Overweight Our recent move from underweight to neutral in the S&P chemicals sub-industry pushed the entire S&P materials sector to overweight. There are also several key drivers that will serve as a basis for…

Highlights The economic performance of Sweden, which did not have a lockdown, has been almost as bad as Denmark, which did have a lockdown. This proves that the current recession is not ‘man-made’, it is ‘pandemic-…

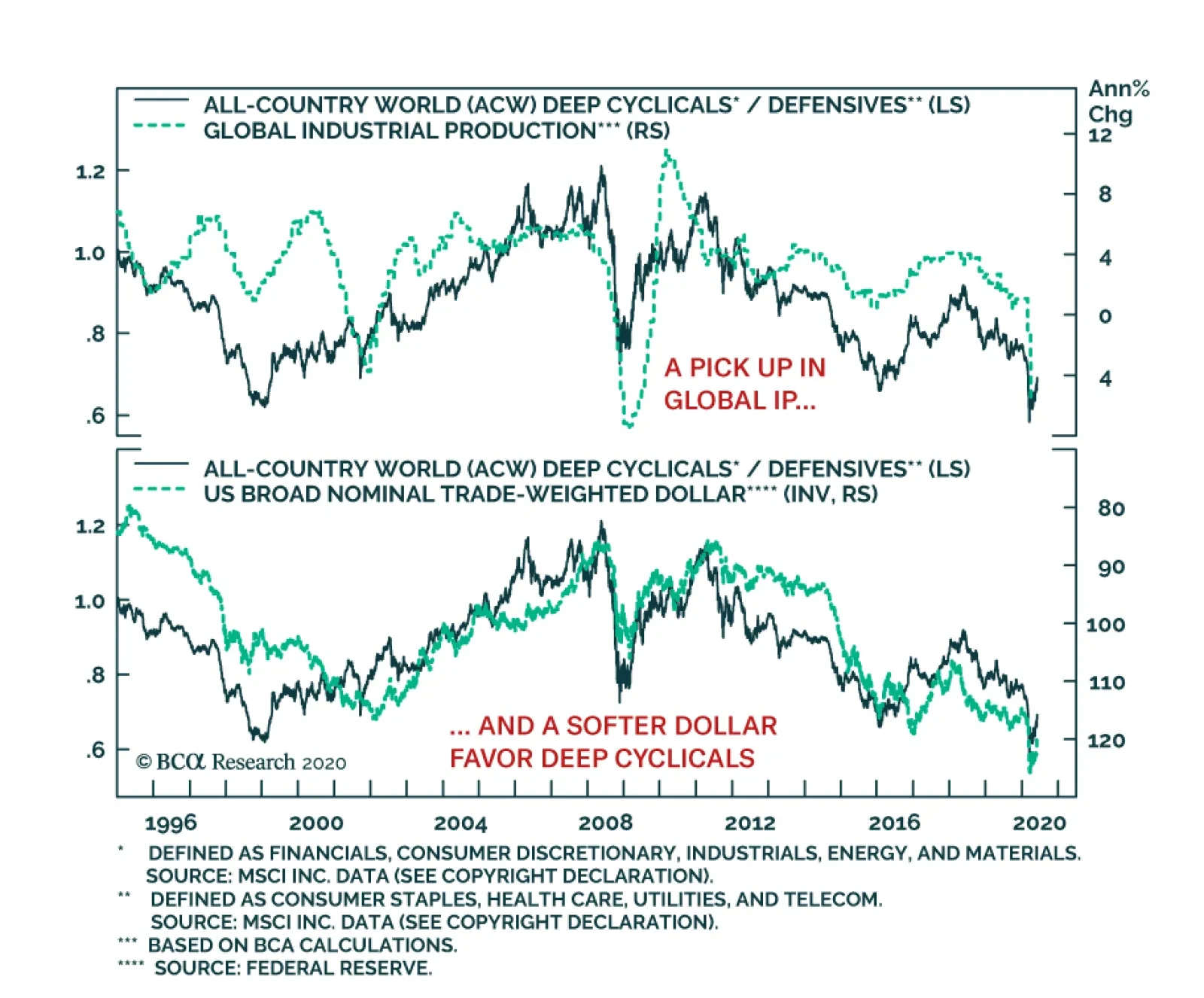

Highlights The cyclical rally in stocks is not over, but the S&P 500 will churn between 2800 and 3200 this summer. Supportive policy, robust household balance sheets and budding economic growth have put a floor under global…

Despite the strong rally in stocks since mid-March and a looming second wave of the pandemic, we continue to recommend that investors overweight equities on a 12-month horizon. Needless to say, this view has raised some eyebrows. With…

In a webcast this Friday I will be joined by our Chief US Equity Strategist, Anastasios Avgeriou to debate ‘Sectors To Own, And Sectors To Avoid In The Post-Covid World’. Today’s report preludes five of the points…

Dear client, Along with an abbreviated report this week we are sending you this Geopolitical Strategy service report written by my colleague Matt Gertken, BCA’s Geopolitical Strategist. Matt argues that US social unrest is…

The stock market offers an increasingly tenuous reward/risk proposition after its incredible run from March 23 to last Friday. The put-to-call ratio is flashing an elevated risk of an imminent correction and rising bond yields…

Highlights The Chinese economy continues to recover, albeit less quickly than the first two months following a re-opening of the economy. The demand side of the Chinese economic recovery in May marginally outpaced the supply side,…