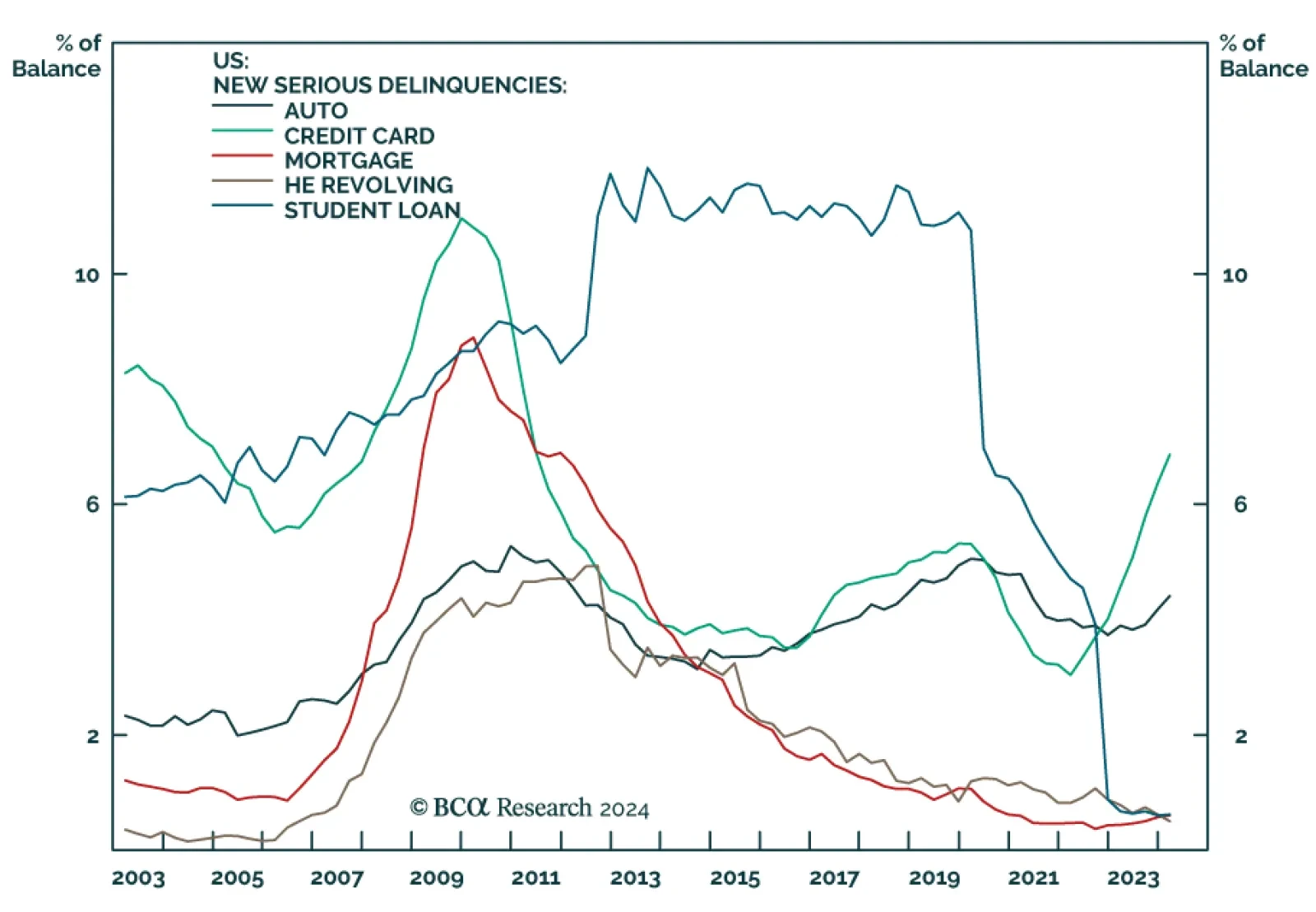

The New York Fed Quarterly Report on Household Debt and Credit indicates that US household debt rose 1.1% q/q in Q1 to $17.7 trillion. Higher mortgage, home equity loan and auto loan balances drove the bulk of the Q1 increase,…

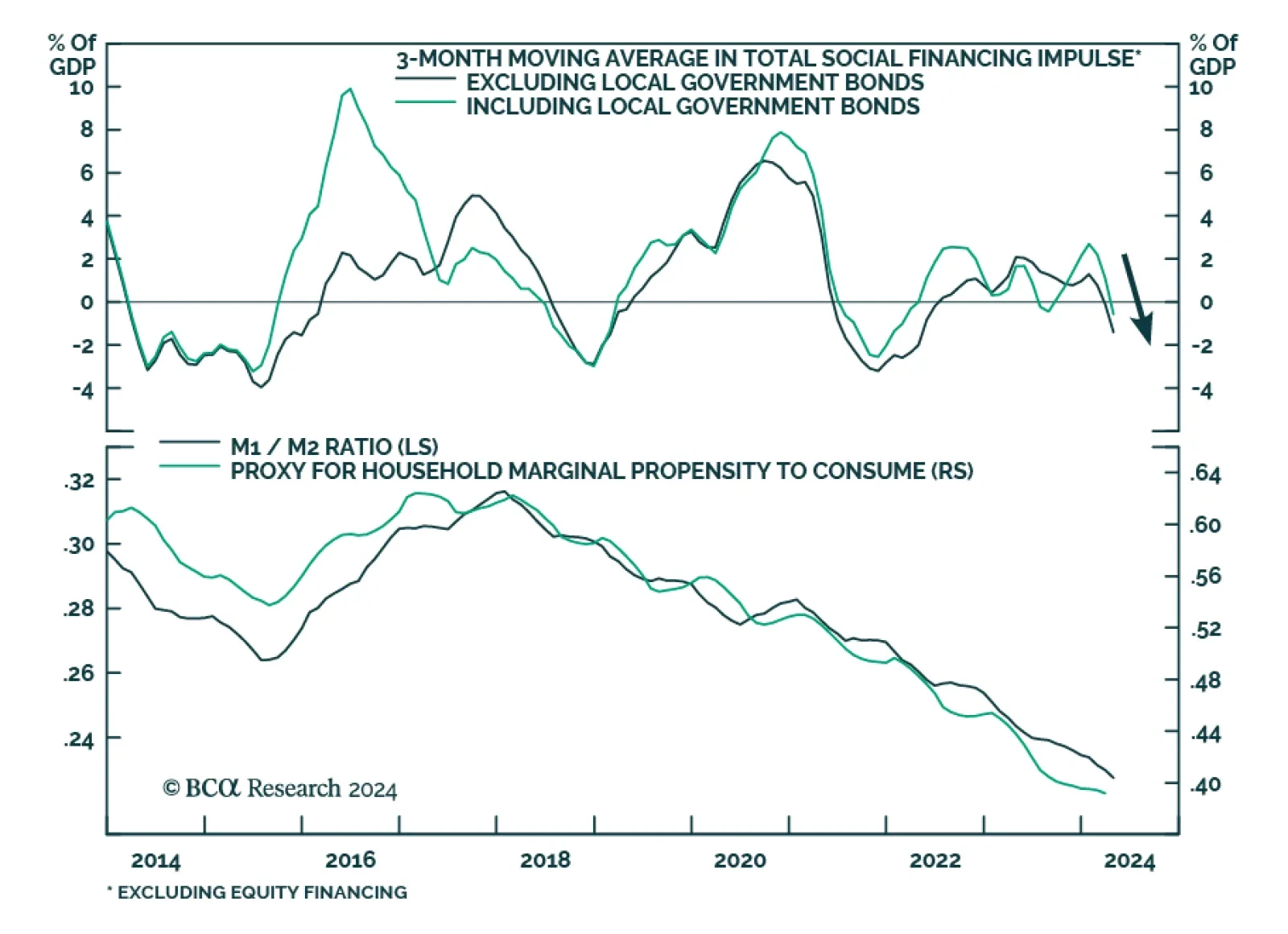

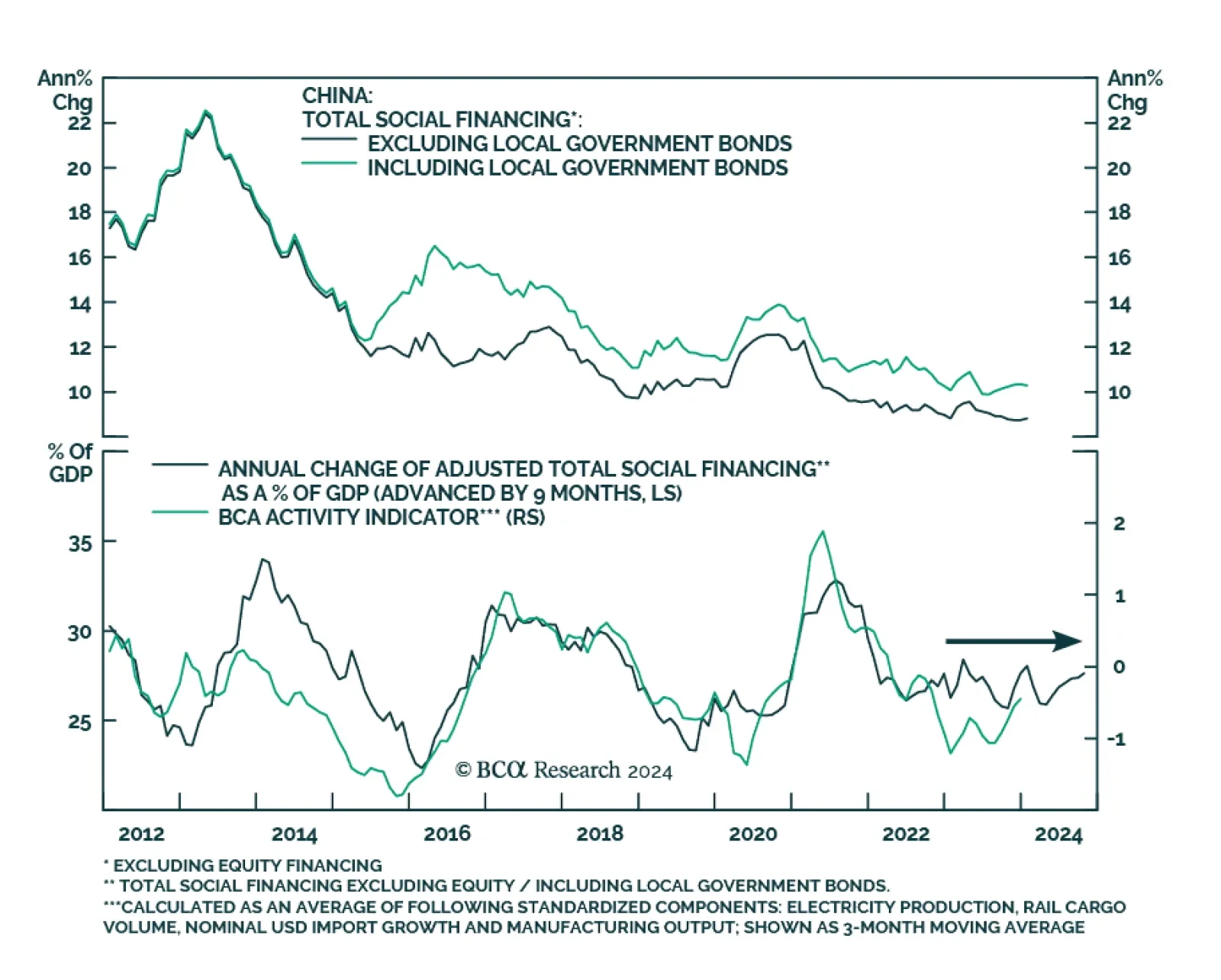

Chinese aggregate financing, a broad measure of credit, declined on a YTD basis, from CNY 12.9tr to CNY 12.7tr in April, disappointing expectations that it would grow to CNY 13.9tr. Moreover, new loan growth missed expectations (…

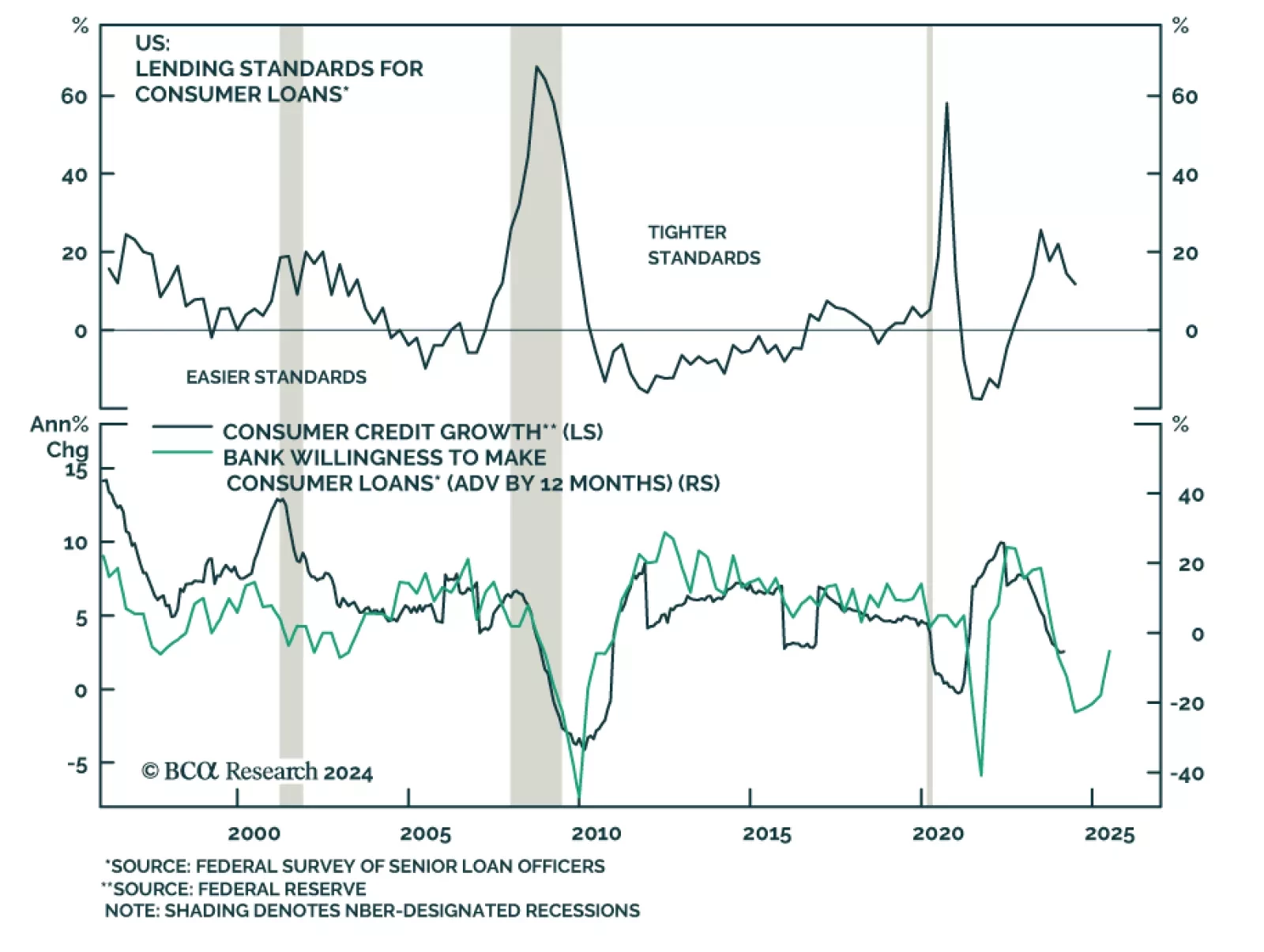

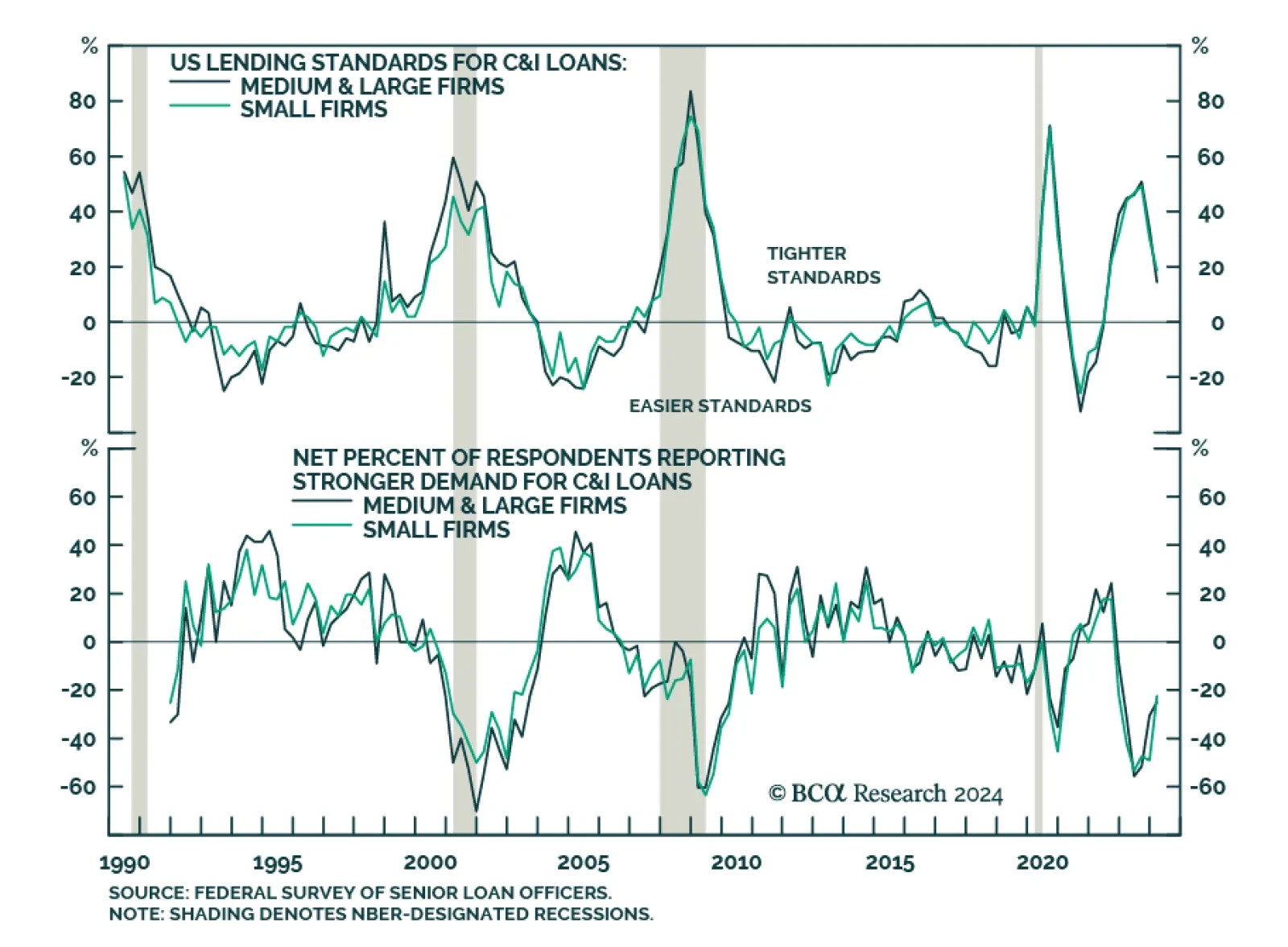

Lending standards continued to tighten for most loan categories in Q1 2024. US banks reported tightening lending standards for C&I and CRE. For real-estate-backed loans to households, lending standards tightened further…

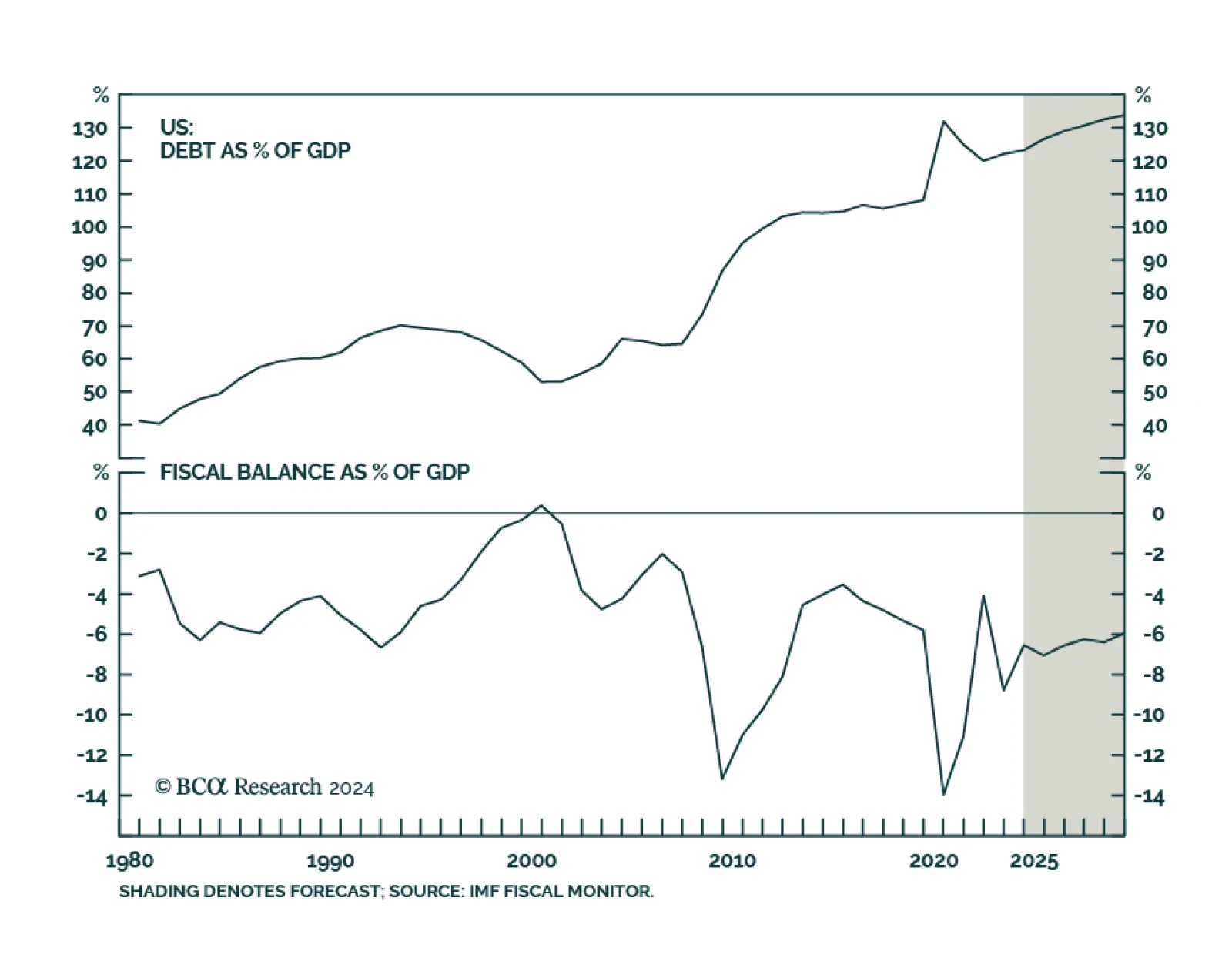

The IMF’s latest fiscal monitor report highlighted the dangers that rising sovereign debt alongside rising deficits pose to advanced economies. The United States, in particular, is at risk. The IMF projects that fiscal…

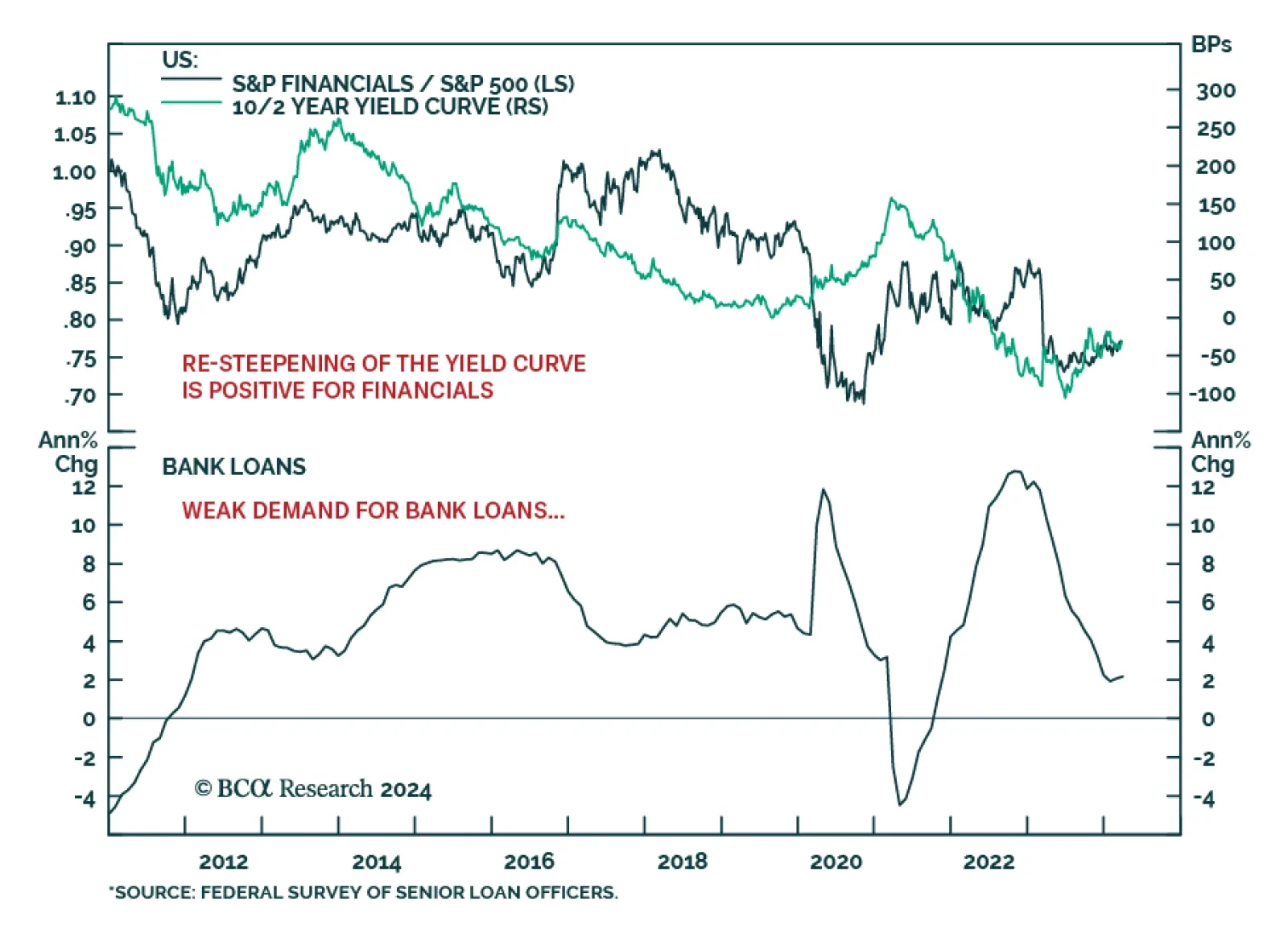

The steepening of the yield-curve powered the outperformance of the S&P 500 Financials relative to the overall market since the spring of 2023 banking crisis. This sector returned 30.1% over this period, against 27.3% for the…

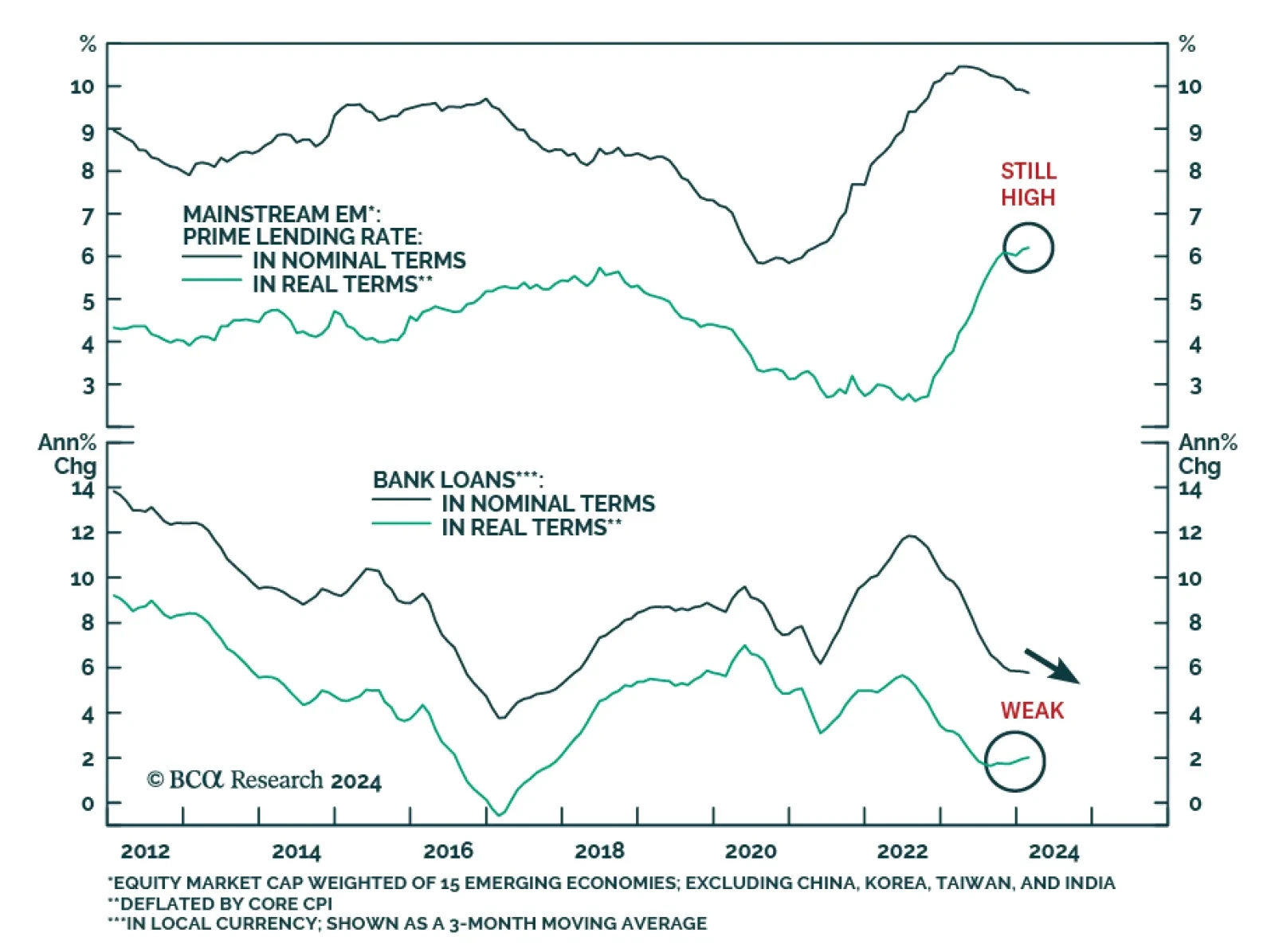

According to BCA Research’s Emerging Markets Strategy service, although certain Chinese industries and individual EM economies are growing briskly, overall EM growth will remain tepid, with risks skewed to the downside.…

China’s credit data update for January delivered a mixed signal on Friday. The CNY 6.50 trillion increase in aggregate financing beat expectations of CNY 5.60 trillion and marked a significant acceleration from CNY 1.94…

The US Federal Reserve Senior Loan Officer Opinion Survey (SLOOS) continues to show the impact of the Fed’s tightening cycle. Banks were still tightening lending standards for commercial and industrial (C&I),…

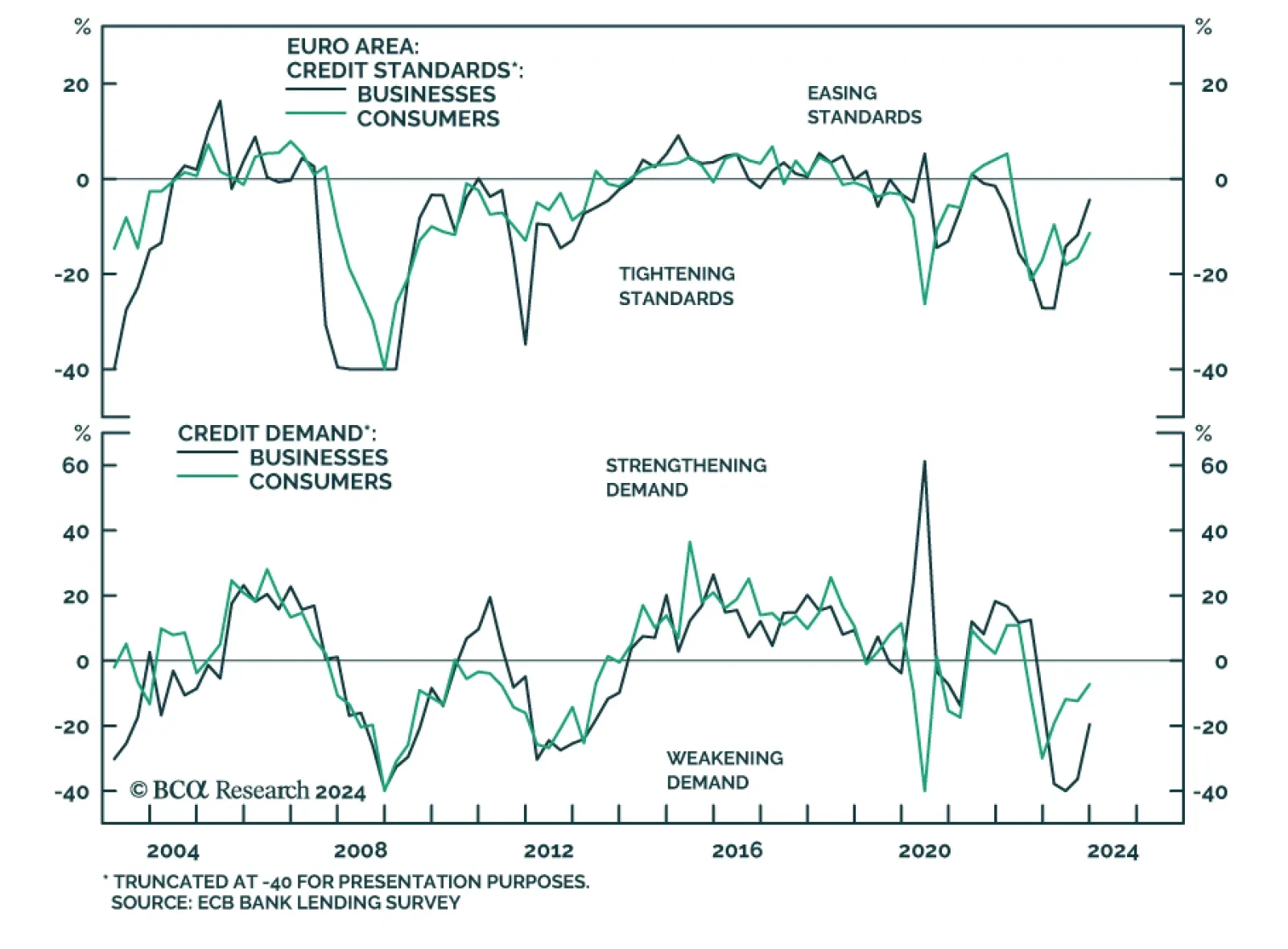

Results of the ECB’s quarterly Bank Lending Survey suggest that the tight monetary policy stance is still weighing on the Eurozone economy. Banks tightened credit standards for businesses and consumers further in Q4…