We are pushing back the anticipated start date for a Eurozone recession and assessing how it affects our equity stance.

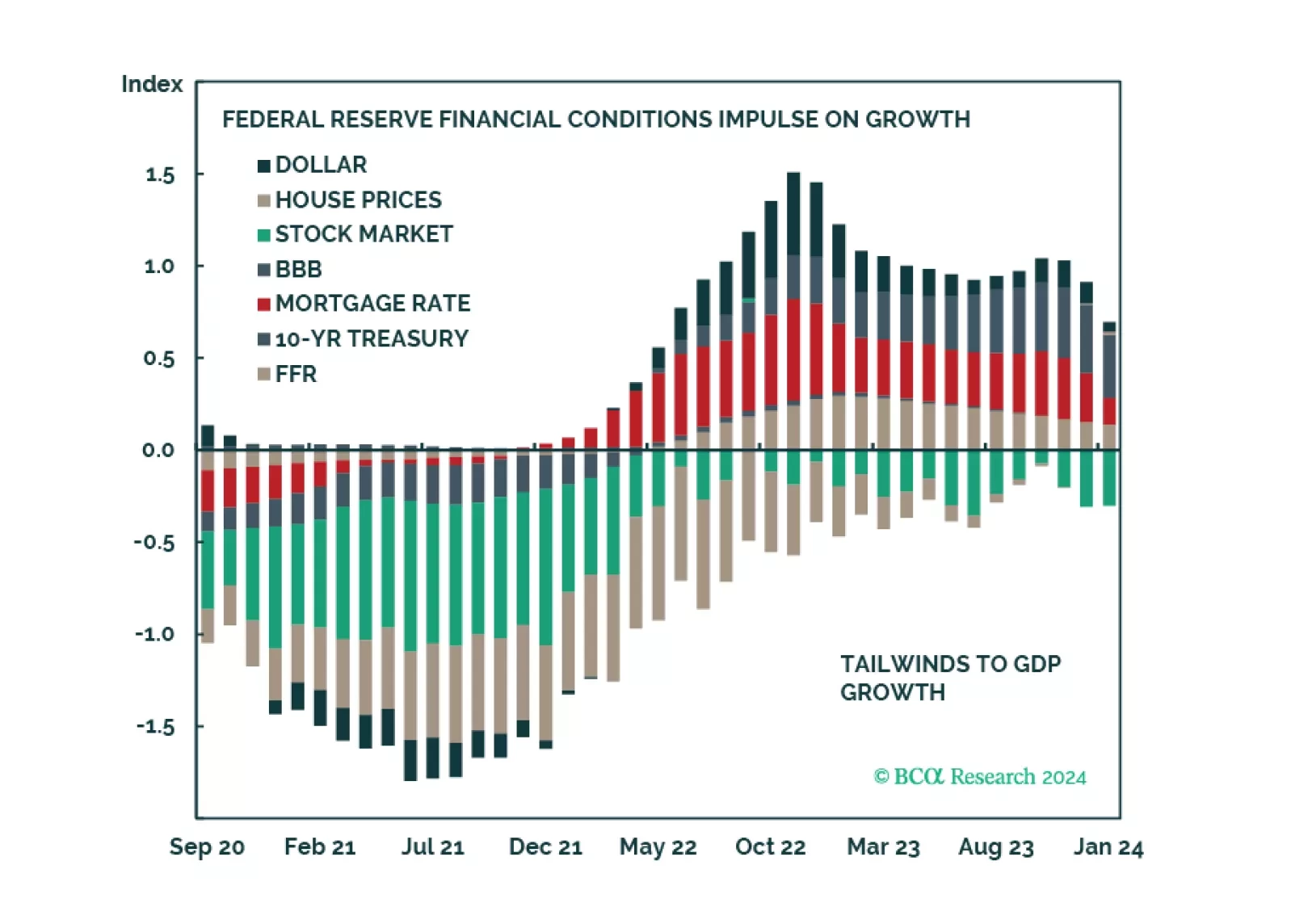

Clients are increasingly more positive about the US economy, but there are no signs of exuberance. The rally could continue as the majority is not fully invested. Financial conditions have already eased, and the Fed is unlikely to…

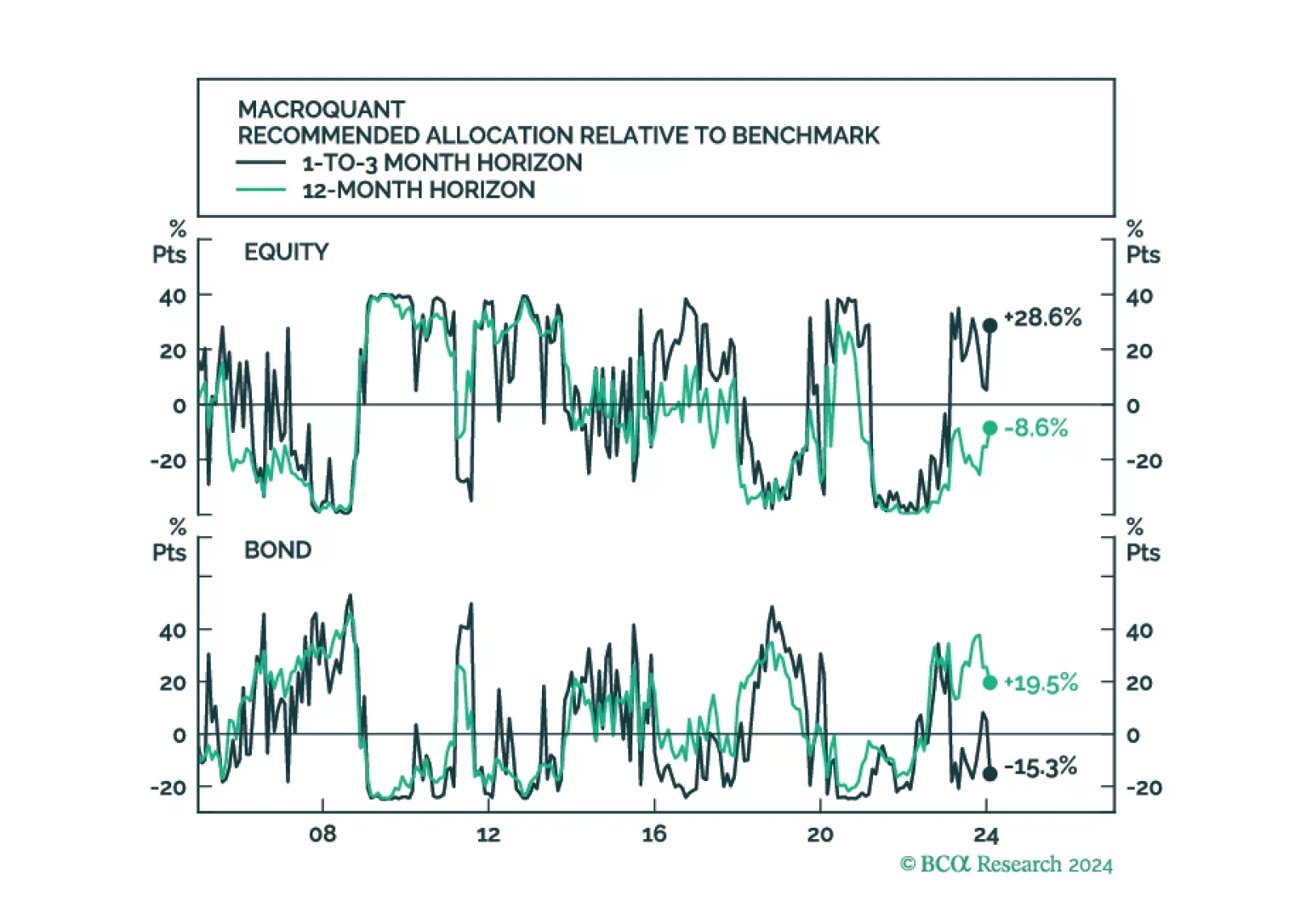

MacroQuant upgraded equities to overweight in February on a tactical short-term (1-to-3 month) horizon, but it continues to see downside risks to stocks on a medium-term (12-month) horizon. Consistent with the model’s relatively…

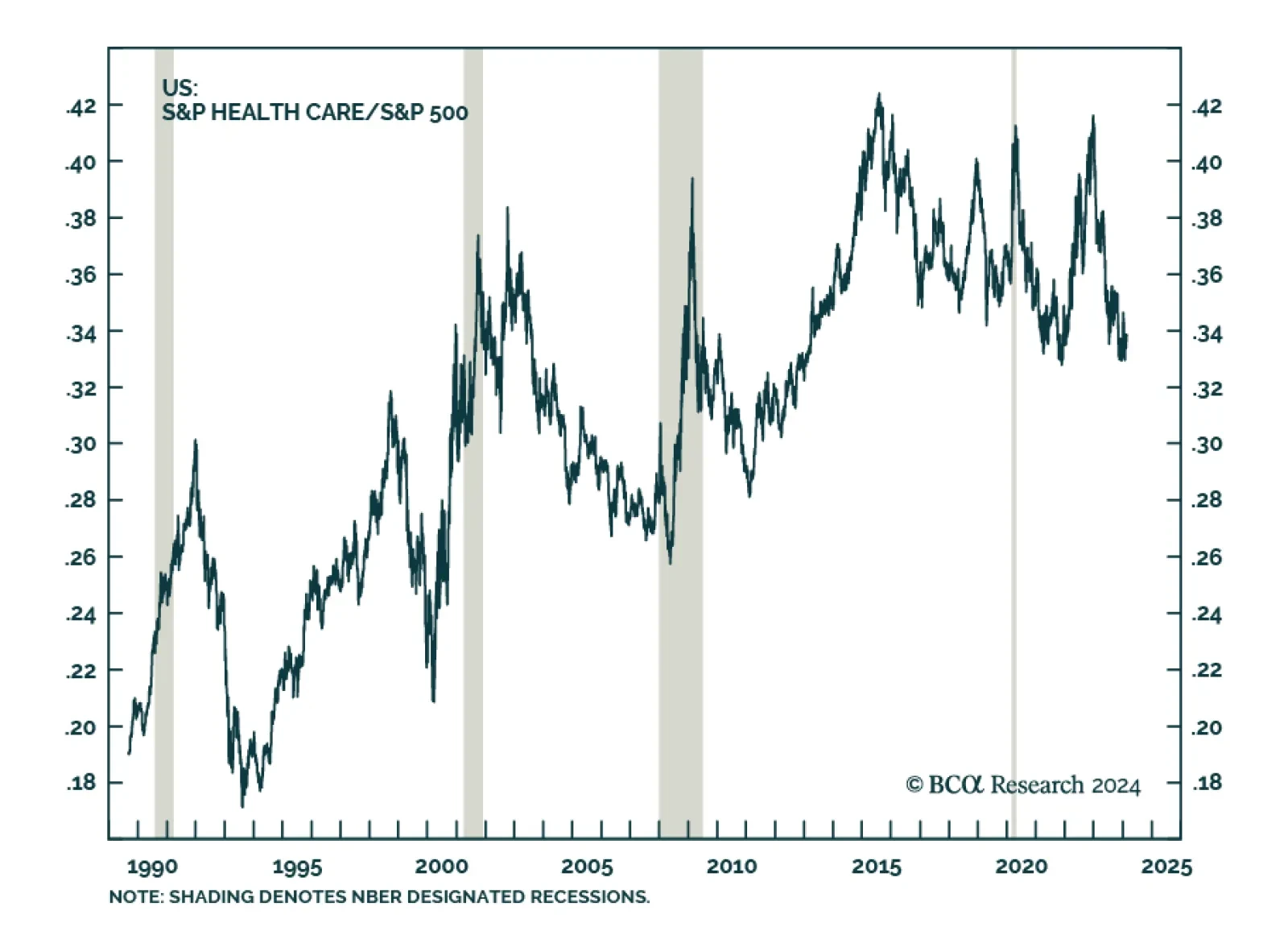

The Health Care sector is among the best performing US equity sectors so far this year. Its 6.2% year-to-date price gain exceeds the S&P 500’s 4.3% increase and is second only to Communication Services. This marks a…

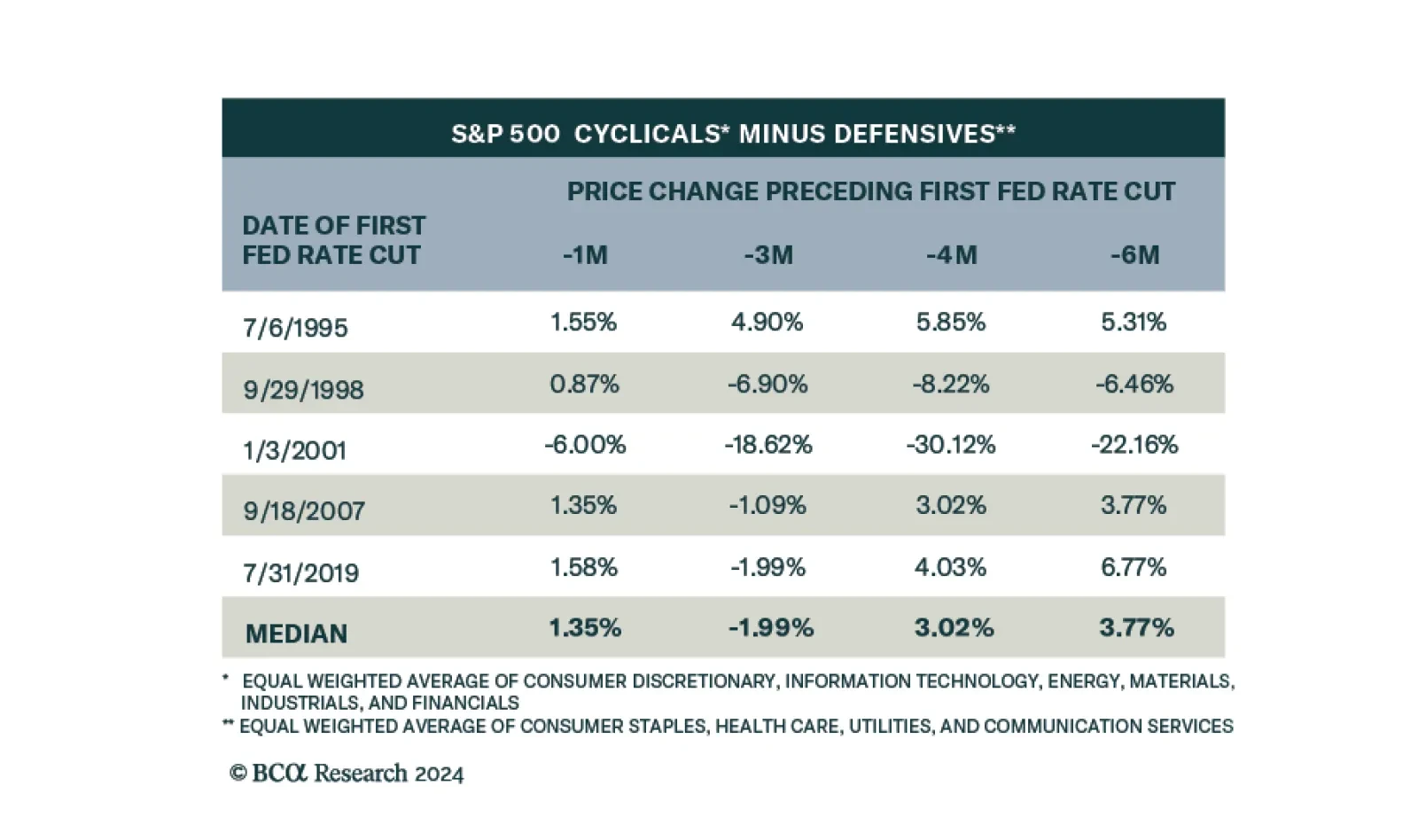

In a recent Insight we looked at the performance of equities following the start of monetary easing cycles. Specifically, we looked at the historical performance of US cyclical sectors versus defensive sectors at various points…

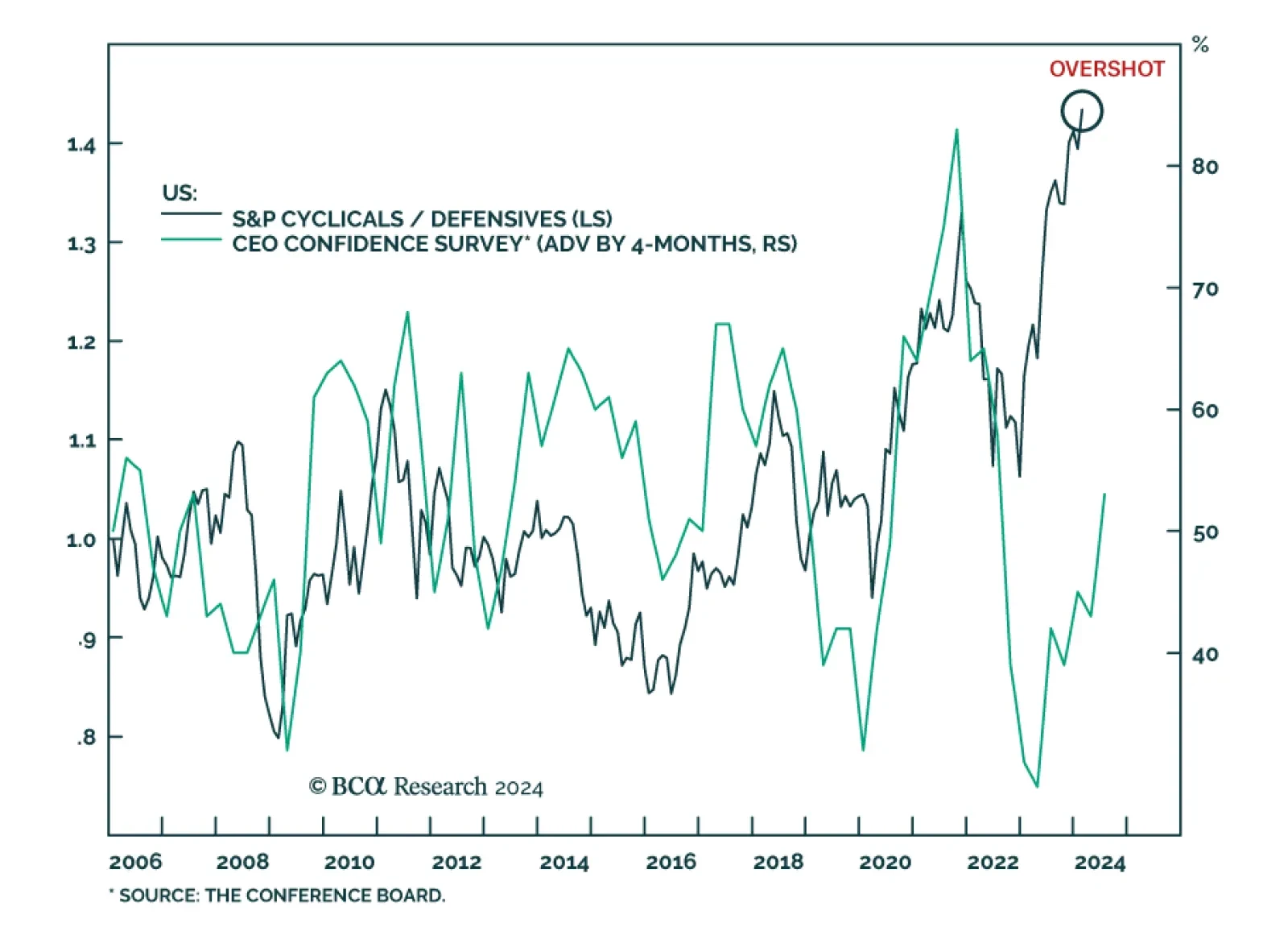

Results of the US Conference Board’s latest quarterly survey show an improvement in sentiment among business leaders. The CEO Confidence measure rose above 50 for the first time in two years – indicating that…

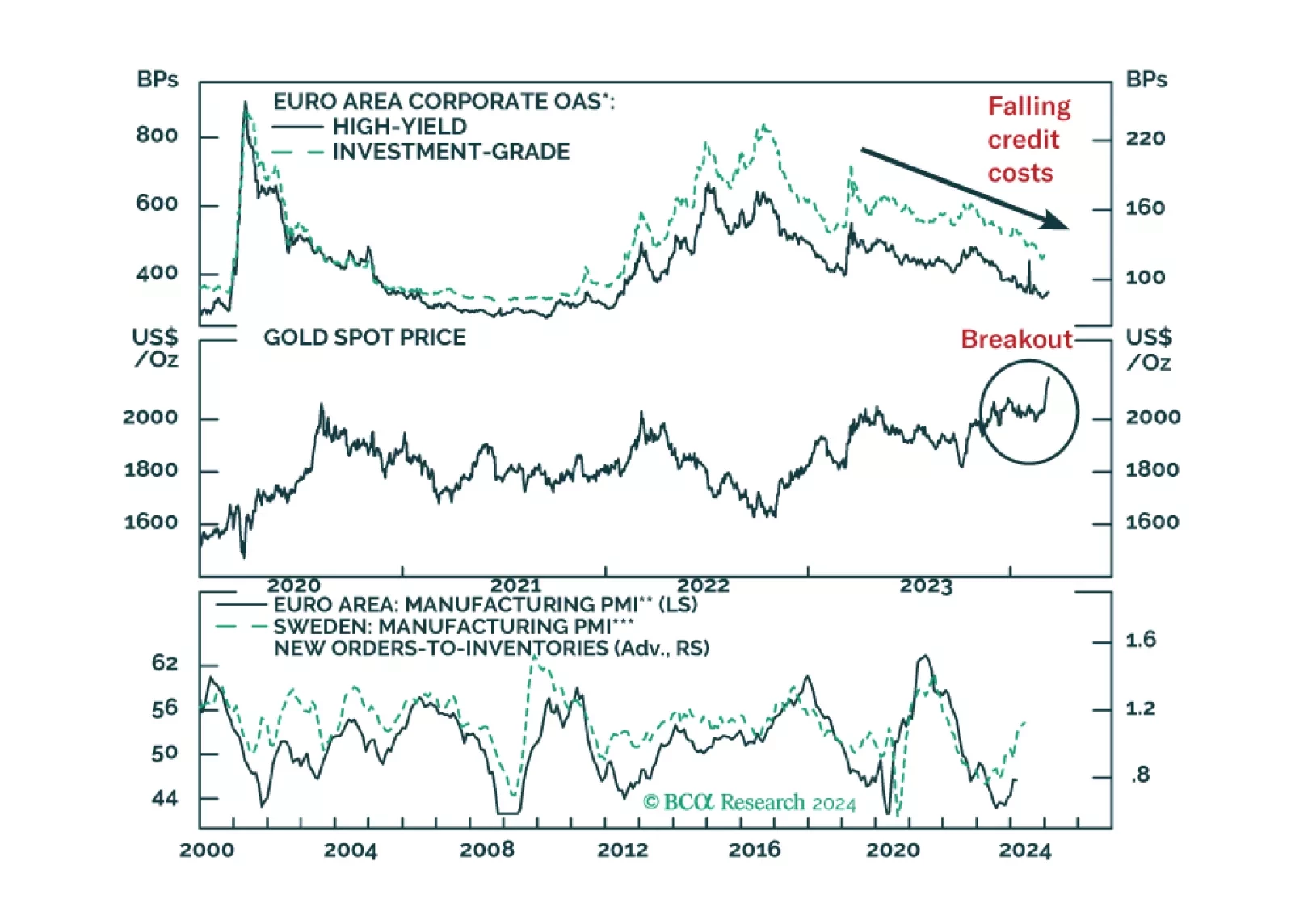

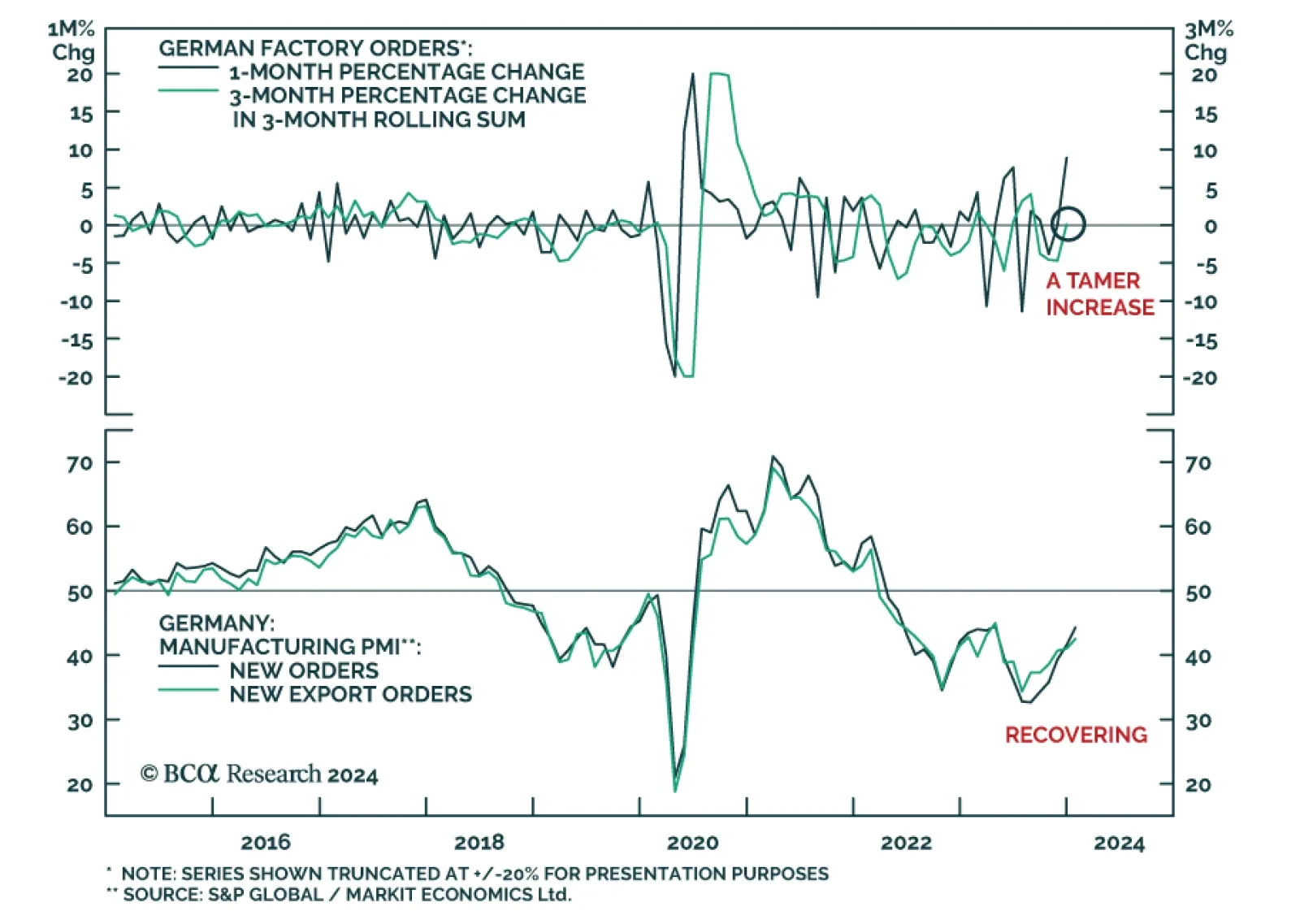

German factory orders delivered a positive surprise on Tuesday, unexpectedly increasing on both a monthly and annual basis. The 8.9% m/m increase in December came in well above consensus estimates of a 0.2% m/m decline. This…

Since the low of 27 October last year, MSCI US has rallied by 19.1% and this rally has been firmly driven by cyclical sectors. Performance-wise Information Technology (IT), Communication Services and Financials and Real Estate…

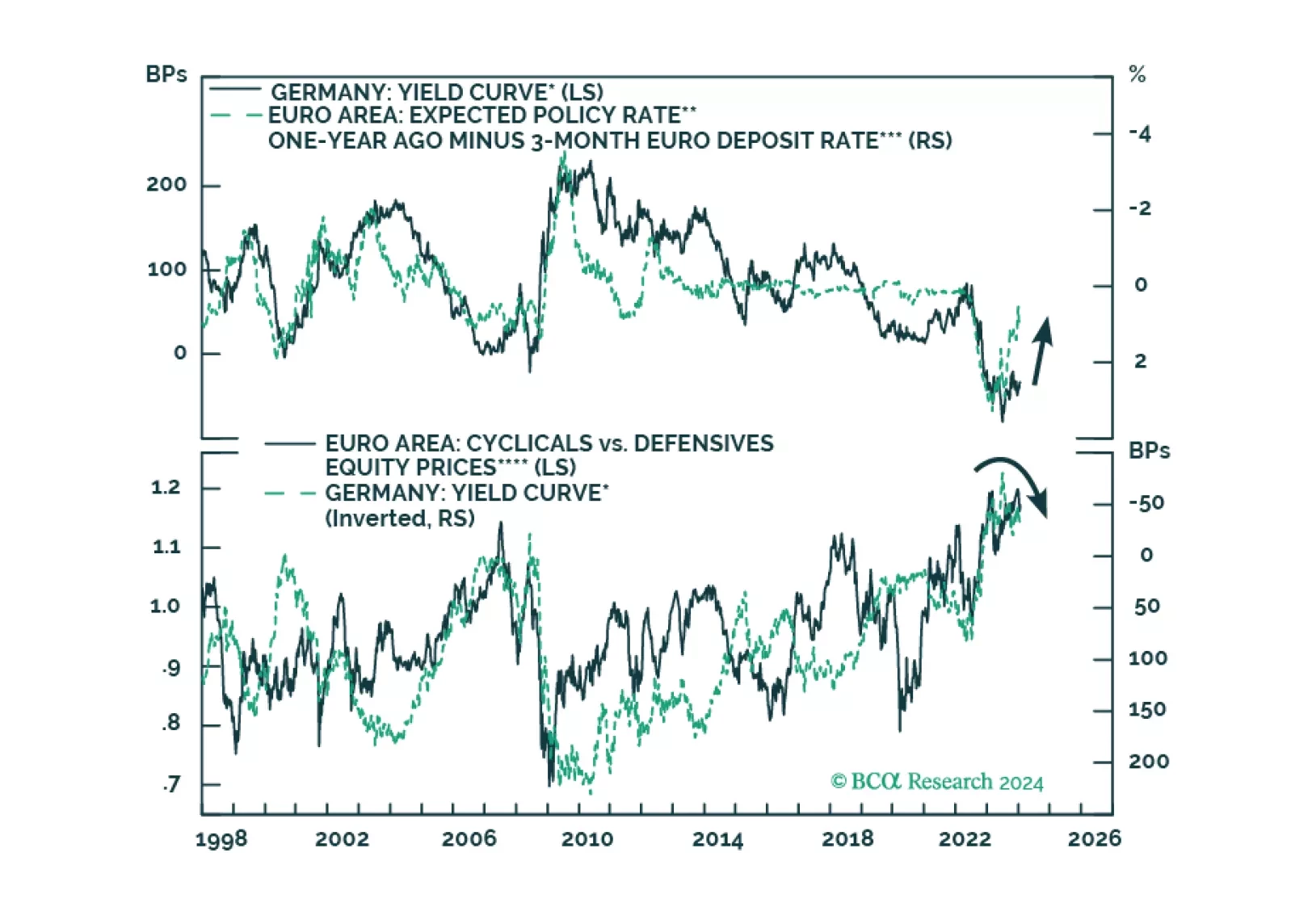

The ECB will begin cutting rates in June, what does this start date imply for the yield curve and European cyclicals?

The market will eventually be forced to react to rising odds of a sharp US national policy reversal. Investors should overweight government bonds and defensive equity sectors.