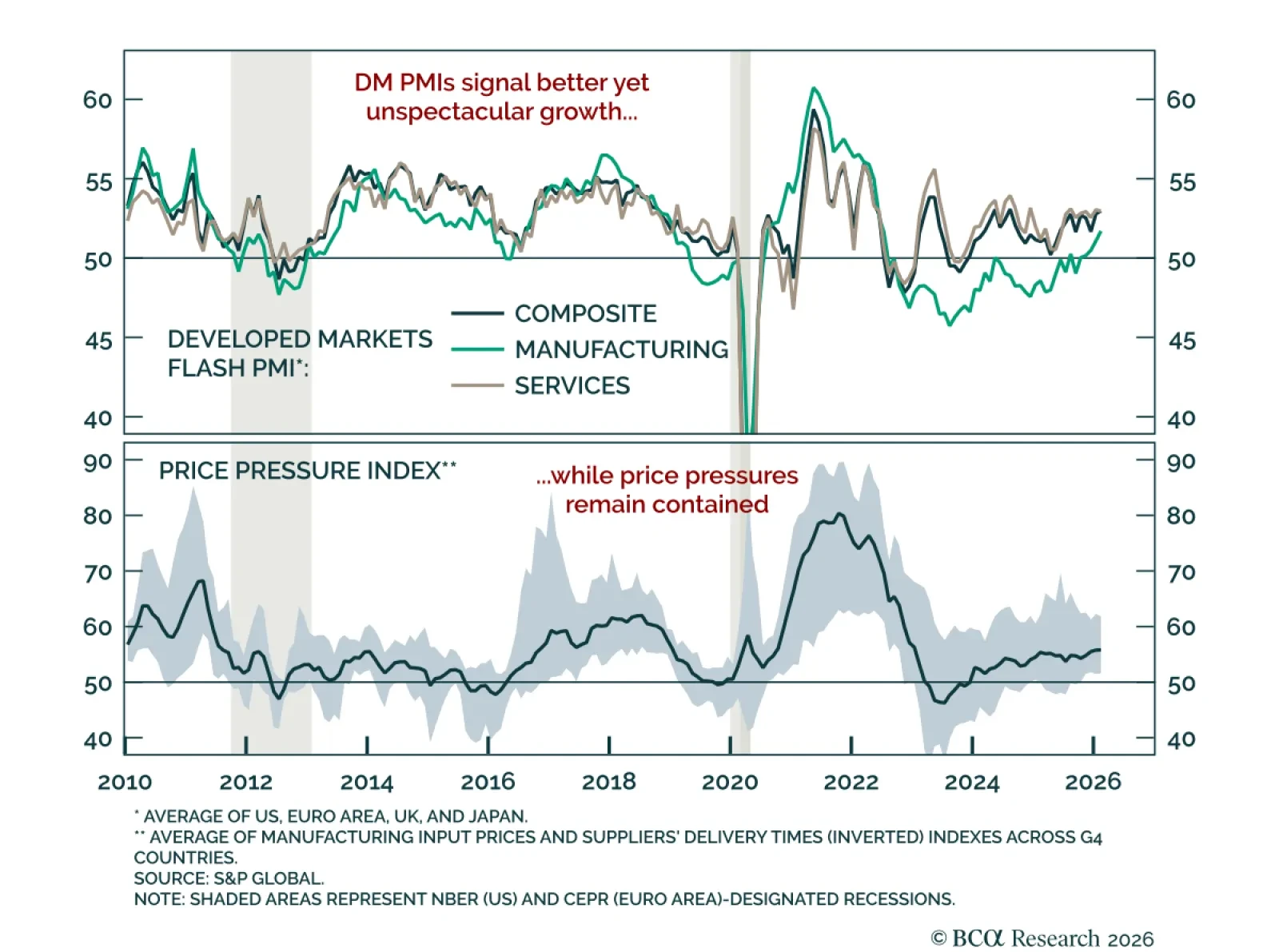

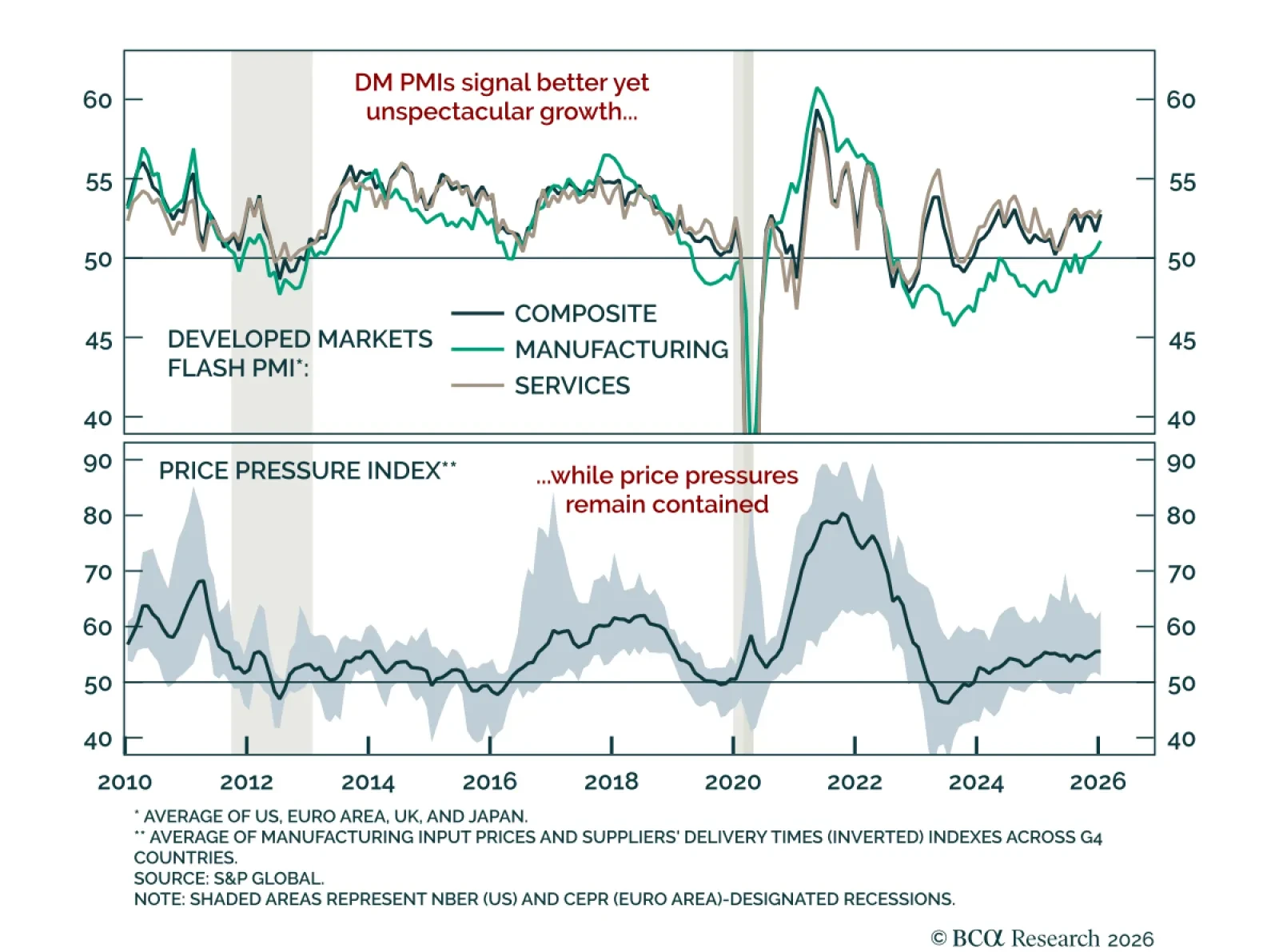

February flash PMIs edged higher, pointing to gradual improvement in global growth. After moving mostly sideways through 2025, developed markets PMIs are picking up. Manufacturing is showing decent momentum, rebounding after being…

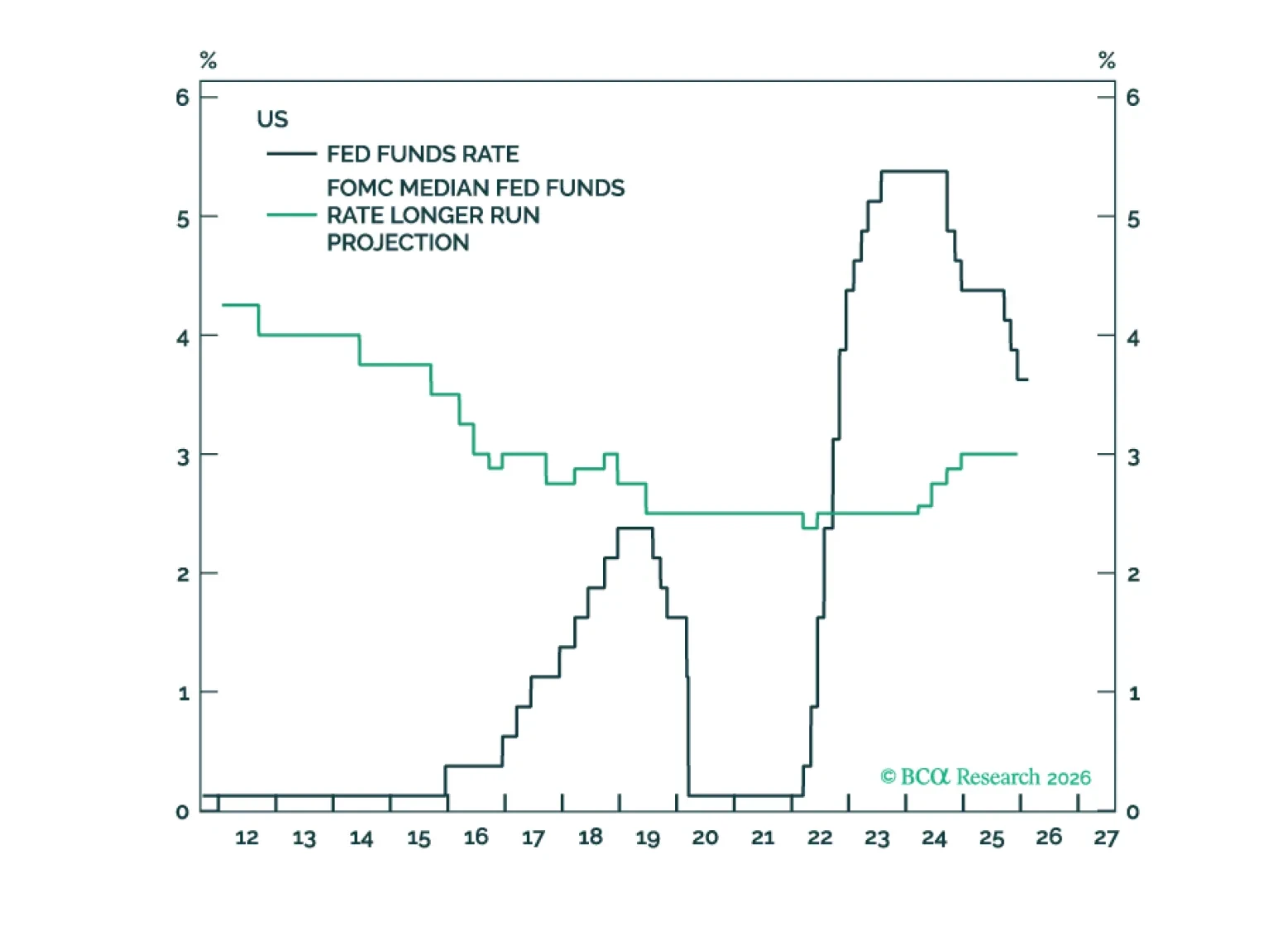

The neutral rate in the US is being propped up by a variety of forces that are at risk of reversing. These include the AI capex boom, large budget deficits, and the extraordinarily high level of household wealth. As such, interest…

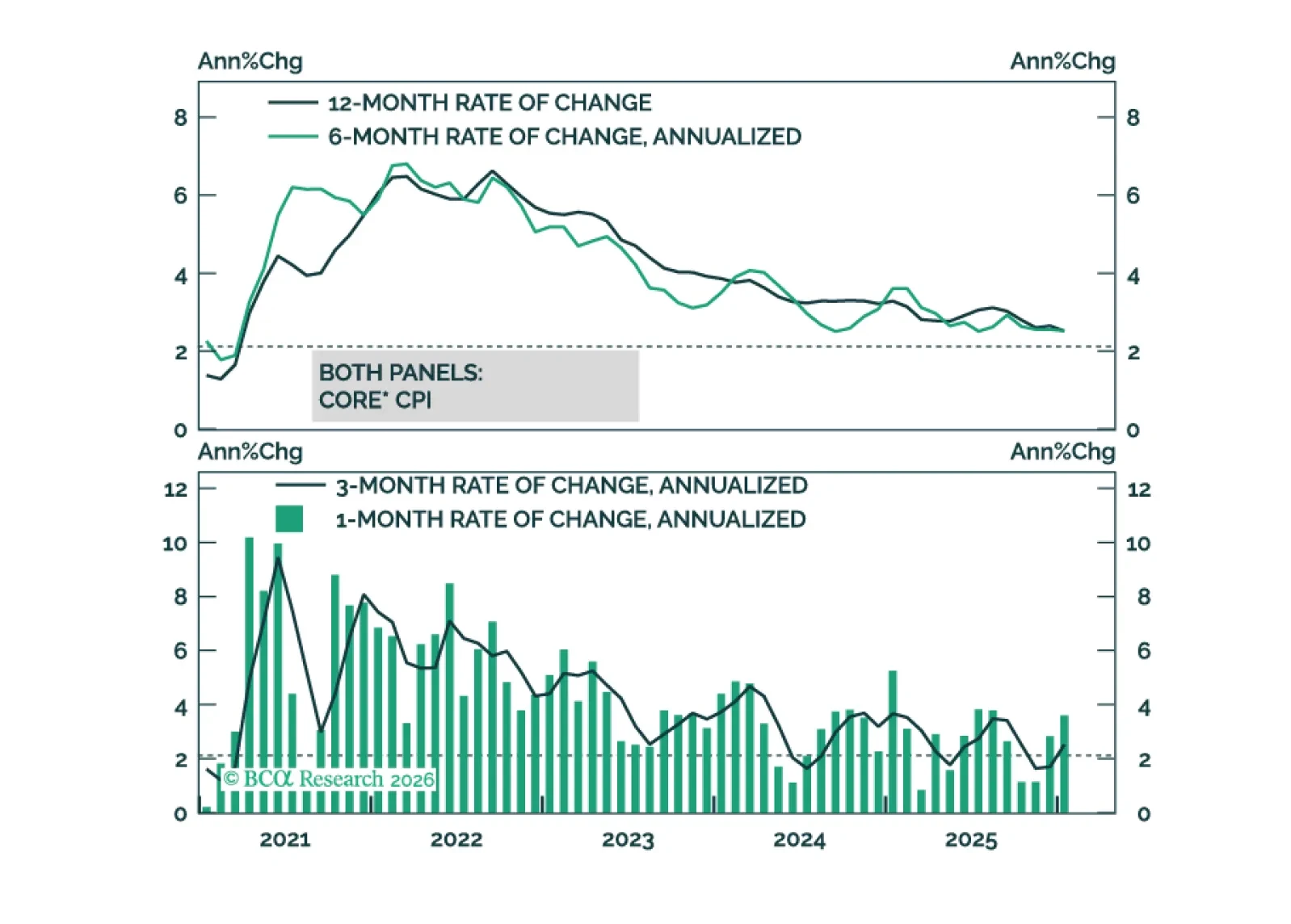

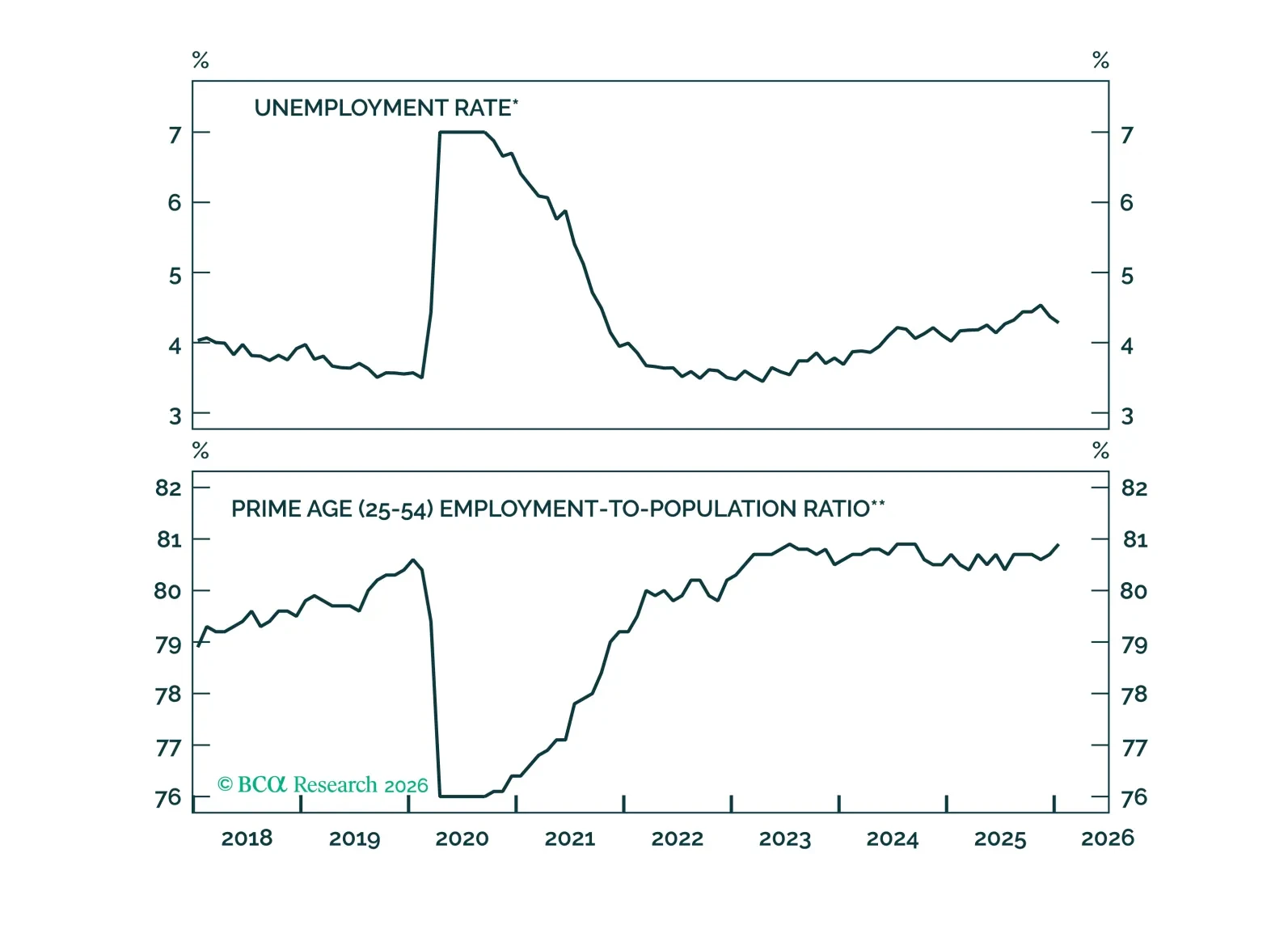

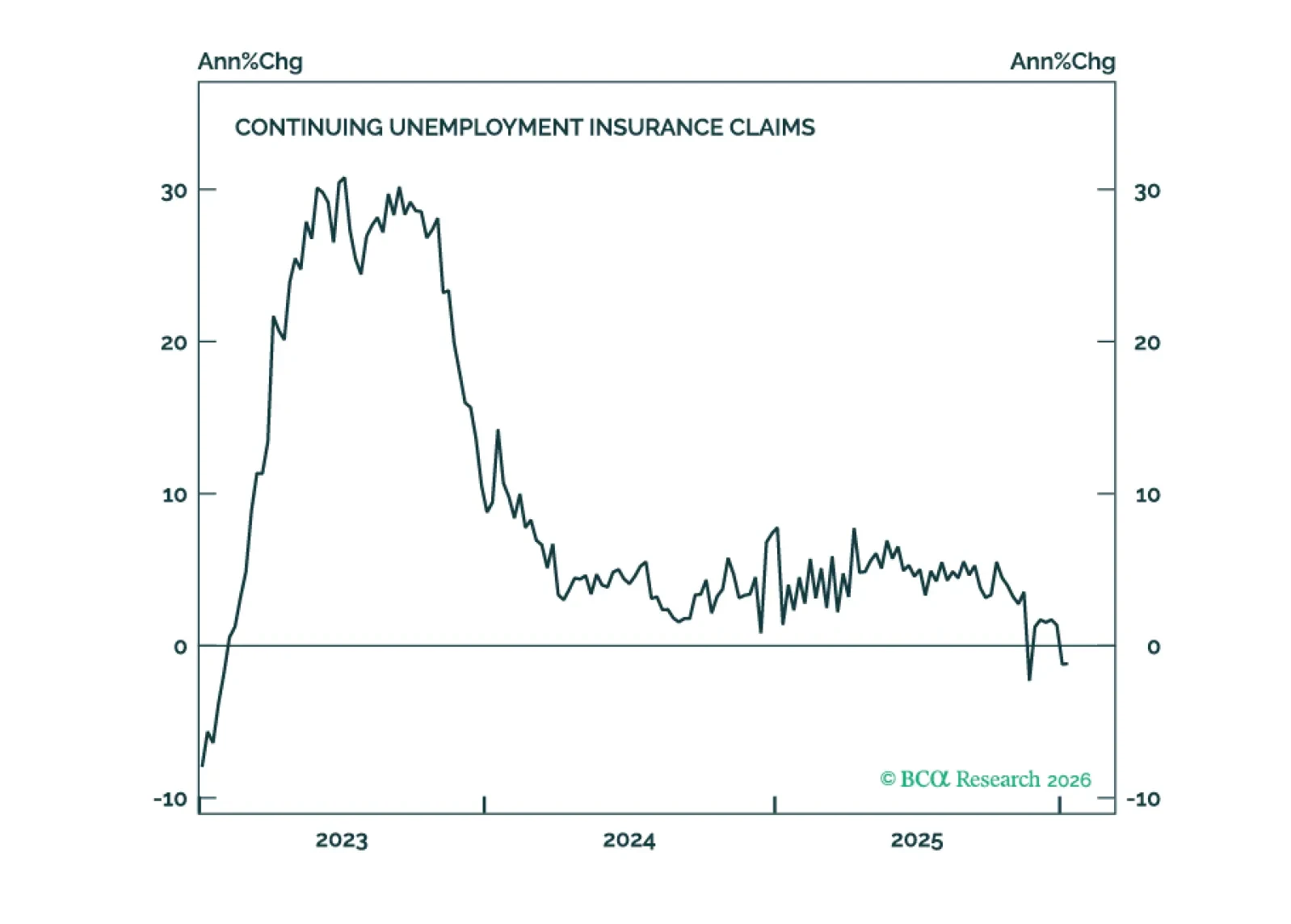

The labor market tightened in January, significantly lowering the odds of a H1 2026 rate cut. Rate cuts driven by lower inflation are still likely in H2 2026.

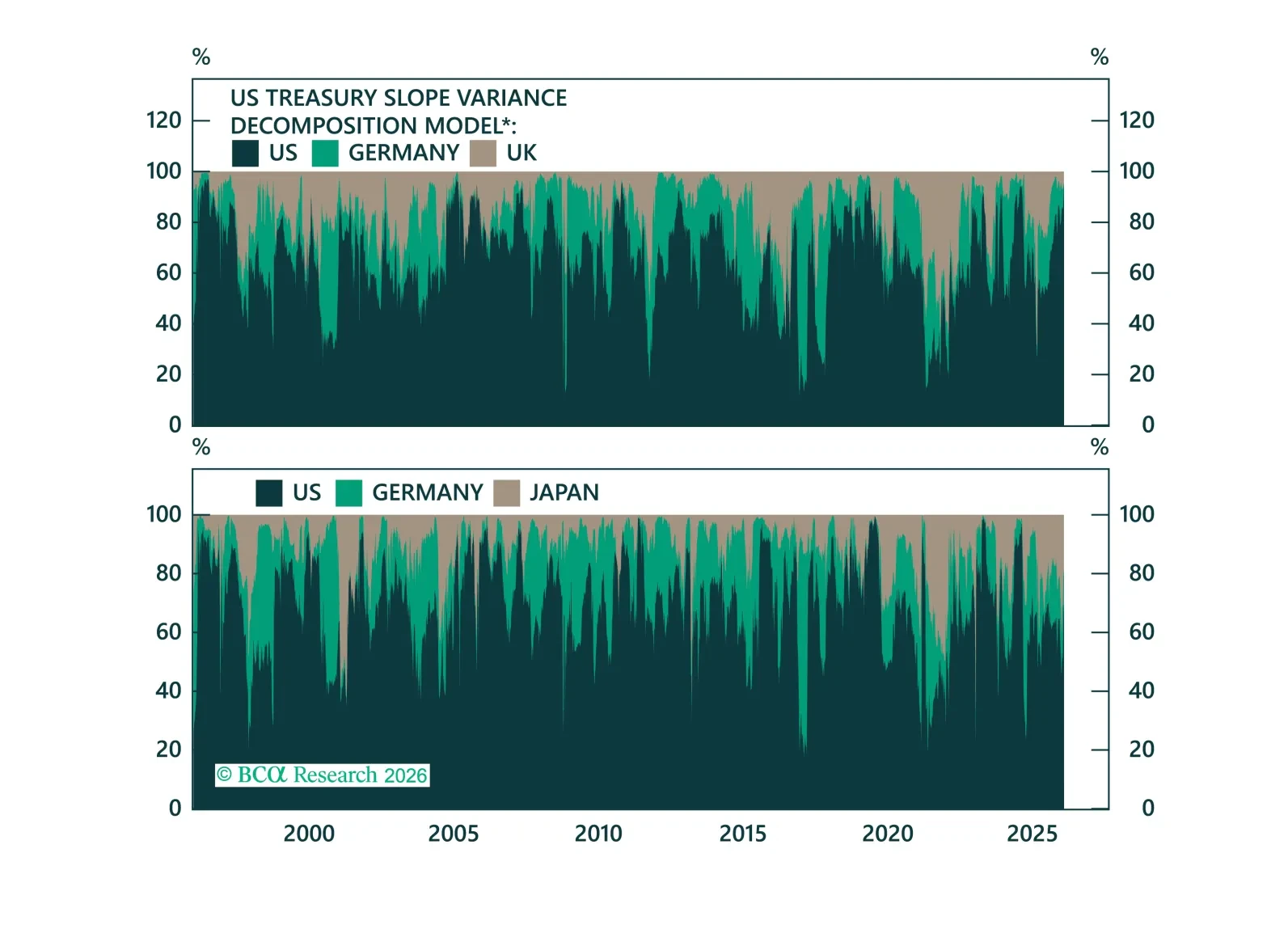

What’s driving government bond yields, and how do different bond markets impact each other? In today's Strategy Insight, we decompose yield moves into global drivers and idiosyncratic local drivers.

Our Portfolio Allocation Summary for February 2026.

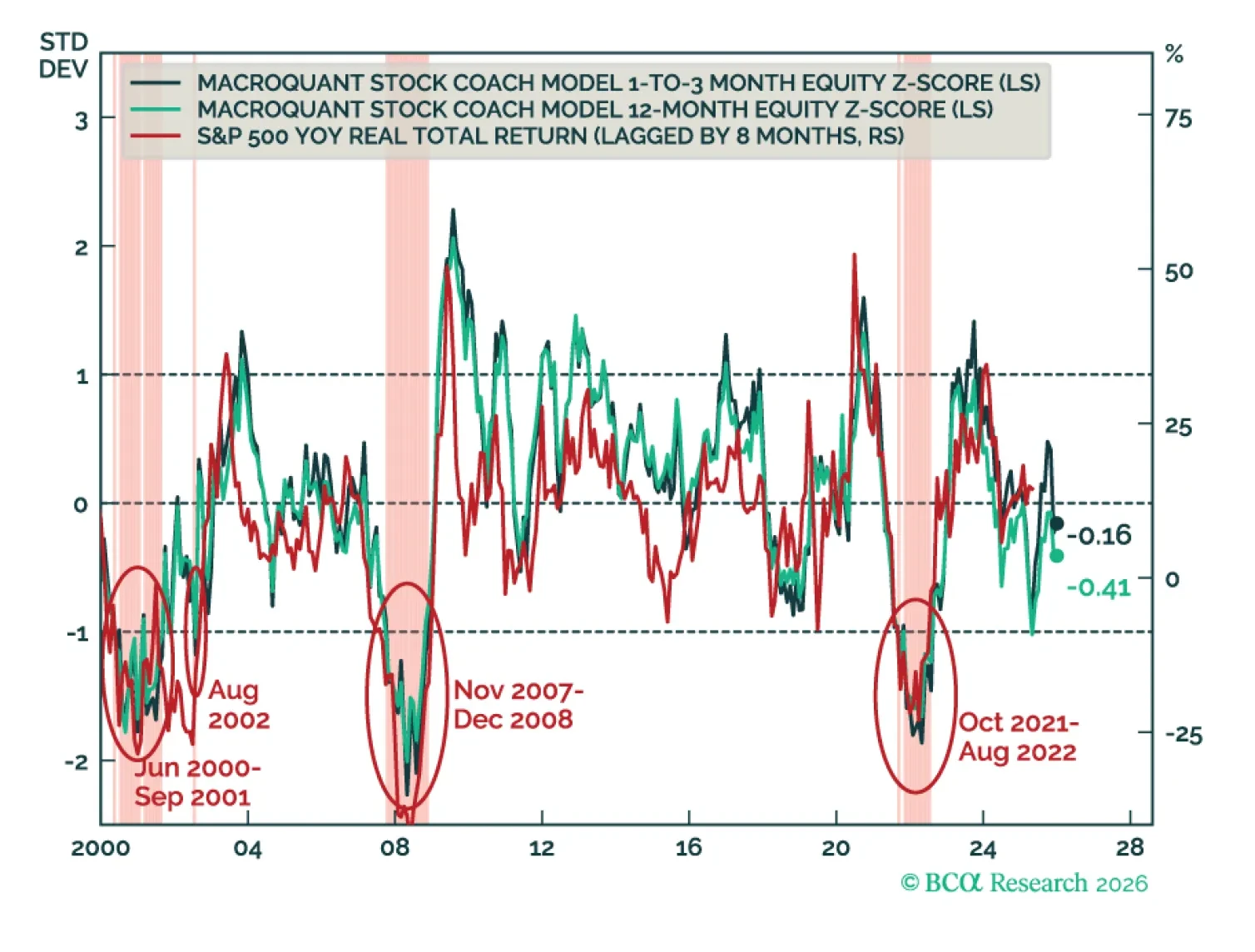

MacroQuant recommends a slight underweight in equities, favors a below-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, has upgraded oil and copper to overweight, and is bullish on gold.

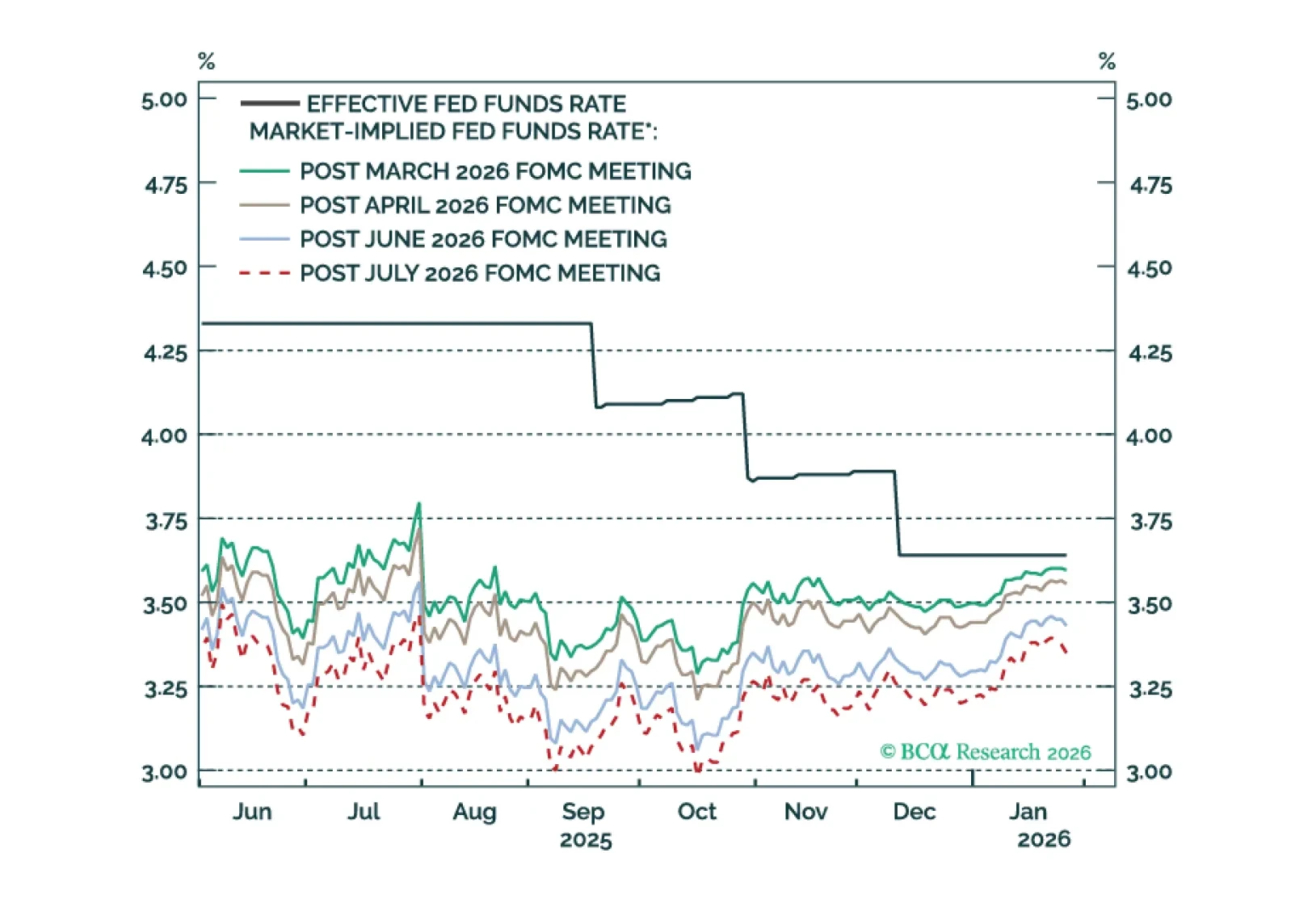

The Fed will keep rates on hold in H1 2026, but dovish policy surprises are likely in the second half of the year.

January flash PMIs point to better, though unspectacular, global growth momentum. Developed markets PMIs showed improvement in global growth momentum. PMIs have largely moved sideways through 2025, with manufacturing now recovering…

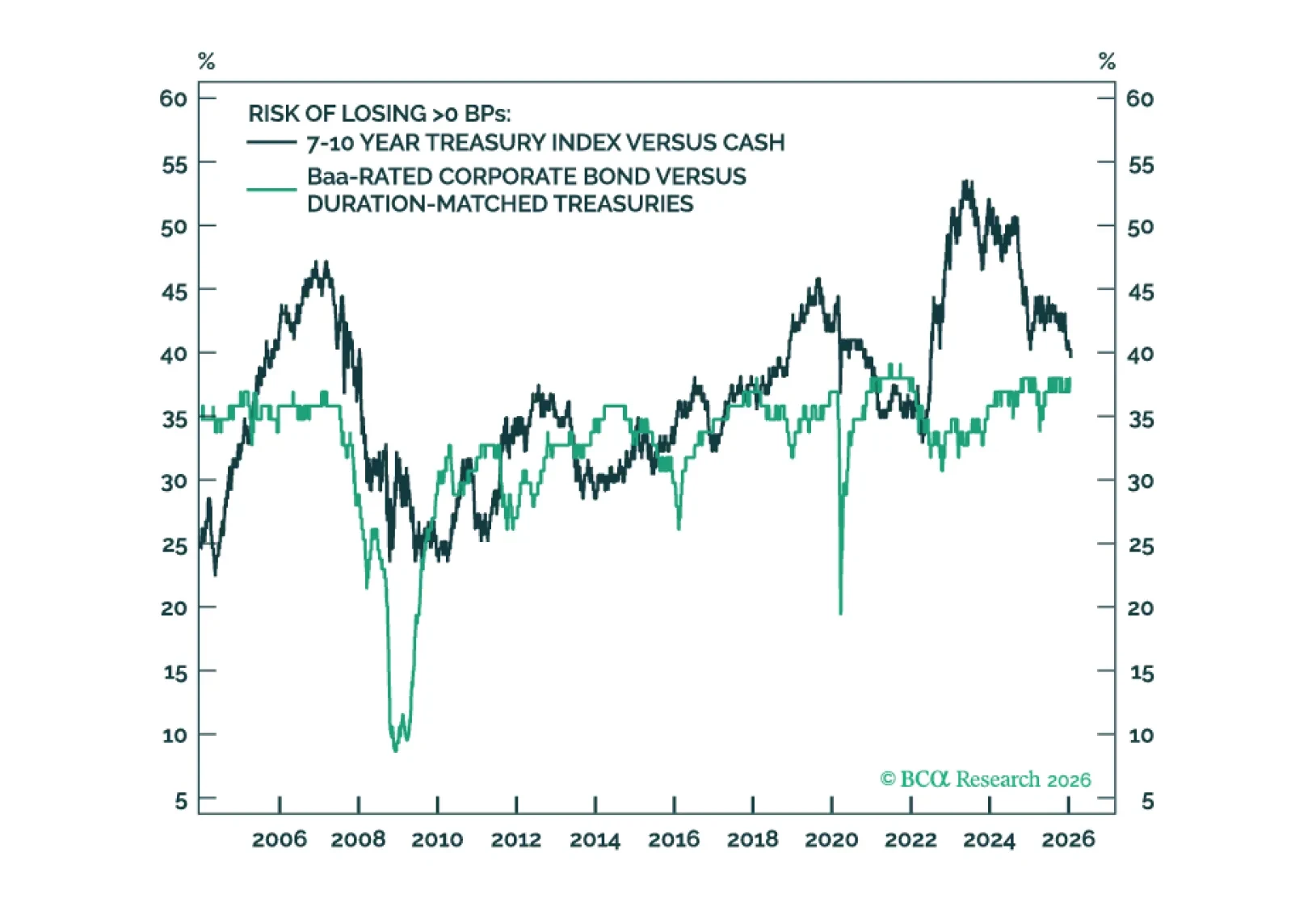

The 10-year Treasury term premium is now competitive with Baa- and Ba-rated credit spreads. Even without term premium compression, duration carry trades could outperform credit carry trades in a low rate vol environment.