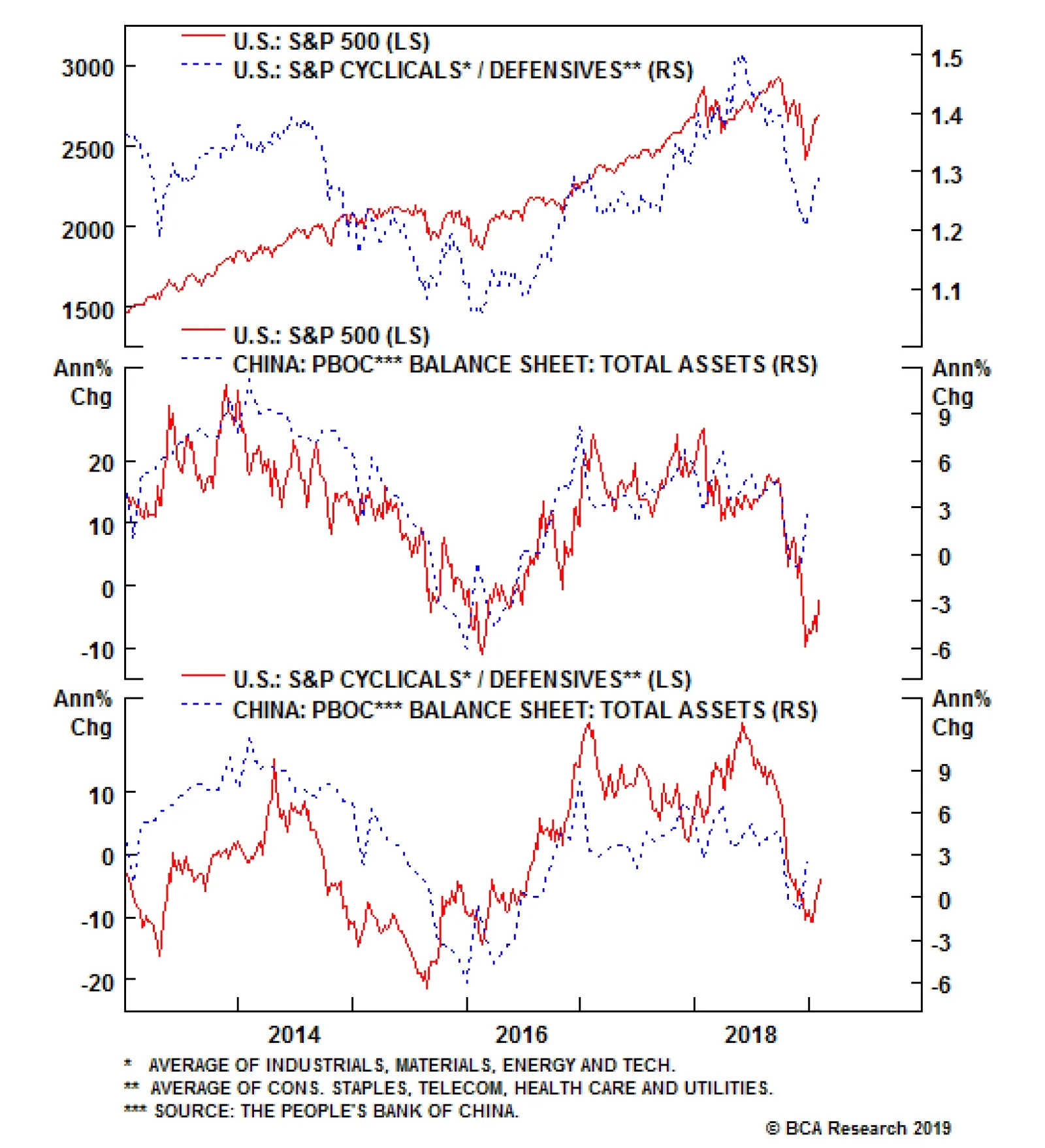

How much of the looming Chinese recovery is currently priced in the V-shaped cyclical/defensives rebound? Our U.S. Equity Strategy team’s understanding is that while most of the good news is largely reflected in the…

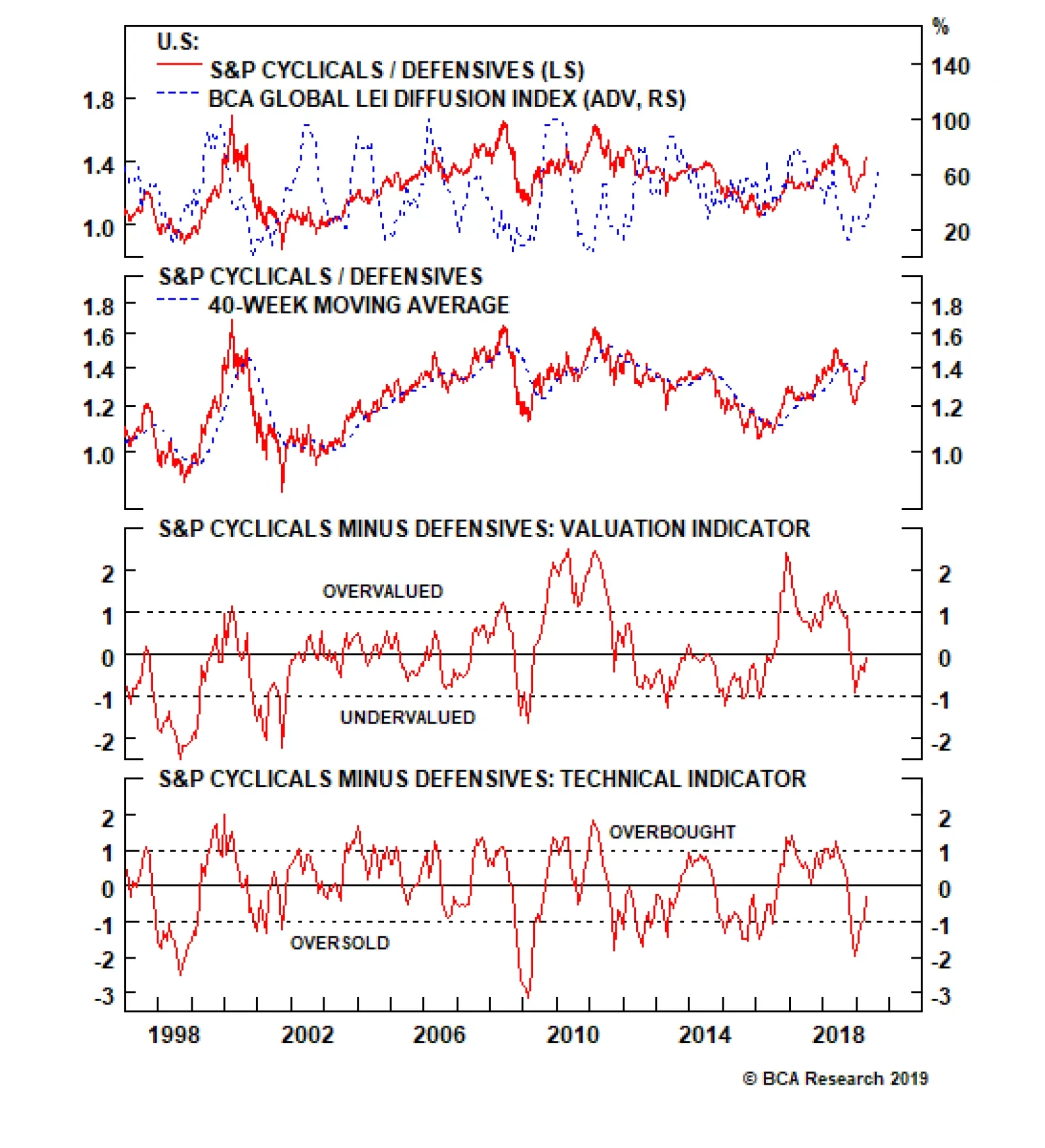

China is not the only factor flashing an unambiguously positive signal for the U.S. cyclicals/defensive ratio. BCA’s global leading economic indicator diffusion index is pushing 65%, underscoring that the majority of the…

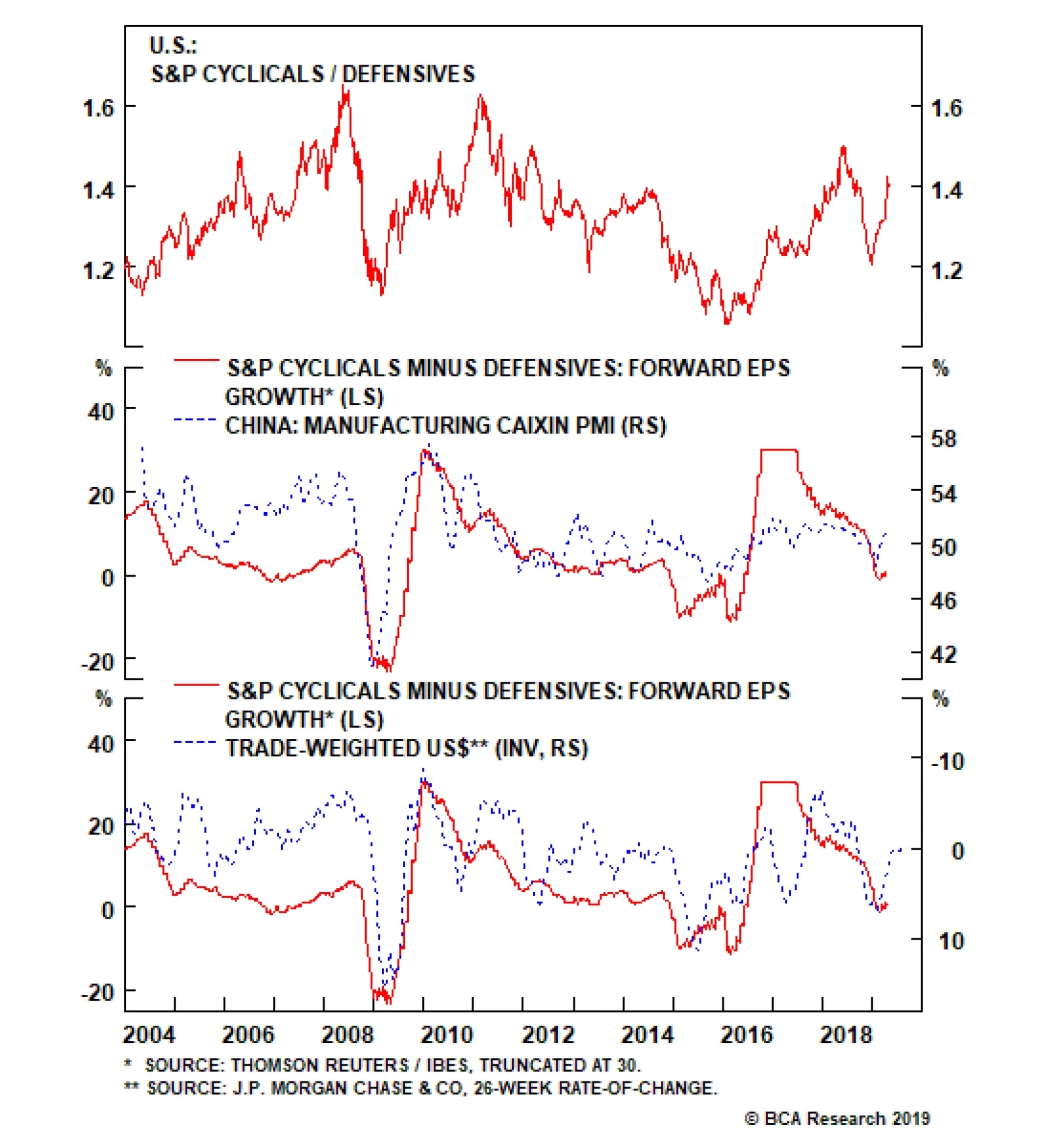

Overweight Cyclicals Over Defensives We were early and right in January when we posited that China’s slowdown was yesteryear’s story and more than discounted in the collapse of the U.S. cyclicals vs. defensives…

Highlights Portfolio Strategy China’s ongoing reflation trifecta, rising commodity prices, a back-half of the year global growth recovery, favorable balance sheet metrics and neutral valuations and technicals all signal that the…

Highlights Maintain a pro-cyclical stance for the time being – overweight equities versus bonds, long commodities, overweight industrial equities, and underweight healthcare equities. But be warned, absent a continued decline in…

Highlights U.S. growth remains robust, despite some temporary softness in recent months. Ex U.S., growth continues to fall but, with China probably now ramping up monetary stimulus, should bottom in the second half. Central banks…

Highlights Stay tactically overweight to equities for the time being. Close the overweight to industrial commodities versus equities. The financials, basic resources, and industrials equity sectors can continue to outperform for a…

A positive resolution to the U.S./China trade spat is one of the major catalysts needed for equities to break out to fresh all-time highs. Nonetheless, China’s reflation efforts may provide another tailwind. On that front,…