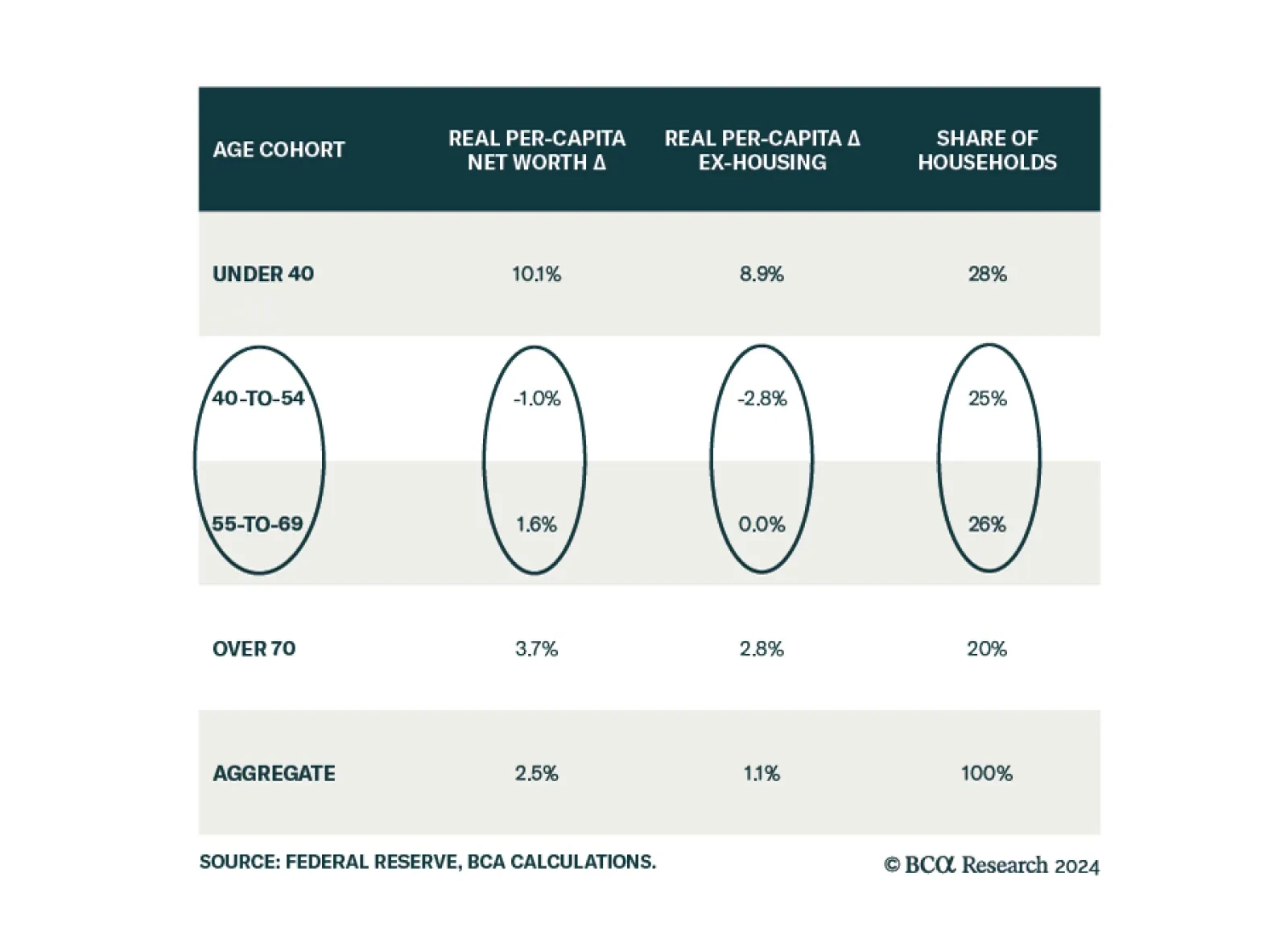

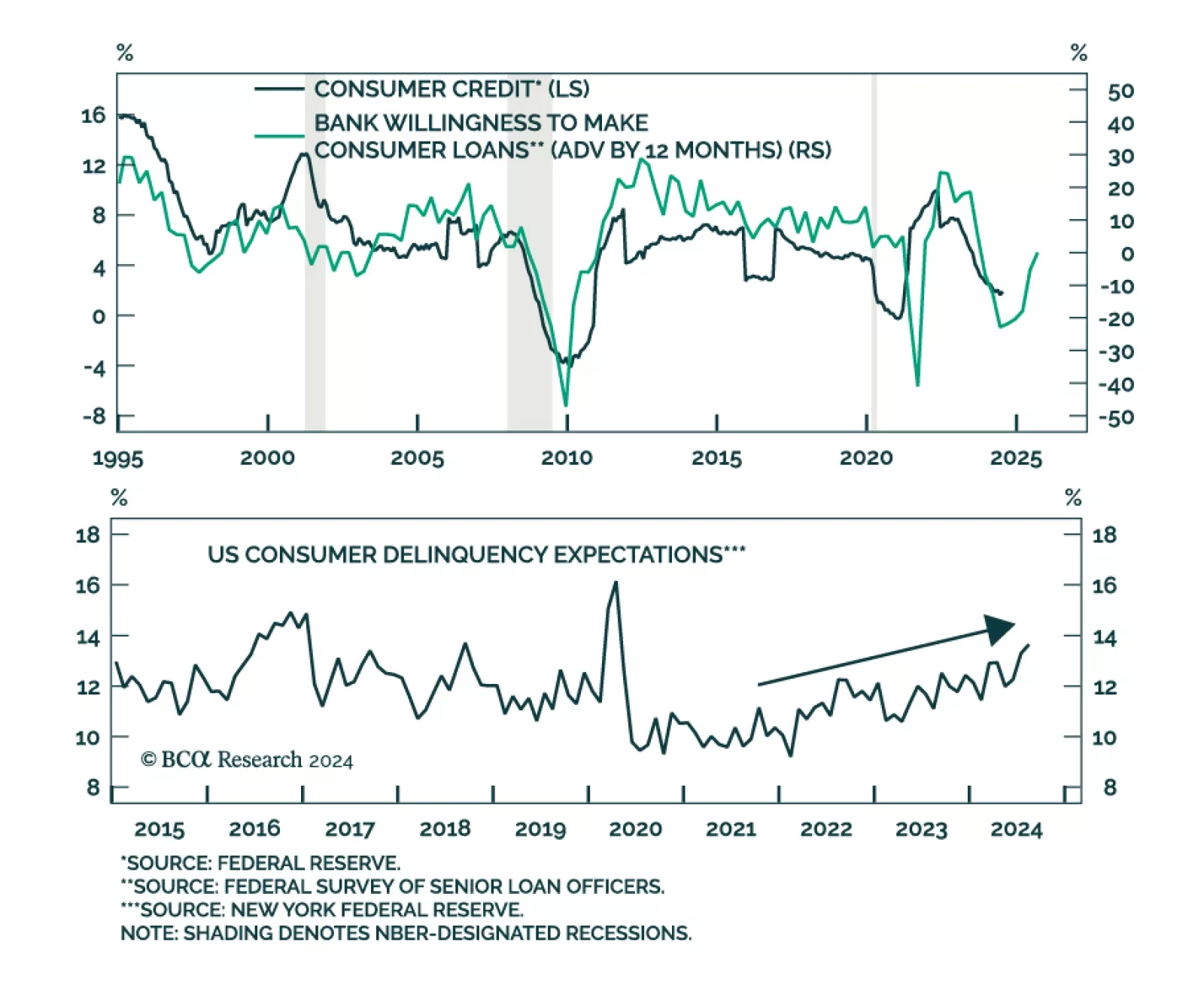

As US consumers remain one of the few engines of global growth, our US Investment Strategy colleagues took a deep dive on consumer trends, augmented with comments from US banks’ earnings calls. Middle-aged consumers have…

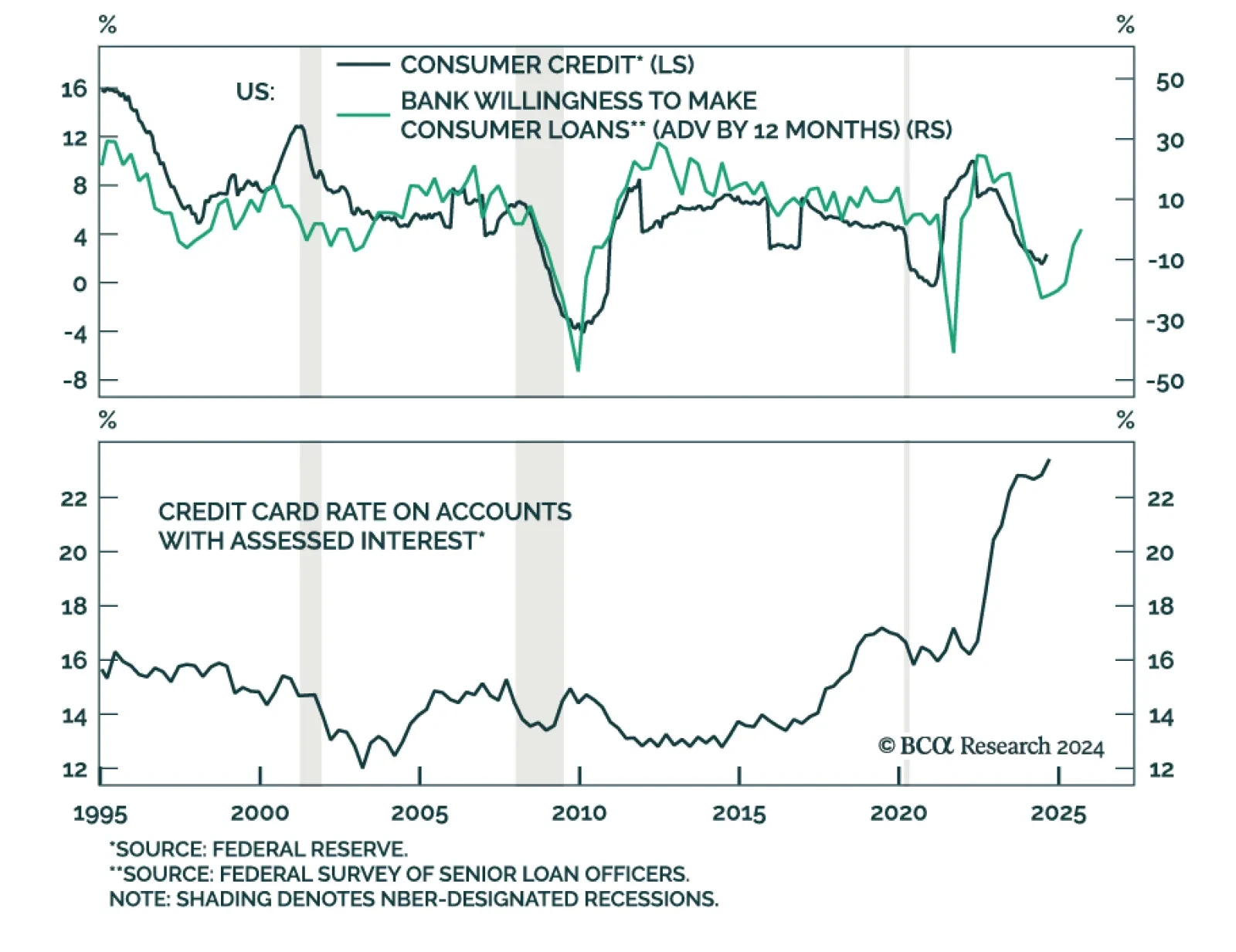

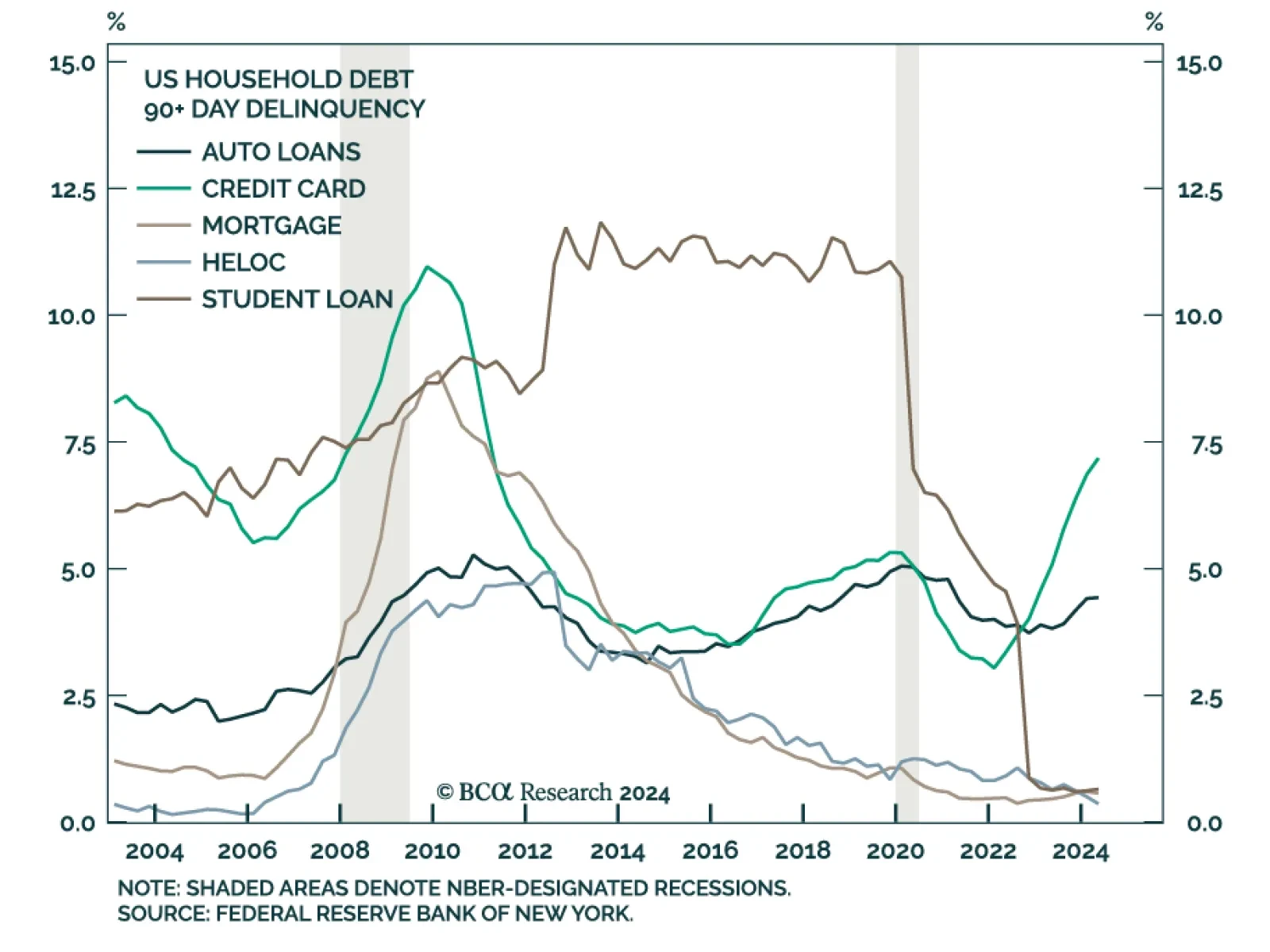

Consumer credit growth slowed in August, rising by USD 8.9 bn (to USD 5,097.6 bn outstanding) from USD 26.6 bn, disappointing expectations of a USD 12 bn monthly increase. Notably, revolving credit (which includes credit cards)…

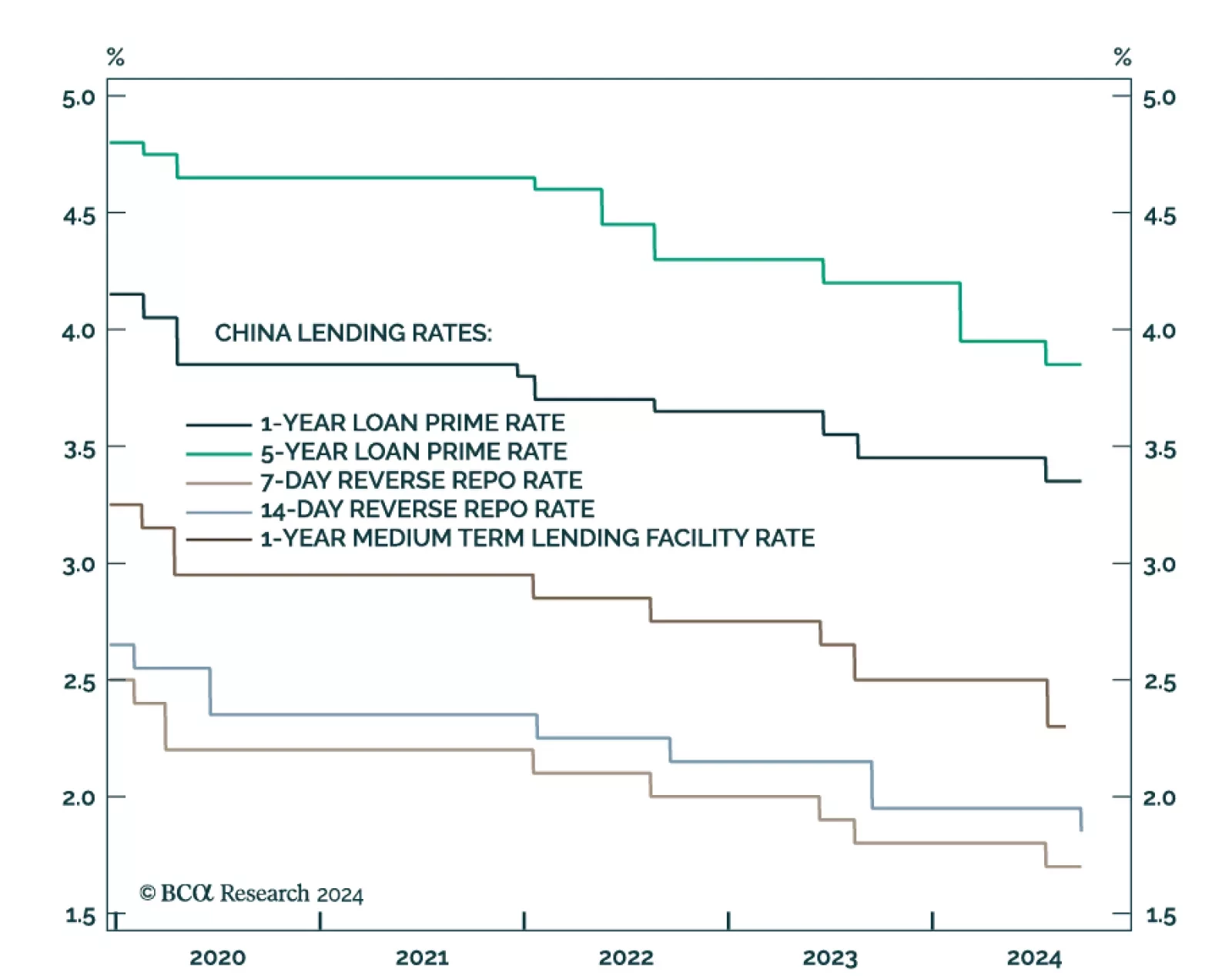

The PBoC lowered the 14-day reverse repo rate by 10 bps on Monday, a move that follows a string of easing measures in late July when the central bank lowered the 7-day reverse repo rate, several maturities of the loan prime rate…

Following a 12-year-long bear market, Greek equities have returned a whopping 186% in EUR terms from their 2016 lows. The Greek macroeconomic backdrop has indeed improved. Since 2021, Greece’s nominal GDP growth has…

Consumer credit rose by USD 25.5bn in July (to USD 5,093.7 bn outstanding), more than twice the expected growth. However, revisions suggest that June’s consumer credit growth was slower than initially reported (USD 8.9bn to…

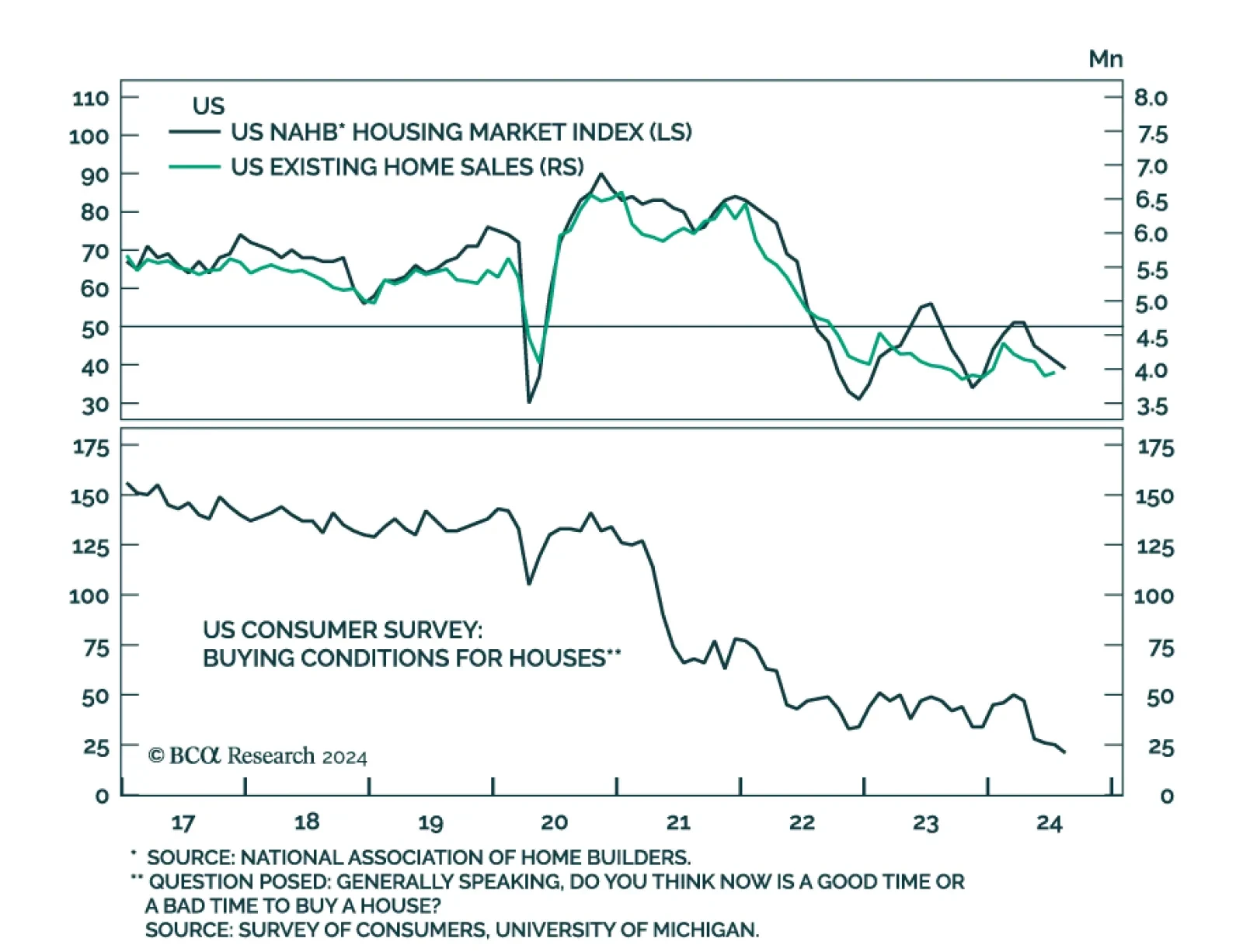

US housing market data have been mixed. In June, the FHFA House Price index unexpectedly declined 0.1% m/m and the NAHB housing market index unexpectedly eased to 39 from a 41 reading. In July, starts and permits both…

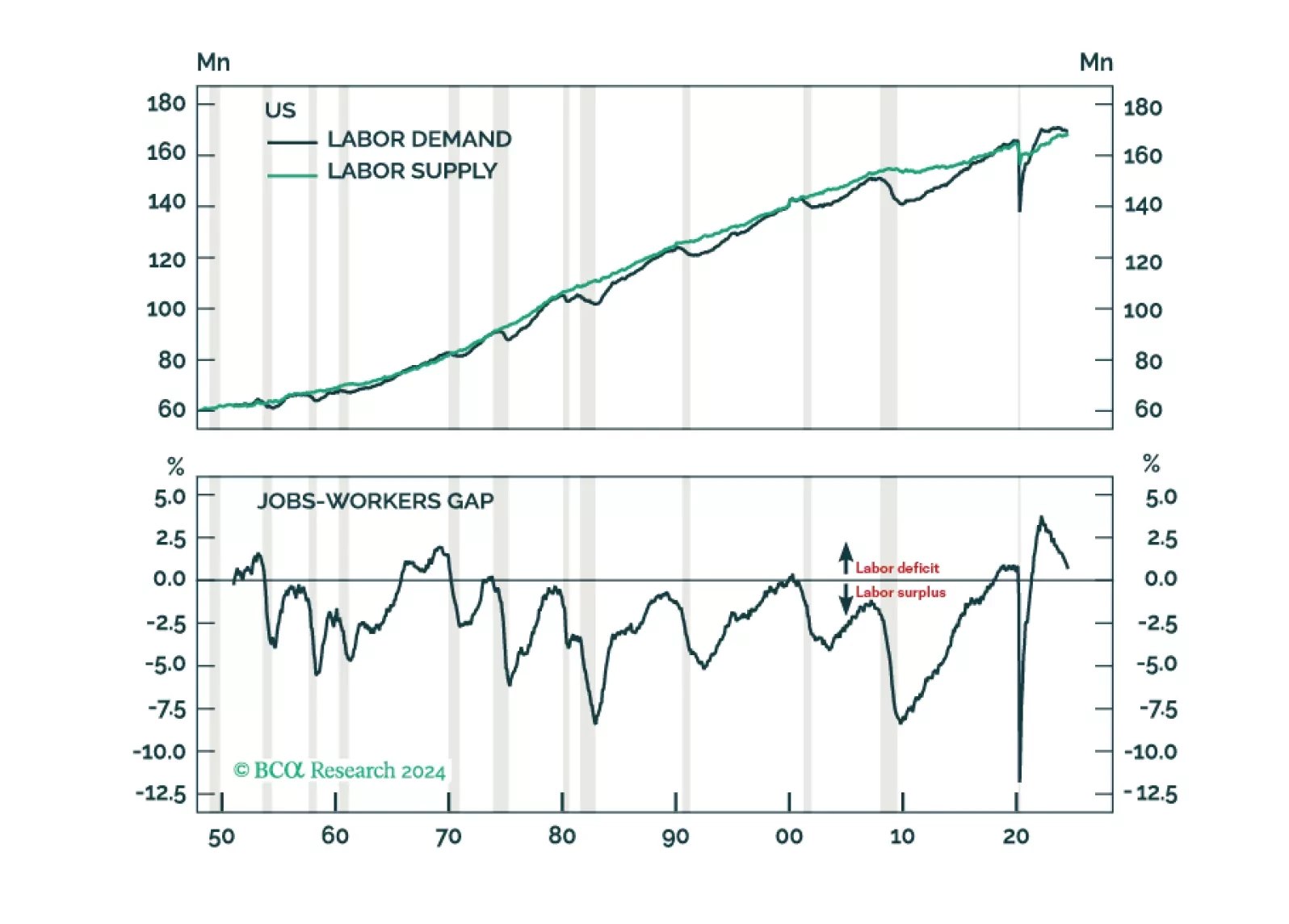

The great US labor market shortage is over. Labor demand will likely fall short of supply by the end of this year, causing unemployment to soar. Neither fiscal nor monetary policy will be able to prevent the coming recession.…

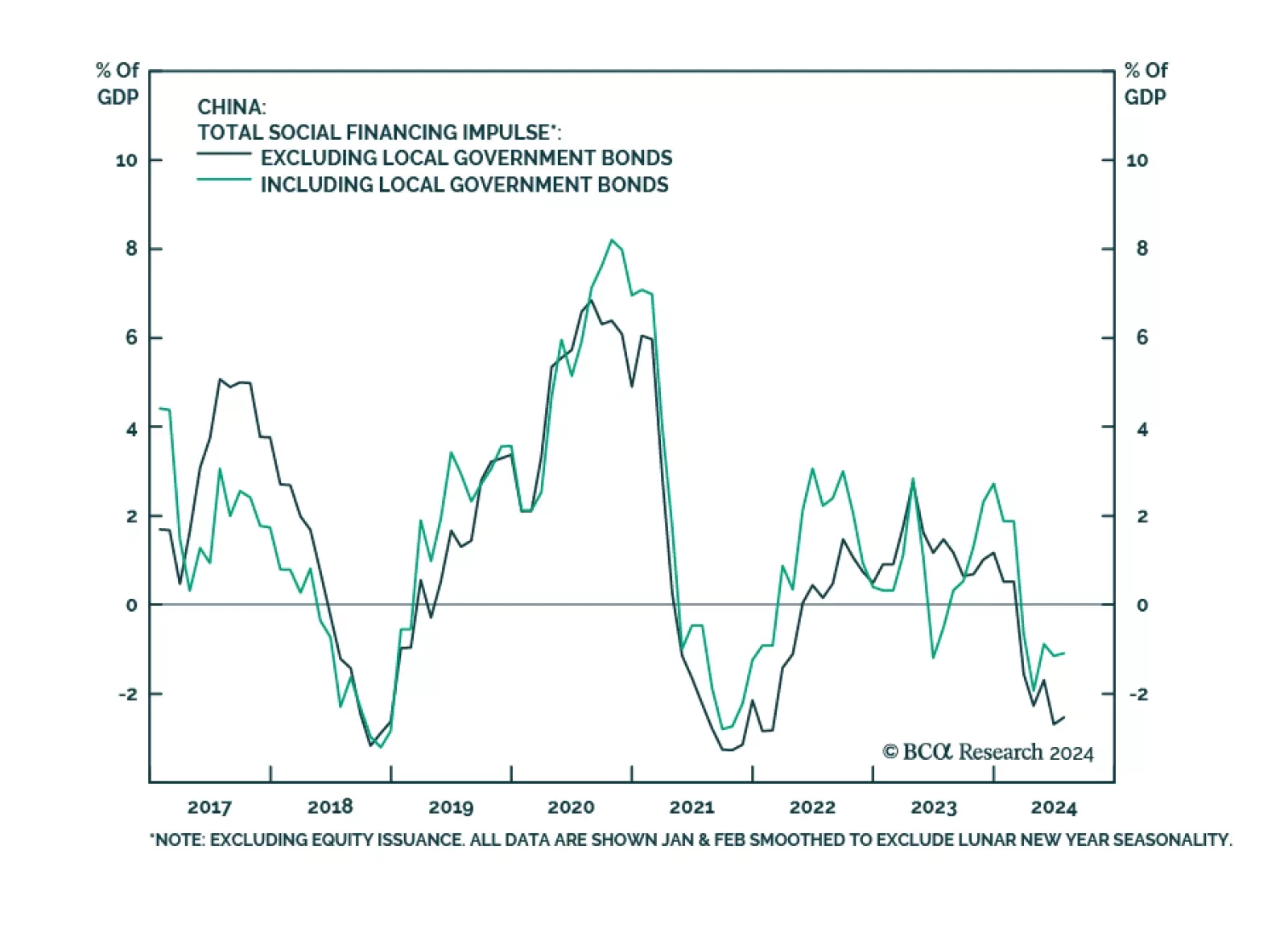

Subdued demand for credit among Chinese private-sector businesses and households persisted through July. Aggregate financing missed expectations, growing CNY 0.8bn to CNY 18.9bn in July on a YTD basis. New loans grew CNY 0.2bn…

Consumer credit growth disappointed in June. Total credit outstanding rose by USD 8.9 billion, in June, lower than May's USD 13.9 billion, and shy of expectations of USD 10 billion. Revolving credit (which includes credit…