Investors typically associate high-flying tech stocks with high sensitivity to interest rates. The rationale is simple: Given that most of their cashflows are further into the future, their value will be more sensitive to changes…

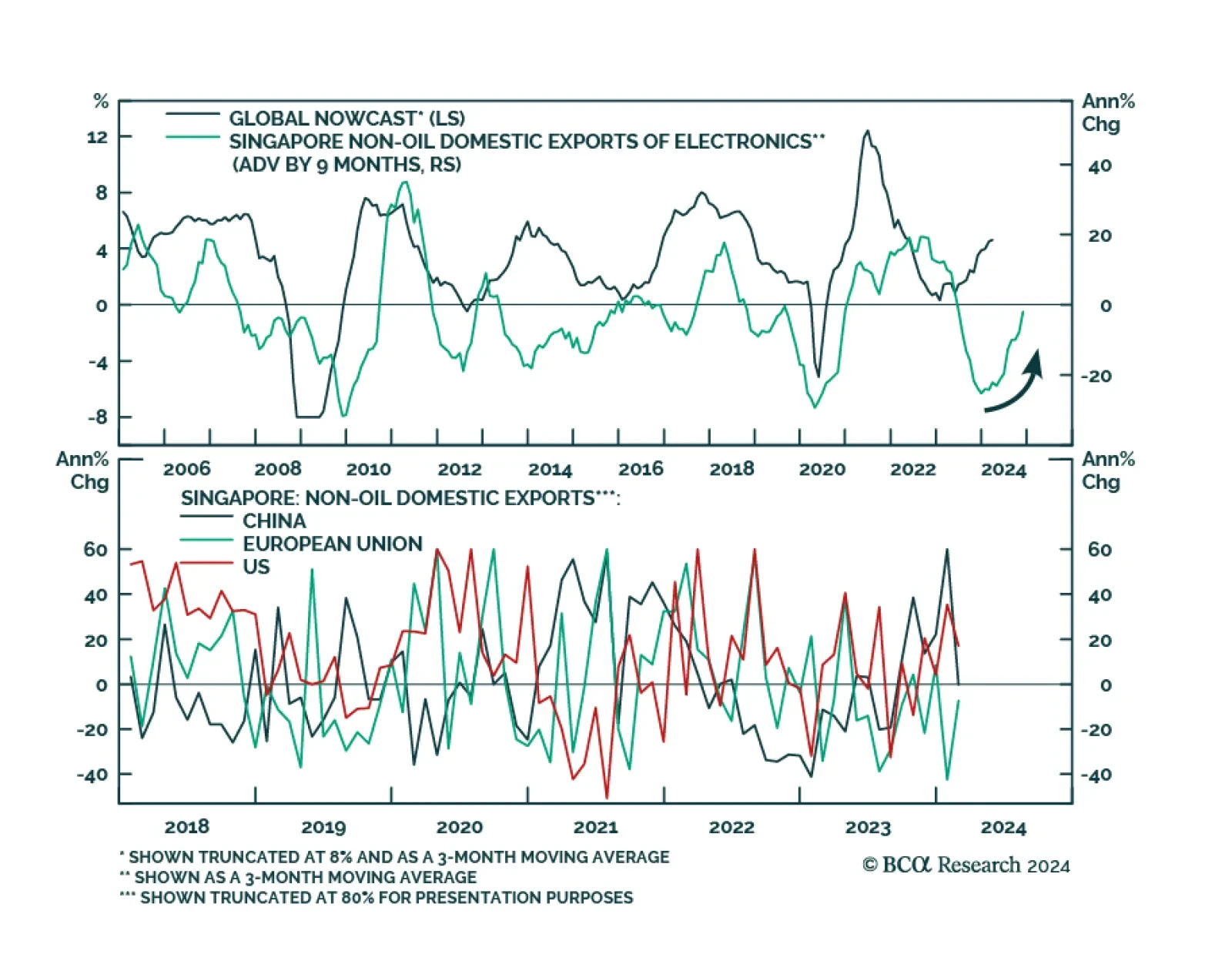

Singapore non-oil exports (NODX) largely disappointed in February, contracting by 4.8% m/m following a 2.3% m/m expansion in January, and falling below expectations of a milder 0.5% m/m decline. In a similar vein, the 0.1% y/y…

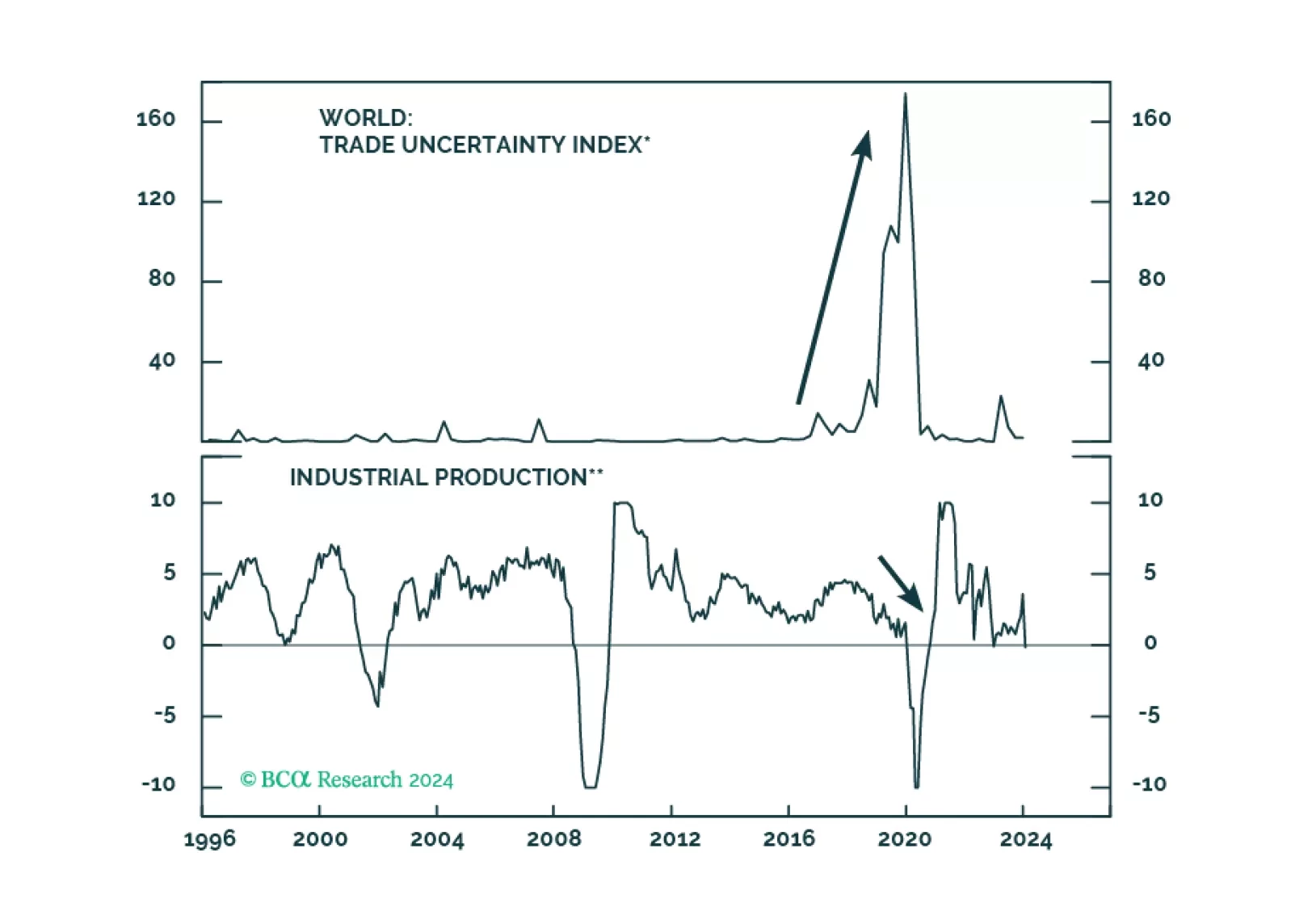

A soft landing can be achieved but not maintained. We are cutting our tactical recommendation on stocks from overweight to neutral and scaling back our long-duration stance.

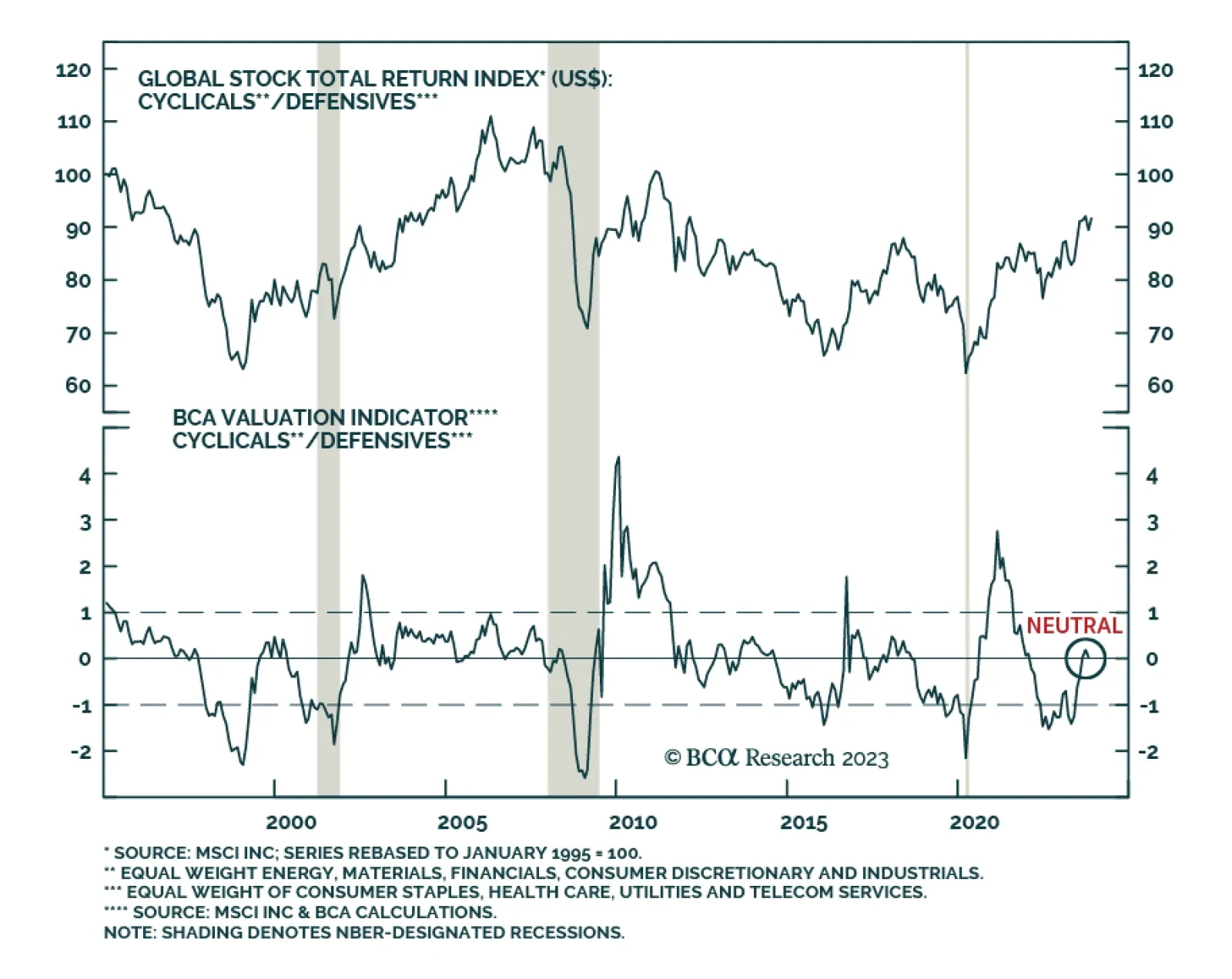

Global cyclical sectors are outperforming defensive sectors on a year-to-date basis. The bulk of this outperformance occurred in the first seven months of the year. Relative valuations contributed to this dynamic as last year…

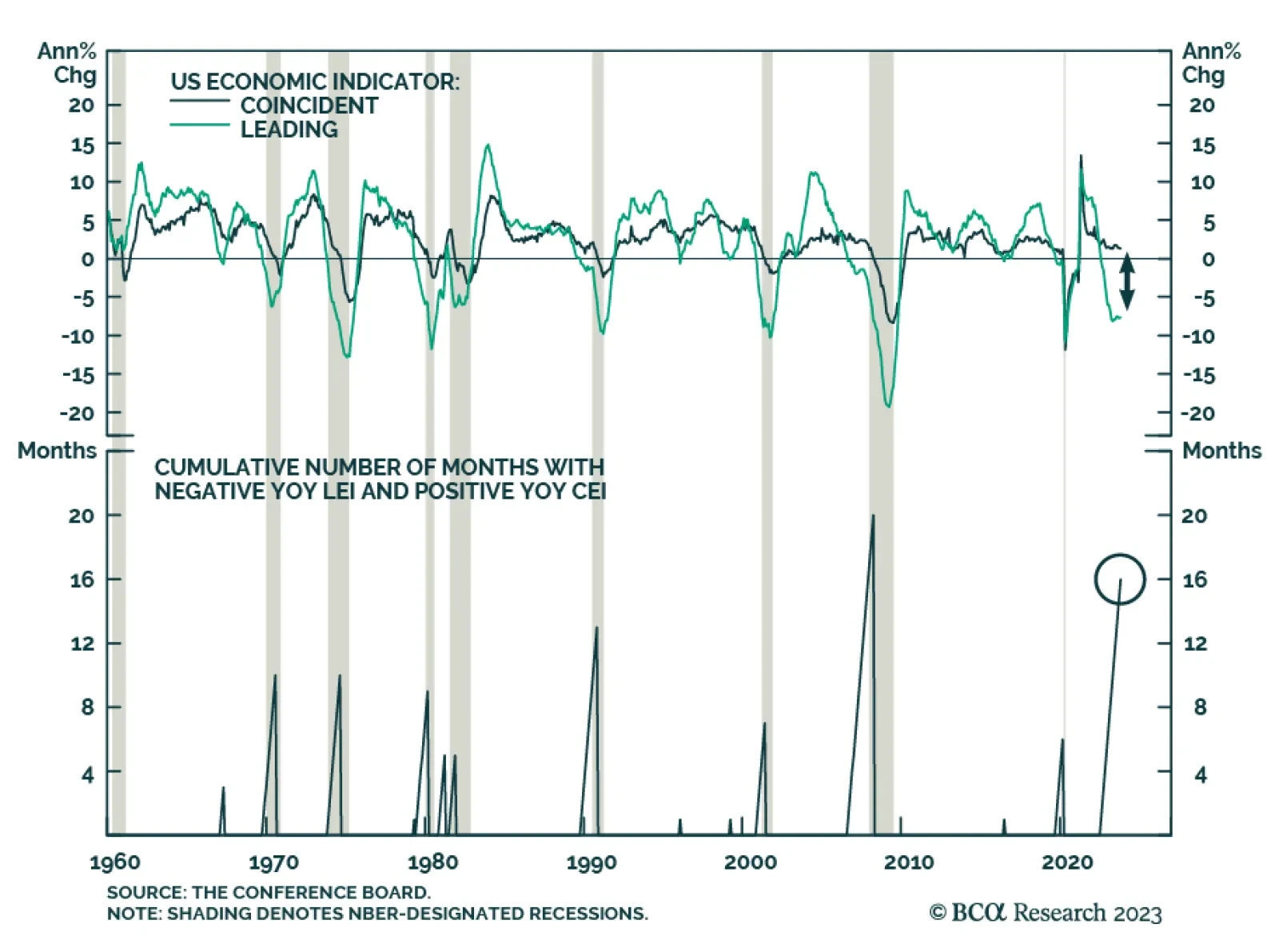

The US Conference Board's Leading Economic Indicator (LEI) continues to send a poor signal about the economic outlook. The monthly pace of contraction quickened to -0.8% m/m in October from -0.7% m/m in September. In terms…

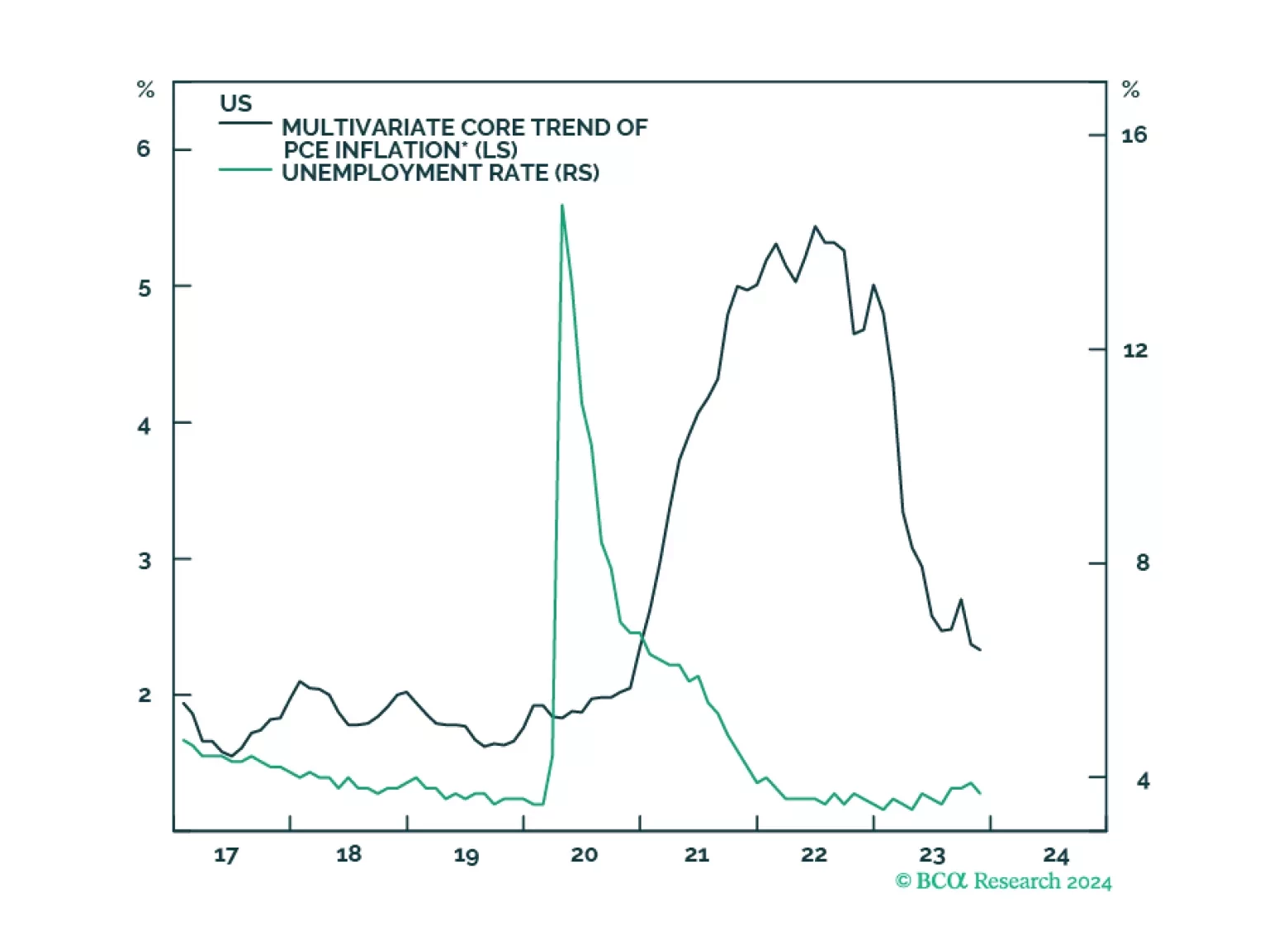

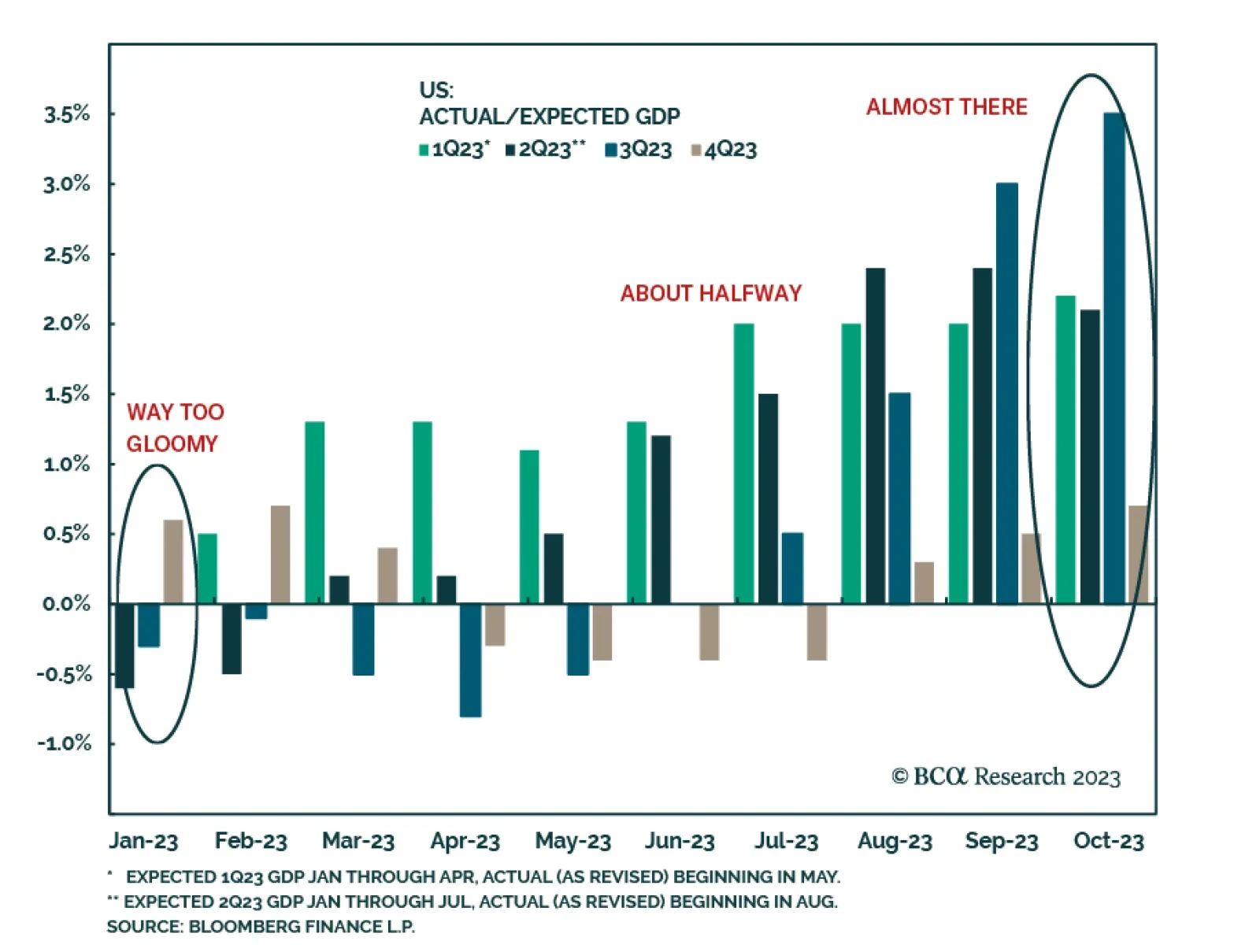

The soft-landing narrative is gaining momentum, pushing equities higher and potentially offering investors a better entry point to position against it. Financial markets appear to have been surprised by the comforting…

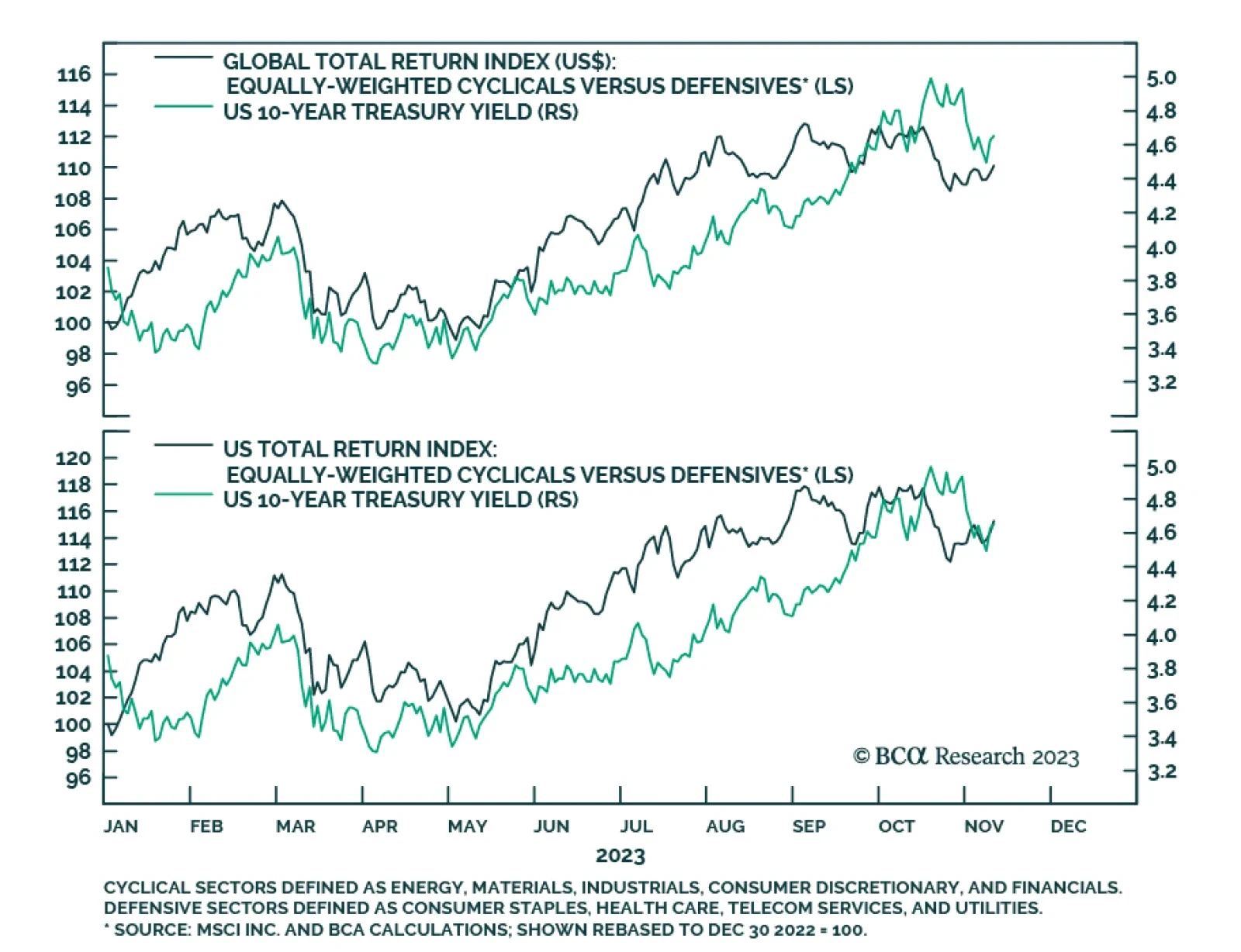

Our equally weighted global cyclical equity index has outperformed equally weighted defensives for most of this year. By October 17, this outperformance stood at about 12.6%. This outperformance is consistent with US Treasury…

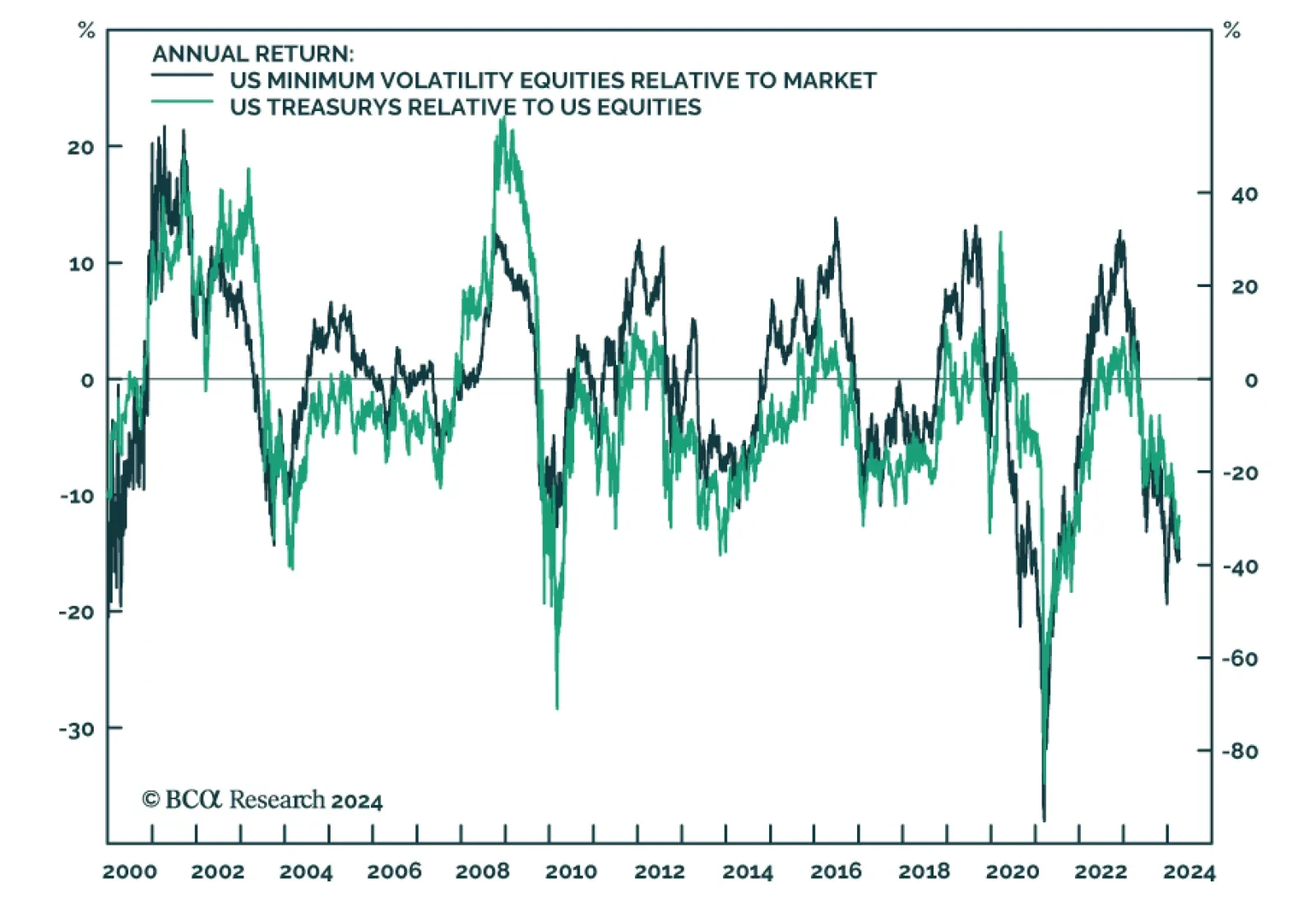

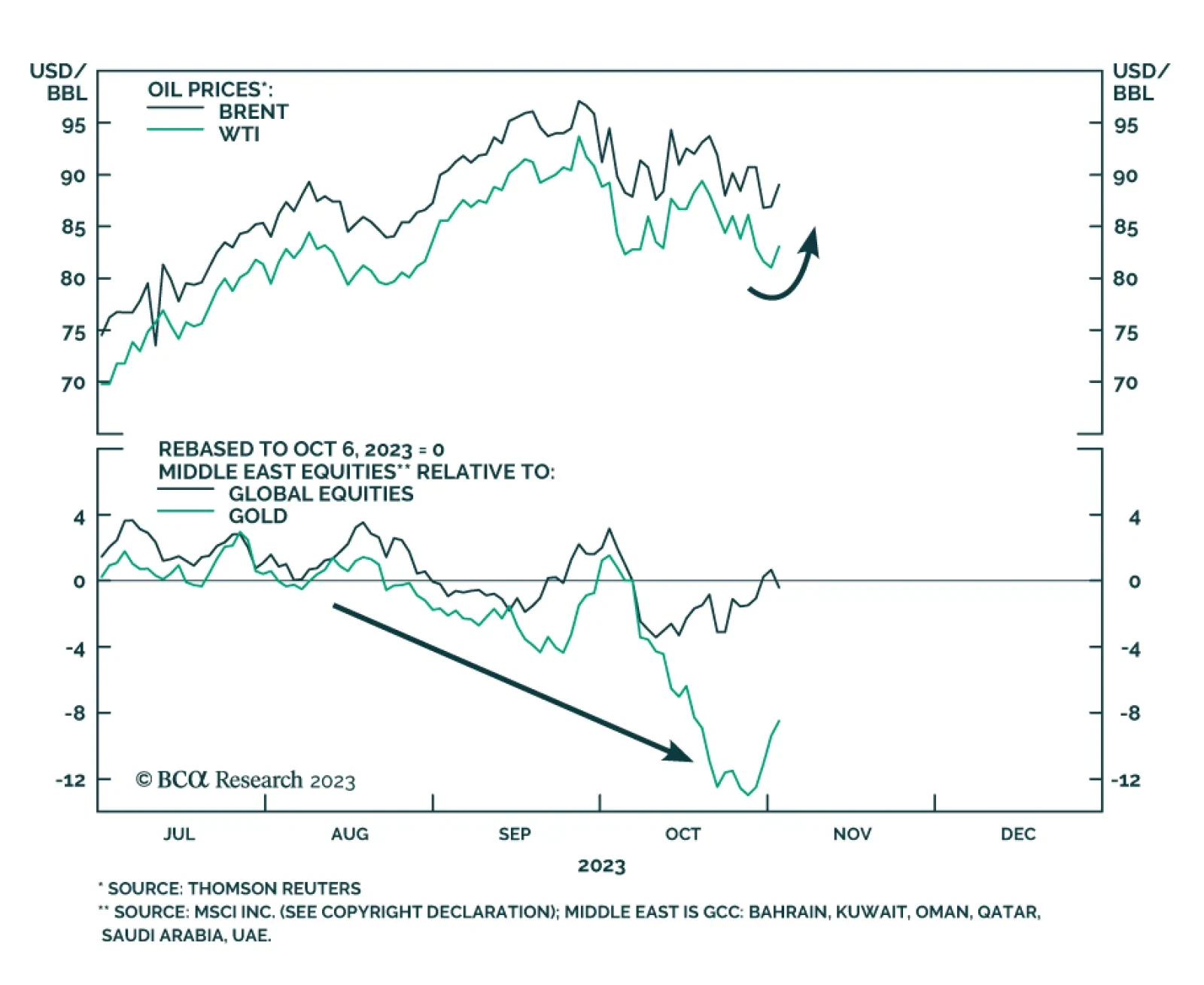

According to BCA Research's Geopolitical Strategy service, investors should reduce risk, increase allocation to safe havens, and brace for oil price volatility and supply disruptions stemming from the Middle East over the…

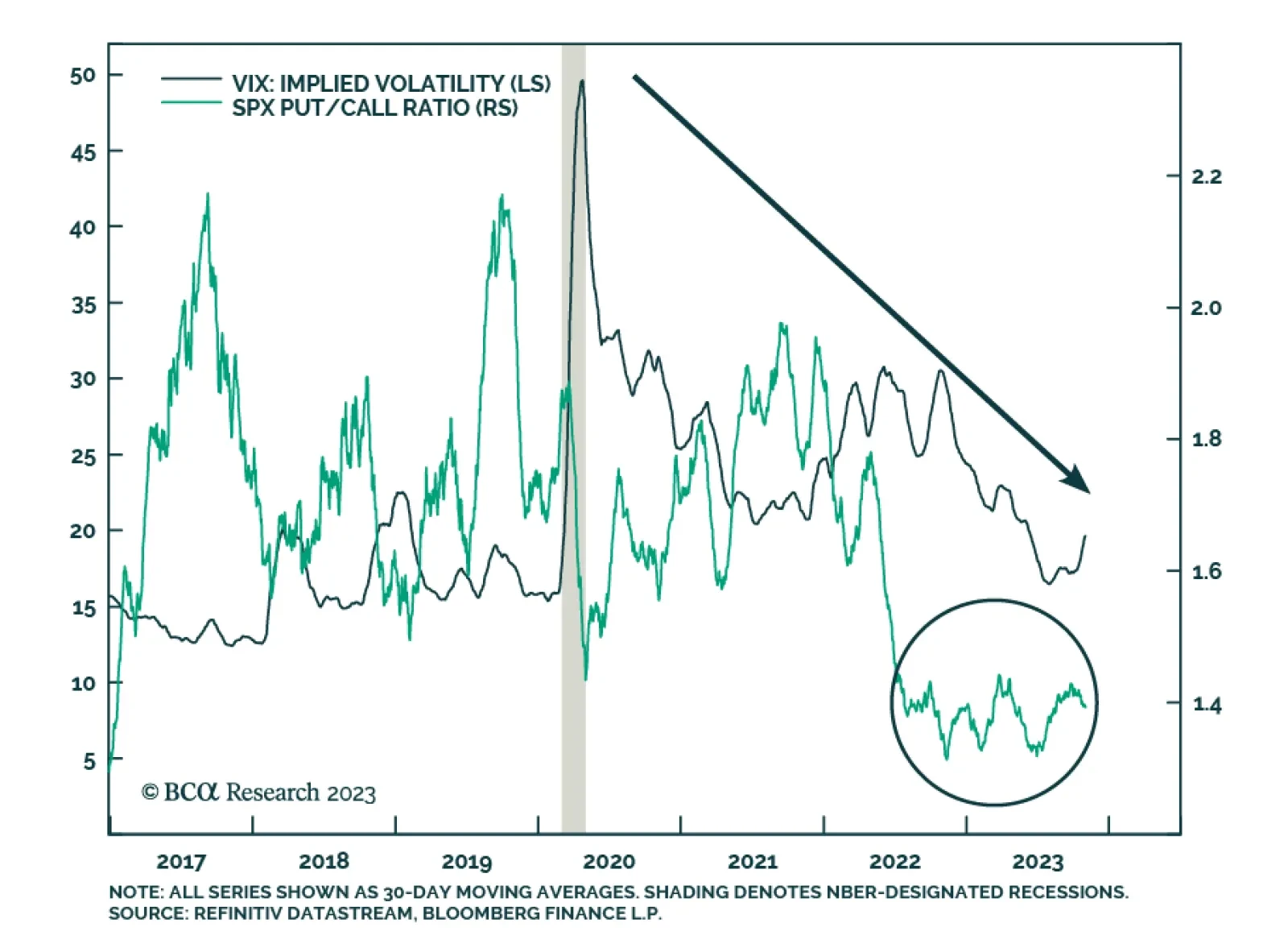

Our Private Market & Alternatives strategists recently upgraded their recommendation on Crisis Risk Offset (CRO) strategies within Hedge Funds from neutral to overweight. They are not making a tactical call around tail risk…