The SIFI banks (BAC, C, JPM and WFC) kicked off the fourth-quarter US reporting season on January 12th. As usual, our US Investment Strategists studied the SIFI’s earnings calls looking for macroeconomic insights from…

Today, we are sending you the BCA annual outlook for 2024. The report is an edited transcript of our recent conversation with Mr. X and his daughter, Ms. X, who are long-time BCA clients with whom we discuss the economic and…

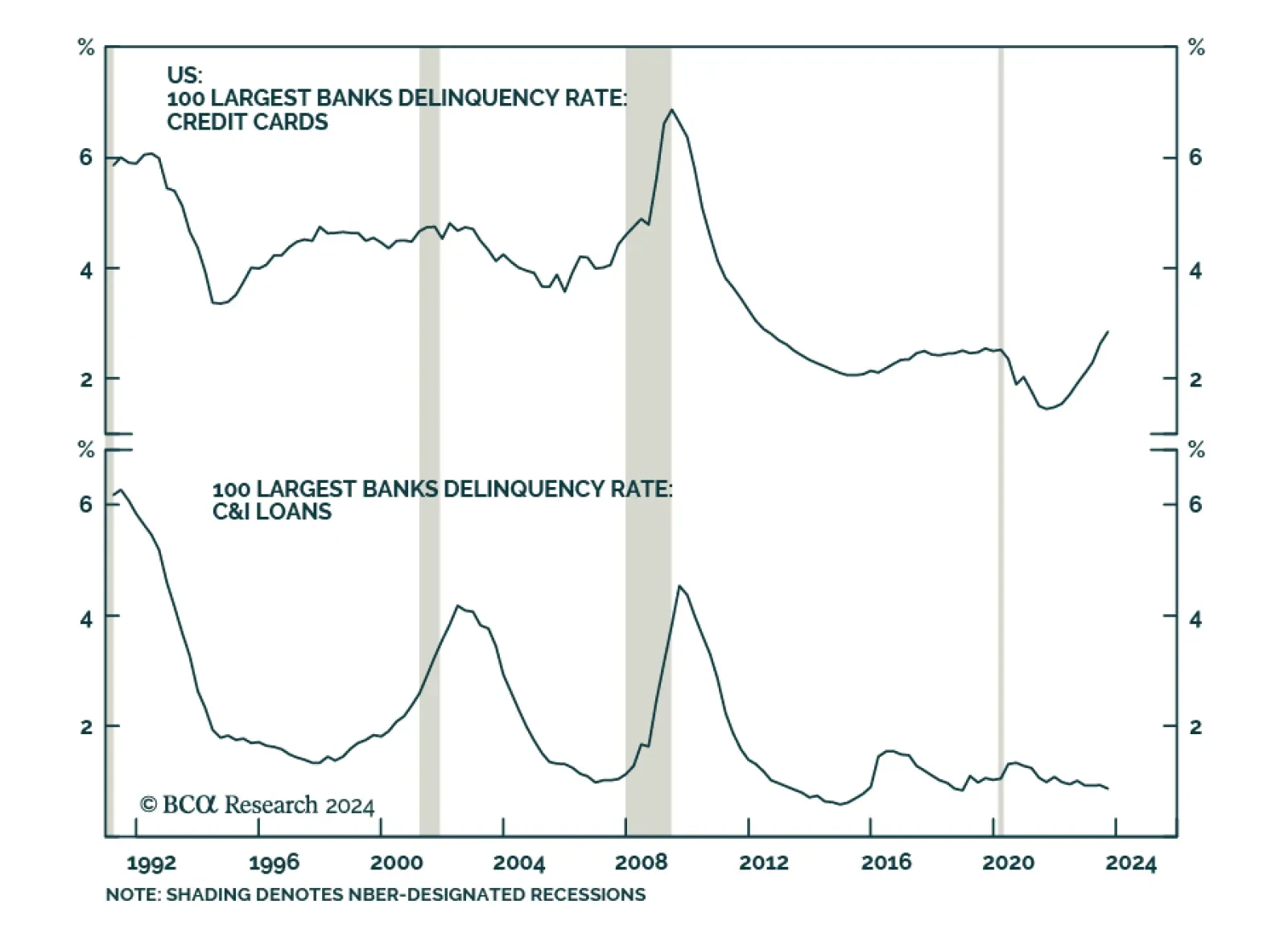

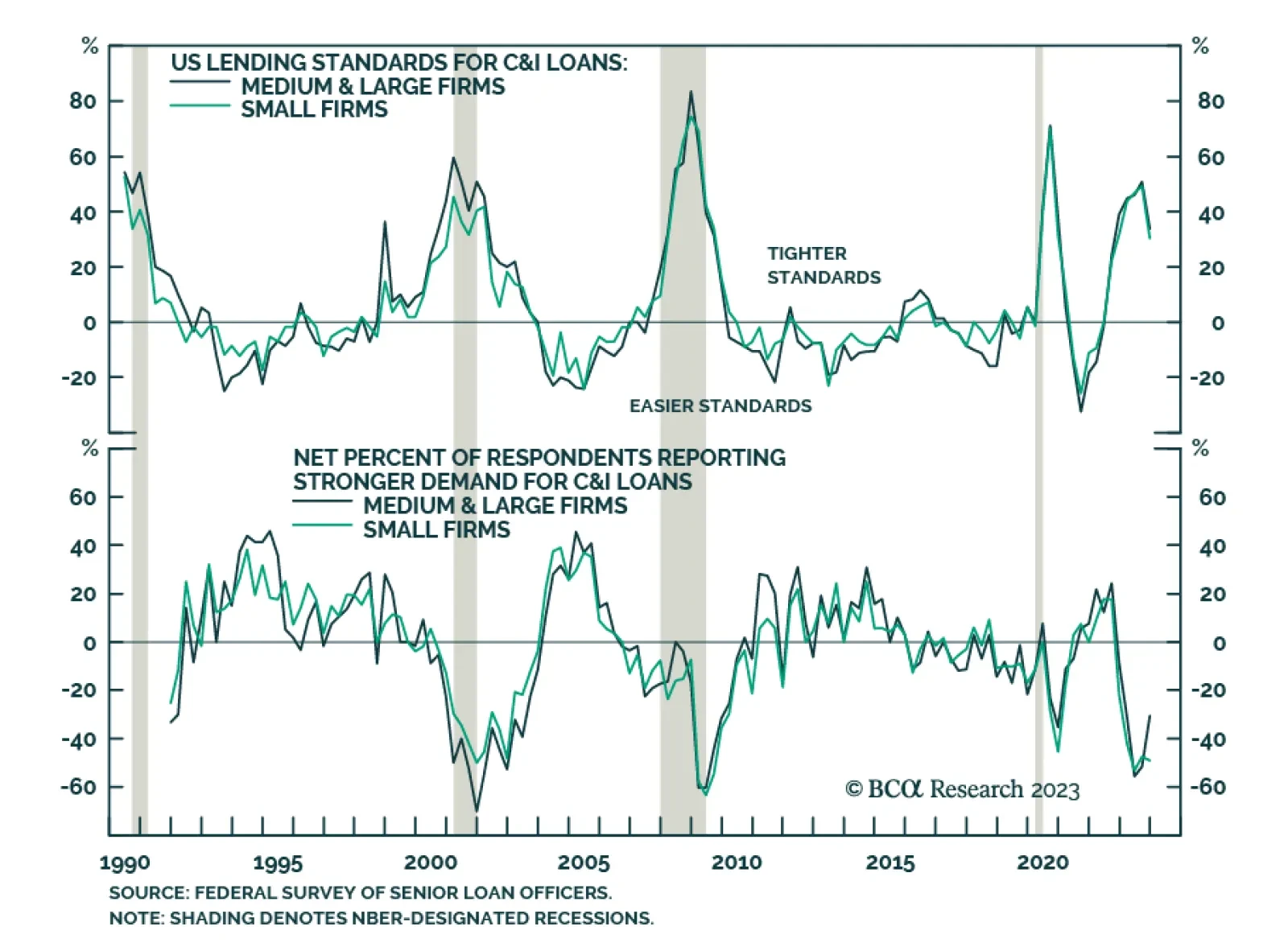

The US Federal Reserve Senior Loan Officer Opinion Survey (SLOOS) reveals that US banks continued to tighten lending standards for commercial and industrial (C&I), commercial real estate (CRE), residential real estate (RRE)…

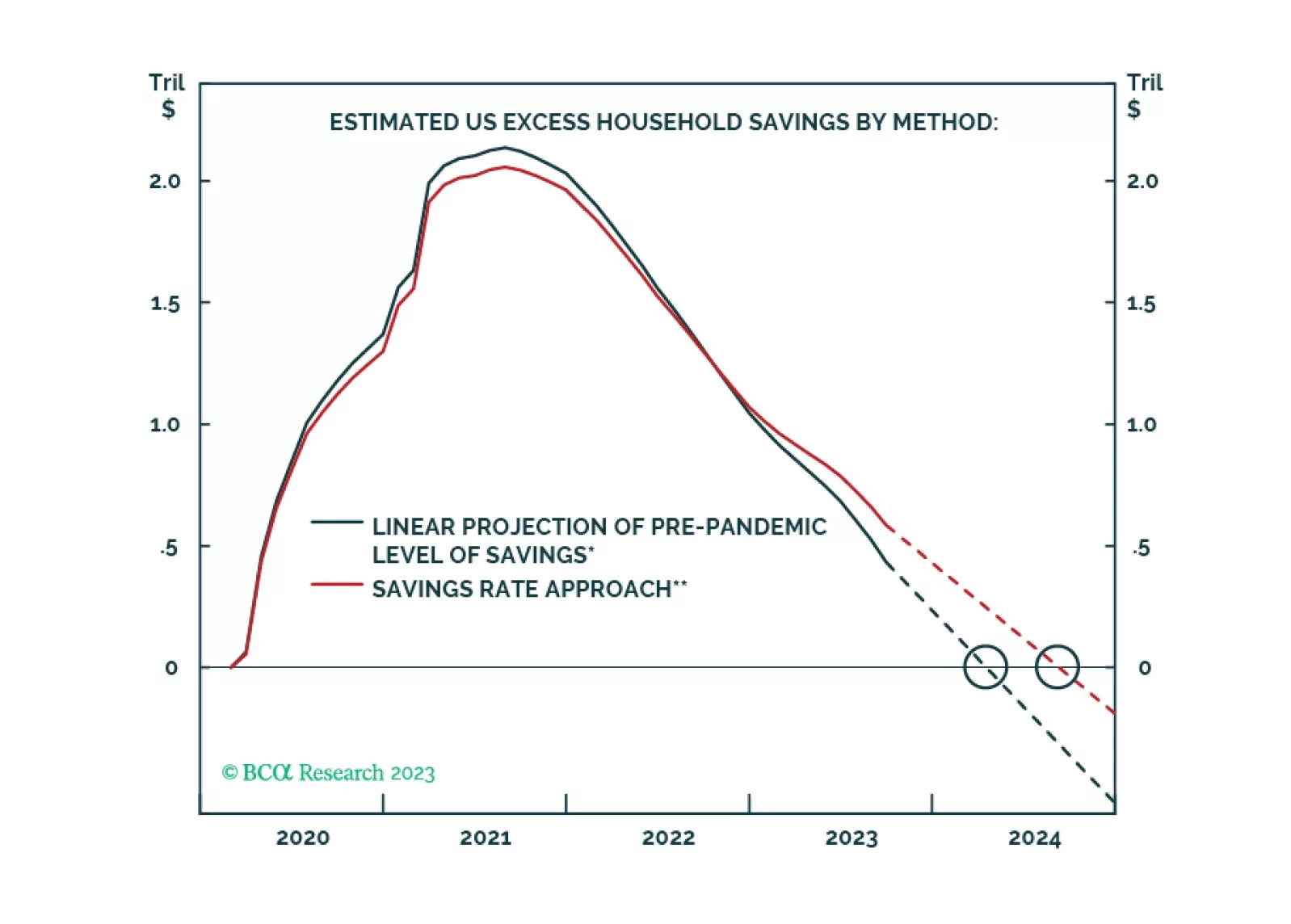

The Fed’s latest triennial Survey of Consumer Finances (SCF), spanning the period from 2019 to 2022, was released on October 18th. It augments the Distributional Financial Accounts' (DFA) depiction of the distribution…

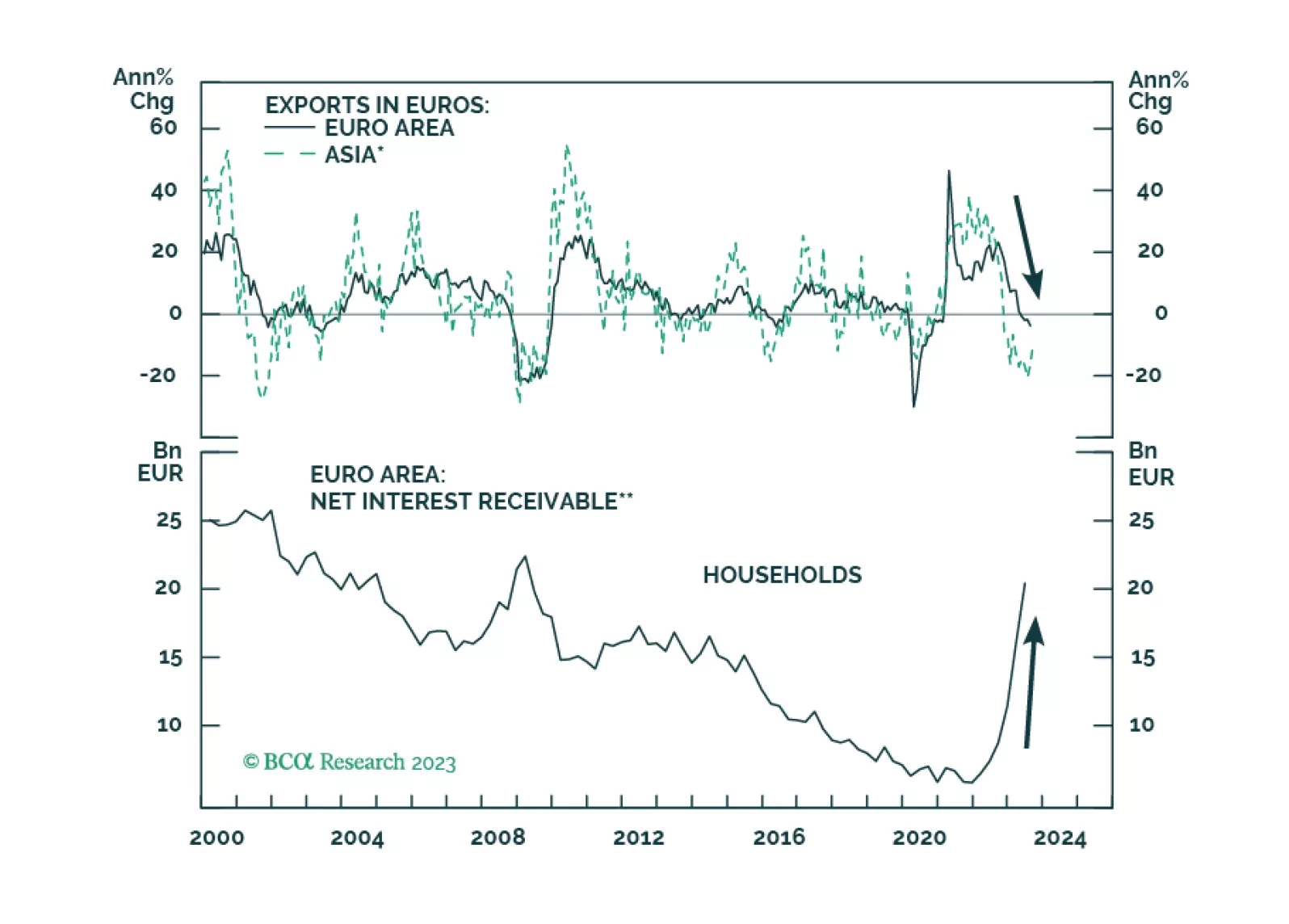

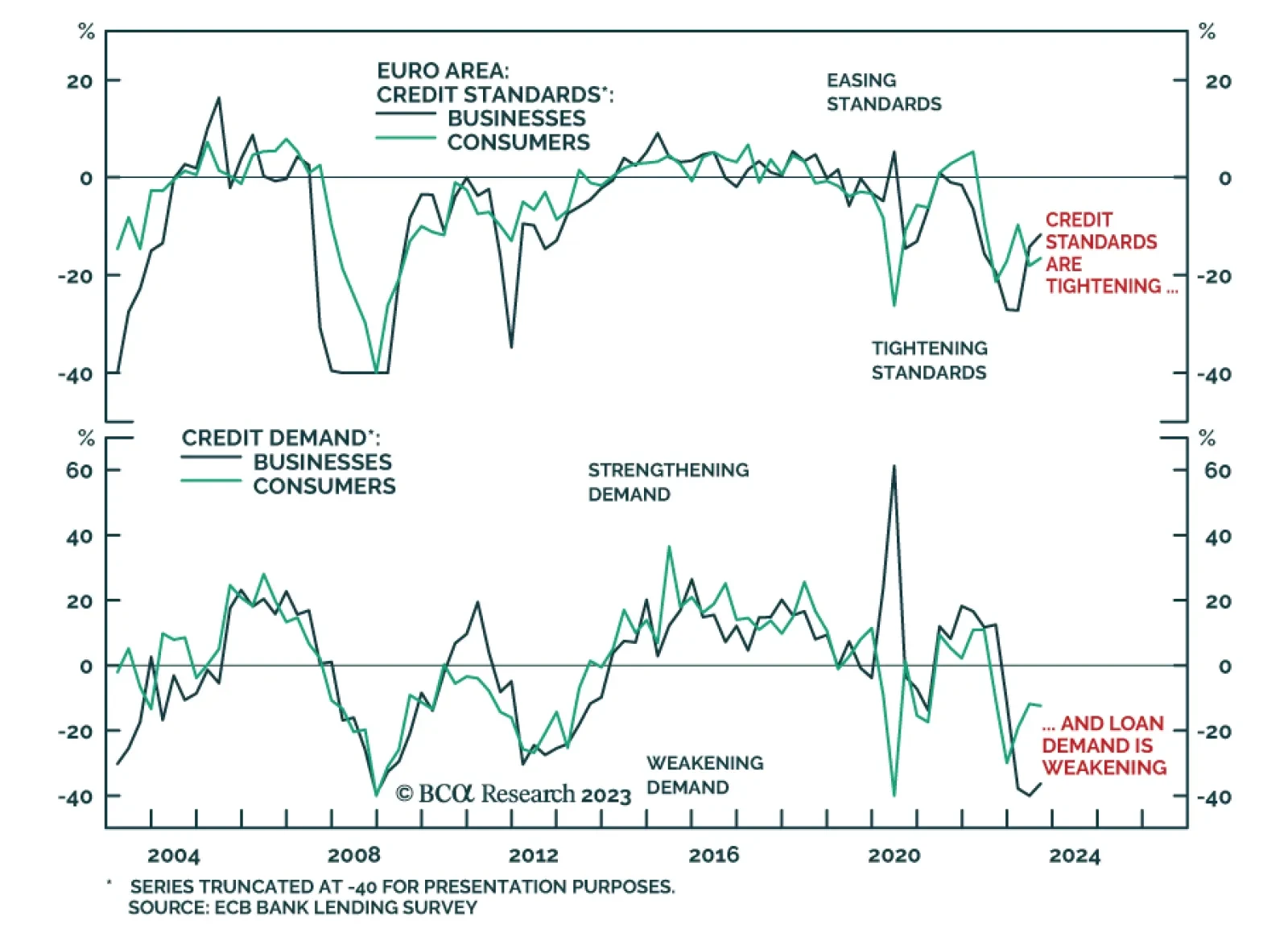

Results of the ECB's Q3 Bank Lending Survey indicate that the impact of tight monetary policy is weighing down on lending conditions and loan demand in the Euro Area. In terms of credit standards, the survey results reveal…

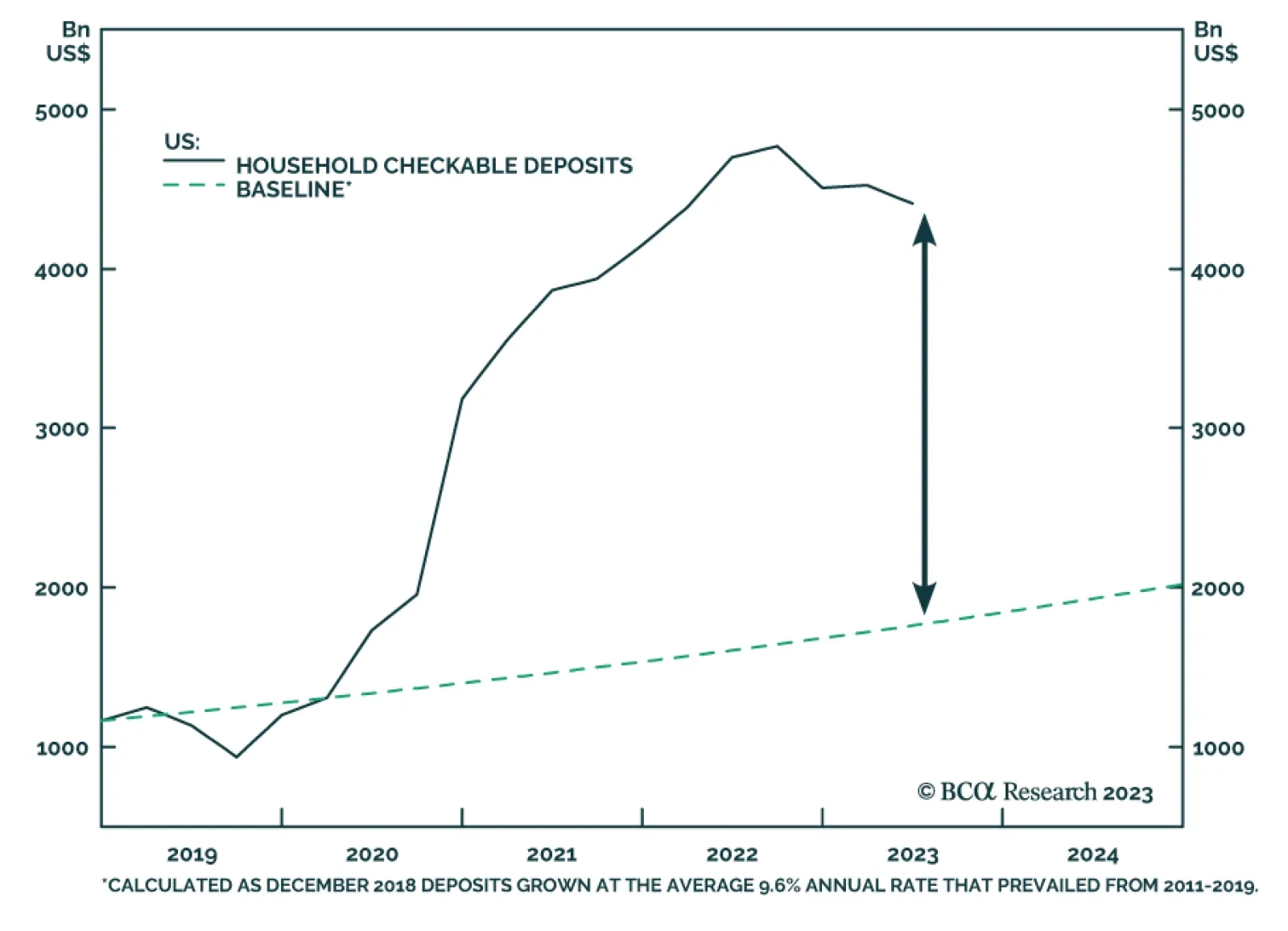

BCA Research’s US Investment Strategy service studied the SIFIs’ earnings calls for insights into borrower performance, lender willingness, liquidity and the actions and intentions of households and businesses.…

Europe’s weak patch is not about the ECB’s policy tightening, at least not yet. 2024 is another story, and the ECB’s policy will prompt a Eurozone’s recession around the summer.

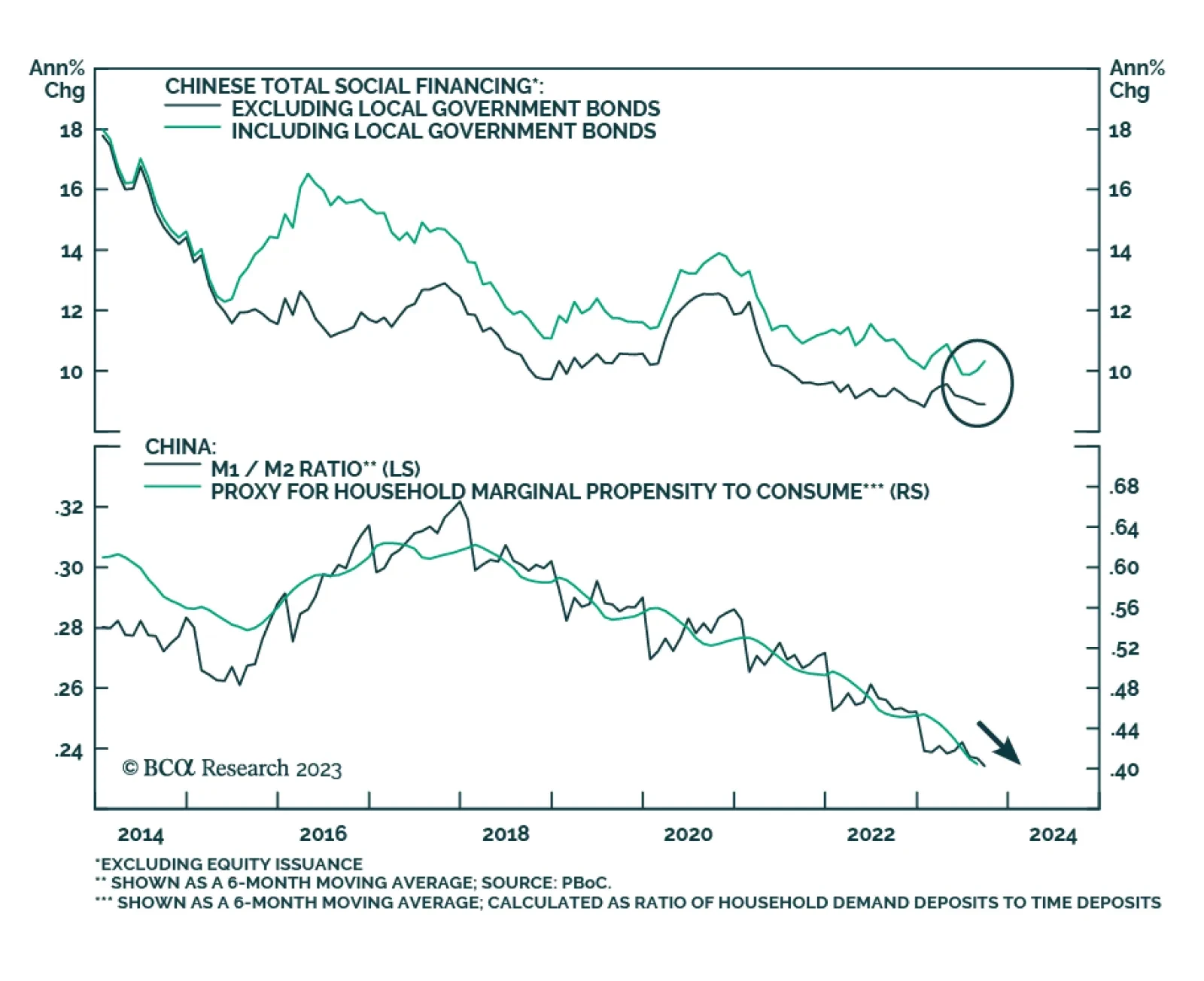

On the surface, Chinese credit data sent a positive signal about the domestic economy. Chinese aggregate social financing totaled CNY 4.1 trillion in September – exceeding both August’s CNY 3.1 trillion and…

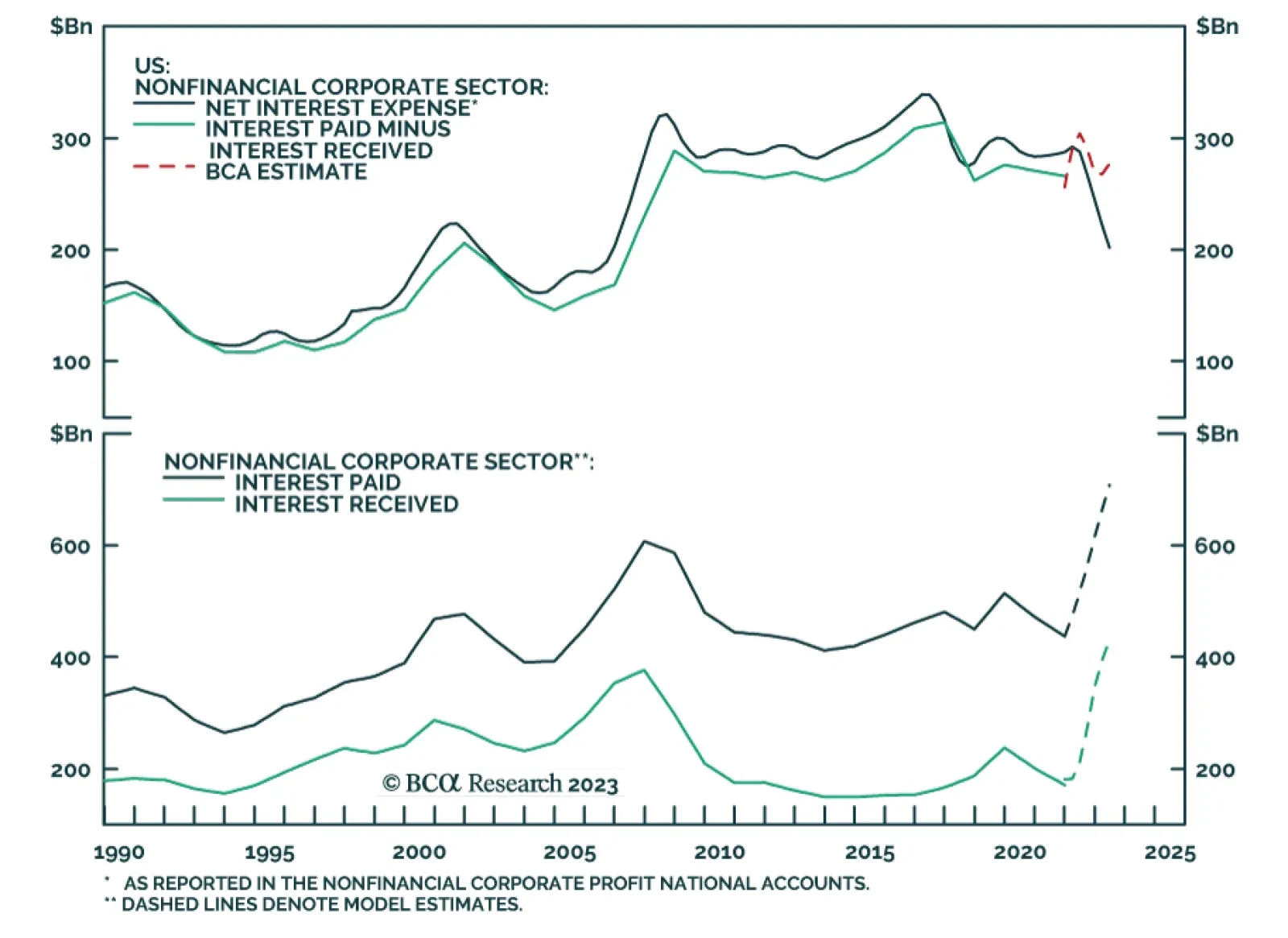

BCA Research’s US Bond Strategy service concludes that recent BEA data are understating corporate net interest expense by a significant amount. Given the recent climb in interest rates, it would be reasonable to expect…