The cyclical vs. defensive share price ratio has come full circle since our early-October 2017 initiation of the preference, having jumped initially and subsequently given up all those gains and more, before recovering to the original…

Highlights Portfolio Strategy Chinese reflation, the ongoing global capex upcycle, and the Fed induced cap on the greenback with the knock-on effect of higher commodity prices, all signal that it still pays to overweight S&P…

On the earnings front, while most GICS1 sectors are projected to decelerate following the 2018 tax-induced boost to profits, the energy sector is the clear outlier. We expect upward surprises in this deep cyclical sector given…

Dear Client, This will be the last Global Investment Strategy report of 2018. Publication will resume on January 4th. On behalf of the entire Global Investment Strategy team, I would like to wish you a Merry Christmas, Happy Holidays,…

Highlights Macro Outlook: Global growth is decelerating and the composition of that growth is shifting back towards the United States. Policy backdrop: The specter of trade wars represents a real and immediate threat to risk assets.…

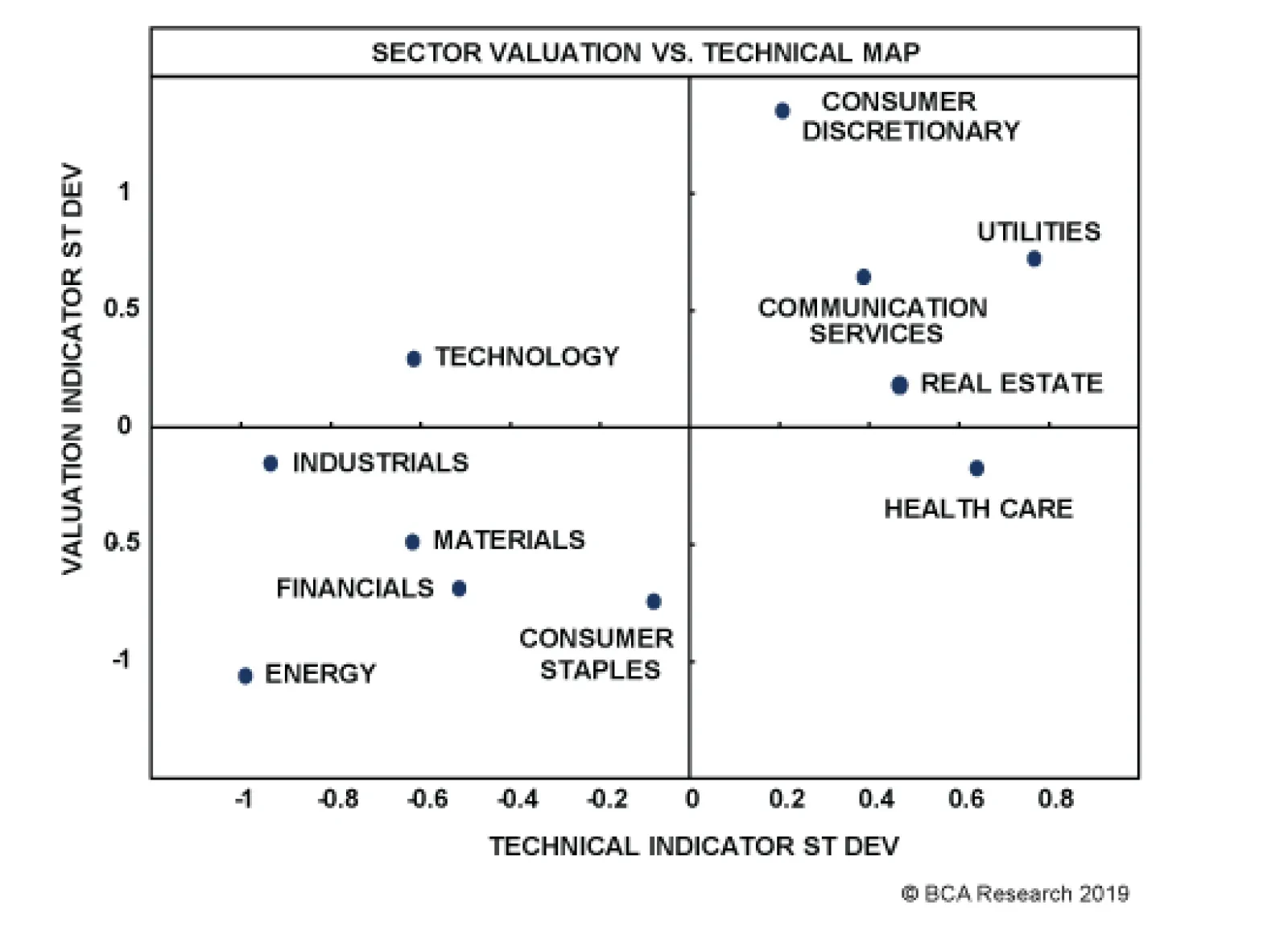

Highlights Short oil and gas versus financials. Stick with underweights in the classically cyclical sectors. Downgrade the FTSE100 to neutral. Overweight France, Ireland, Switzerland and Denmark. Underweight Italy, Spain, Sweden…

Highlights Portfolio Strategy A rare buying opportunity has emerged in the S&P consumer staples index, especially for long-term oriented capital. The bearish story is already baked into current valuations, and industry green-…

As stocks have been stuck in a mini 'risk-off' phase, investors have begun to question whether the current global growth soft patch will prove transitory or morph into a severe global growth deceleration. We side with the…

Highlights The 10-year Italian BTP yield at 4% yield marks a 'line in the sand' at which the current drama could escalate into something considerably worse. The global 6-month credit impulse is now indisputably in a mini-…