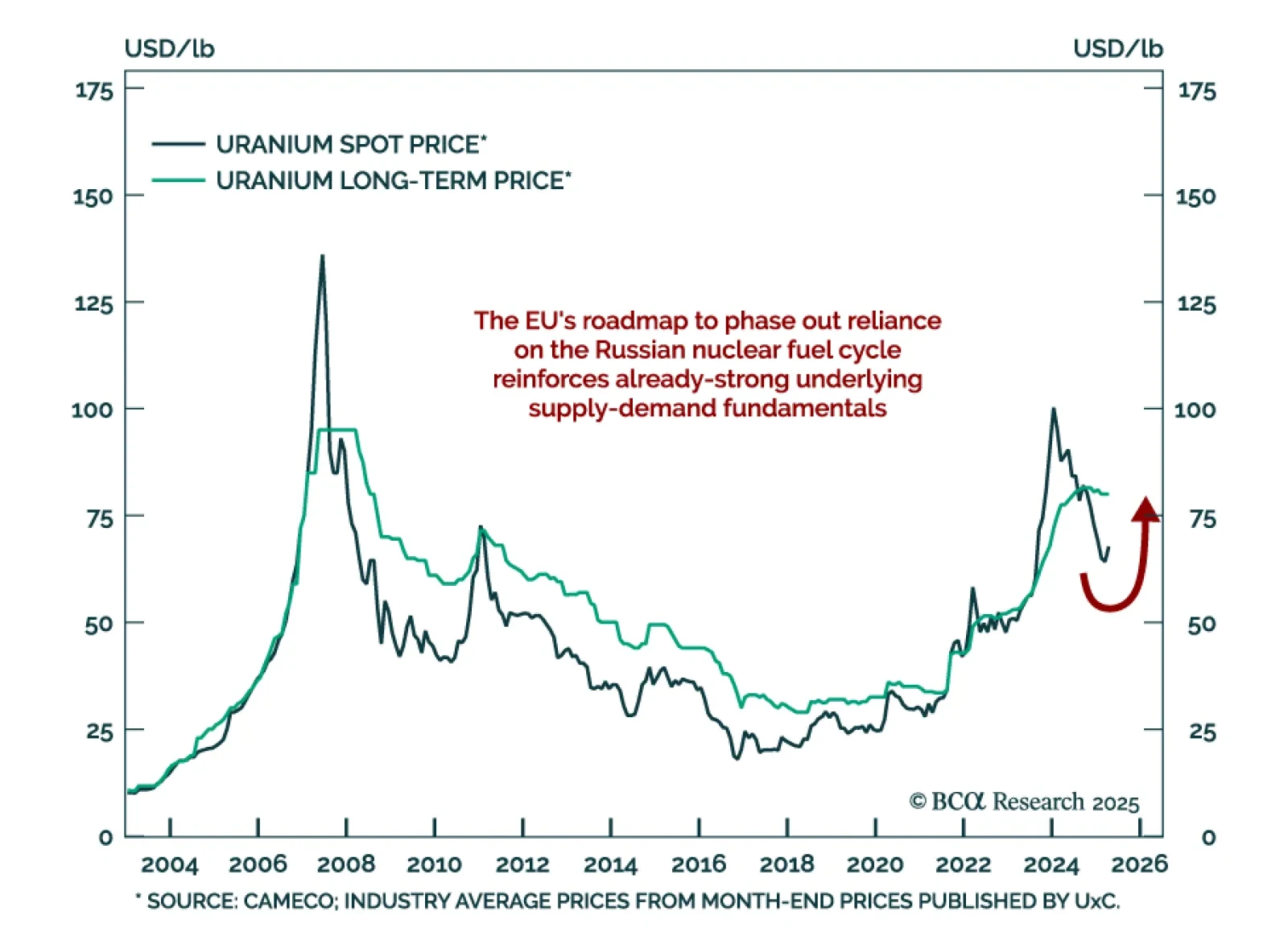

Uranium spot prices may have found a floor after falling to $64/lb from a $107/lb peak in February last year. This drawdown has been unexpected considering the strength of the underlying supply-demand fundamentals for uranium.…

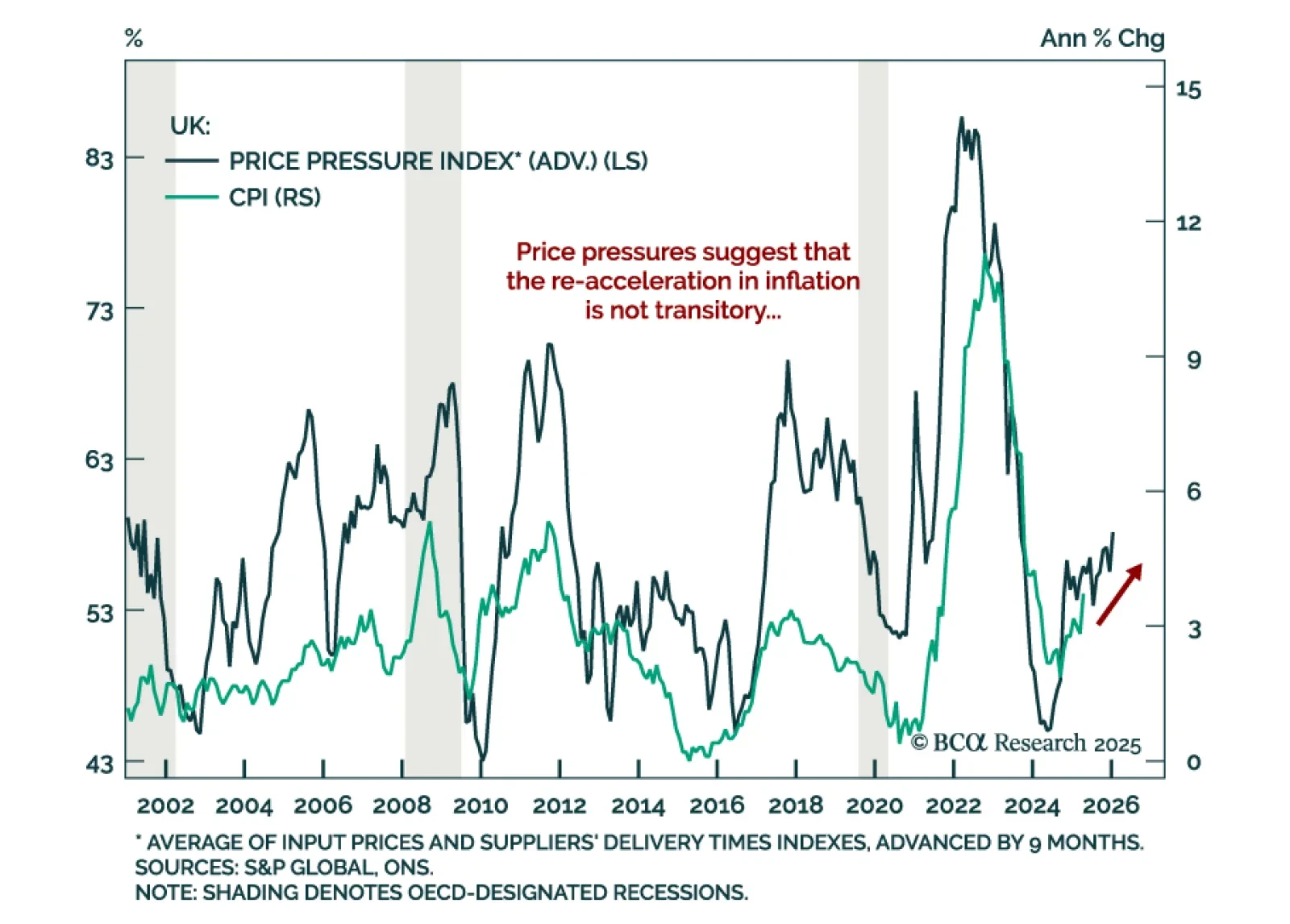

UK inflation surprised to the upside in April. Headline inflation rose to a 15-month high of 3.5%, from 2.6% the month before. Core inflation also surprised above estimates, printing 3.8% vs. 3.4% in March. Services inflation climbed…

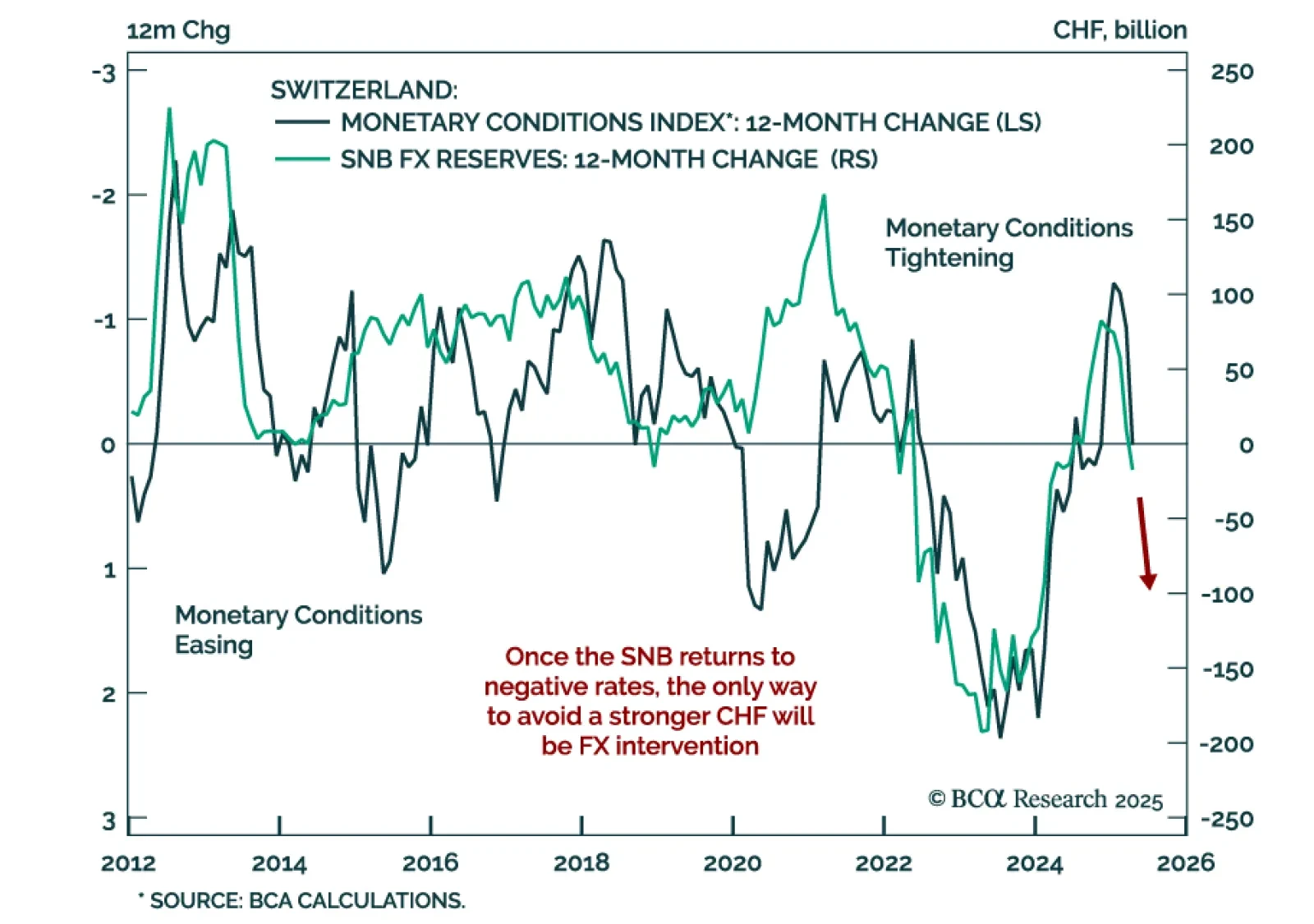

Swiss National Bank will have to resort to negative interest rates and FX intervention before year-end. Swiss inflation fell to 0% year-over-year in April, or the lower end of the SNB’s 0%-2% target range, and the continued…

The European bond market is pricing in a more optimistic outlook. The BTP-Bund spreads have narrowed 30bps since April 9 and are now within reach of their pre-Ukraine war level. BCA’s European strategists do not share this…

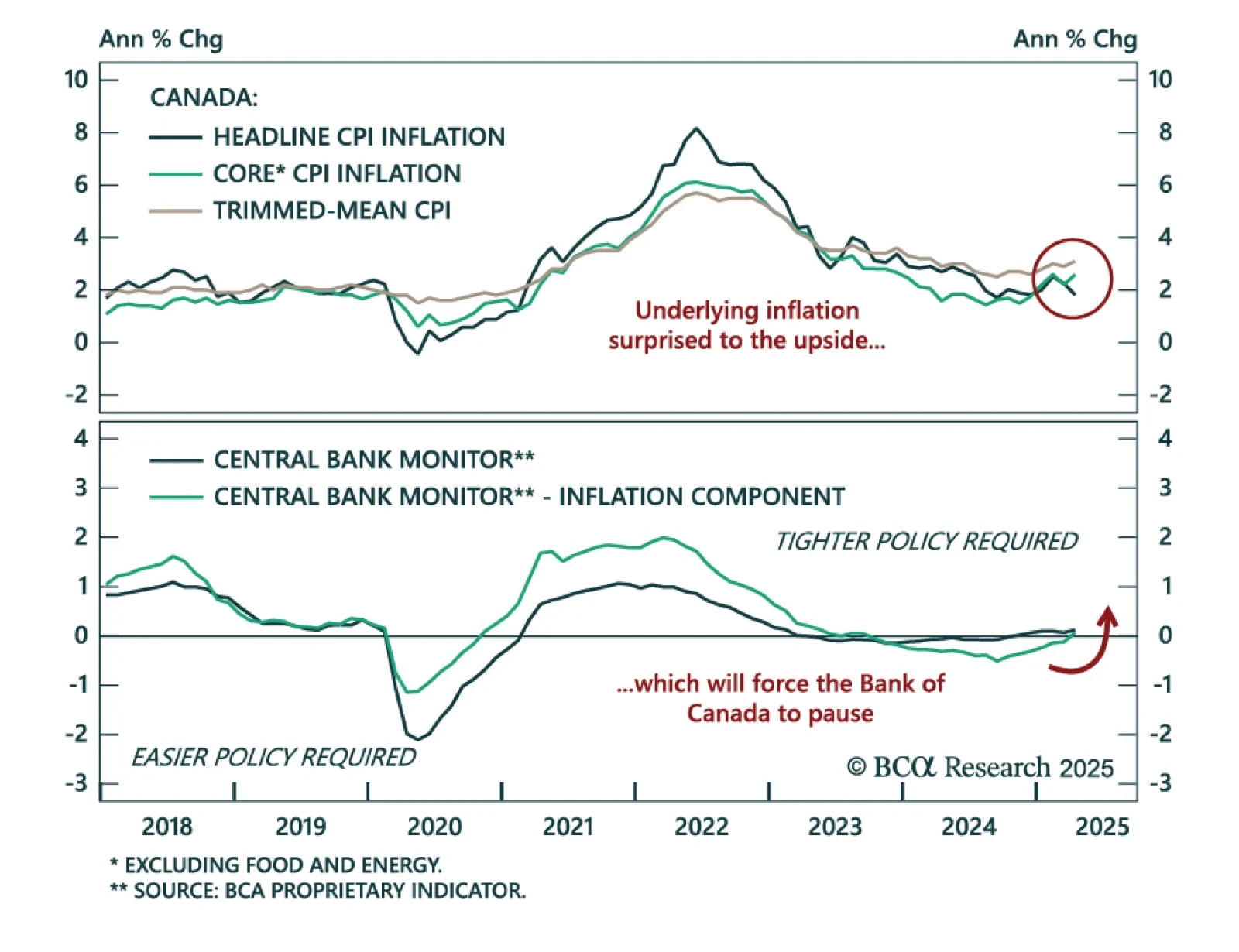

Although Canada’s headline CPI slowed to 1.7% y/y from 2.3% on Tuesday, most measures of underlying inflation surprised to the upside, thus raising the likelihood that the Bank of Canada (BoC) will stay put at its next meeting in…

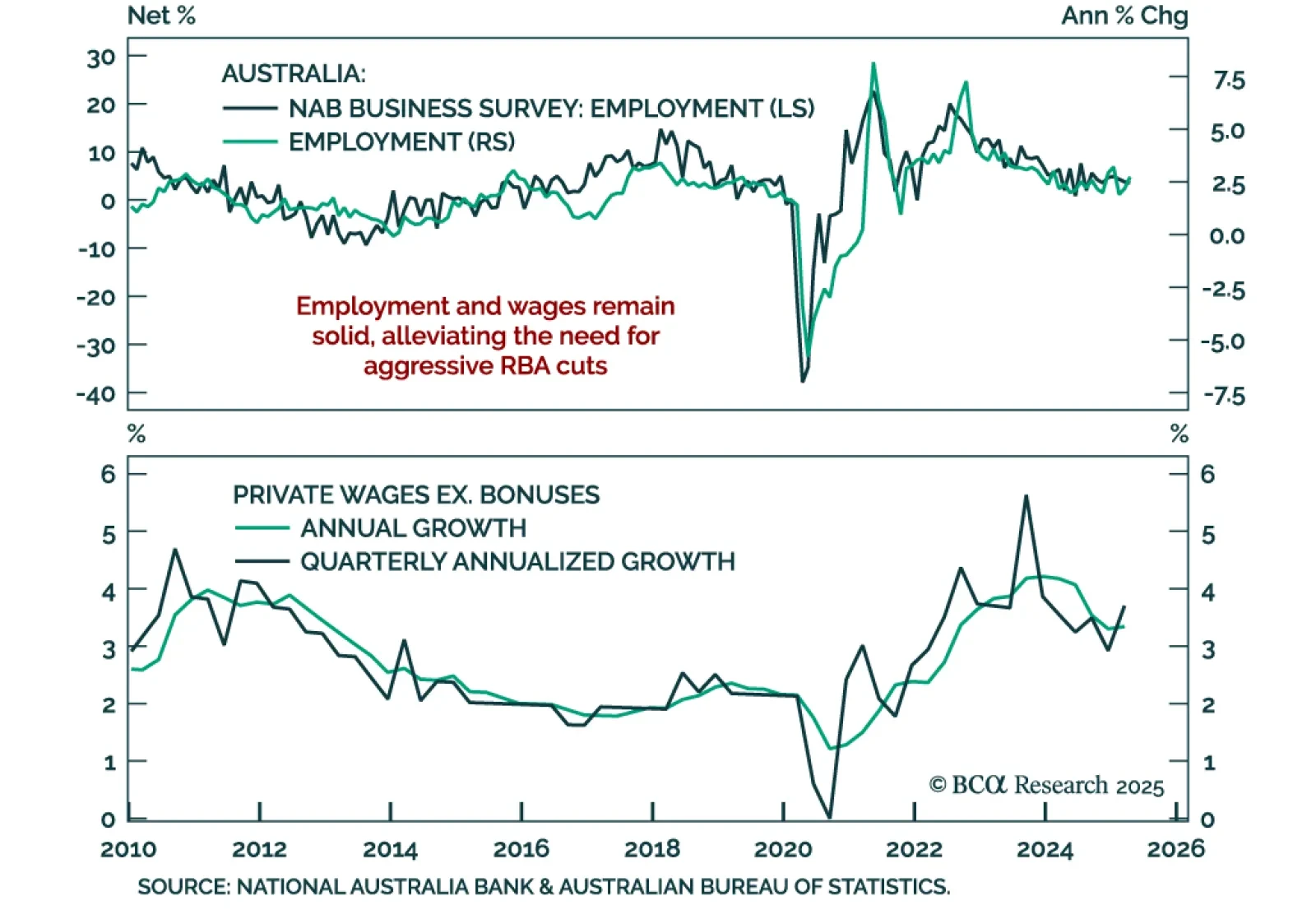

A strong Australian labor market is limiting the scope for RBA easing, reinforcing our underweight on Australian government bonds. Our Chart Of The Week comes from Robert Timper, strategist in our Global Fixed Income Strategy team.…

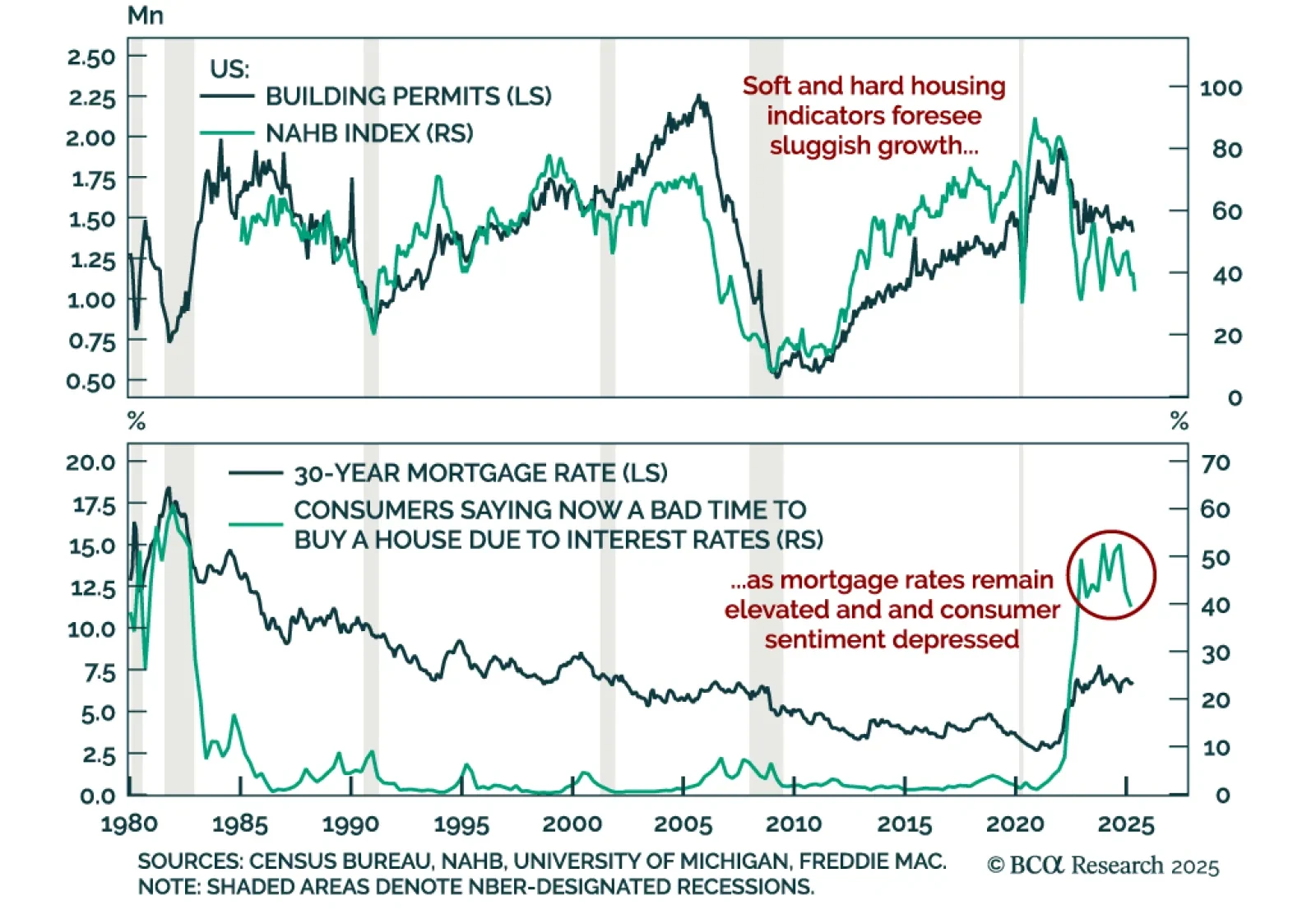

Weak April housing data and deteriorating builder sentiment reinforce our defensive stance, as recession risks remain underpriced. Housing starts rose at a 1.6% m/m annualized rate, missing expectations. Similarly, building permits,…

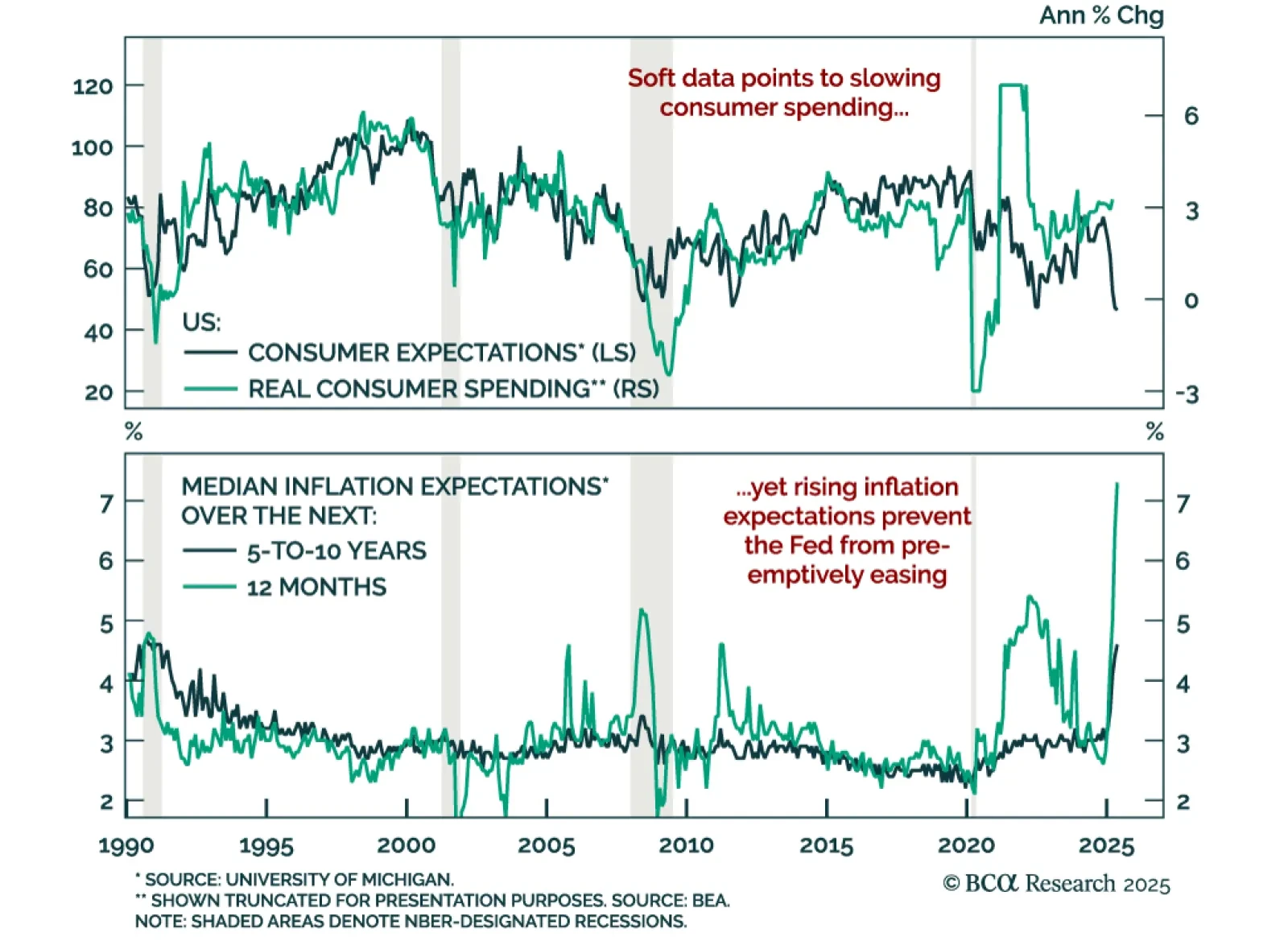

Deteriorating US consumer sentiment and surging inflation expectations add to growth concerns and reinforce our long-duration bond stance. The preliminary May University of Michigan Consumer Sentiment Index missed expectations,…

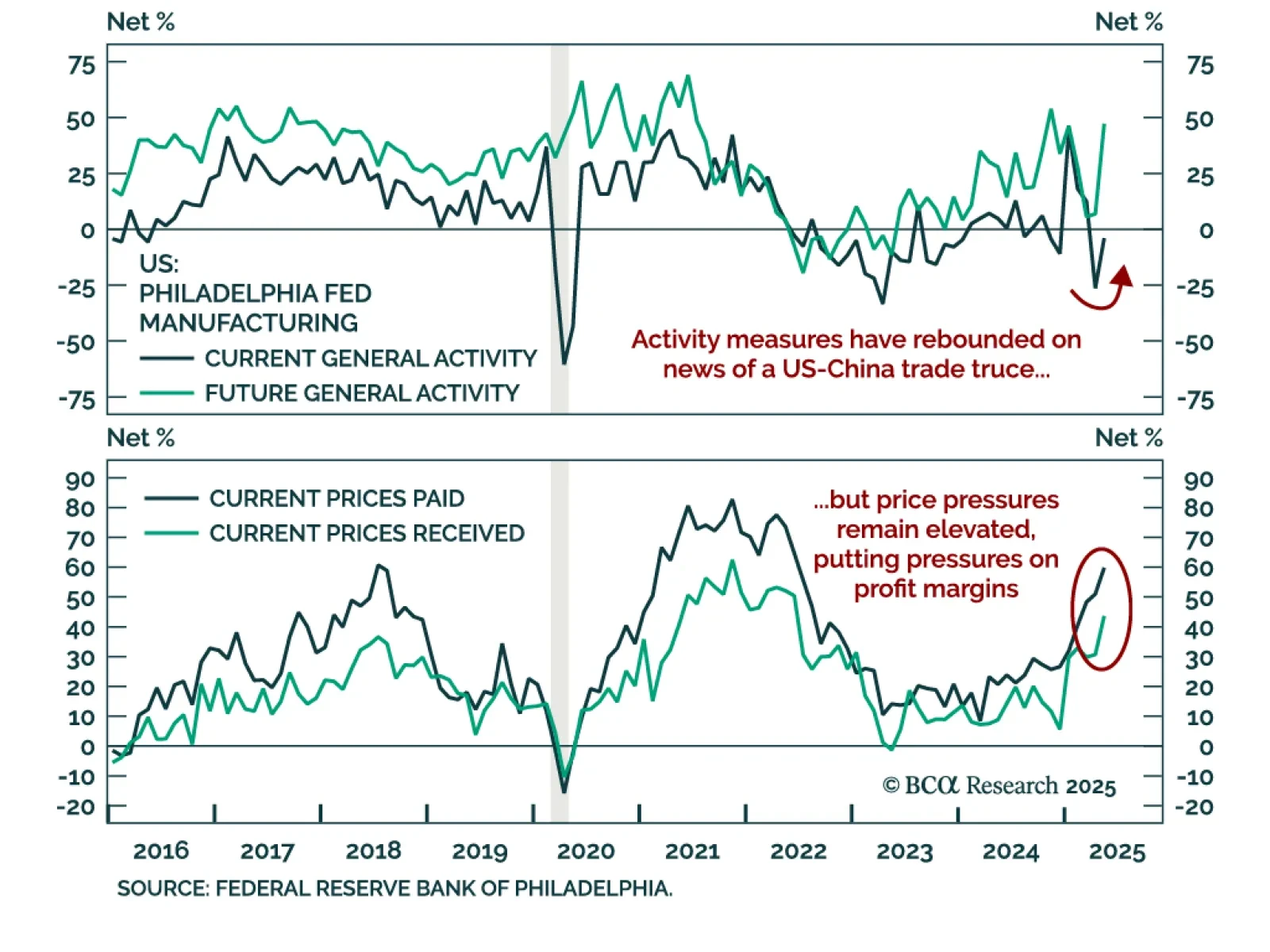

The US-China trade truce lifted short-term manufacturing sentiment in May, but margin pressures persist, reinforcing the case for defensive, domestic-focused equity positioning. The Empire and Philly Fed regional manufacturing…

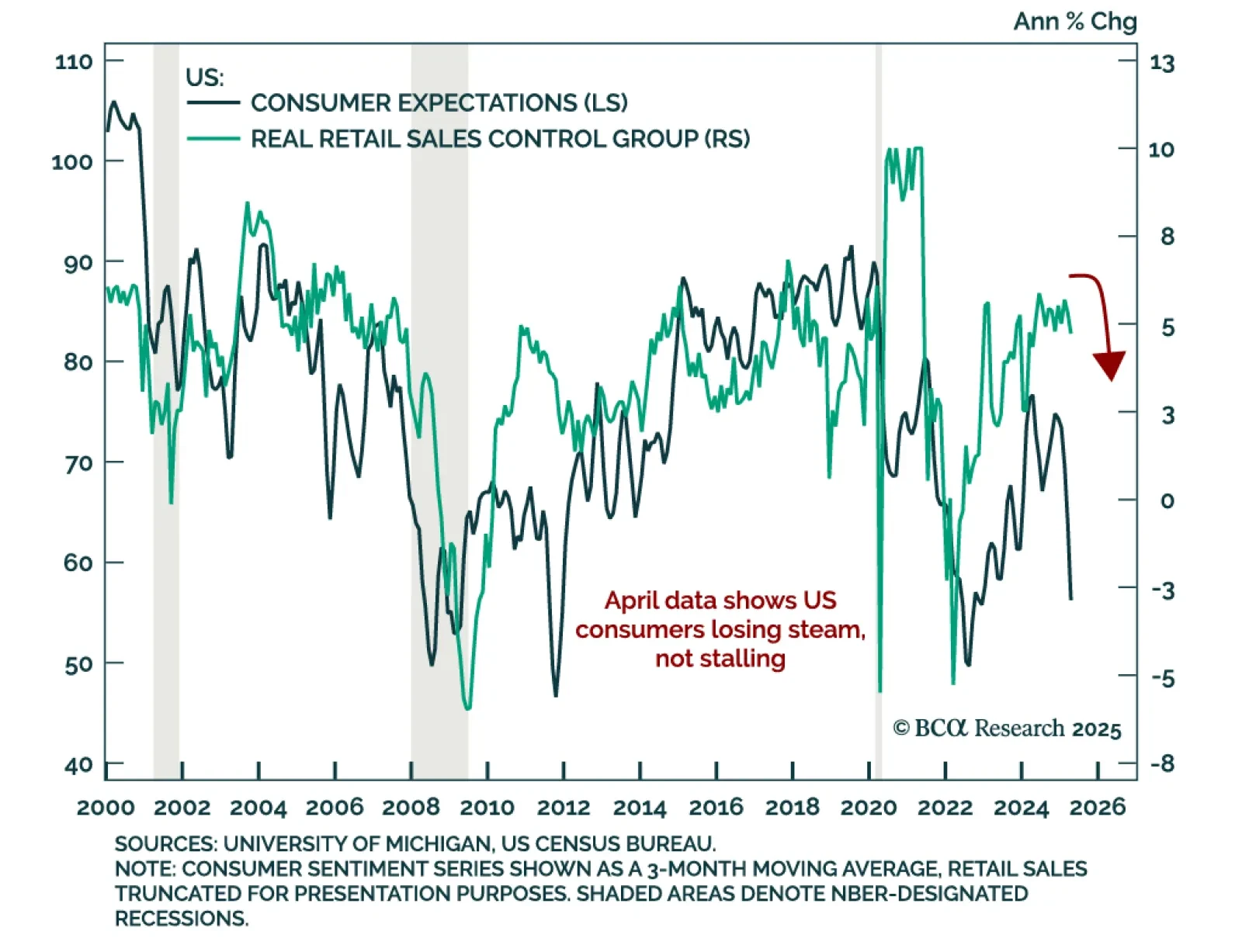

April retail sales slowed, but signs of resilience in discretionary spending and labor data suggest US consumers are holding up. Headline retail sales rose 0.1% m/m, above expectations but decelerating from the upwardly revised 1.7%…