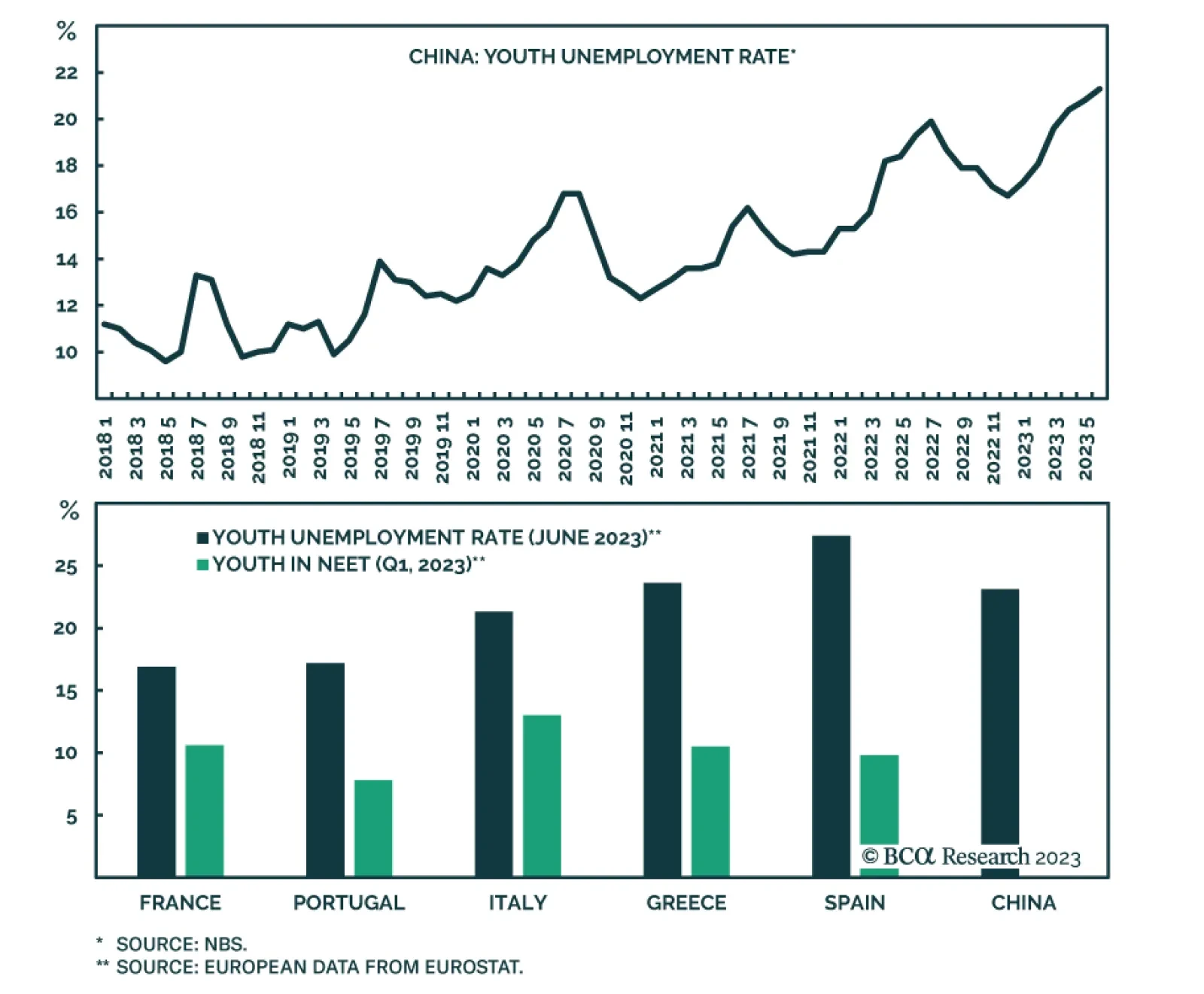

The Chinese government today announced that it is suspending the reporting of urban youth unemployment rate. This rate reached 21.3% in June after climbing since December. While there is an element of seasonality to the data…

The global economy will not enjoy an “immaculate disinflation” but will suffer a very maculate one due to China’s growth slowdown and restrictive monetary policy in the developed world. Investors should stay overweight low-beta…

The snap election which took place on Sunday resulted in a political deadlock in Spain. No single party has won enough seats to form a government. More importantly, both the left-wing bloc and the right-bloc fell short of the 176-…

President Erdogan and the Justice and Development Party emerged as the winner of the Turkish general election which was concluded yesterday. This victory means that their expansive policies of the past decade will continue, and…

Macro and geopolitical risks may spoil the narrow window for a stock market rally before recessionary trends rise to the fore.

Great Power Rivalry is taking another leg up as Russia and China further align their geopolitical interests. Investors should stay long USD-CNY, favor defensives over cyclicals, and markets like North America and DM Europe that have…

Remain cautious and defensive overall. Stay long DM Europe over EM Europe. Look for EM opportunities in Southeast Asia and Latin America over Greater China.

The Chinese government will repress social unrest, then relax Covid-19 social restrictions to try to stabilize the economy. Russia will be aggressive in the short term but will pursue a ceasefire before March 2024. European and…