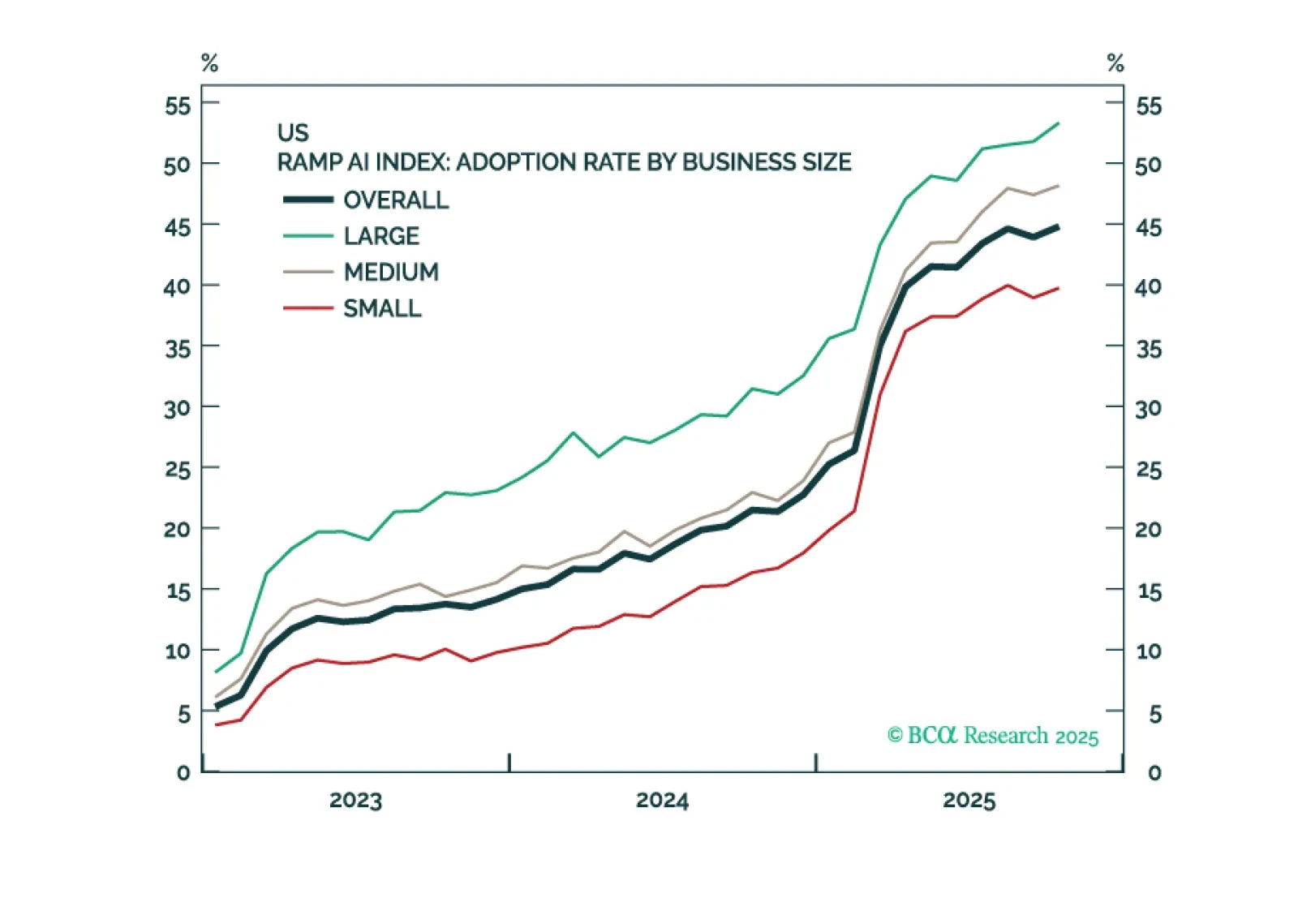

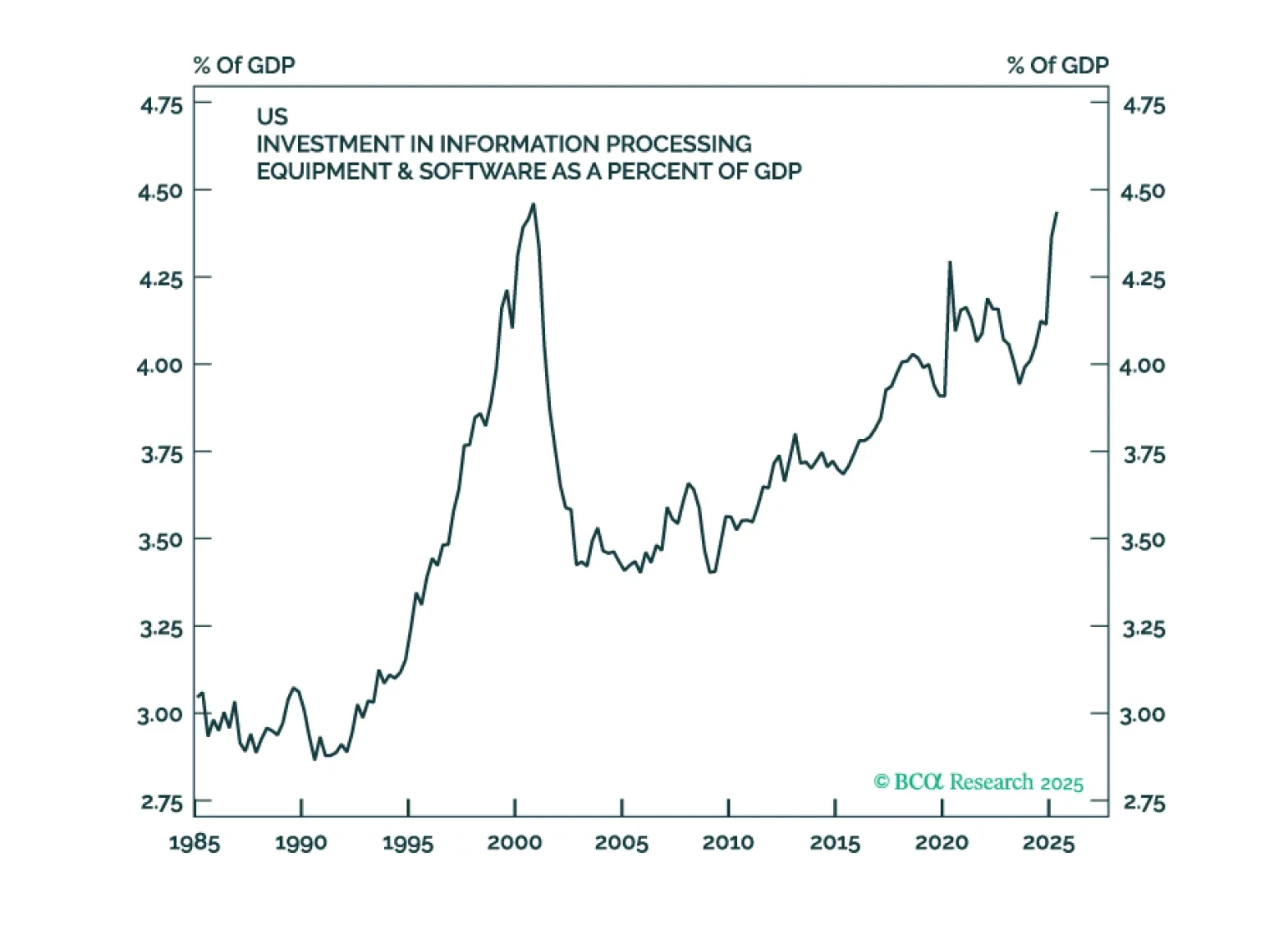

The odds have risen that we have reached a “Metaverse Moment” – a situation where investors punish AI companies for increasing capex. This warrants greater caution towards AI stocks specifically, and the broader S&P 500 more…

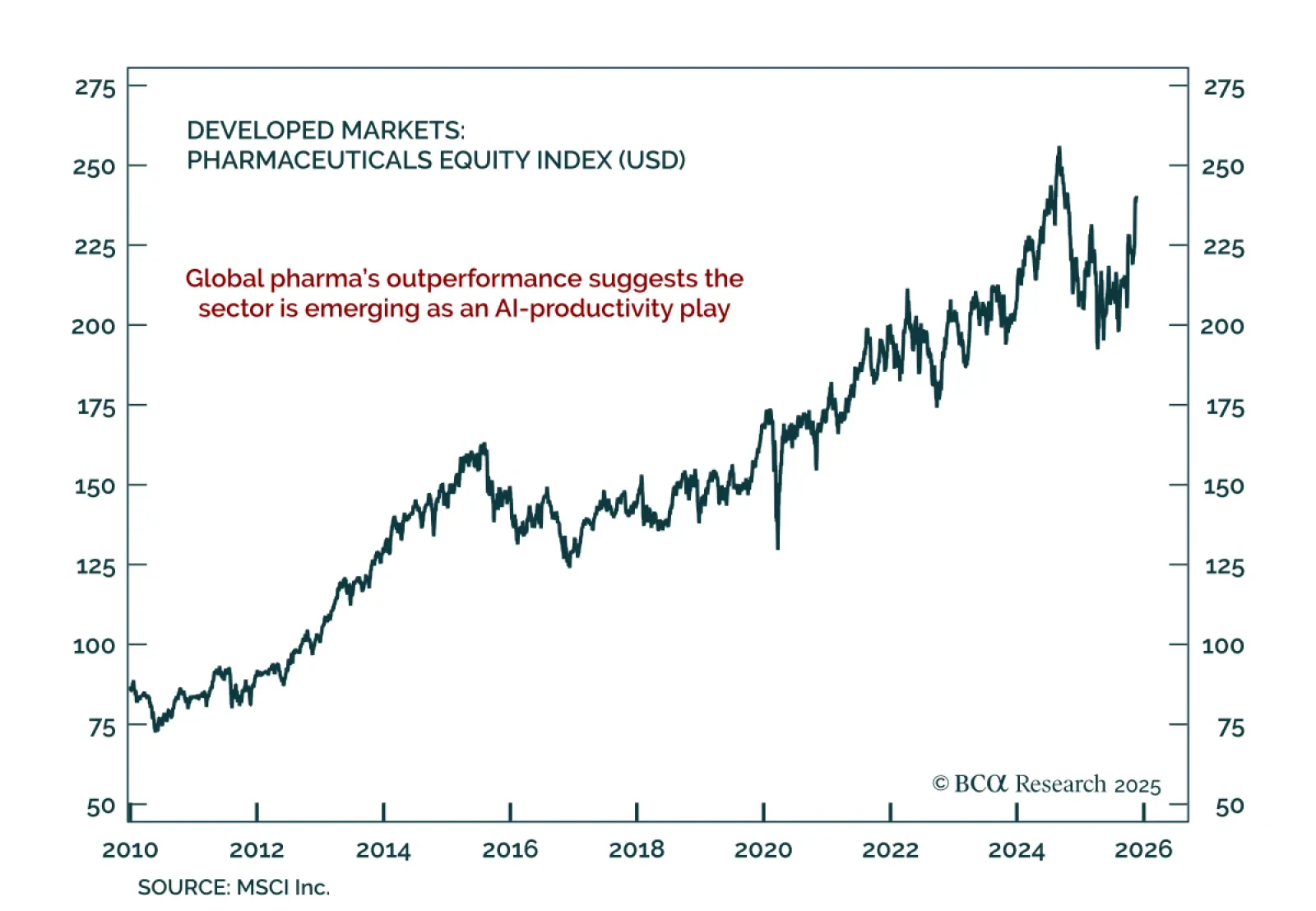

The global pharmaceuticals sector is signaling something more than defensive resilience. Our Chart of the Week comes from Mathieu Savary, Chief Strategist for Developed Markets excl. US, and shows a strong upward trend even as…

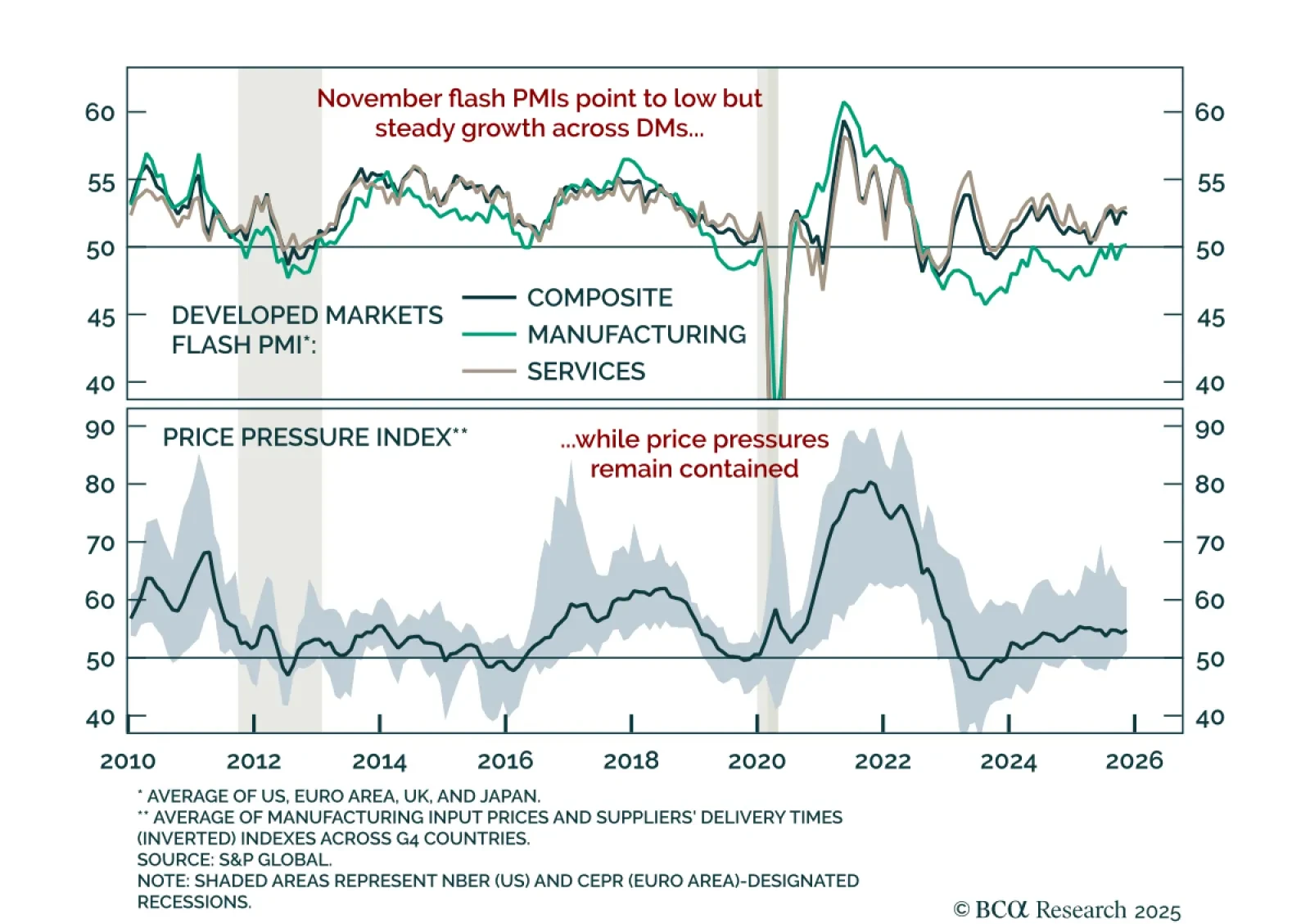

November flash PMIs confirmed sluggish global momentum, reinforcing a defensive stance with tactical support for the USD. The US composite PMI rose to 54.8, driven by stronger services but weaker manufacturing. The Euro area showed a…

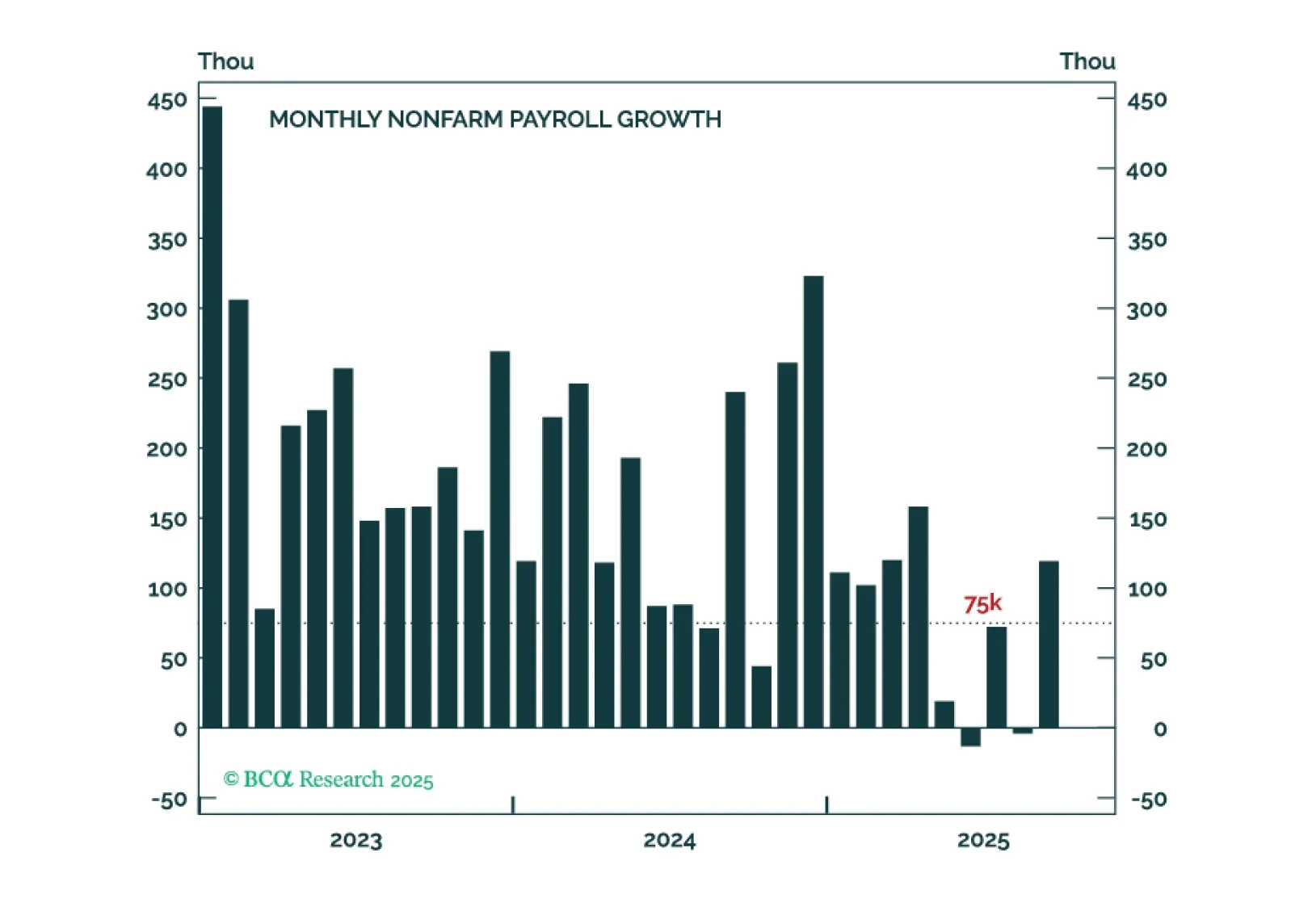

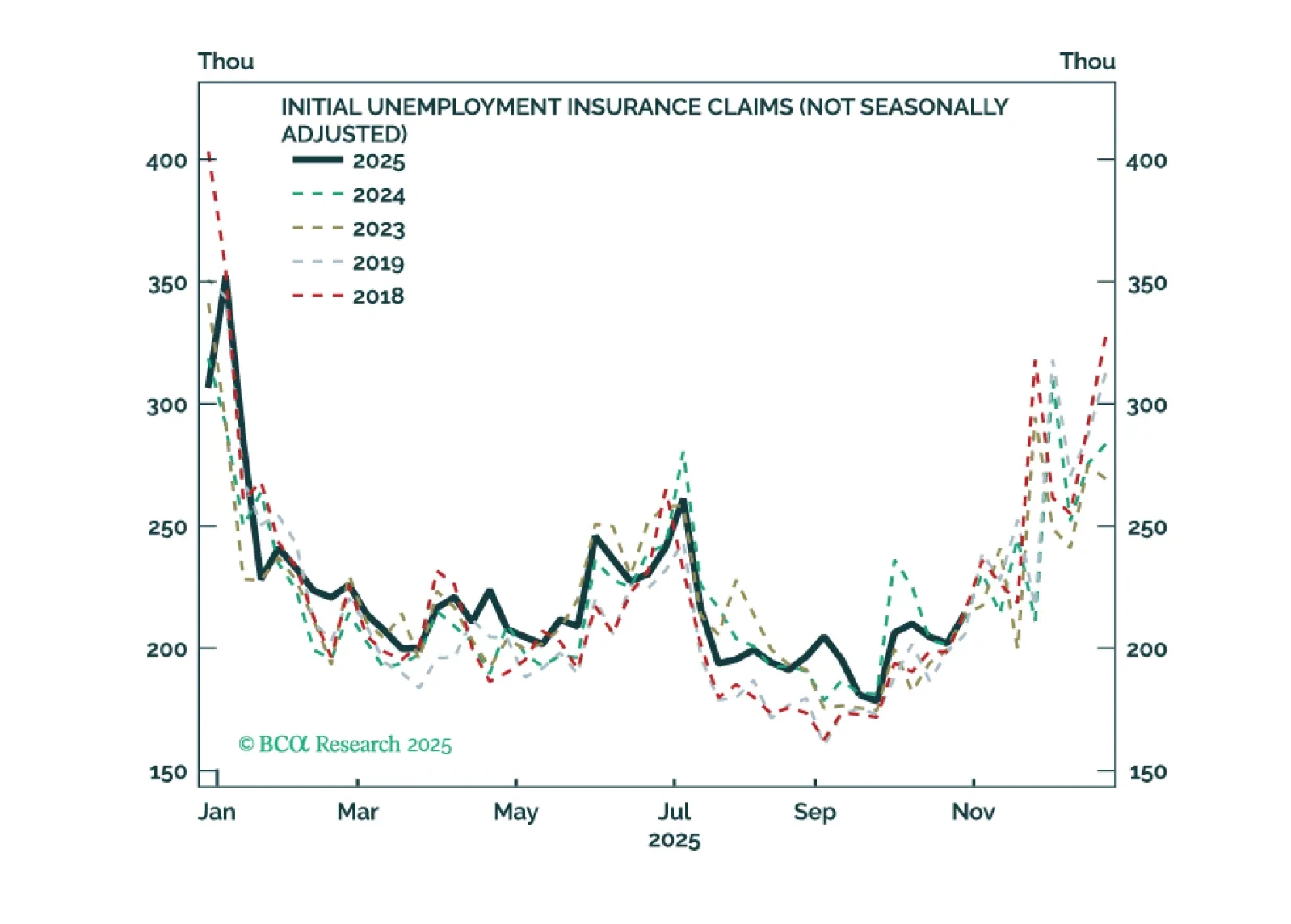

The September employment report probably won’t convince enough hawks to vote for a rate cut in December.

Our Portfolio Allocation Summary for November 2025.

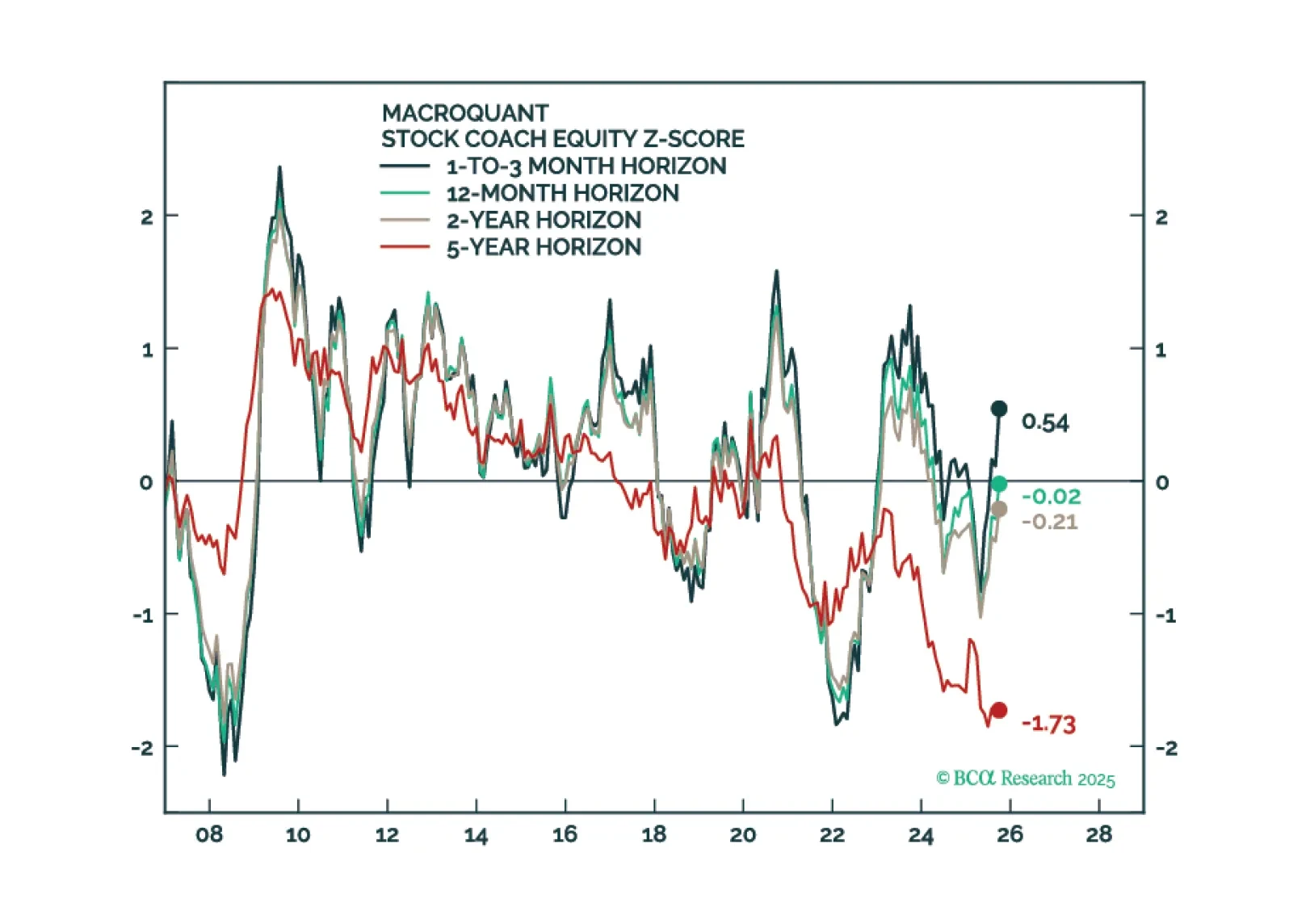

MacroQuant is tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold and copper.

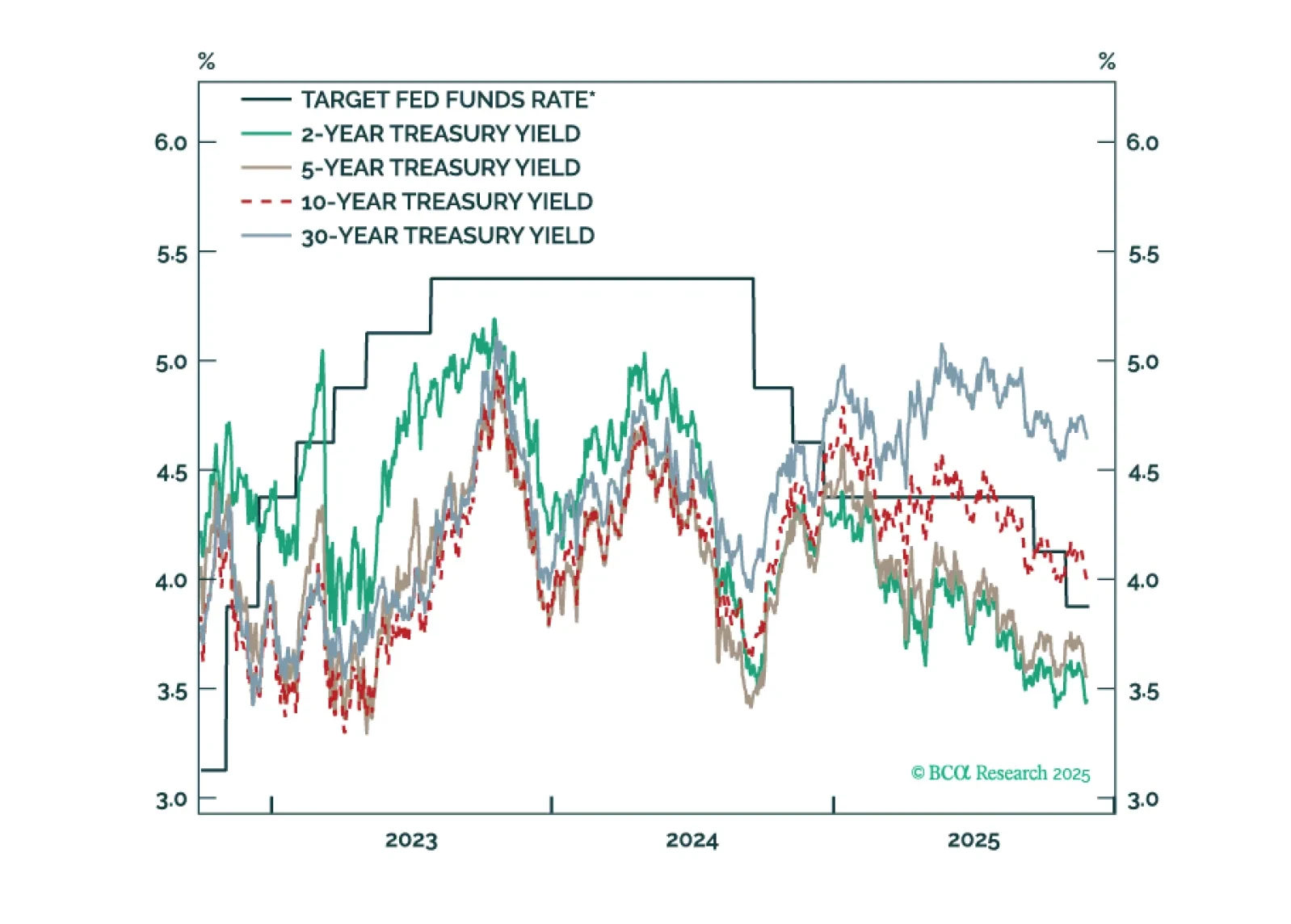

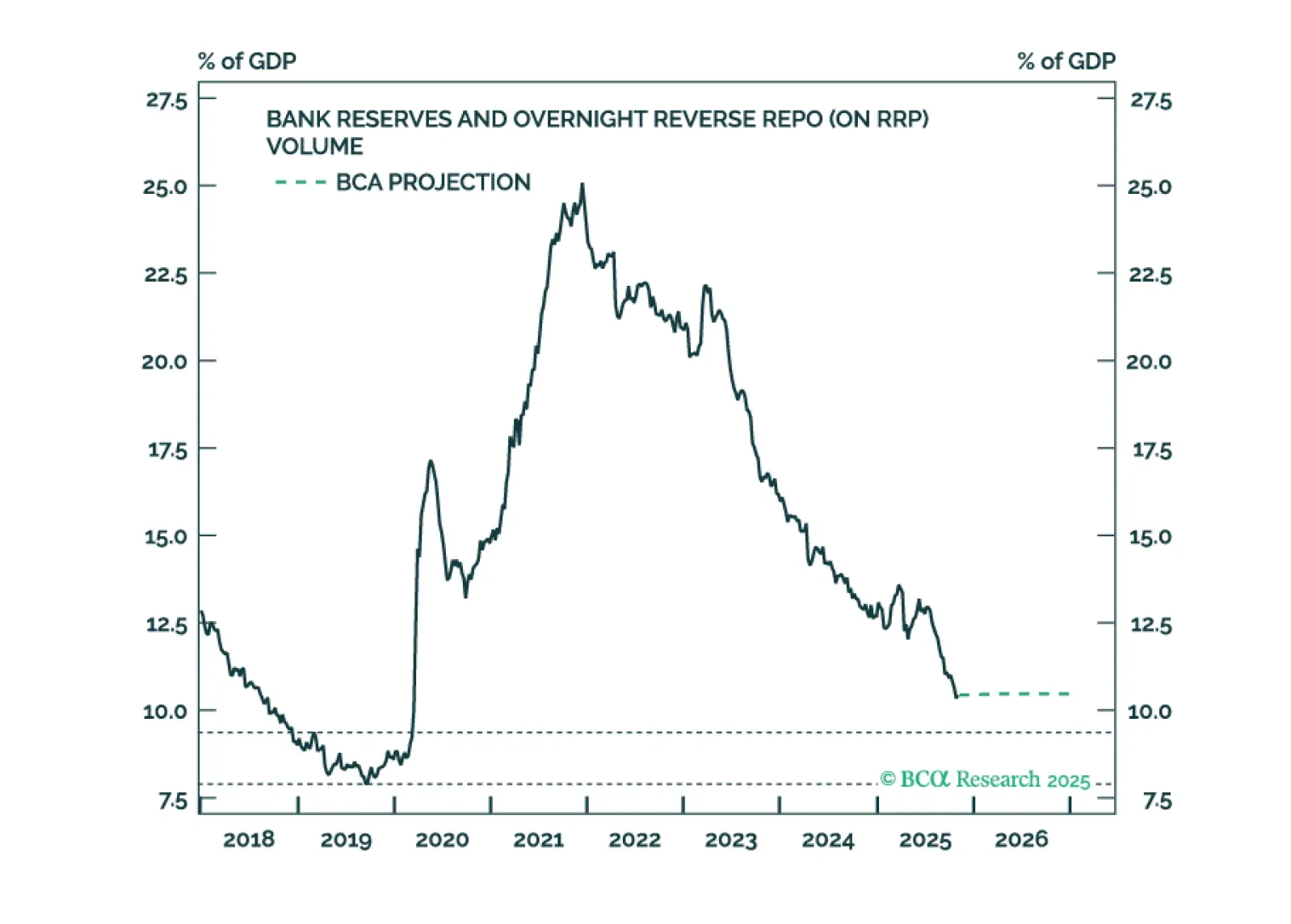

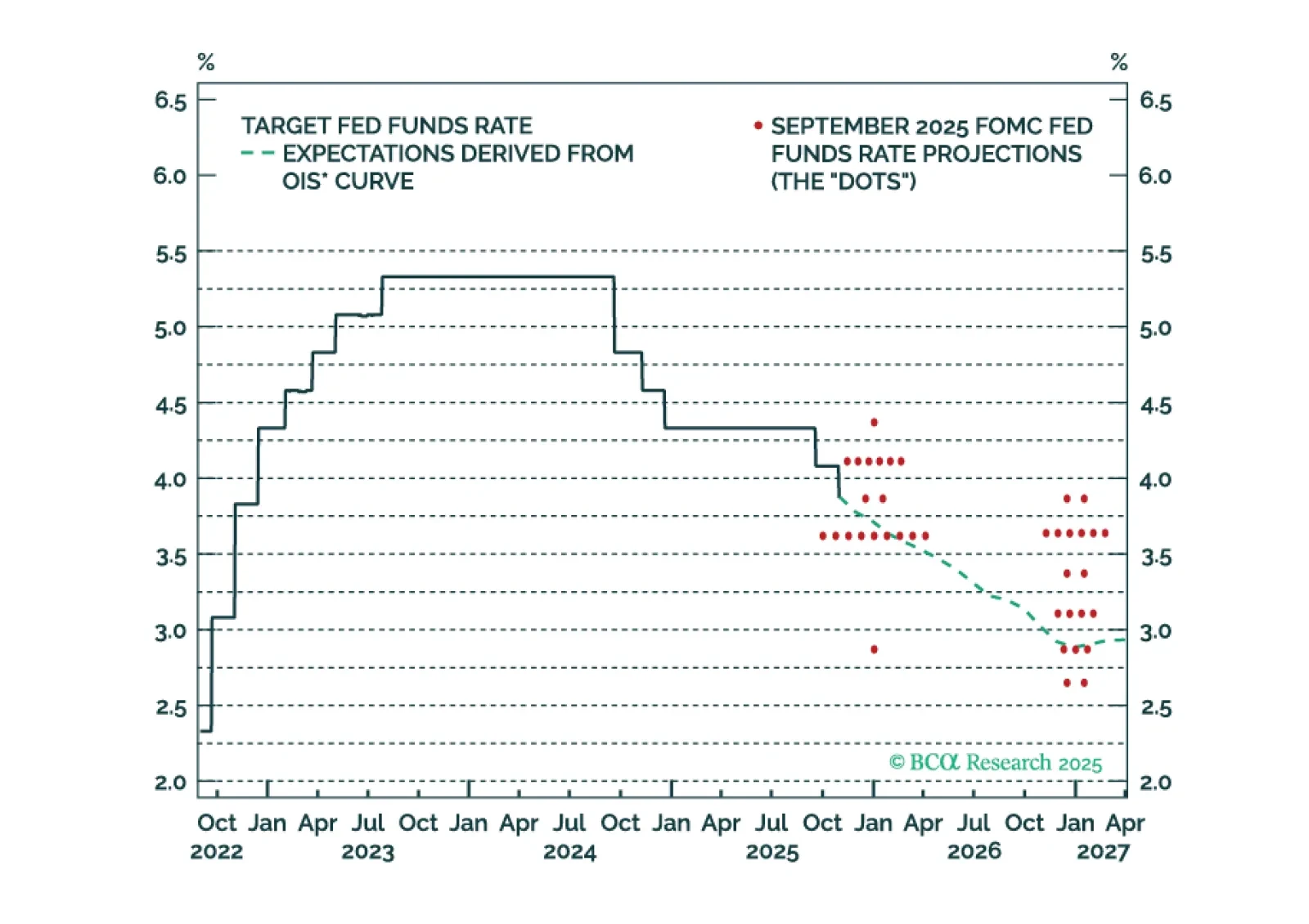

The Fed cut rates today, but a follow-up rate cut in December is uncertain. It will depend, in large part, on who wins a debate about the neutral rate of interest.