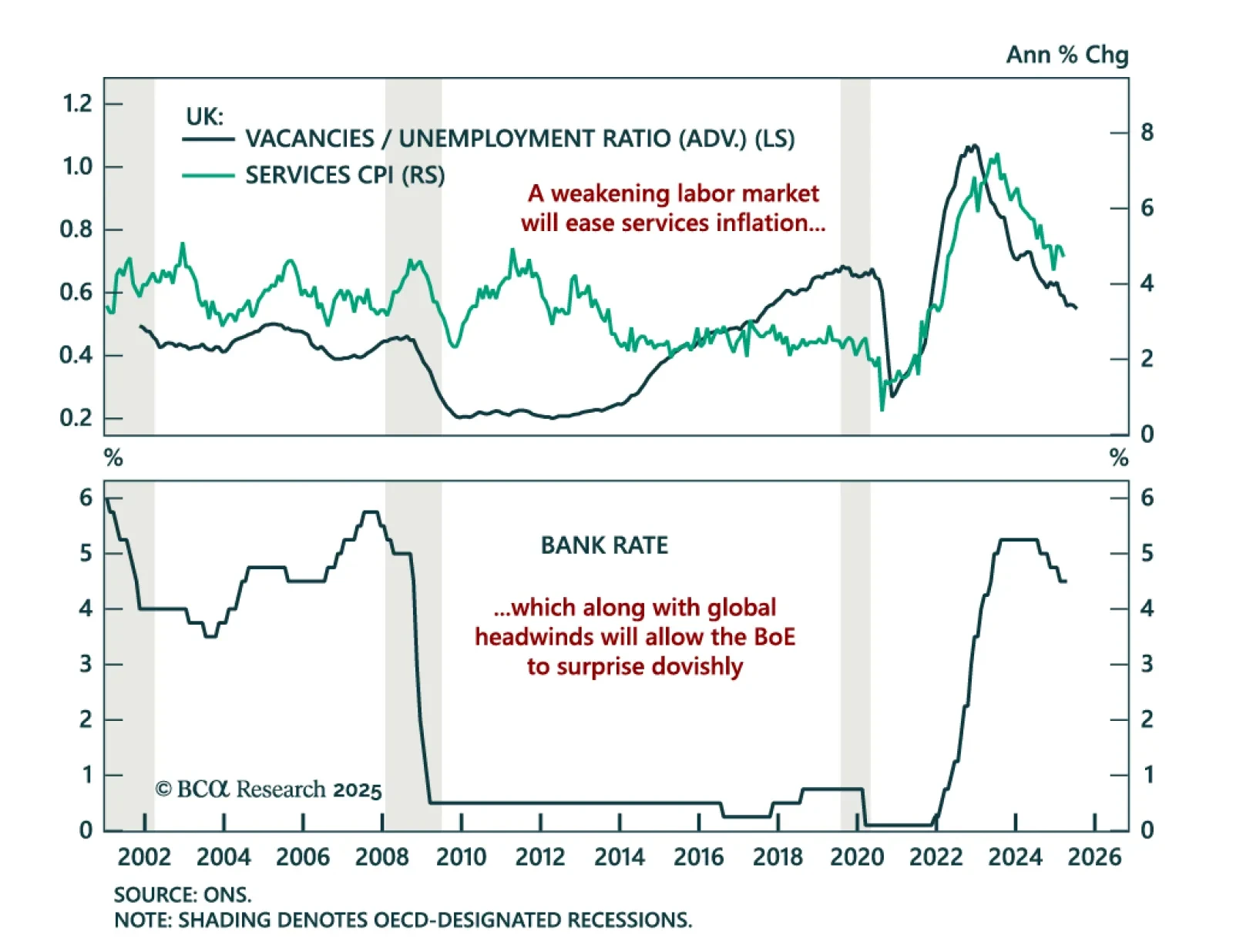

The Bank of England’s hawkish cut reinforces our Gilts overweight and tactical short GBP view as global headwinds persist. The BoE lowered rates by 25 bps to 4.25% as expected, but the MPC vote was more split than expected. Five…

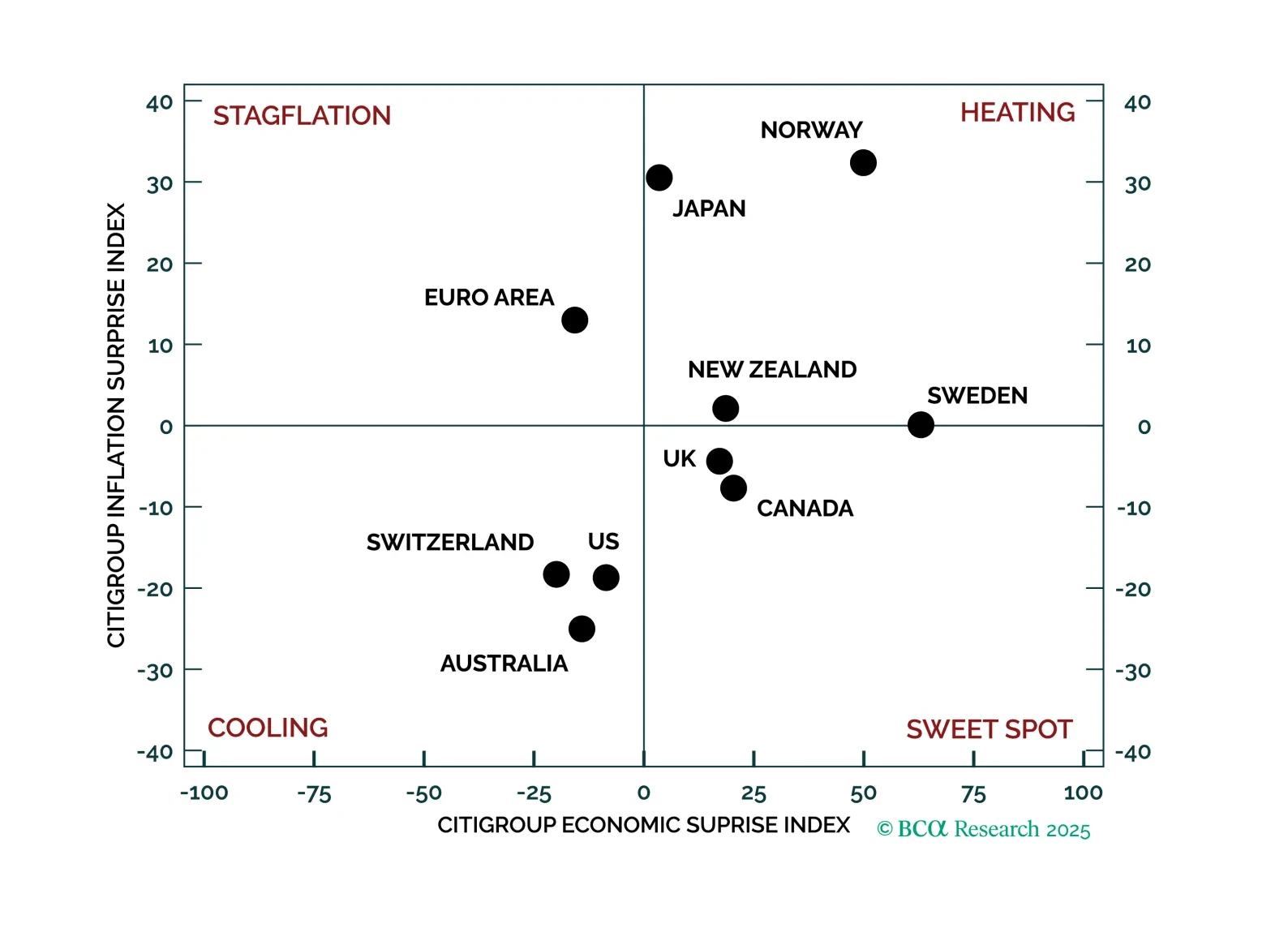

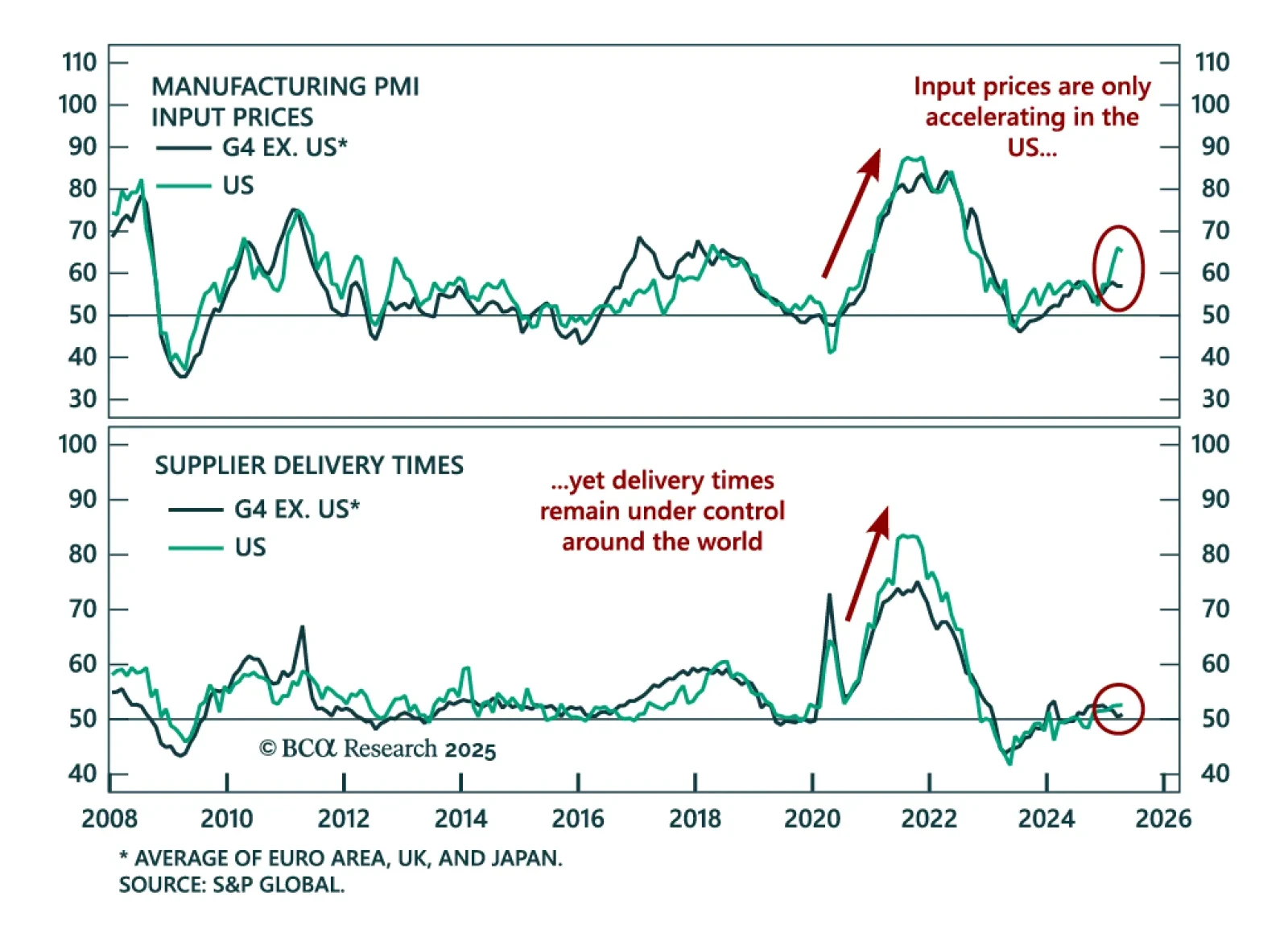

The inflation divergence between the US and Eurozone drives our call to stay long US duration. Inflation, typically a lagging indicator, blends slow-moving labor pressures with fast-moving supply drivers. The COVID inflation spike…

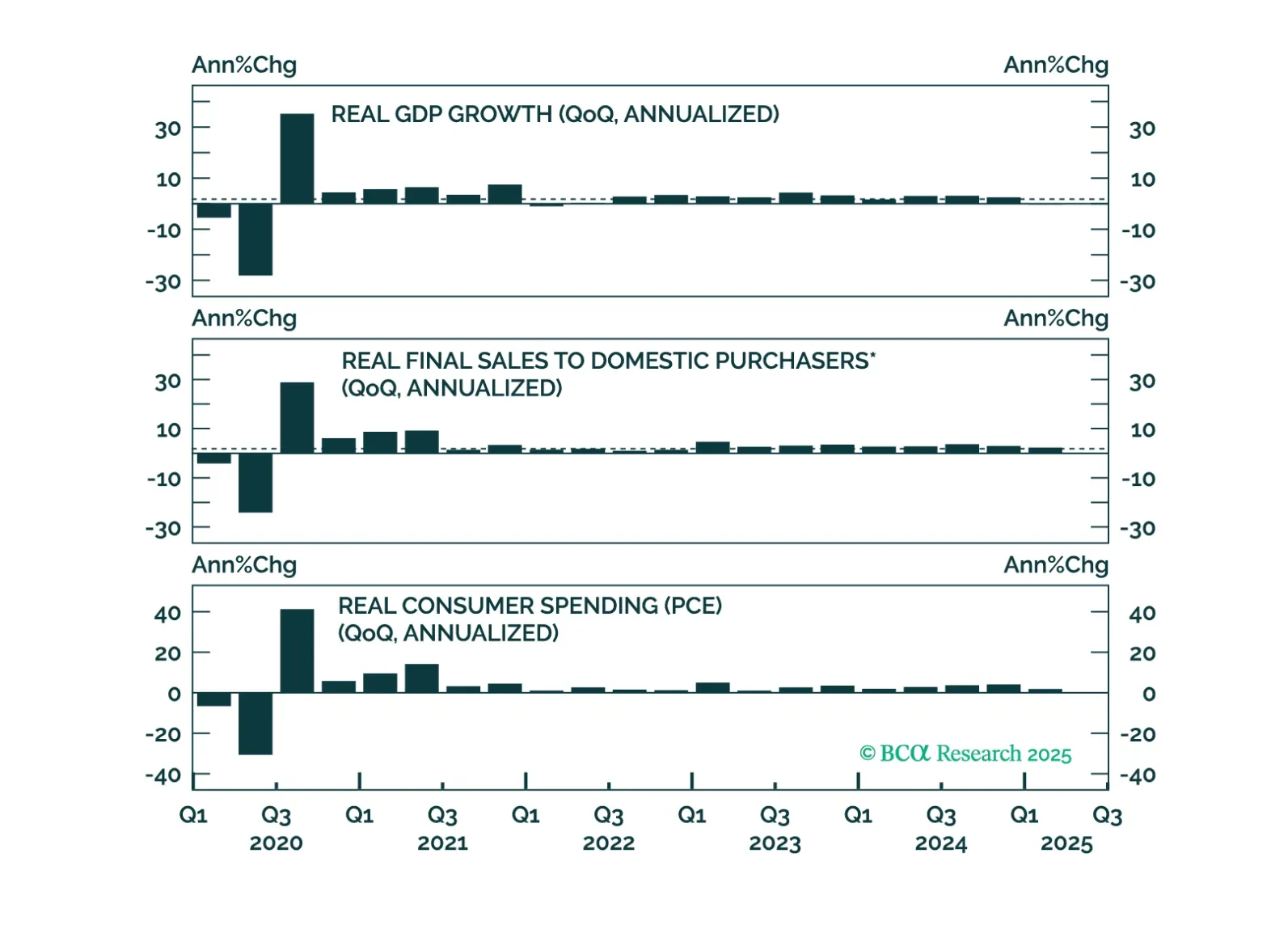

The Fed held rates steady this afternoon, and the timing of its next move will be dictated by whether the tariff shock to inflation is transitory or more long lasting.

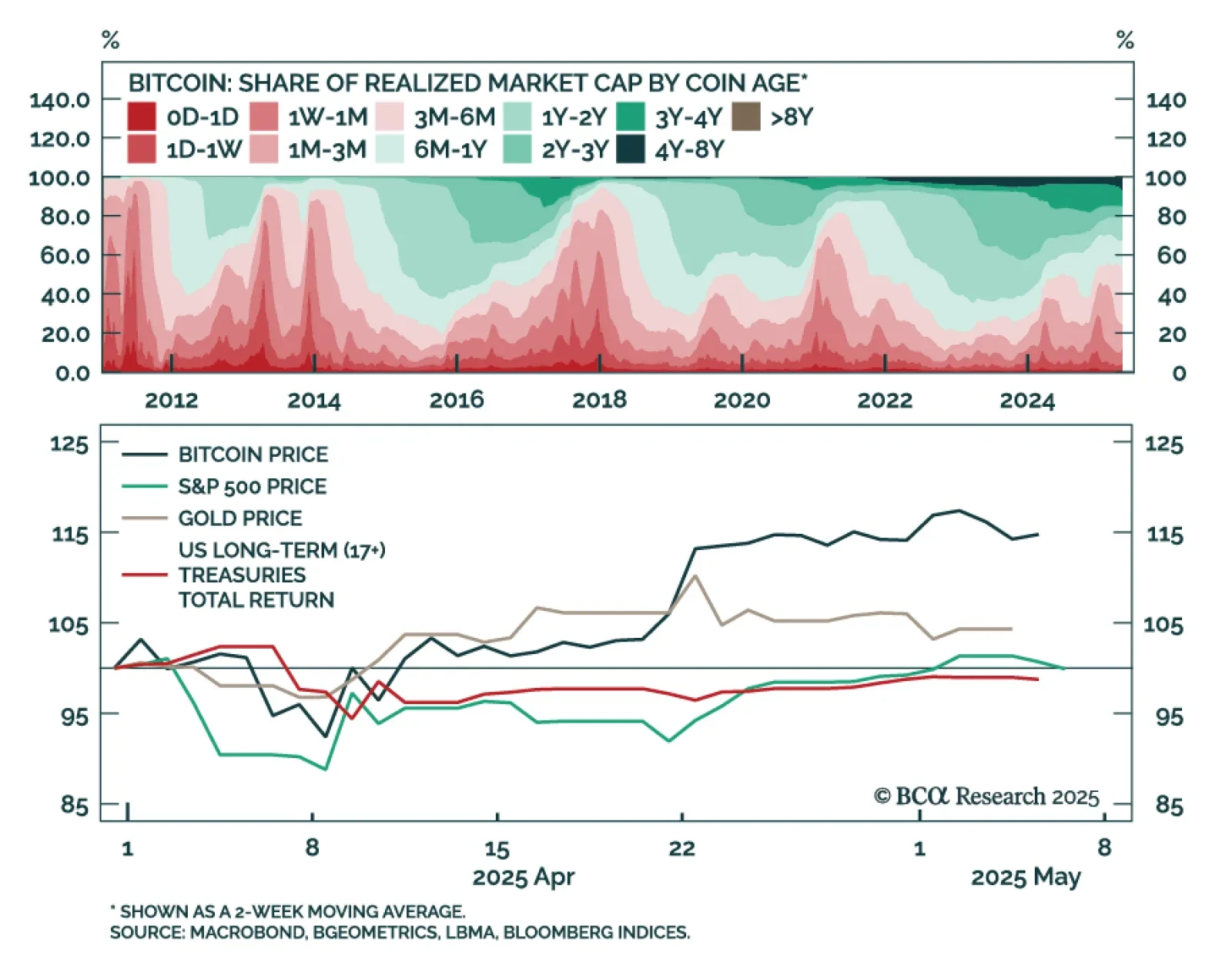

Our Global Asset Allocation strategists recommend staying defensively positioned. They remain underweight equities and the US specifically, while maintaining an overweight in fixed income yet downgrading duration to neutral.…

Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…

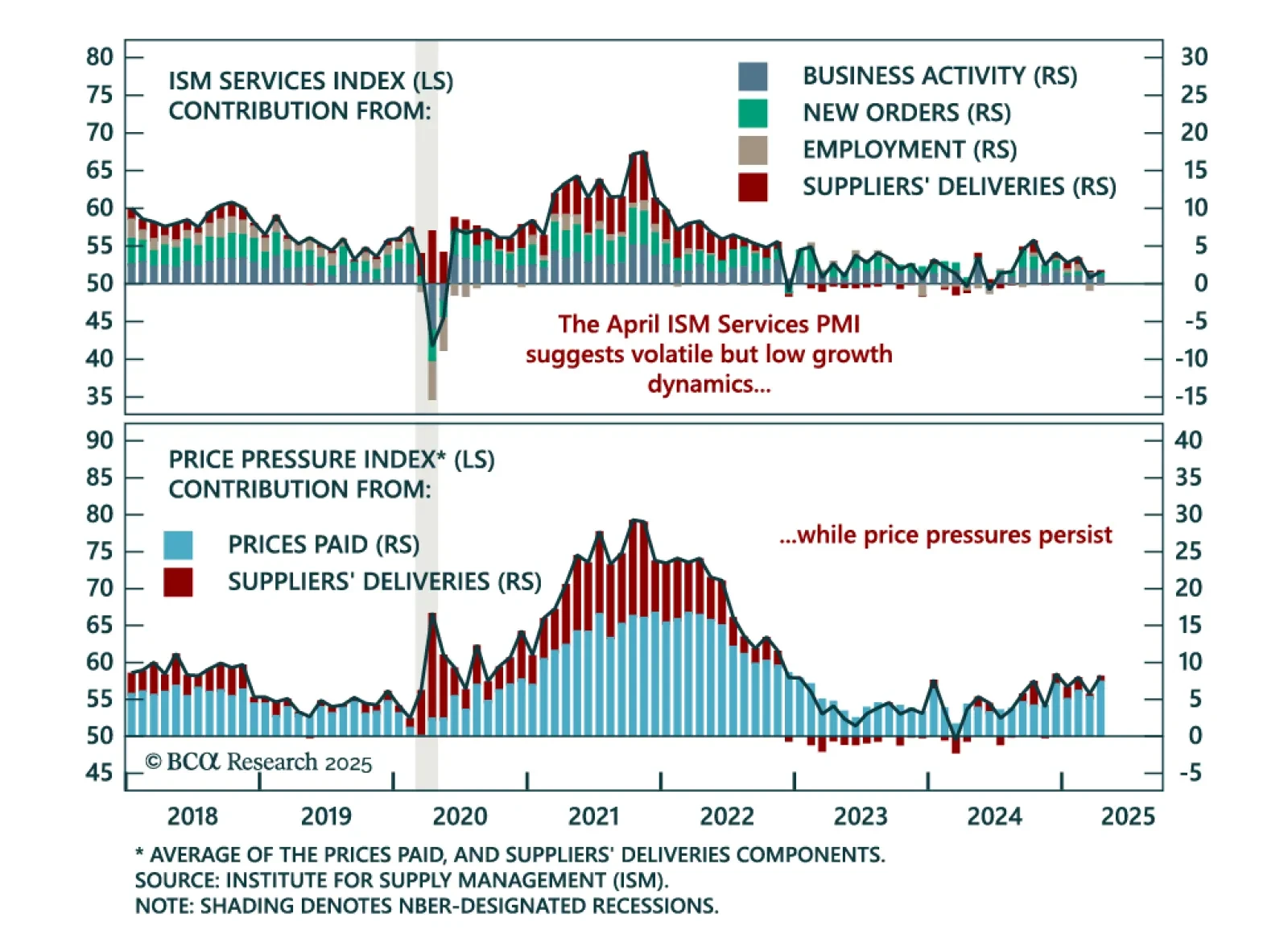

April’s ISM Services upside surprise does not shift our defensive stance, as its components show mixed momentum and rising price pressures. The headline index beat estimates, rising to 51.6 from 50.8. Business activity and new orders…

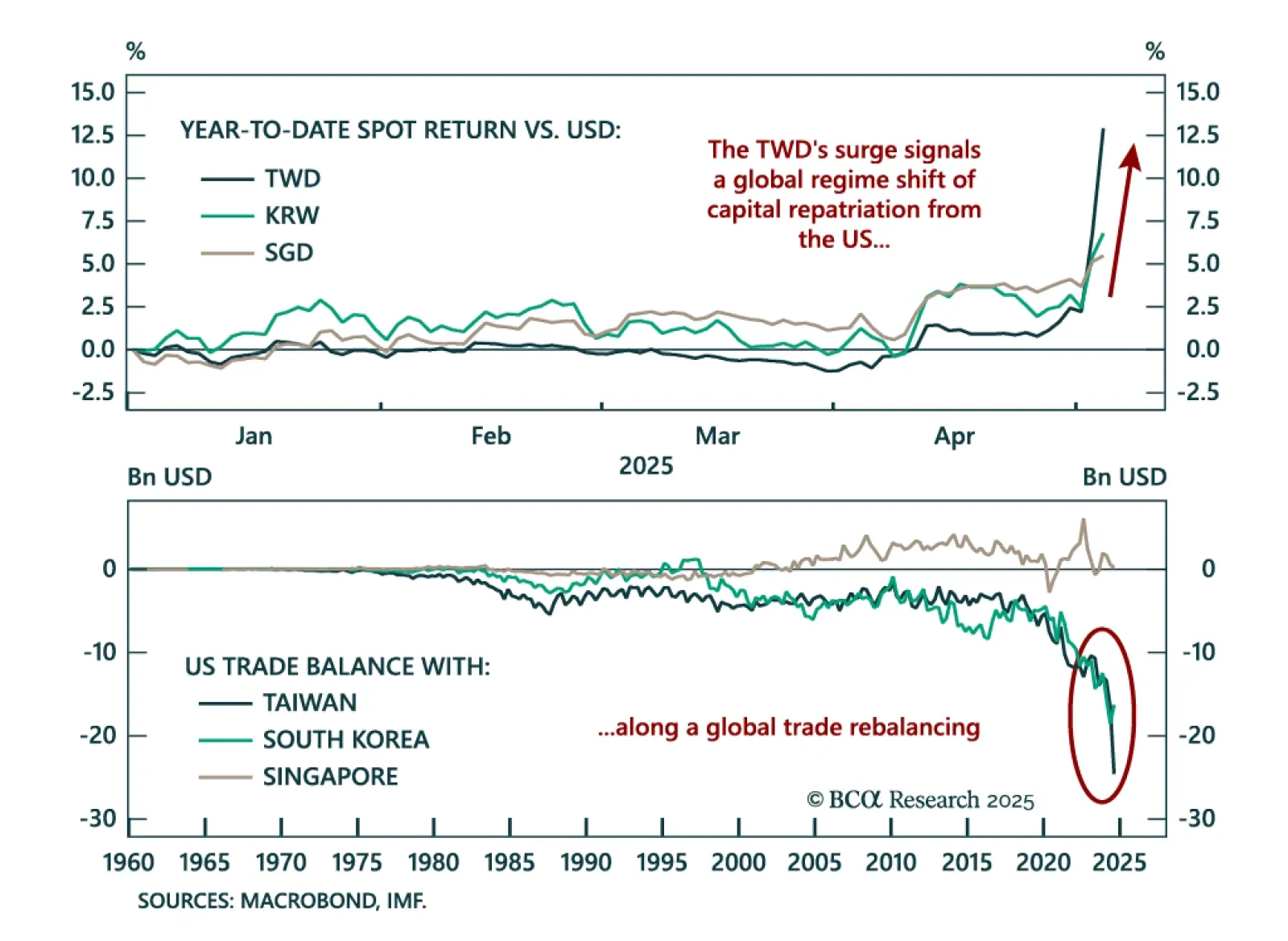

The TWD’s surge reflects a regime shift in global capital flows that supports EM Asia government bonds. Alongside other Asian currencies, the TWD has rallied sharply against the USD since late last week. While the first wave of…

We apply our systematic approach to investing based on economic, inflation, and monetary policy surprises to the major global bond markets. The economic regimes defined by the current macro-surprises setup confirm our existing fixed-…

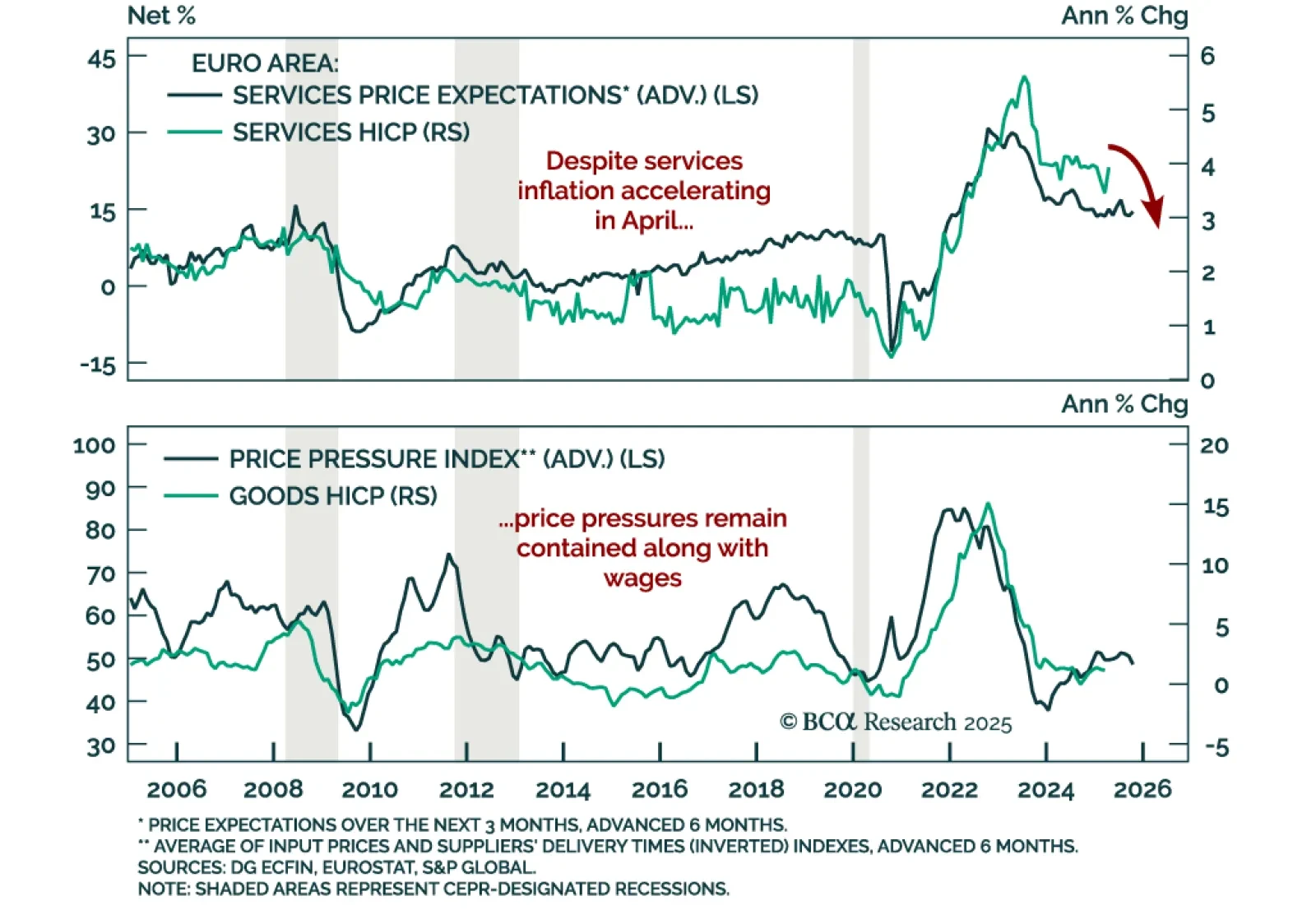

April’s Eurozone inflation data supports BCA’s bullish Bund stance and cautious view on EUR/USD. Headline HICP inflation held steady at 2.2% y/y while core ticked up to 2.7% from 2.4%. Services inflation rebounded to 3.9%,…

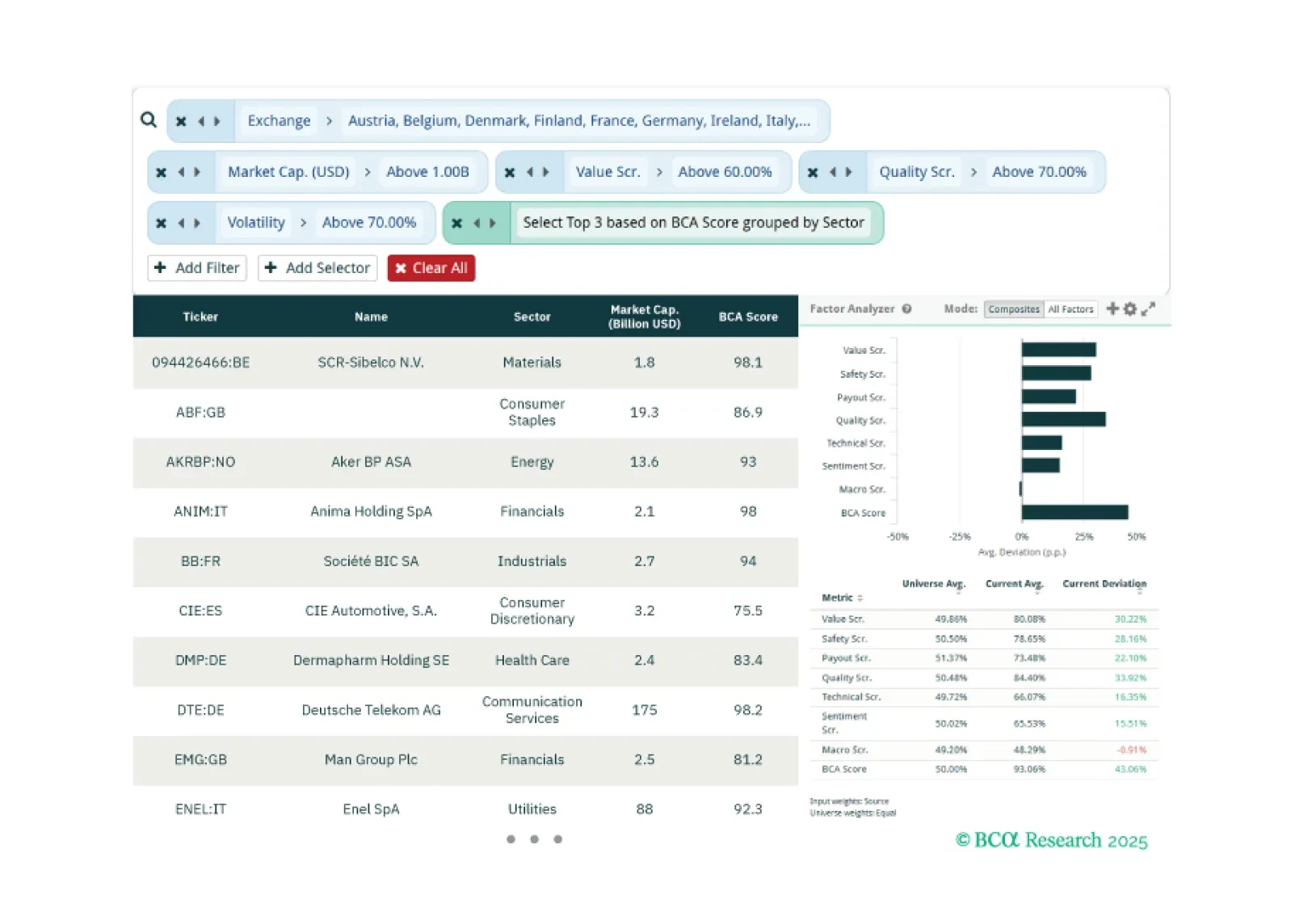

This week, our three screeners cover: Favoring European equities over US equities, cybersecurity stocks, and large caps with large moves in their BCA Score.