Dear Client, Next week, in lieu of our regular weekly report, I will be hosting two webcasts where I will discuss the outlook for China’s economy and financial markets, a year into policy normalization. The webcasts will be held…

Highlights The US business cycle is shifting into a slowdown stage: US economic and earnings growth will remain robust but decelerate from their peak. Treasury rates have stabilized, and inflation fears, if not dissipated, have…

Highlights President Biden has called for the US intelligence community to investigate the origins of COVID-19 and one of Biden’s top diplomats has stated the obvious: the era of “engagement” with China is over. This…

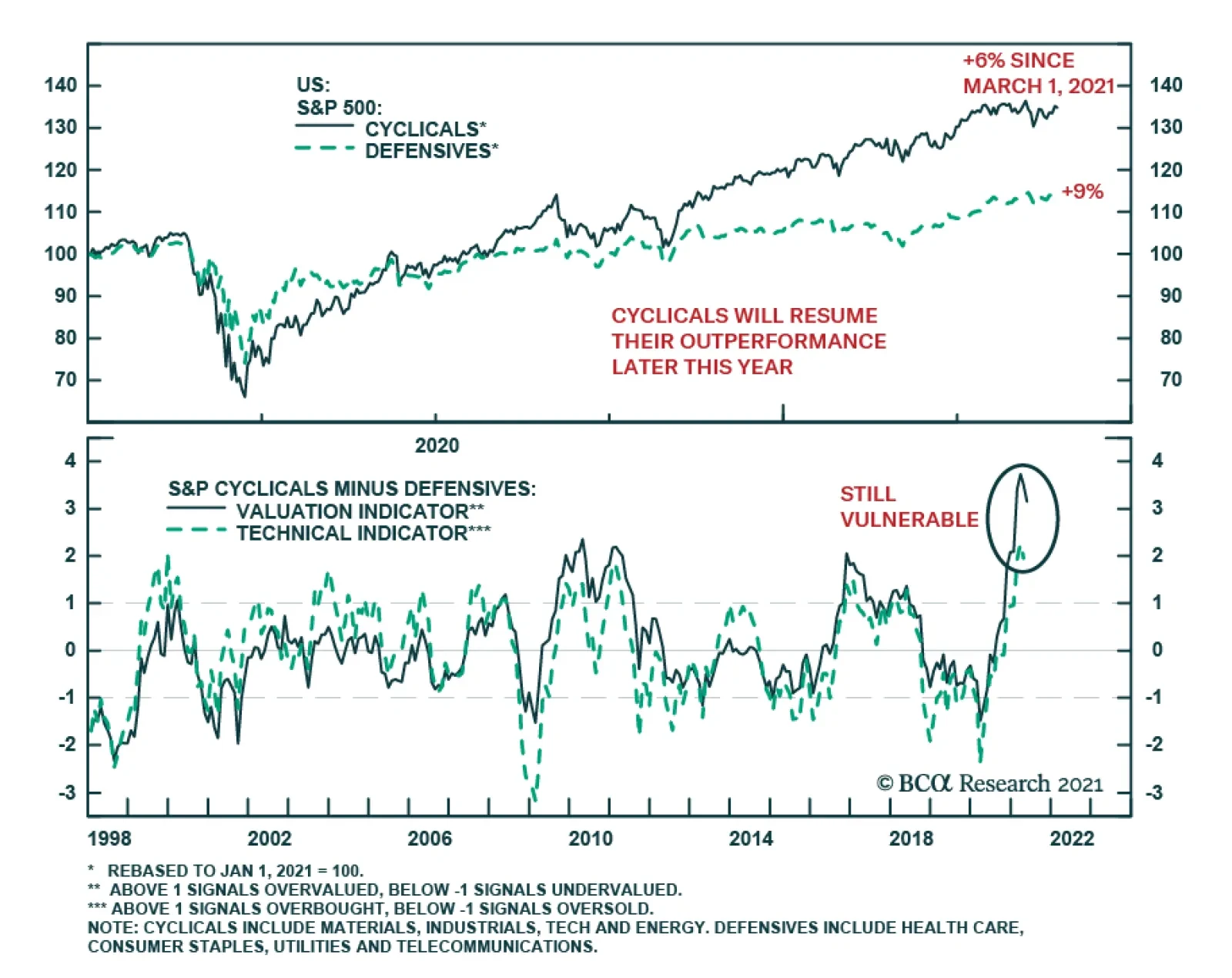

Over the past several weeks, the S&P 500 has failed to break above its May 7 all-time high. This stagnation is consistent with indications that the rally was vulnerable to some profit taking. Inflationary fears highlighted by…

Highlights Clients countered our opinion that China’s economy has reached its cyclical peak. However, we have already incorporated the supporting facts into our analysis so they will not alter our cyclical outlook for the economy…

Highlights Structural headwinds are still too strong to hold a long-term bullish view on Eurozone equities relative to the US. However, the coming two years should be kind to euro area stocks. The relative performance of European…

Feature The selloff in Chinese stocks since mid-February reflects a rollover in earnings growth and multiples. Lofty valuations in Chinese equities driven by last year’s massive stimulus means that stock prices are vulnerable to any…

Highlights Global manufacturing activity will soon peak due to growing costs and China’s policy tightening. This process will allow the dollar’s rebound to continue. EUR/USD’s correction will run further. This…

The BCA Research Global Asset Allocation (GAA) Forum will take place online on May 18th. We have put together a great lineup of speakers to discuss issues of importance to CIOs and asset allocators. These include the latest thinking…

Highlights Underweighting T-bonds, tech versus the market, growth versus value, new economy versus old economy, and US versus the euro area are all just one massive correlated trade. Get the direction of the T-bond yield right, and you…