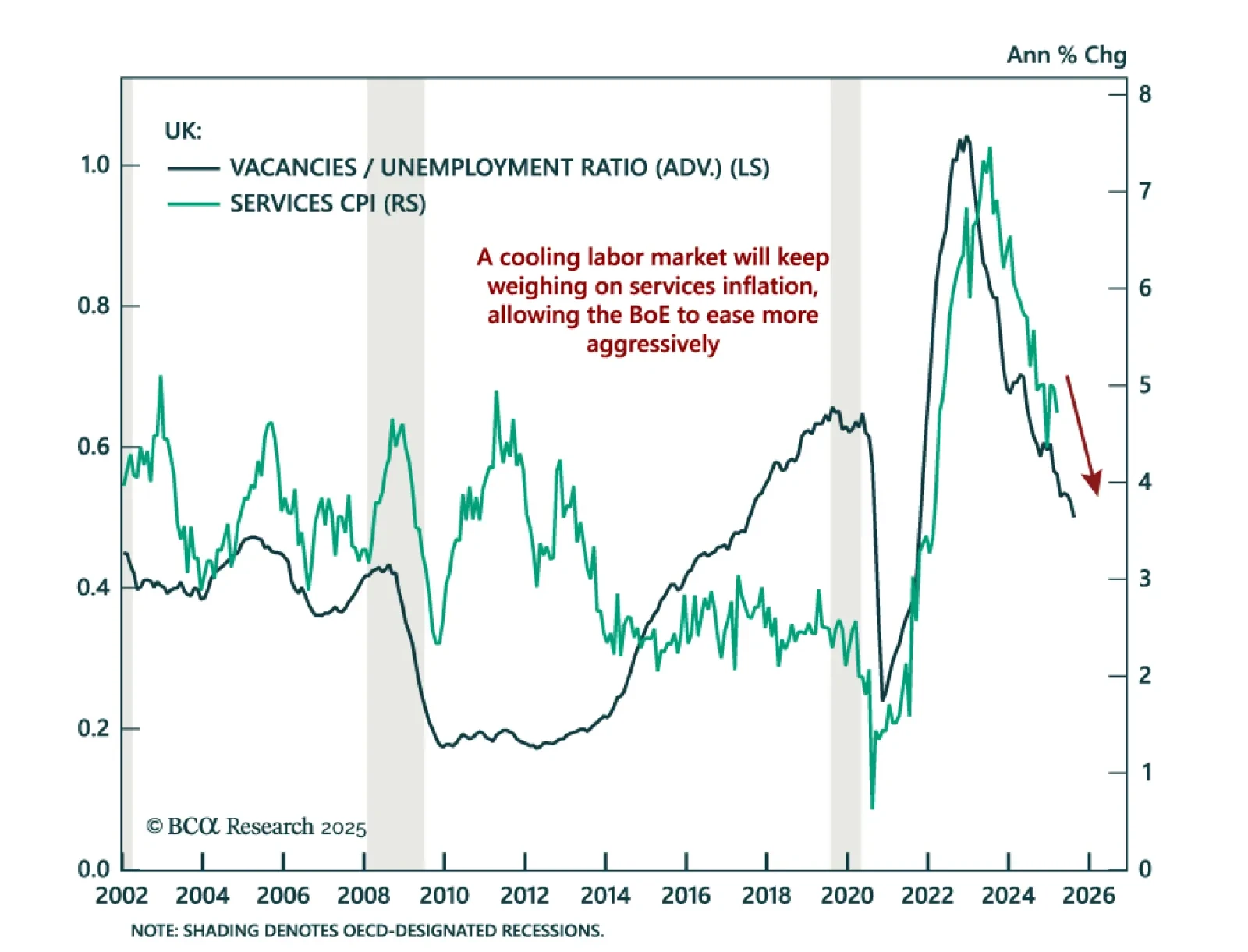

UK labor market weakness is reinforcing the case for BoE cuts and supporting our overweight in UK Gilts. April payrolls fell by 33k, marking a third consecutive monthly decline, while job vacancies remain below pre-COVID levels for…

The stock-bond yield correlation is stabilizing after months of jitters, setting the stage for renewed Treasury demand as recession risks build. A negative correlation typically points to inflation concerns, while a positive one…

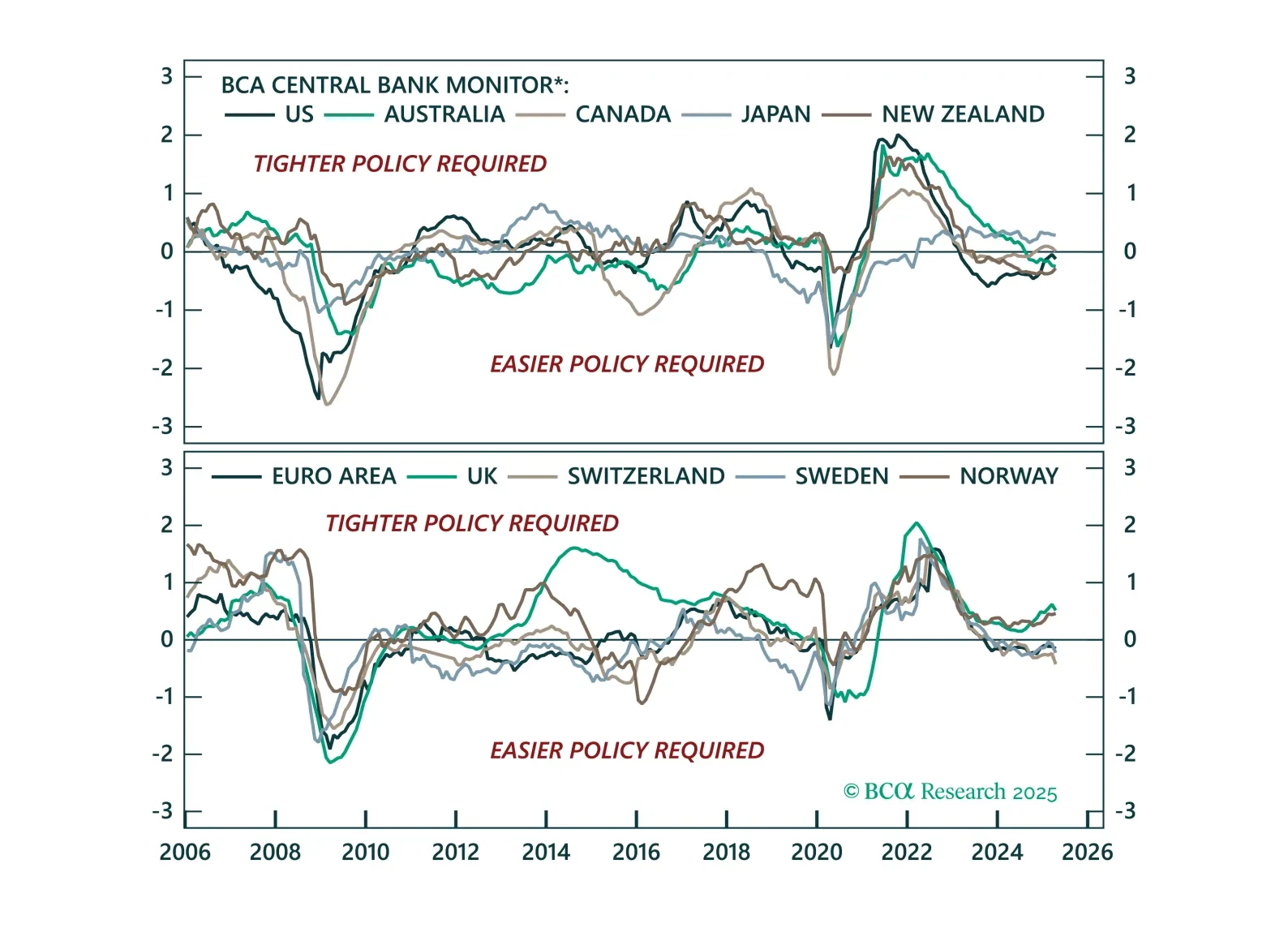

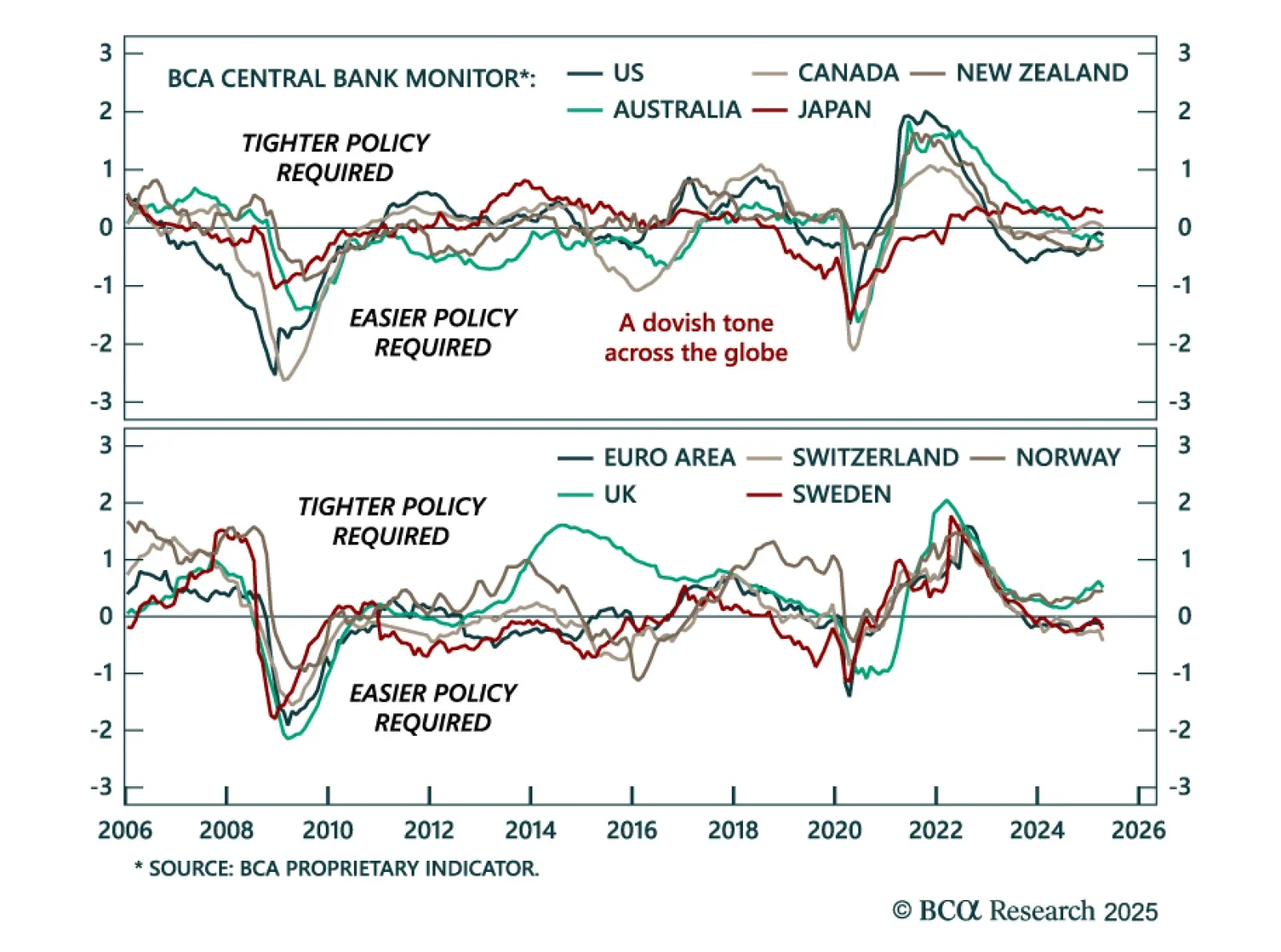

Expect broad-based dovish surprises from major central banks, and stay overweight UK and euro area government bonds. Our Global Fixed Income, European, and FX strategists published a joint update of BCA’s Central Bank Monitors. They…

A weakening economy will apply downward pressure to Treasury yields, but the Trump term premium will keep long-dated yields higher than they would otherwise be. This makes Treasury curve steepeners the most attractive trade in US…

The easing bias remains, but not all central banks are equal. This Central Bank Monitor update reveals who is ready to cut more and who is still pretending not to.

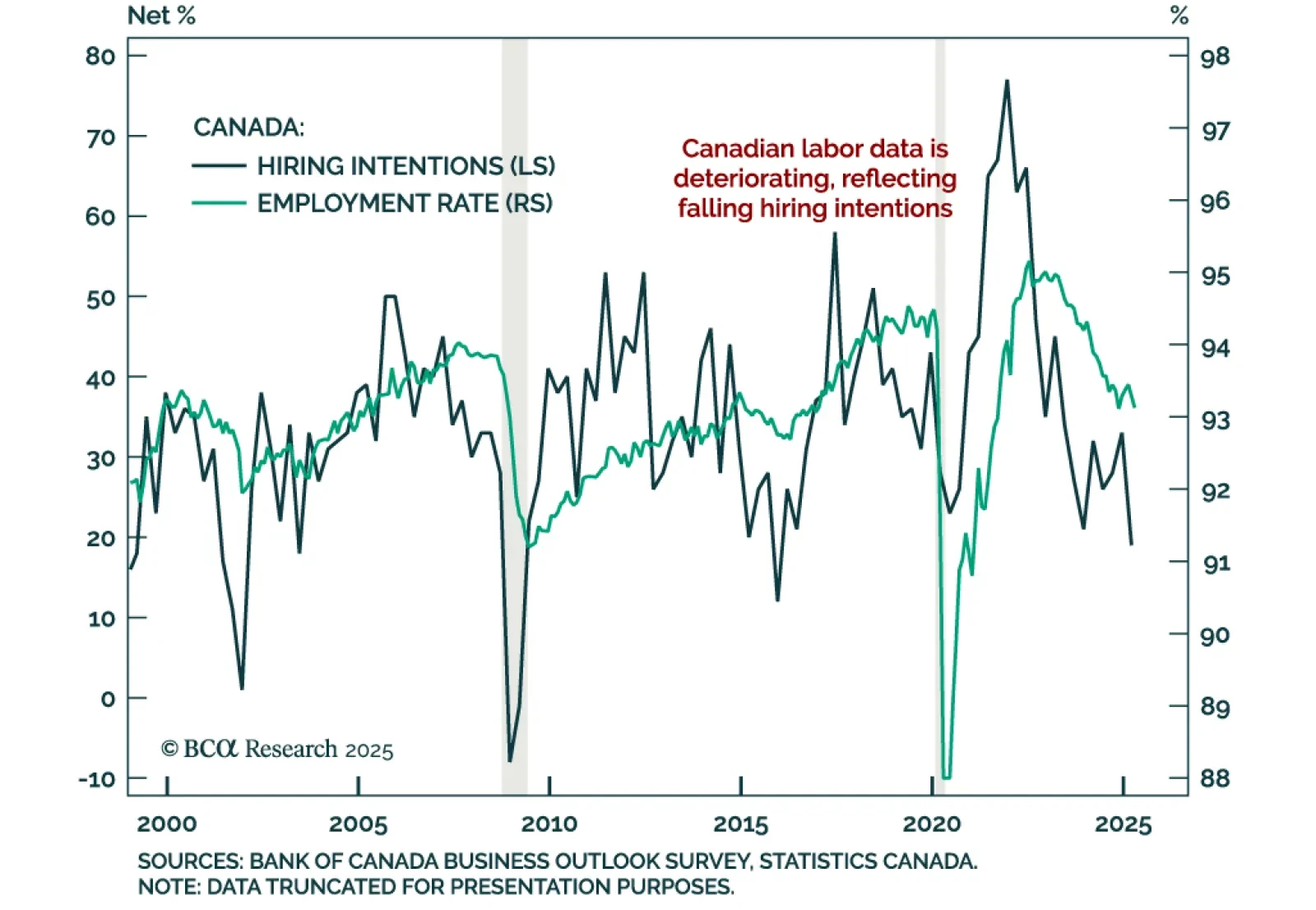

Soft April jobs confirm the Canadian labor market stall, yet we remain neutral on CGBs and structurally bullish on the CAD. The unemployment rate rose more than expected to 6.9% from 6.7%. Employment growth exceeded expectations but…

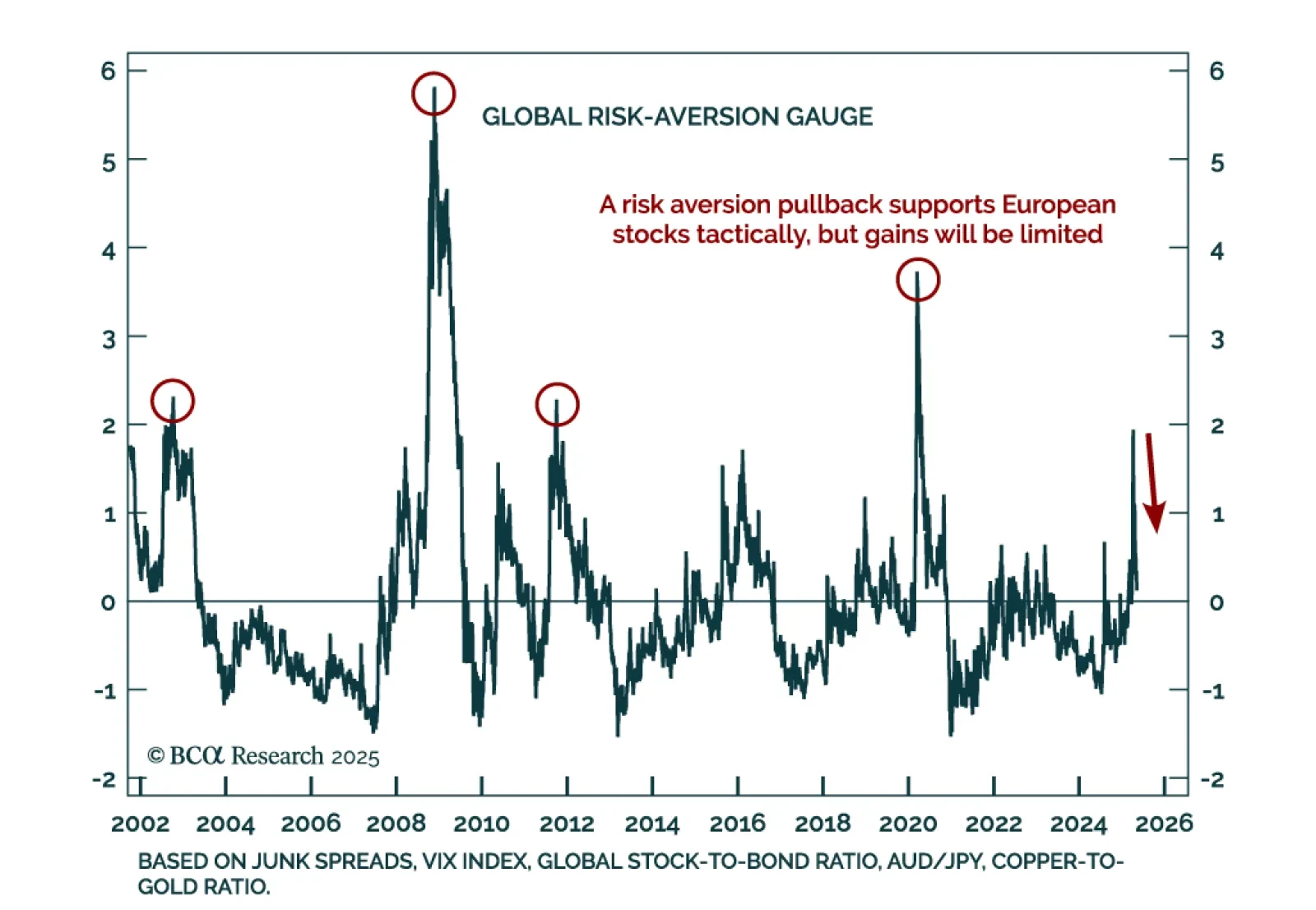

European equities have some short-term support, but global growth risks will cap gains. Our Chart Of The Week comes from Mathieu Savary, Chief European Investment Strategist. Mathieu sees probable but limited upside for European…

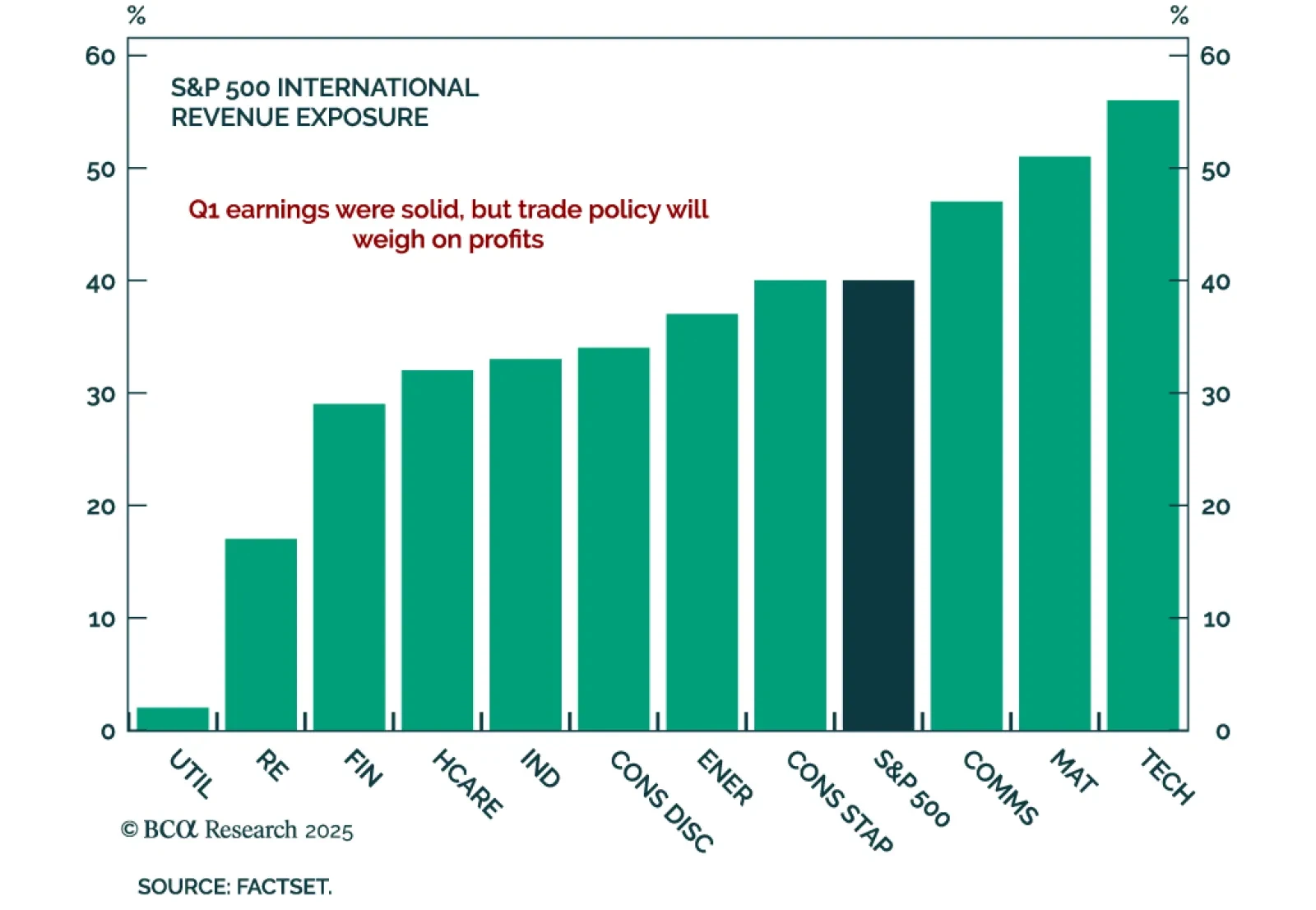

Q1 earnings point to risks for goods-focused sectors, reinforcing our US Equity strategists’ call to overweight services, upstream names, and domestic plays. With most S&P 500 companies having reported Q1 2025 earnings, the…

Our Portfolio Allocation Summary for May 2025.

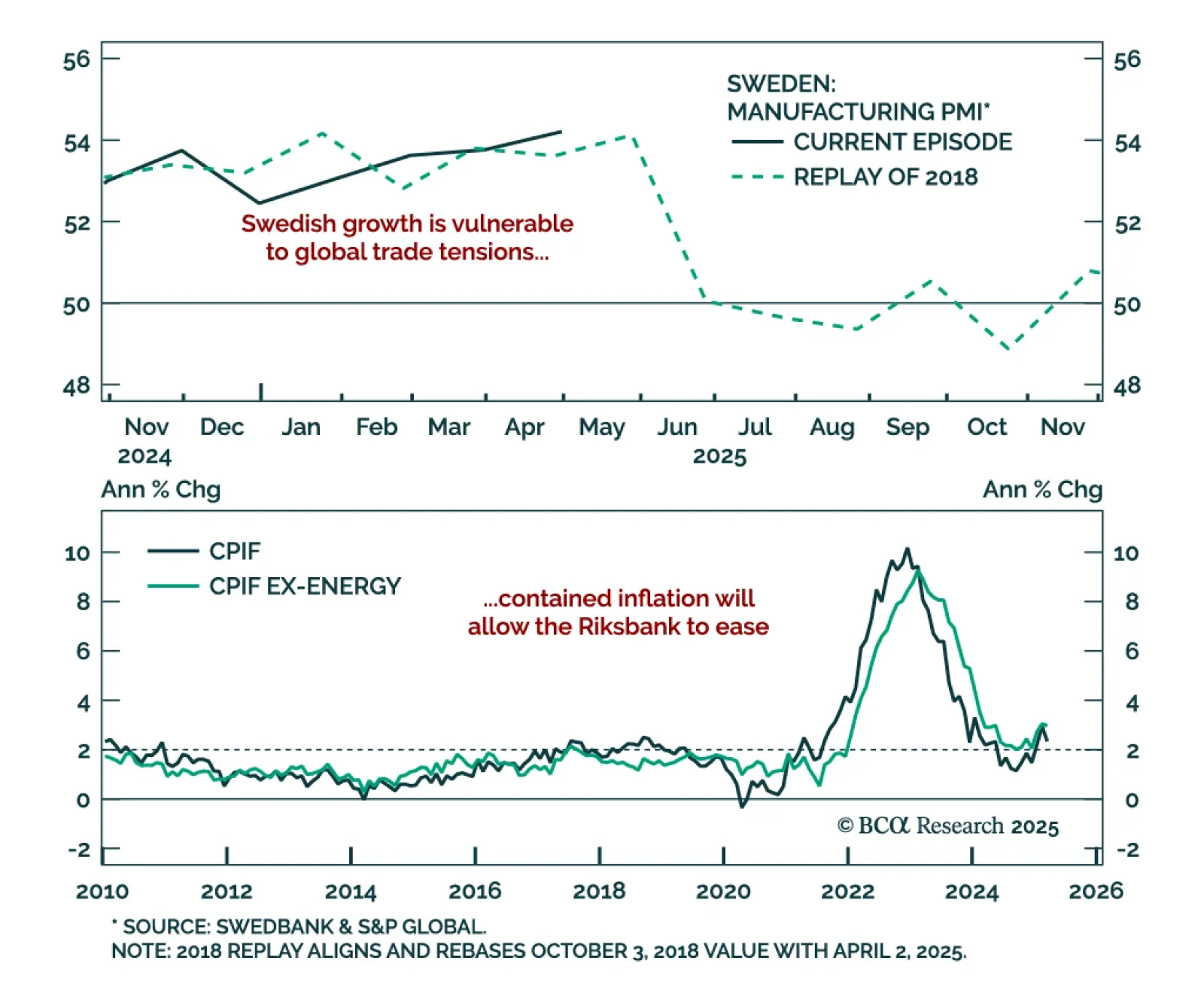

The Riksbank’s cautious stance sets up a dovish pivot, reinforcing our long Swedish bonds view and SEK fade vs. USD. The central bank held rates at 2.25% for the second time this year, with Governor Thedéen describing policy as well-…