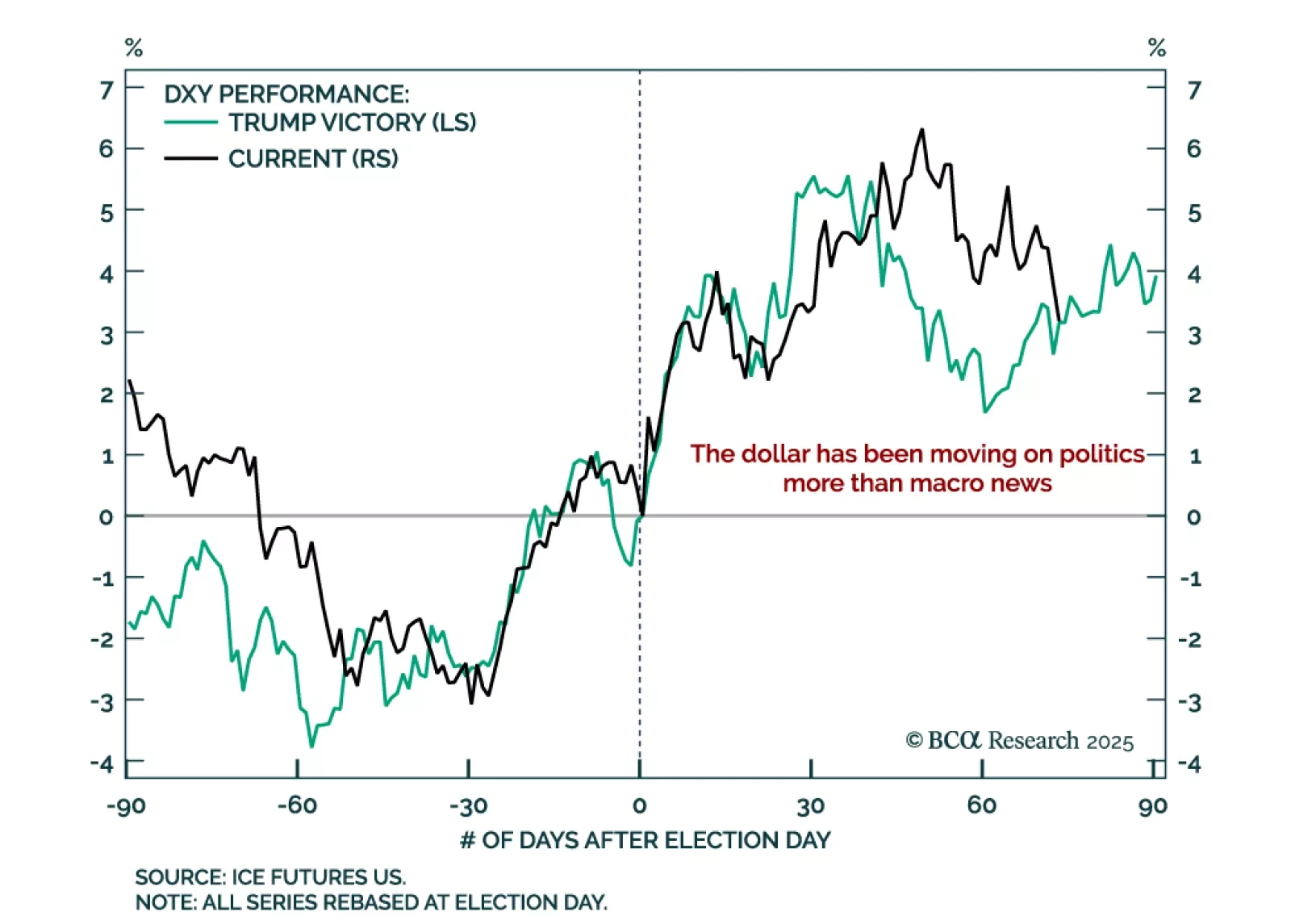

Our Foreign Exchange strategists reviewed the rationale to their short US dollar position as the DXY has been in a trading range with resistance near 110 and support around 100. The widening US budget deficit caps the dollar’s…

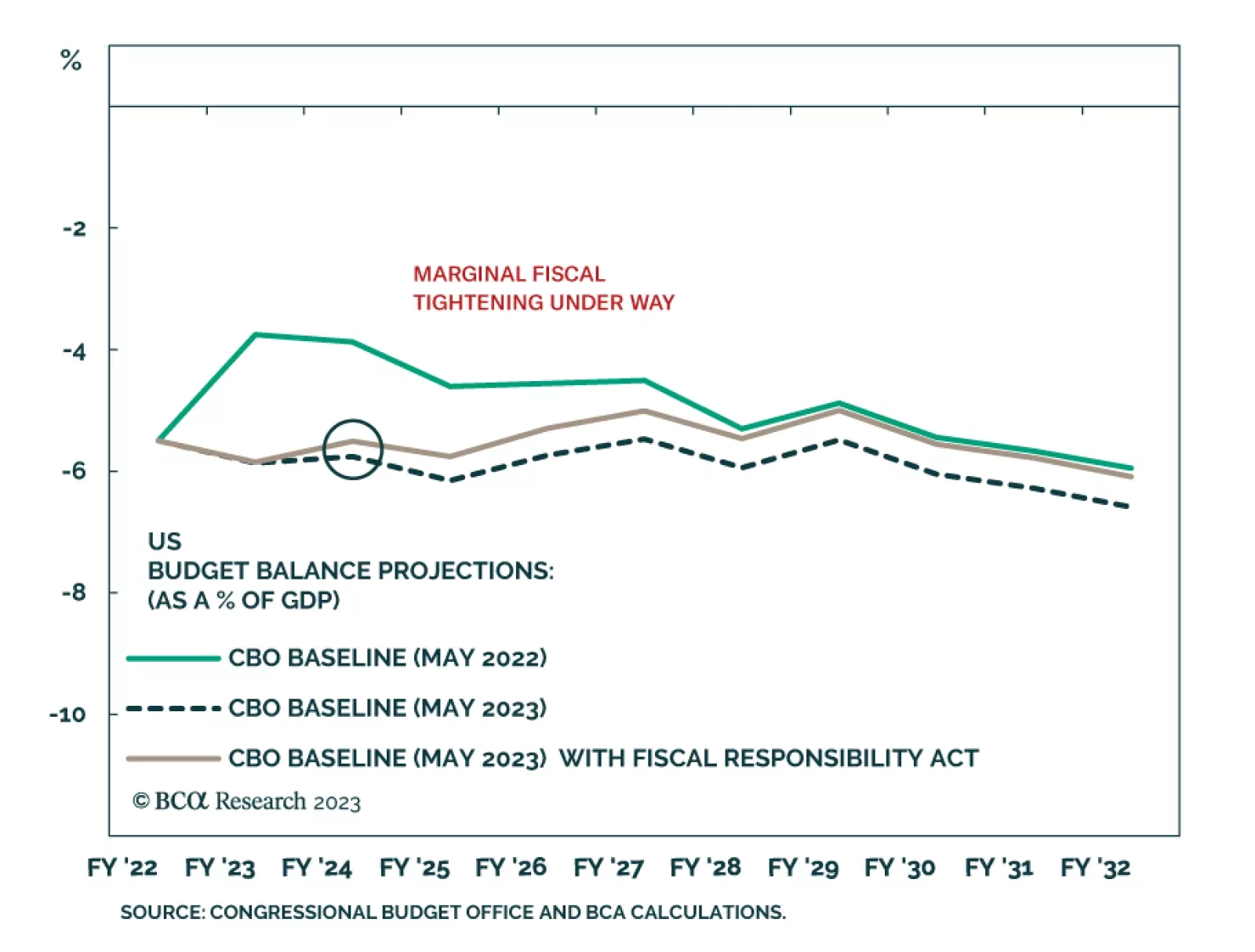

According to BCA Research’s US Political Strategy service, US fiscal policy is marginally negative for the economy and marginally increases the odds of recession in 2023-24. It is not a positive catalyst for equities in the…

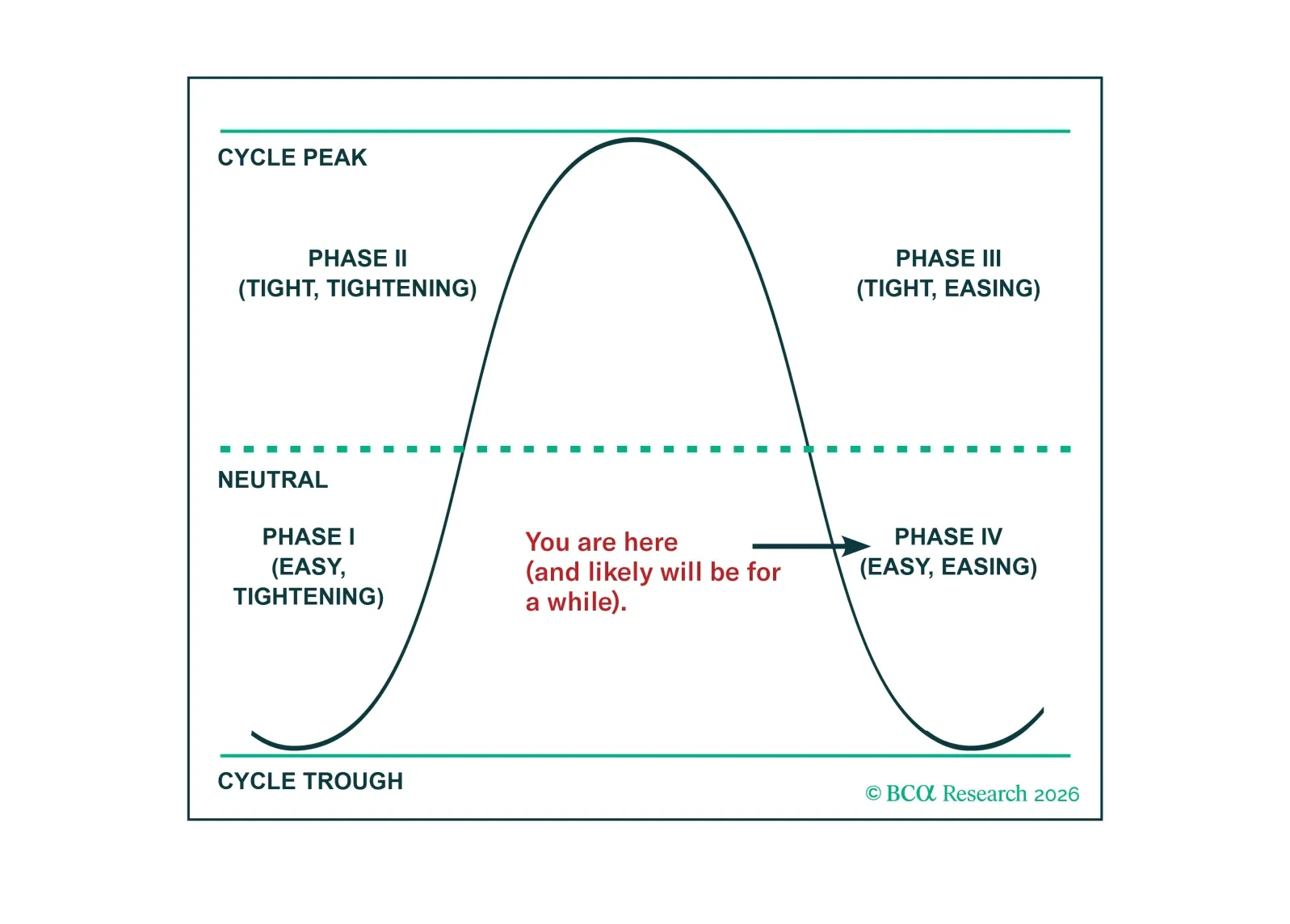

In Section I, we review the three possible economic scenarios over the coming year, and underscore that the “soft landing” scenario remains improbable. A “no landing” scenario could occur, but it would ultimately lead back to the…

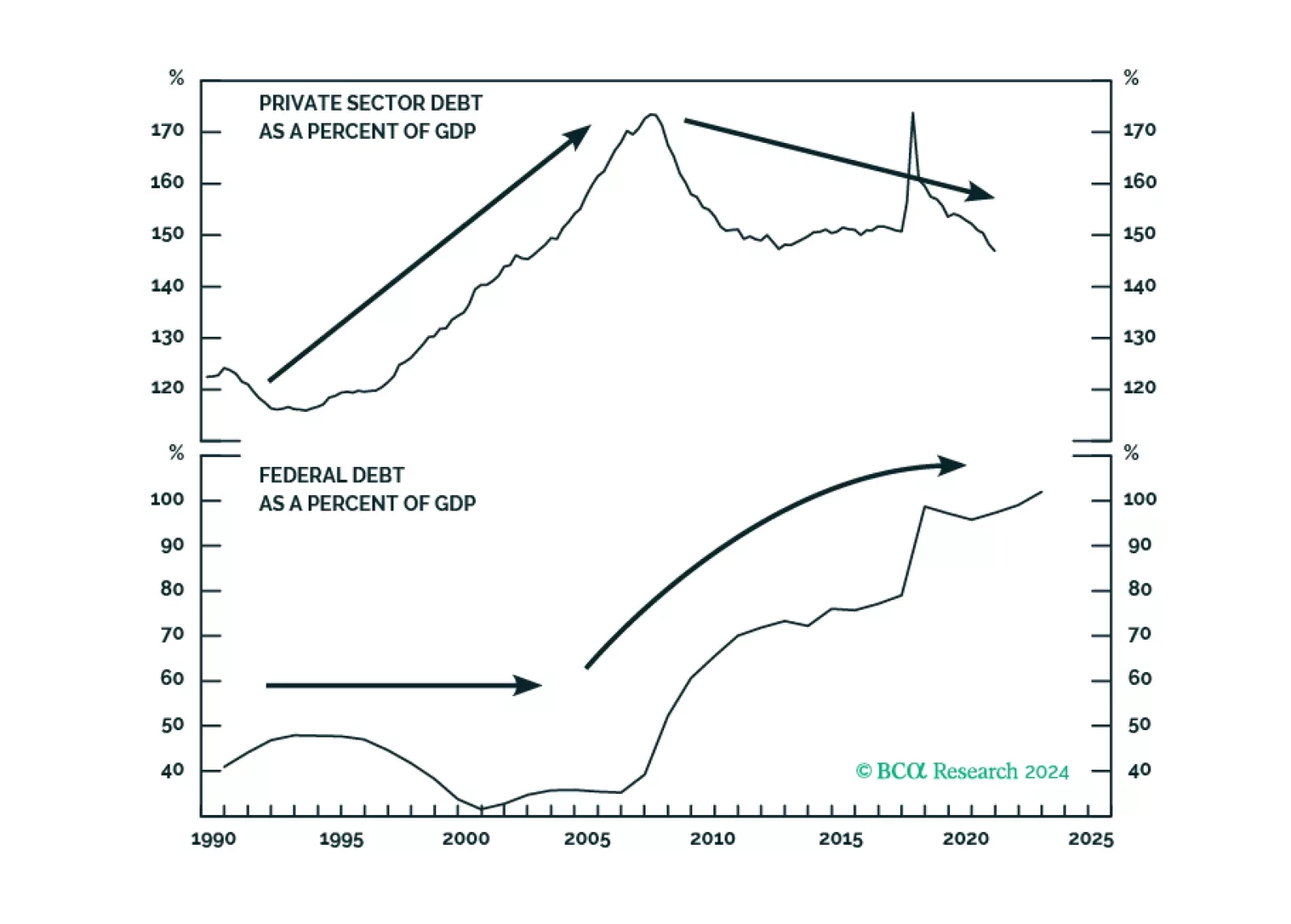

Highlights The post-pandemic investment phase is just a continuation of the post-credit boom investment phase. This is because the pandemic has just accelerated the pre-existing shifts to a more remote way of working, shopping and…