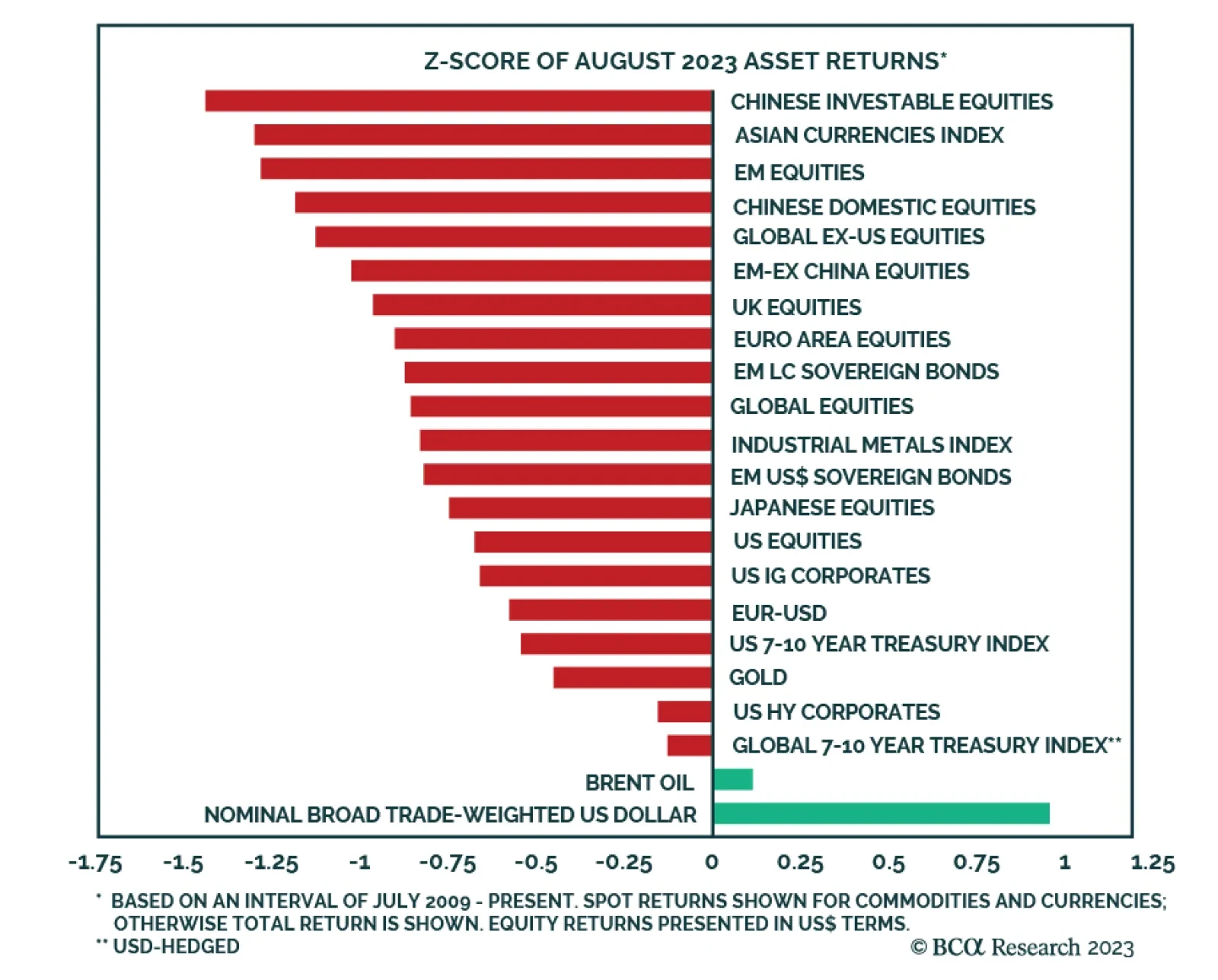

Global financial markets relapsed in August. After a relatively strong performance in June and July, most of the major financial assets we track generated below average returns last month as investors shifted their focus to the…

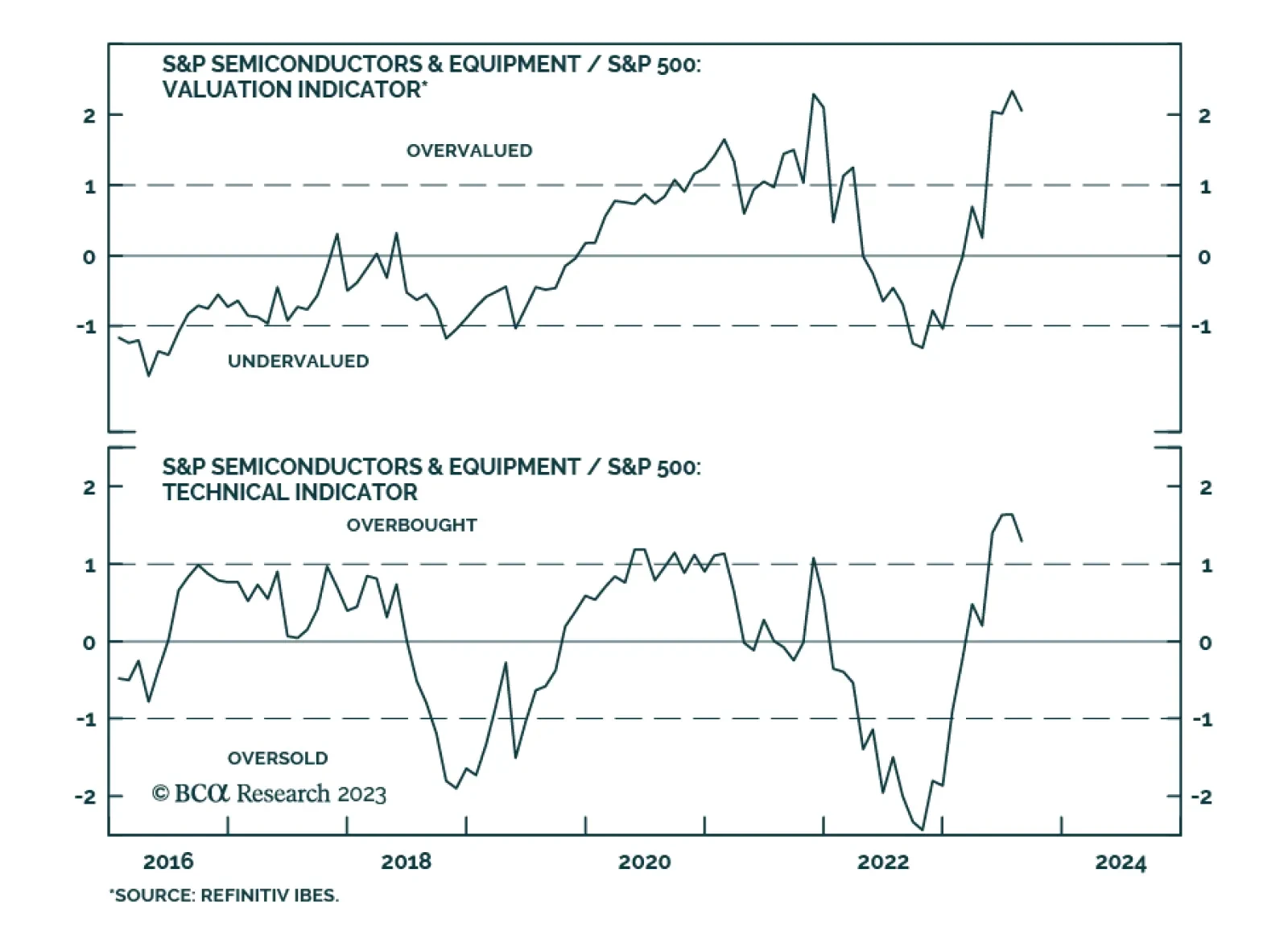

Nvidia’s stock price hit a fresh all-time high on Thursday after its blockbuster Q2 earnings call. The company reported it generated $13.51 billion in revenue last month (above expectations of $11.2 billion) and forecasted…

Yesterday we highlighted that the August update of the Philly Fed’s Nonmanufacturing Business Outlook survey sent a negative signal, with the New Orders, Sales, and Employment components all deteriorating. On Wednesday, the…

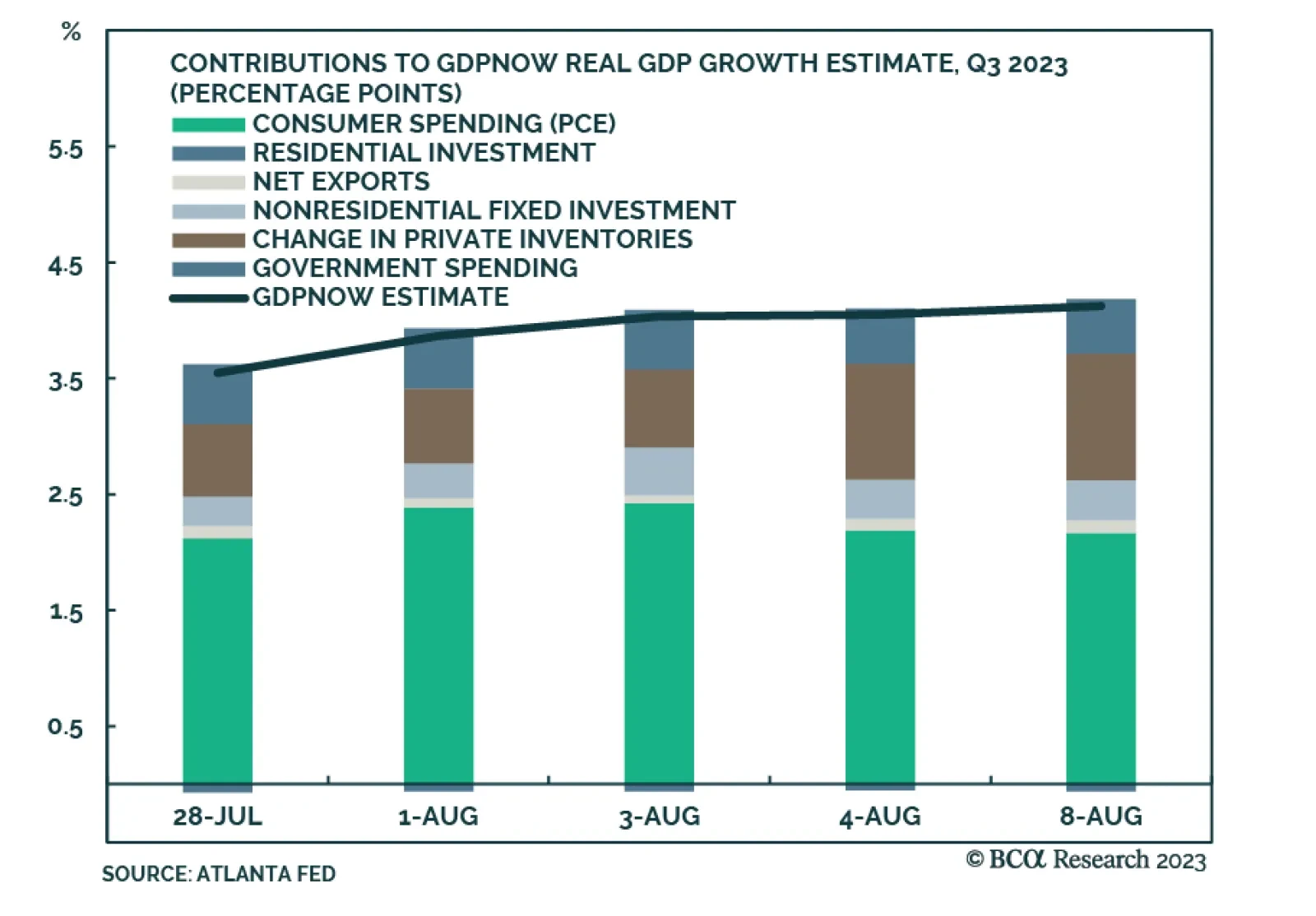

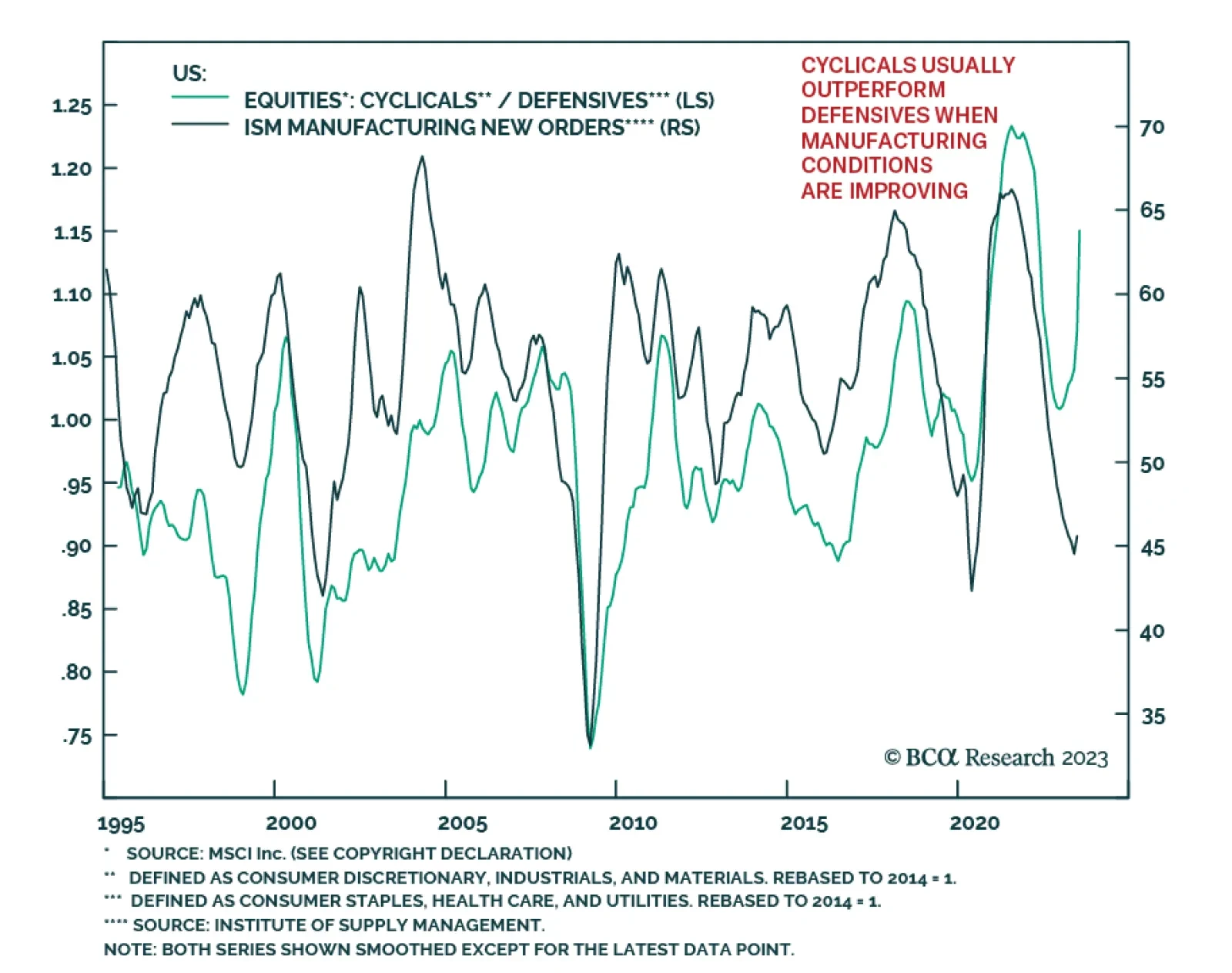

Over the past two months, risk sentiment has improved amid receding fears of an imminent US recession. Economic data have been generating strong upside surprises and the US equity rally has broadened with cyclicals outperforming…

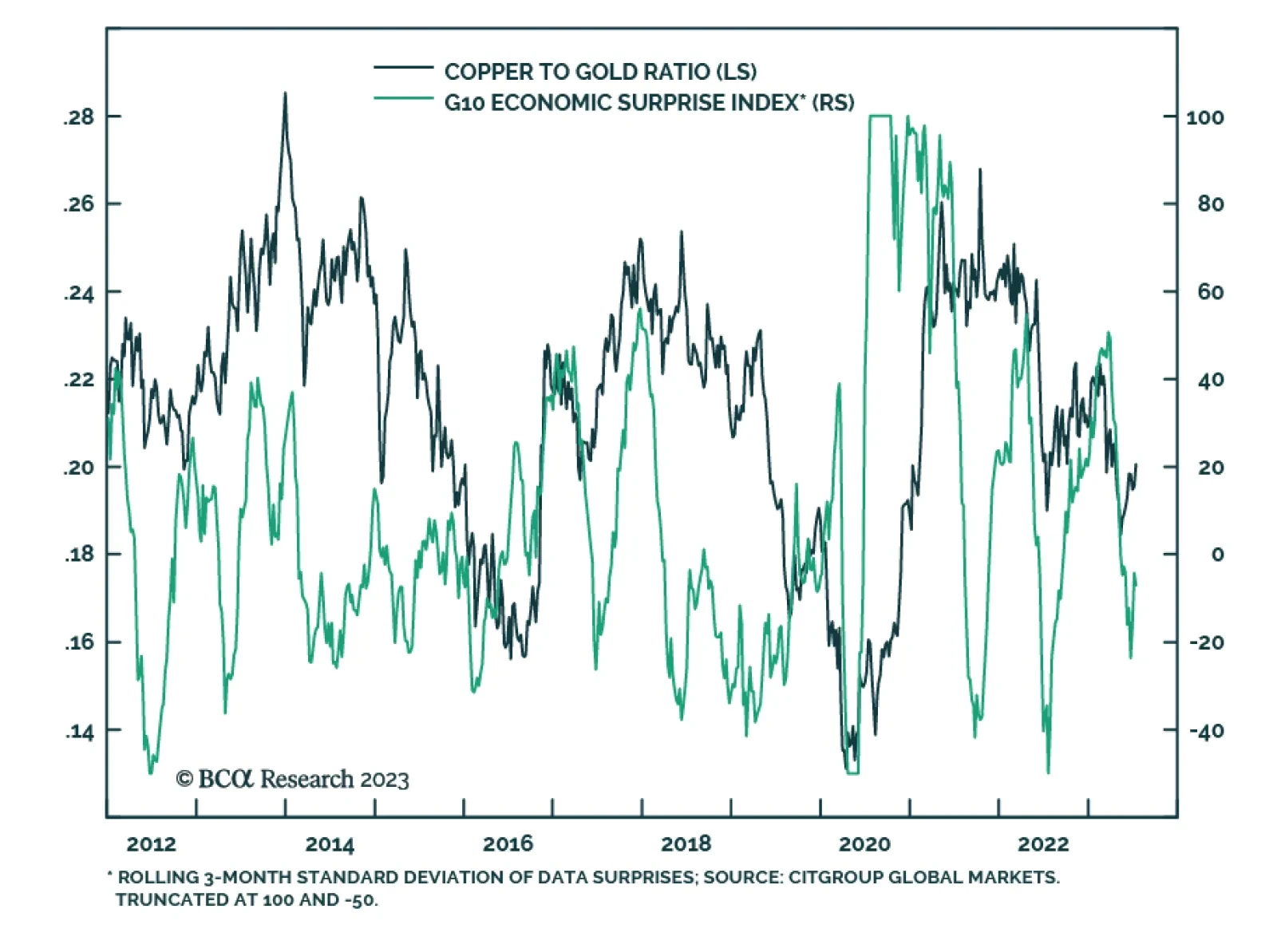

Copper rallied to a two-month high by the end of last week. Importantly, this move did not occur in isolation. It coincides with greater optimism about the prospects of a soft landing. Indeed, the US economic surprise index is…

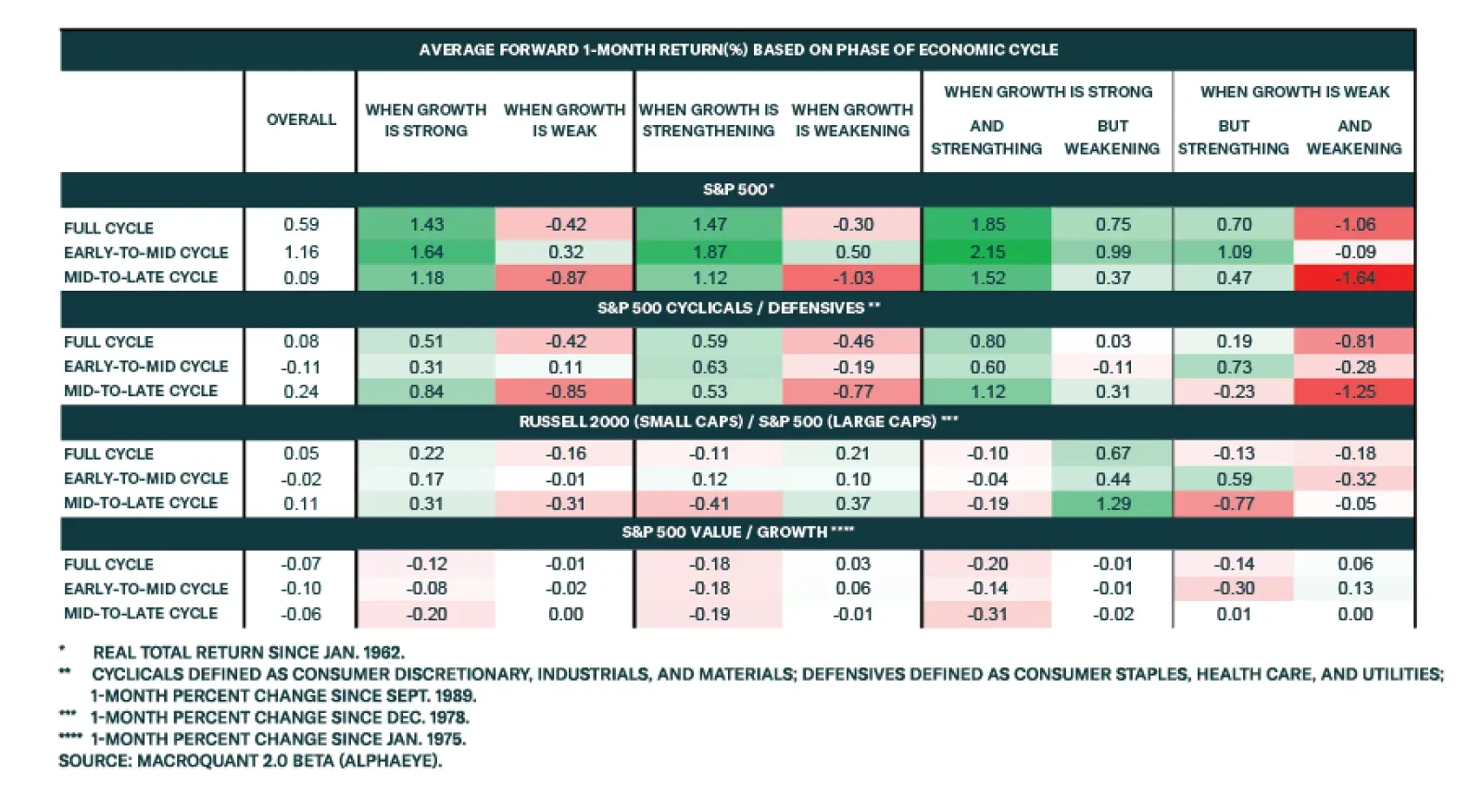

According to BCA Research’s Global Investment Strategy service, stocks fare best when there is plenty of slack in the economy and growth is strong and getting stronger. In classical physics, the trajectory of an object…

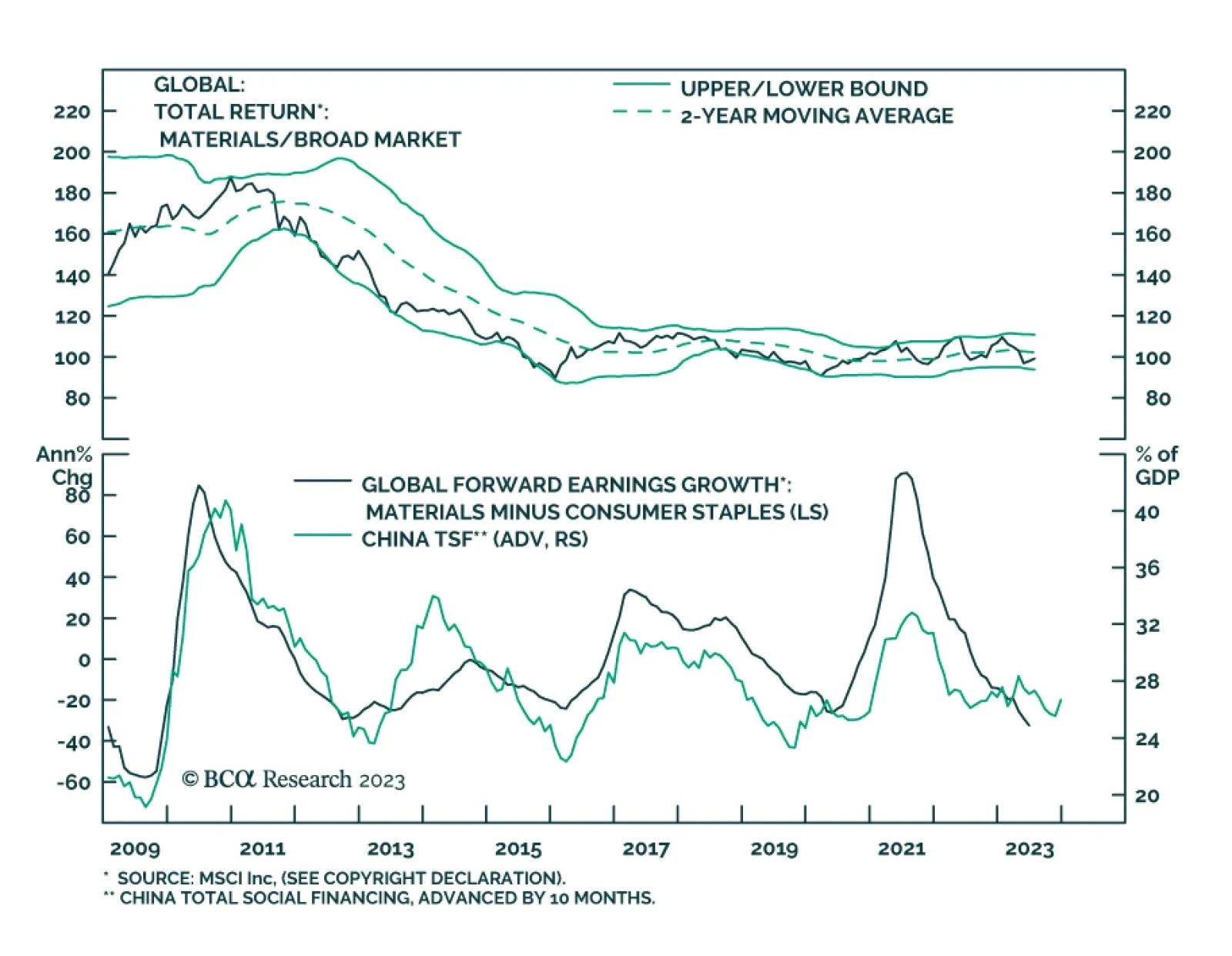

BCA’s Global Asset Allocation service (GAA) recommends a defensive multi-asset portfolio allocation due to a high probability of recession. However, our colleagues also add a hedge to manage upside risk because they do not…

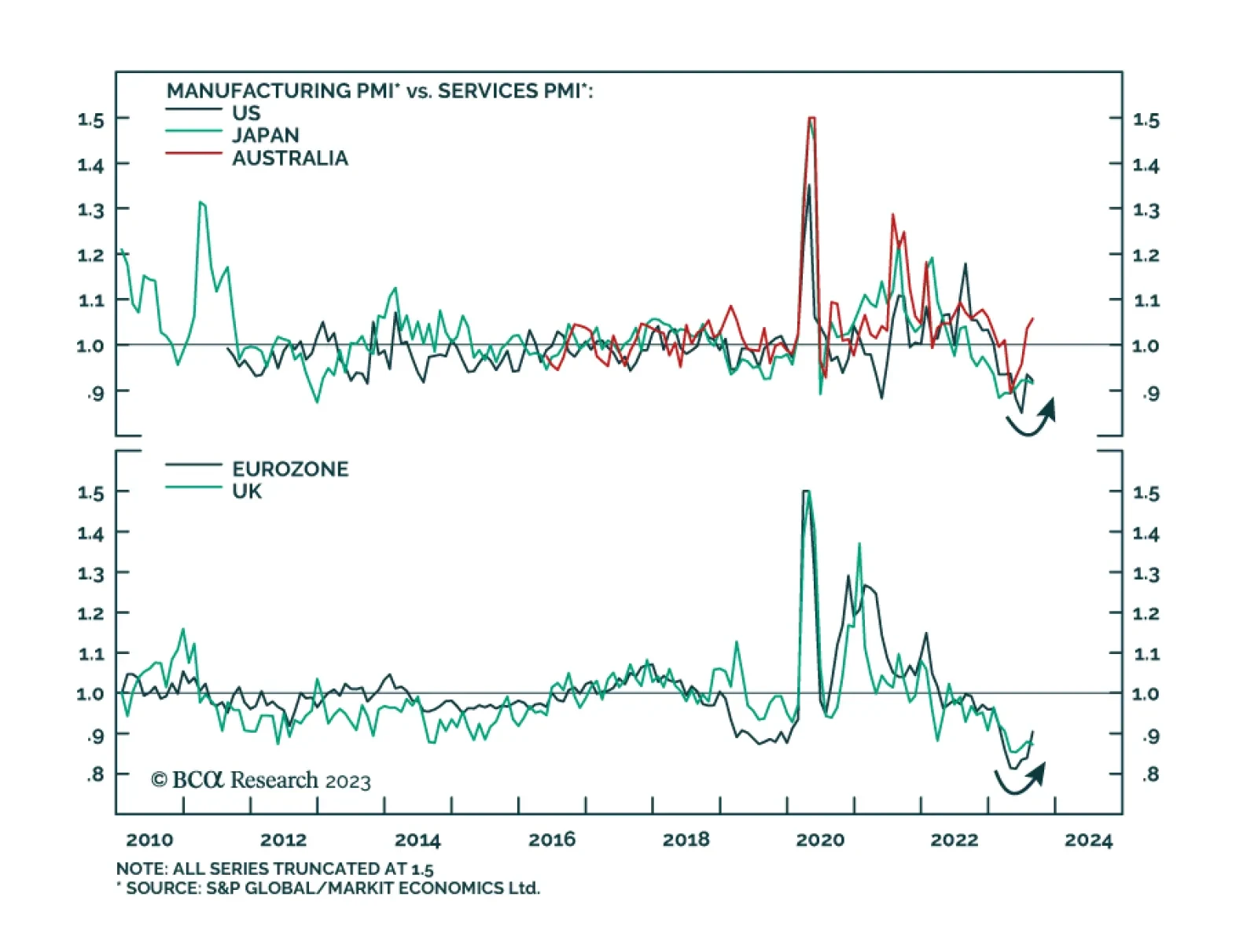

A range of indicators suggest that the US manufacturing sector is currently under duress. But should this weakness be extrapolated into the rest of the year? The US manufacturing cycle tends to follow a very predictable wave-…

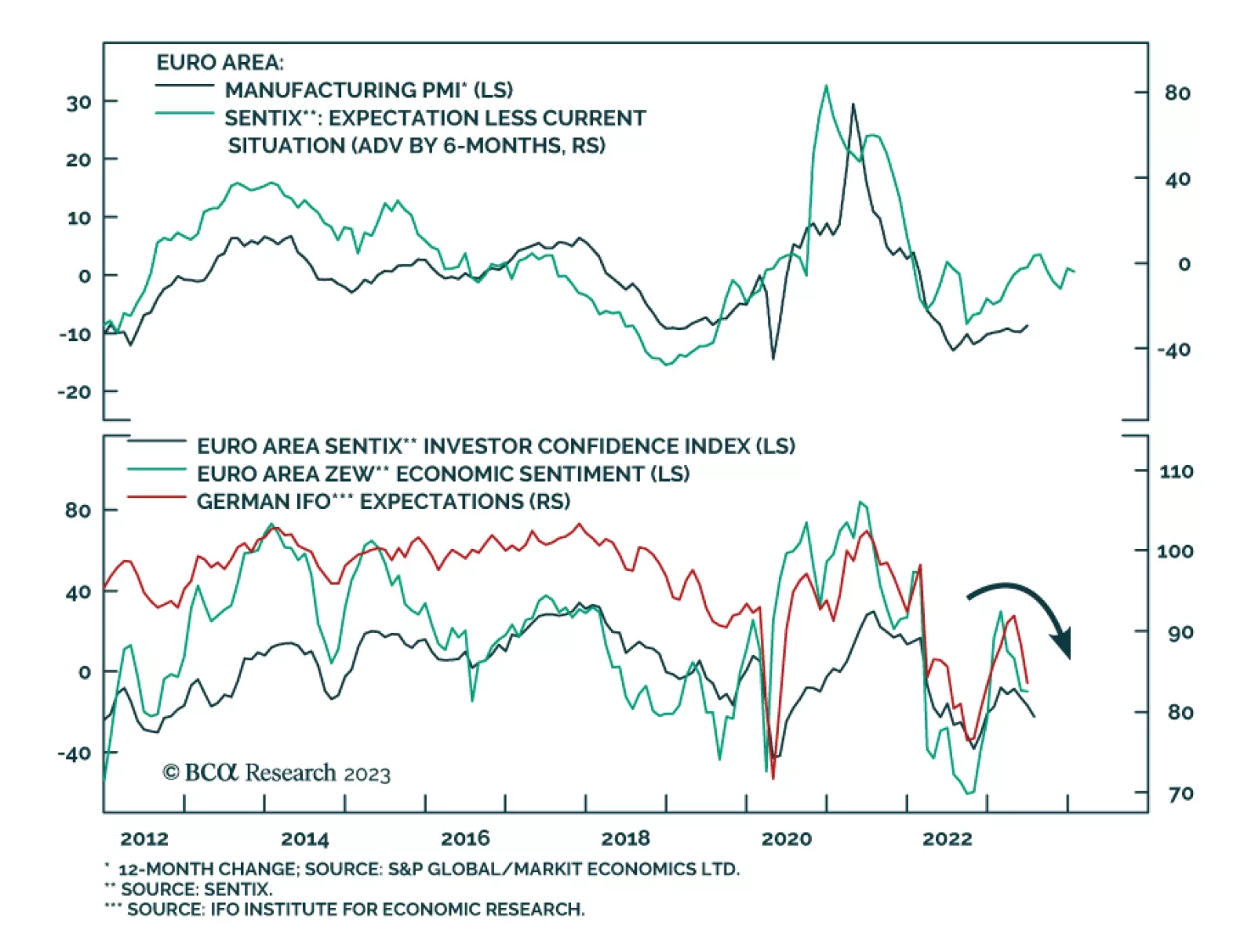

On Monday, the Eurozone Sentix sent a pessimistic signal about investor confidence in the Eurozone economy. The headline index dropped from -17.0 to -22.5 in July, significantly below expectations of a more muted deterioration to…