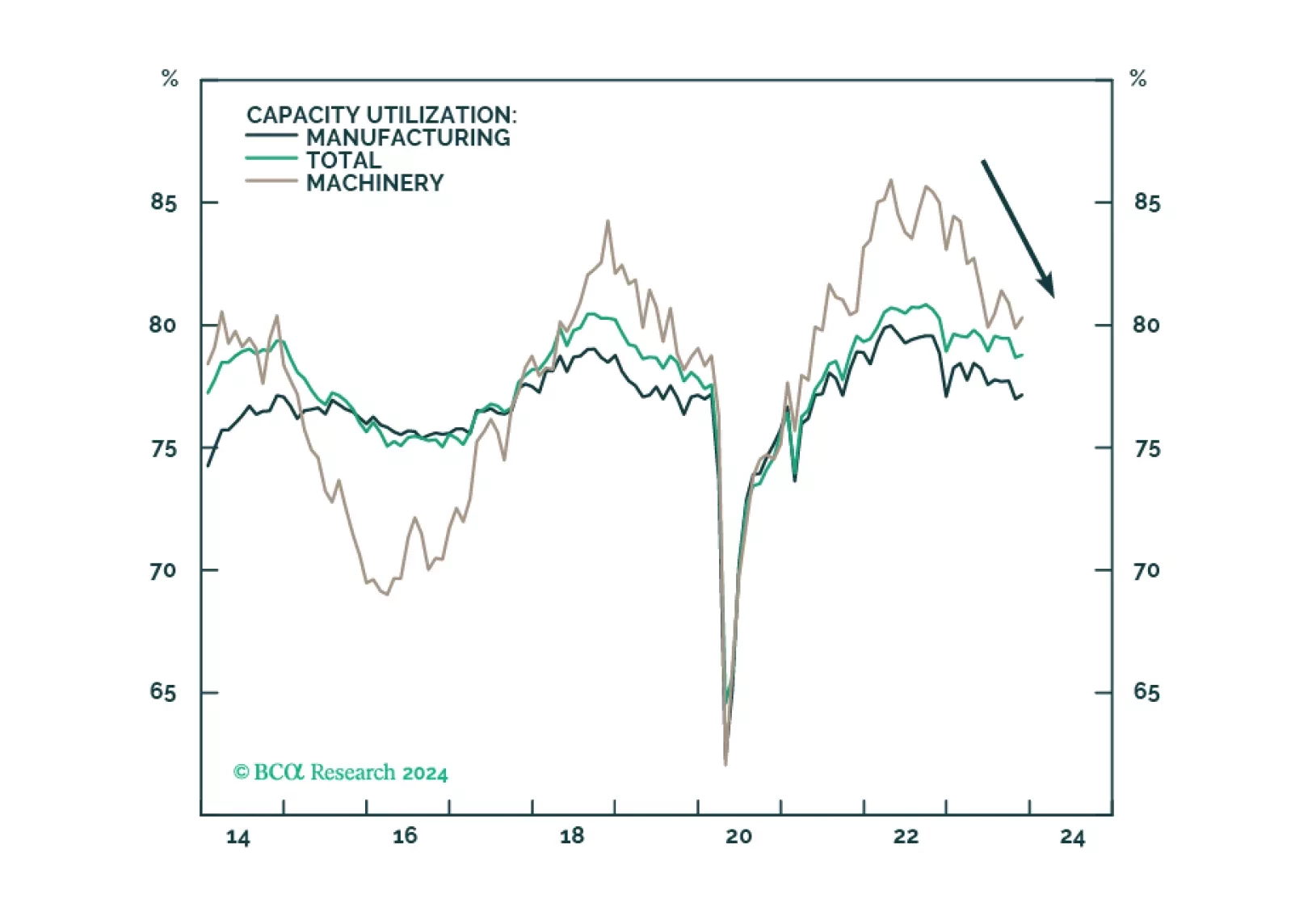

The US manufacturing renaissance, spurred on by reshoring, automation, and government spending, is running its course but progress has slowed on the back of tight monetary conditions and the manufacturing recession. The deceleration…

The market’s pricing of a soft landing means that geopolitical risks are becoming more, not less, relevant in 2024. US domestic divisions will invite challenges as foreign powers rightly fear that US policy will turn more hawkish…

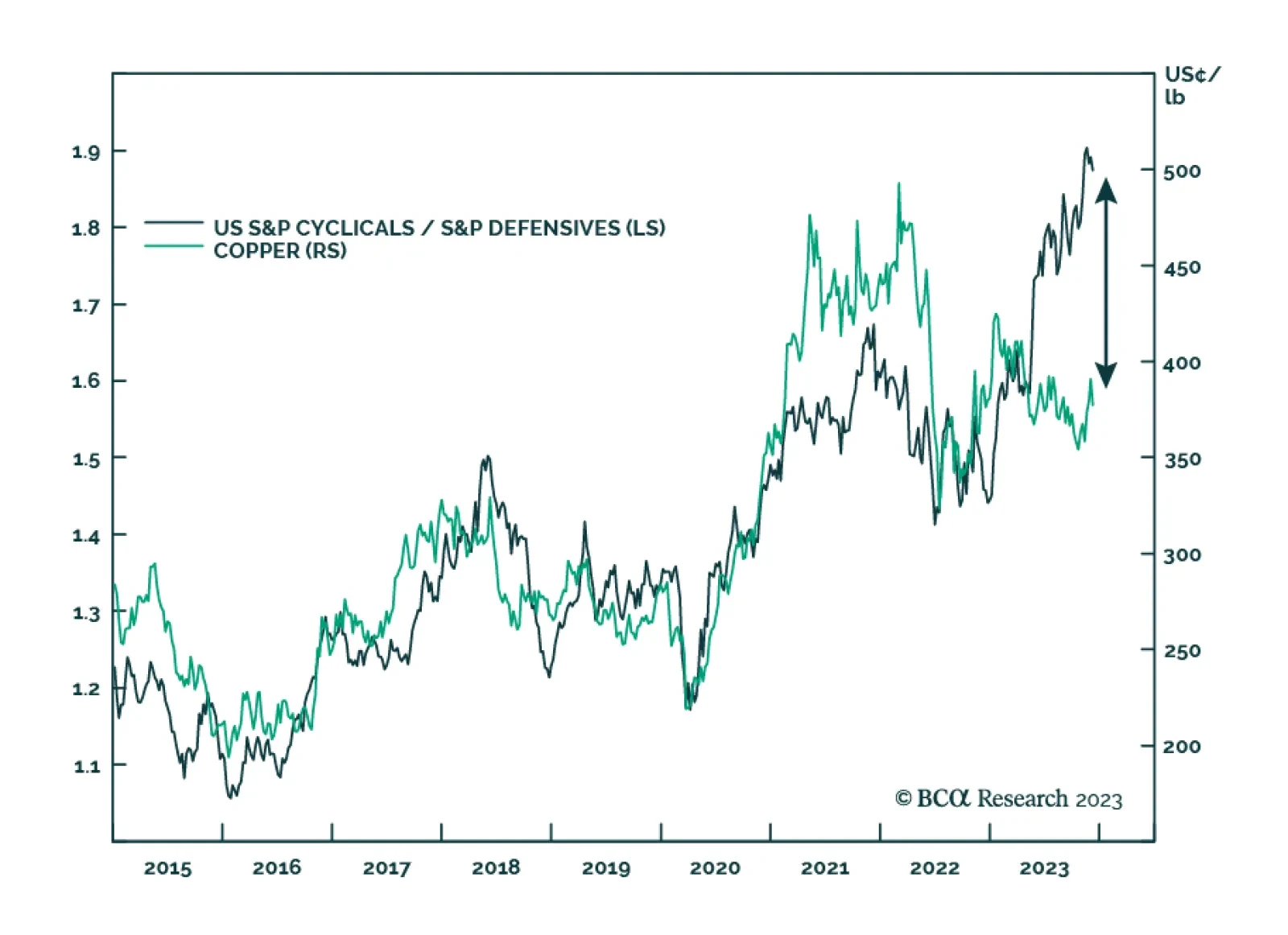

After rallying by 11.2% between October 5 and December 27, the price of copper has since been on a losing streak, falling in each of the subsequent six trading sessions. Notably, this decline has coincided with weakness among…

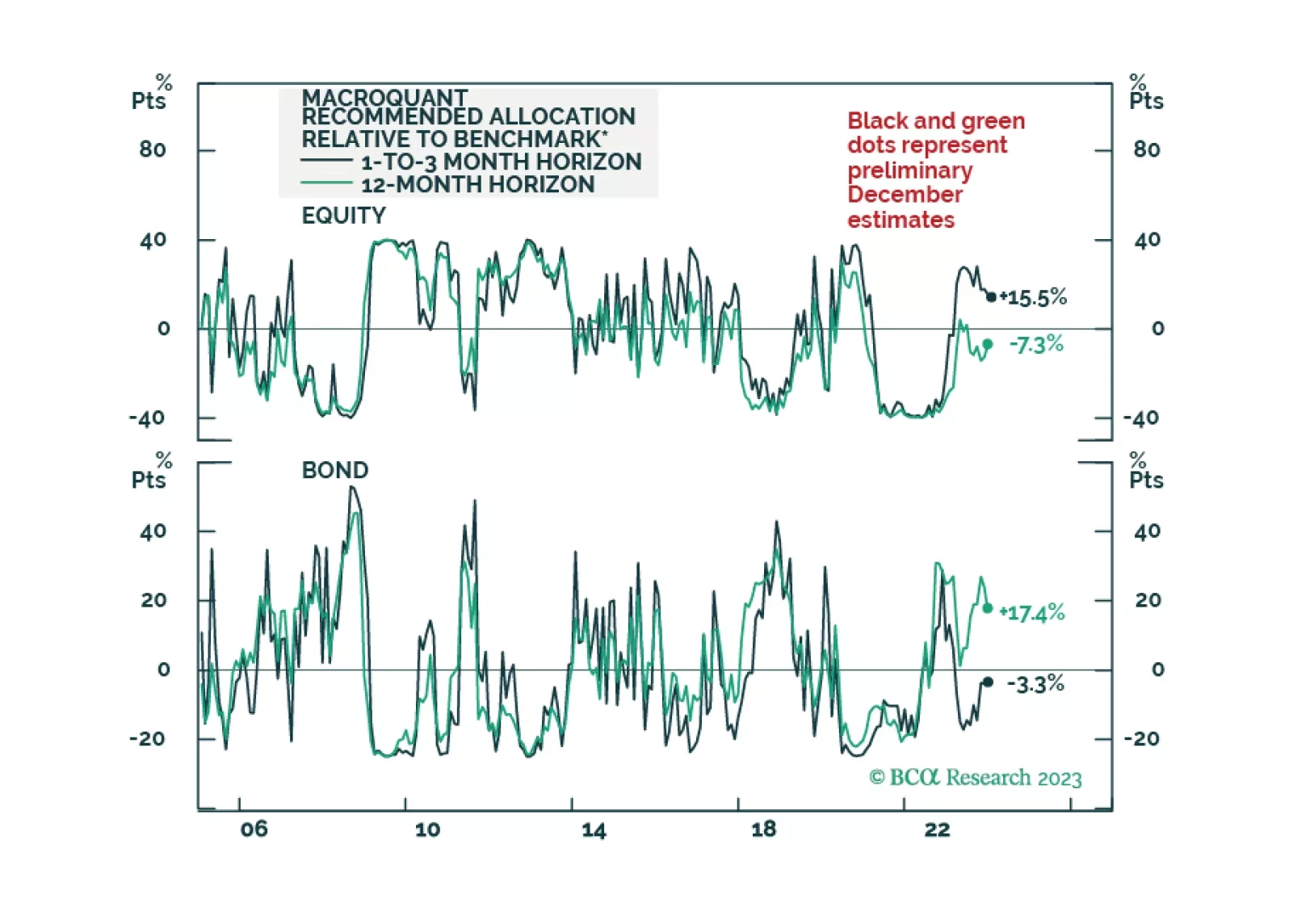

A soft landing can be achieved but not maintained. We are cutting our tactical recommendation on stocks from overweight to neutral and scaling back our long-duration stance.

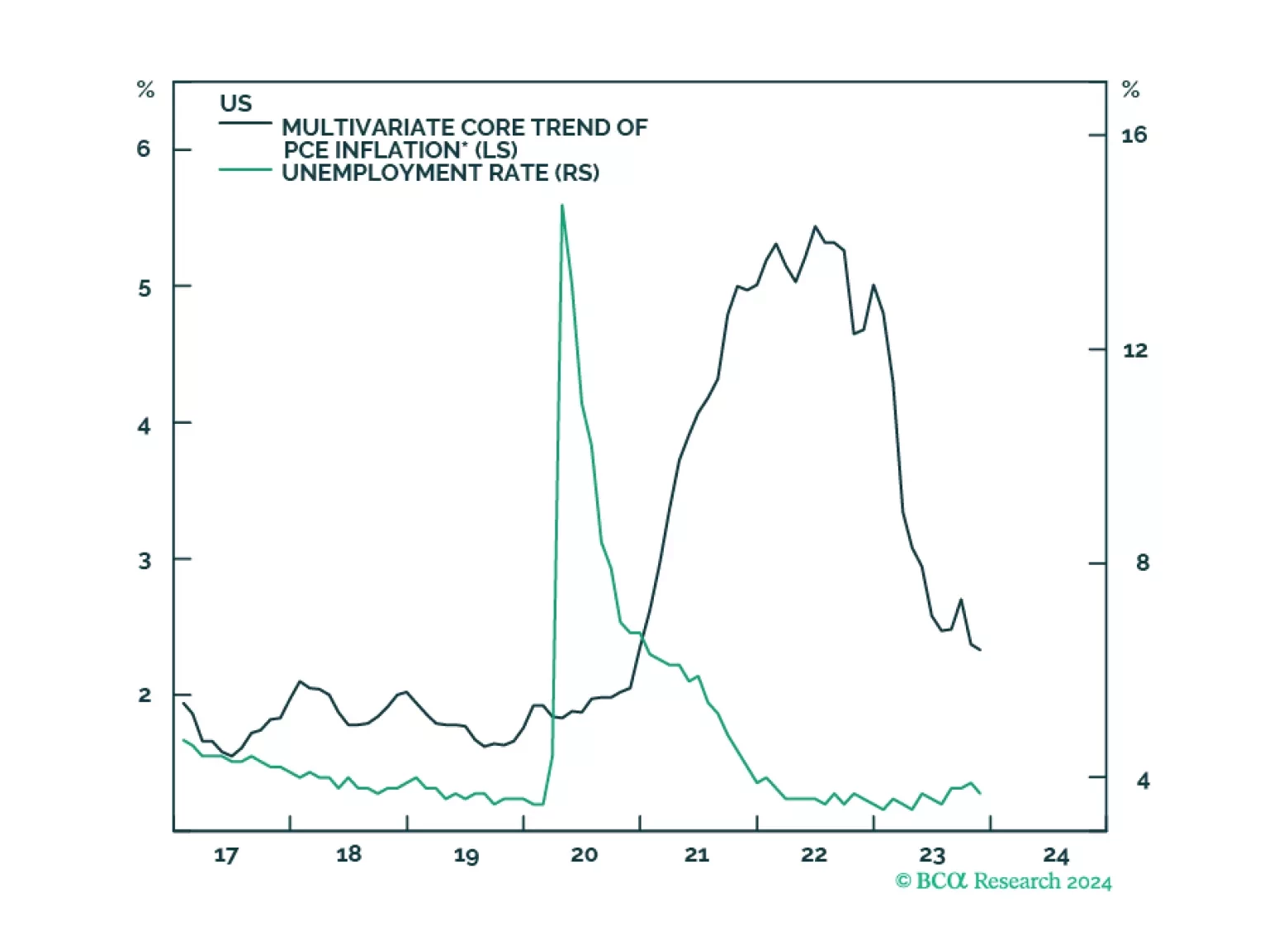

Global Investment Strategy predicted the surge of inflation in 2021/22 and the immaculate disinflation of 2023. Now their unique framework is predicting a recession in the second half of 2024.

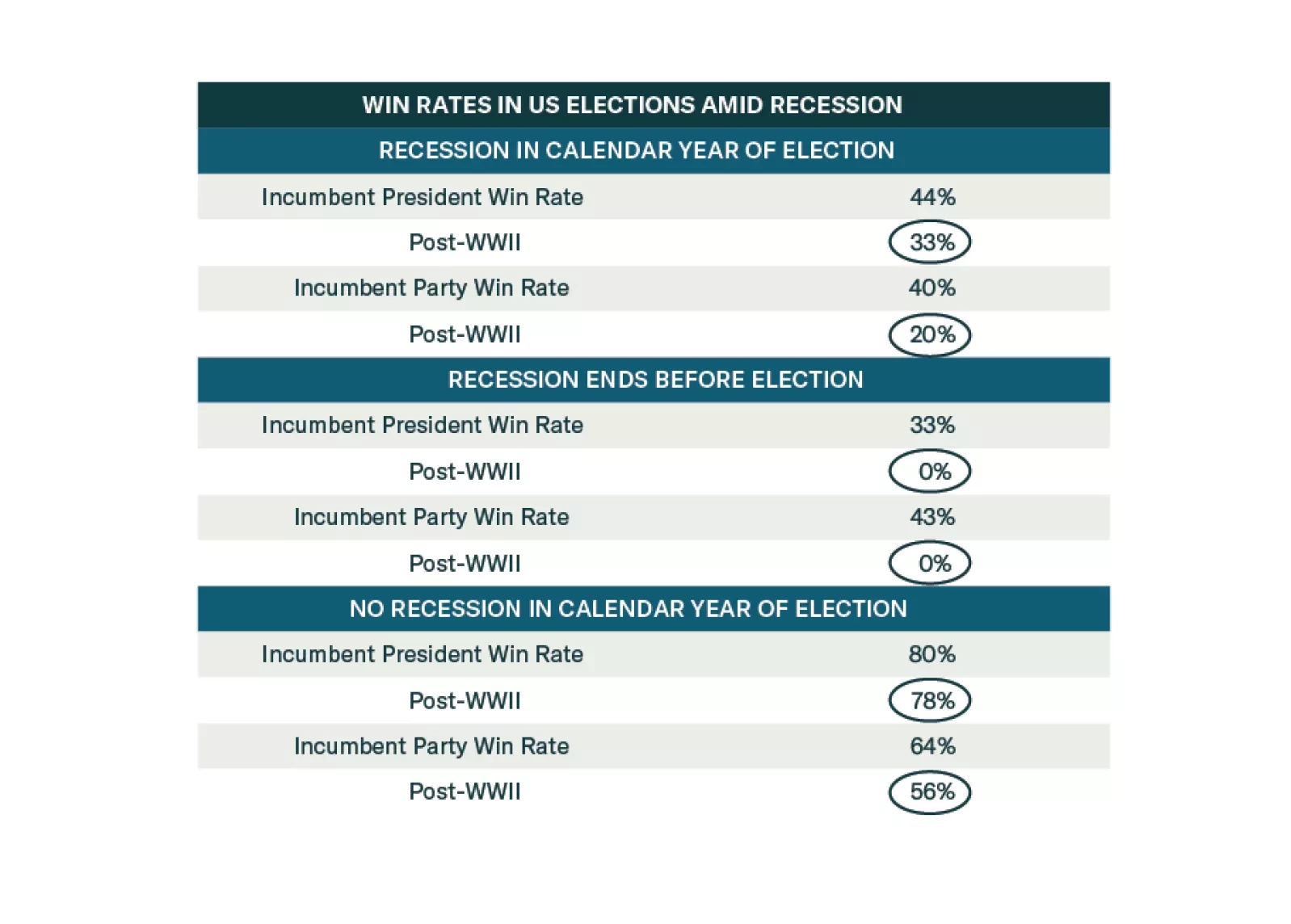

Democrats are favored to win the election until recession materializes. But recession risks are high. Investors should adopt a defensive and conservative strategy in 2024 amid extreme US policy uncertainty.

Copper benefited from the recent improvement in global risk sentiment, participating in the broad-based rally in November. To the extent that the red metal has vast applications across many economic sectors, it is…

Our political forecasting scored wins in 2023 but we failed to capitalize on it adequately in our trade recommendations.

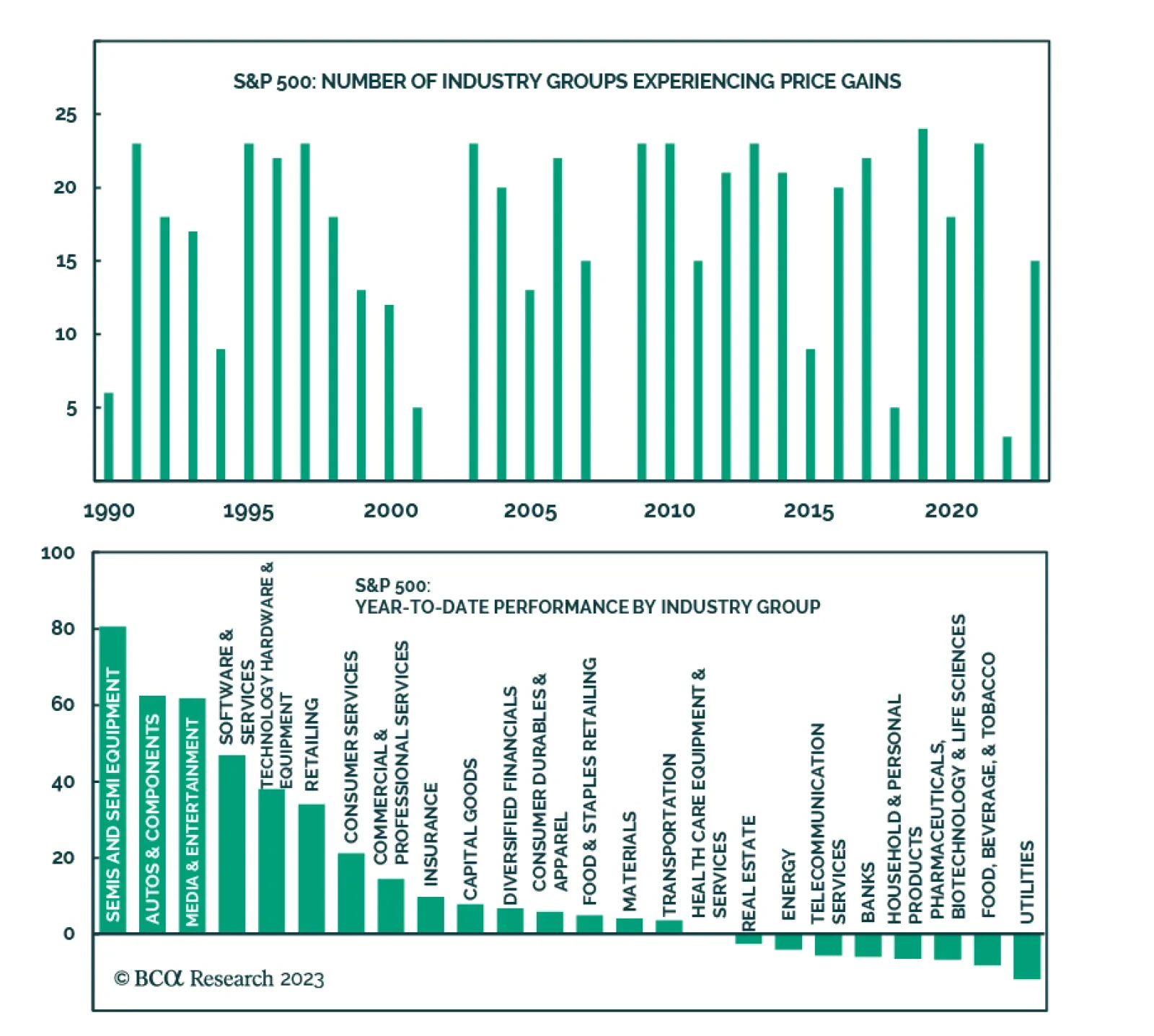

While the S&P 500 has rallied by 18.8% so far this year, not all sectors and industries have gained on a year-to-date basis. Nearly half of the 11 sectors are in the red. This list, which is made up of Utilities (-11.7%),…