The year-to-date rally in US cyclical stocks has fizzled. After climbing 29% in the first seven months of the year, cyclical equities are down 6.0% since the beginning of August. This drop is happening in the context of a general…

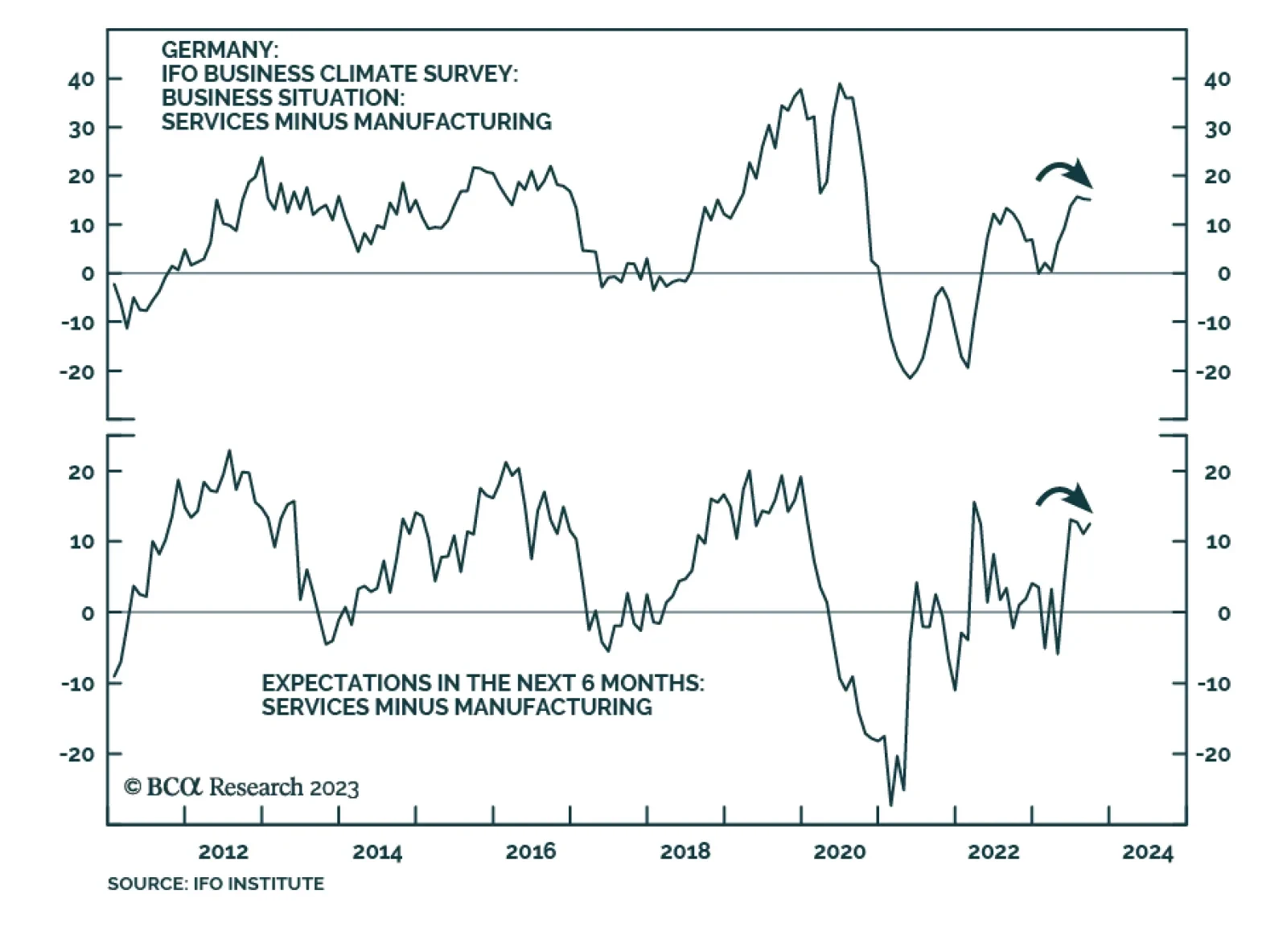

The message from the German Ifo is that although business sentiment continues to weaken, the pace of deterioration slowed in September and appears to be in the process of bottoming. The Business Climate Index’s marginal…

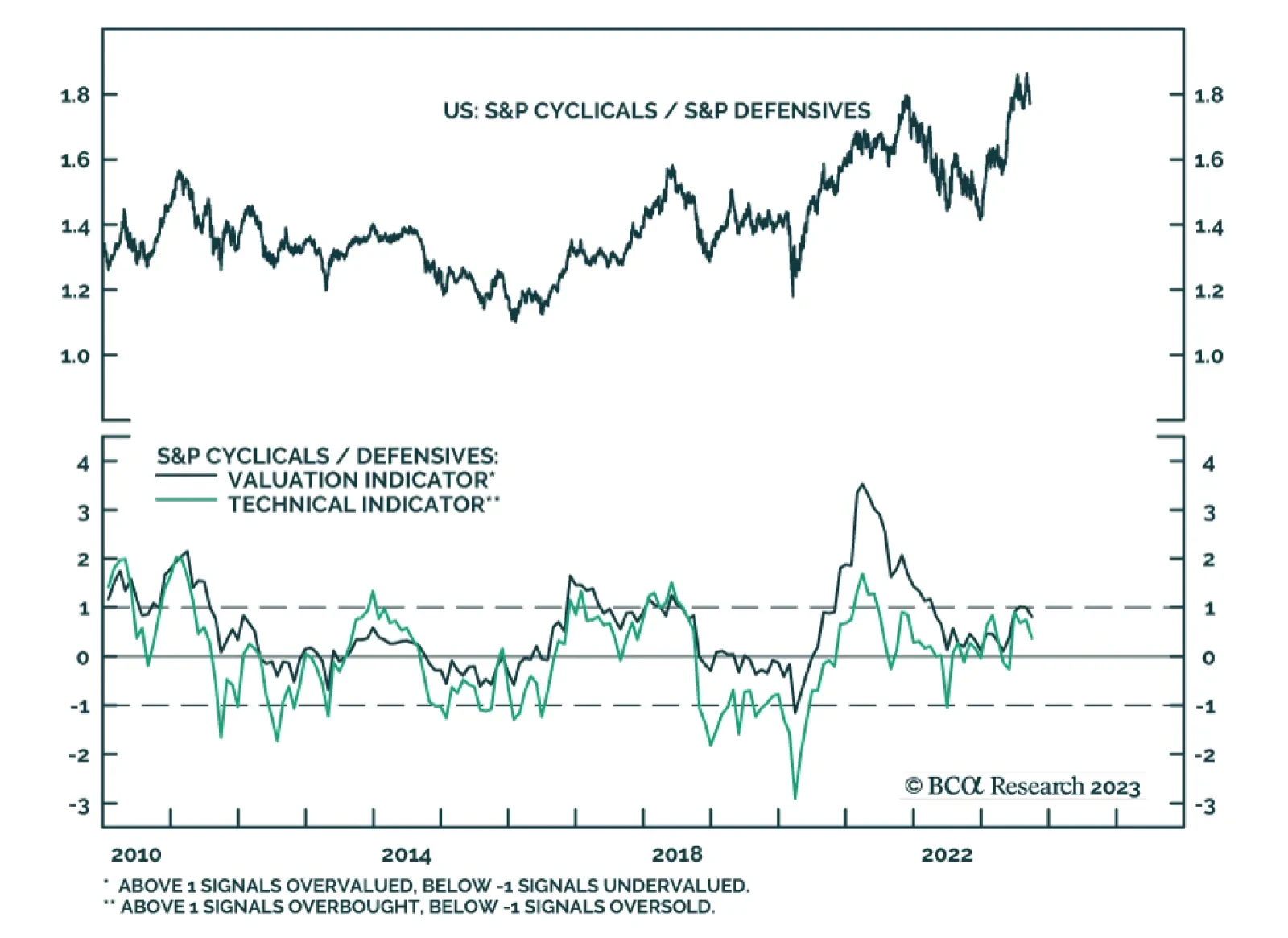

Bulls and bears have capitulated, and the majority of the clients surveyed expect a rangebound market in the near term. Our fair value PE NTM indicates that the S&P 500 is only modestly overvalued. The continued outperformance…

US fiscal, monetary, and foreign policies are unlikely to deliver any dovish surprises for investors in Q4, due to the impending government shutdown, persistent inflation, and instability among OPEC+ and China.

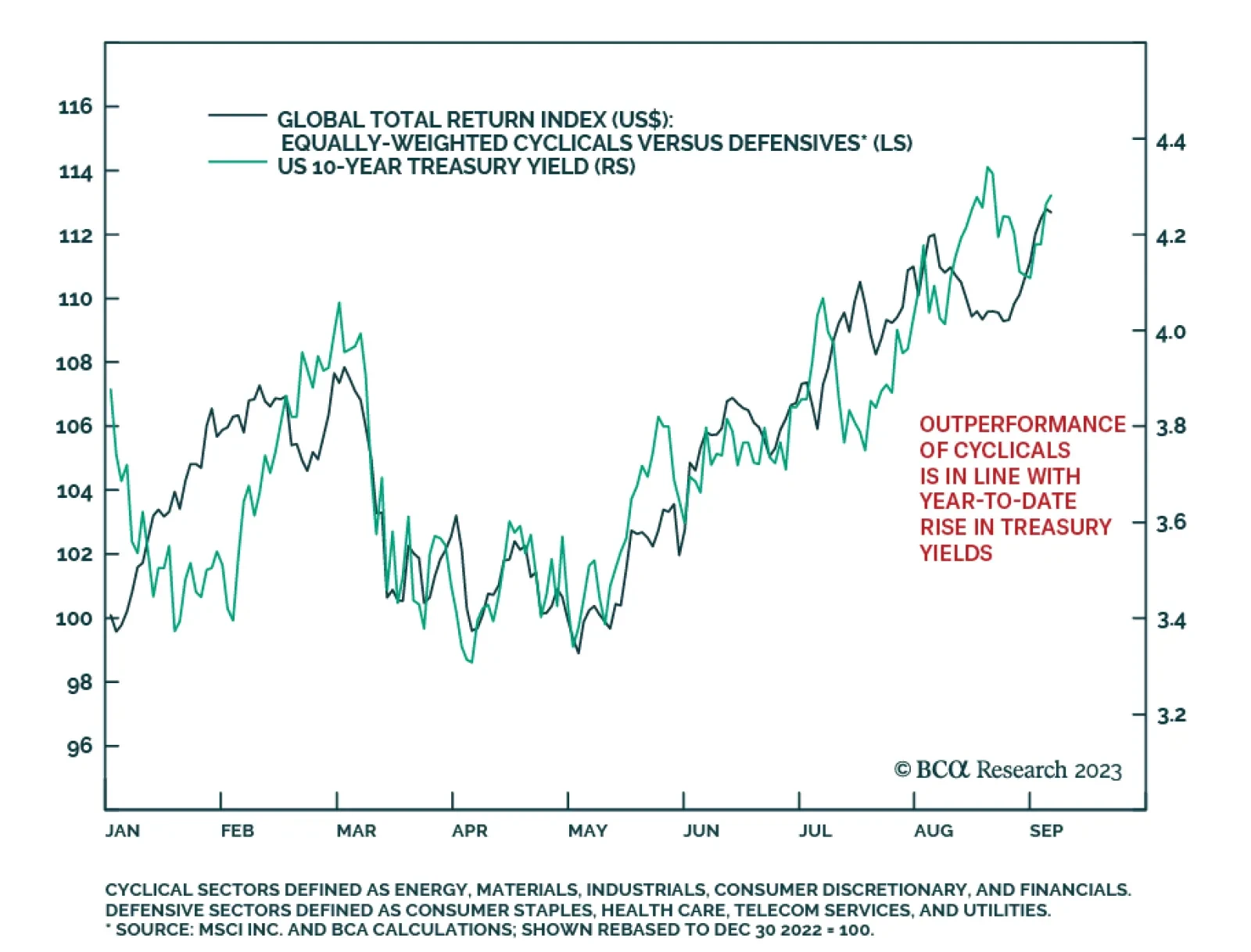

Since the beginning of the year, our equally-weighted global cyclicals index has outperformed equally-weighted defensives by about 13%. As the chart above shows, this relative performance trend has been extremely positively…

Stocks should continue to rally in the near term, but investors should prepare to turn more defensive towards the end of the year in advance of a recession in 2024.

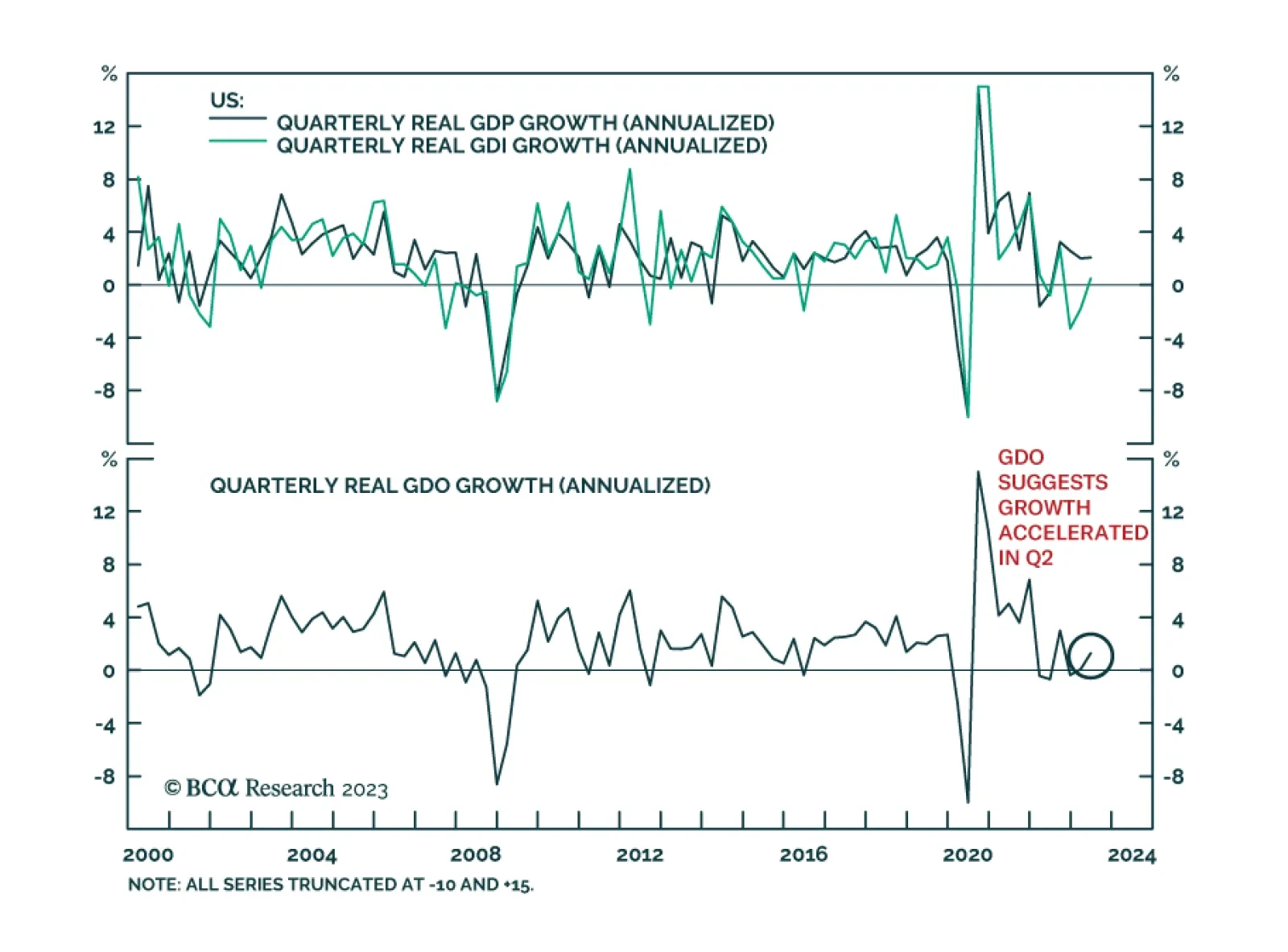

US Q2 GDP growth was revised down from 2.4% to 2.1% on a quarterly annualized basis, only slightly above Q1 growth of 2.0%. Although consumption was revised up by 0.1 percentage points to 1.7%, business spending grew at a slower…

Investors should prepare for an equity market pullback this fall, prefer Treasuries over stocks, and US defensives over cyclicals. A pullback could also morph into another bear market given that monetary policy is tight, policy…

Outperformance of Growth sectors most likely has run its course. It is time to shift Growth vs. Value allocation to neutral, downgrade Semis, and upgrade Energy to overweight.

European real GDP growth is stabilizing, so why would European equities continue to trade sideways for the remainder of the year? The answer lies with nominal growth and its impact on earnings.