The war in Ukraine has ended in late 2022… for markets at least. This is the conclusion from our GeoMacro team’s latest report, which aims to dispel five crucial myths surrounding the conflict. The myths are the…

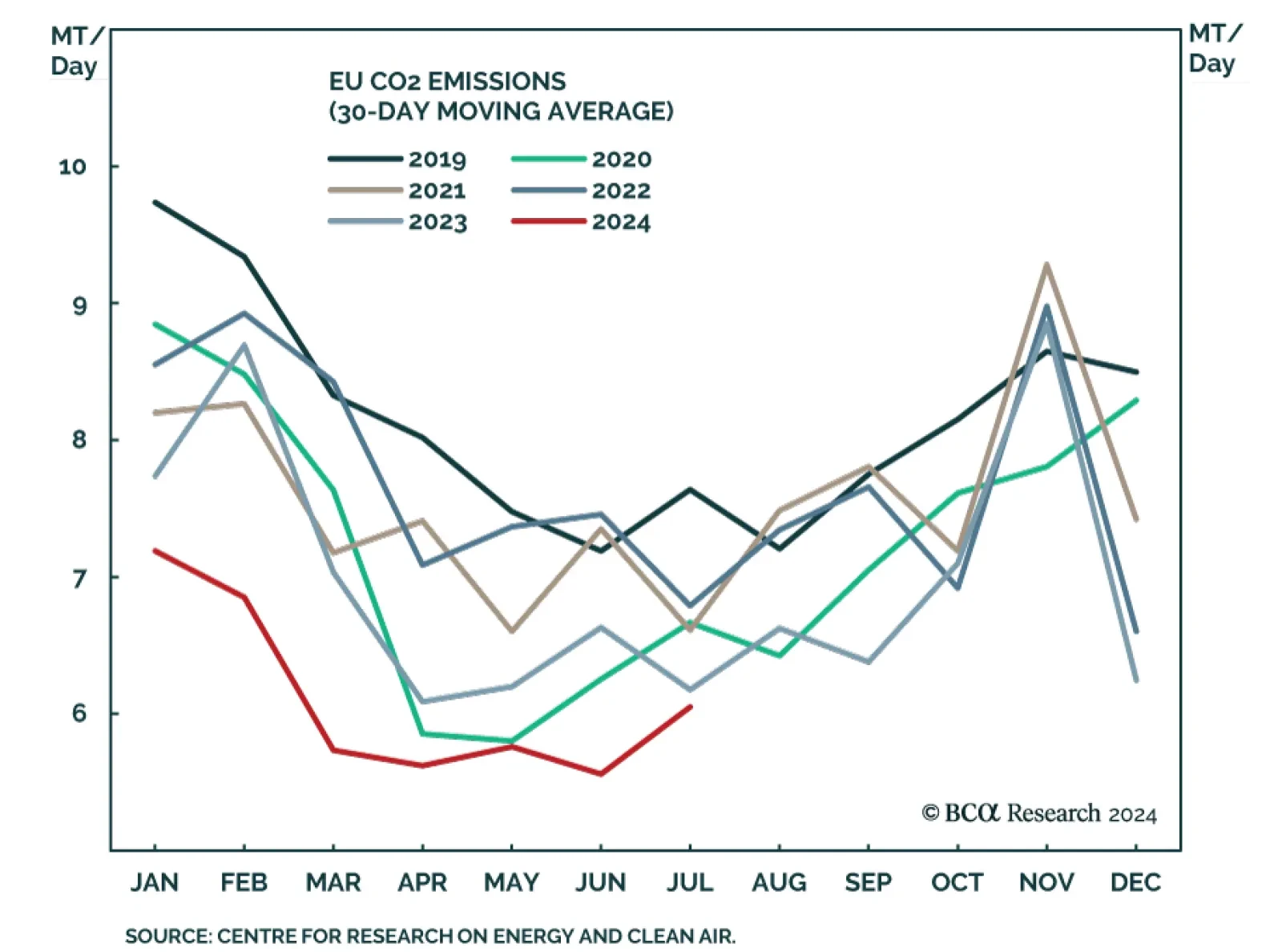

European regulatory carbon credits (EUAs) are becoming increasingly investable as an asset class. In a Special Report published last September, our Global Investment strategists agreed to the strategic bull case for EUAs, but…

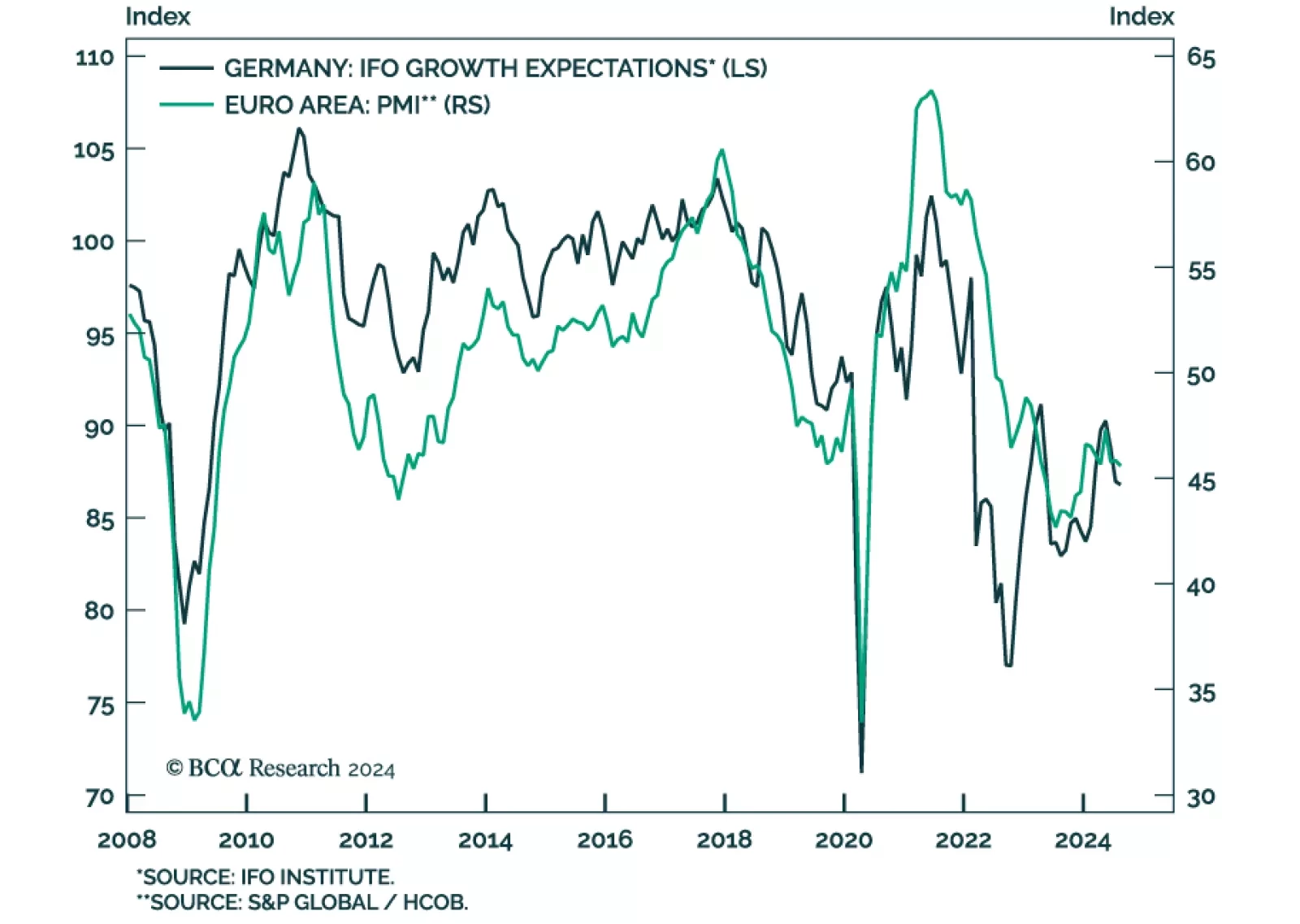

Sentiment among German companies declined in August from 87.0 to 86.6. Current conditions shed 0.6 points to 86.5 while the expectations component ticked 0.2 points lower. It nevertheless exceeded consensus expectations for a…

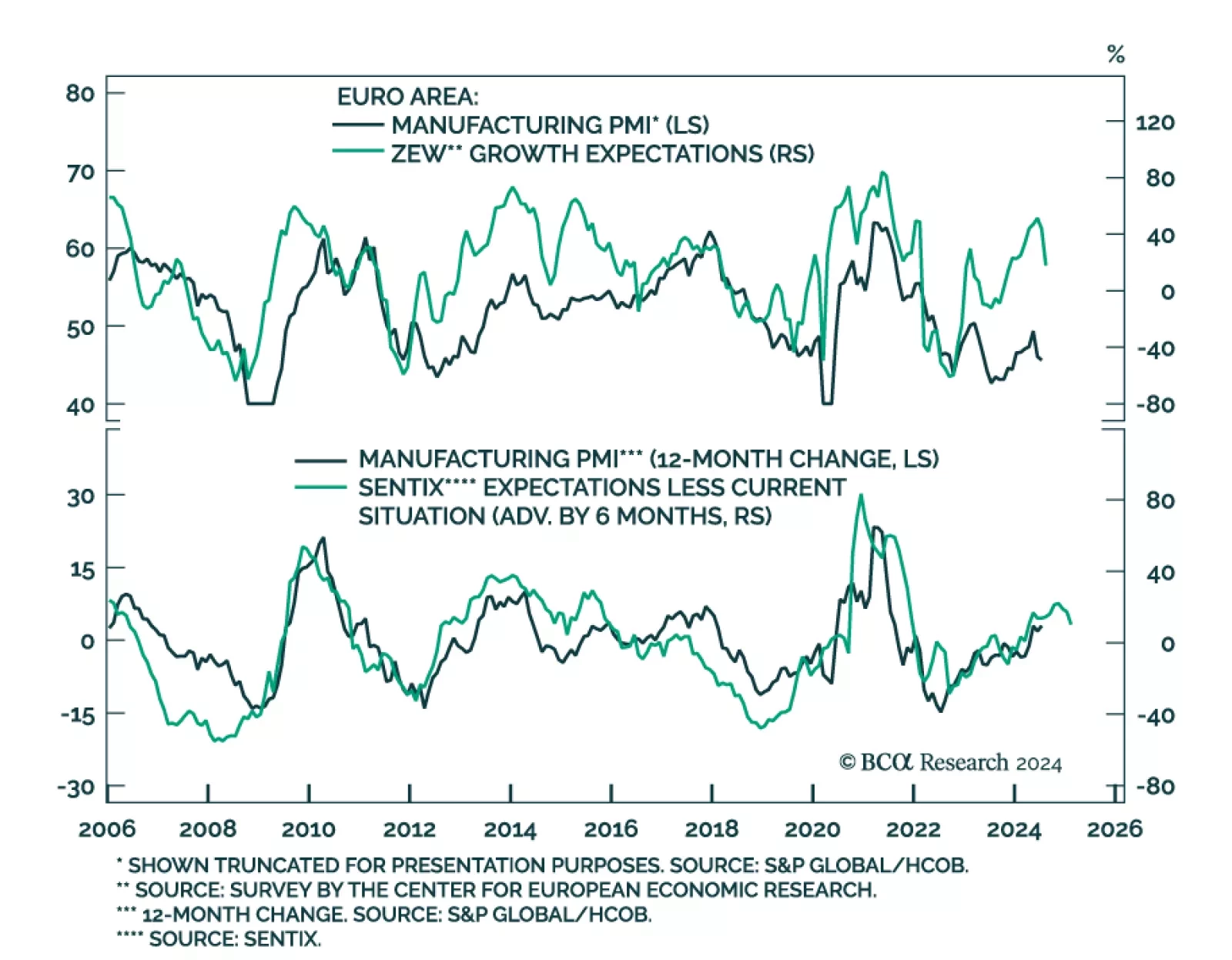

The ZEW survey of Eurozone business expectations decreased by a whopping 25.8 points to 17.9 in August. Notably, expectations for Germany’s current situation disappointed, worsening from an already depressed -68.9 level to…

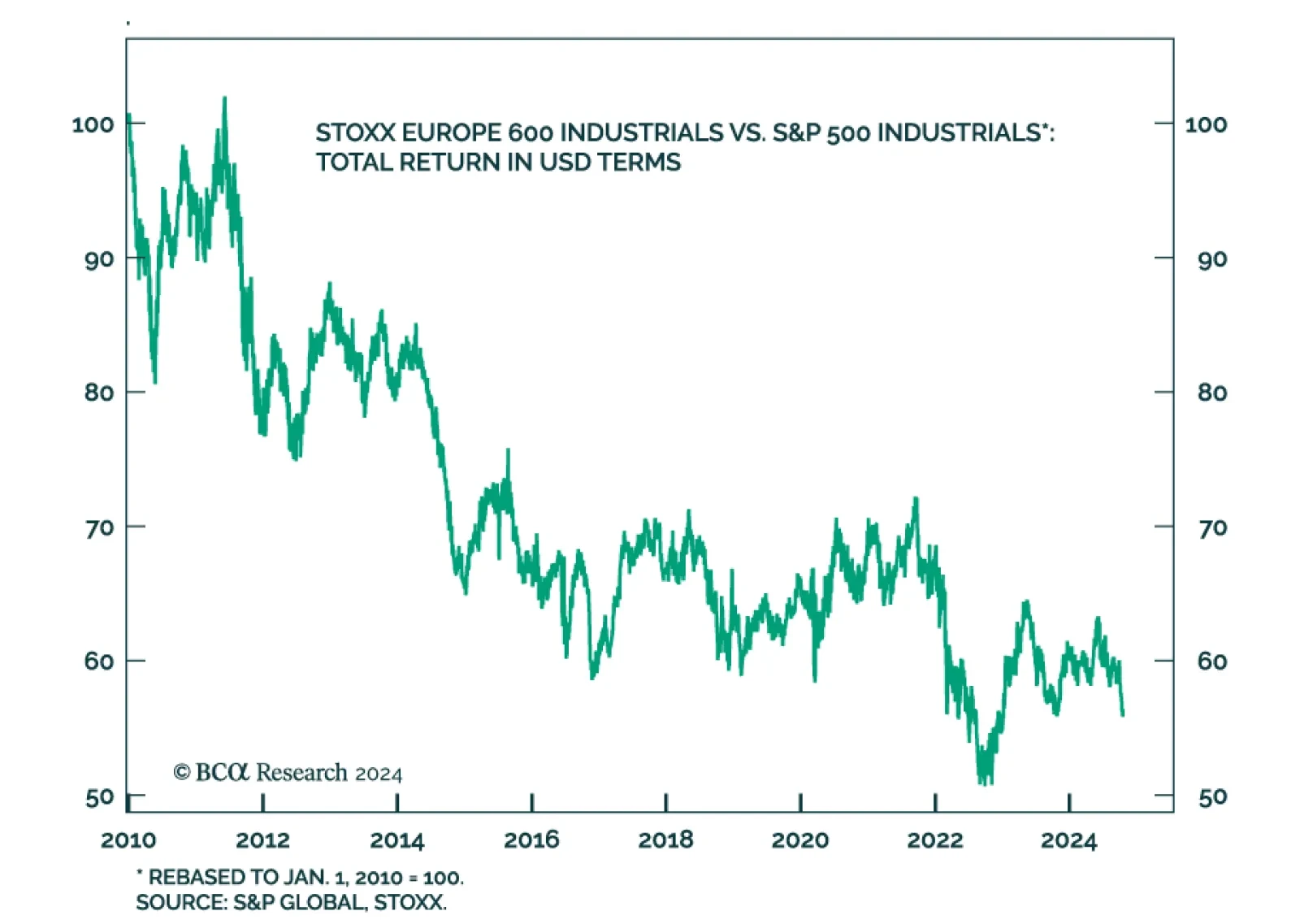

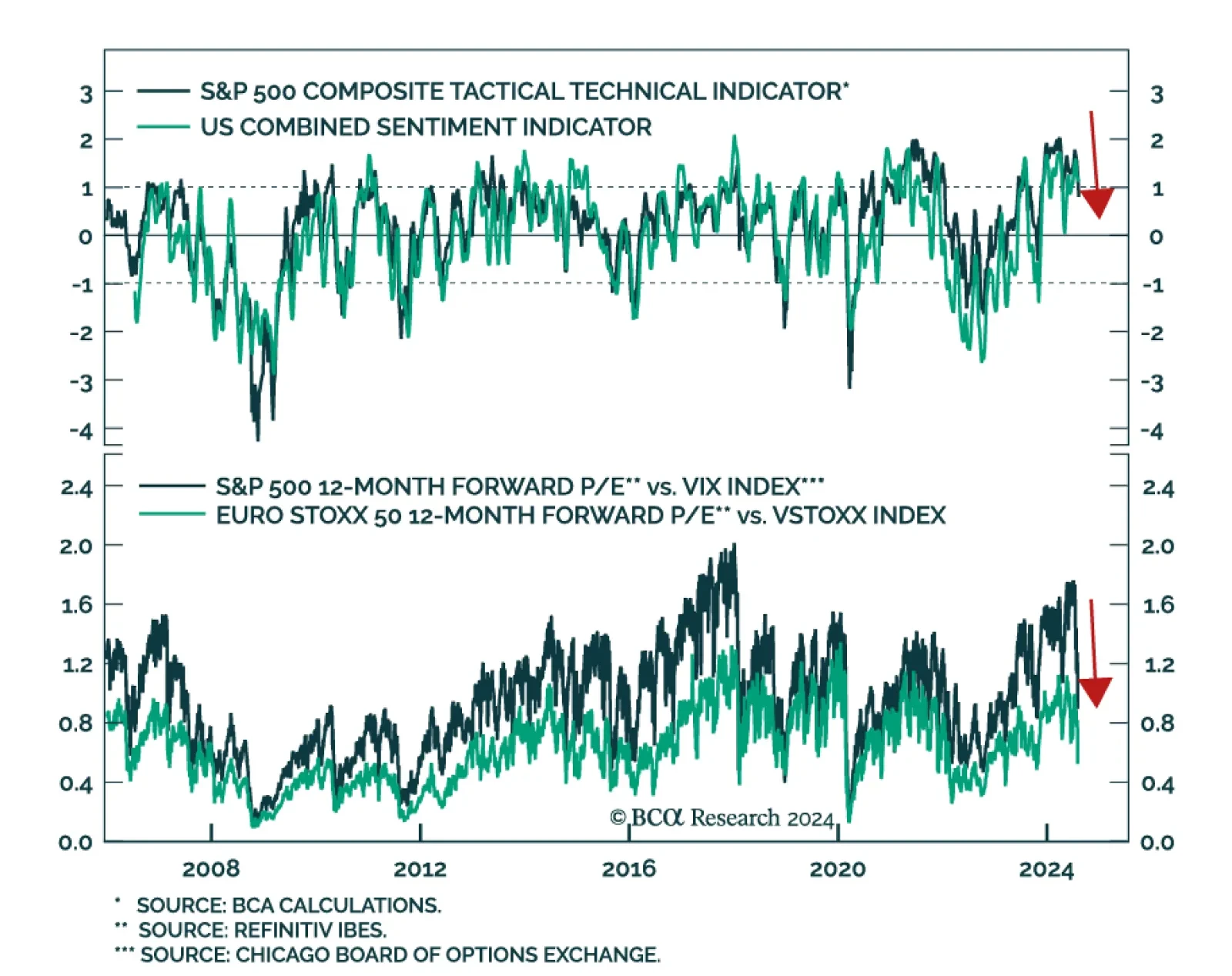

According to BCA Research’s European Investment Strategy service, investors should fade the rebound in European equities and bond yields as the euro is also at risk. Last week’s bounce in global equities is…

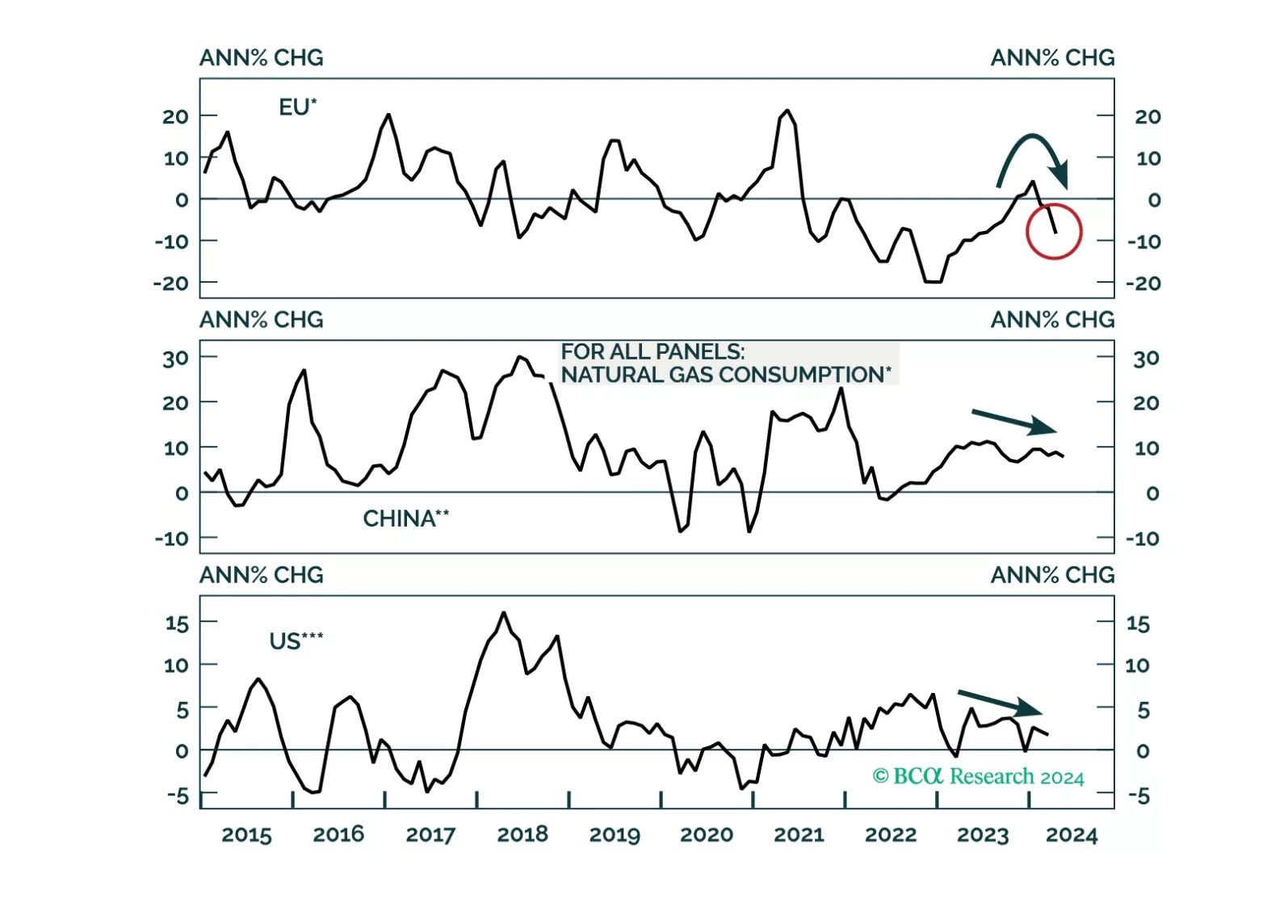

A global economic downturn will be a headwind for natgas prices over the cyclical horizon. Thereafter, LNG capacity additions will help keep the market in balance into the end of the decade. That said, Europe’s increased dependence…

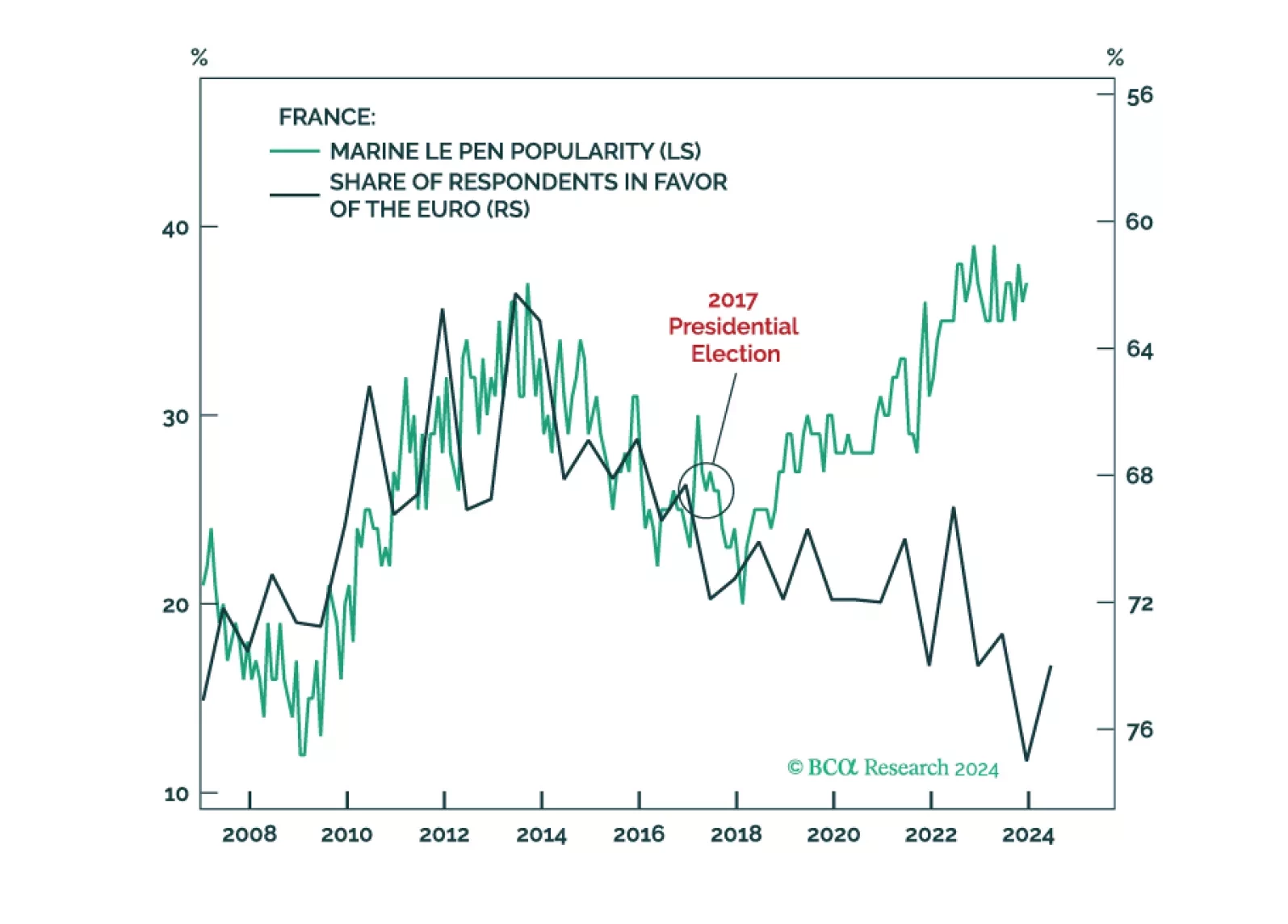

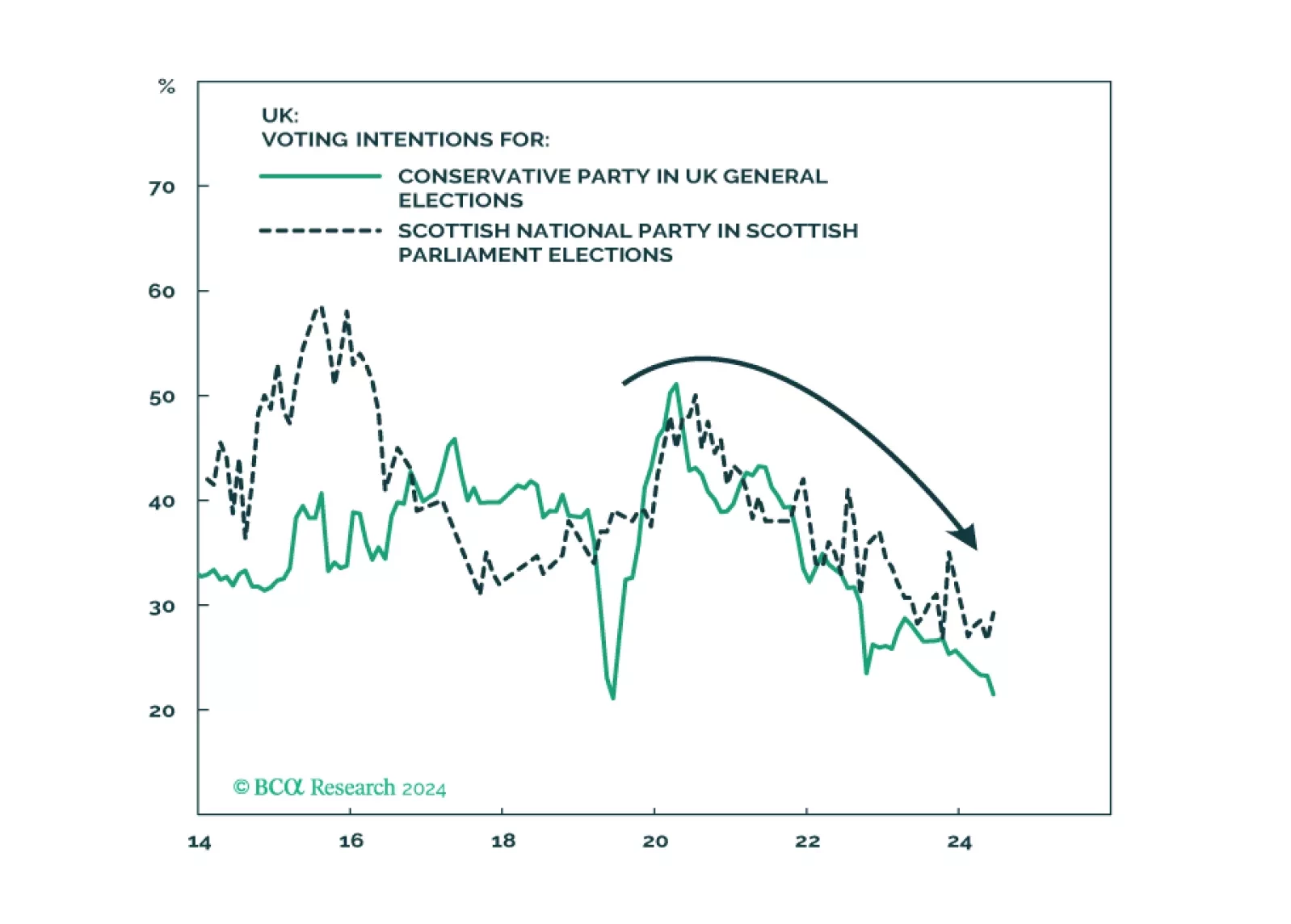

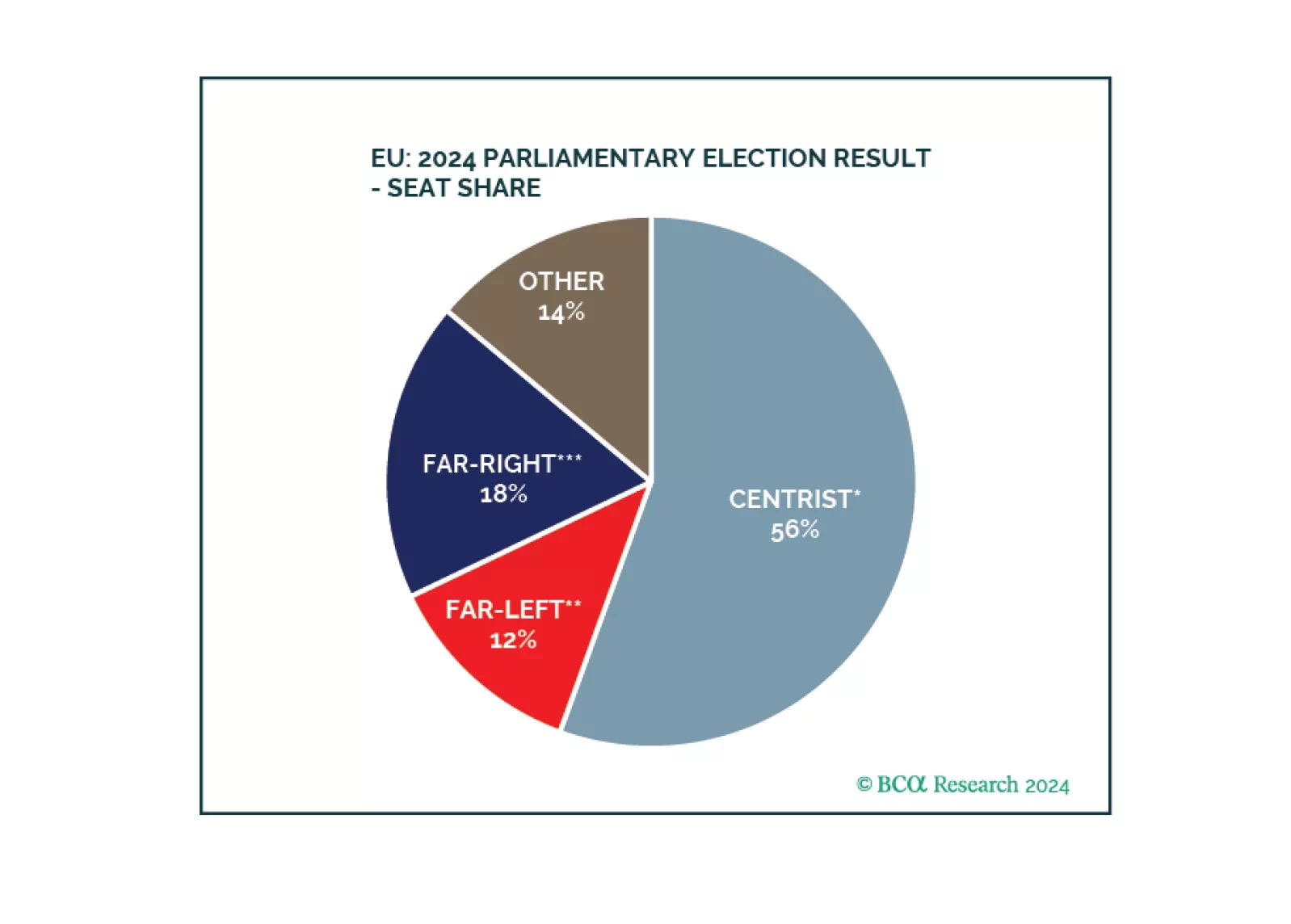

Investors in European sovereign bonds should find solace that continental voters are not turning away from support for EU integration. As such, populist parties are not really that “far” left or right. And as long as they want to…

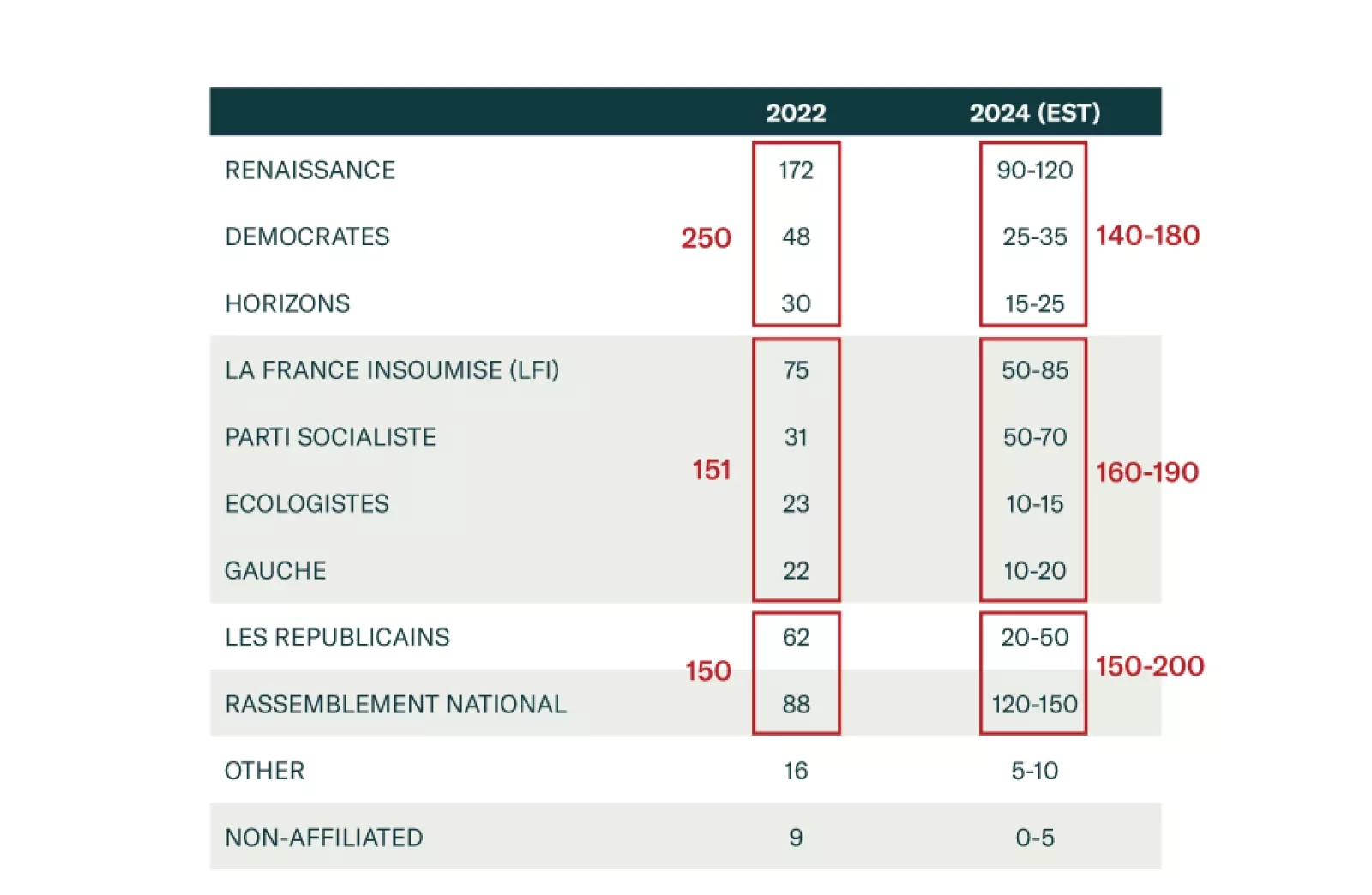

European assets are selling off as investors panic about the upcoming French election. Is this panic justified, and if so, for how long?

Europe did not witness a major policy reversal. Inflationary pressures are coming down, enabling the ECB to cut rates and European states to maintain soft budgets. Geopolitical challenges ensure that European parties continue to…