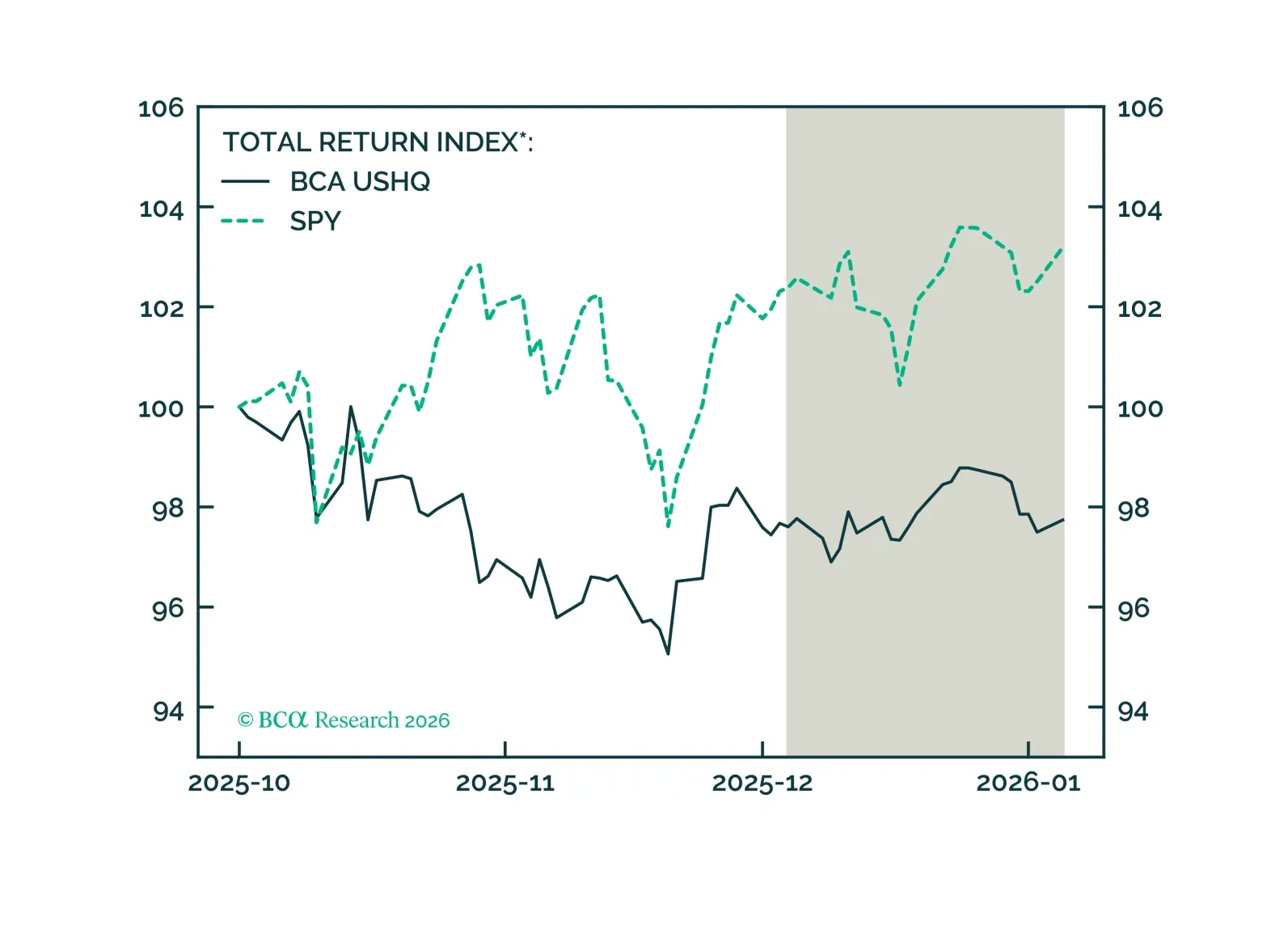

The US High Quality portfolio underperformed its benchmark through December, returning 0.14%, while its SPY benchmark returned 0.78%. On a trailing three-month basis, the USHQ portfolio’s performance was weaker than the benchmark,…

We discuss which variables we are tracking to assess the risks to the bull market in the absence of government data. So far, we do not see any obvious red flags. Remain overweight on equities and fixed income.

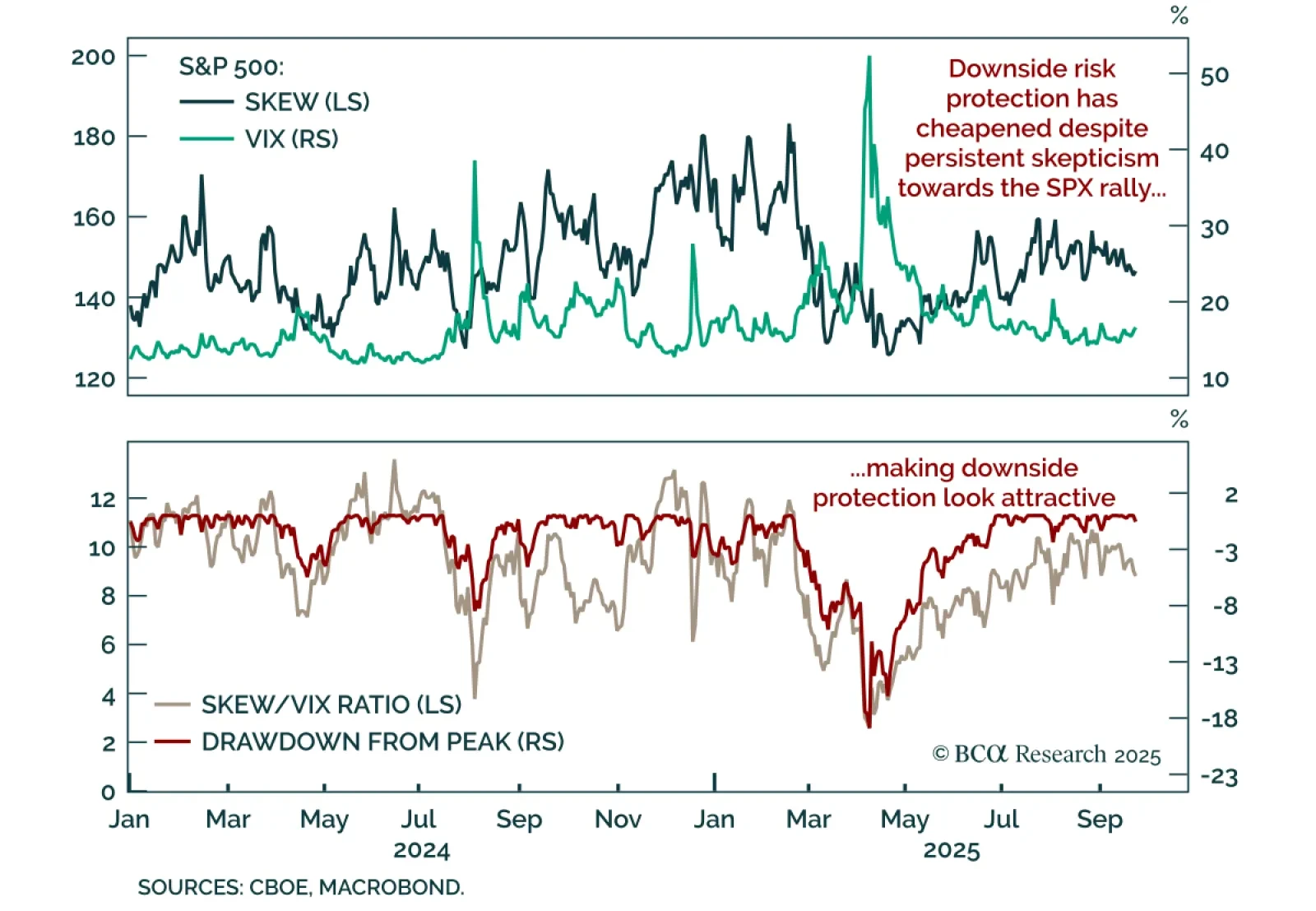

Despite talk of September seasonality, the S&P 500 has not pulled back, and the pain trade remains higher. The sell-off many expected failed to materialize. Positioning is not stretched, and in an environment where dip-buying…

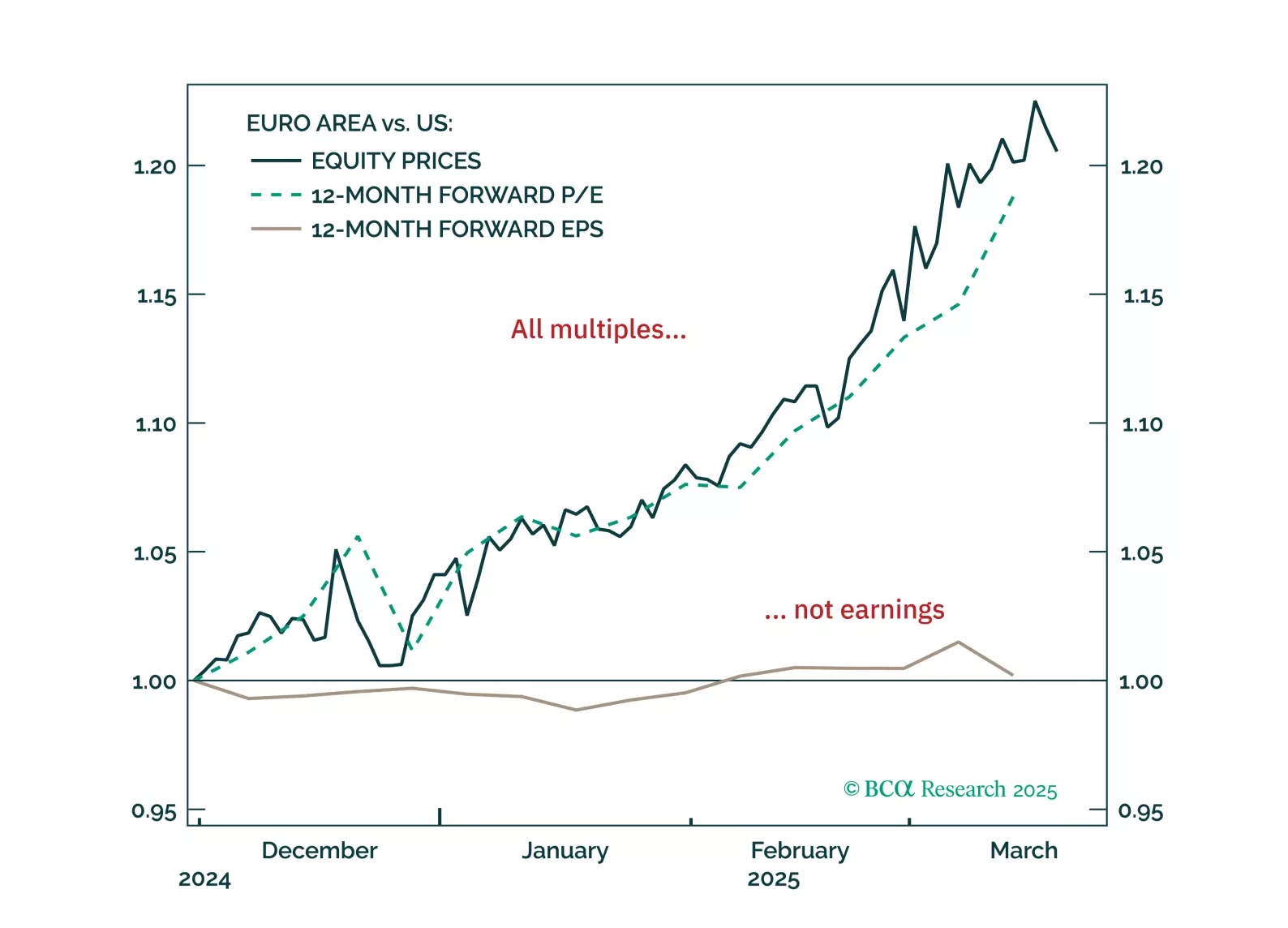

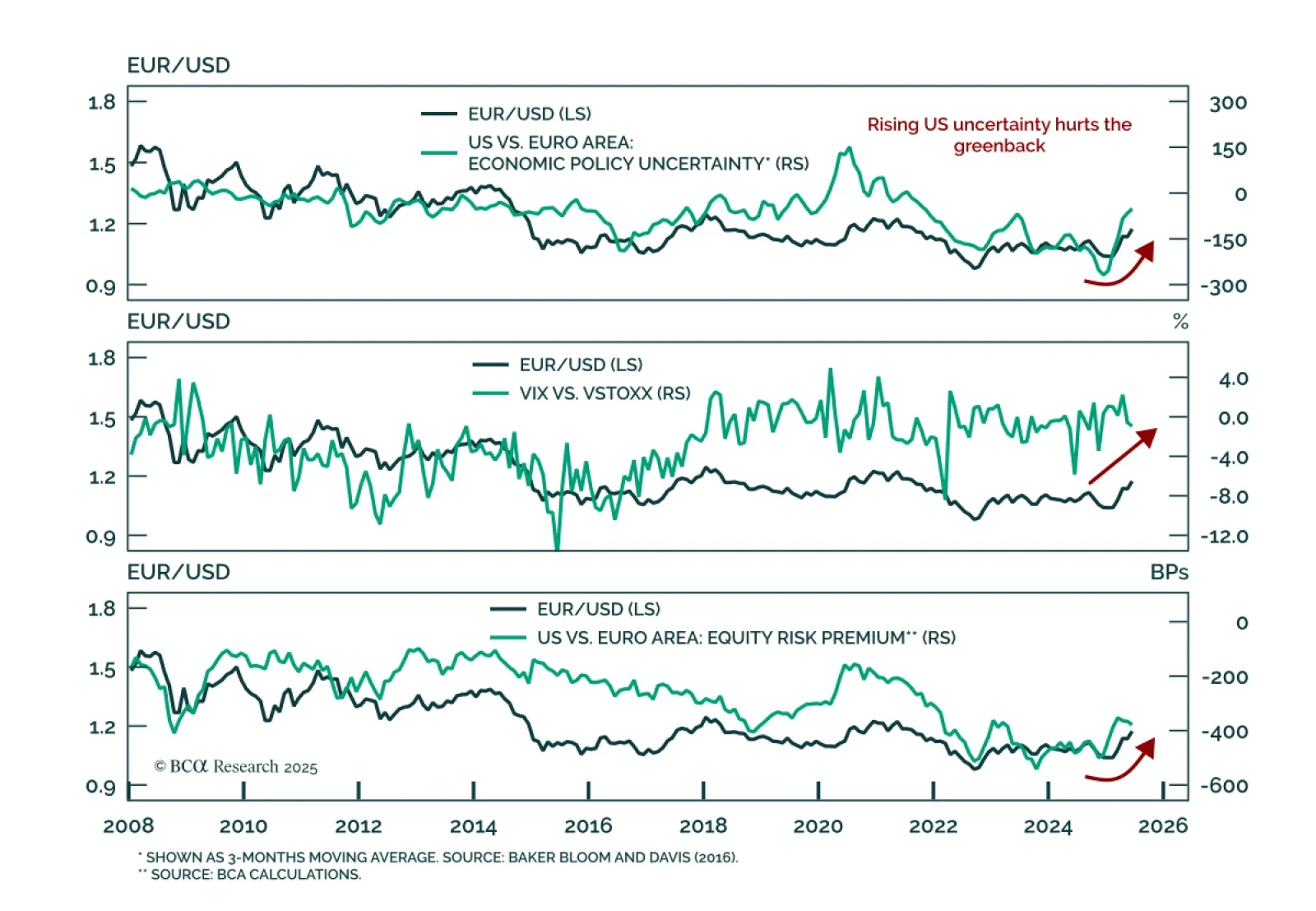

Rising US macro uncertainty and external imbalances are reinforcing euro strength and are supportive of a long-term bullish view on EUR/USD. Our Chart Of The Week comes from Mathieu Savary, Chief Strategist for Developed Markets ex…

Five questions, five answers from the road. We unpack what Europe’s biggest investors are worried about right now, from trade‑war whiplash to bund‑versus‑Treasury positioning; and where the real opportunities still lie.

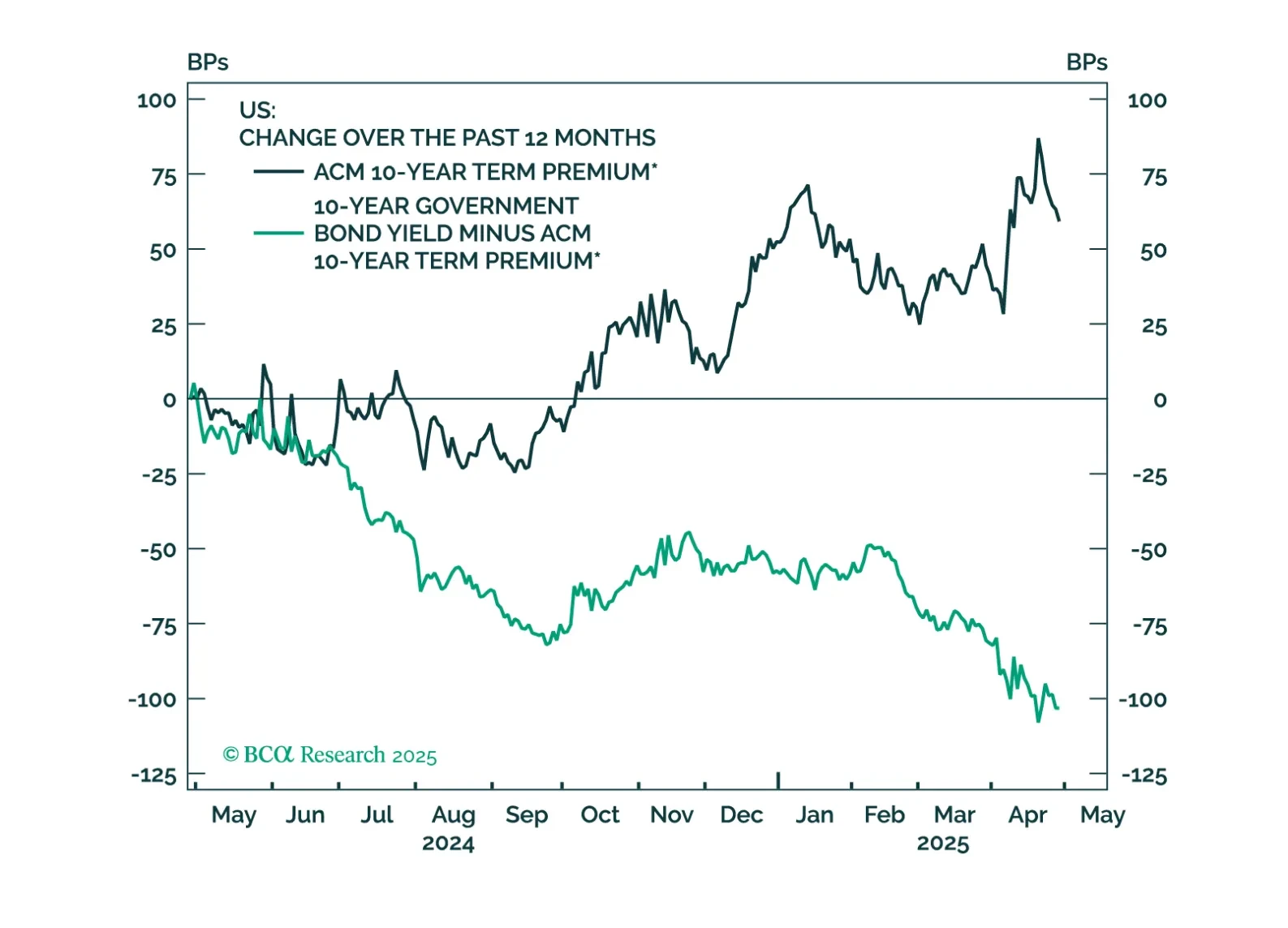

While most investors spent the month of April frantically refreshing their Twitter feeds for the next tariff announcement, we reiterate our stance that details on tariffs should be left to day traders. Long-term investors should be…

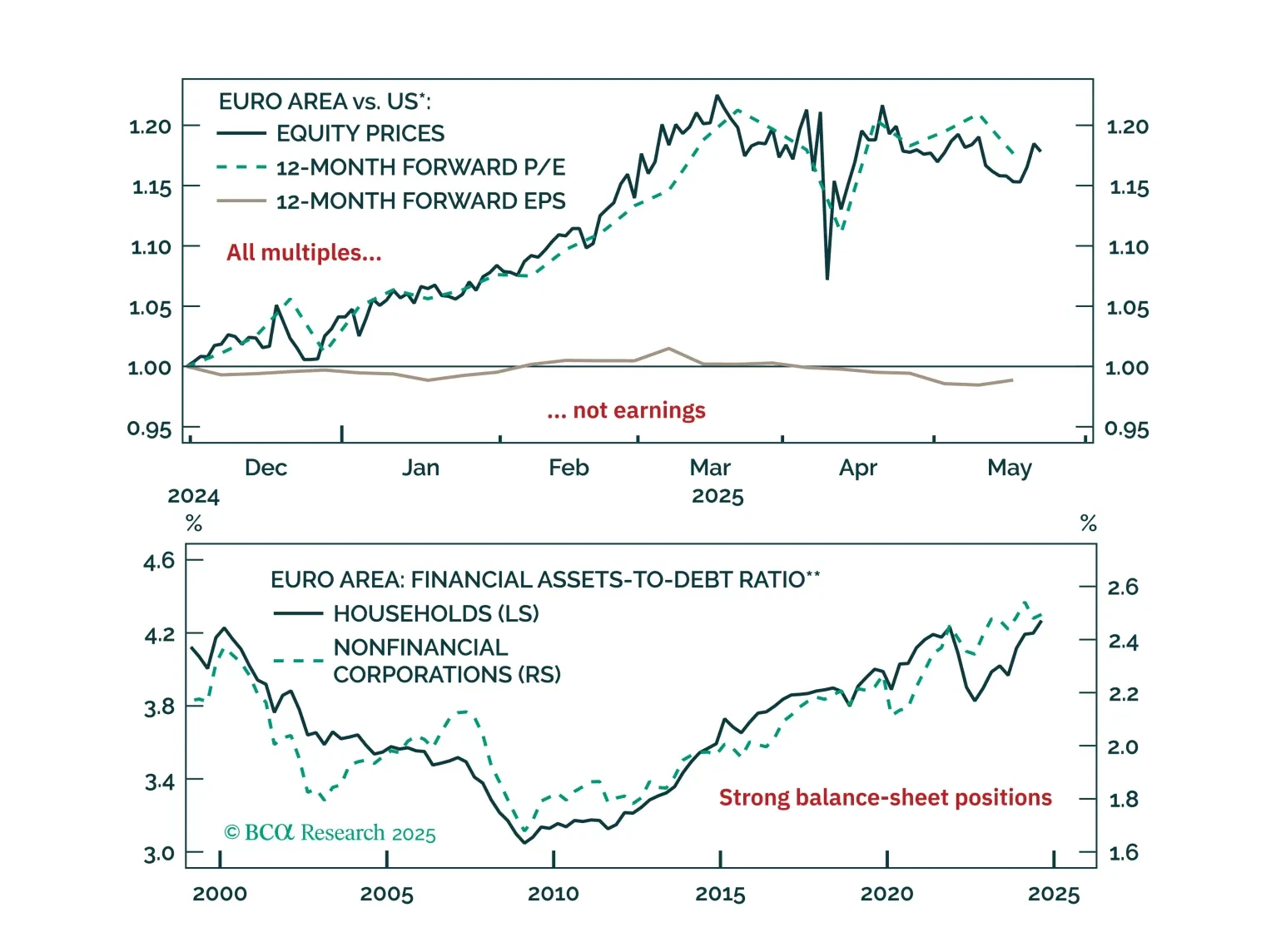

European equities have surged on hopes of a low-inflation boom—but the rally has likely gone too far, too fast. With a pullback now likely, how should investors position themselves over the next 3–6 months?

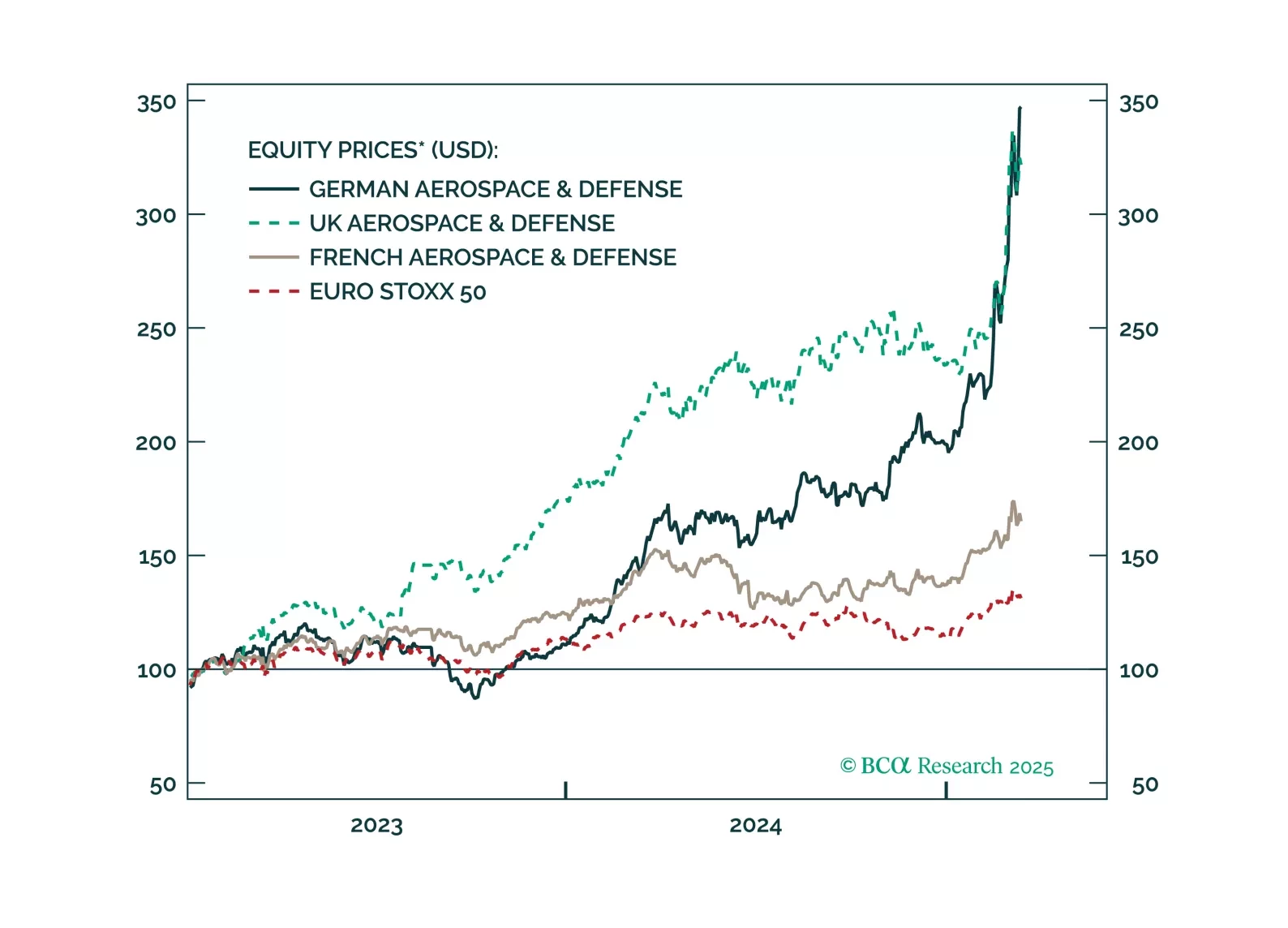

Investors should not chase the rally in European defense names any further. Too much good news has been priced in too quickly.

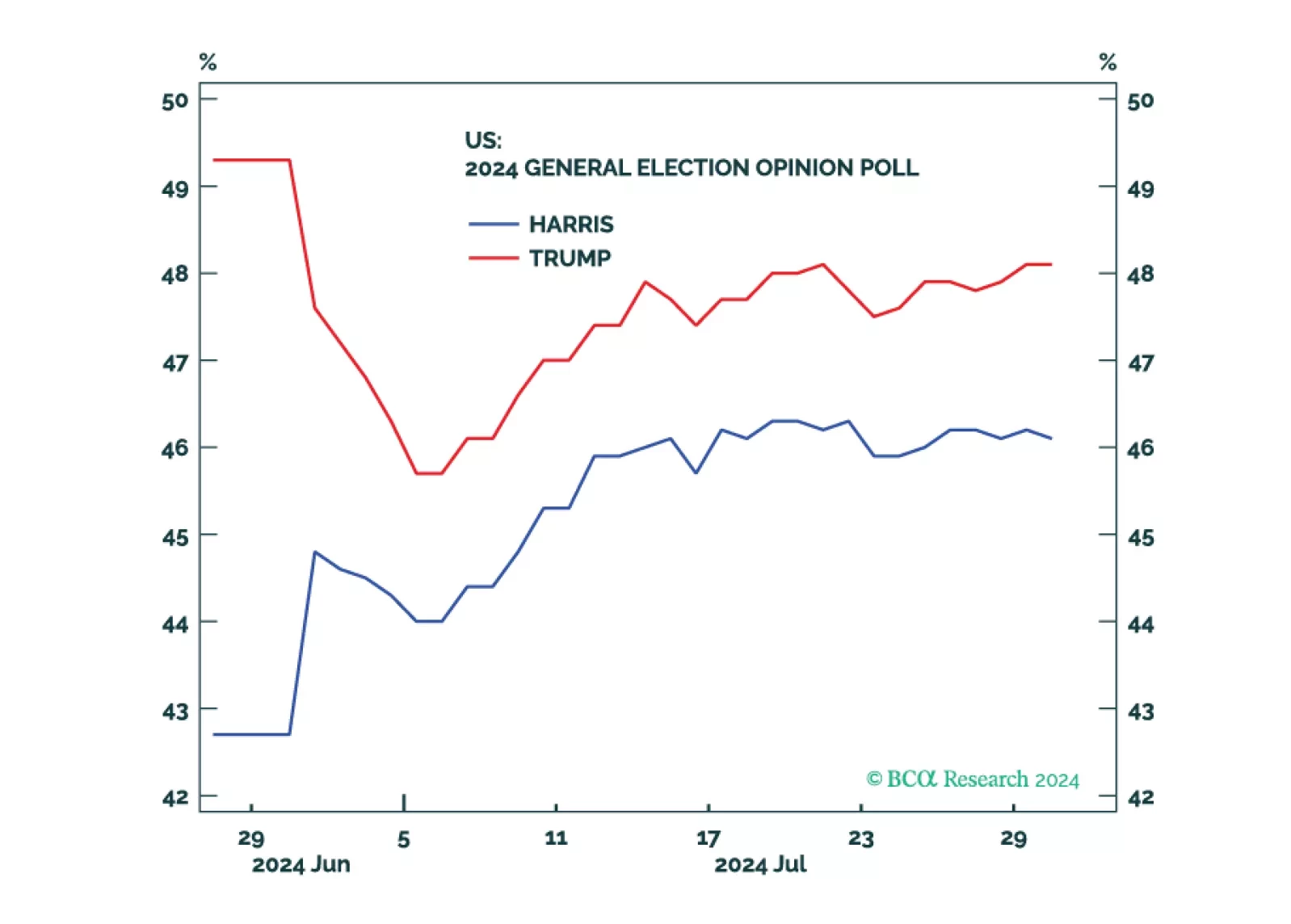

Republicans are favored but the election is still competitive. Equities, corporate credit, and cyclical sectors will fall until policy uncertainty is reduced.