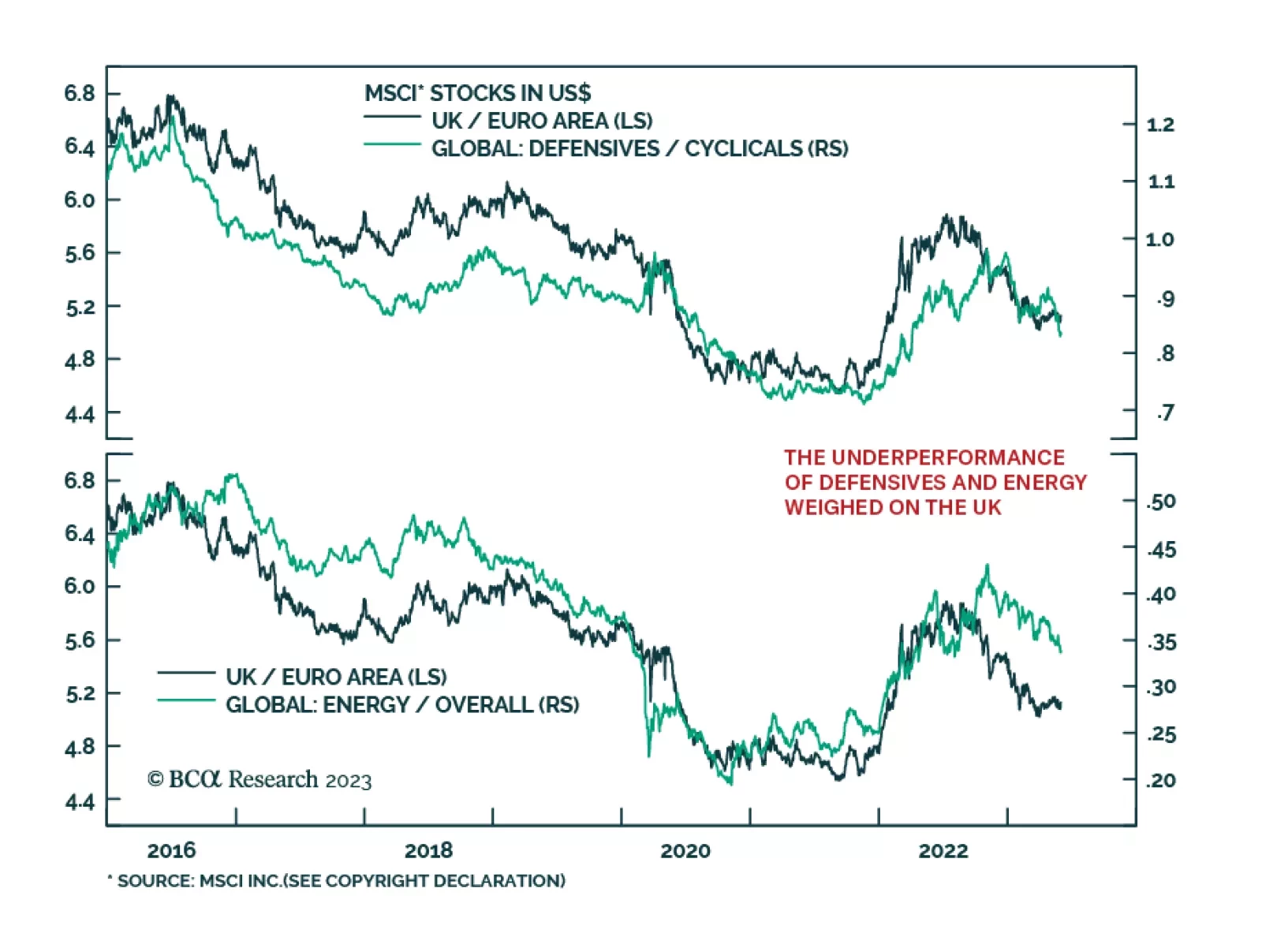

In our May In Review Insight, we showed that last month, UK stocks posted the lowest z-score among all major global equity markets, underperforming their Eurozone peers. What explains this relative weakness? The chart above…

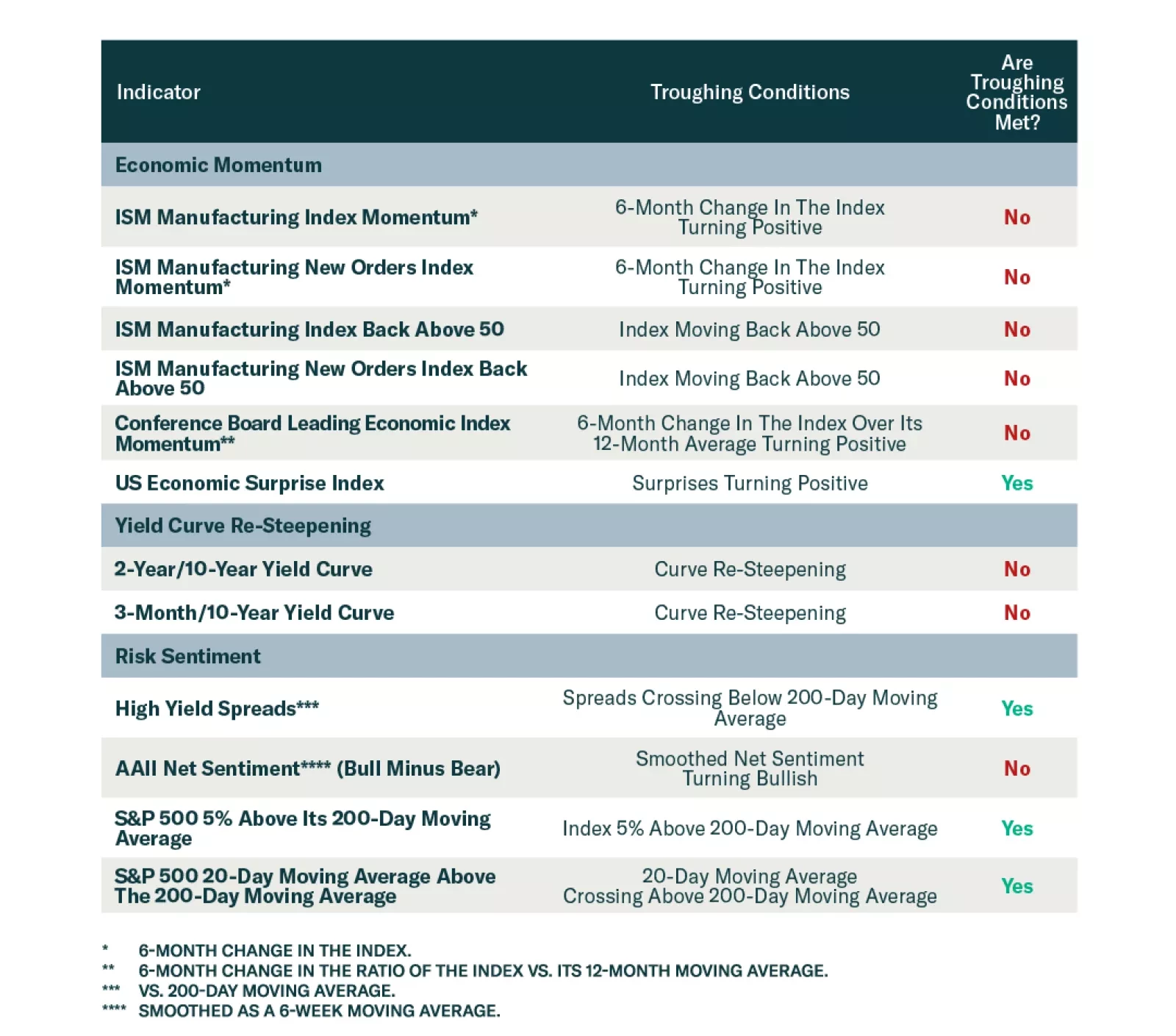

BCA Research’s Global Asset Allocation service continues to recommend an overweight on government bonds, neutral on cash, and underweight on equities and credit. Market technicals do not suggest this is a robust…

In Section I, we review the three possible economic scenarios over the coming year, and underscore that the “soft landing” scenario remains improbable. A “no landing” scenario could occur, but it would ultimately lead back to the…

A restrictive policy by the ECB and a weak manufacturing sector will create headwinds for European stocks this summer. How should investors position their portfolios in this context?

Macro and geopolitical risks may spoil the narrow window for a stock market rally before recessionary trends rise to the fore.

We Introduce our new macro models for the Eurozone’s equity earnings, which include sectoral forecasts. Find out what they predict for the next six-to-nine months.

European inflation has further downside and core CPI will soon begin to fall too. However, European growth will remain soggy in Q2. What does this environment mean for investors?

Stay defensive in the second quarter. We can see a narrow window for risky assets to outperform but we recommend investors stay wary amid high rates, supply risks, extreme uncertainty, peak polarization, and structurally rising…

In Section I, we discuss the implications of the banking crisis that emerged in March. We do not expect what happened in the US or Europe to morph into a full-blown meltdown of the financial system, but this month’s events will…