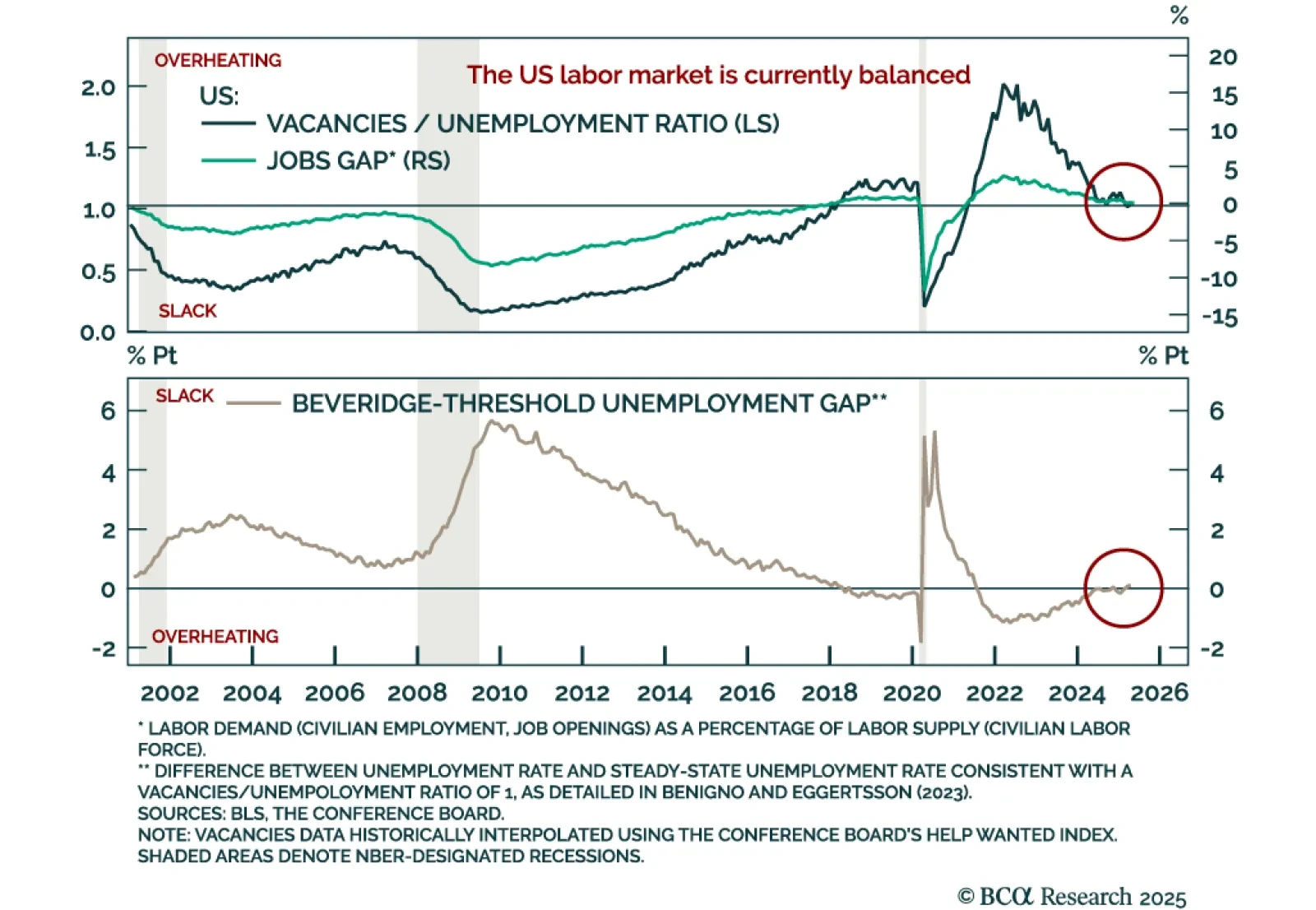

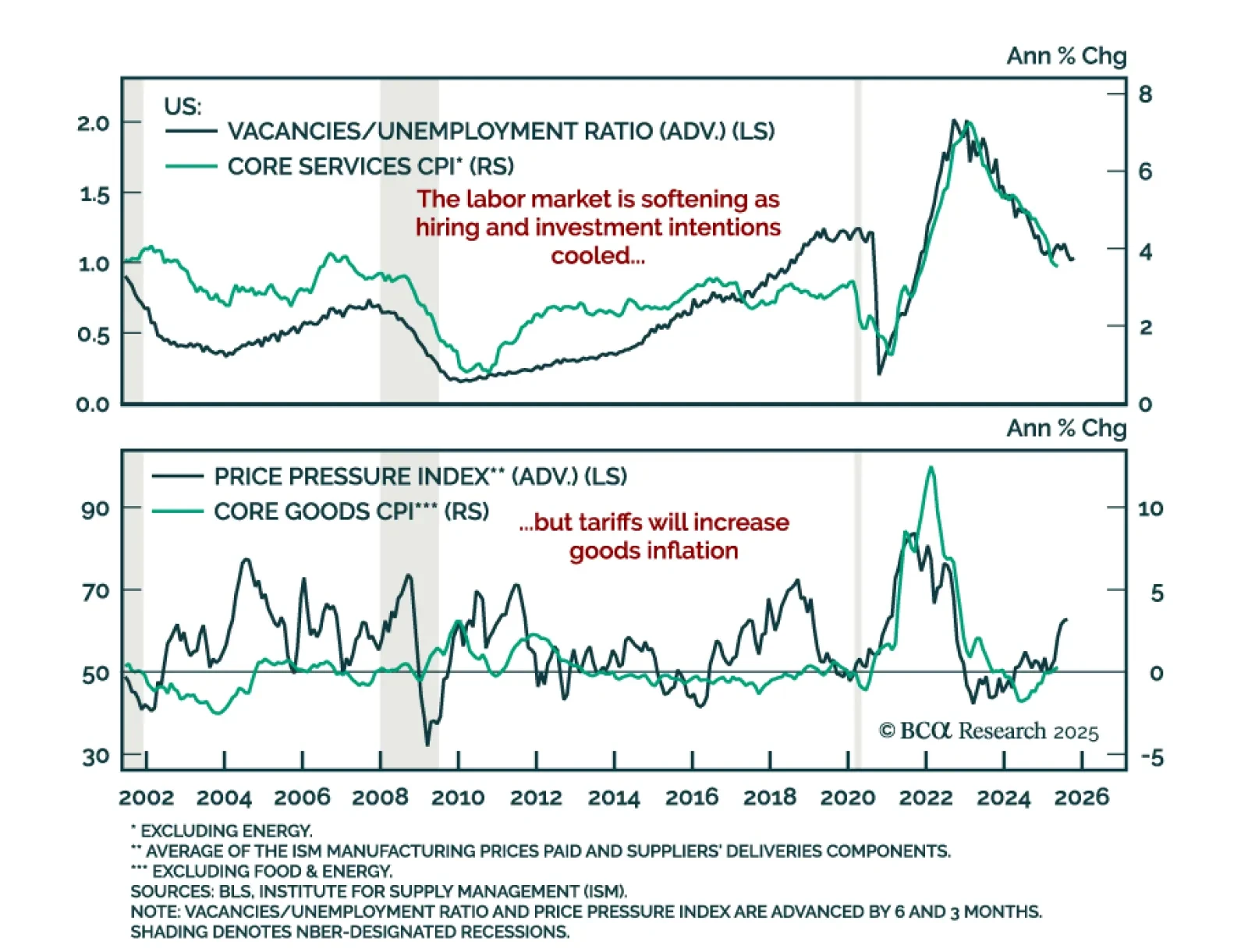

The US labor market appears balanced but at a pivotal point, with further weakness likely to prompt a shift to maximum defensiveness. After running the hottest since the 1960s, the labor market has gradually cooled. That rebalancing…

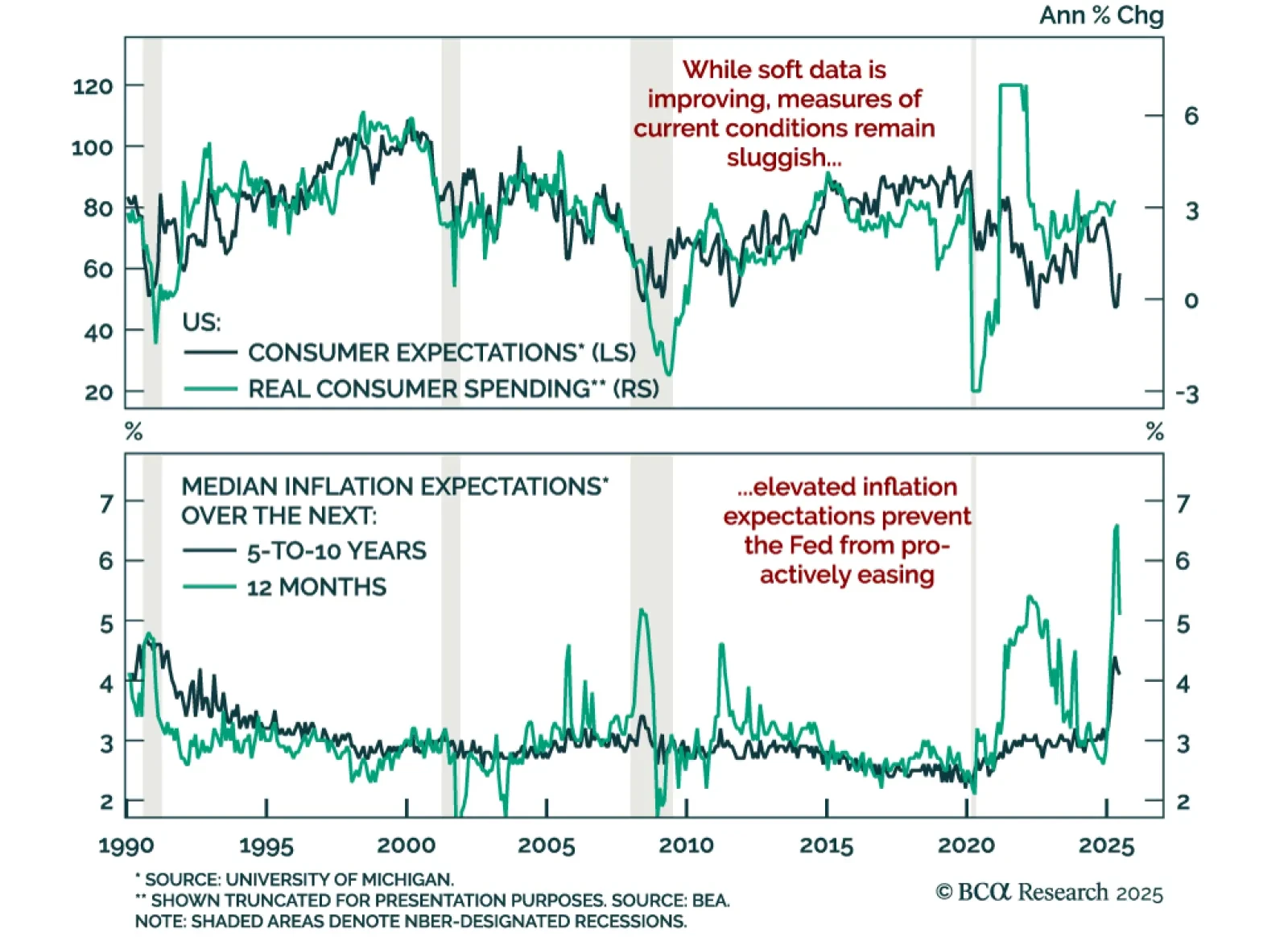

While consumer sentiment is rebounding, sticky inflation expectations and slowing growth warrant staying long duration and steepeners. The preliminary June University of Michigan Consumer Sentiment Index surprised to the upside,…

Further labor market deterioration would trigger a shift to maximum underweight in equities. While soft indicators have markedly deteriorated, hard labor data remains relatively resilient, though it has clearly weakened.…

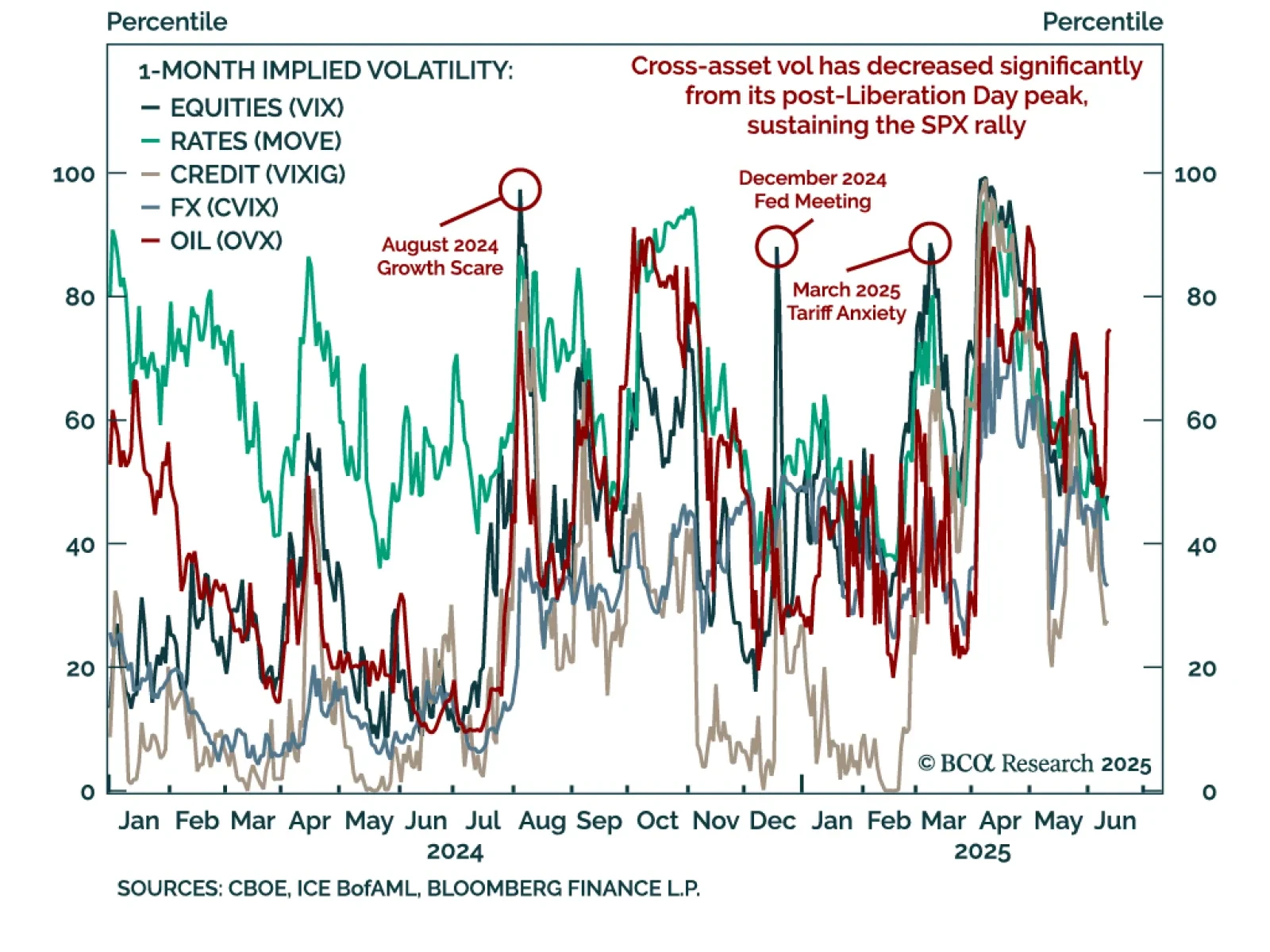

The S&P 500 has breached 6000 and may retest all-time highs, but we would not recommend chasing the rally. Risk assets have shrugged off recession fears, with stress indicators like the VIX, SKEW, and VVIX still subdued,…

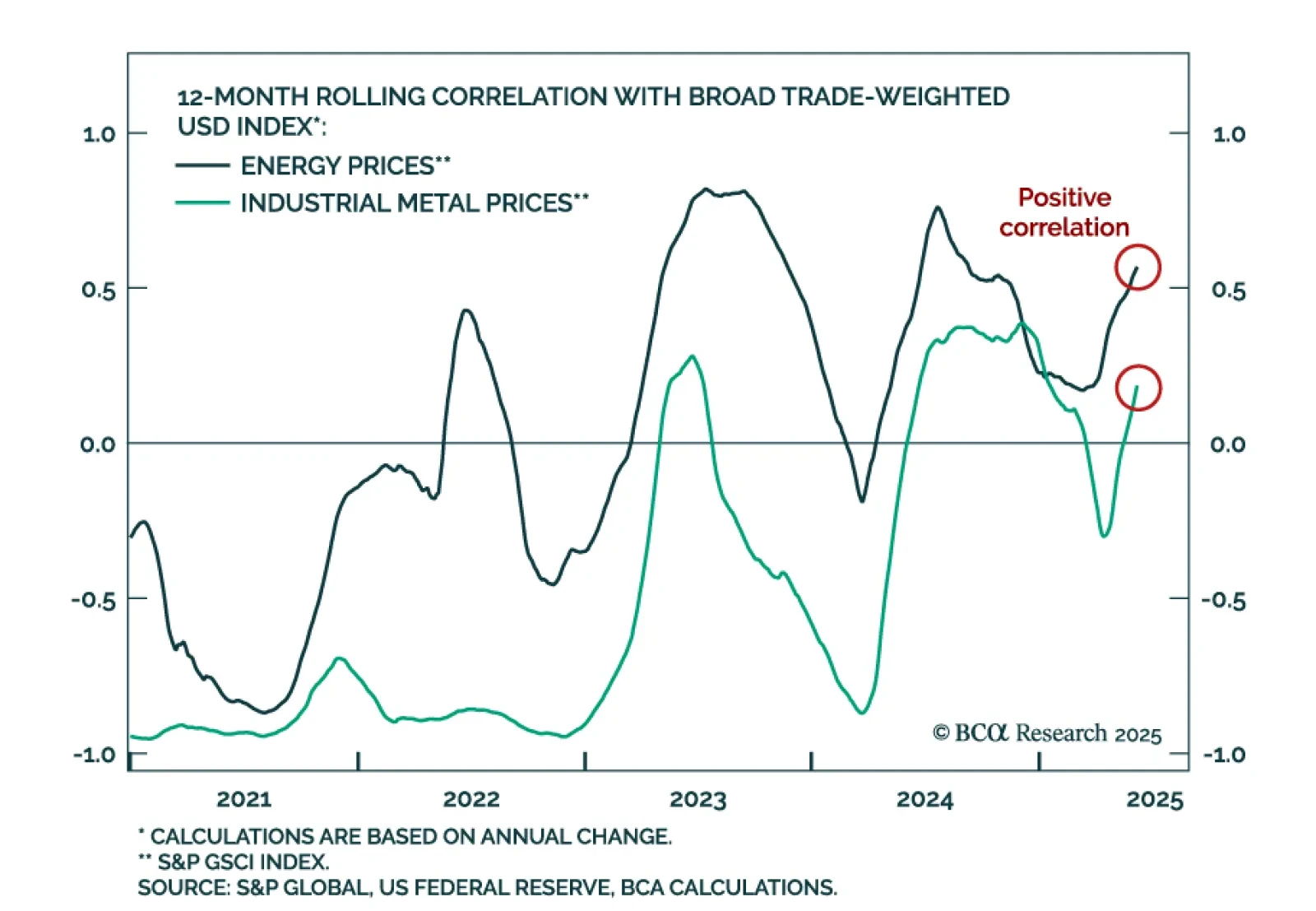

Our Commodity strategists see a breakdown of historical commodity correlations. The US dollar now shows a positive correlation with commodities, particularly energy, and a weaker dollar will no longer guarantee upside for commodity…

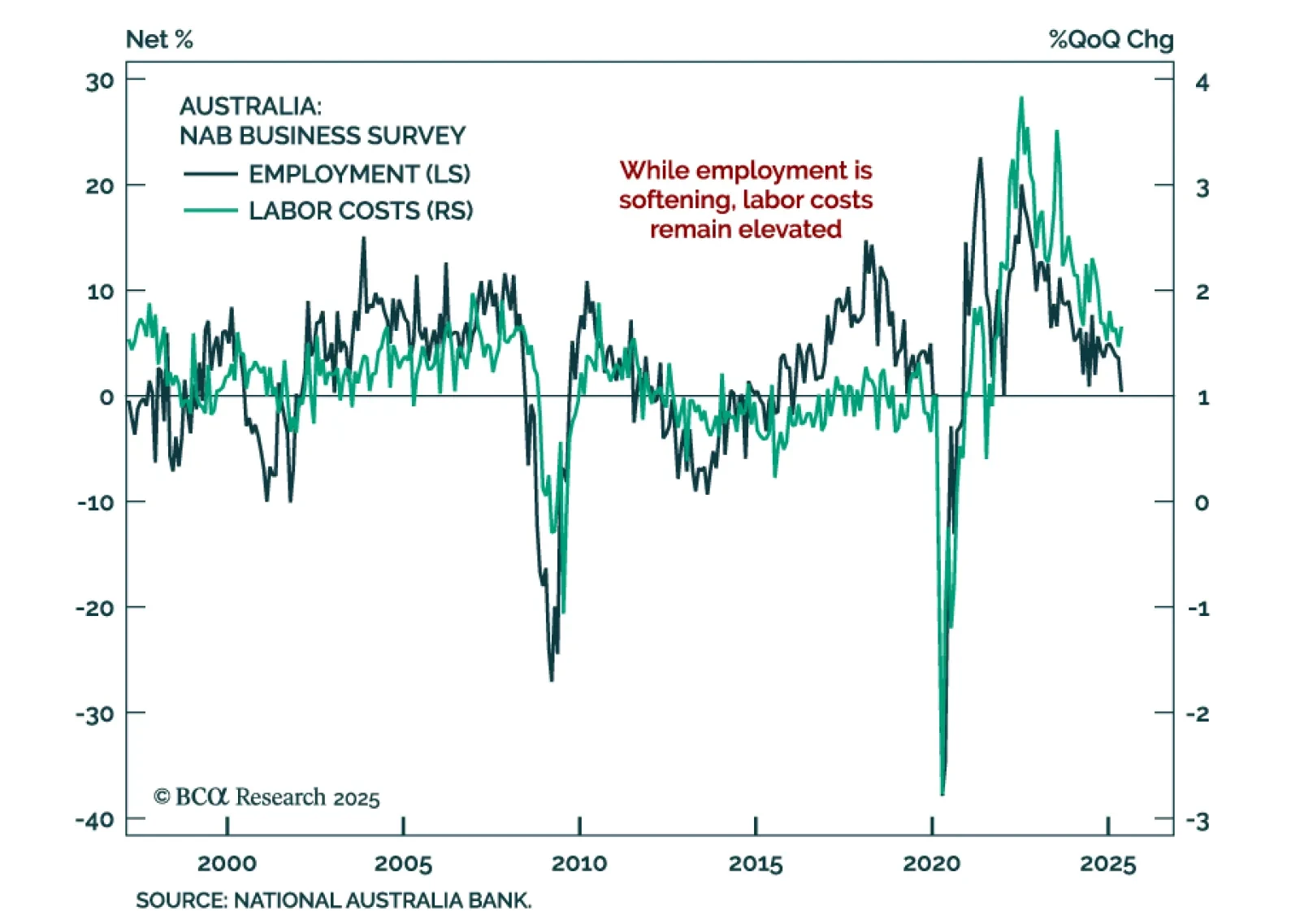

Mixed signals from the NAB Business Survey reinforce our underweight in Australian government bonds and long AUD exposure. In May, business confidence rebounded slightly, rising to 2 from -1, but current conditions dipped to 0 from 2…

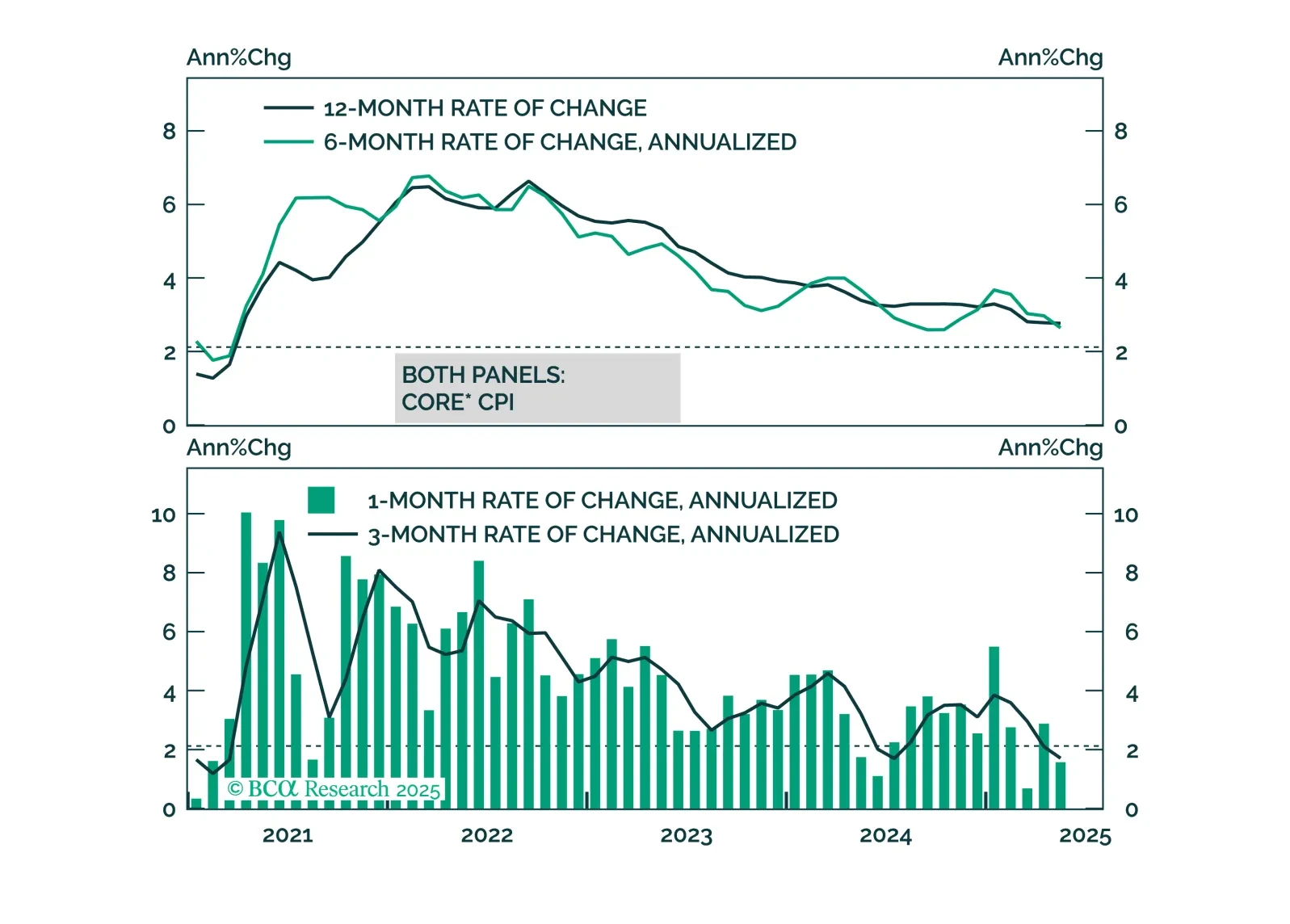

Colder May CPI reinforces our overweight in government bonds and tactical steepener trades as growth slows and the Fed stays cautious. Headline inflation rose 0.1% (2.4% y/y), below expectations, as did core CPI (2.8% y/y). Goods…

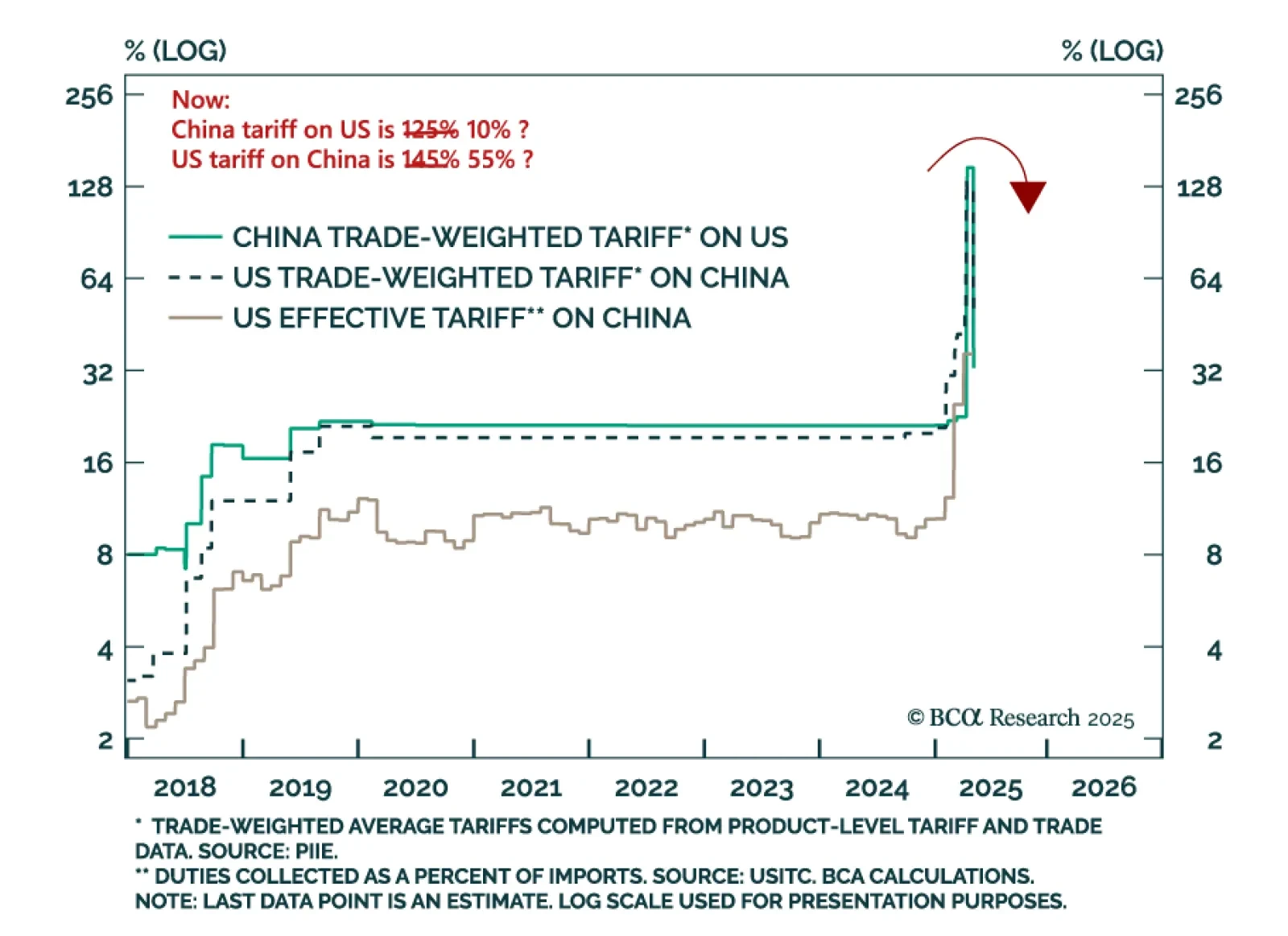

The US-China tariff deal confirms one thing: markets are still priced for perfection, with little upside even if a recession is dodged. The London negotiations yielded a partial agreement: The US will reduce tariffs, and China will…

While we anticipate higher inflation in June, it looks increasingly likely that the price impact from tariffs will be less aggressive and long-lasting than many feared.

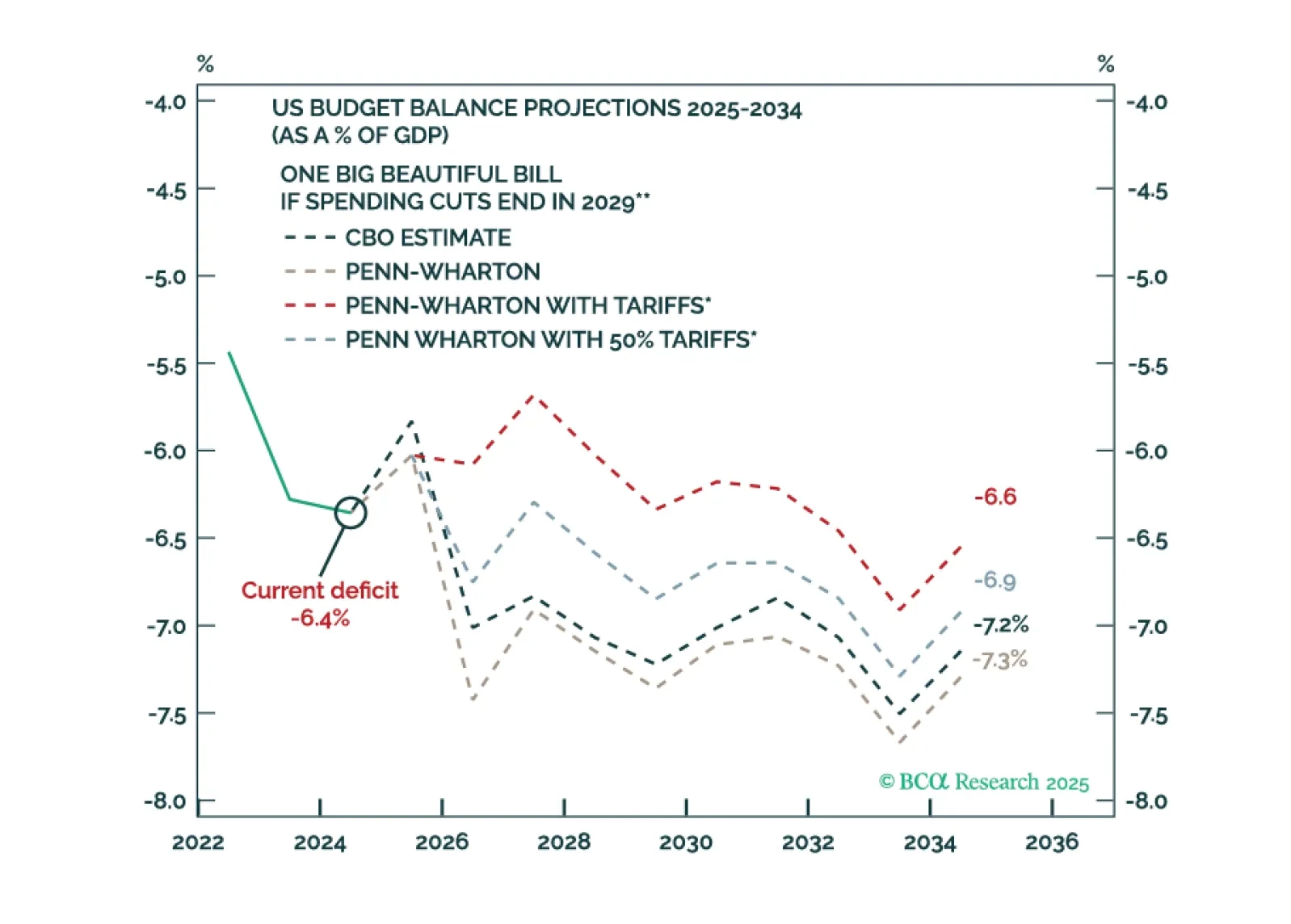

Bond market volatility will spike again in the near term. The Fed is committed to an easing cycle yet the Trump administration’s signature fiscal policy action will stimulate the economy. Tariffs are supposed to keep the budget…