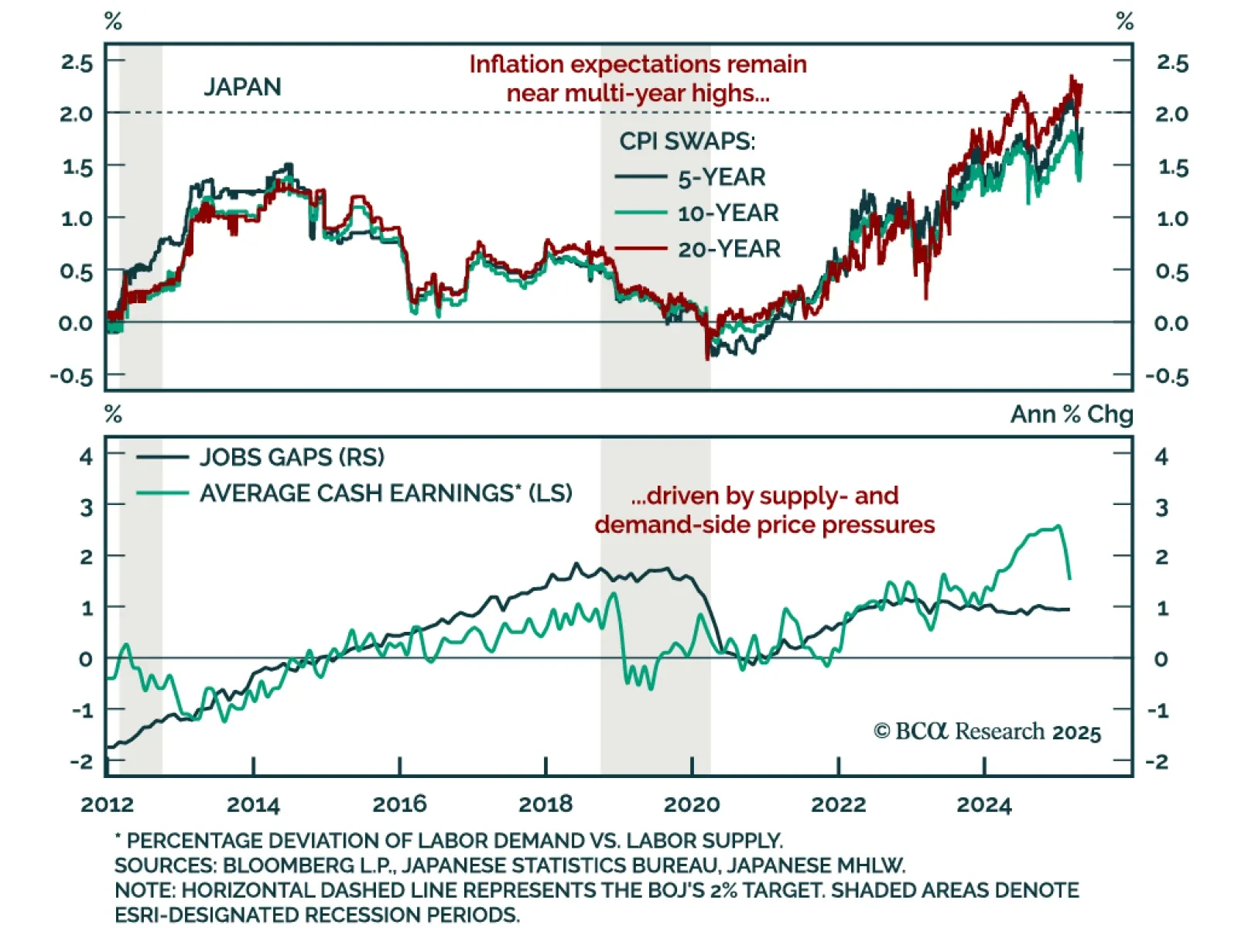

The Bank of Japan’s dovish hold does not contradict BCA’s underweight JGBs and long JPY recommendations. The BoJ left its policy rate unchanged at 0.5% for a second meeting, but slashed its GDP and inflation forecasts for 2025 and…

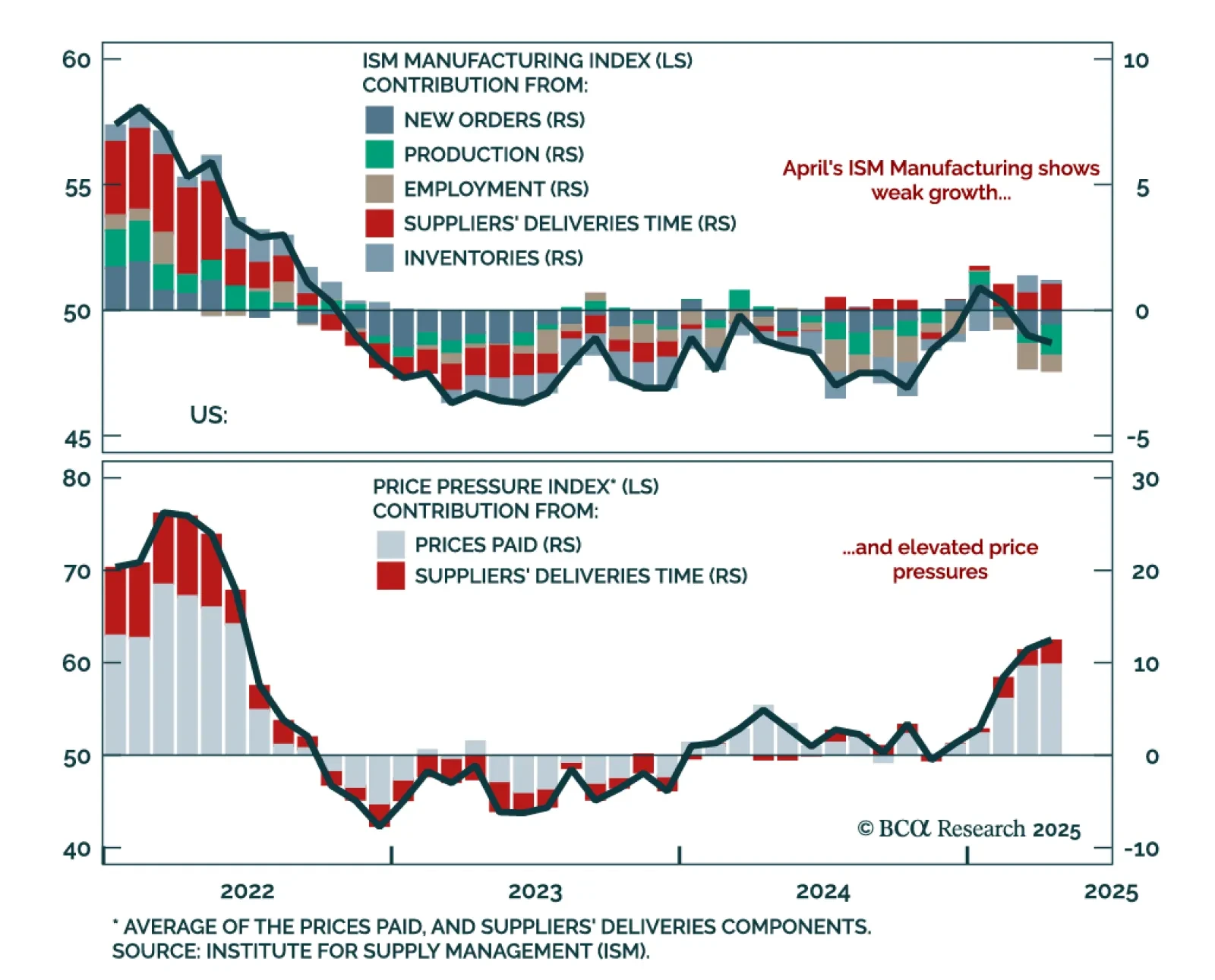

The April ISM Manufacturing adds to recession risks: Collapsing export orders and weak domestic momentum reinforce our defensive positioning. The index slipped to 48.7 from 49.0, with new orders still contracting and new export…

This year’s corporate bond sell off has hit high-yield more than investment grade, and high-yield spreads have turned relatively more attractive as a result.

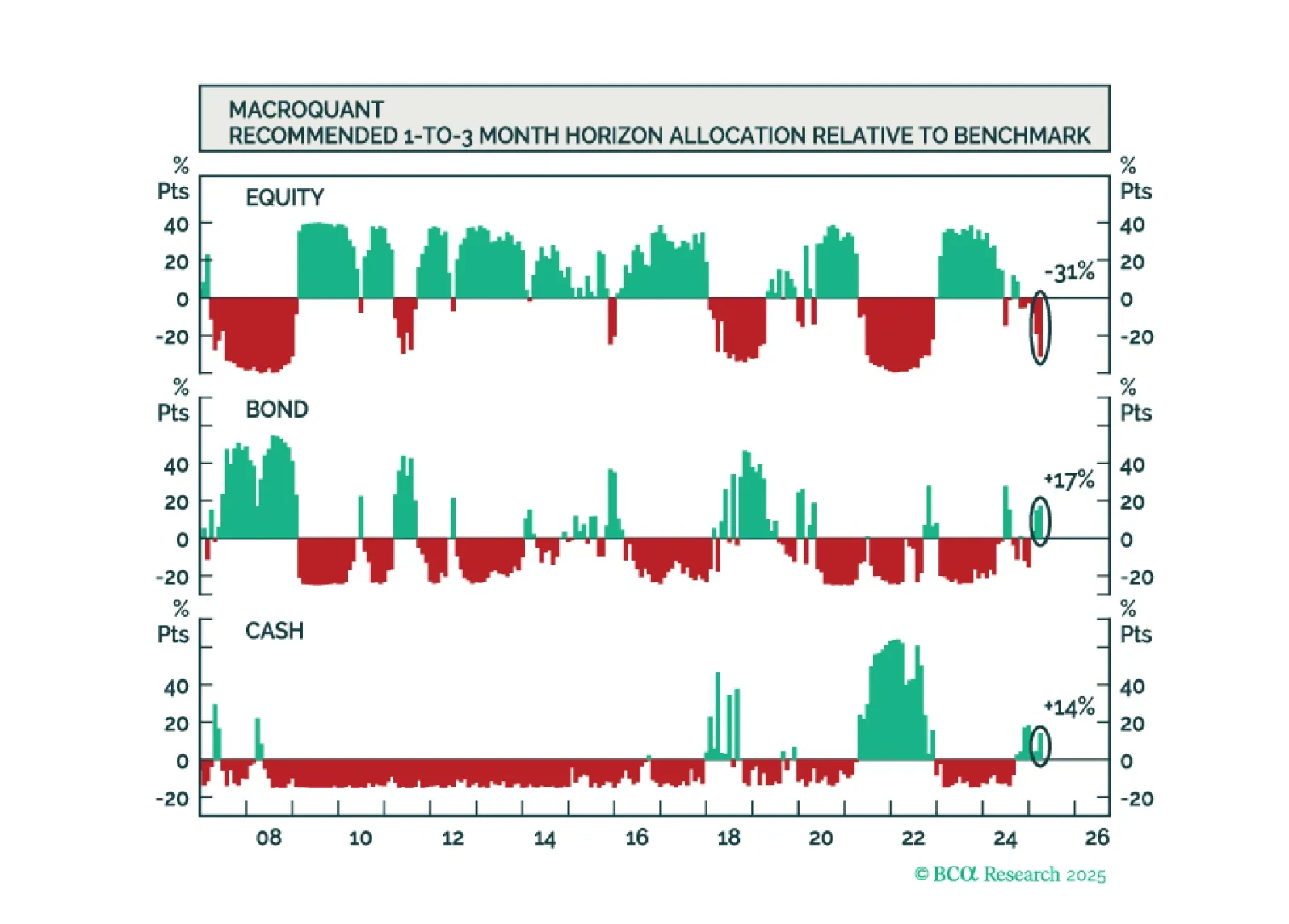

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

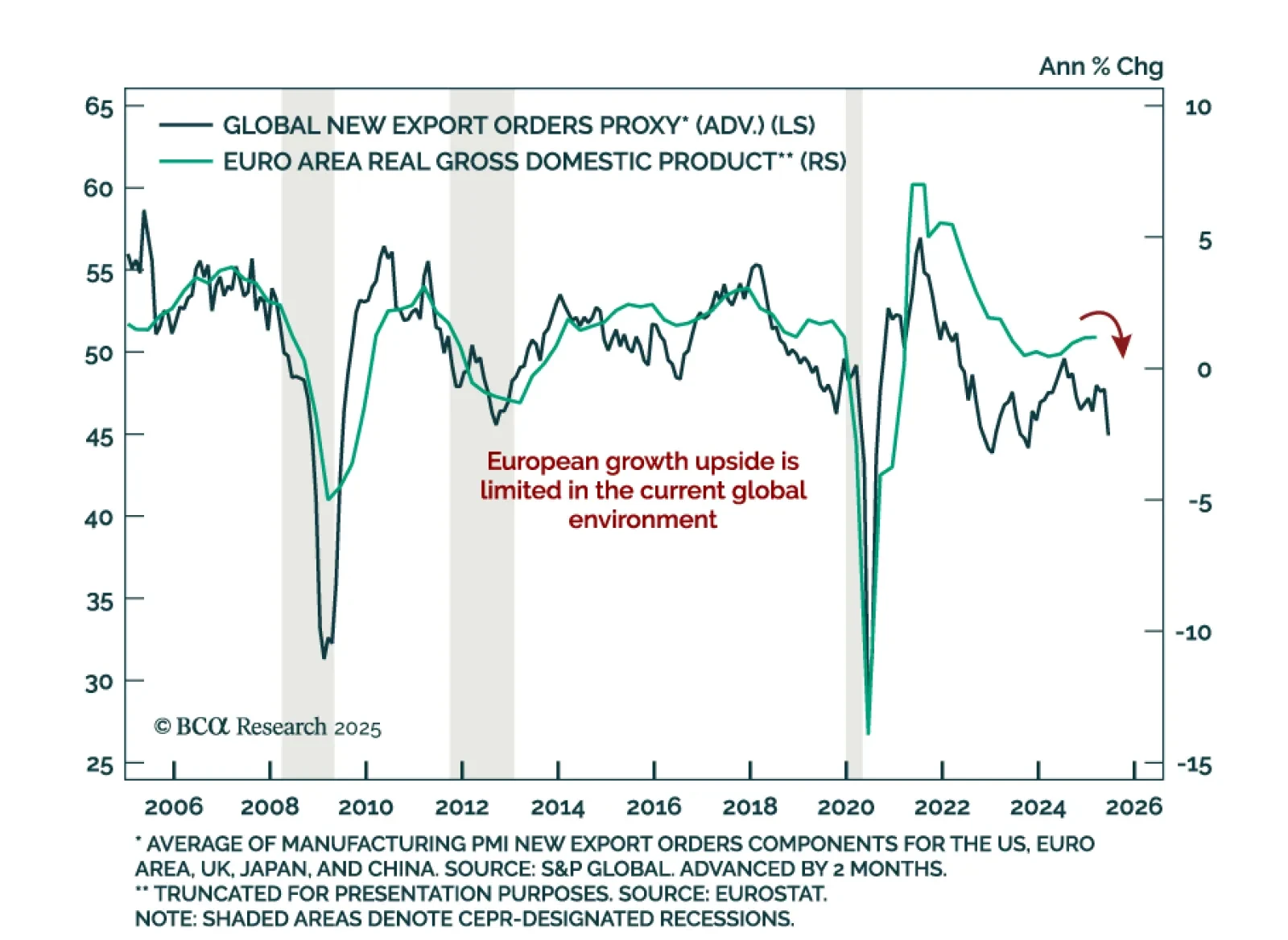

Eurozone GDP beats expectations, but trade distortions and weakening demand momentum support a risk-off Eurozone playbook. Flash Q1 GDP rose 0.4% q/q (1.2% y/y), up from 0.2% in Q4, driven largely by net exports. A key contributor…

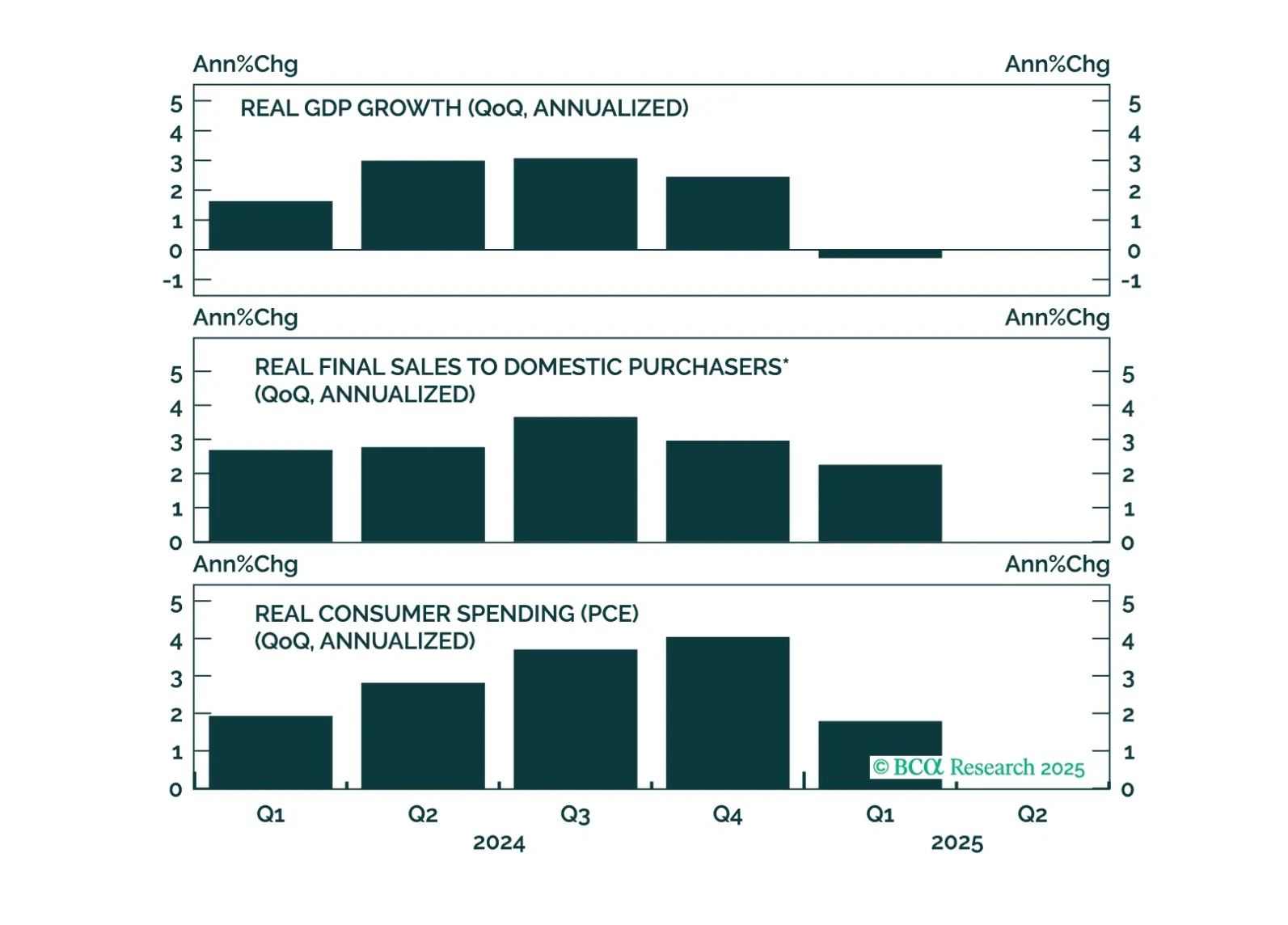

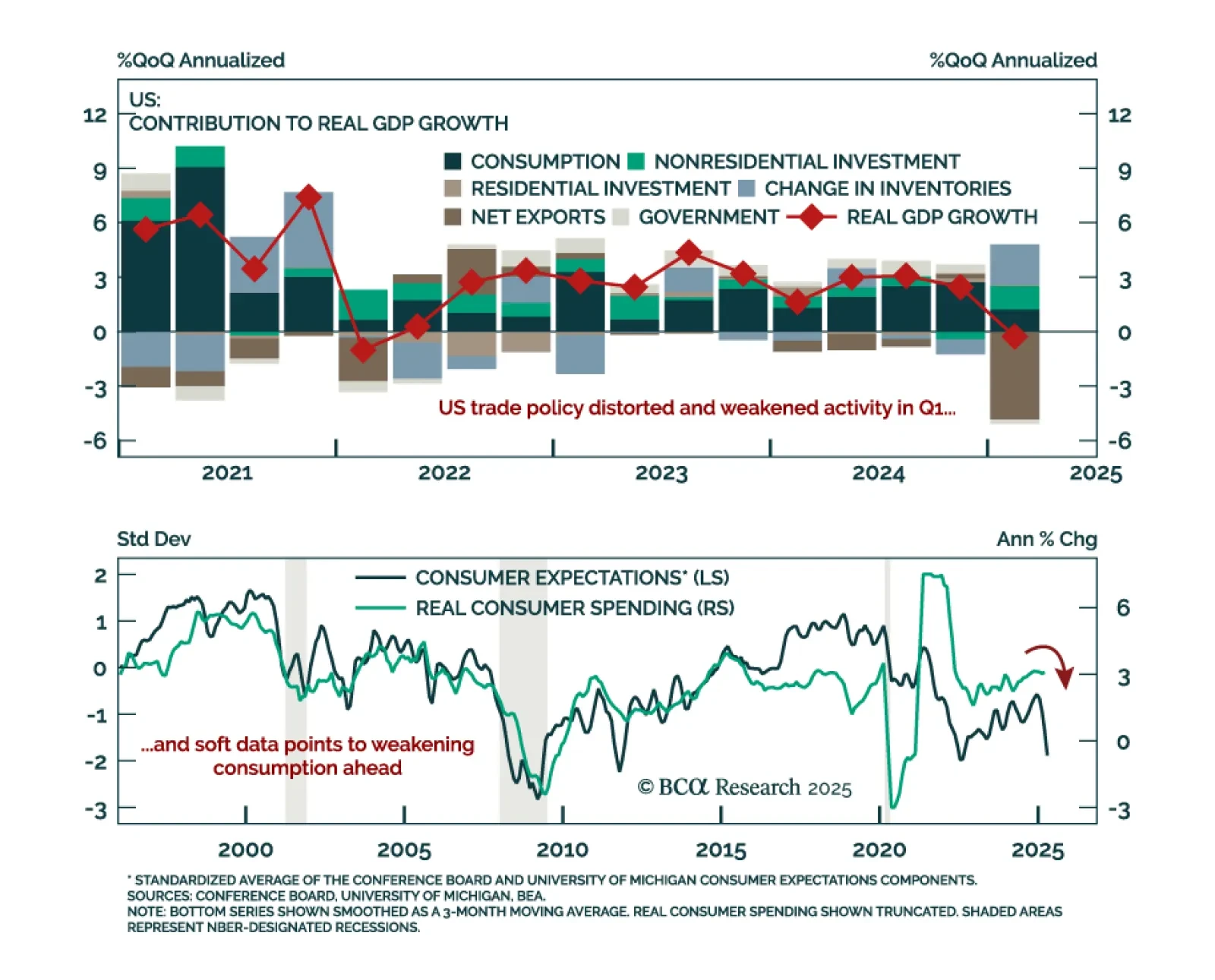

The Q1 US GDP contraction and inflation dynamics reinforce our defensive asset allocation. GDP missed estimates and contracted -0.3% annualized, led by a sharp slowdown in net exports. Consumption slid to 1.8% from 4.0%, reflecting…

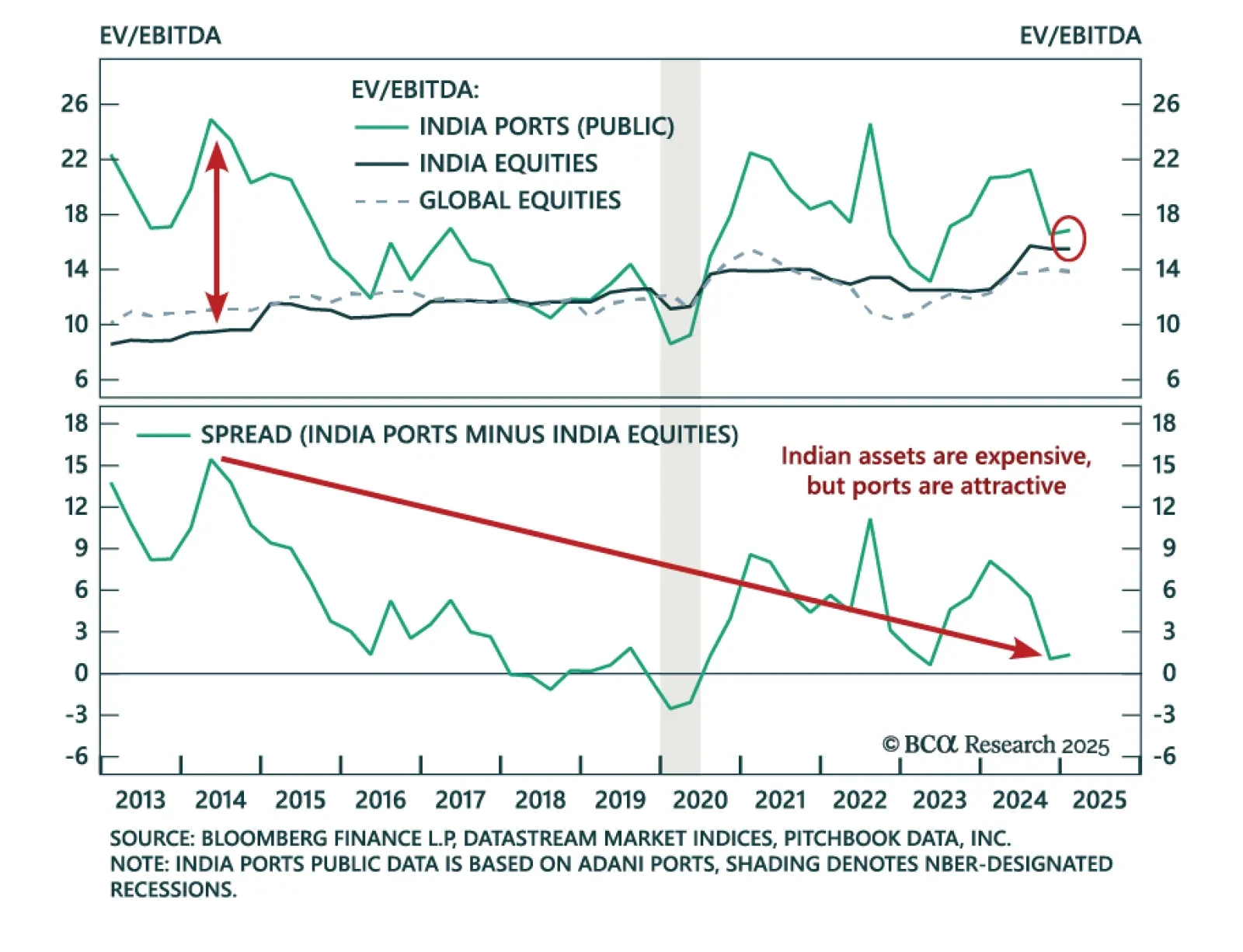

Our Private Markets & Alternatives strategists recommend shifting exposure within Port Infrastructure to India as re-globalization reshapes trade flows. The US will remain a trade leader, but tensions with China and the…