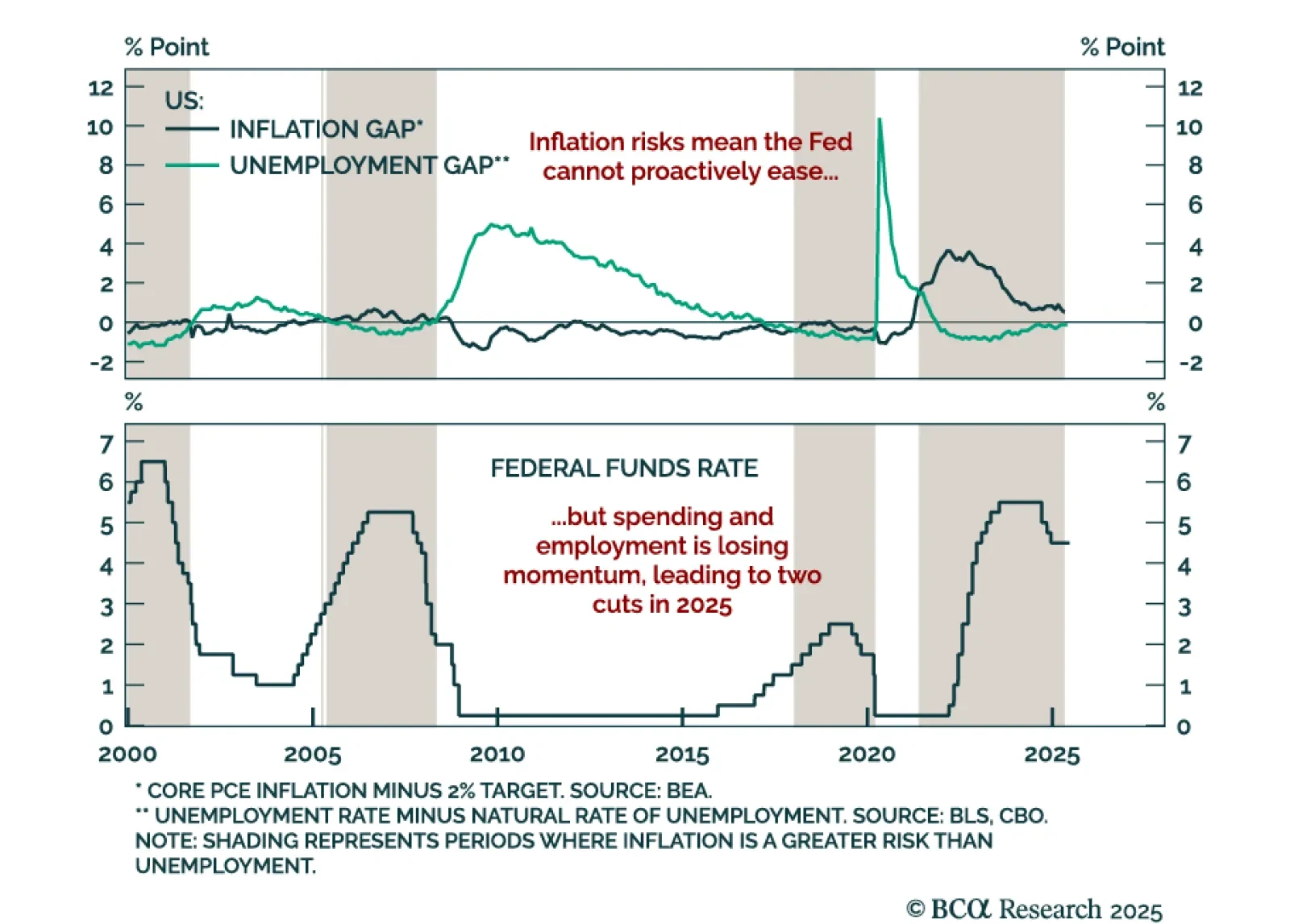

The Fed held rates steady between 4.25% to 4.5% and maintained a hawkish tilt despite soft data, reinforcing our long-duration and steepener trades. The updated dot plot showed upward revisions to both inflation and unemployment…

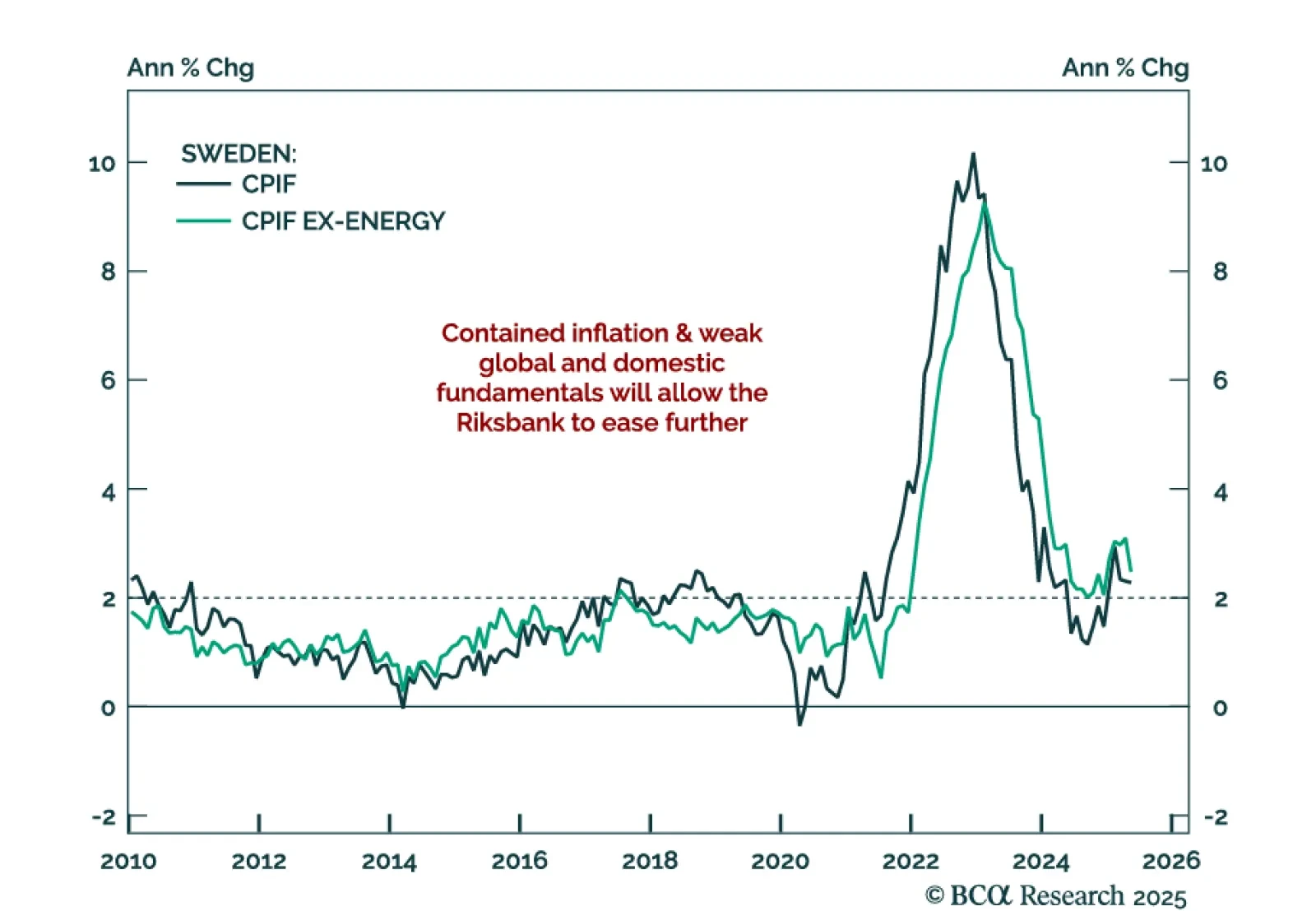

Sweden’s economic fragility and disinflation support further easing, reinforcing our long SEK rates and NOK/SEK trades. The Riksbank cut rates by 25 bps to 2.0% and projected an additional cut, consistent with prior OIS pricing.…

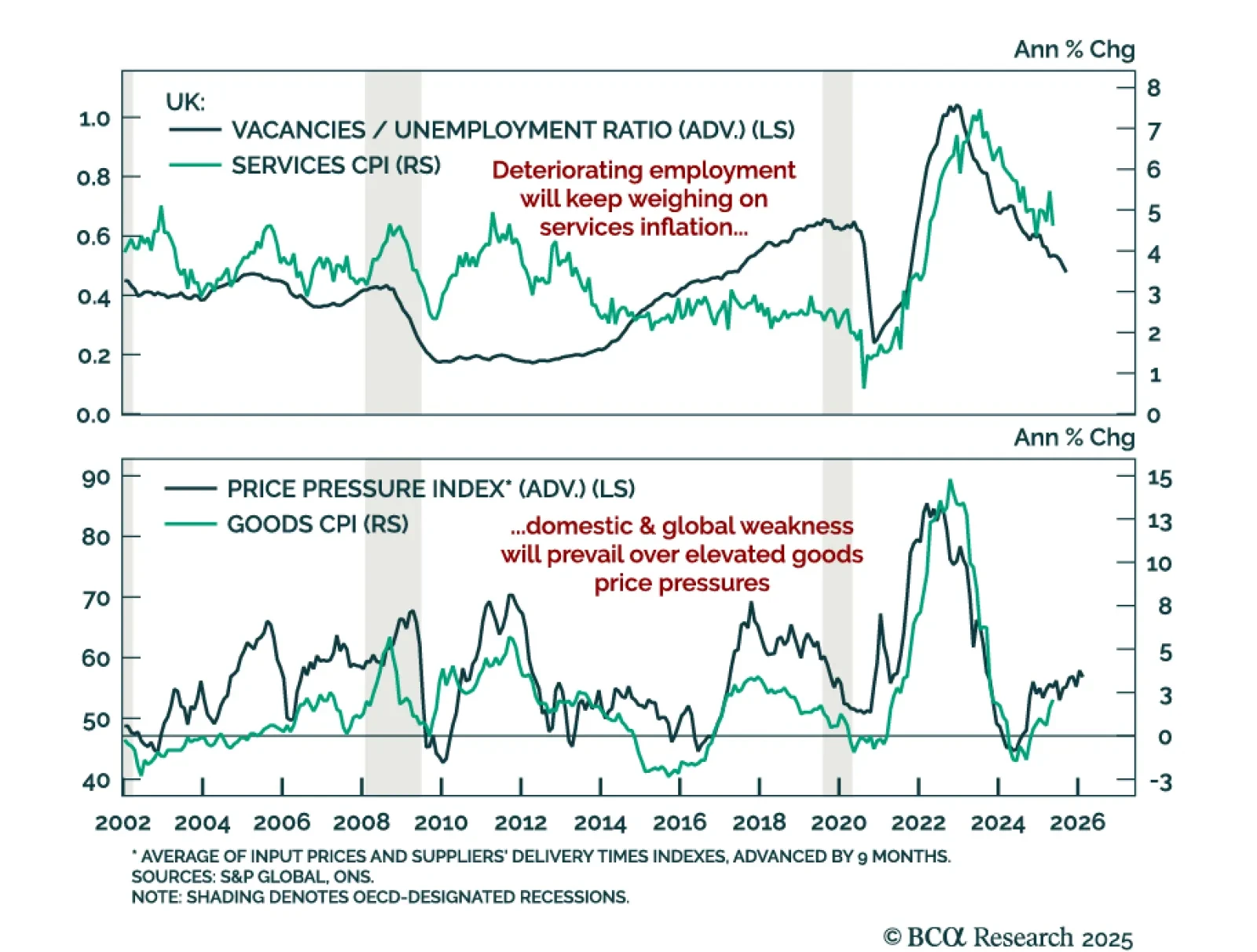

UK disinflation and labor market softening support our overweight in Gilts and short GBP trade. UK CPI came in slightly hotter than expected in May, with headline inflation at 3.4% y/y (vs. 3.5% in April) and core CPI meeting…

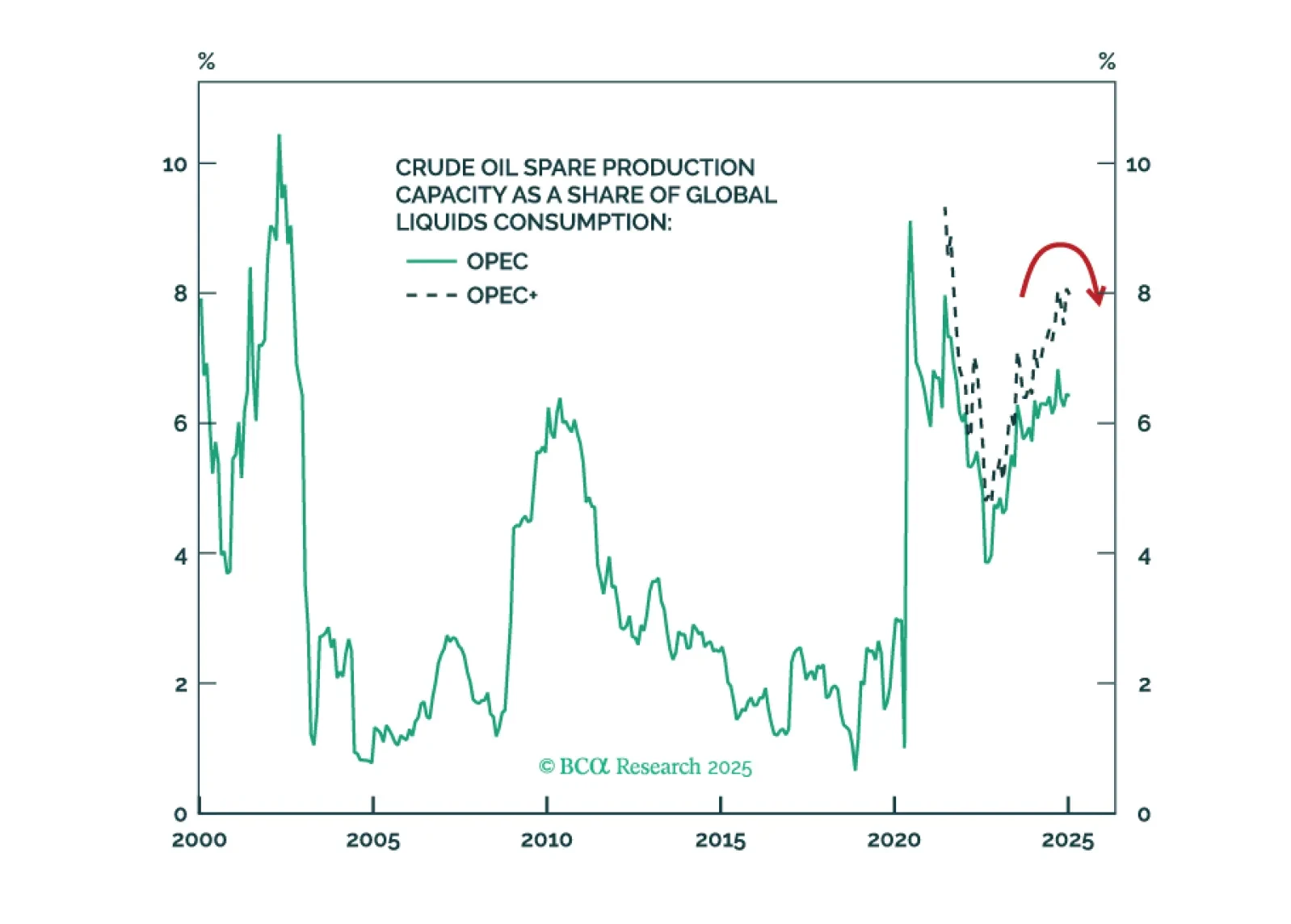

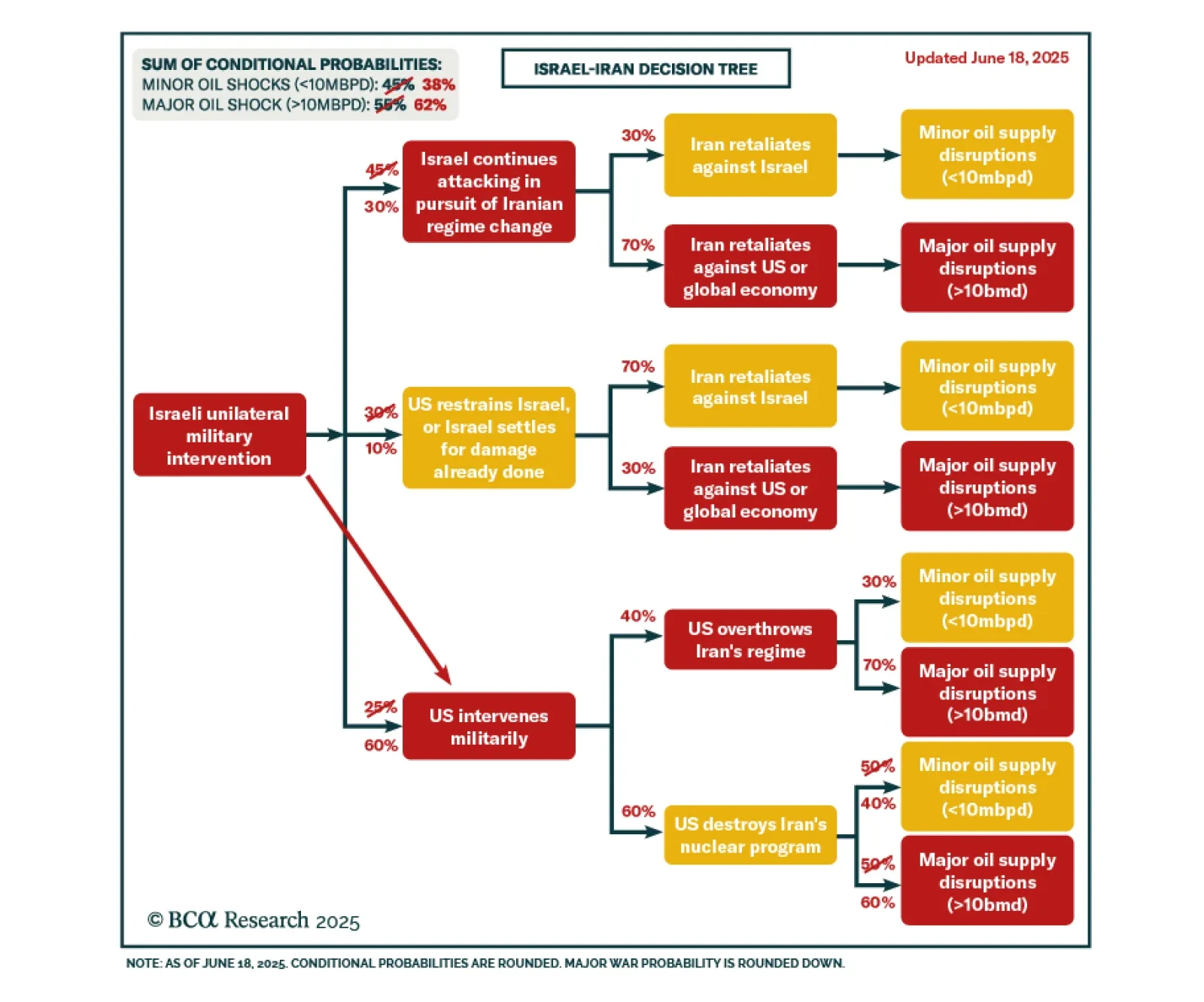

Our Geopolitical strategists expect US involvement in Israel’s military campaign against Iran, raising near-term risks to oil supply and market stability. Iran is likely to retaliate by targeting regional oil production and transport…

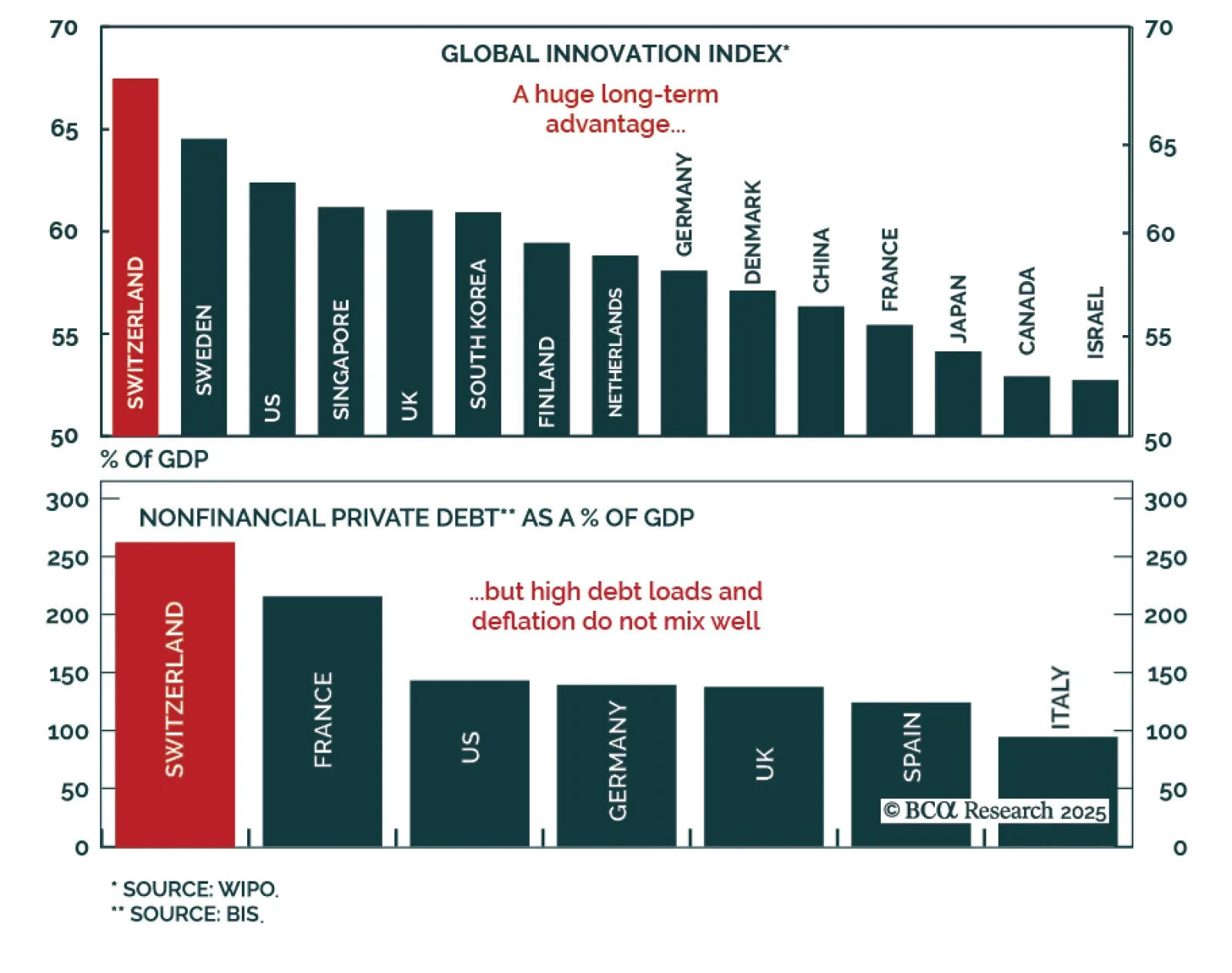

Our European Investment strategists believe Switzerland is no longer a tactical haven and recommend underweighting CHF and Swiss equities in favor of Swiss bonds. The country retains strong structural fundamentals: High productivity…

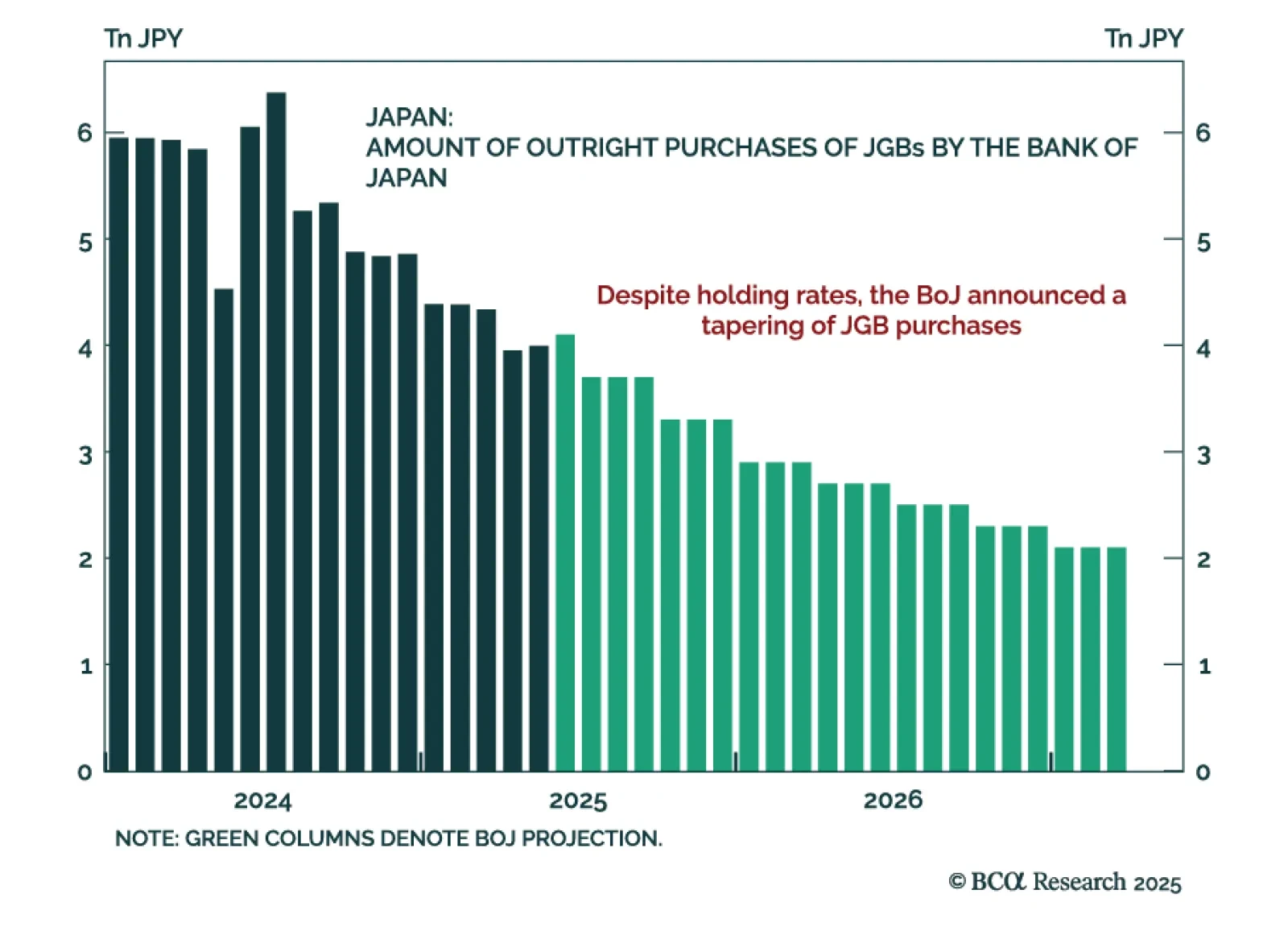

The BoJ’s decision to keep rates unchanged while announcing a tapering of bond purchases reinforces our underweight stance on JGBs and long bias on the yen. While the decision was broadly neutral, the reduction in asset purchases…

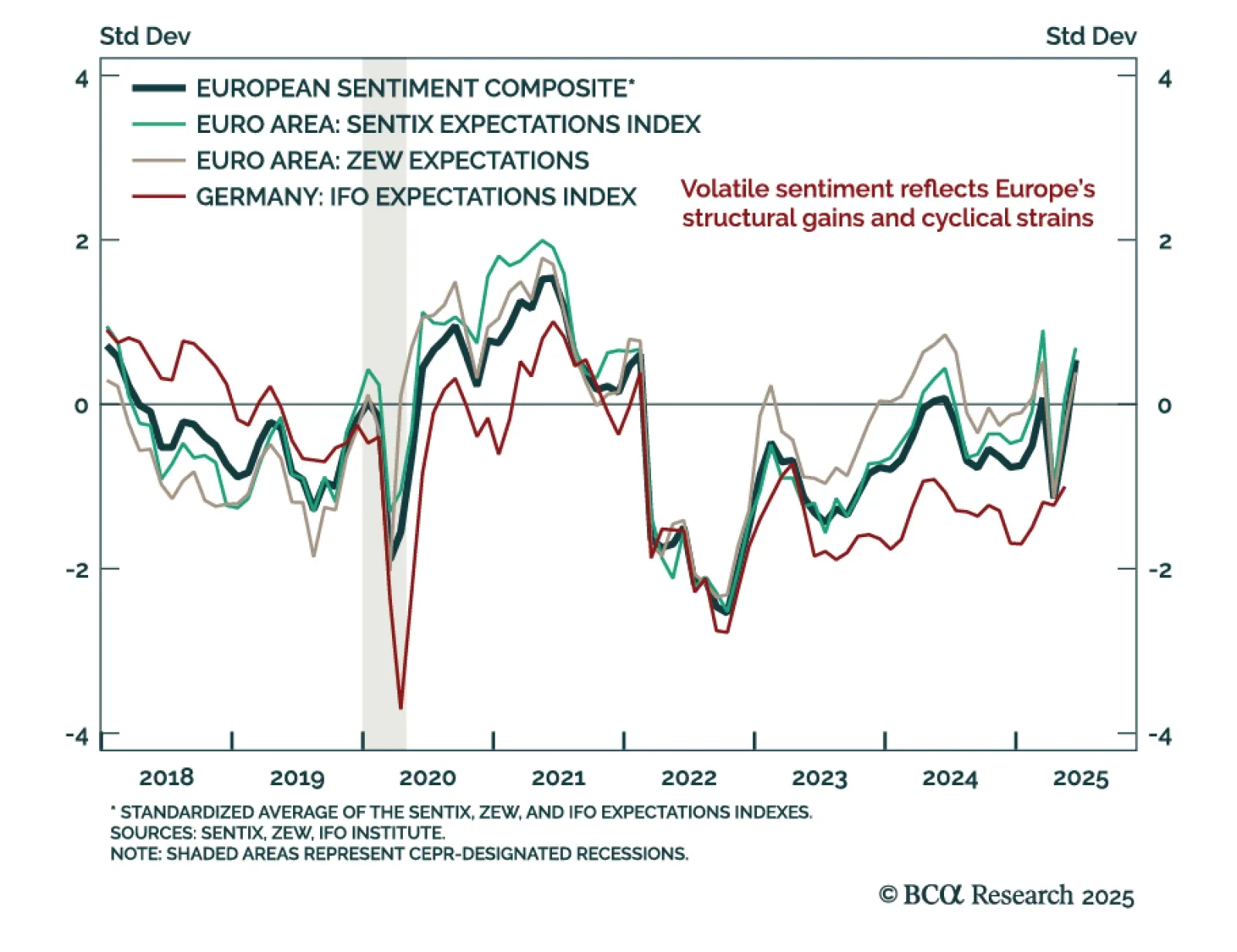

ZEW expectations jumped in May, but underlying macro fragility supports a cautious stance on eurozone assets. The ZEW expectations index for the euro area rose to 35.3 from 11.6, with Germany also beating expectations. The current…

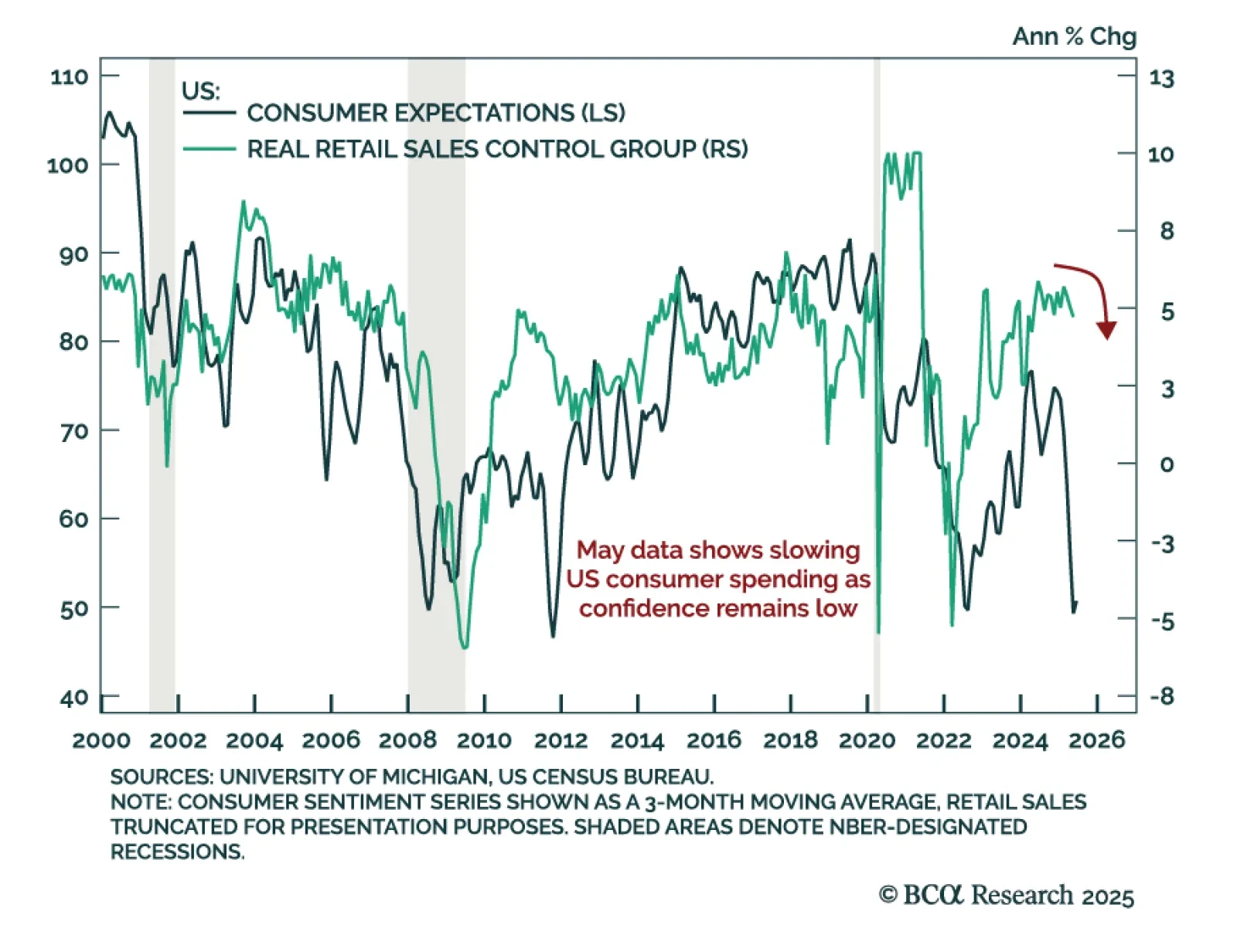

US May retail sales missed expectations, reinforcing our defensive allocation stance. Headline sales fell 0.9% m/m from a downwardly revised -0.1%. Core sales dropped 0.1%, while the control group rose 0.4%, beating estimates. Auto…

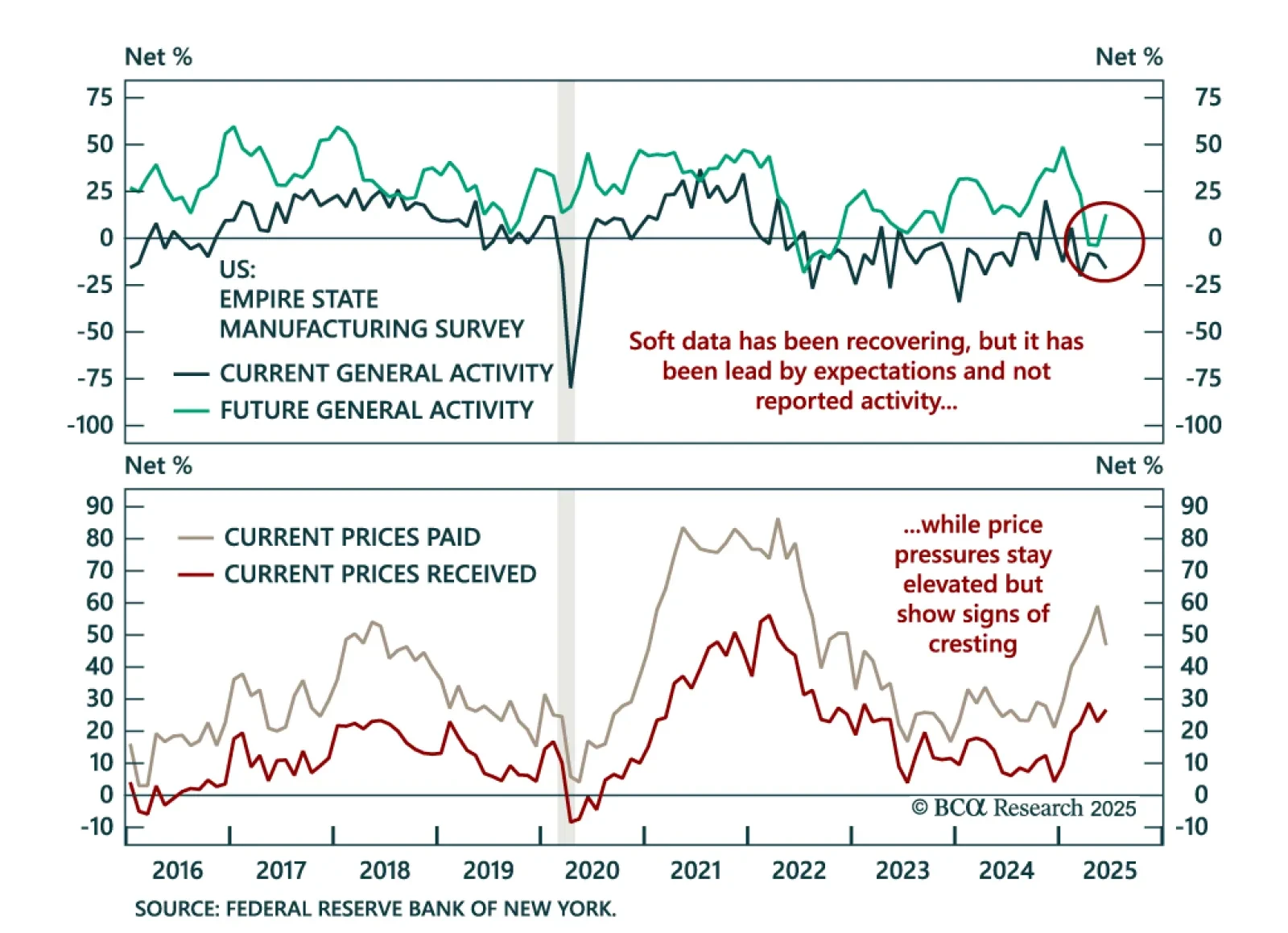

Worsening manufacturing data reinforces our defensive stance as expectations rebound but observed activity continues to deteriorate. The June Empire State Manufacturing Survey fell to -16.0 from -9.2, well below estimates.…

Investors should hold gold, build up some cash, tactically overweight US equities relative to global, and prepare for at least minor oil supply shocks – possibly major shocks – as the Israel-Iran war escalates.