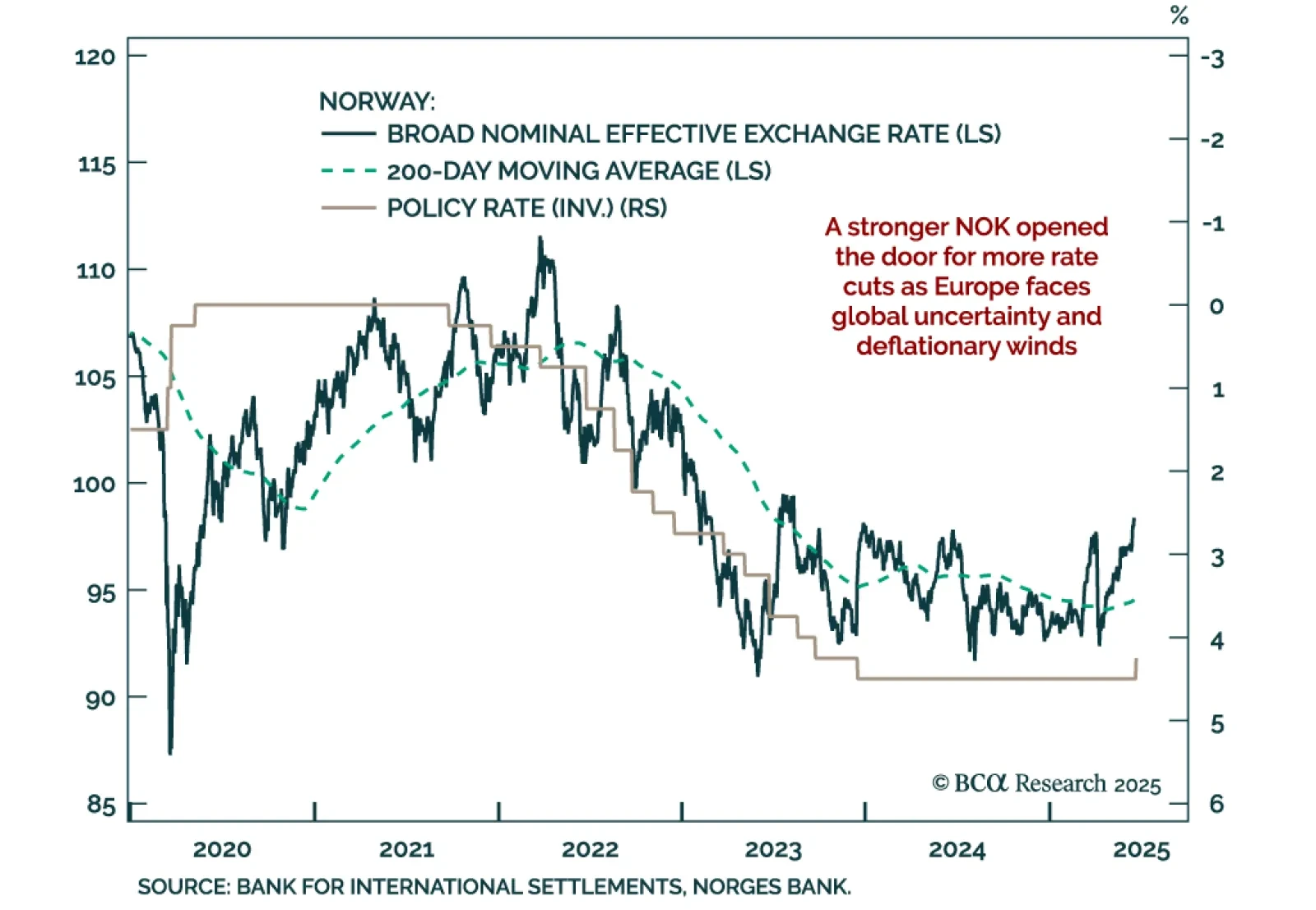

A stronger Norwegian krone has opened the door to more rate cuts, making Norwegian government bonds more attractive. Our Chart Of The Week comes from Jeremie Peloso, European Strategist. With its surprise 25 basis point cut, the…

In this Insight, we highlight our strong conviction trades based on the central bank meetings held by the Bank of England, the Norges Bank, the Swiss National Bank and the Riksbank.

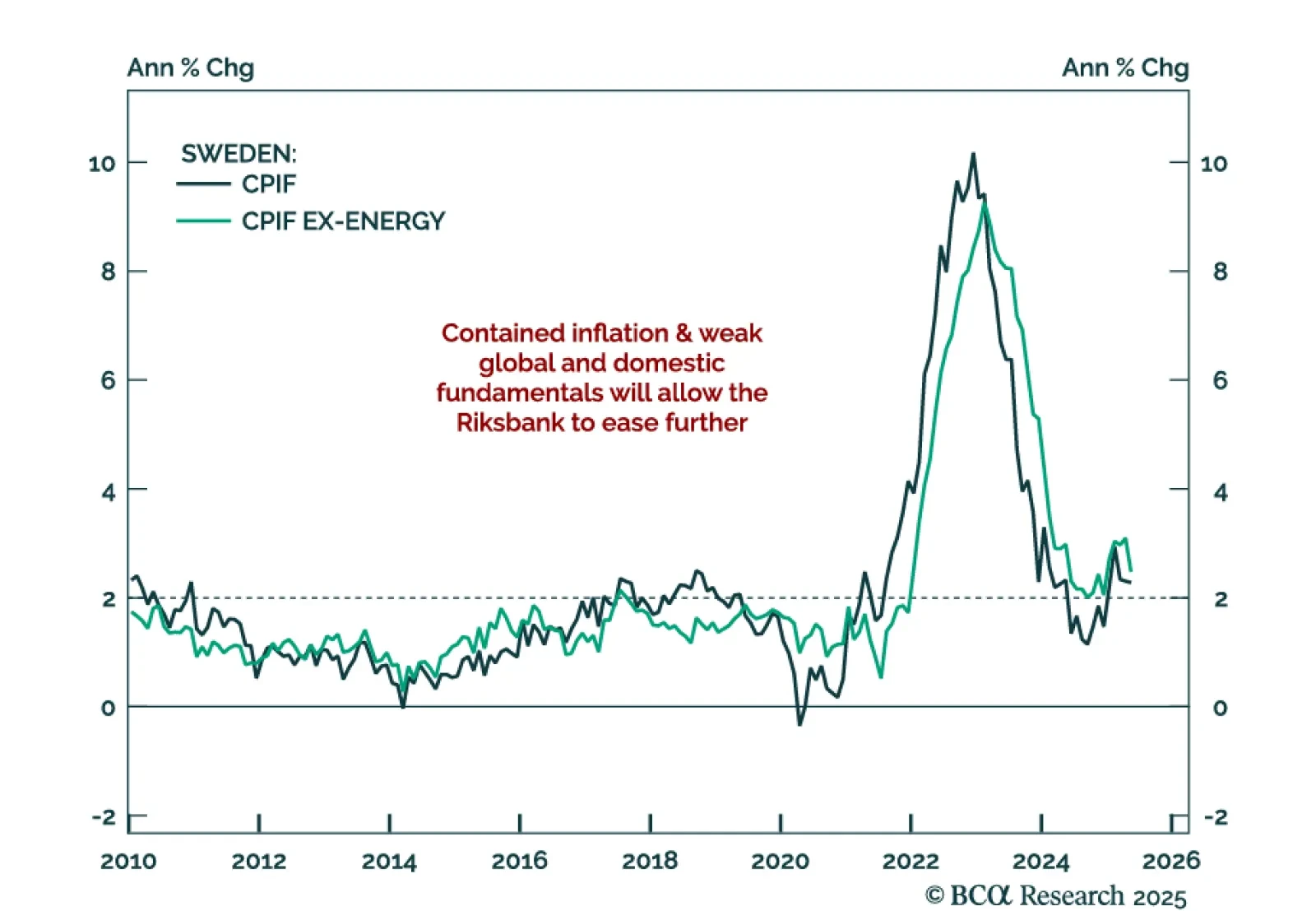

Sweden’s economic fragility and disinflation support further easing, reinforcing our long SEK rates and NOK/SEK trades. The Riksbank cut rates by 25 bps to 2.0% and projected an additional cut, consistent with prior OIS pricing.…

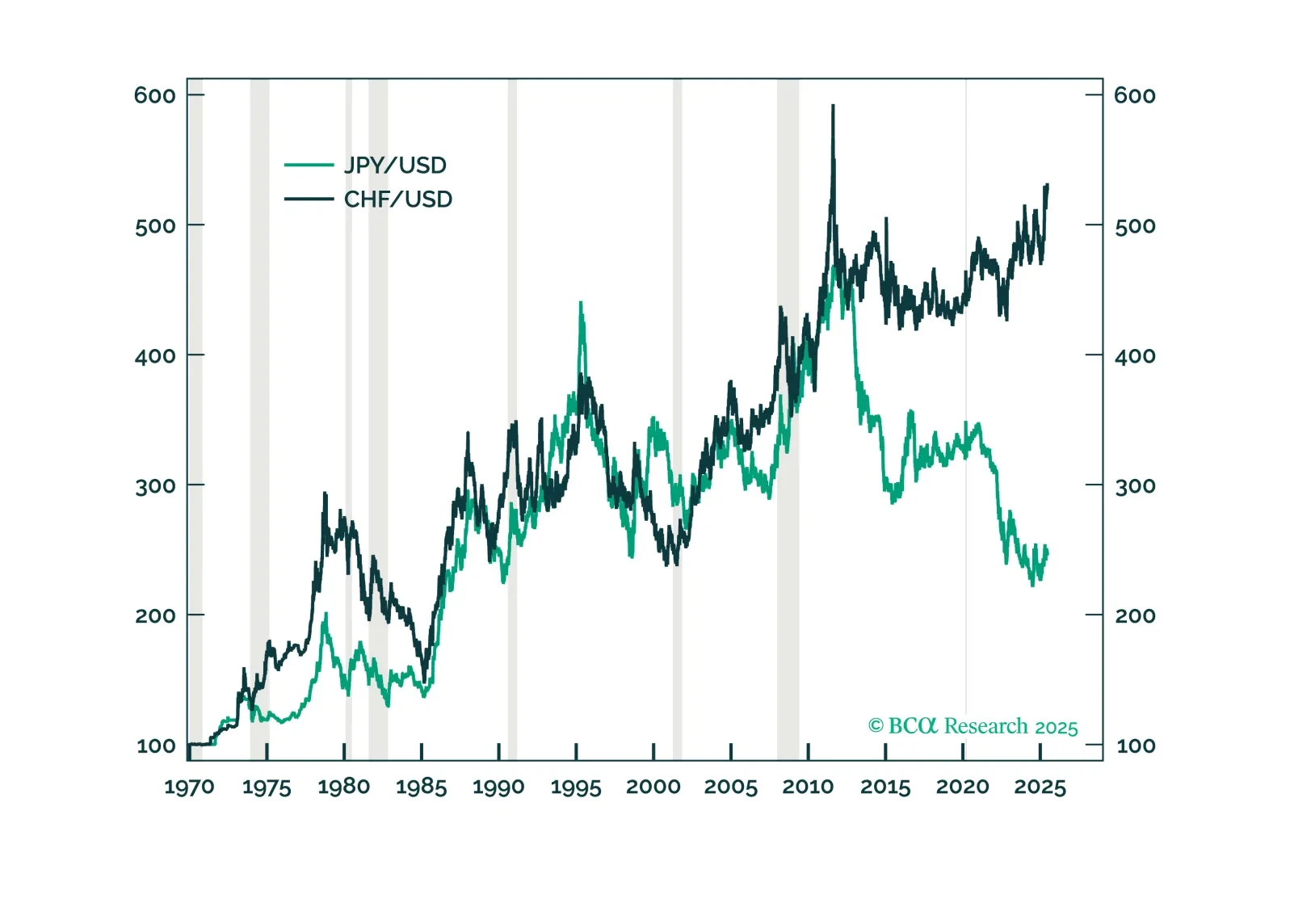

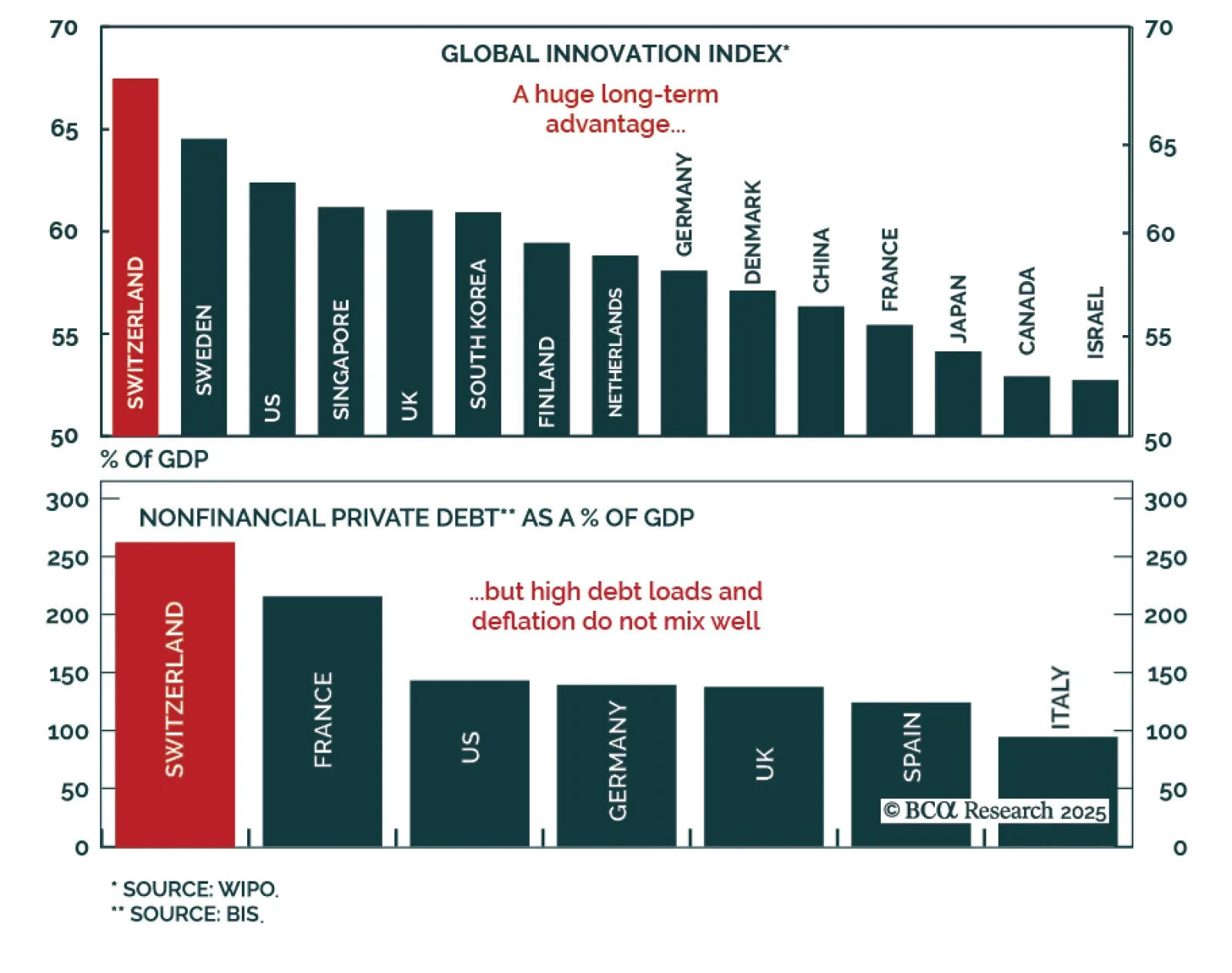

Our European Investment strategists believe Switzerland is no longer a tactical haven and recommend underweighting CHF and Swiss equities in favor of Swiss bonds. The country retains strong structural fundamentals: High productivity…

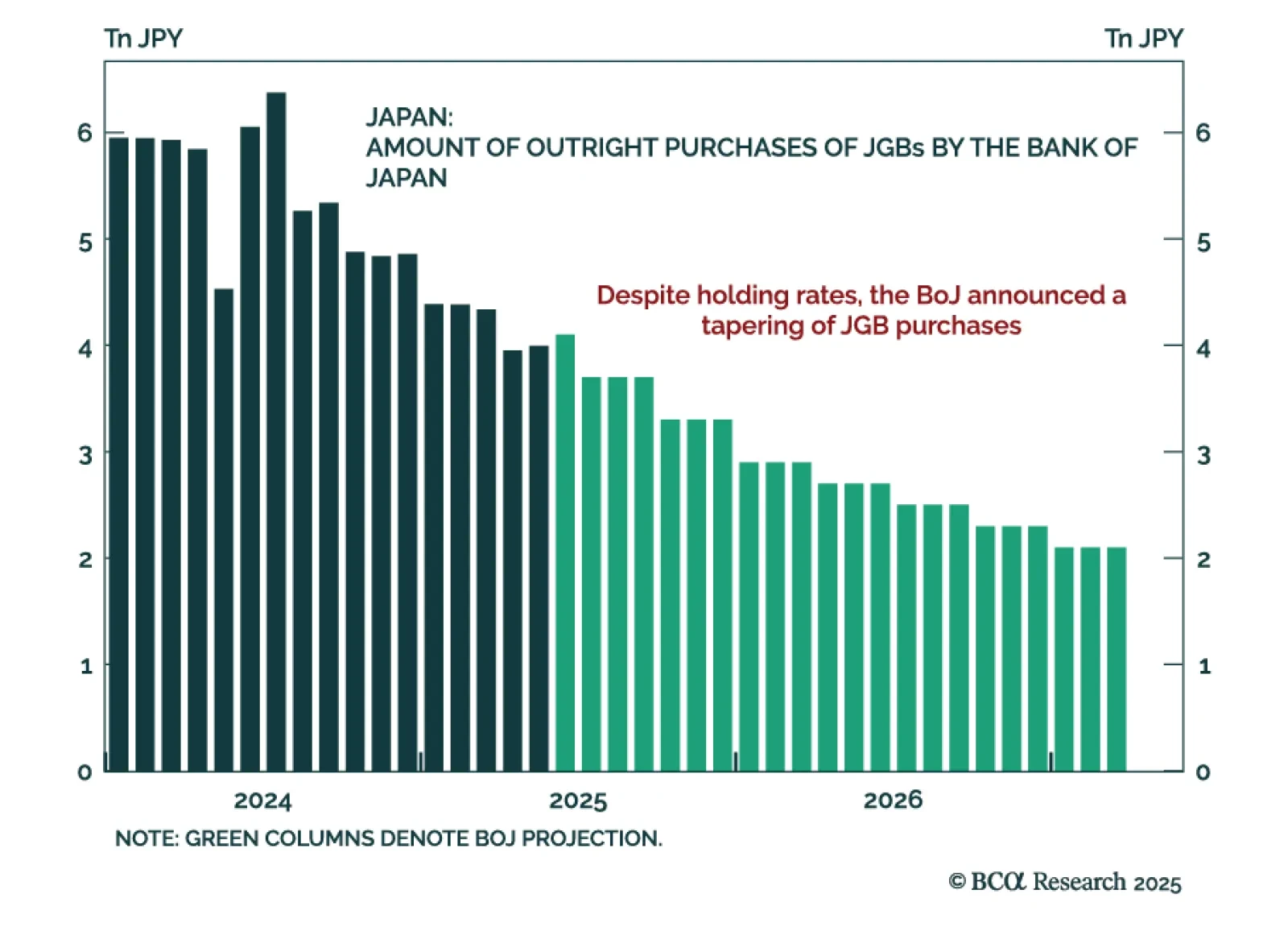

The BoJ’s decision to keep rates unchanged while announcing a tapering of bond purchases reinforces our underweight stance on JGBs and long bias on the yen. While the decision was broadly neutral, the reduction in asset purchases…

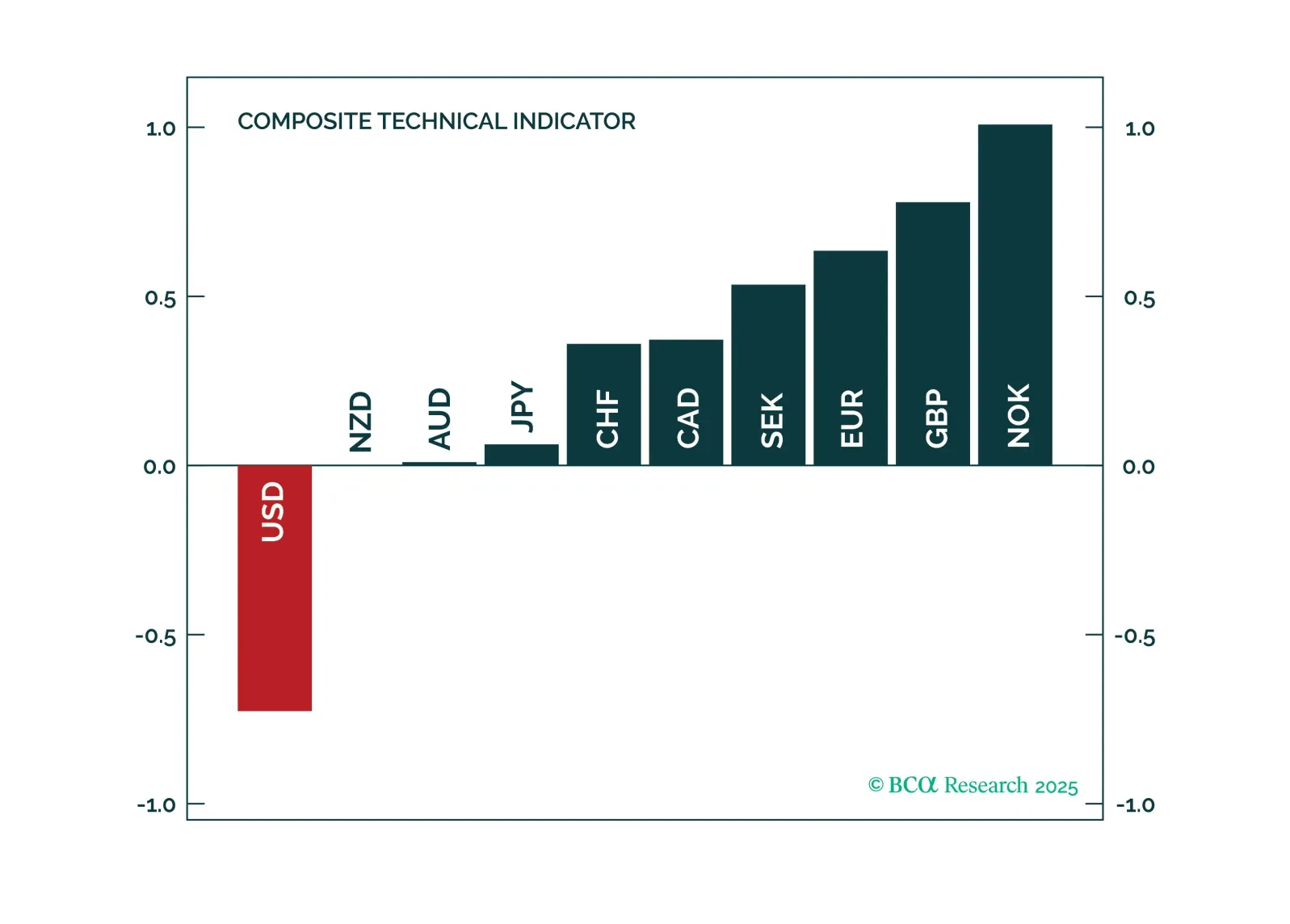

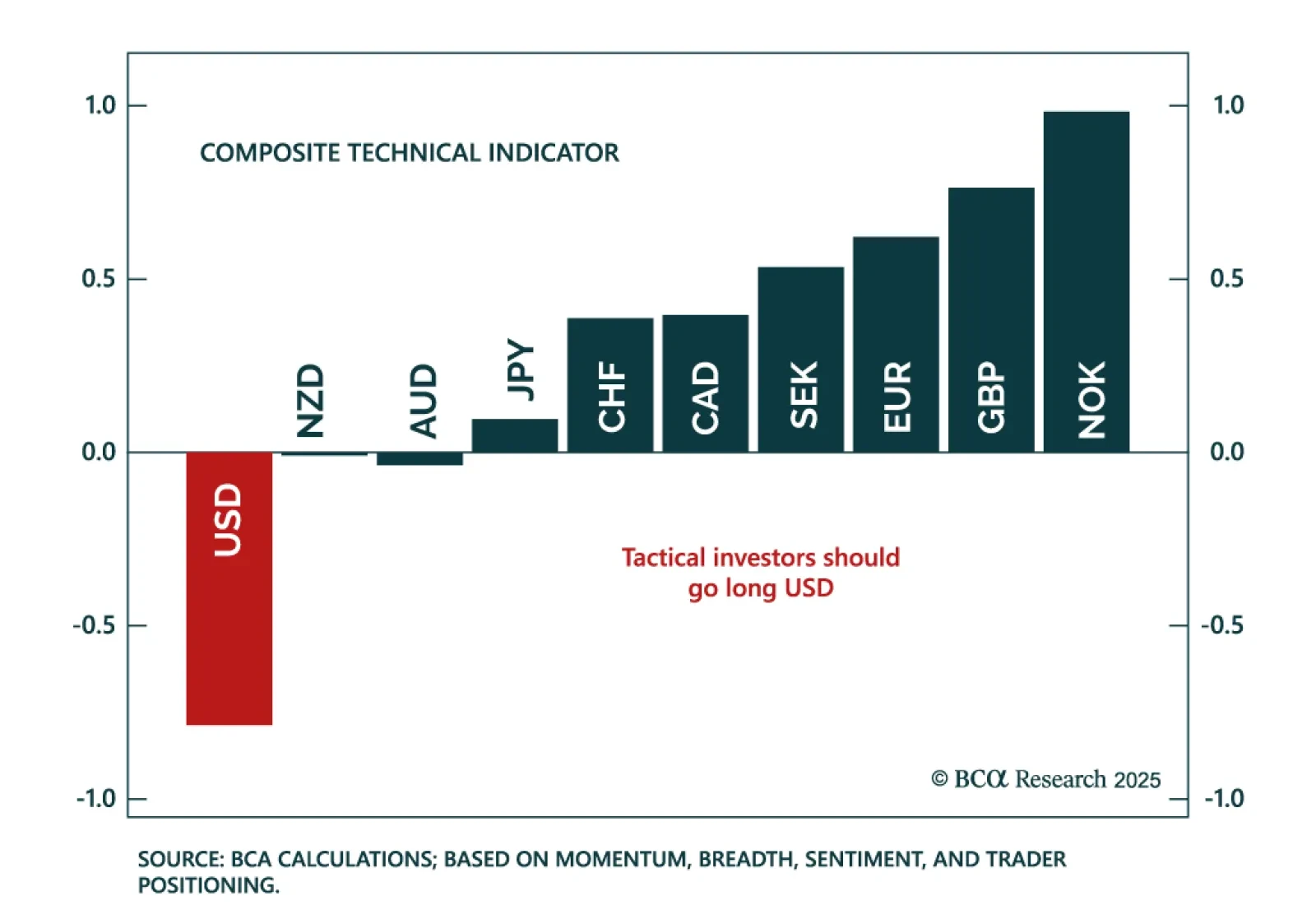

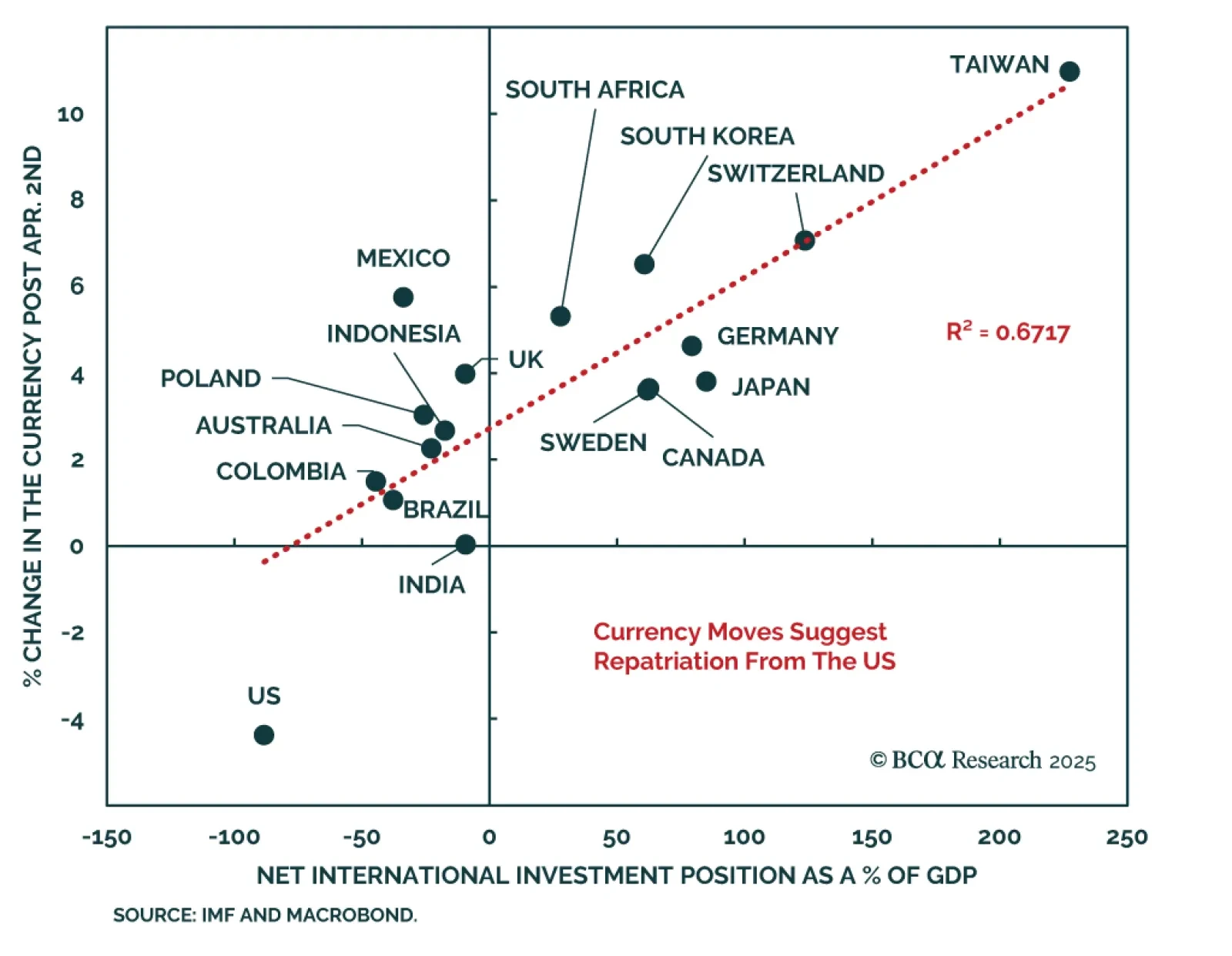

Our Foreign Exchange strategists recommend strategic investors sell the dollar on strength, while tactical investors position for a near-term bounce. The key risk for the dollar today is a potential balance-of-payments crisis.…

In this FX note, we provide a rationale for why it is important to pay attention to technical indicators, while still keeping your eyeball on the structural factors that drive currencies. This report answers the following questions:…

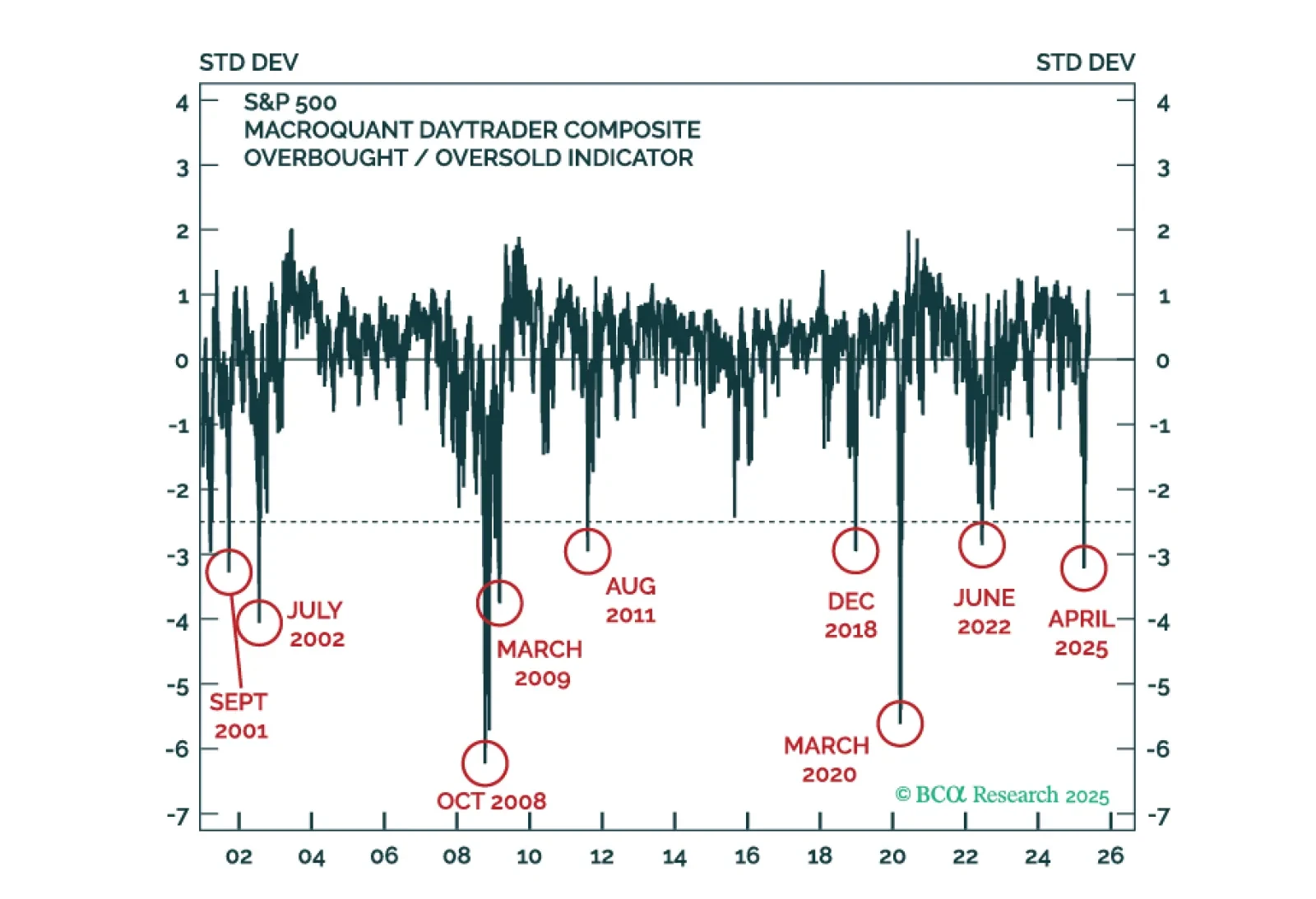

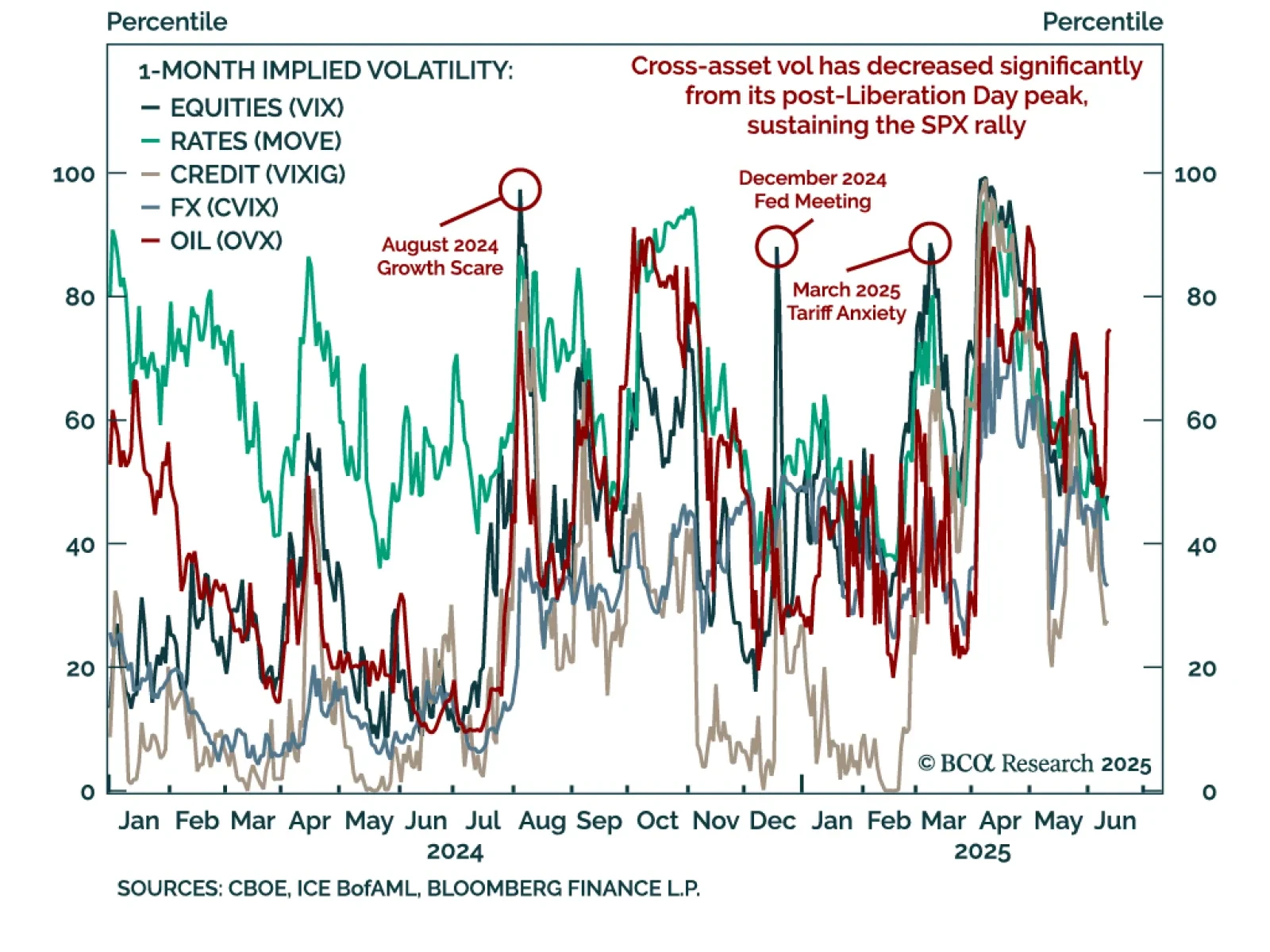

The S&P 500 has breached 6000 and may retest all-time highs, but we would not recommend chasing the rally. Risk assets have shrugged off recession fears, with stress indicators like the VIX, SKEW, and VVIX still subdued,…

Our Global Asset Allocation strategists remain underweight US equities and the dollar, as fiscal policy overtakes tariffs as the key market driver. The “One Big Beautiful Bill” may avoid worst-case scenarios, but rising US yields are…

MacroQuant warns that US equities are pricing in very little economic risk. The model is shunning equities and recommends a large overweight to cash.