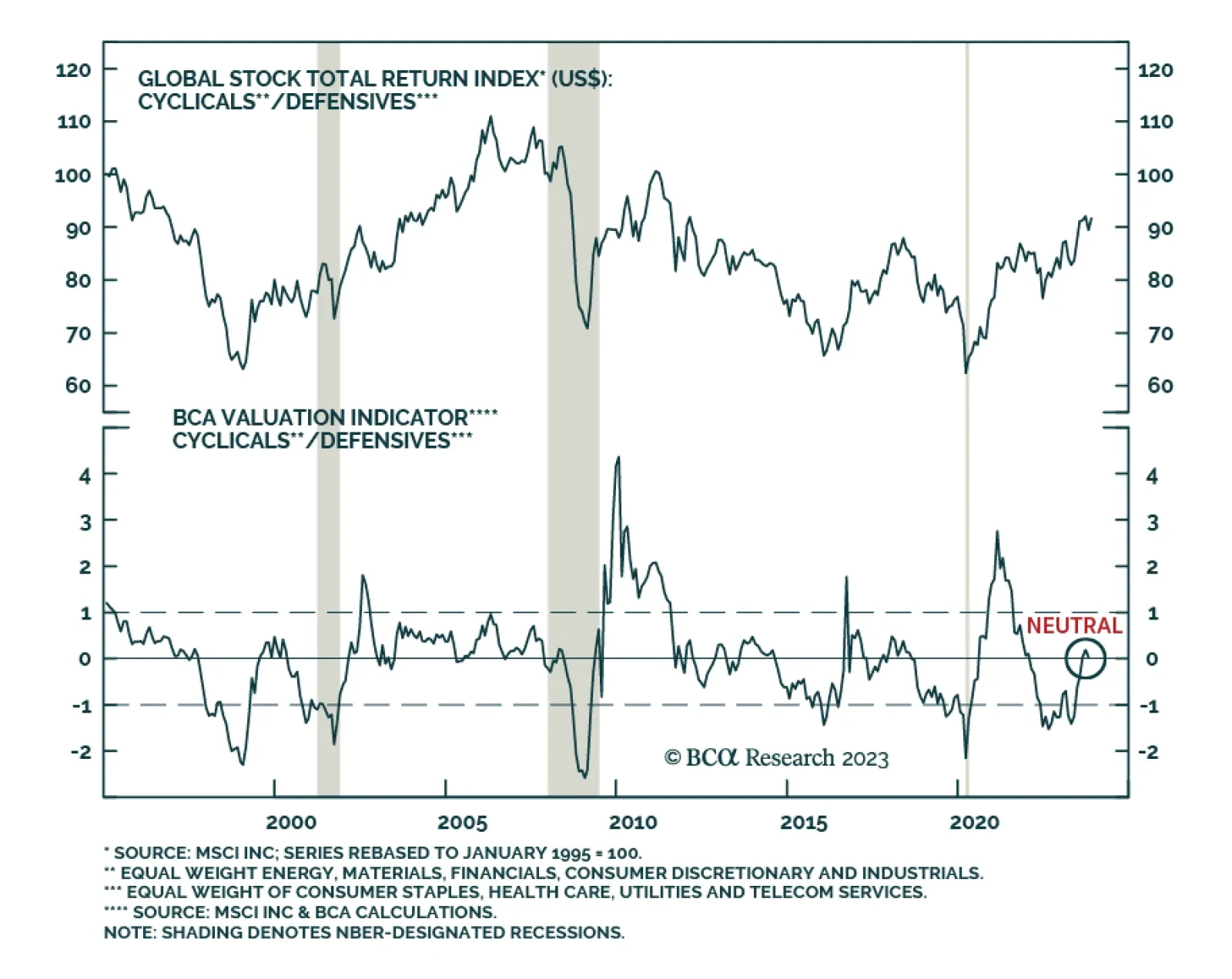

Global cyclical sectors are outperforming defensive sectors on a year-to-date basis. The bulk of this outperformance occurred in the first seven months of the year. Relative valuations contributed to this dynamic as last year…

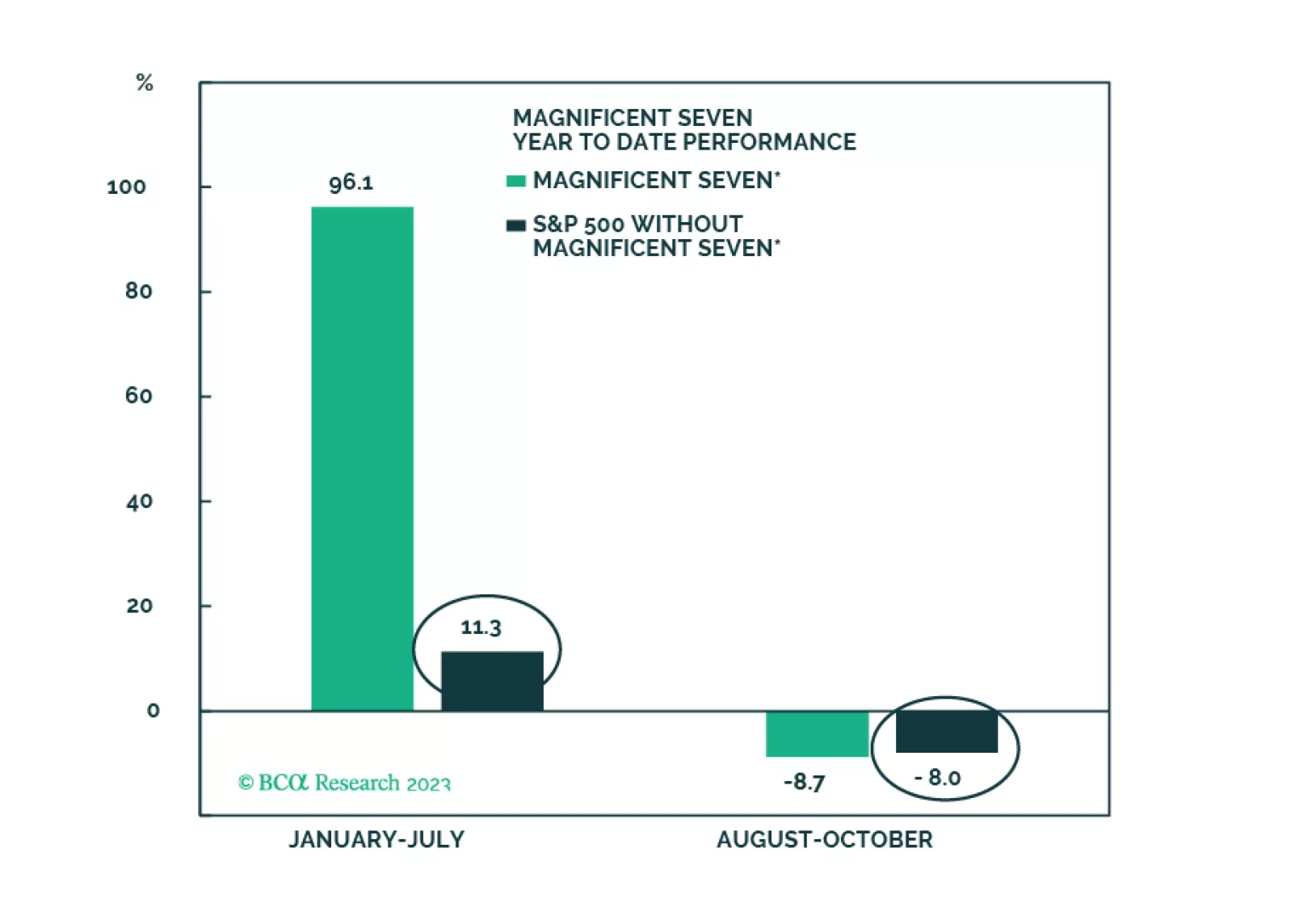

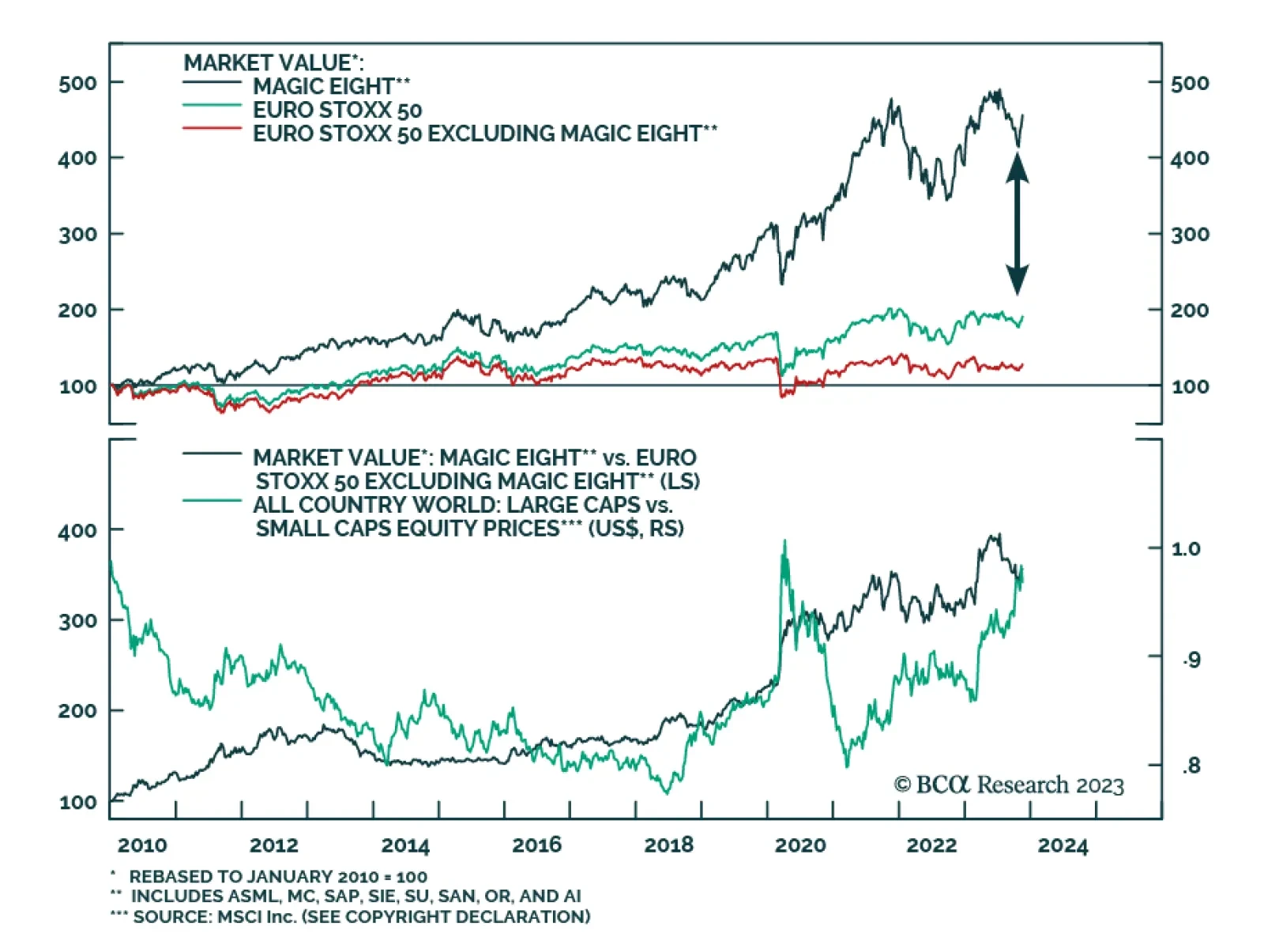

According to BCA Research’s European Investment Strategy service, the Magic Eight are the European counterpart to the US’ Magnificent Seven. The dominance of the so-called Magnificent Seven in the US S&P 500 is…

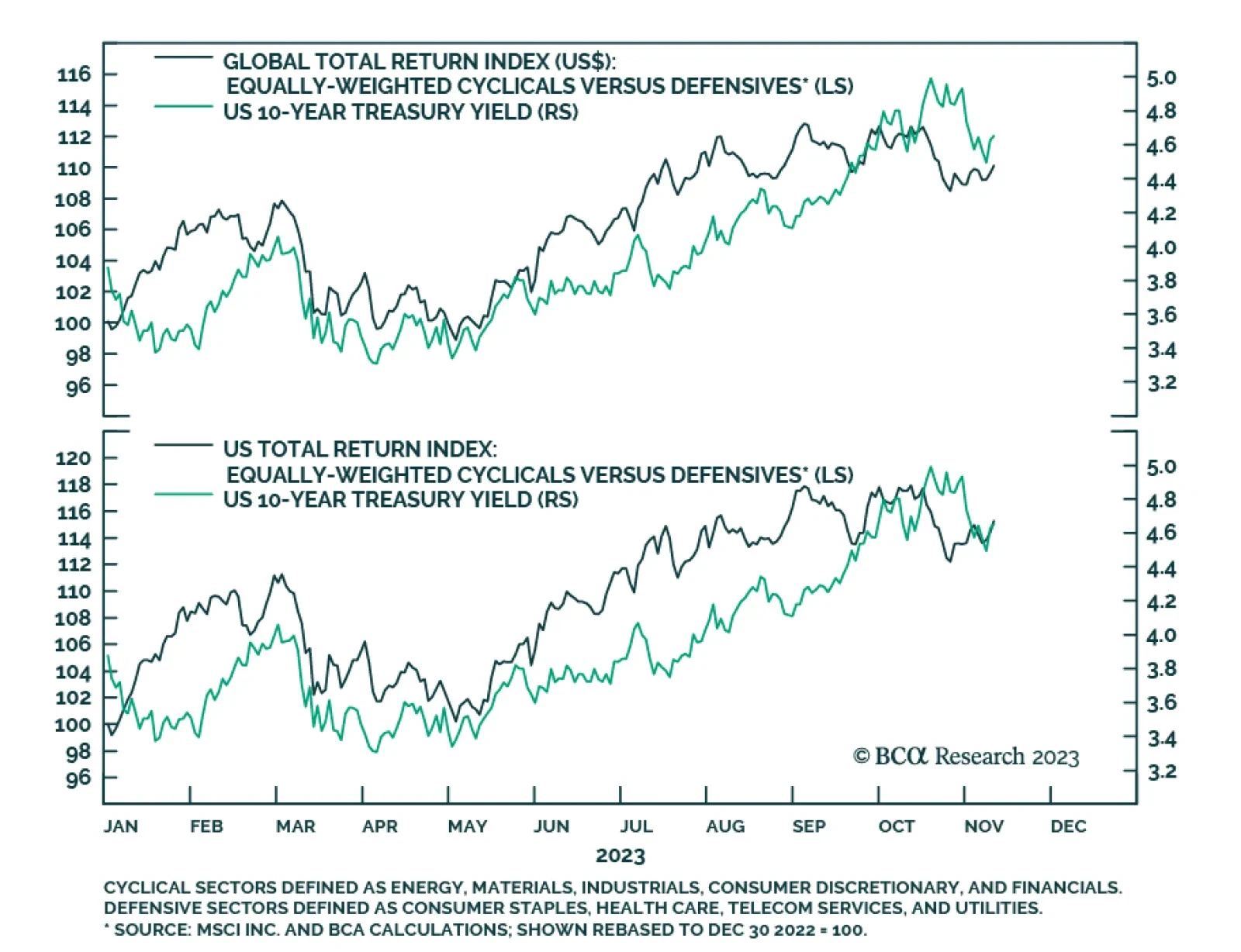

Our equally weighted global cyclical equity index has outperformed equally weighted defensives for most of this year. By October 17, this outperformance stood at about 12.6%. This outperformance is consistent with US Treasury…

The Vicious Troika remains a long-term threat, but over the short term, rates will likely have another leg down on growth concerns, offering support to equities, which are now fairly valued and are no longer overbought. Longer-term…

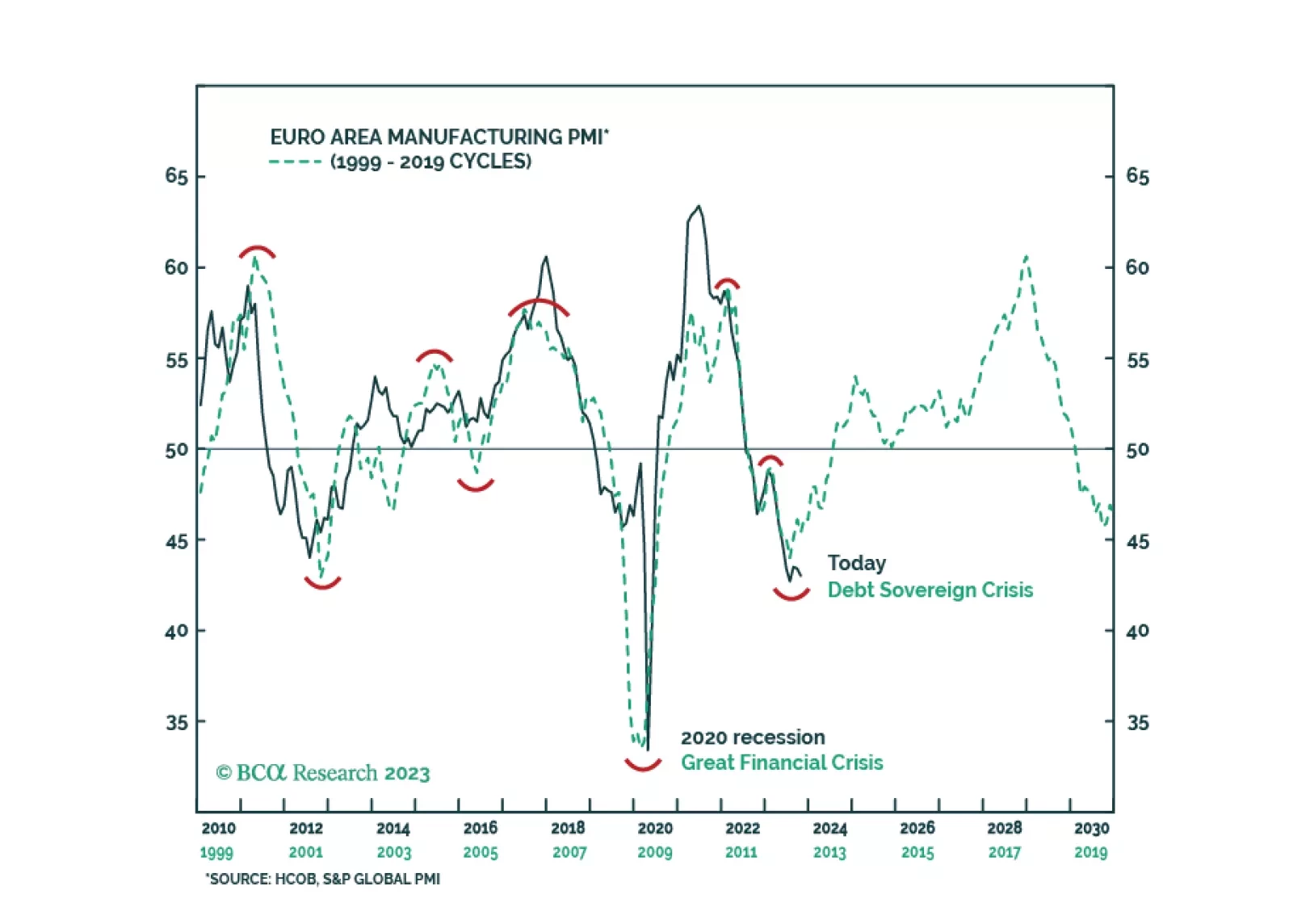

What will the next manufacturing cycle look like in Europe and how will risk assets perform? Lessons from the recent past.

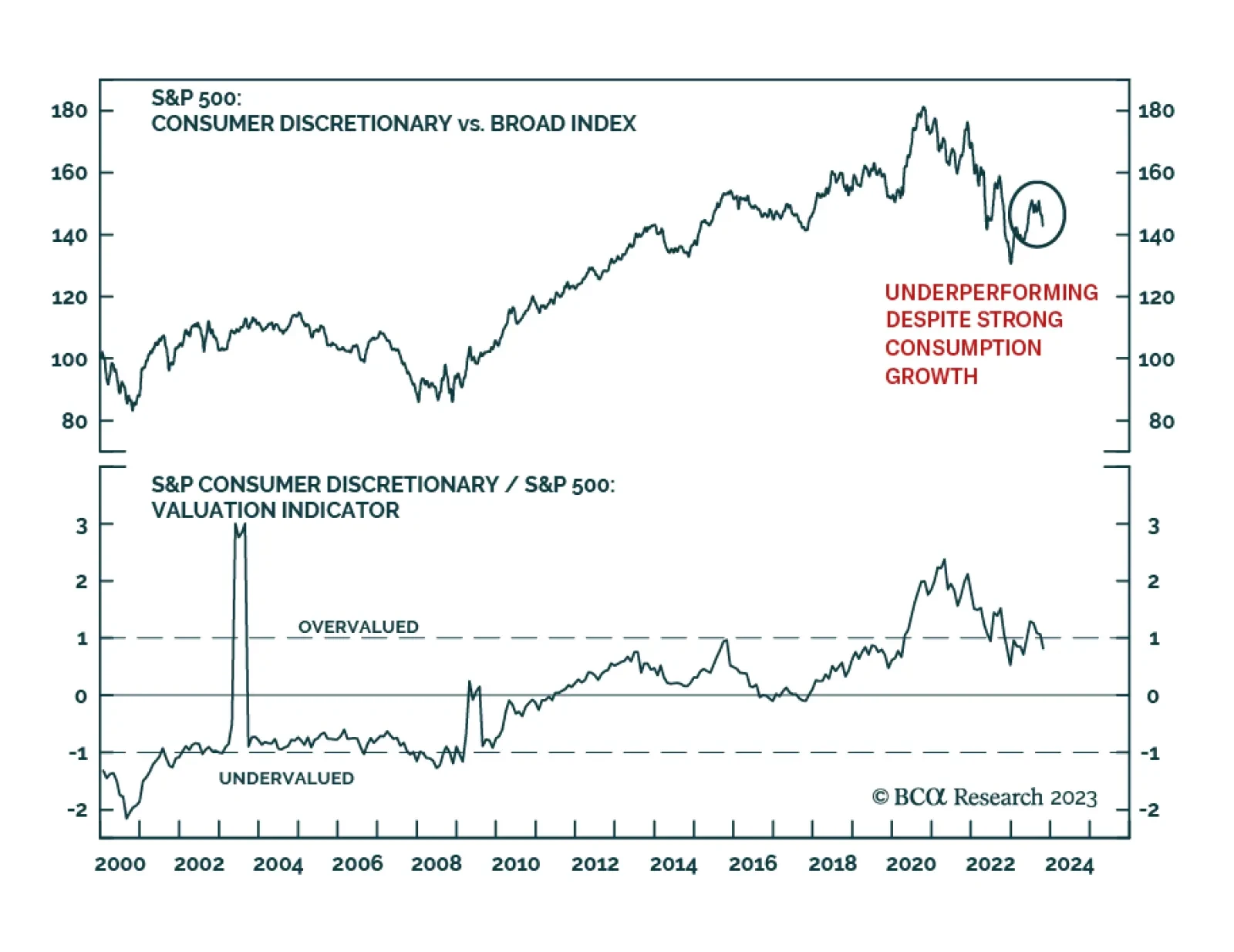

Recent US data reveals that consumer spending has been extremely robust in the US (see The Numbers). Personal consumption expanded by 4.0% q/q annualized in Q3, helping lift aggregate economic growth. Nevertheless, Consumer…

Taiwanese exports unexpectedly grew for the first time in just over a year in September – sending a positive signal about the global manufacturing cycle. The 3.4% y/y increase surprised anticipations of a moderation in the…

In this Strategy Outlook, we present the major investment themes and views we see playing out for the rest of 2023 and beyond.