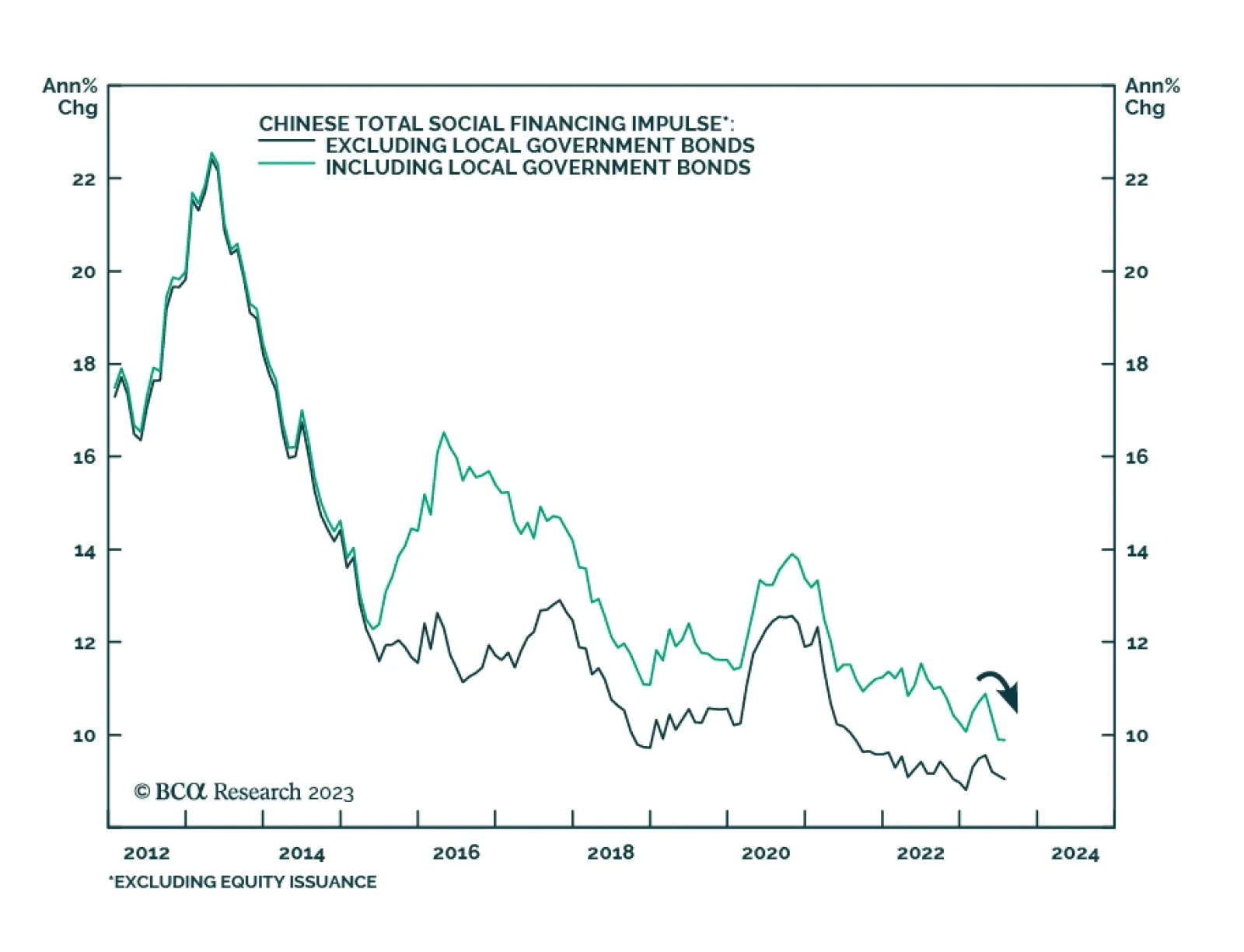

Recent Chinese economic data show some signs of stabilization. China’s credit expansion surprised to the upside in August. Aggregate social financing totaled CNY3.12 trillion – above expectations of CNY2.69…

In this report, we explore what a new BRICS+ union means for the dollar over the next 6-to-9 months.

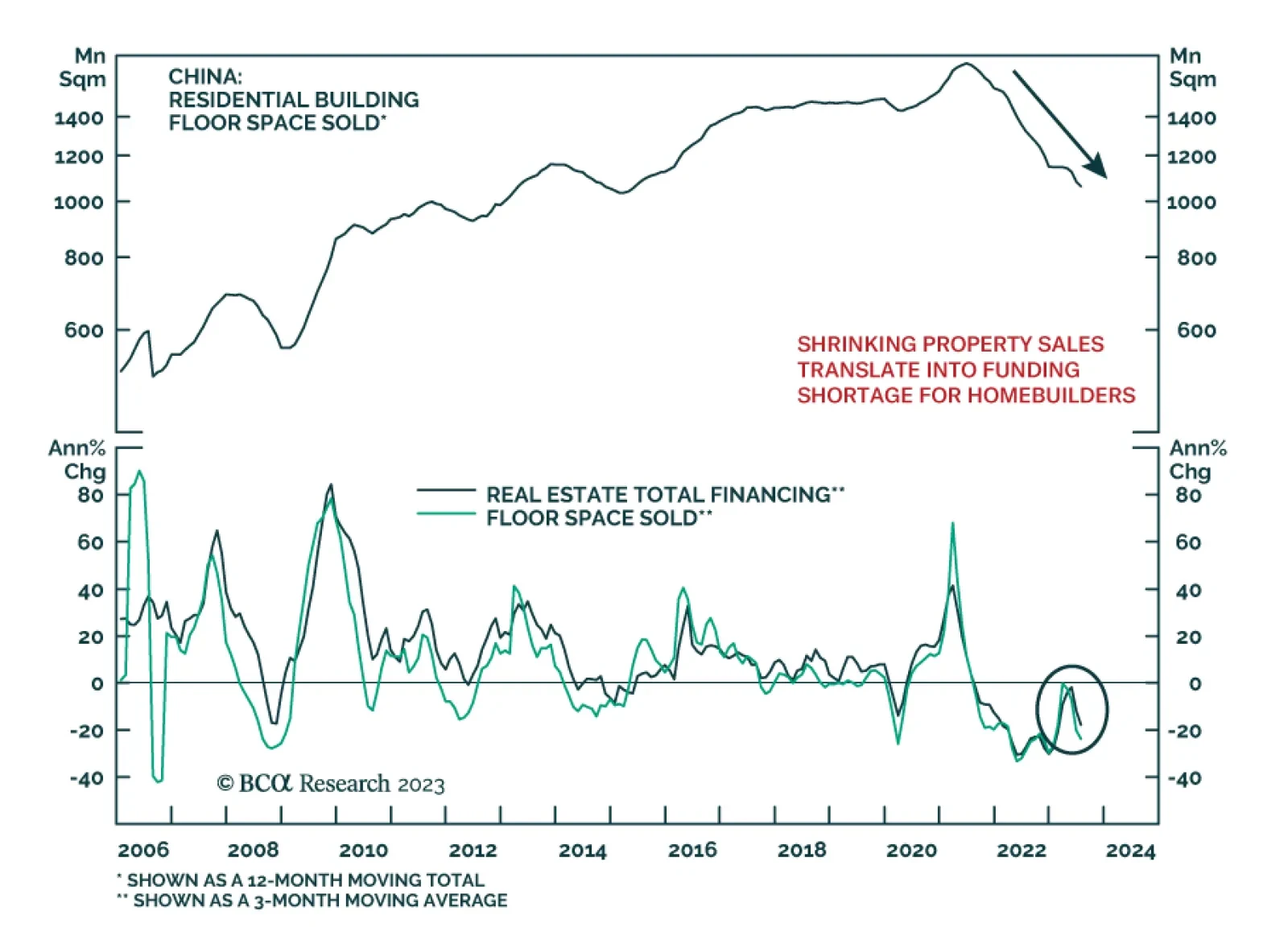

According to BCA Research’s China Investment Strategy service, although property-sector stocks in China’s onshore and offshore markets have been beaten down, they have not yet reached their bottom. The property…

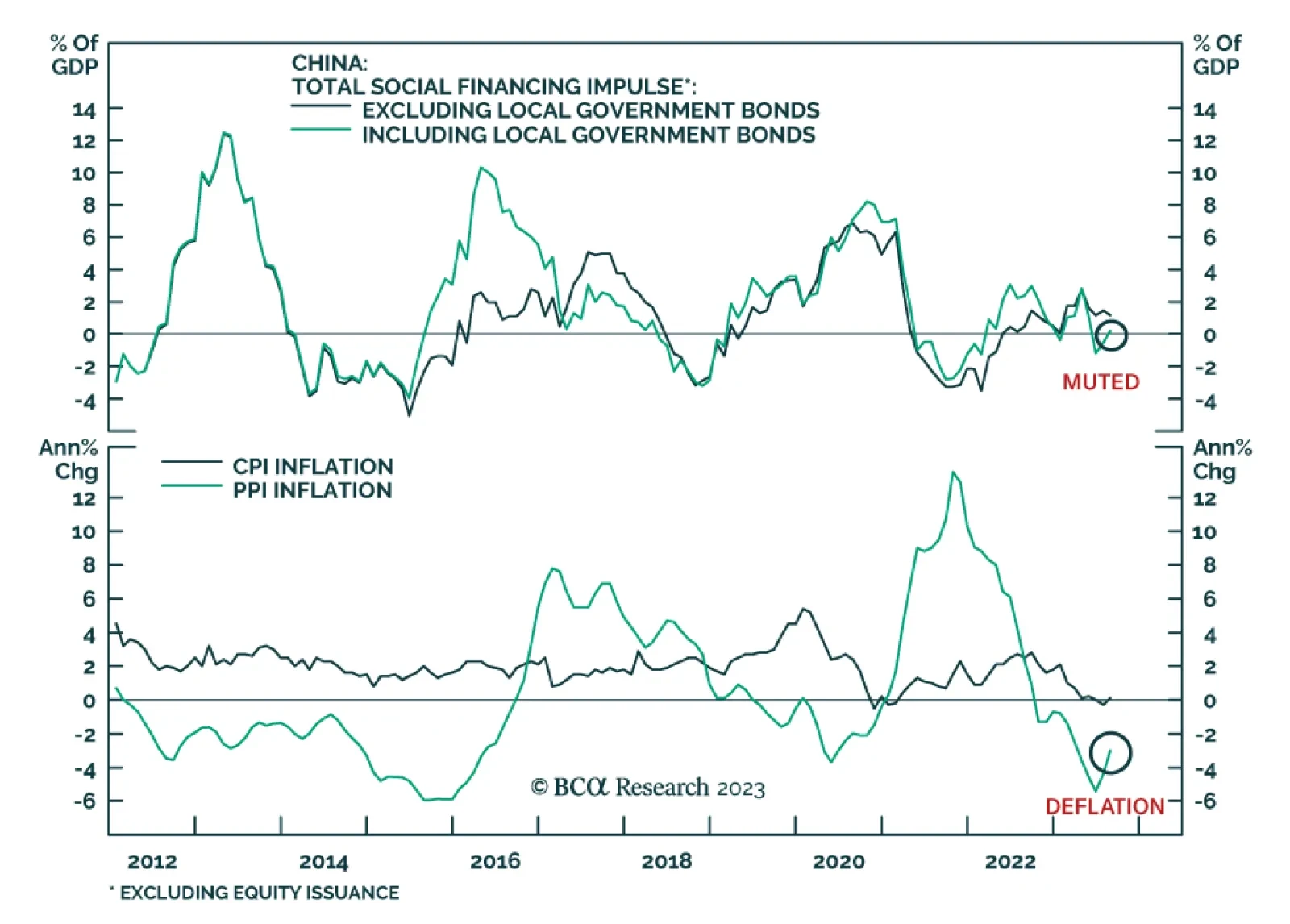

Chinese credit and money data fell significantly below expectations in July. The CNY 0.53 trillion increase in aggregate social financing marks a significant slowdown from CNY 4.22 trillion in June and came in significantly below…

The latest round of earnings calls from the systemically important banks suggested that the expansion is still intact. Households are still flush and still spending and consumer and business delinquencies remain remarkably low.

Over the past two months, copper has rallied alongside risk assets and now stands 9% above its late-May trough. Here, the outlook for China’s economy – which accounts for over half of global refined copper usage…

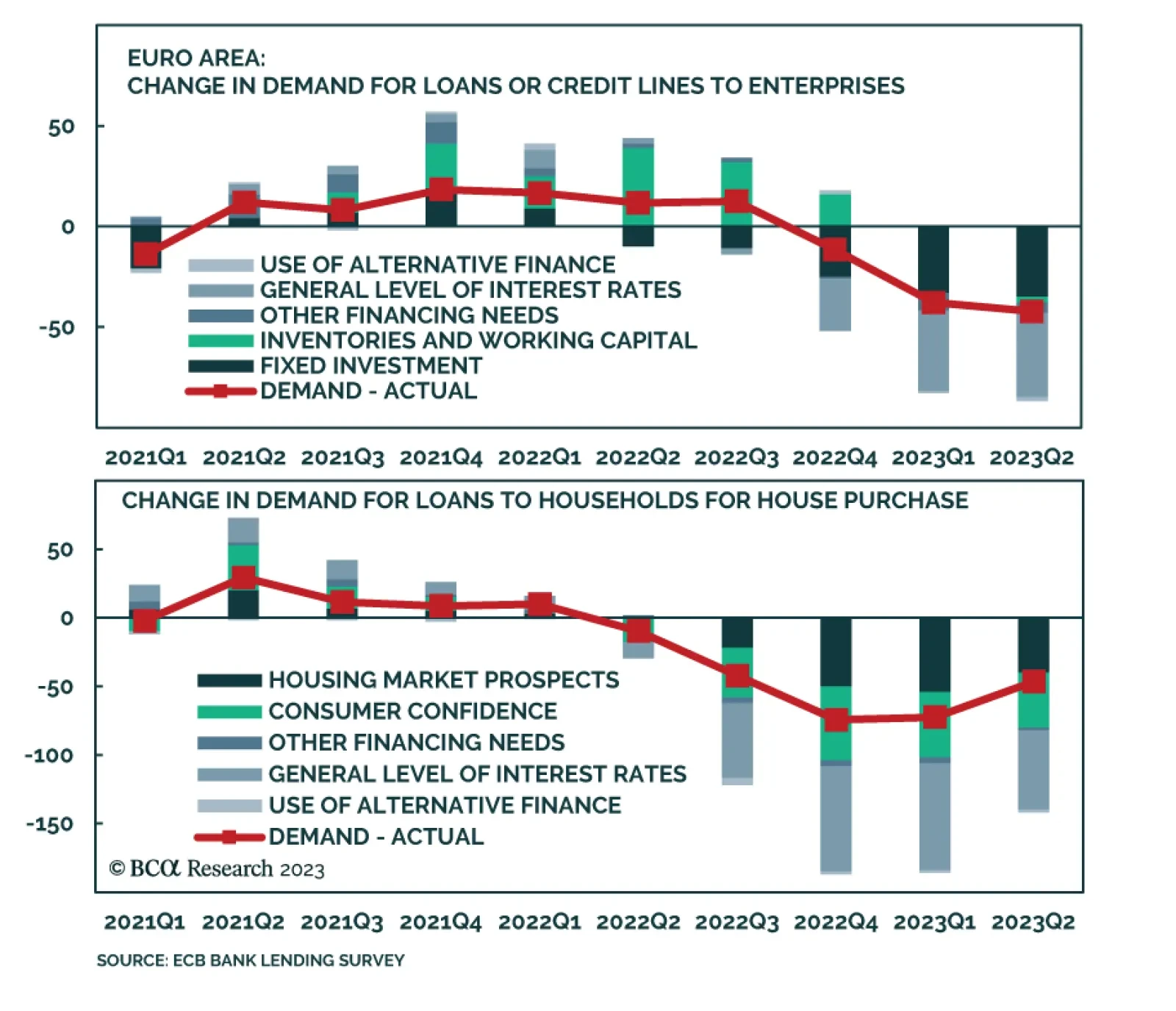

Results of the ECB’s bank lending survey (BLS) show the impact of the central bank’s aggressive tightening cycle on the region’s economy. Uncertainty about the economic outlook, borrower-specific dynamics,…

Falling inflation enables central banks to pause rate hikes, which is good news. But time goes on. Restrictive monetary policy, Chinese debt-deflation, energy supply shocks, US and global policy uncertainty, and extreme geopolitical…

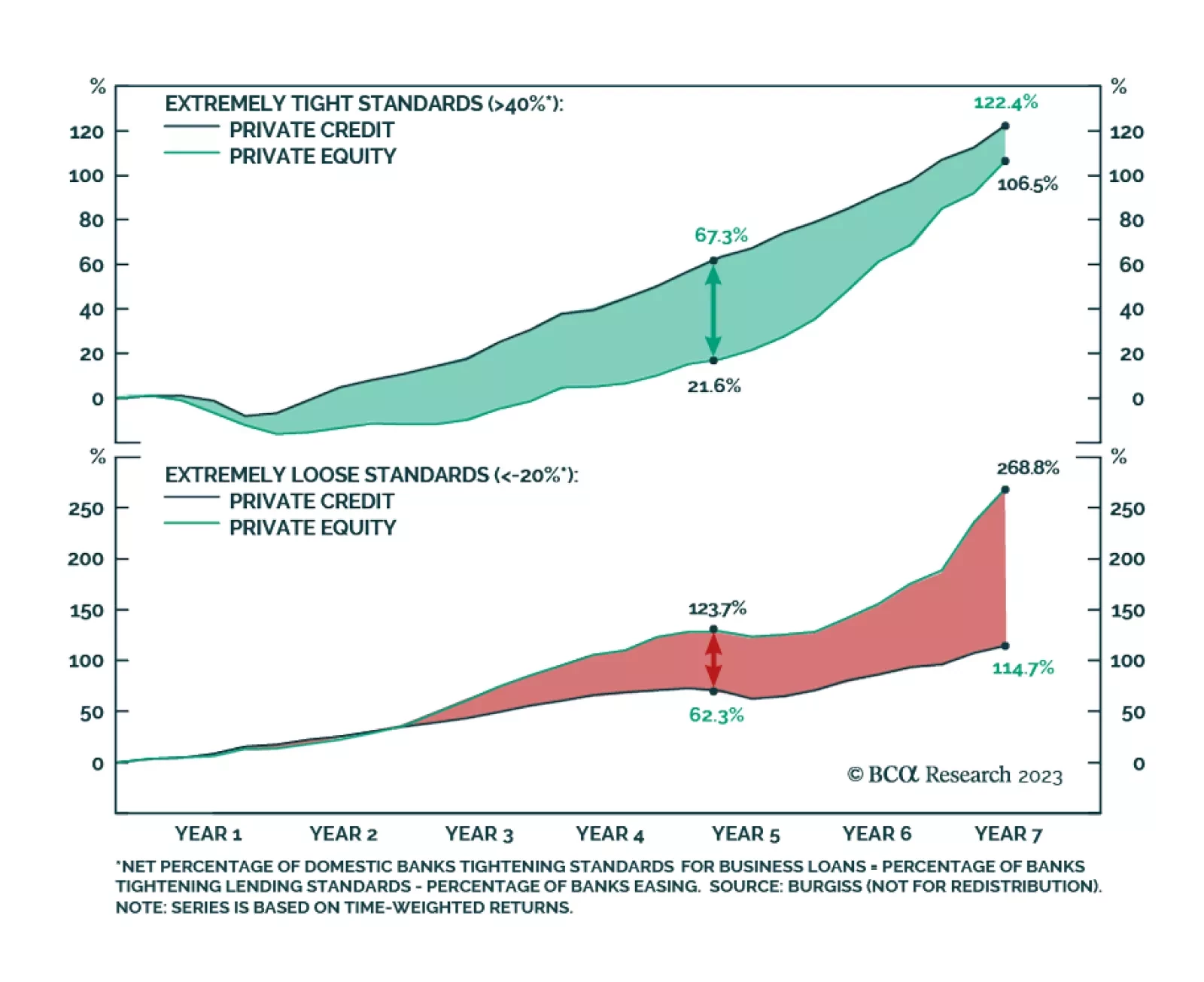

According to BCA Research’s newly launched Private Markets & Alternatives service, the present moment in the business cycle appears to be favorable for Private Credit relative to Private Equity. The current…