Highlights The good stock market = ‘growth defensives’ like technology that benefit from lower bond yields. The bad stock market = ‘value cyclicals’ like banks that suffer from lower bond yields. Structurally…

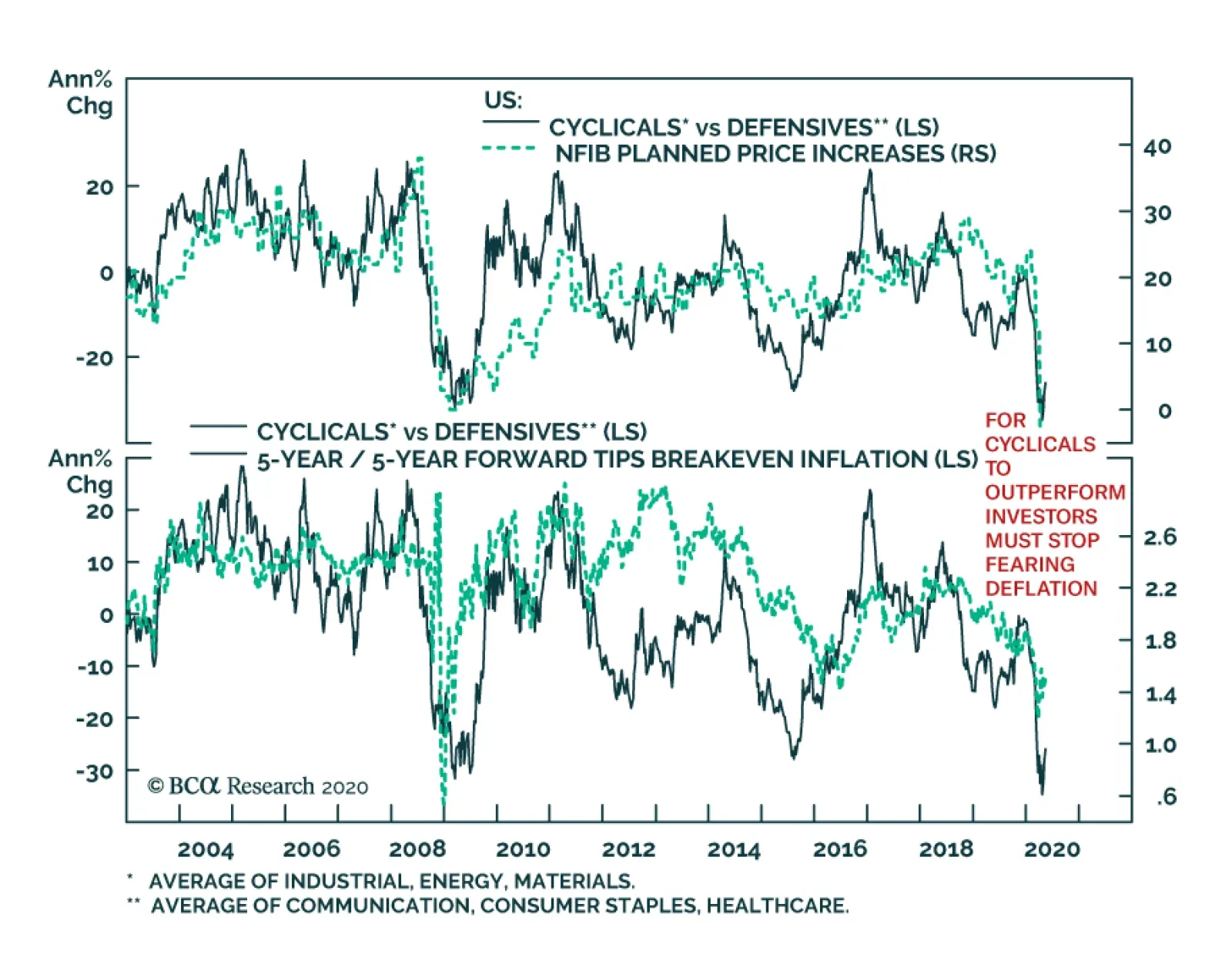

Cyclical stocks have underperformed defensive equities by their greatest extent since the great recession of 2008. A key driver of their underperformance has been the expanding deflationary fears engulfing the global economy. The…

Dear Client, I will be discussing the economic and financial implications of the pandemic with my colleague Caroline Miller this Friday, March 27 at 8:00 AM EDT (12:00 PM GMT, 1:00 PM CET, 8:00 PM HKT). I hope you will be able to join…

Highlights At the current rate of work resumption, March’s PMI should rebound to its “normal range” from February’s historic lows. If so, our simple calculation, using China’s PMI figures and GDP growth in…

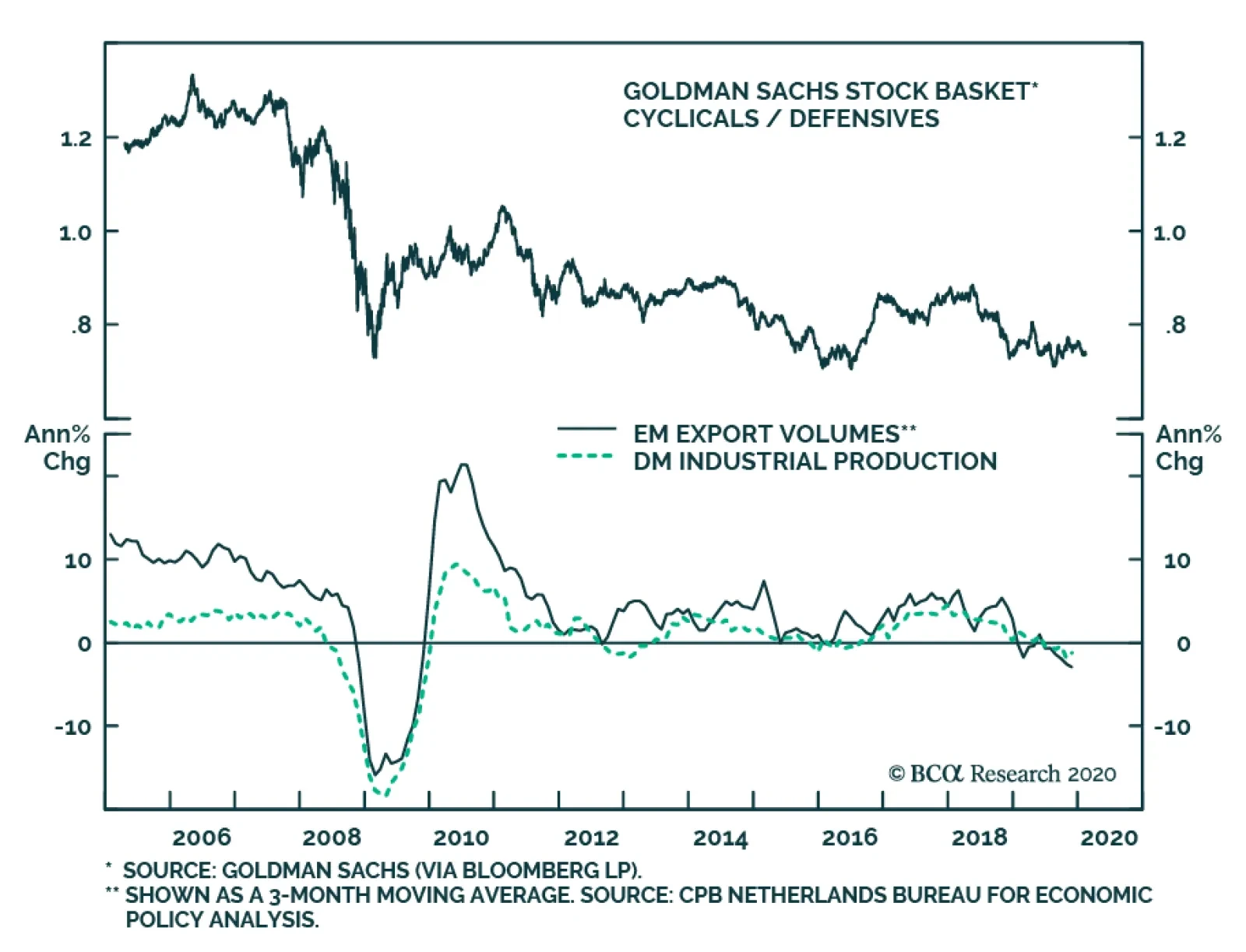

Neutral It has been particularly difficult to distinguish a clear signal from noise lately with regard to the cyclicals versus defensives ratio. Relevant macro drivers, operating metrics and profit fundamentals, valuations…

Cyclical stocks have been stuck in the doldrums versus defensives for the better part of two years. This is unsurprising, given the manufacturing downturn which arrested global trade, commodity prices, and overall business…

Highlights Portfolio Strategy Most of the macro and operating indicators we track are sending conflicting messages on the anticipated direction in the cyclical/defensive ratio. Stay on the sidelines on cyclicals versus defensives.…

GAA DM Equity Country Allocation Model Update The GAA DM Equity Country Allocation model is updated as of December 31, 2019. The model made two significant changes to its allocations this month. First, the allocation to the US is…

Dear Client, In lieu of our regular report next week, I will be hosting a webcast on Wednesday, December 18th at 10:00 AM EST, where I will discuss the major investment themes and views I see playing out for 2020. This will be…

Highlights China’s PMIs continue to flash a positive signal, but the hard data trend remains negative. There has been a notable improvement in China’s cyclical sectors (versus defensives) over the past month, but broad…