On Friday, shipping giant Maersk delivered a pessimistic outlook for global trade. Although the company raised its 2023 earnings forecast, the upgrade comes on the back of a better-than-anticipated performance in the first half…

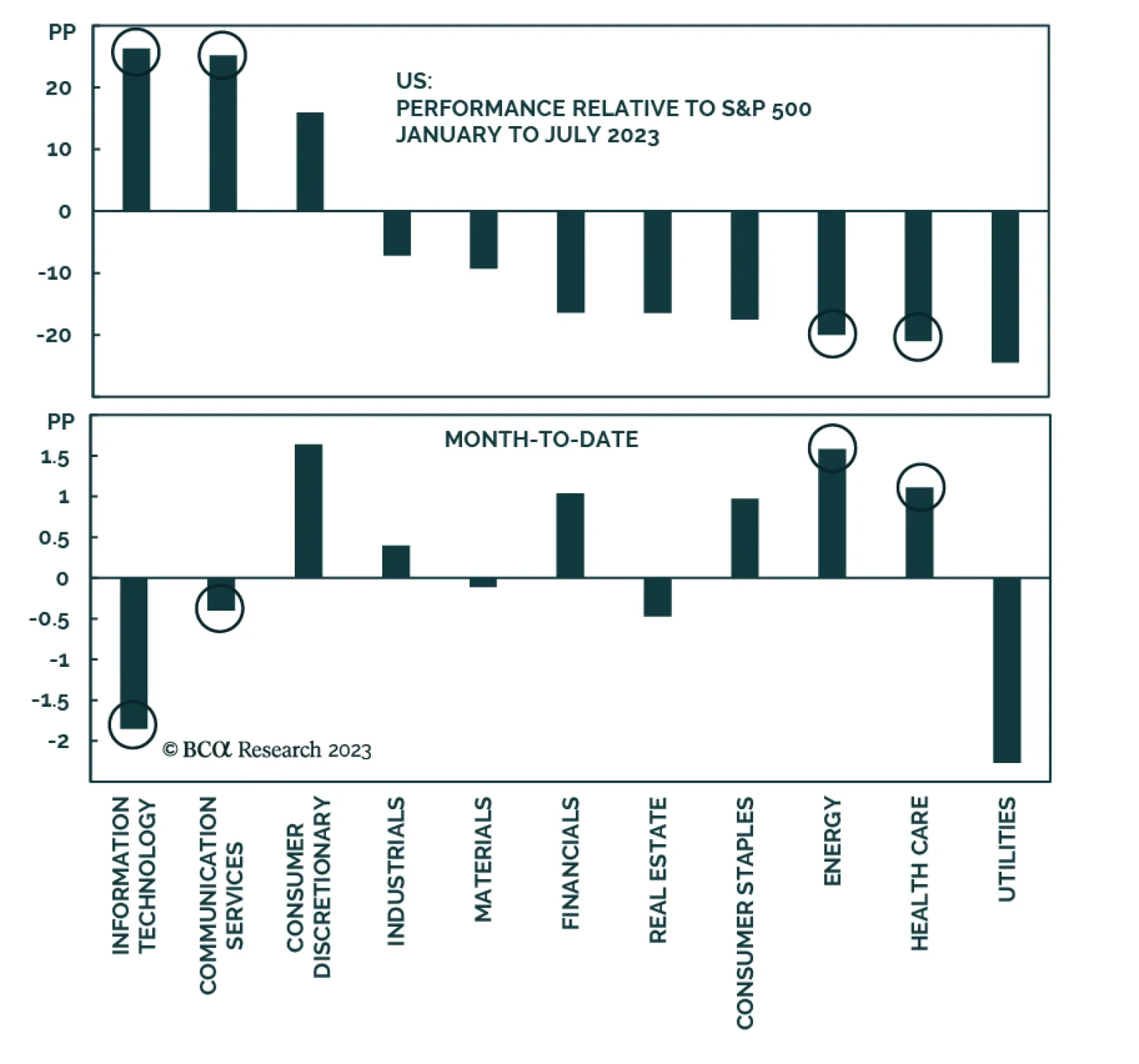

The S&P 500 has had a rough start to August. The index’s selloff since the end of July has pushed it down by 2.4%. Notably, the weakness is broad-based with all S&P 500 sectors in the red over this period. This…

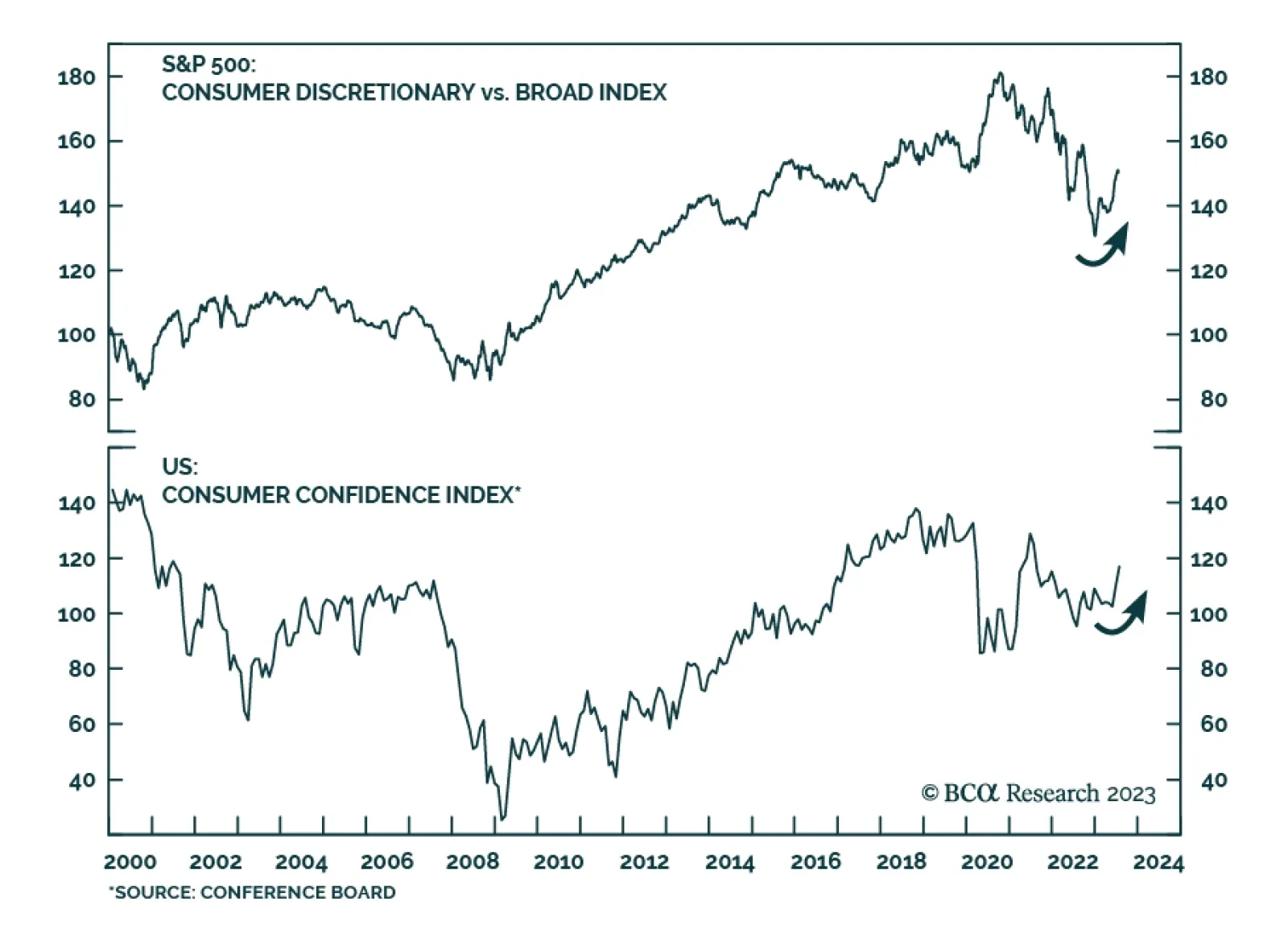

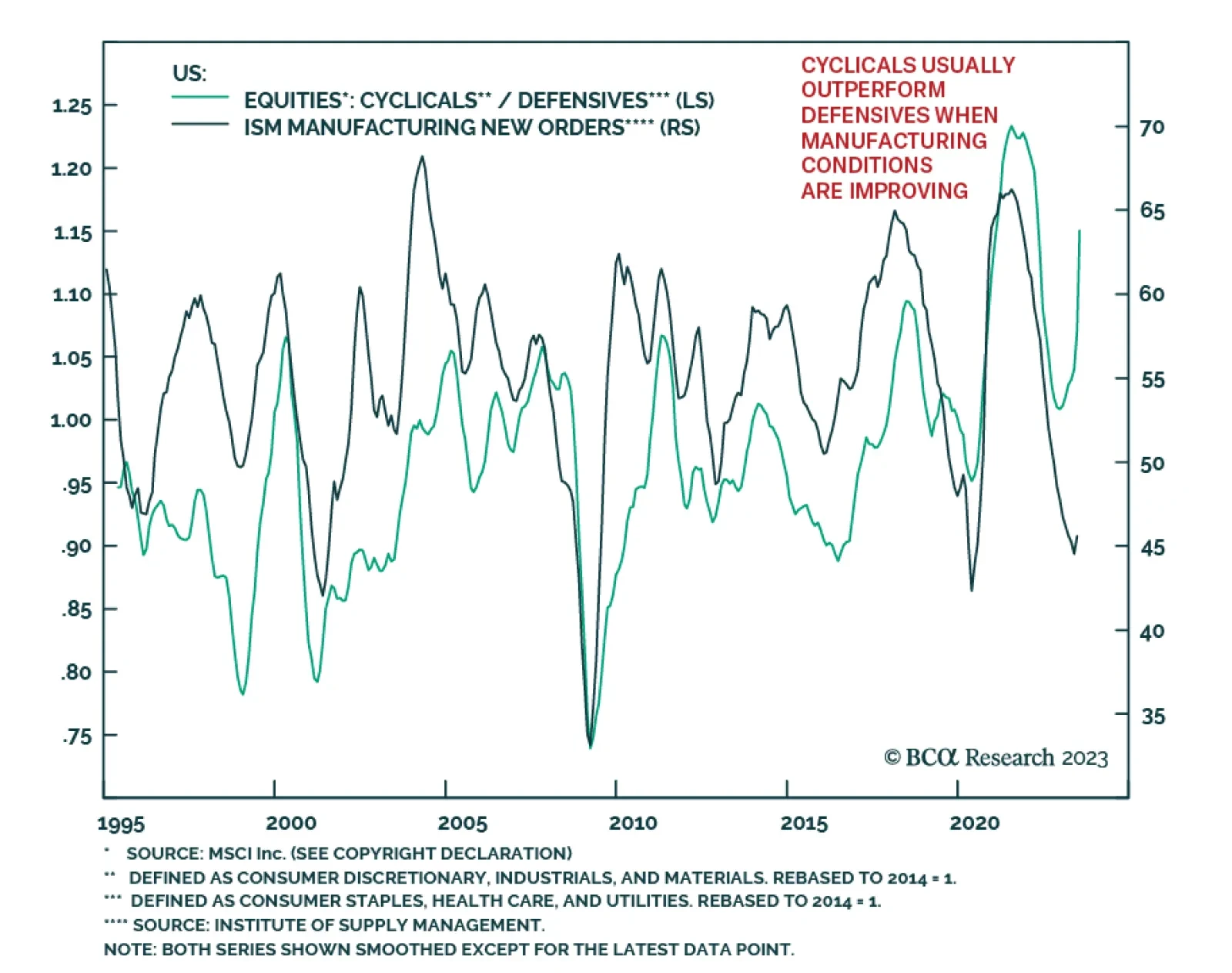

The US Consumer Discretionary sector has been one of the top winners since the equity rally broadened two months ago. Its 13% gain since the end of May outpaces the S&P 500’s rally by 3.8 percentage points This…

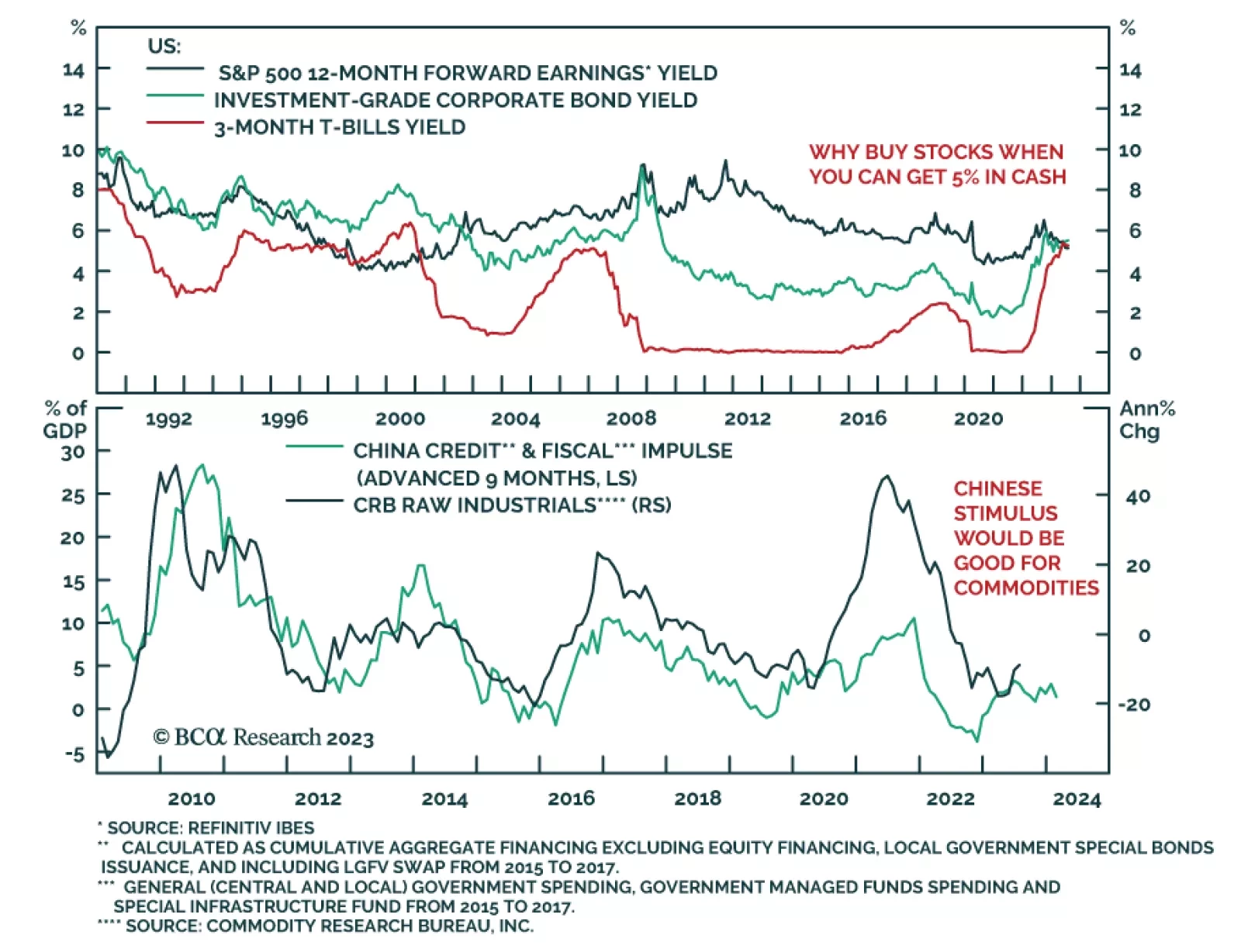

Although not our base case, there is a path for the US economy to avoid a recession over the next few years. We see the risks to stocks as tilted to the upside in the near term but to the downside over a 12-month horizon.

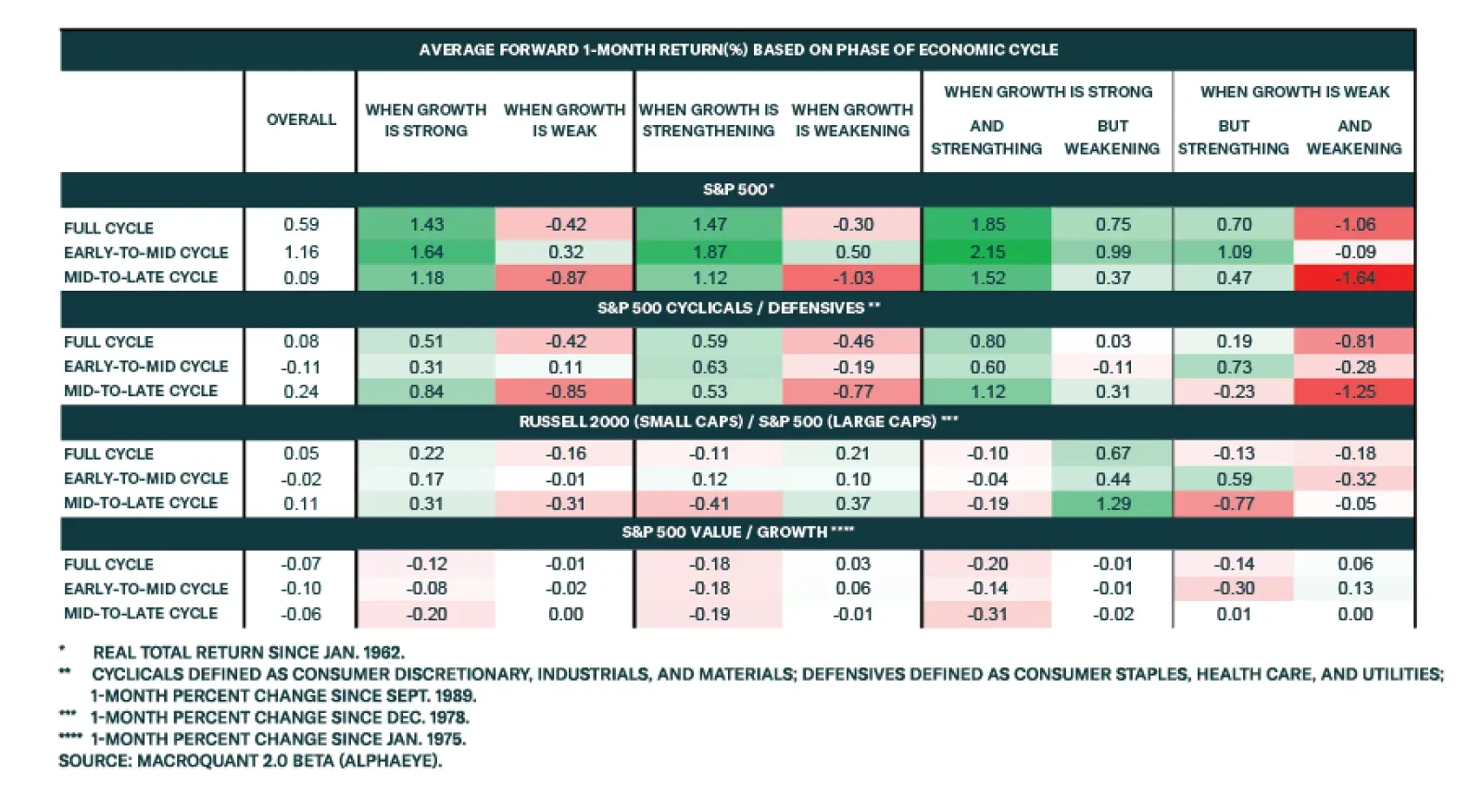

According to BCA Research’s Global Investment Strategy service, stocks fare best when there is plenty of slack in the economy and growth is strong and getting stronger. In classical physics, the trajectory of an object…

Stocks fare best when there is plenty of slack in the economy and growth is strong and getting stronger. The good news is that the economic growth score for the US in our MacroQuant model is above its historic average. The bad news…

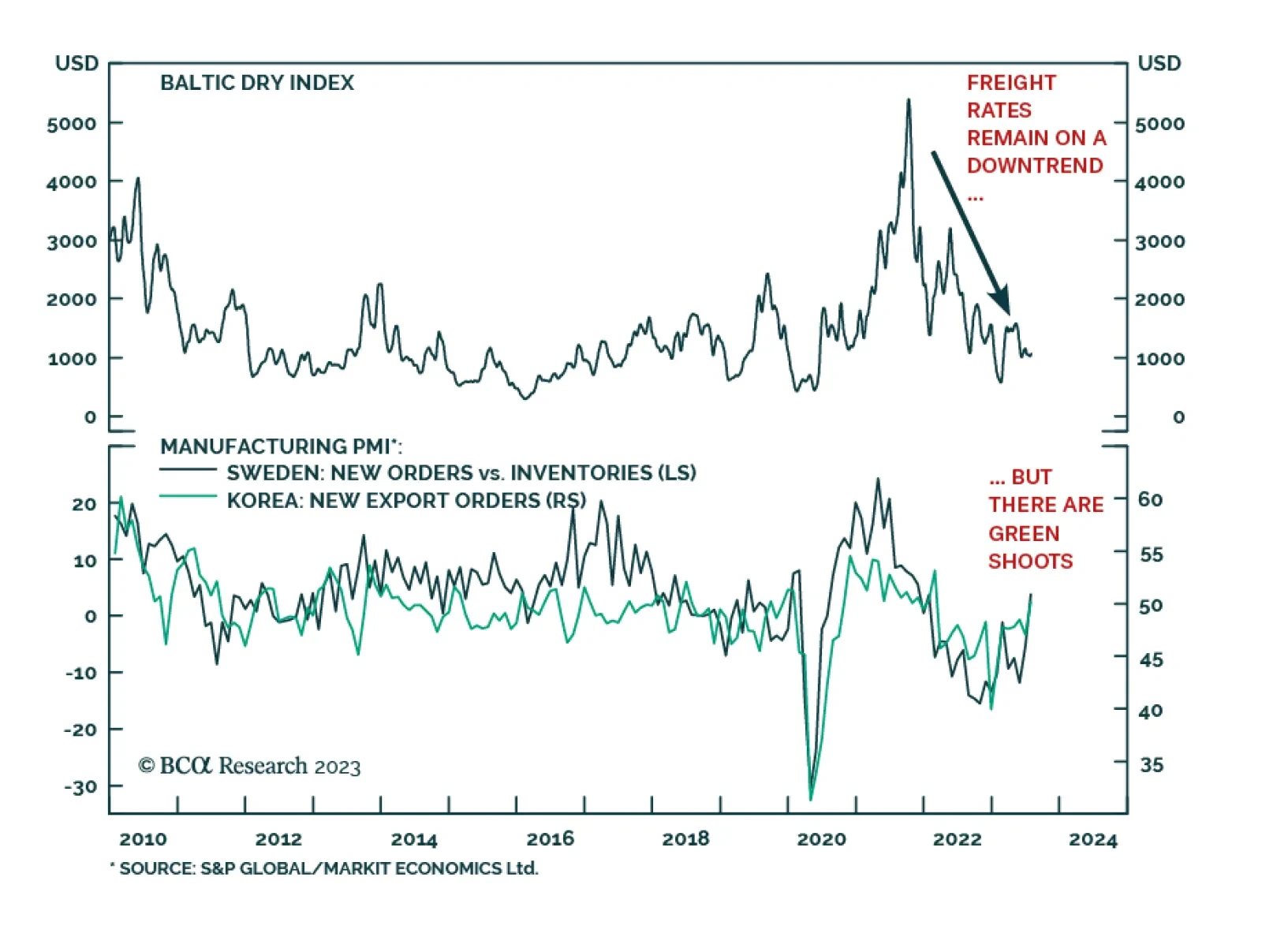

A range of indicators suggest that the US manufacturing sector is currently under duress. But should this weakness be extrapolated into the rest of the year? The US manufacturing cycle tends to follow a very predictable wave-…

Positive economic surprises have delayed the onset of recession in the United States. But tighter monetary and fiscal policy, slowing global growth, and a looming rebound in policy uncertainty and geopolitical risk suggest that…

On a 12-month investment horizon, BCA Research’s Global Asset Allocation service recommends a defensive stance: Overweight government bonds, and underweight equities and credit. The US stock market trades on 19x forward…

Recession is on track to start around year-end. Stocks usually peak shortly before recession begins. So, position defensively but be prepared for a few more months of the rally.