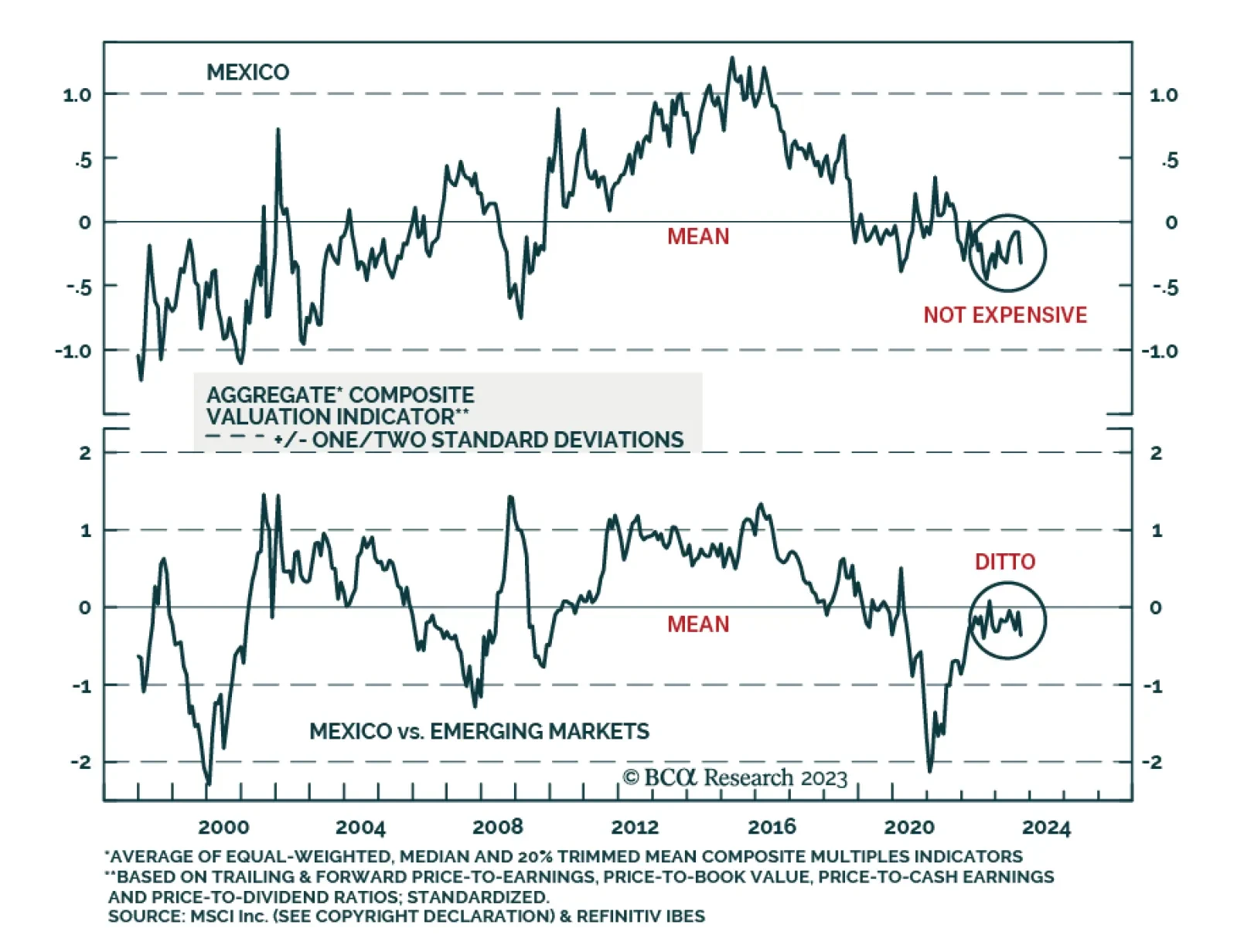

BCA Research’s Emerging Markets Strategy service remains overweight Mexican financial markets relative to their EM counterparts on a cyclical and structural basis. While Mexican markets will suffer in absolute terms with…

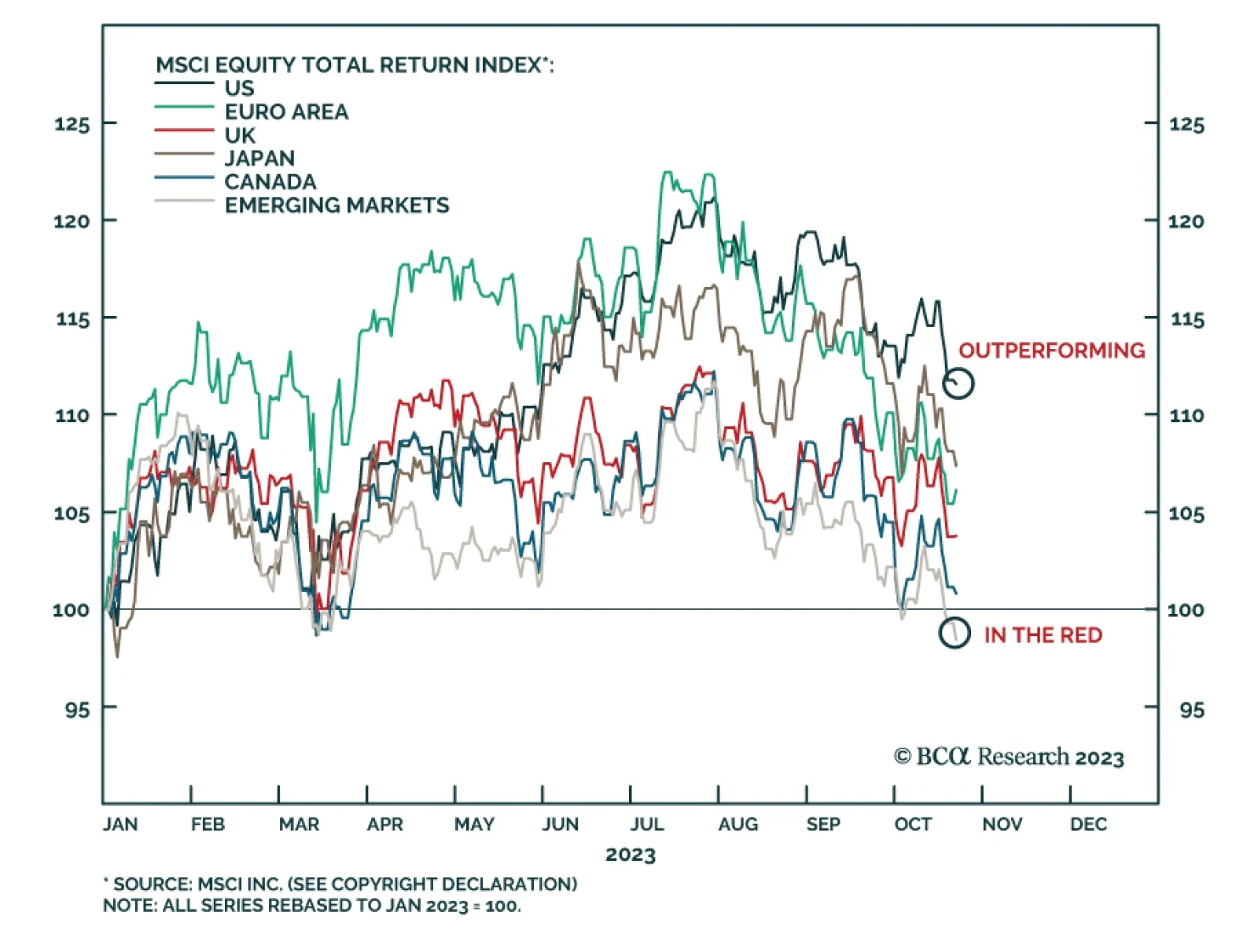

So far, 2023 is proving to be a year of two phases for global equity markets. Despite the bout of bank turmoil which weighed on equities in Q1, stocks rallied for the most part of the first seven months of the year. This rally…

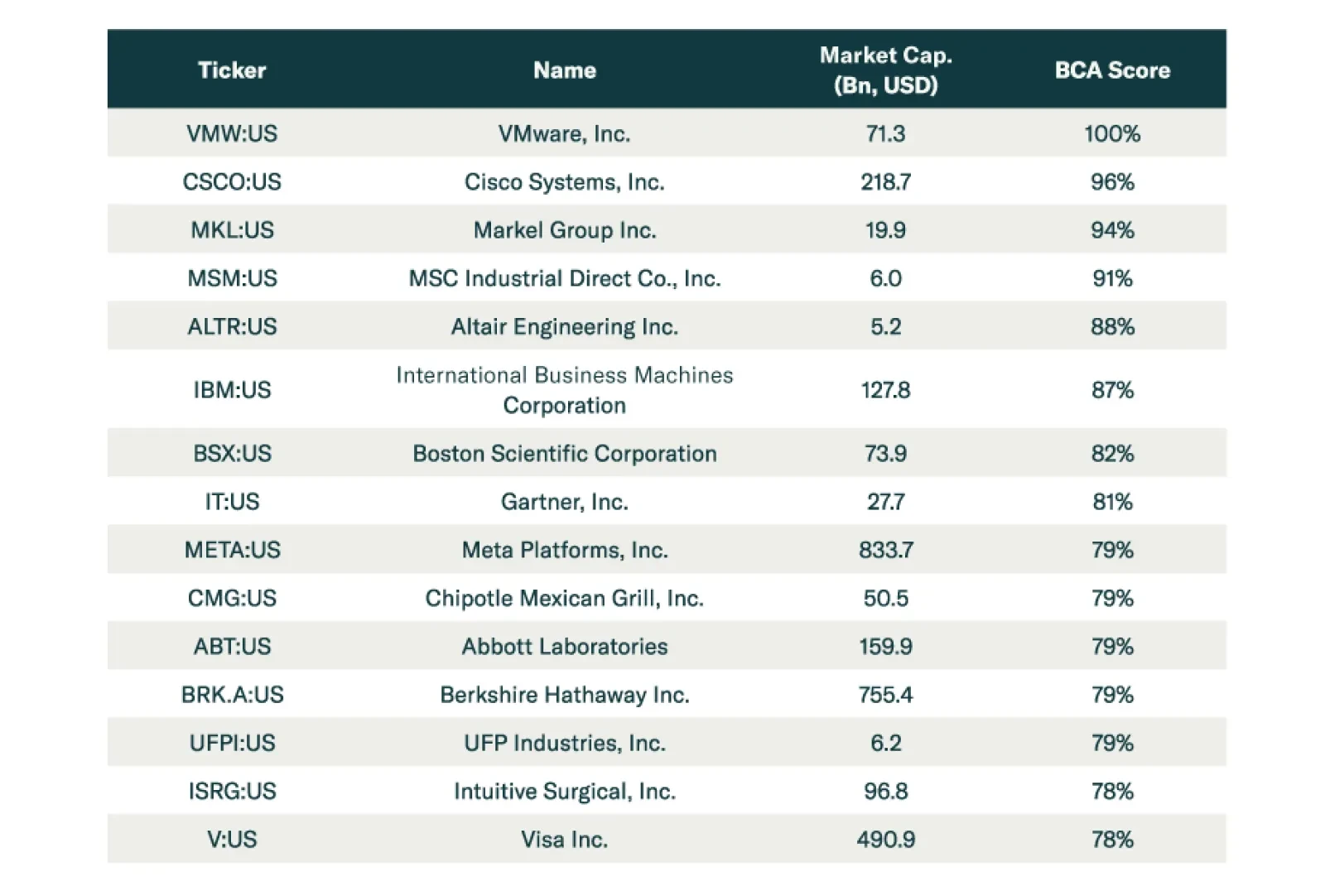

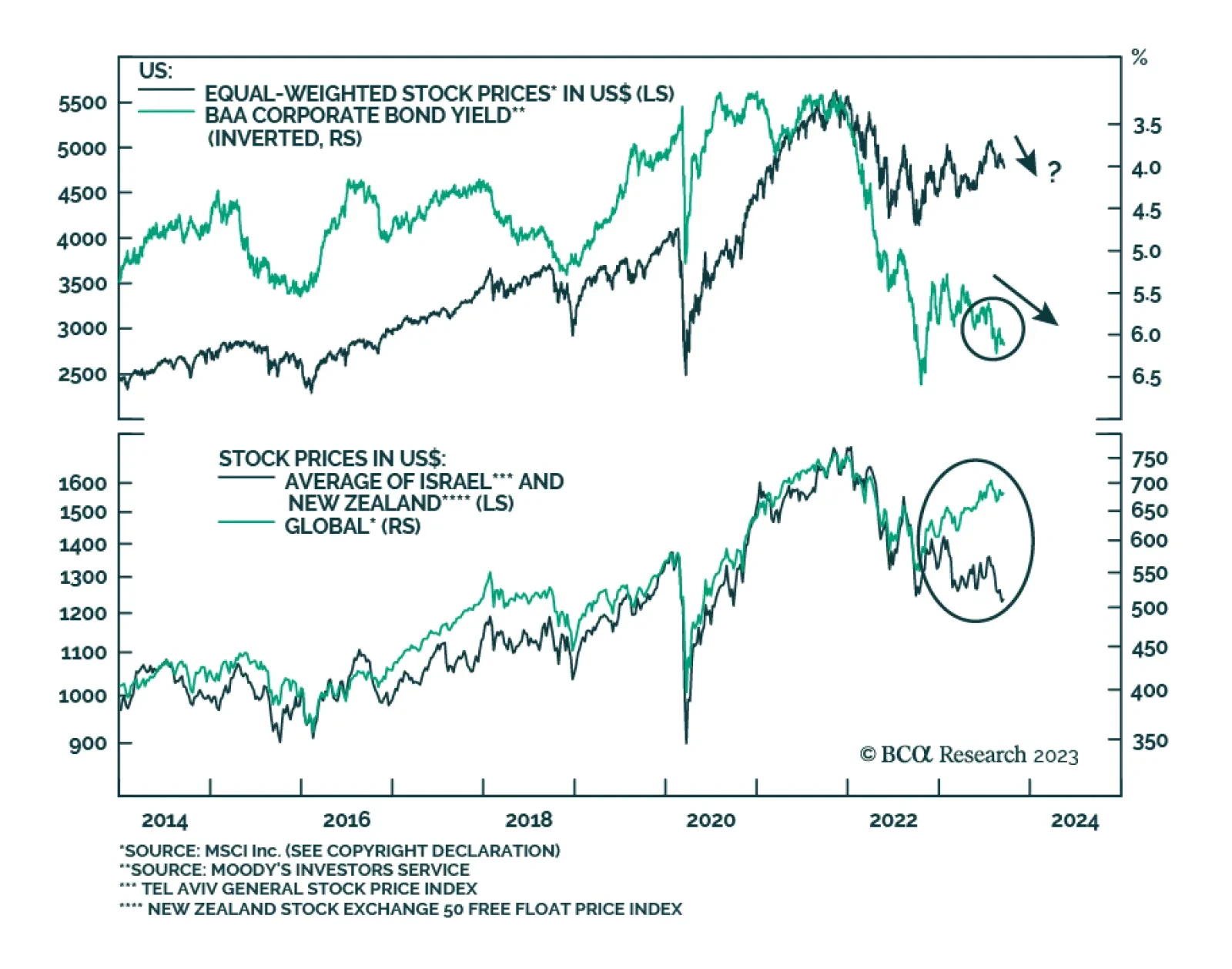

In a recent report, BCA Research’s Equity Analyzer service proposes two strategies to help investors navigate the conflict in the Middle East. The first strategy uses the “Macro Sensitivities” filter on…

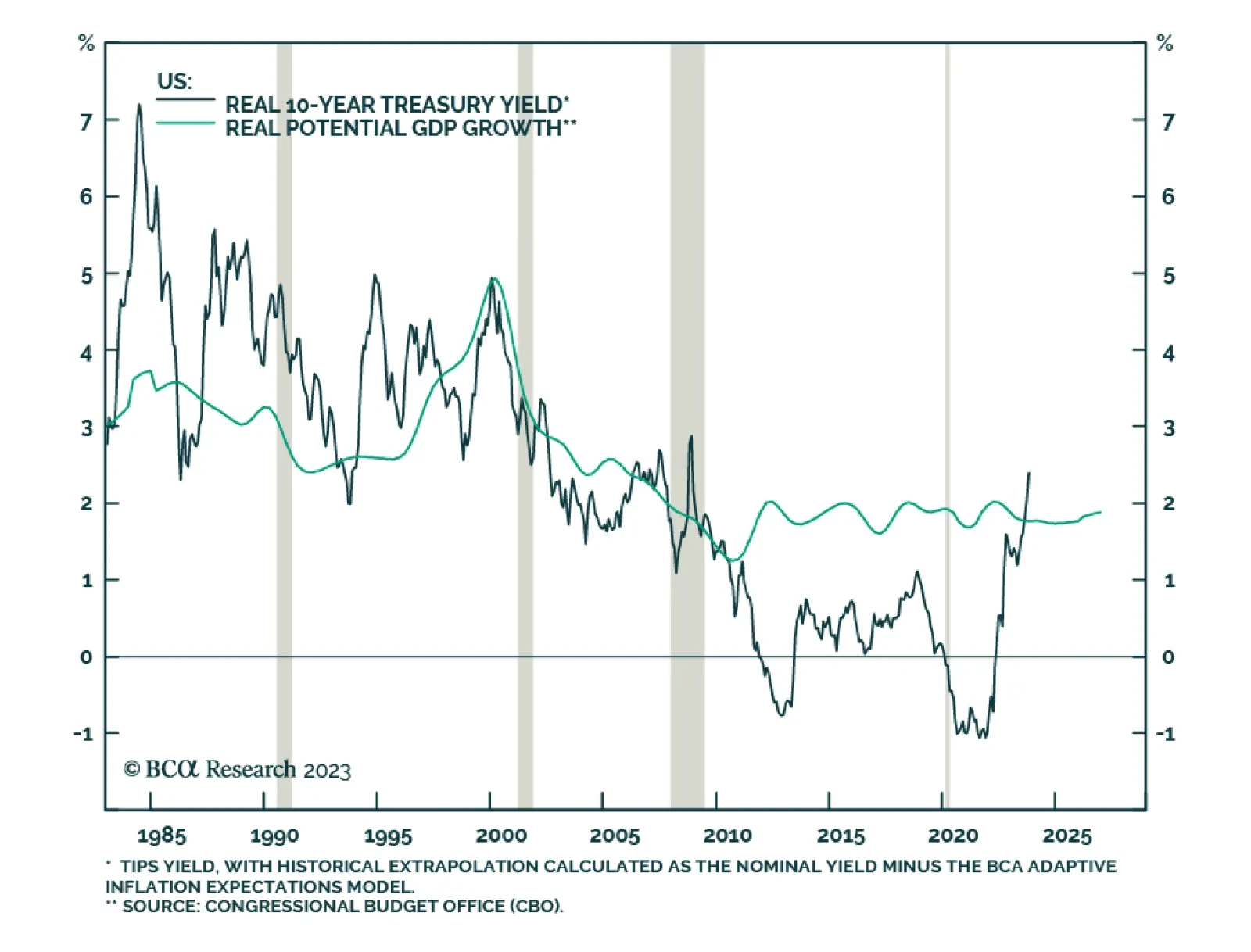

The last few weeks saw a repricing of nominal yields to levels not breached since before the Great Financial Crisis. Breaking down the US 10-year Treasury yield into real and inflation expectations components reveals the selloff…

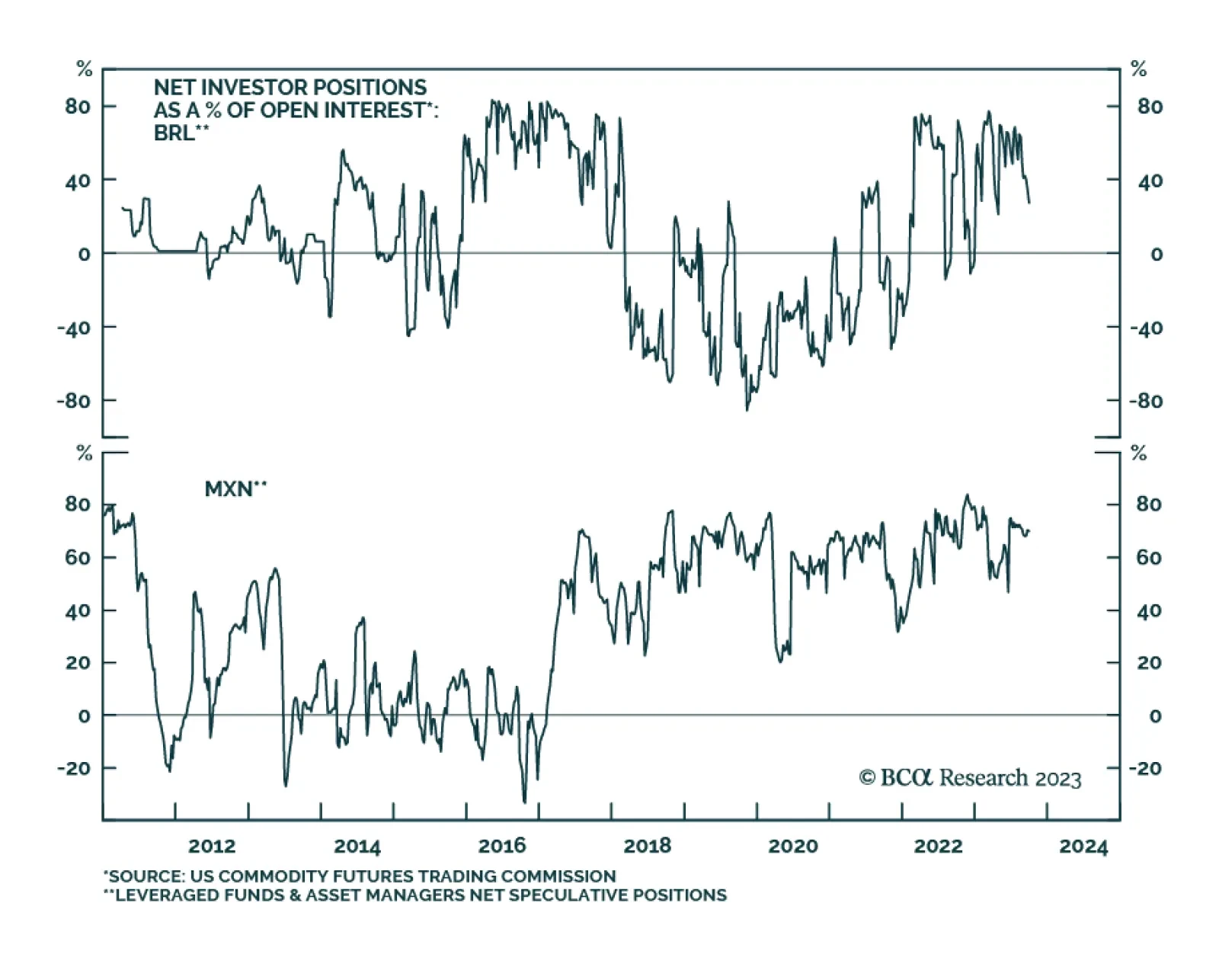

EM currencies have gotten caught up in the risk off sentiment across global financial markets. The JP Morgan Emerging Markets currency index has fallen to a new record low amid the US dollar’s ongoing appreciation. While…

There is a connection between the bond market meltdown and Republican Party’s meltdown. Investors should expect more short-term financial market volatility as a result of the triple whammy of high bond yields, high oil prices, and a…

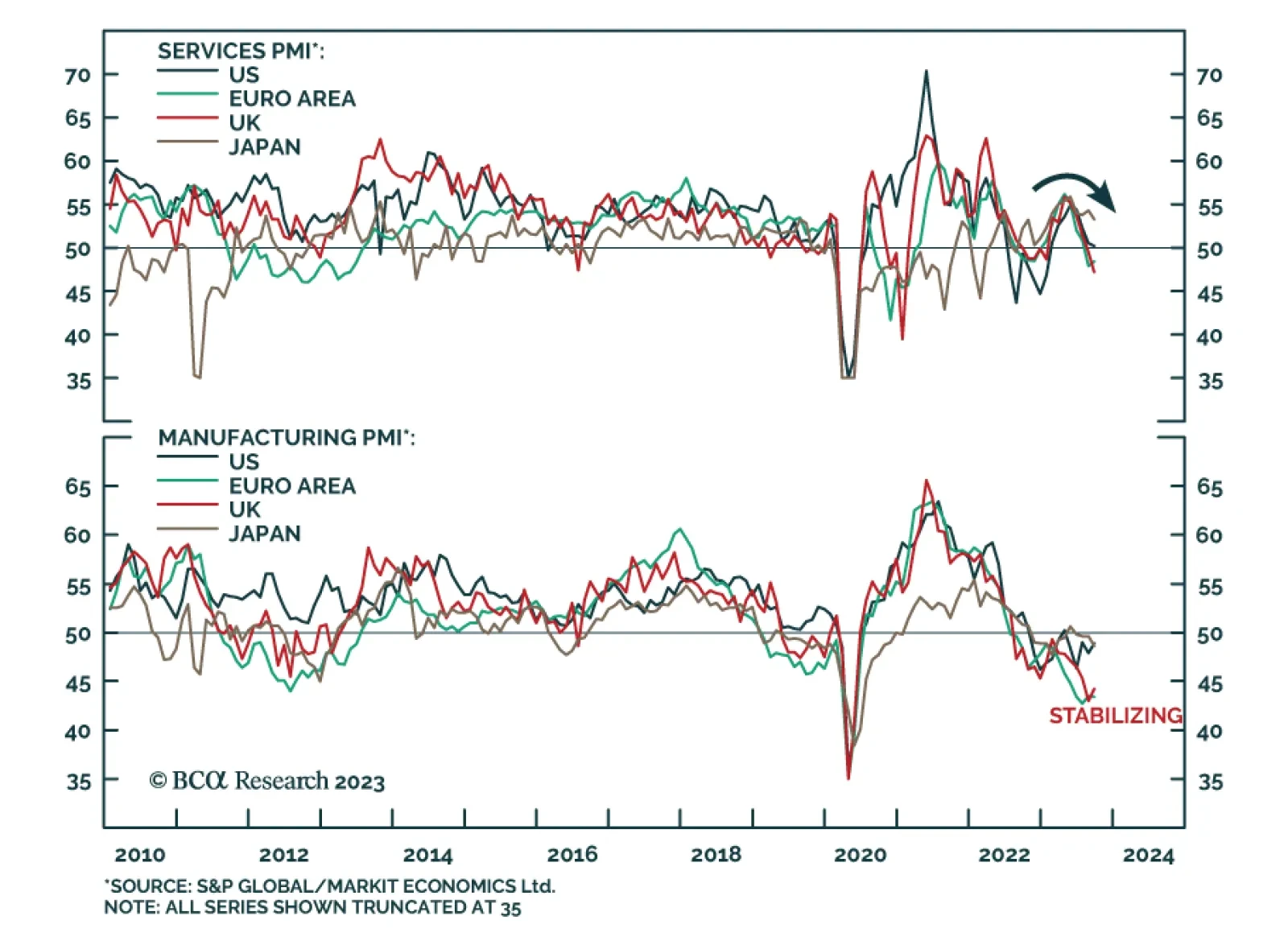

Flash PMIs suggests that the tailwind to services from pent-up demand during the pandemic is easing and that although the global manufacturing downturn is bottoming, it is not meaningfully reaccelerating. In the case of the US…

According to BCA Research’s Emerging Markets Strategy service, the combination of rising oil prices, an appreciating US dollar, and mounting US bond yields constitutes a triple whammy for US share prices. One risk that…

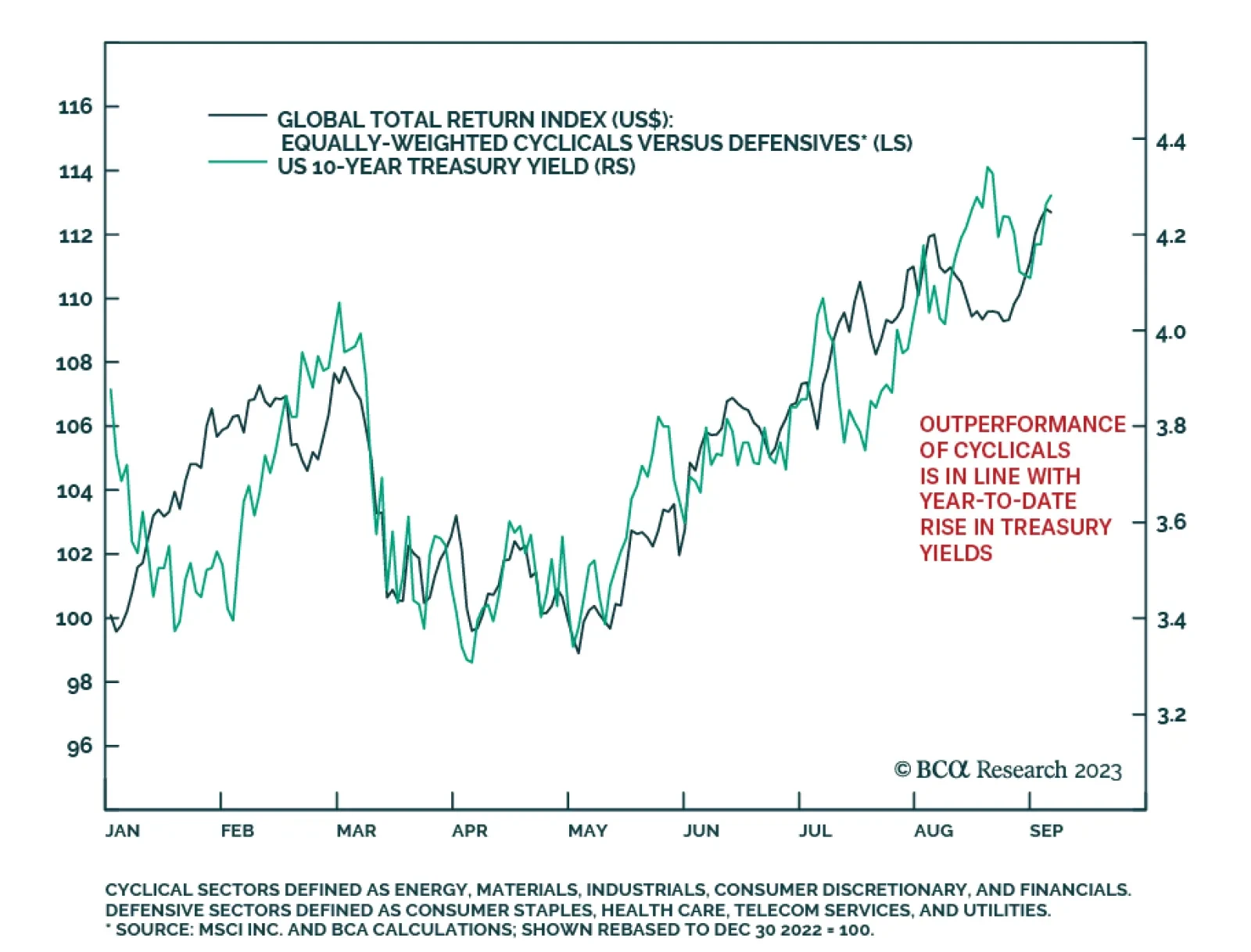

Since the beginning of the year, our equally-weighted global cyclicals index has outperformed equally-weighted defensives by about 13%. As the chart above shows, this relative performance trend has been extremely positively…

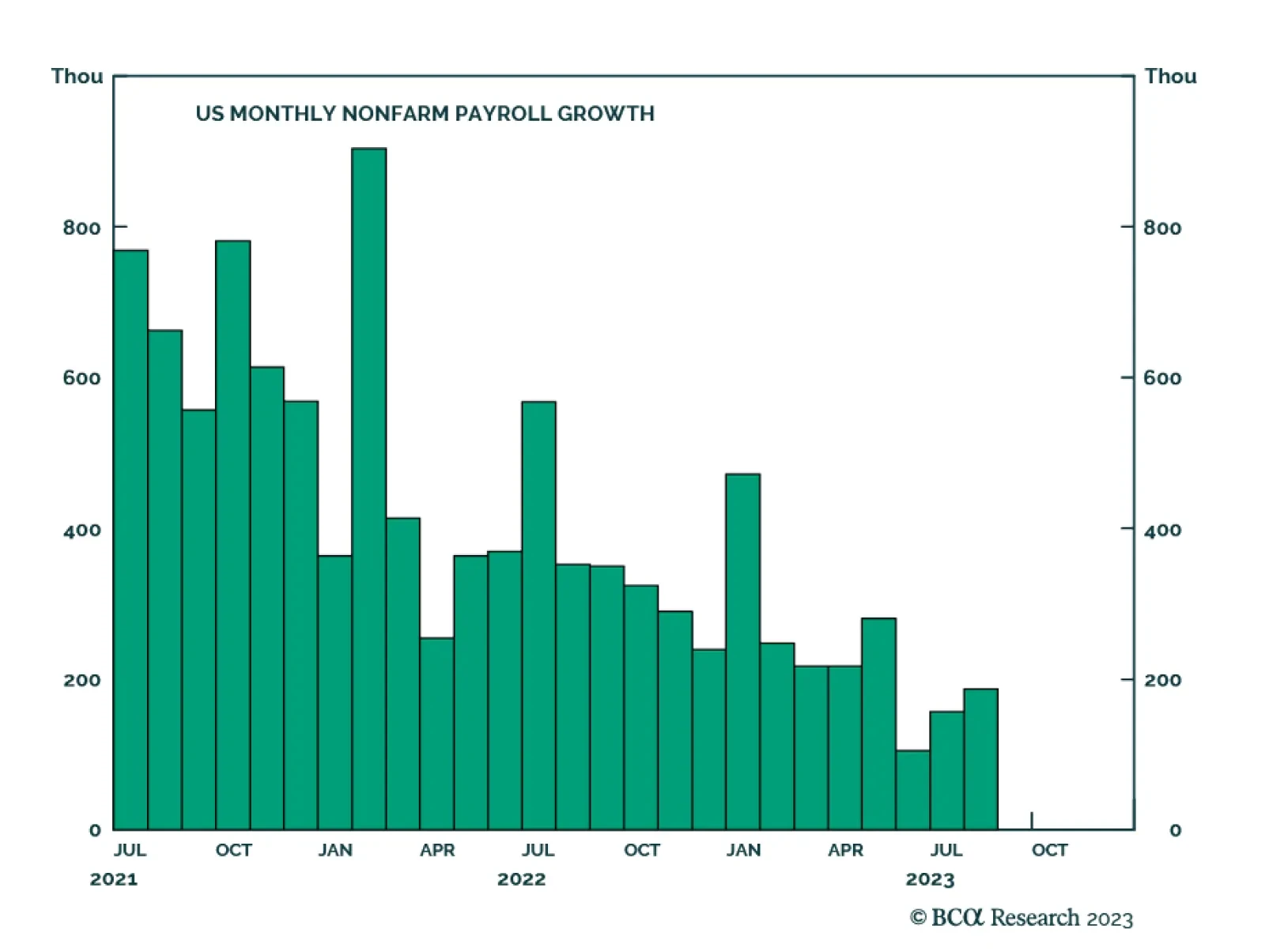

Friday’s US employment report suggests that the softening of the labor market is continuing at a steady pace. Although nonfarm payroll employment in June and July was revised down by 110 thousand, the 187 thousand increase…