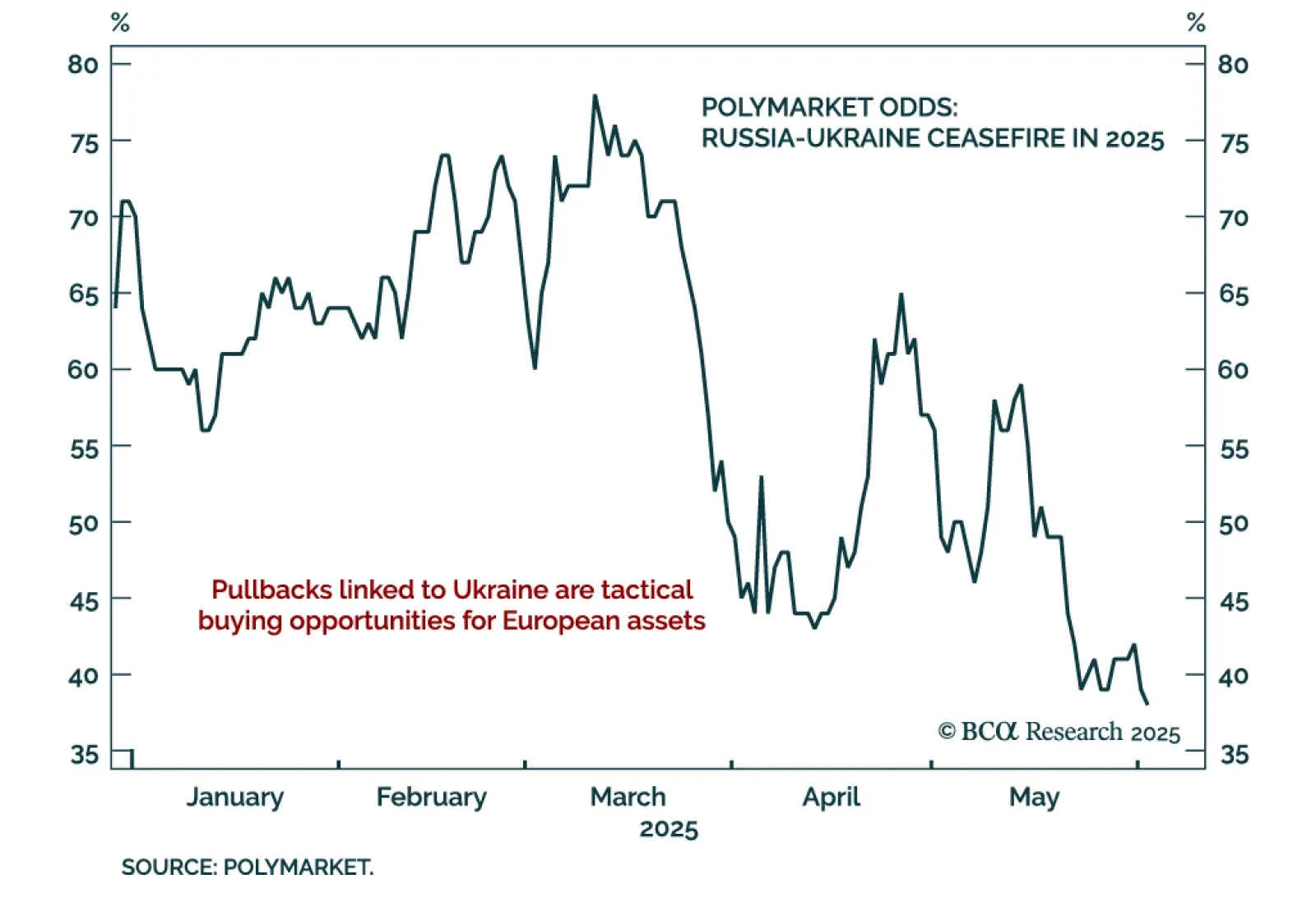

Ongoing military tensions between Ukraine and Rusia and renewed US-EU trade friction reinforce tactical opportunities to add European exposure on dips. Ukraine’s drone strike on Russian air assets and the limited outcome of the…

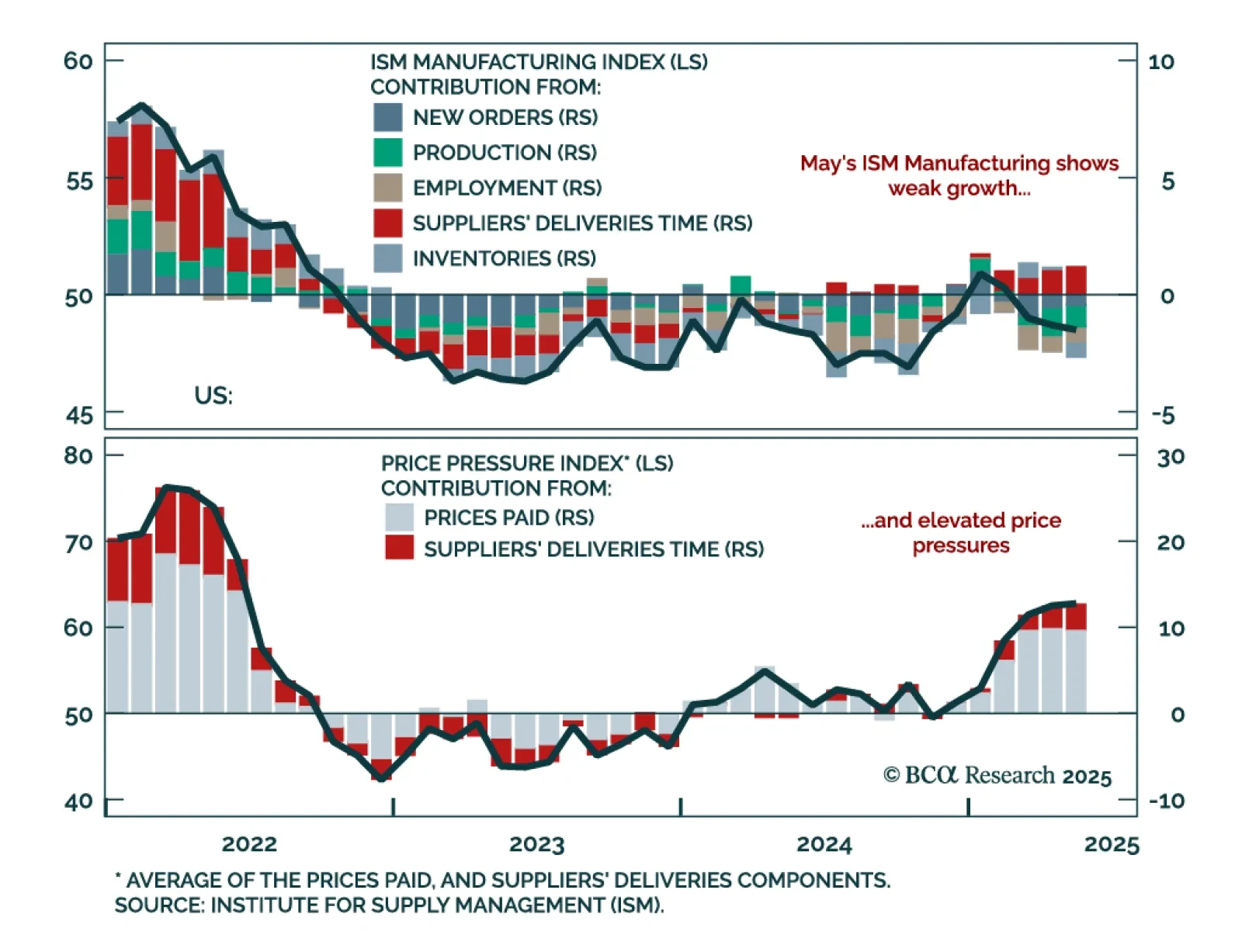

The May ISM Manufacturing Index missed expectations, reinforcing our view that recession risks remain underpriced. The headline fell to 48.5 from 48.7, while new orders and employment both rebounded slightly but remained below the 50…

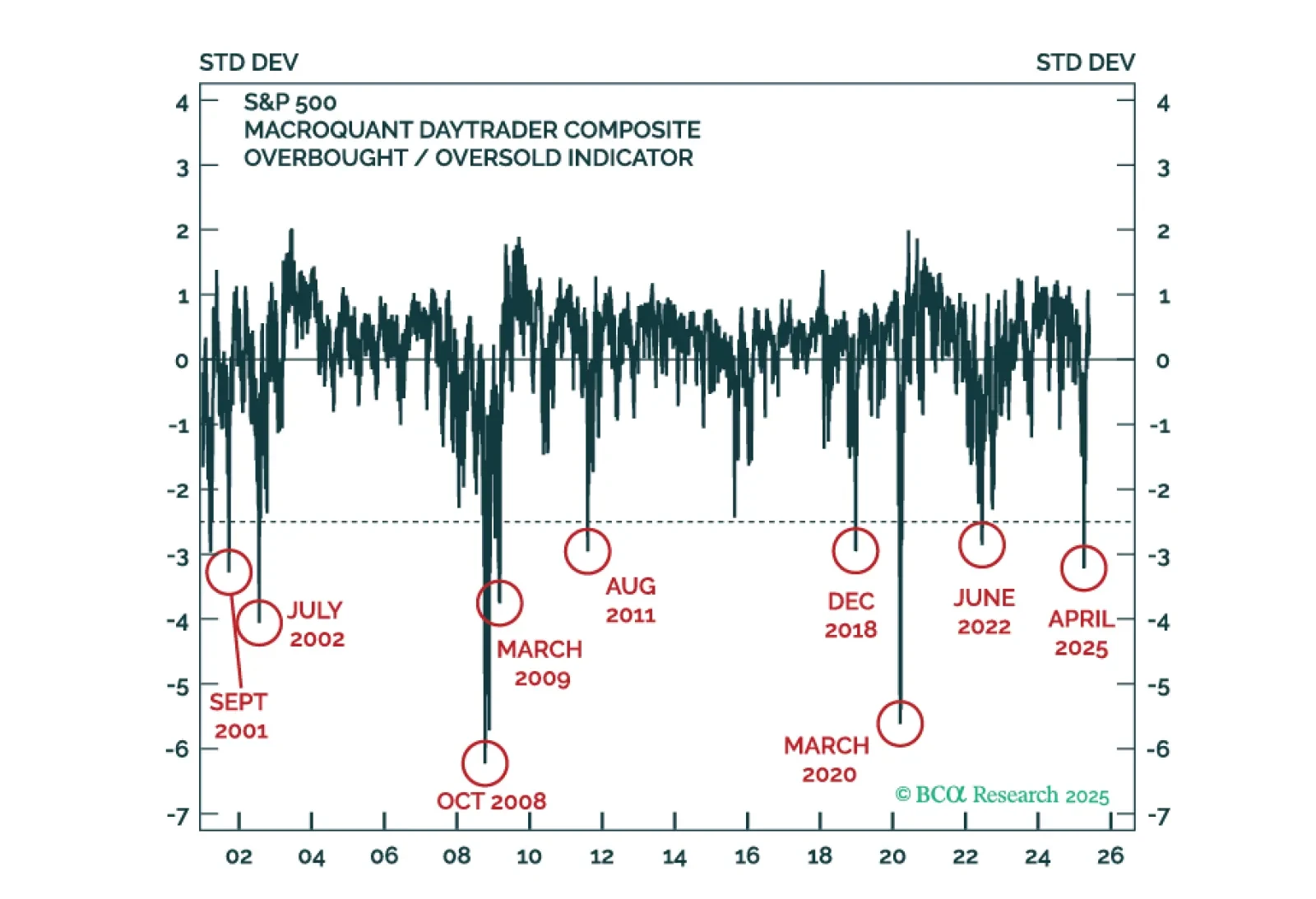

MacroQuant warns that US equities are pricing in very little economic risk. The model is shunning equities and recommends a large overweight to cash.

MacroQuant warns that US equities are pricing in very little economic risk. The model is shunning equities and recommends a large overweight to cash.

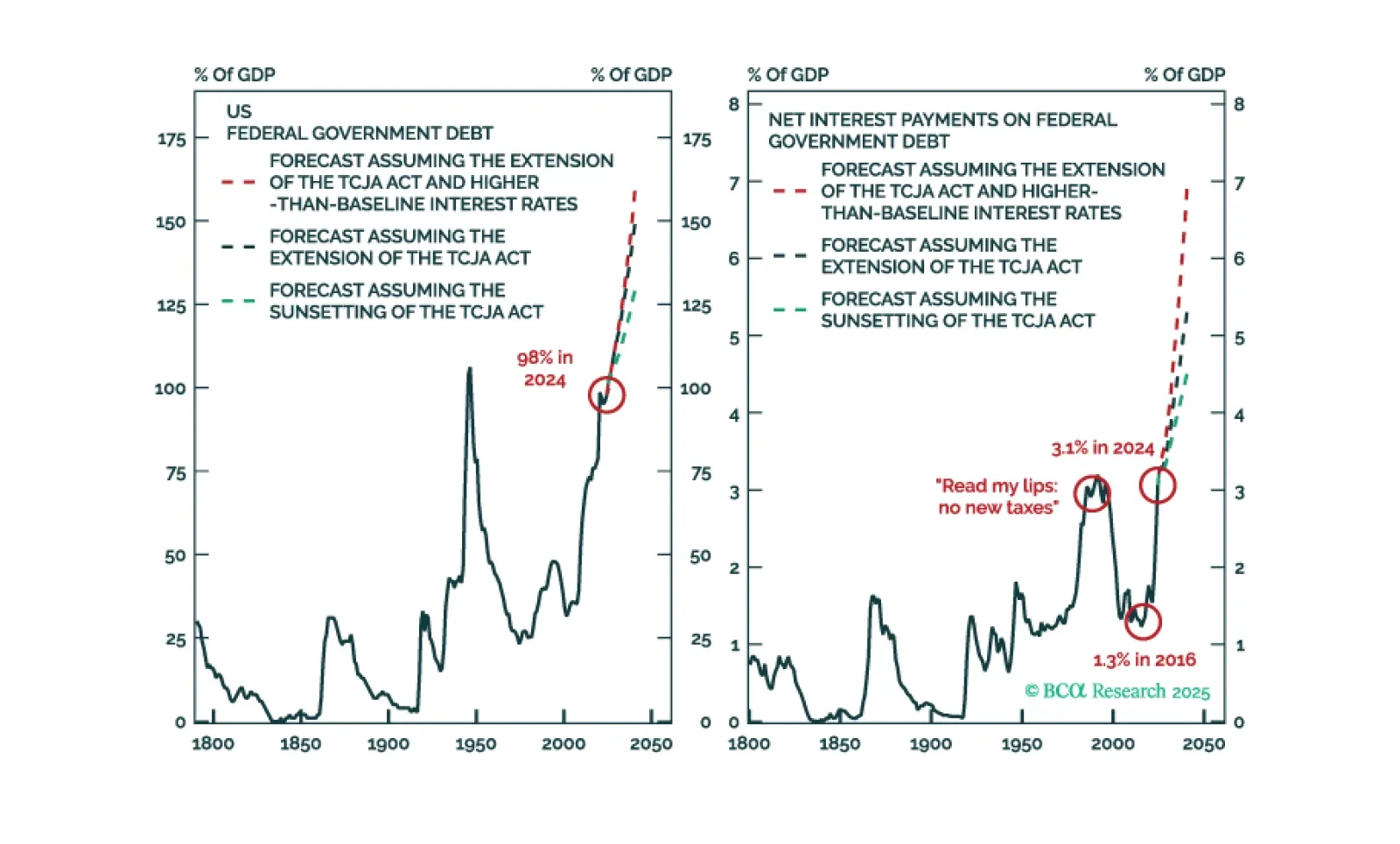

Rising bond yields may present an even greater danger to the global economy than the trade war. With equity valuations no longer discounting much economic risk, investors should position themselves defensively.

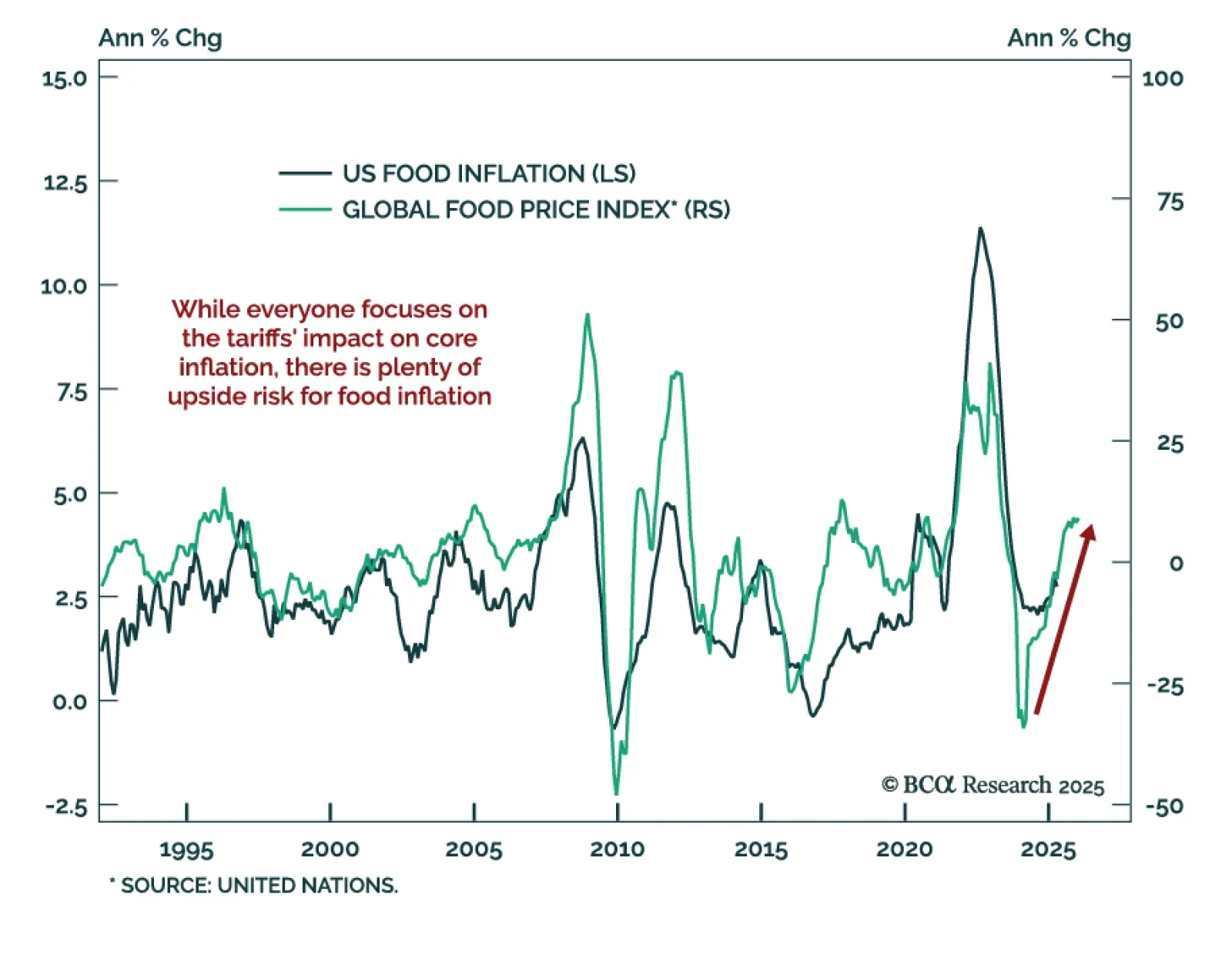

The upward trend in global food prices suggests that food inflation risks re-accelerating in the US. Historically, US food inflation lags the United Nations’ global food price index by about nine months. The annual growth in…

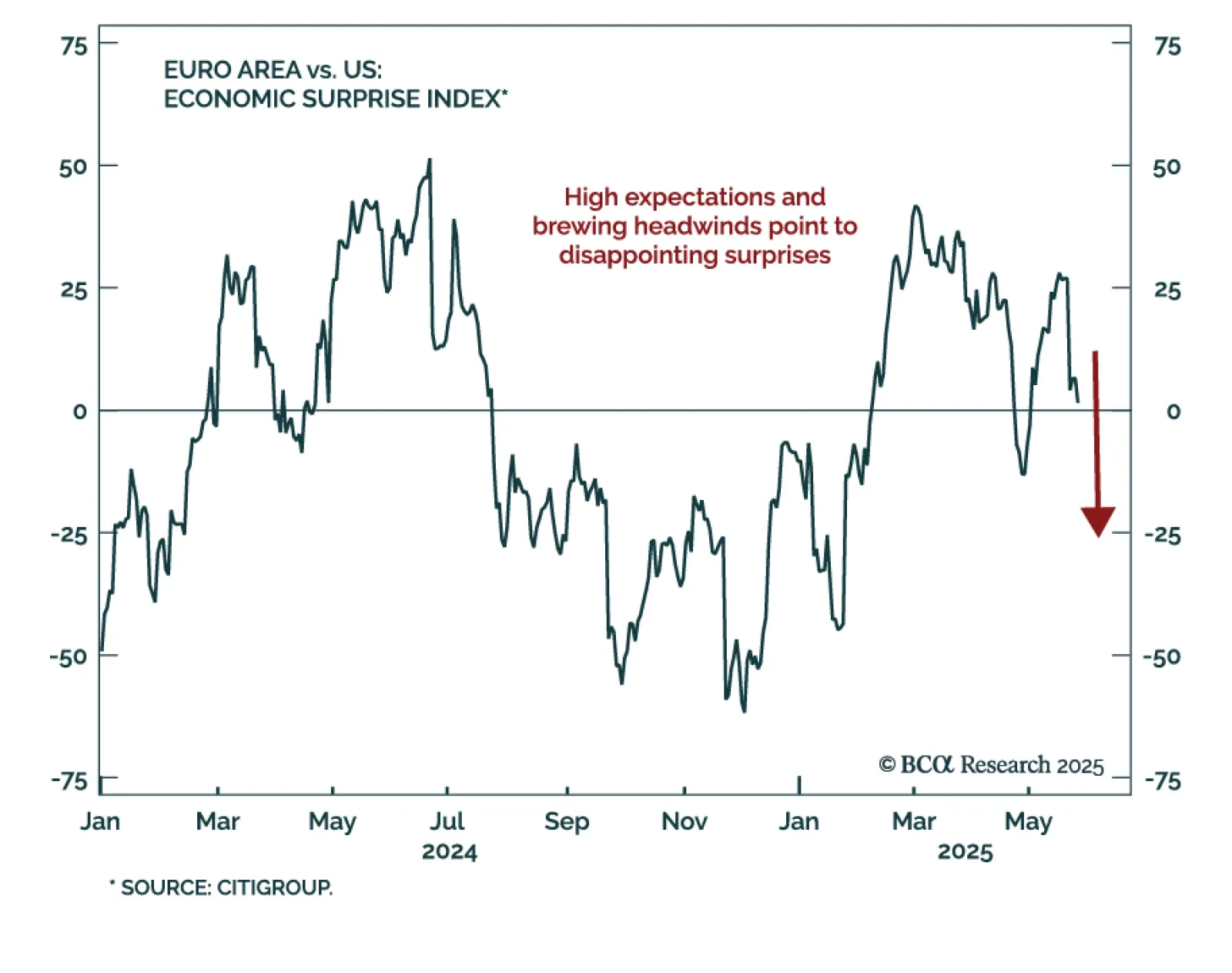

The structural outlook for European assets remains bright, but near-term headwinds argue for longer duration and caution on equities. Here are three takes that call for a temporary pullback in European assets, and two that explore…

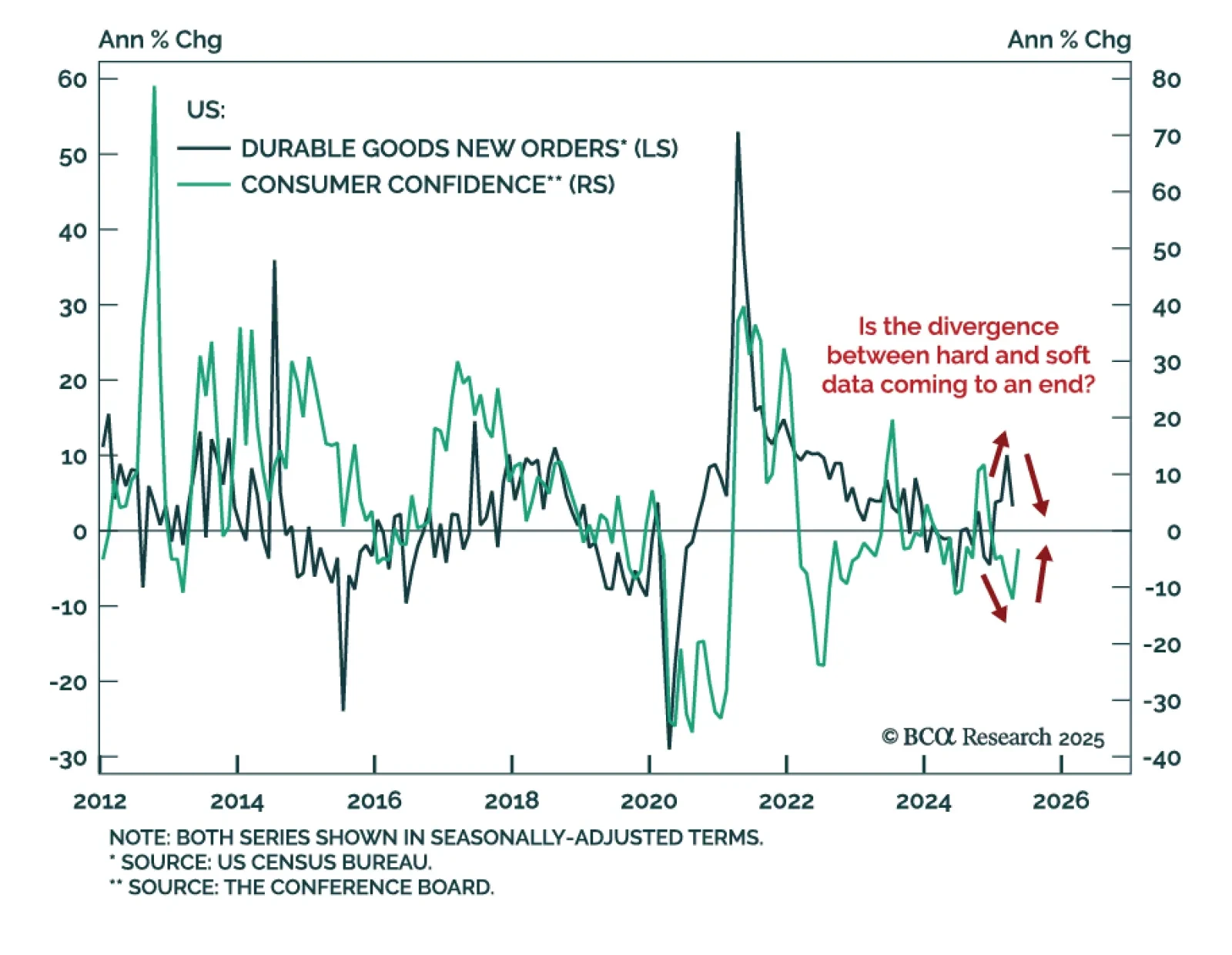

The latest US durable goods orders and consumer confidence figures suggest that hard and soft data are converging, but stocks remain at risk. After months of rising prints, new orders for manufactured goods sank by 6.3% in April…

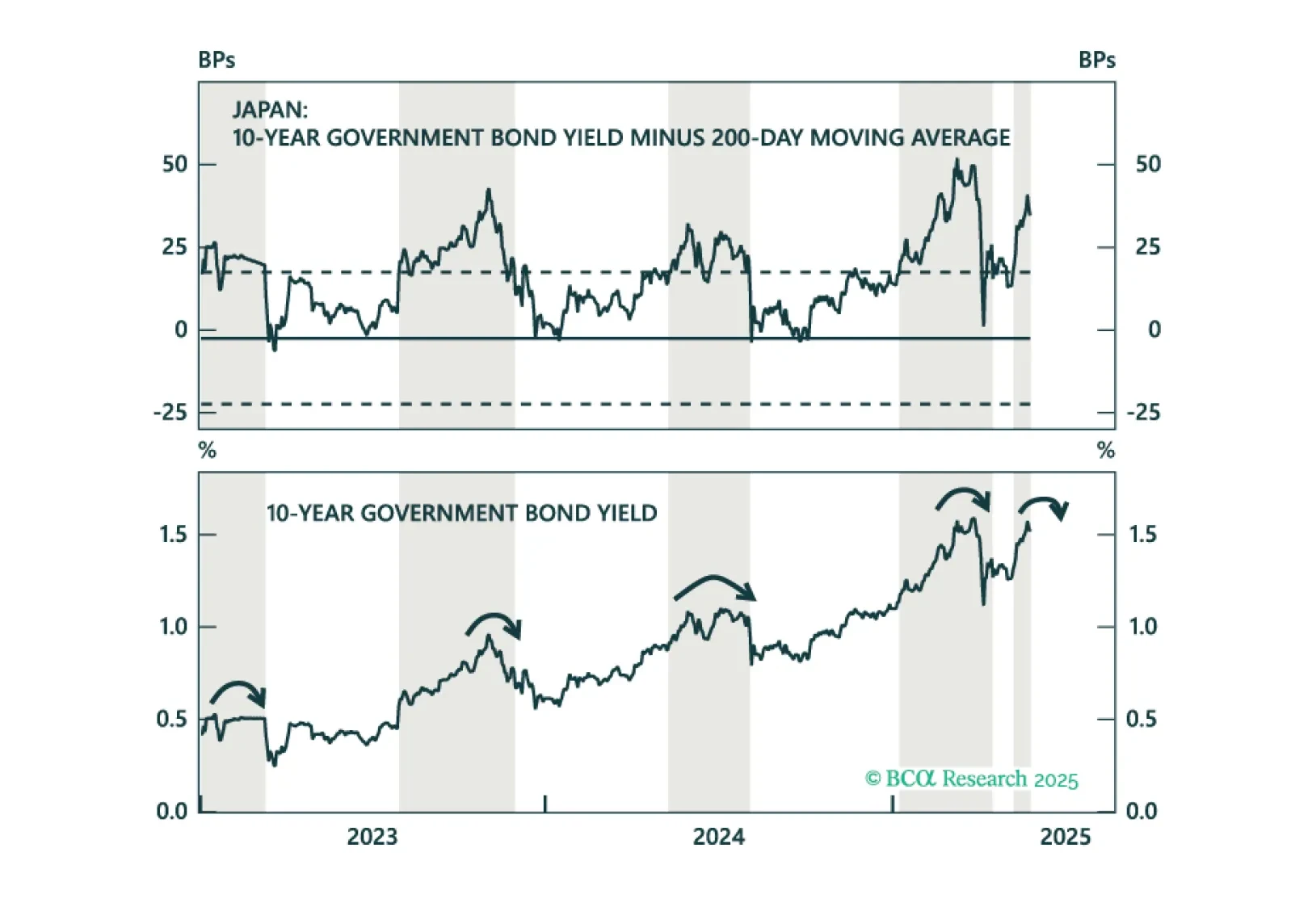

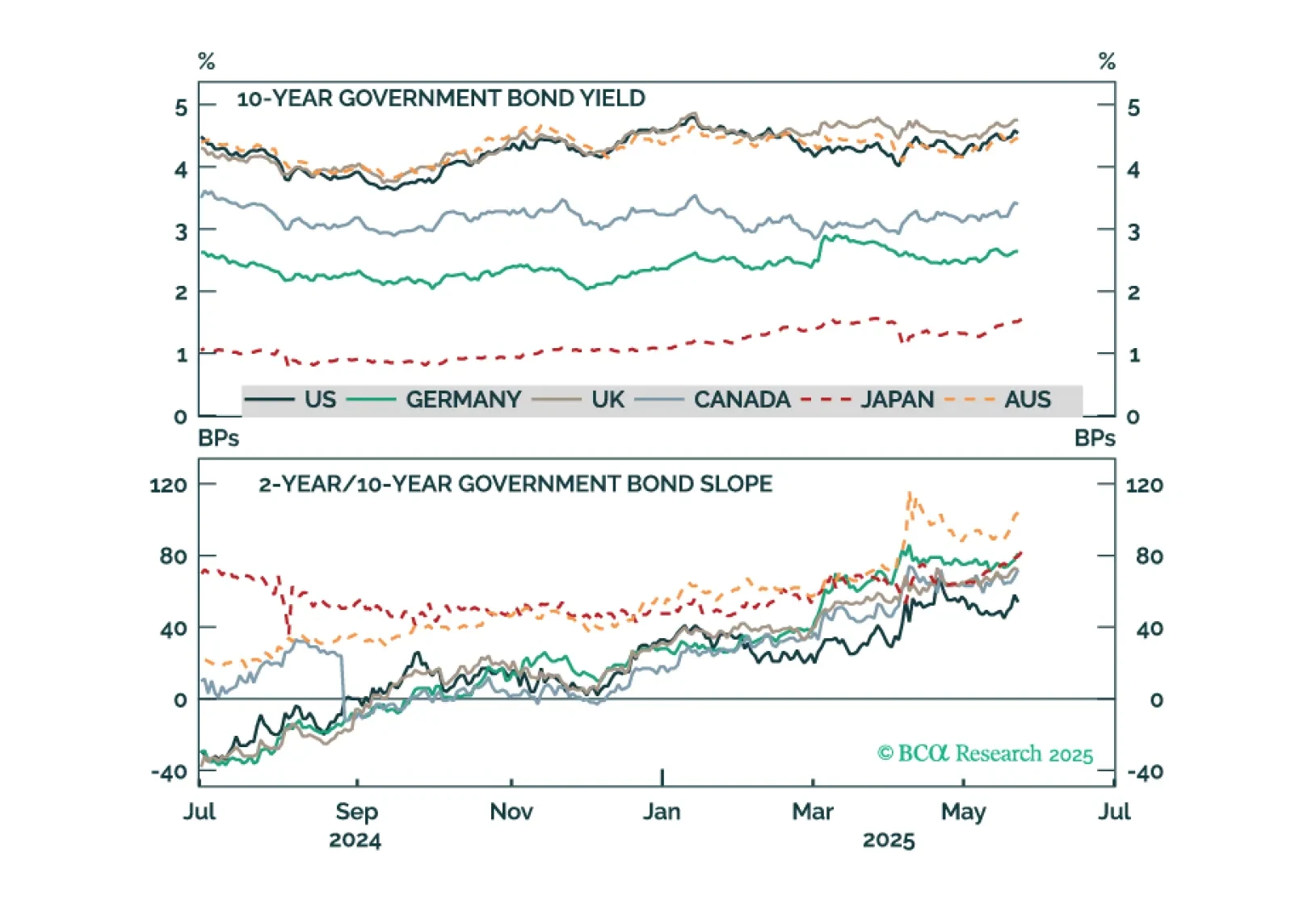

Are bond yields overextended? We introduce a new global technical indicator that helps spot mean-reversion opportunities and shows which markets are nearing exhaustion.