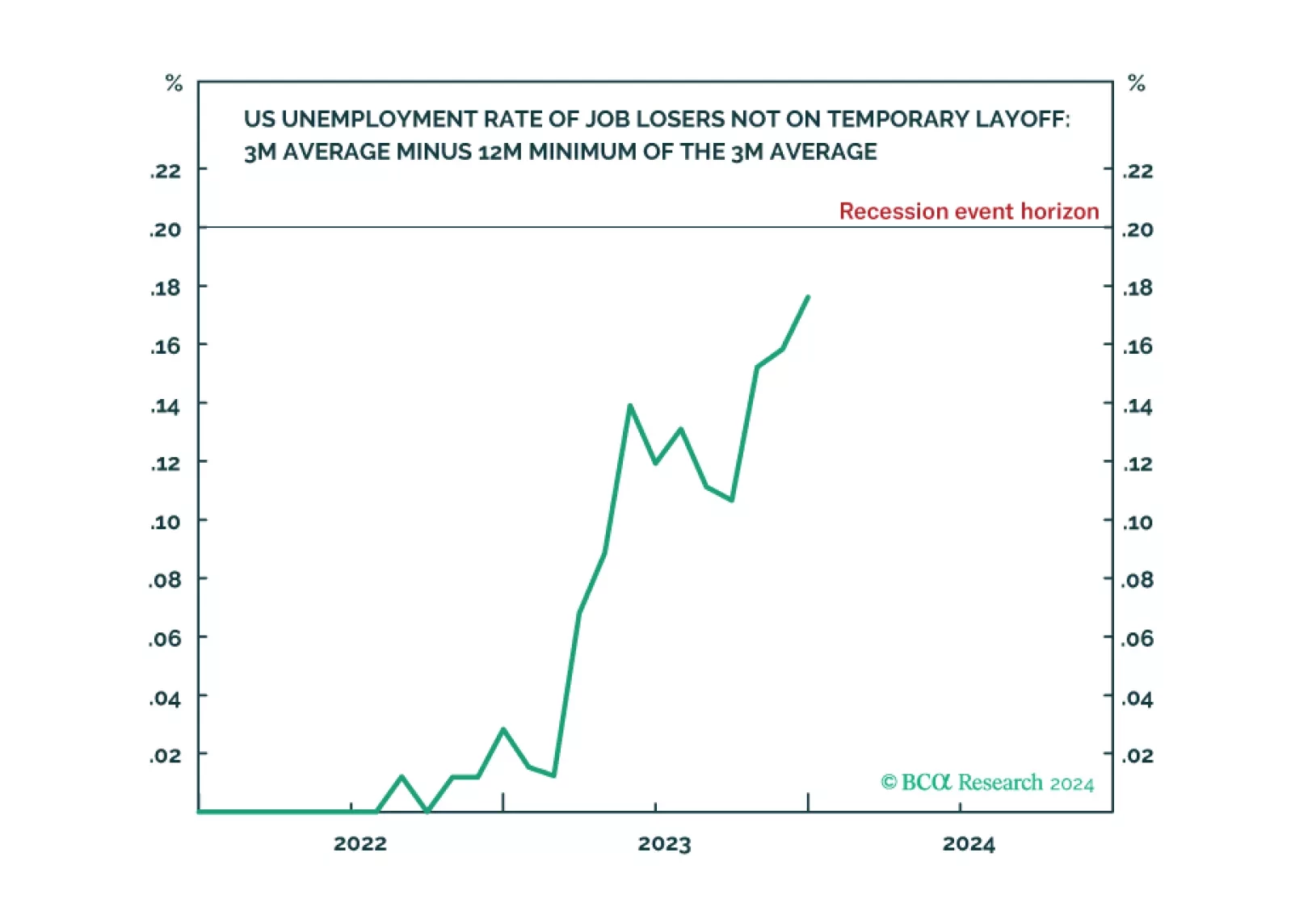

Following today’s US jobs data release, the Joshi rule real-time US recession indicator inched up to 0.18 and is now just a whisker from its recession event-horizon of 0.20.

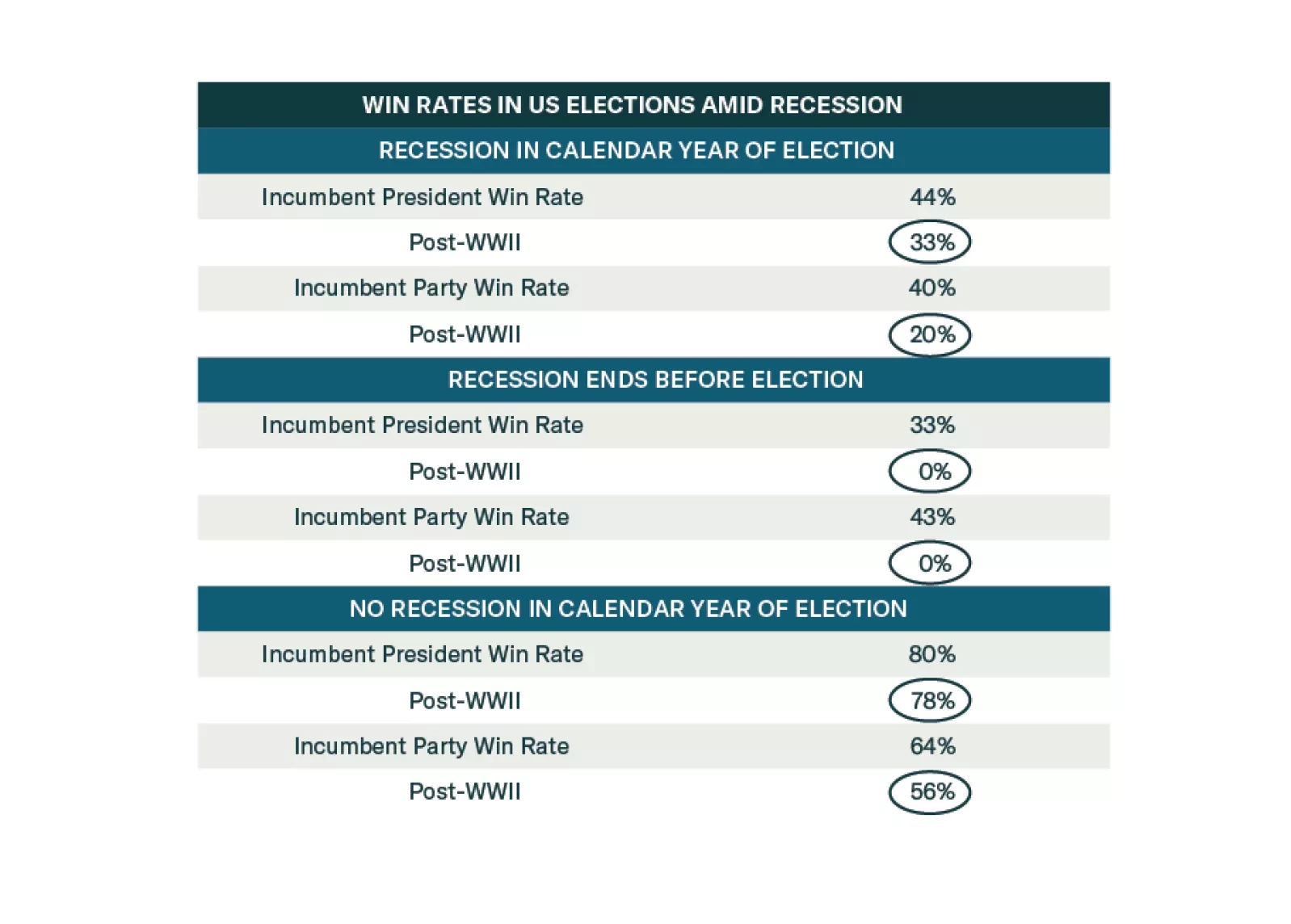

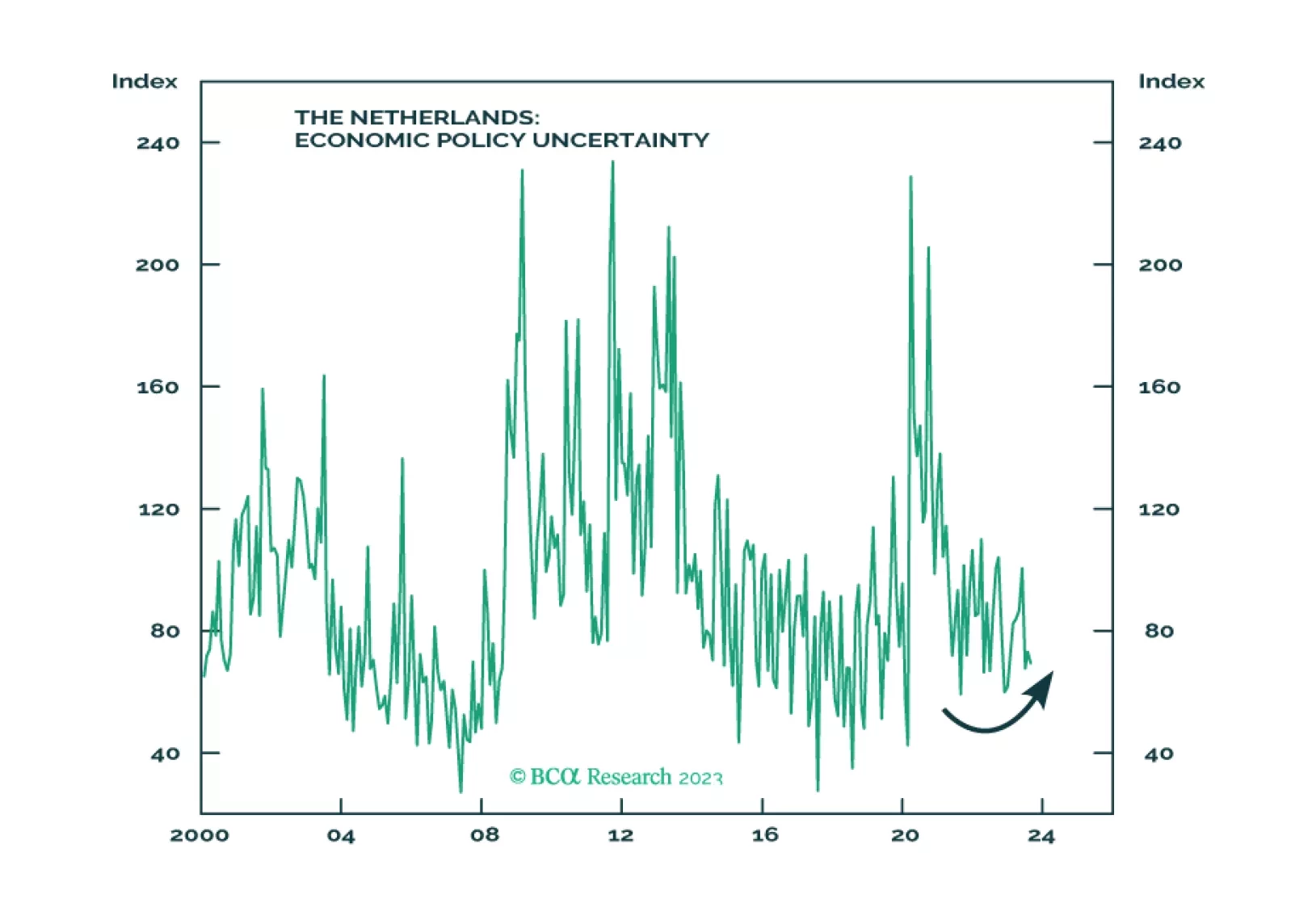

Democrats are favored to win the election until recession materializes. But recession risks are high. Investors should adopt a defensive and conservative strategy in 2024 amid extreme US policy uncertainty.

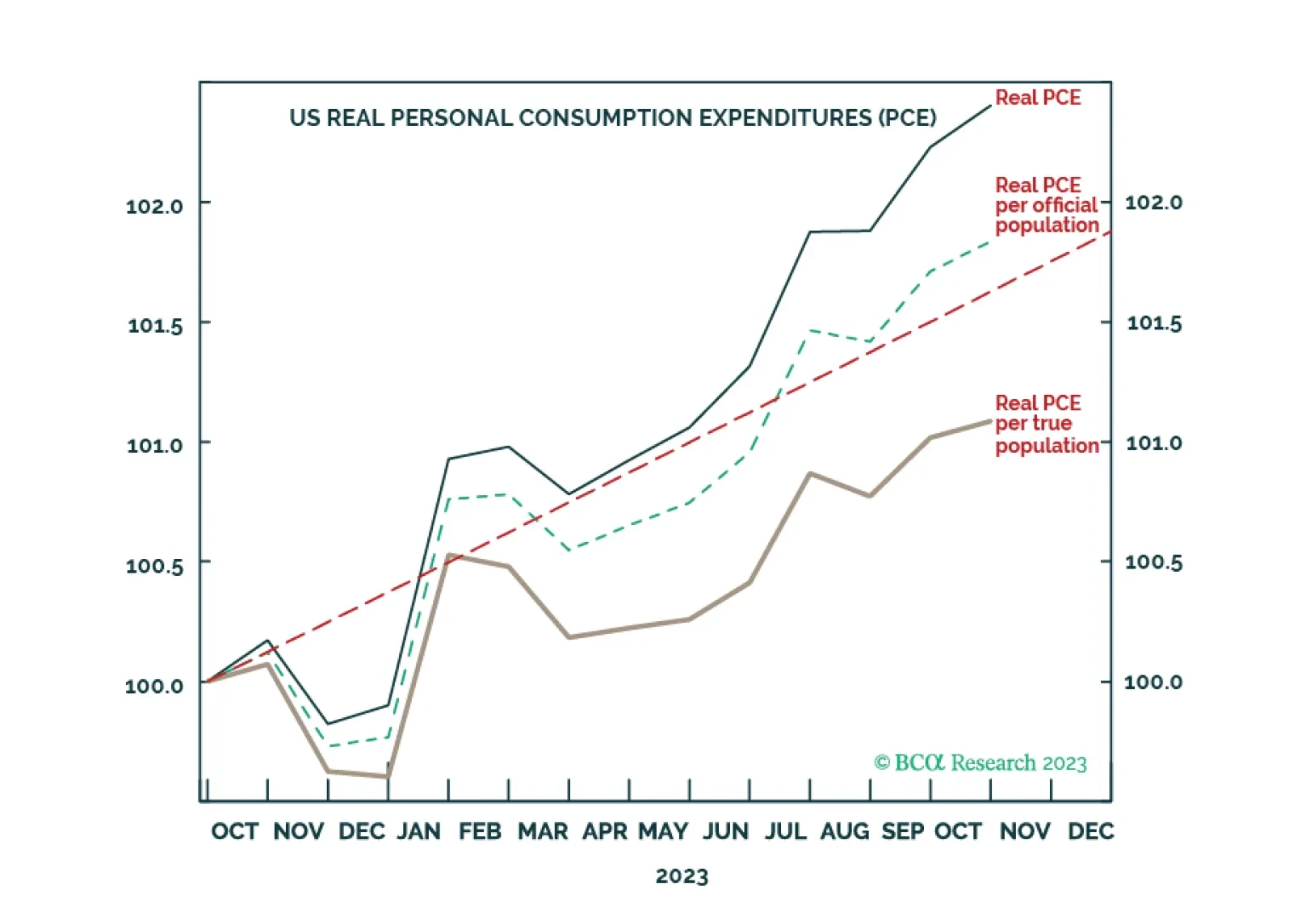

Illegal immigration into the US has skyrocketed to record levels. Correctly accounting for this, US real consumption growth on a per head basis is already fragile. Meanwhile, the real bond yield is only now approaching the pain point…

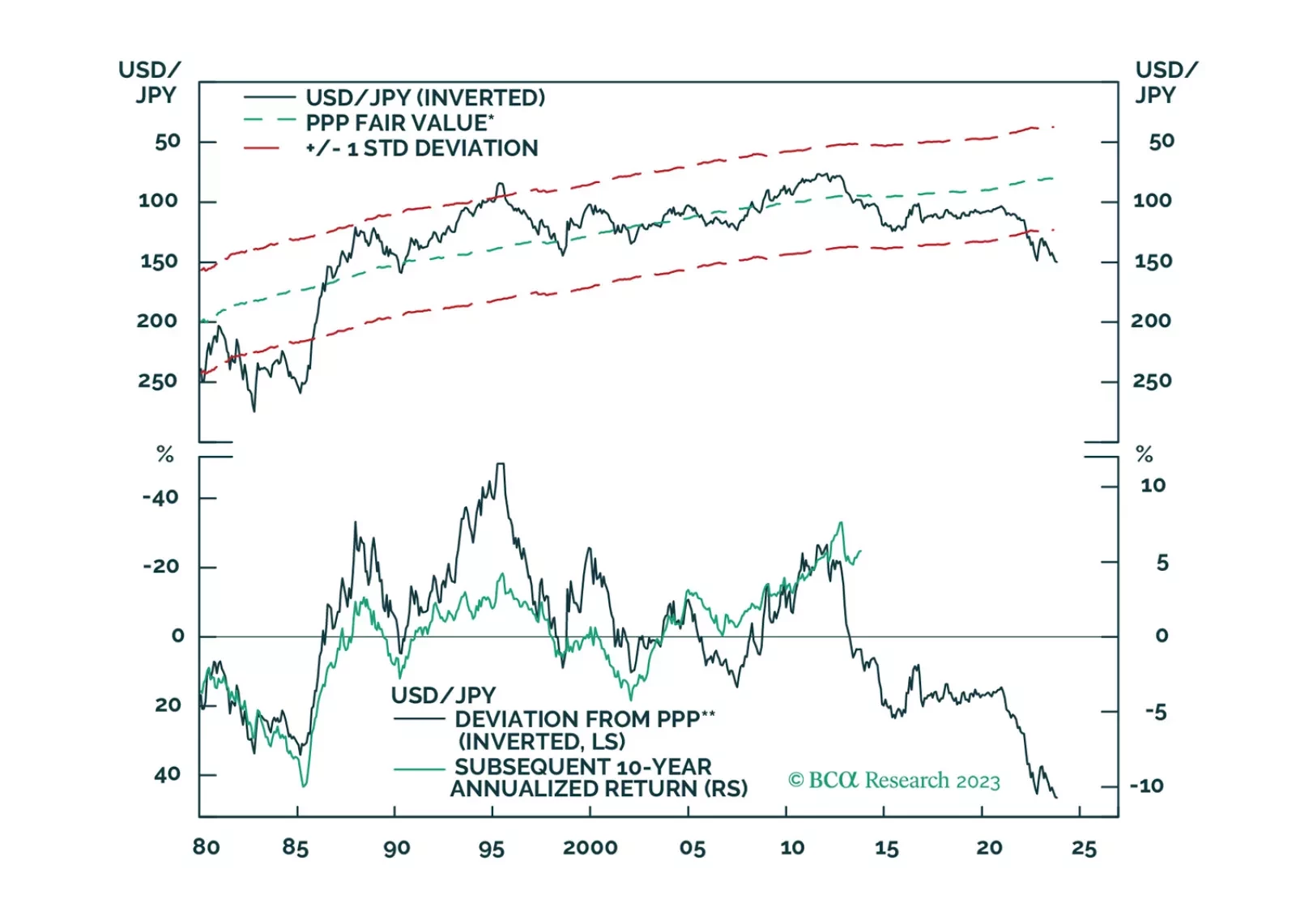

There is a high probability that the global economy will tip into recession in the second half of 2024. A long yen position is an excellent hedge against that risk.

Heading into a black hole, you pass a point of no return known as the ‘event horizon’ after which your impending oblivion is sealed. US recessions also have an event horizon, which we are fast approaching. We reveal a leading…

The crucial question for 2023 is: will the US and UK Beveridge Curves shift back inwards to their pre-pandemic versions, ushering in a soft landing? Or, will we slide down the new post-pandemic Beveridge Curves into recession? Plus:…