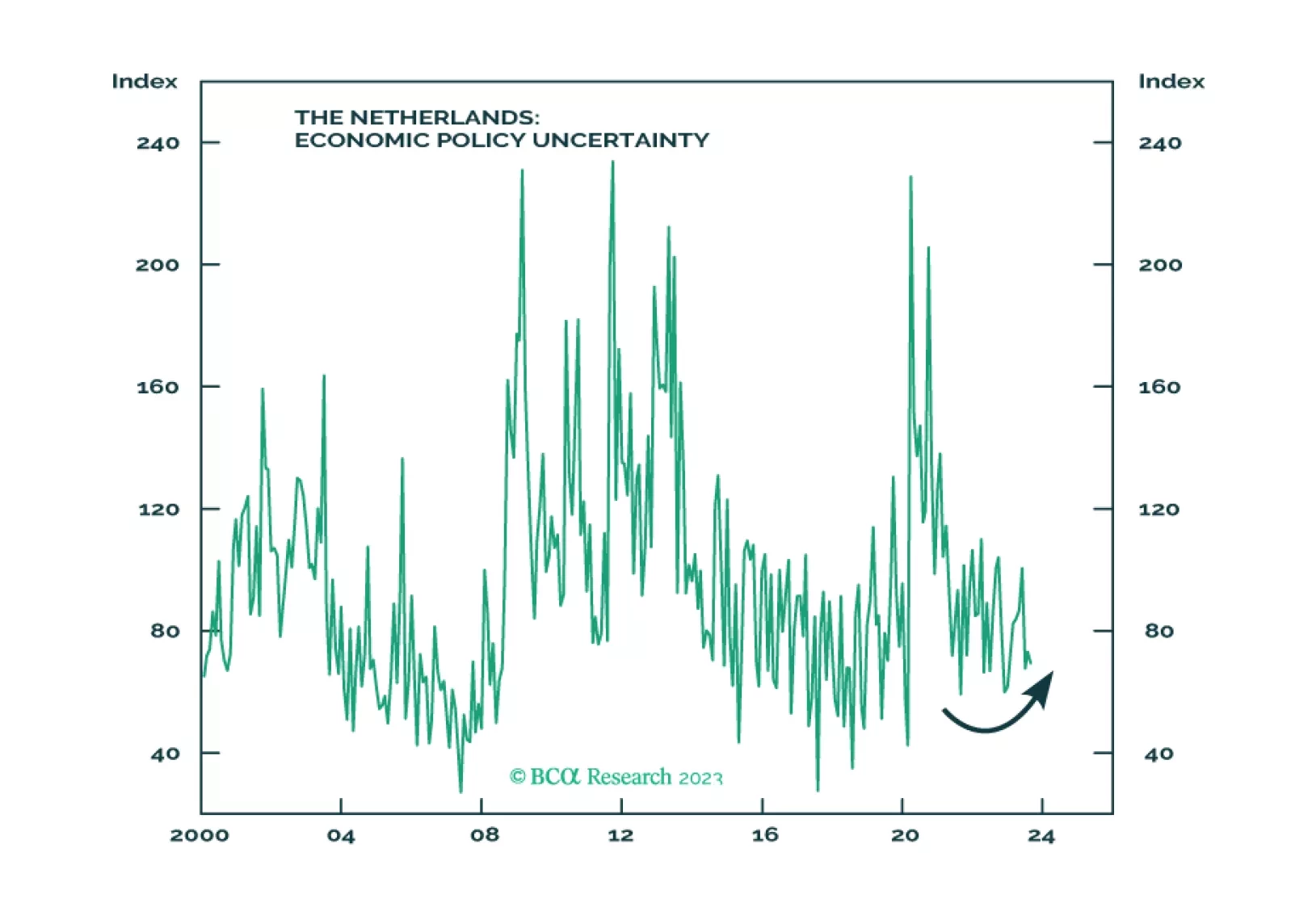

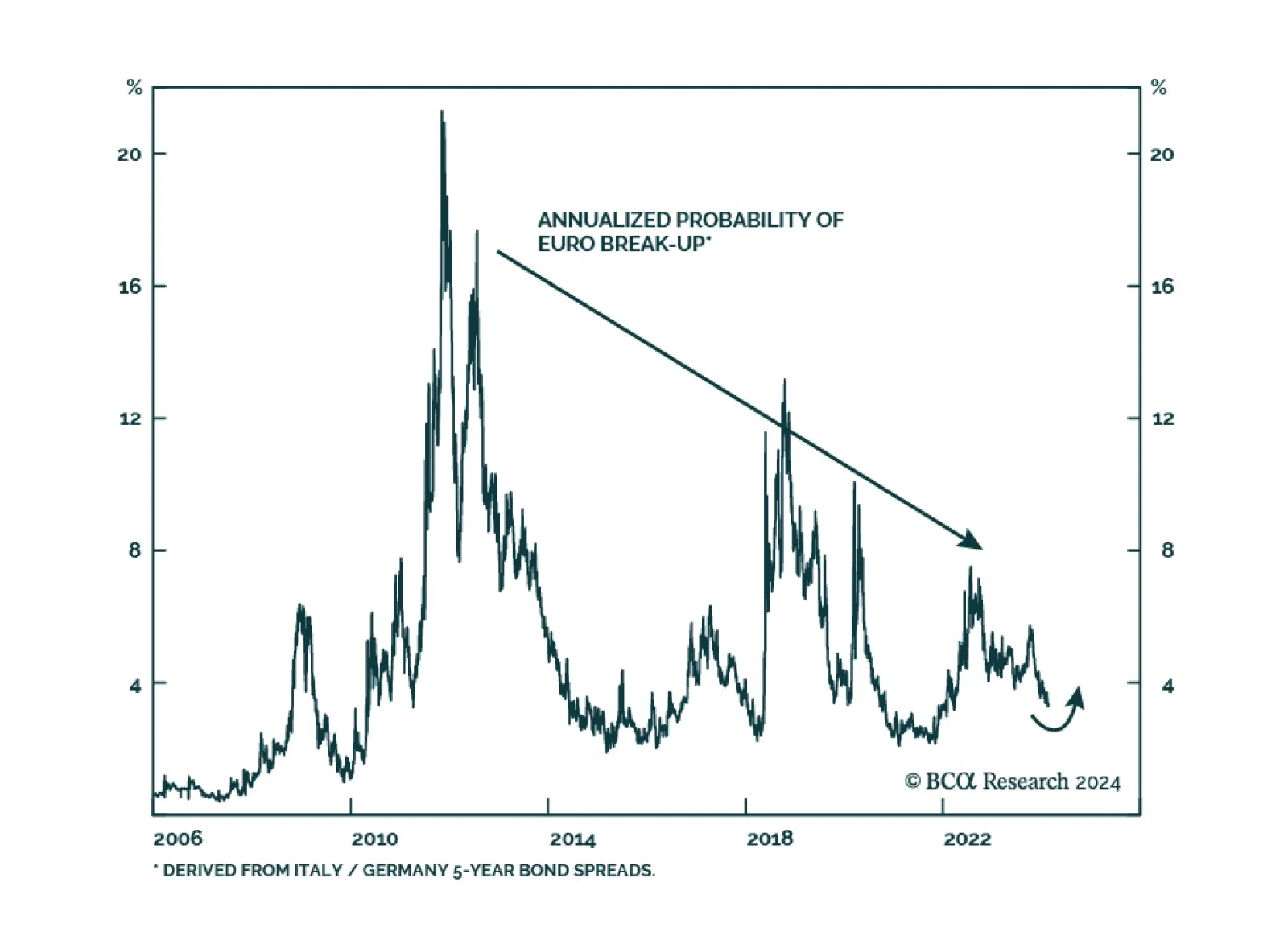

According to BCA Research’s Geopolitical Strategy service, European political risk is turning up again. Increased European political risk is not because of the European parliamentary elections, which will see right-wing…

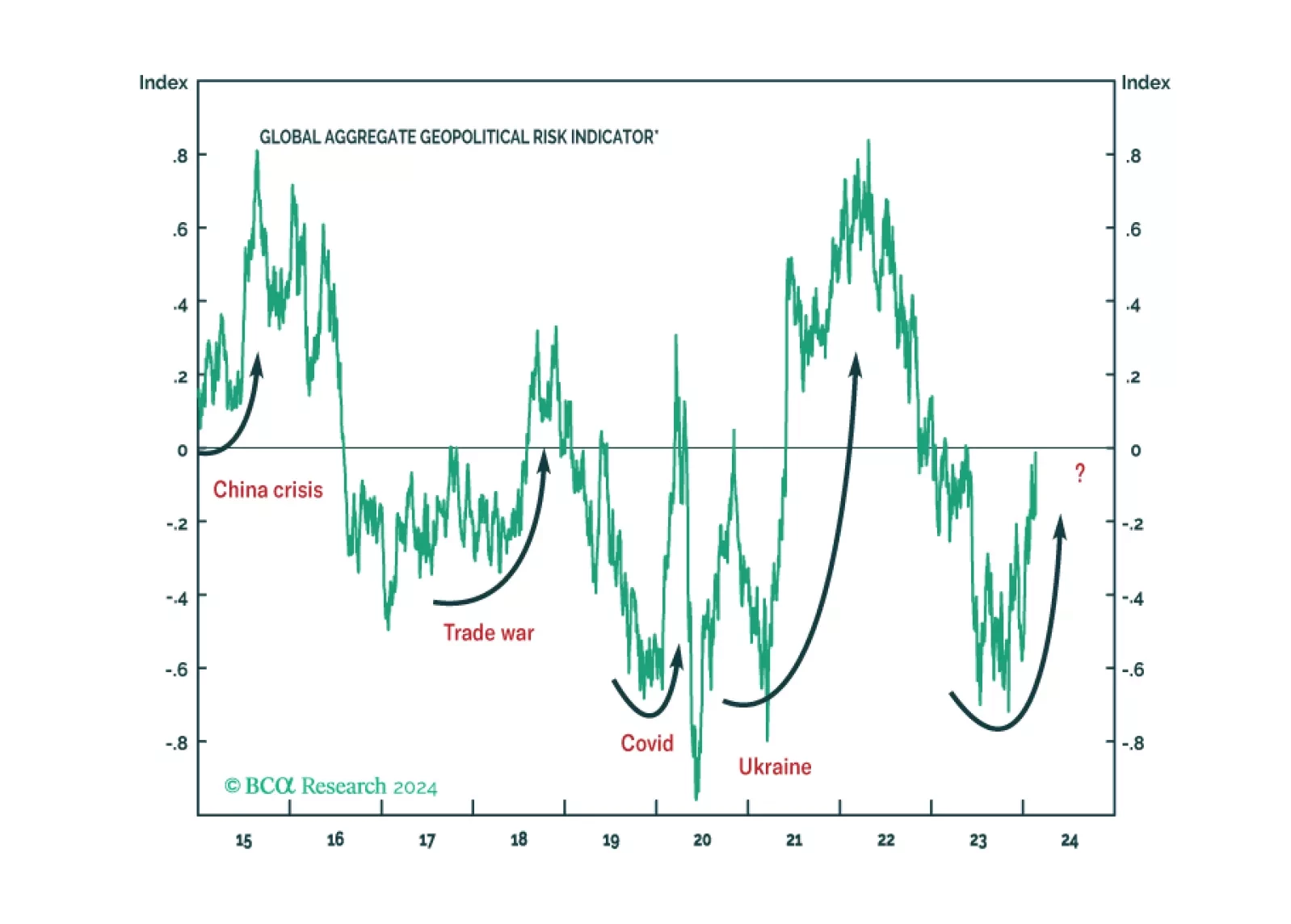

While 2024 will see various election risks, global geopolitical uncertainty is driven by the US election and its struggle with Russia, China, and Iran. The stock market can manage local domestic political risk. But it will correct…

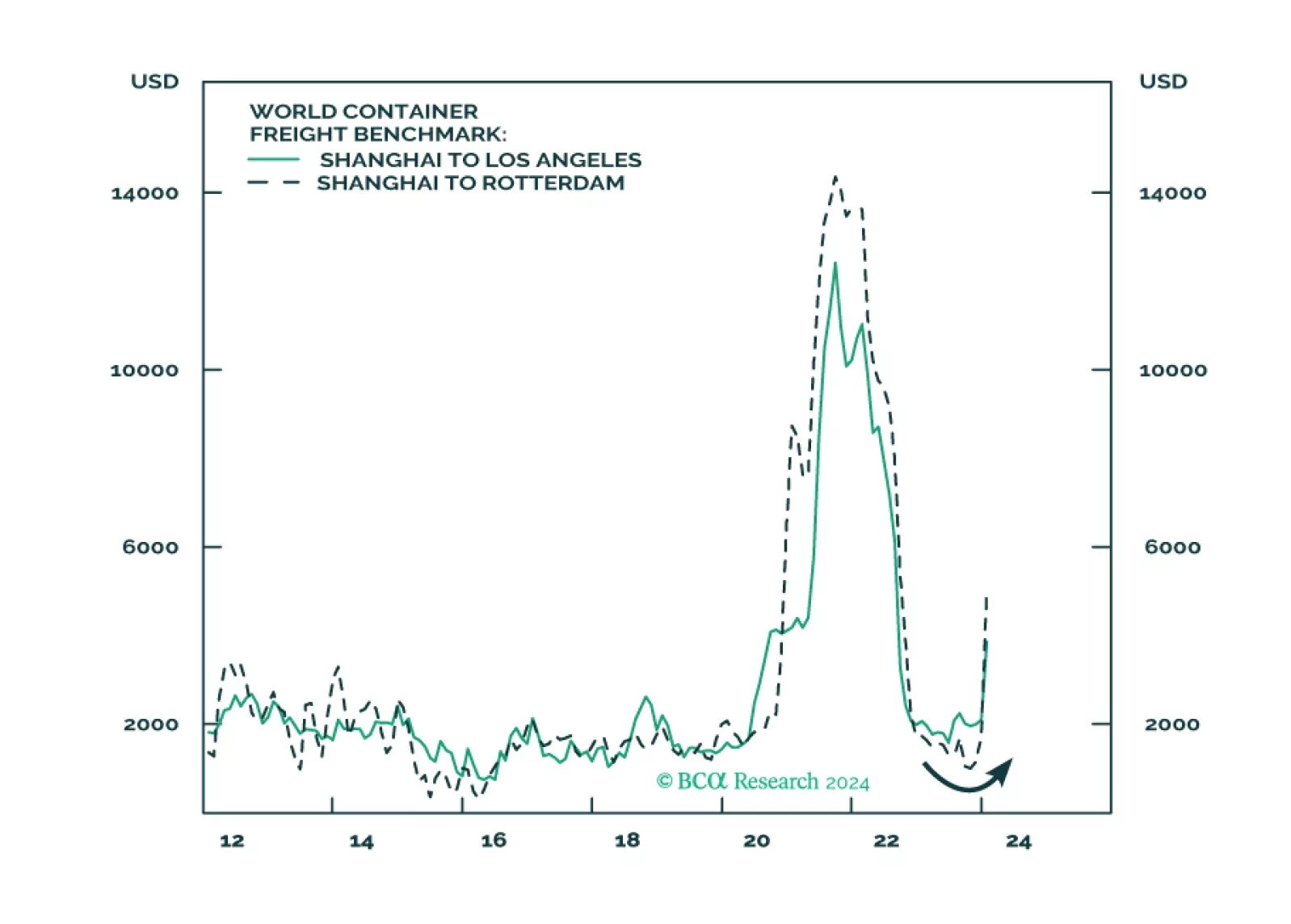

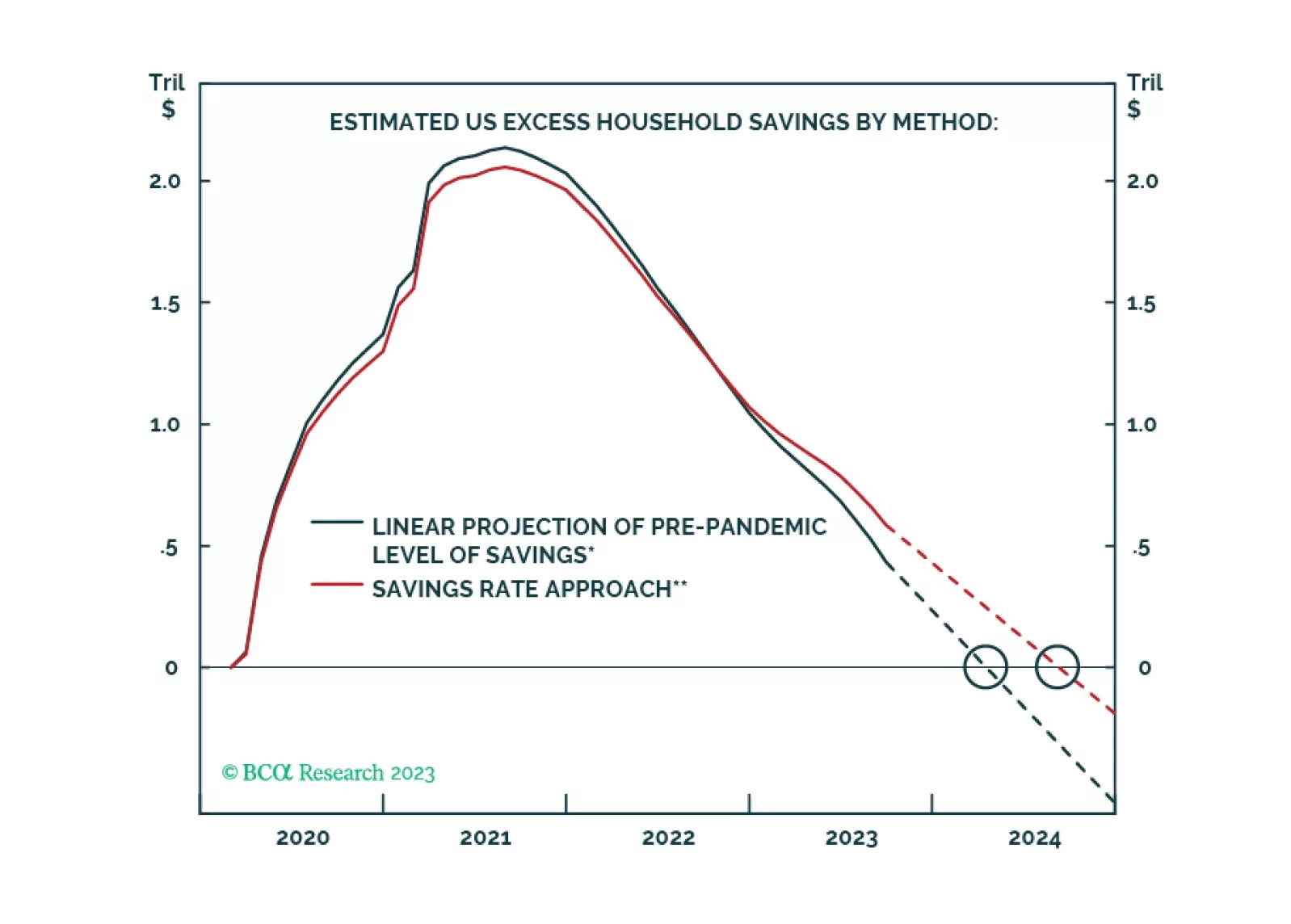

Middle East conflict, extreme US policy uncertainty, Chinese economic slowdown, US-Russian proxy war, and Asian military conflicts do not create a stable investment backdrop for 2024. Our top five “black swan” risks may be highly…

The market’s pricing of a soft landing means that geopolitical risks are becoming more, not less, relevant in 2024. US domestic divisions will invite challenges as foreign powers rightly fear that US policy will turn more hawkish…

Today, we are sending you the BCA annual outlook for 2024. The report is an edited transcript of our recent conversation with Mr. X and his daughter, Ms. X, who are long-time BCA clients with whom we discuss the economic and…

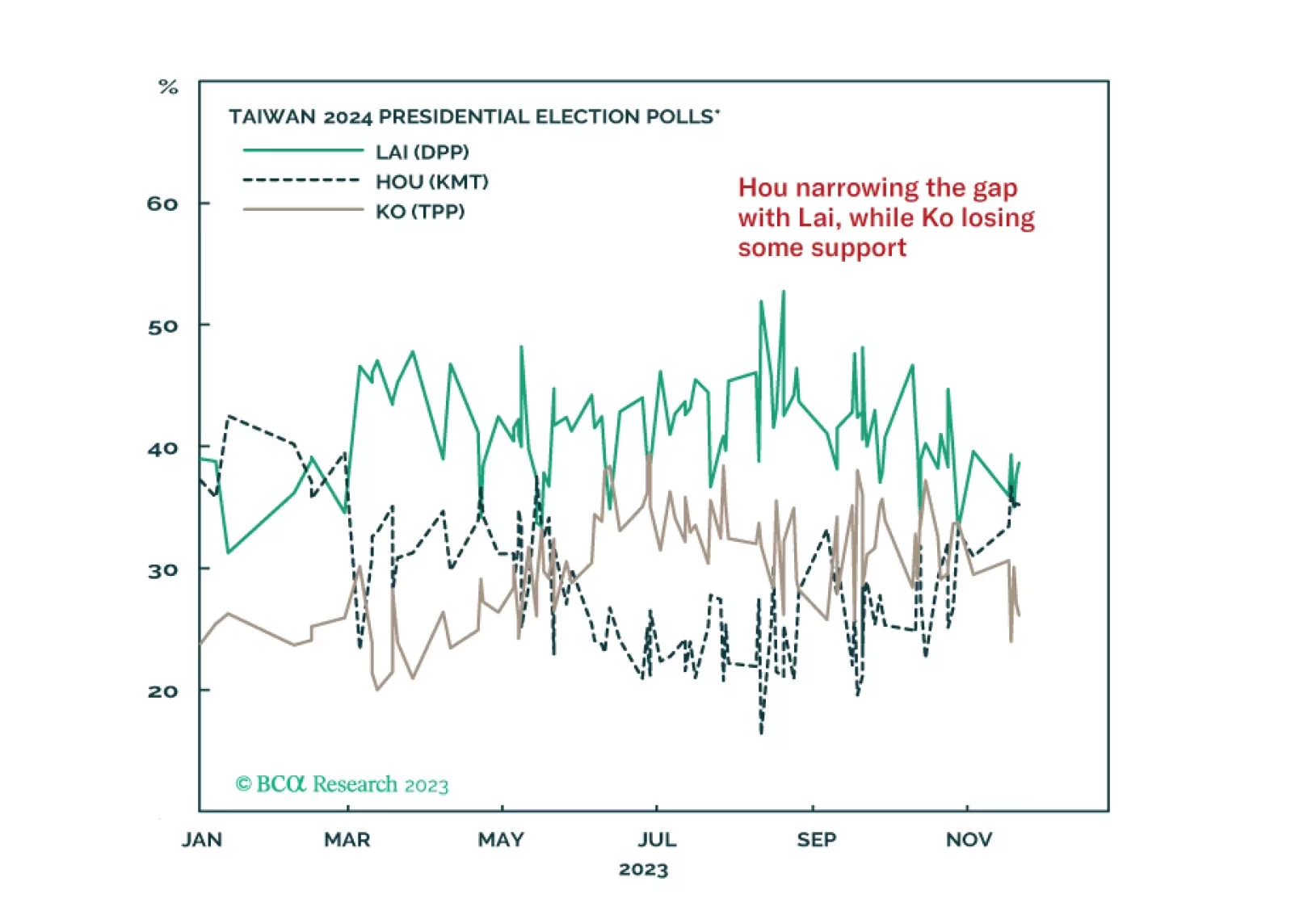

A series of notable events took place over the Thanksgiving holiday but none of them force us to change our fundamental assessments. The conflict in the Middle East is likely to escalate rather than de-escalate, while the Taiwan…

The geopolitical backdrop remains negative despite some marginally less negative news. China’s stimulus is not yet large or fast enough to prevent a market riot. Two of our preferred equity regions, ASEAN and Europe, are struggling…